Rates

Hot CPI Data, Broadening Inflation Pressures Keep The Fed On Course For 25bp Liftoff Next Week, With 6.5 Hikes Priced In This Year

Despite growing inflationary pressures in Europe, the ECB chose not to raise rates today, in line with market consensus, but said they would accelerate the taper of their quantitative easing operations

Published ET

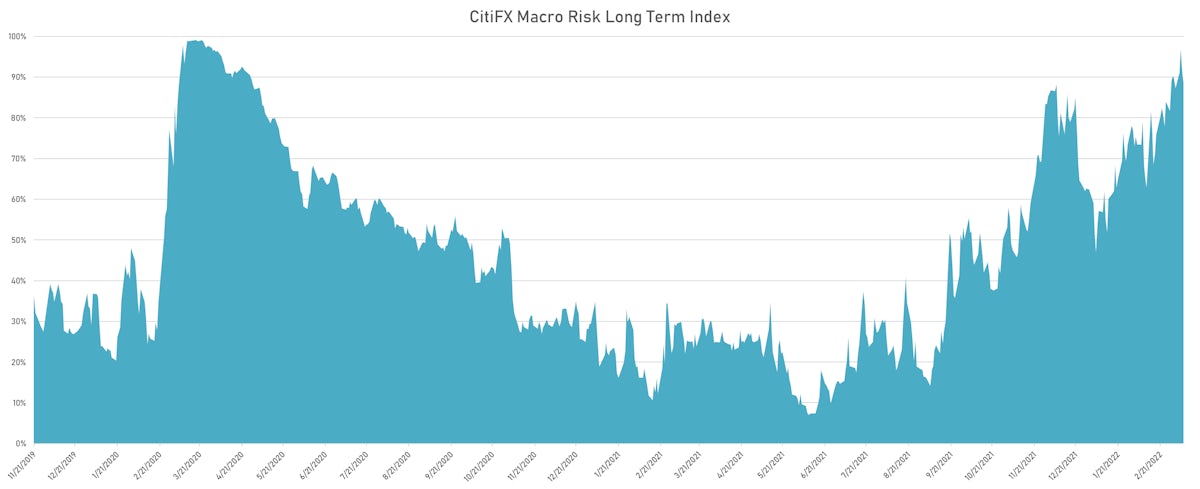

CitiFX Long-Term Macro Risk Index | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

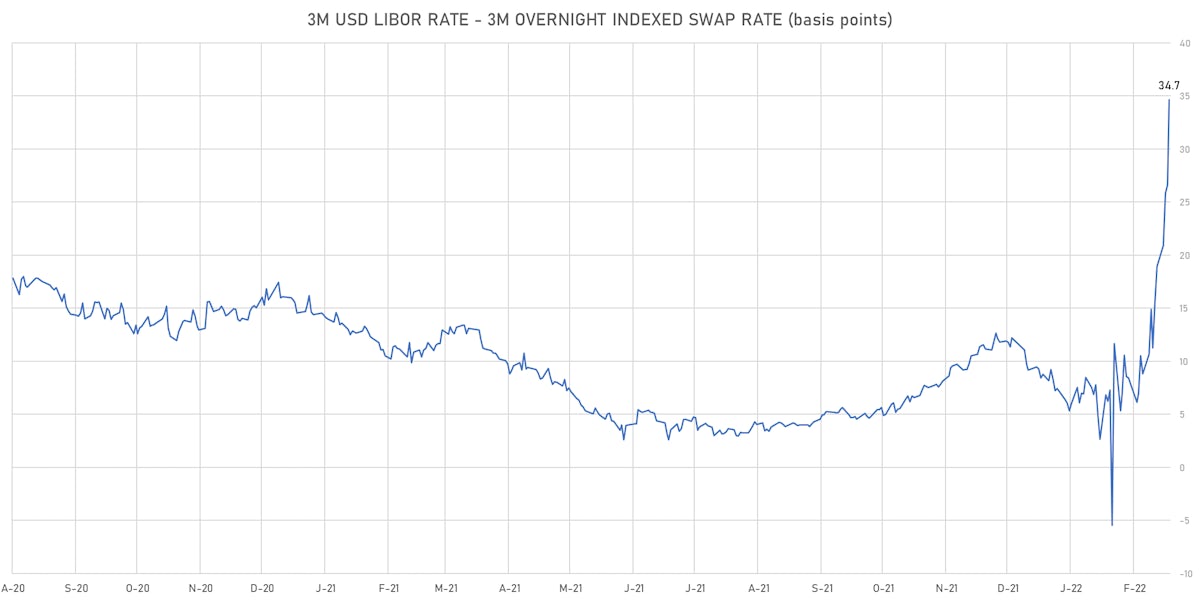

- 3-Month USD LIBOR +8.5bp today, now at 0.8300%; 3-Month OIS +0.5bp at 0.4835%

- The treasury yield curve steepened, with the 1s10s spread widening 0.9 bp, now at 86.6 bp (YTD change: -26.7bp)

- 1Y: 1.1269% (up 3.3 bp)

- 2Y: 1.7004% (up 2.7 bp)

- 5Y: 1.9230% (up 4.5 bp)

- 7Y: 1.9871% (up 5.4 bp)

- 10Y: 1.9925% (up 4.2 bp)

- 30Y: 2.3715% (up 4.2 bp)

- US treasury curve spreads: 3m2Y at 129.9bp (up 0.4bp today), 2s5s at 22.3bp (up 1.6bp), 5s10s at 7.0bp (down -0.3bp), 10s30s at 37.9bp (down -0.1bp)

- Treasuries butterfly spreads: 1s5s10s at -75.1bp (down -4.5bp), 5s10s30s at 30.7bp (up 0.5bp)

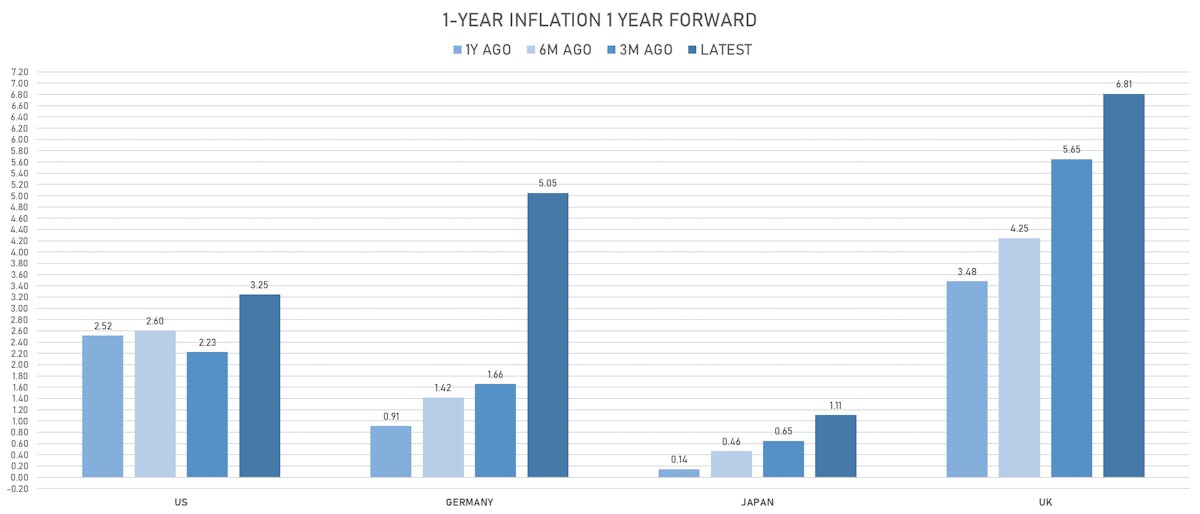

- TIPS 1Y breakeven inflation at 5.64% (up 19.2bp); 2Y at 4.45% (up 10.0bp); 5Y at 3.38% (up 5.2bp); 10Y at 2.89% (down -0.2bp); 30Y at 2.51% (down -2.6bp)

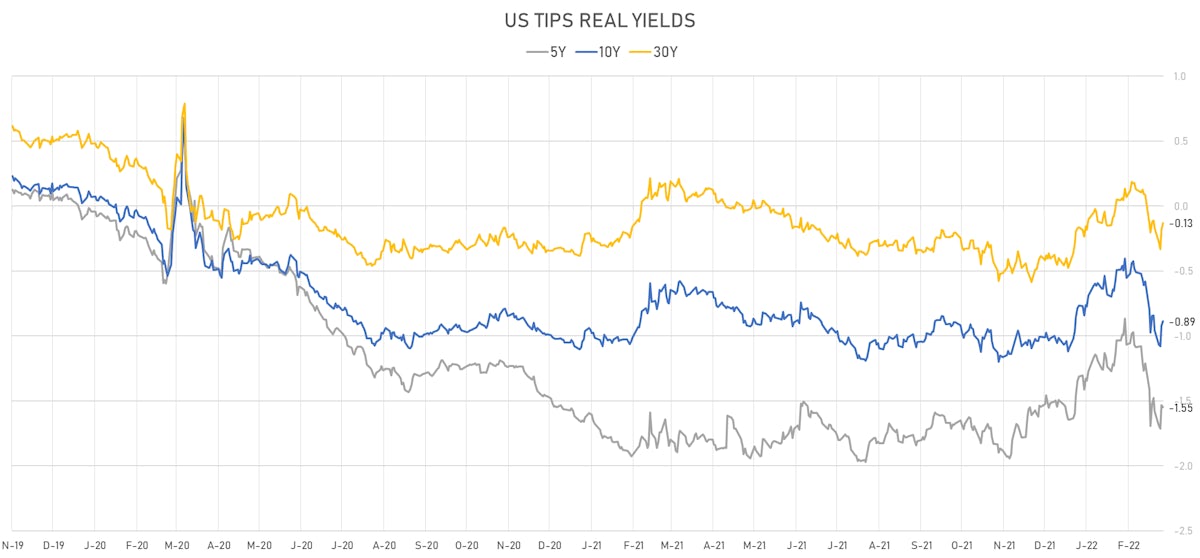

- US 5-Year TIPS Real Yield: -1.8 bp at -1.5510%; 10-Year TIPS Real Yield: +3.6 bp at -0.8860%; 30-Year TIPS Real Yield: +5.4 bp at -0.1300%

AUCTION RESULT: $20BN 2.25% COUPON 30-YEAR TREASURY BOND (912810TD0)

- Good pricing and all-time-high end-user demand (87.9% vs 85.7% prior and 81.8% average)

- High yield: 2.375% , a 2.5bp stop-through vs when-issued at the bid deadline

- Indirect 71.25% (vs 67.95% prior and 63.3% average)

- Direct 16.42% (vs 17.75% prior and 18.4% average)

- Bid-to-cover: 2.46 (vs 2.30 prior and 2.30 average)

US MACRO RELEASES

- CPI - All Urban Samples: All Items, Change Y/Y for Feb 2022 (BLS, U.S Dep. Of Lab) at 7.90 % (vs 7.50 % prior), below consensus estimate of 7.90 %

- CPI, All items less food and energy for Feb 2022 (BLS, U.S Dep. Of Lab) at 287.88 (vs 286.43 prior)

- CPI, All items less food and energy, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.50 % (vs 0.60 % prior), below consensus estimate of 0.50 %

- CPI, All items less food and energy, Change Y/Y, Price Index for Feb 2022 (BLS, U.S Dep. Of Lab) at 6.40 % (vs 6.00 % prior), below consensus estimate of 6.40 %

- CPI, All items, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 0.60 % prior), below consensus estimate of 0.80 %

- CPI, All items, Price Index for Feb 2022 (BLS, U.S Dep. Of Lab) at 283.72 (vs 281.15 prior), above consensus estimate of 283.66

- CPI, FRB Cleveland Median, 1 month, Change M/M for Feb 2022 (Fed Resrv, Cleveland) at 0.50 % (vs 0.60 % prior)

- Earnings, Average Weekly, Total Private, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at -0.50 % (vs -0.50 % prior)

- Federal Budget, Current Prices for Feb 2022 (Fiscal Service, USA) at -217.00 Bln USD (vs 119.00 Bln USD prior), below consensus estimate of -49.50 Bln USD

- Jobless Claims, National, Continued for W 26 Feb (U.S. Dept. of Labor) at 1.49 Mln (vs 1.48 Mln prior), above consensus estimate of 1.46 Mln

- Jobless Claims, National, Initial for W 05 Mar (U.S. Dept. of Labor) at 227.00 k (vs 215.00 k prior), above consensus estimate of 217.00 k

- Jobless Claims, National, Initial, four week moving average for W 05 Mar (U.S. Dept. of Labor) at 231.25 k (vs 230.50 k prior)

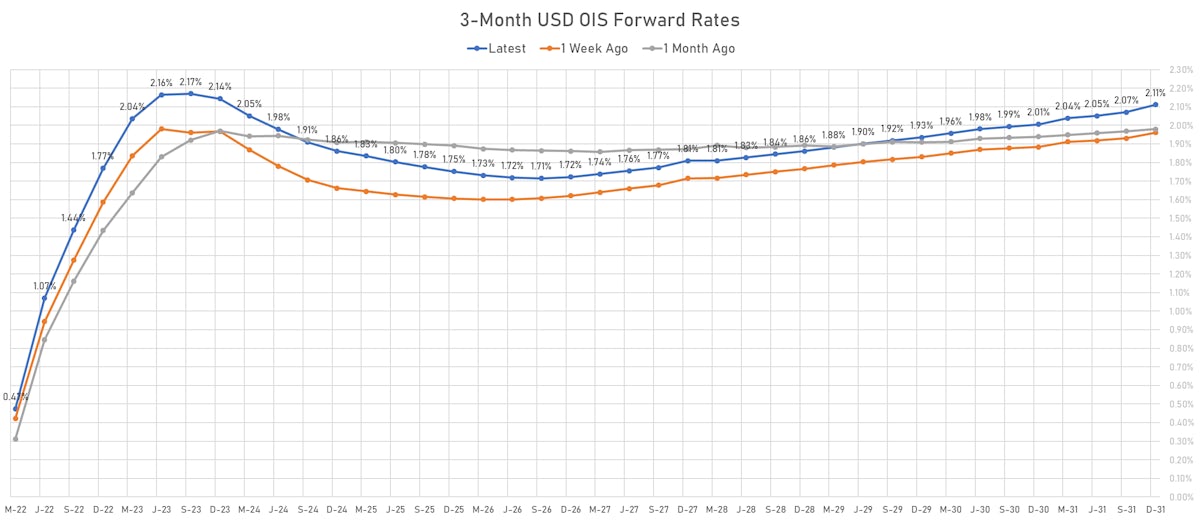

US FORWARD RATES

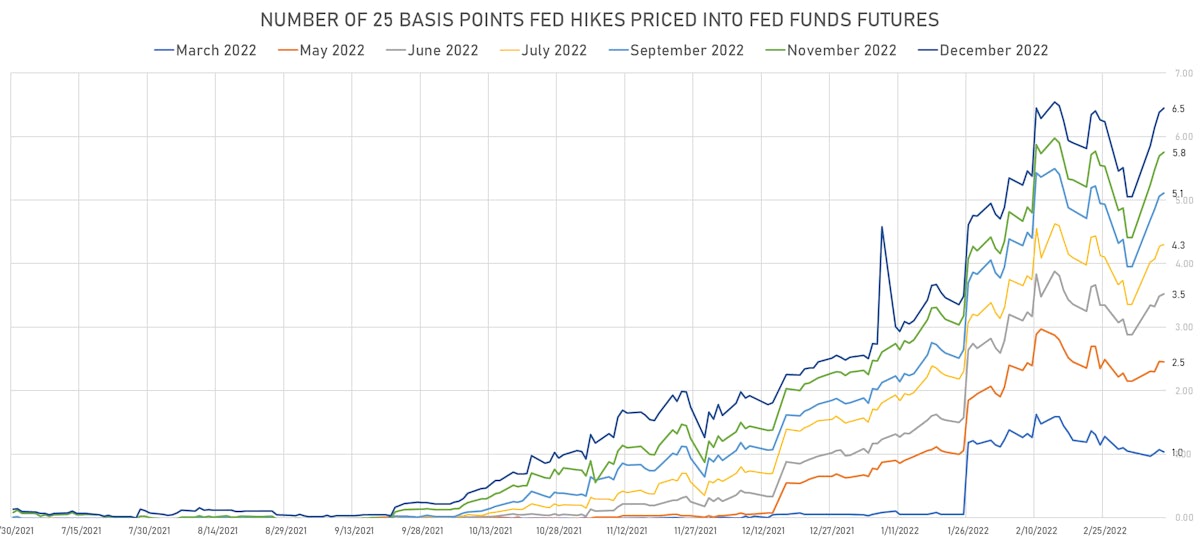

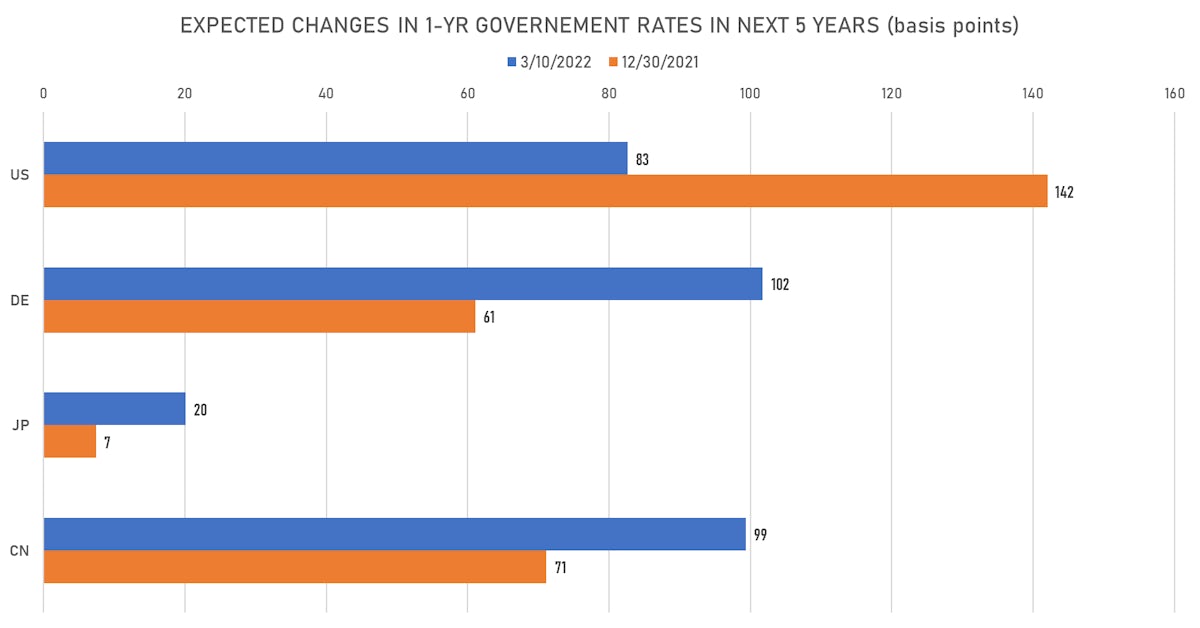

- Fed Funds futures now price in 25.8bp of Fed hikes by the end of March 2022, 61.3bp (2.45 x 25bp hikes) by the end of May 2022, and price in 6.45 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 34 bp of hikes in 2023 (equivalent to 1.4 x 25 bp hikes), up 1.5 bp today, and -18.0 bp of hikes in 2024 (equivalent to -0.7 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.64% (up 19.2bp); 2Y at 4.45% (up 10.0bp); 5Y at 3.38% (up 5.2bp); 10Y at 2.89% (down -0.2bp); 30Y at 2.51% (down -2.6bp)

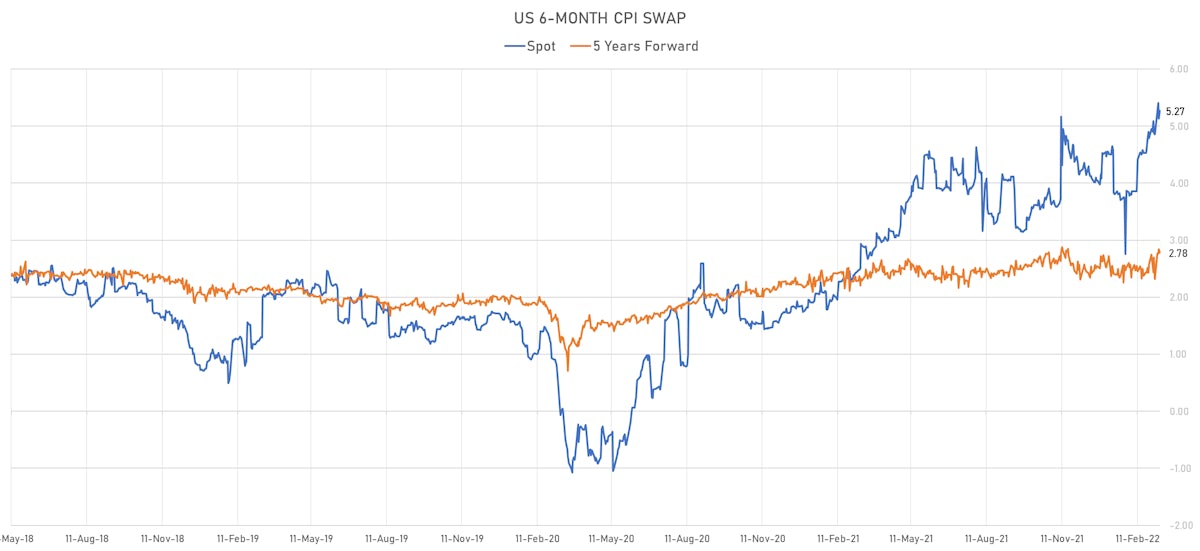

- 6-month spot US CPI swap up 14.0 bp to 5.270%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.5510%, -1.8 bp today; 10Y at -0.8860%, +3.6 bp today; 30Y at -0.1300%, +5.4 bp today

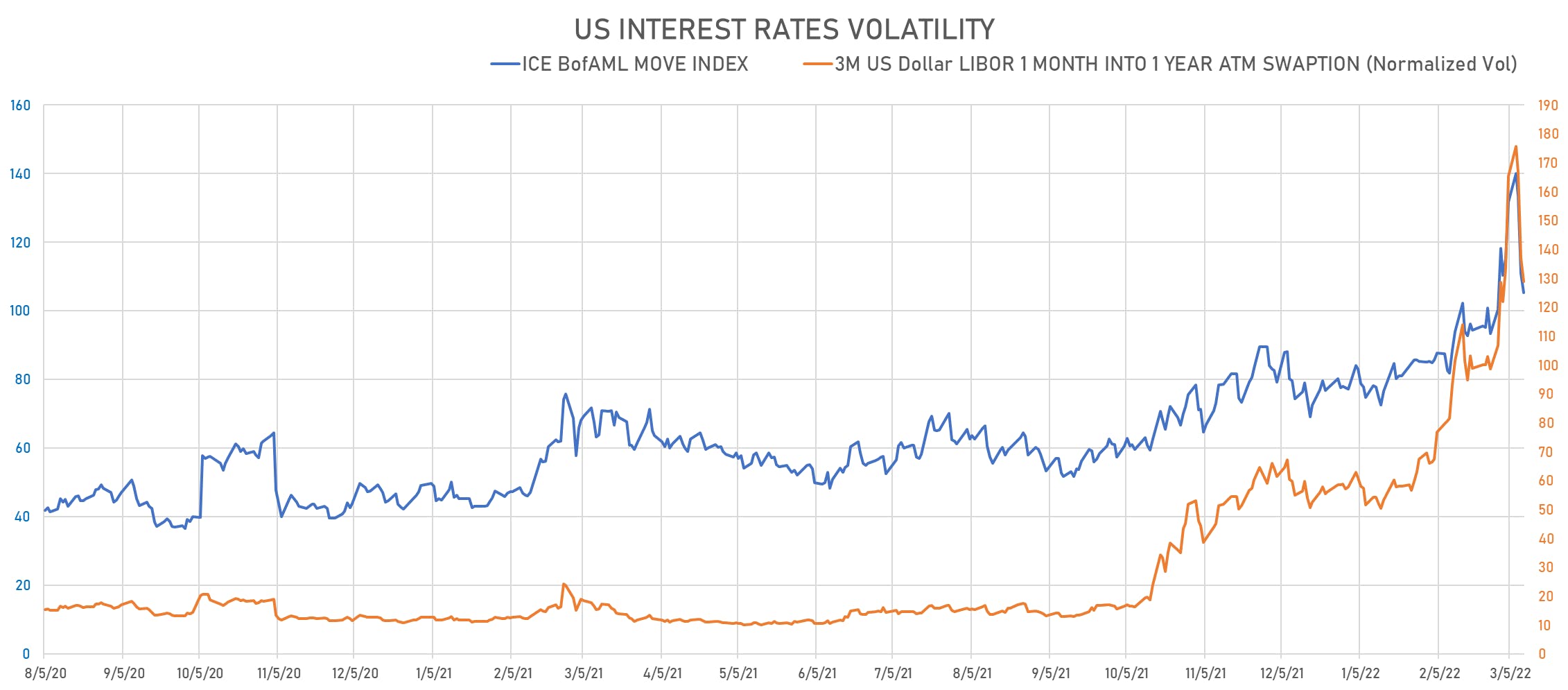

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -8.2 vols at 128.8 normals

- 3-Month LIBOR-OIS spread up 8.0 bp at 34.7 bp (12-months range: -5.5-34.7 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: -0.008% (up 13.2 bp); the German 1Y-10Y curve is 2.9 bp steeper at 91.0bp (YTD change: +46.9 bp)

- Japan 5Y: 0.022% (up 1.9 bp); the Japanese 1Y-10Y curve is 3.0 bp steeper at 27.1bp (YTD change: +10.2 bp)

- China 5Y: 2.573% (up 0.7 bp); the Chinese 1Y-10Y curve is 0.0 bp flatter at 73.8bp (YTD change: +22.8 bp)

- Switzerland 5Y: 0.029% (up 8.6 bp); the Swiss 1Y-10Y curve is 15.5 bp steeper at 94.9bp (YTD change: +42.4 bp)