Rates

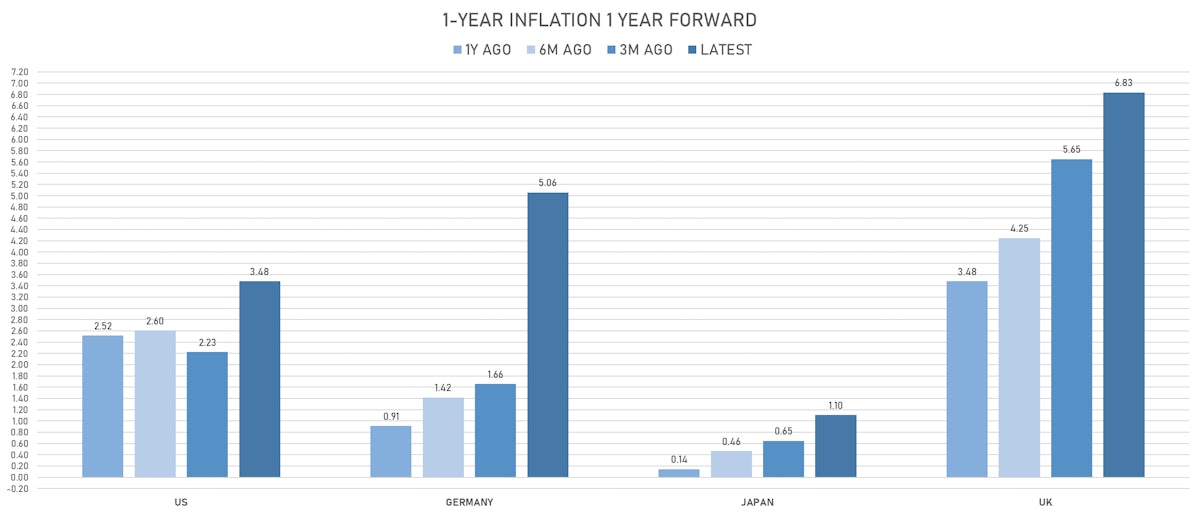

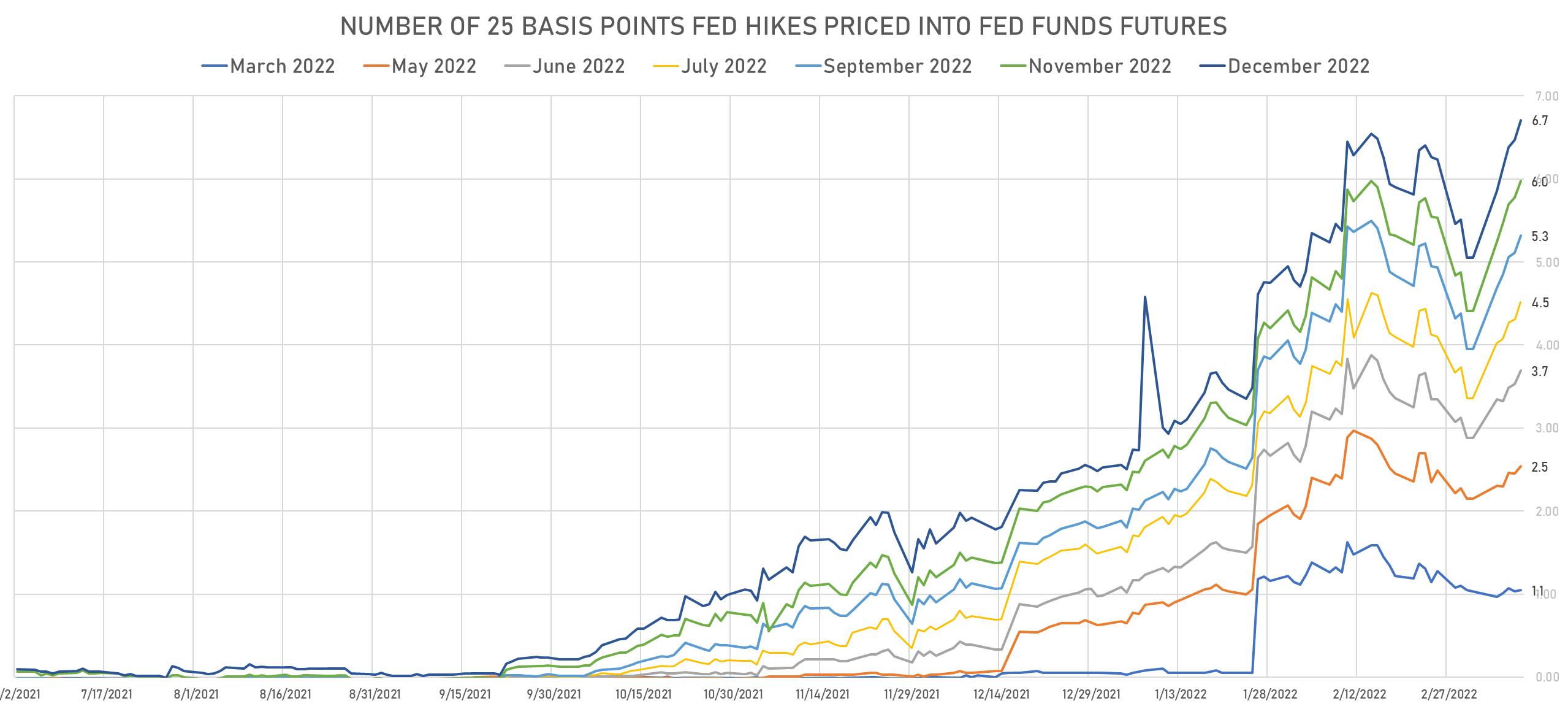

Front End Sells Off Into The Weekend, With Higher Breakevens And Lower Real Yields, As Market Now Prices In 6.5 Hikes By End Of '22

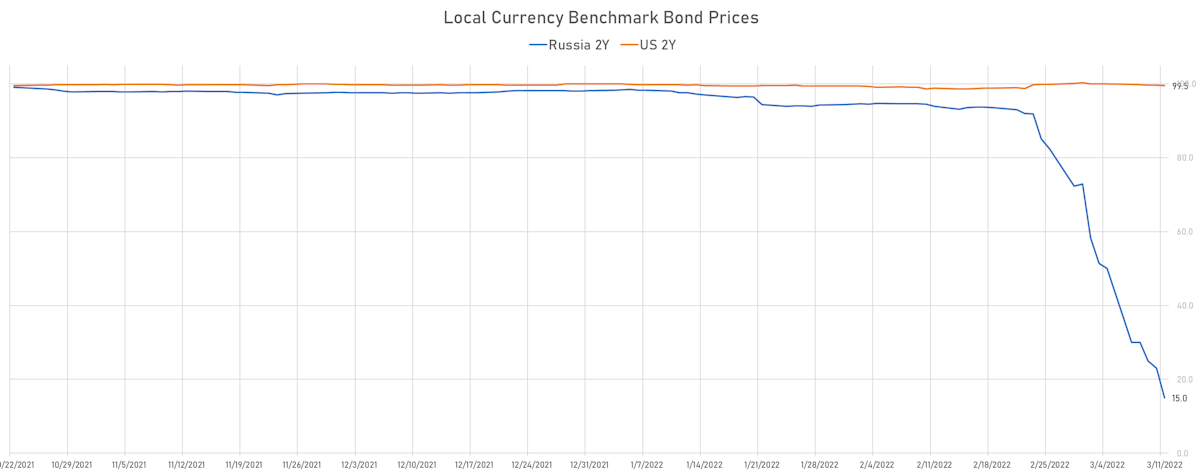

Although US rates volatility has been extraordinarily high this year, it doesn't register when prices of US Treasuries are mapped on the same chart as Russian debt, with 2-year local-currency paper now trading at 15 kopeks on the rouble

Published ET

Daily Prices Of Russia vs US 2-Year Local-Currency Treasury Notes | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

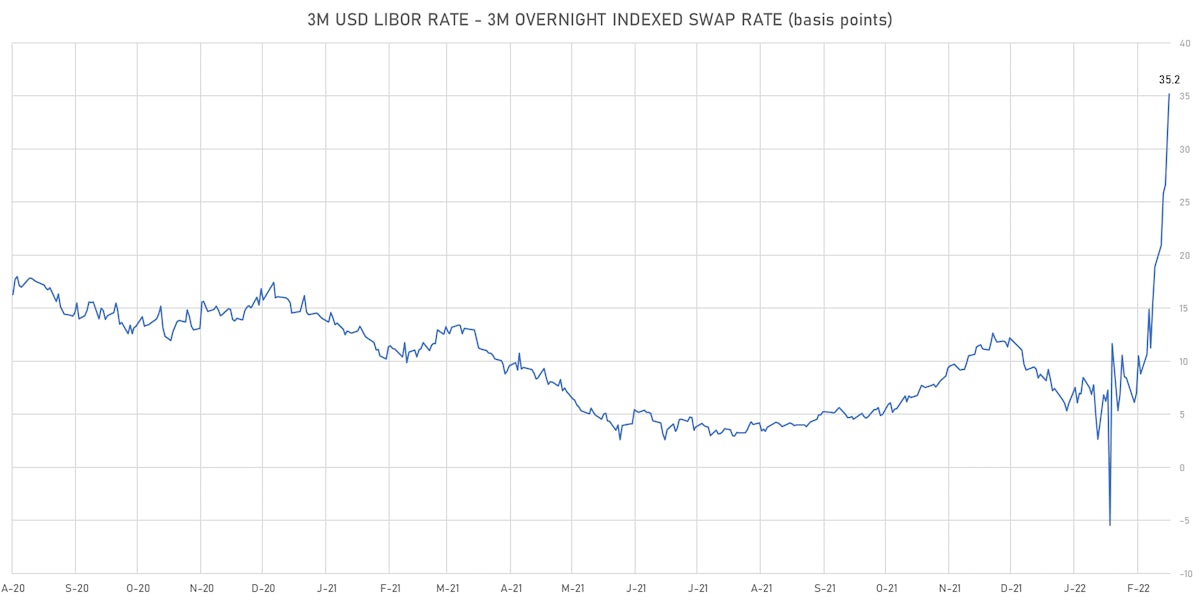

- 3-Month USD LIBOR +5.2bp today, now at 0.8550%; 3-Month OIS +1.6bp at 0.5030%

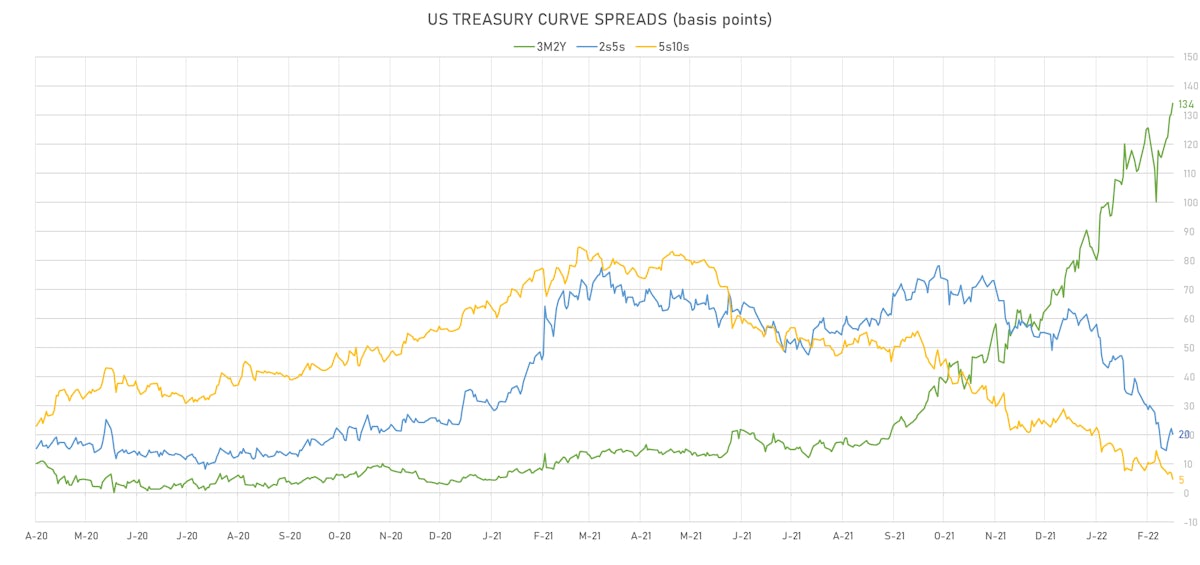

- The treasury yield curve flattened, with the 1s10s spread tightening -2.5 bp, now at 84.1 bp (YTD change: -29.1bp)

- 1Y: 1.1551% (up 2.8 bp)

- 2Y: 1.7450% (up 4.4 bp)

- 5Y: 1.9488% (up 2.5 bp)

- 7Y: 1.9994% (up 1.2 bp)

- 10Y: 1.9961% (up 0.4 bp)

- 30Y: 2.3530% (down 1.9 bp)

- US treasury curve spreads: 3m2Y at 134.0bp (up 3.4bp today), 2s5s at 20.4bp (down -1.7bp), 5s10s at 4.7bp (down -2.1bp), 10s30s at 35.7bp (down -2.1bp)

- Treasuries butterfly spreads: 1s5s10s at -77.0bp (down -1.8bp), 5s10s30s at 30.5bp (down -0.2bp)

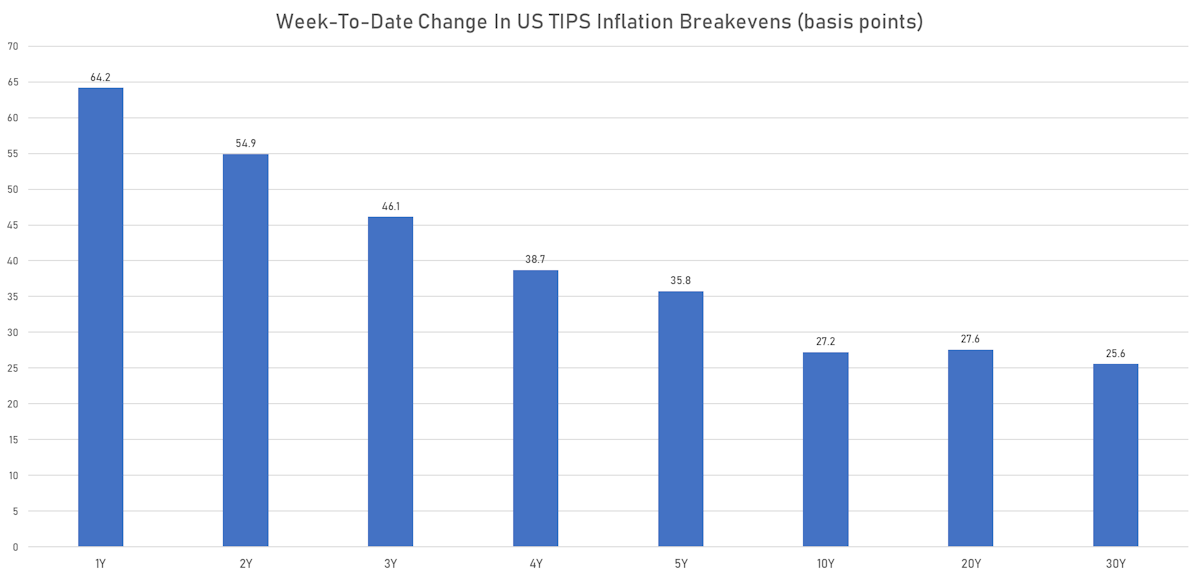

- TIPS 1Y breakeven inflation at 5.91% (up 27.2bp); 2Y at 4.71% (up 25.4bp); 5Y at 3.50% (up 11.9bp); 10Y at 2.97% (up 8.6bp); 30Y at 2.59% (up 8.8bp)

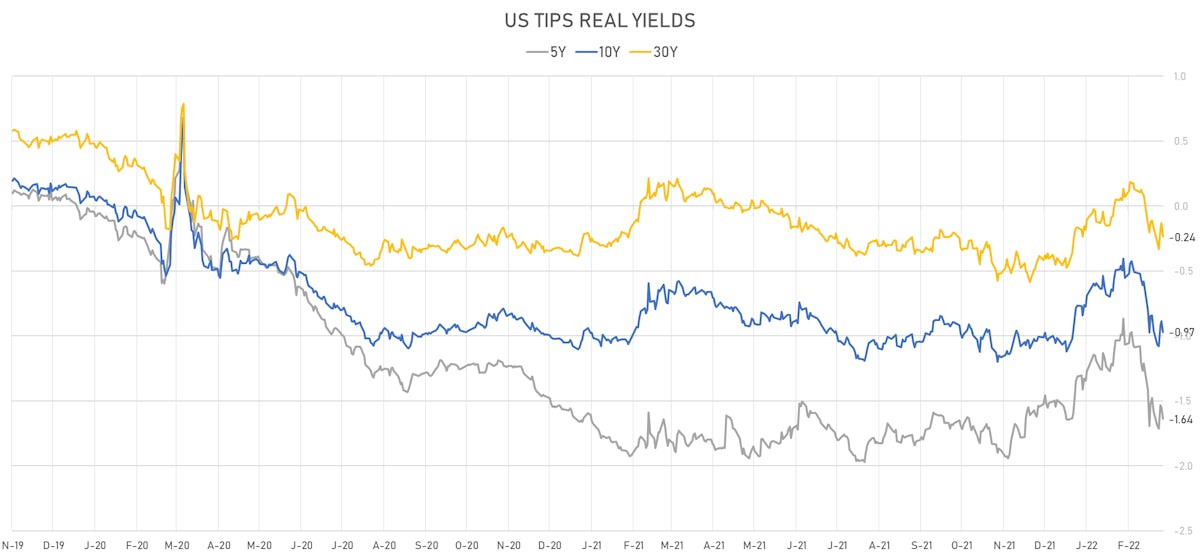

- US 5-Year TIPS Real Yield: -8.6 bp at -1.6370%; 10-Year TIPS Real Yield: -8.3 bp at -0.9690%; 30-Year TIPS Real Yield: -10.7 bp at -0.2370%

US MACRO RELEASES

- University of Michigan, Current Conditions Index-prelim, Volume Index for Mar 2022 (UMICH, Survey) at 67.80 (vs 68.20 prior), above consensus estimate of 66.00

- University of Michigan, Total-prelim, Volume Index for Mar 2022 (UMICH, Survey) at 54.40 (vs 59.40 prior), below consensus estimate of 58.80

- University of Michigan, Total-prelim, Volume Index for Mar 2022 (UMICH, Survey) at 59.70 (vs 62.80 prior), below consensus estimate of 61.40

- 1 Year Inflation Expectations (median), preliminary for Mar 2022 (UMICH, Survey) at 5.40 % (vs 4.90 % prior)

- University of Michigan, Total-prelim, Change Y/Y for Mar 2022 (UMICH, Survey) at 3.00 % (vs 3.00 % prior)

MARCH 2022 FOMC PREVIEW

MARKET OUTLOOK

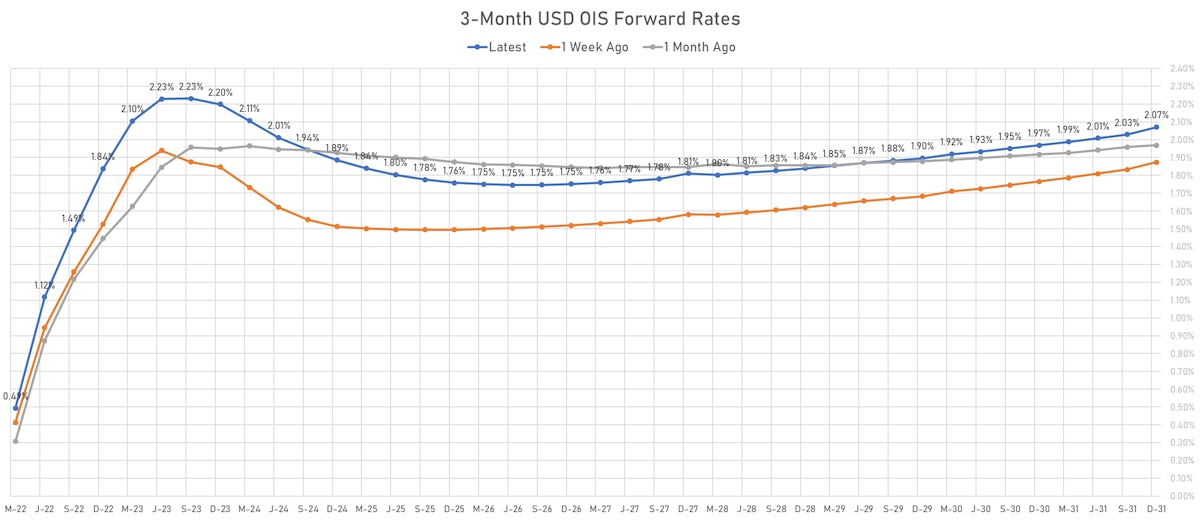

- Looking at Fed Funds futures and 1m OIS forwards, expectations are that the Fed will lift rates by 25bp on Wednesday

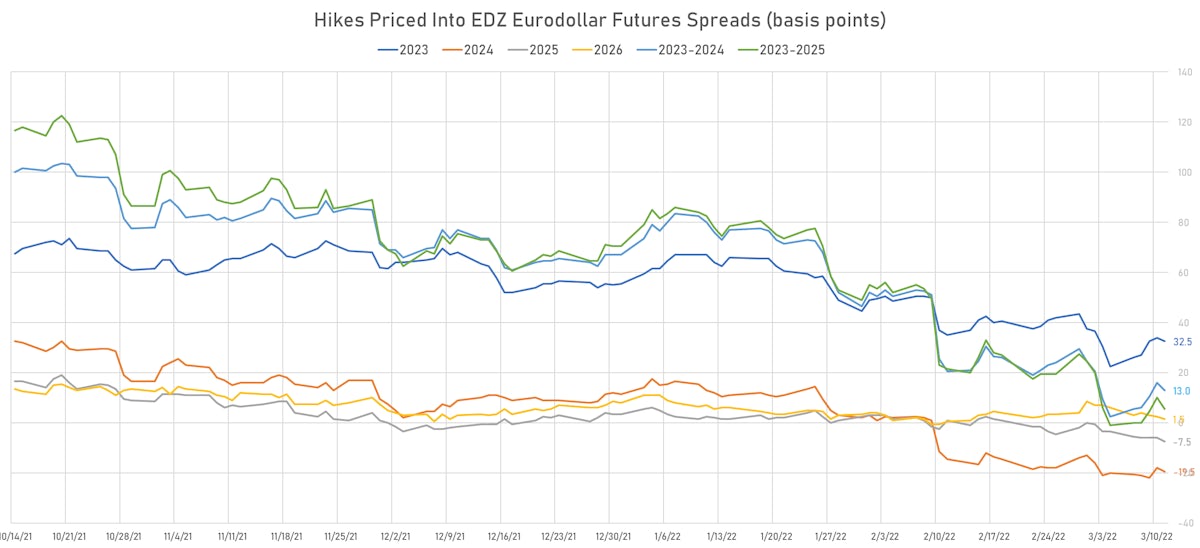

- Money markets price in 6.5 hikes for the full year, with the Fed expected to keep raising rates by 25bp at every remaining FOMC this year in a pretty linear way (with a tilt towards more in the short term, fewer at the end of the year)

- Eurodollar futures price in a single hike next year and a rate cut in 2024 (reversal of policy mistake)

- The Fed will provide updated economic forecasts, and a revised dot plot, which should show 6 hikes this year, 4 hikes next year and possibly one more hike in 2024 to reach a policy rate of 2.75%-3.00%

SELECTION OF PRIMARY DEALERS' FORECASTS

- Barclays: 5 hikes in 2022, 2 hikes in 2023

- BofA Merrill Lynch: 7 hikes in 2022

- Citi: 8 hikes in 2022

- Credit Suisse: 7 hikes in 2022, 4 hikes in 2023

- Deutsche Bank: 7 hikes in 2022, 4 hikes in 2023

- Goldman Sachs: 7 hikes in 2022, 4 hikes in 2023

- JP Morgan: 7 hikes in 2022

- Morgan Stanley: 6 hikes in 2022, 6 hikes in 2023

- Wells Fargo: 5 hikes in 2022, 3 hikes in 2023

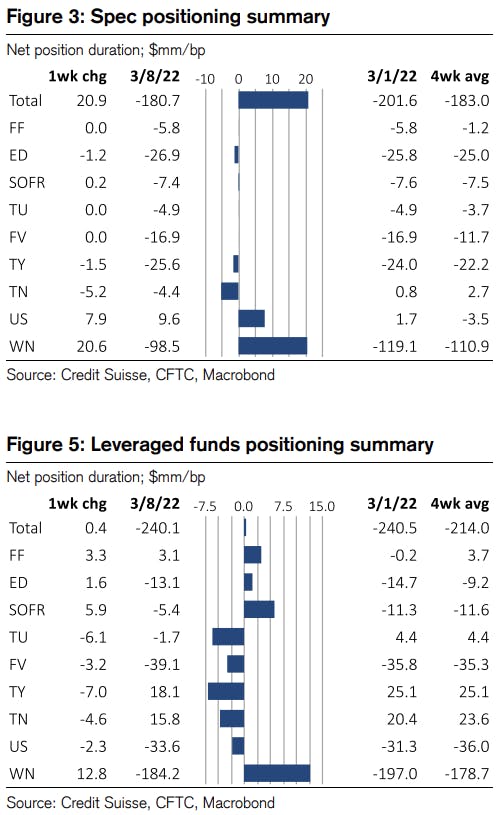

WEEKLY CFTC NET DURATION POSITIONING

- Specs reduced their net short duration, mostly at the long end

- Leveraged Funds didn't change their net short duration, reduced net short 30s while they went net short in 2s, increased net short in 5s and reduced net long in 10s

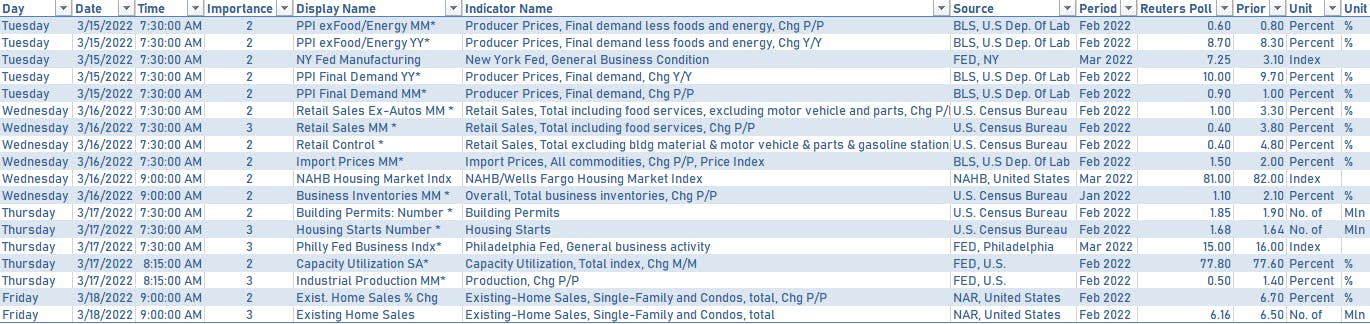

US MACRO RELEASES IN WEEK AHEAD

US FORWARD RATES

- Fed Funds futures now price in 26.3bp of Fed hikes by the end of March 2022, 63.6bp (2.54 x 25bp hikes) by the end of May 2022, and price in 6.71 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 32.5 bp of hikes in 2023 (equivalent to 1.3 x 25 bp hikes), down -1.5 bp today, and -19.5 bp of hikes in 2024 (equivalent to 0.8 x 25 bp rate cut)

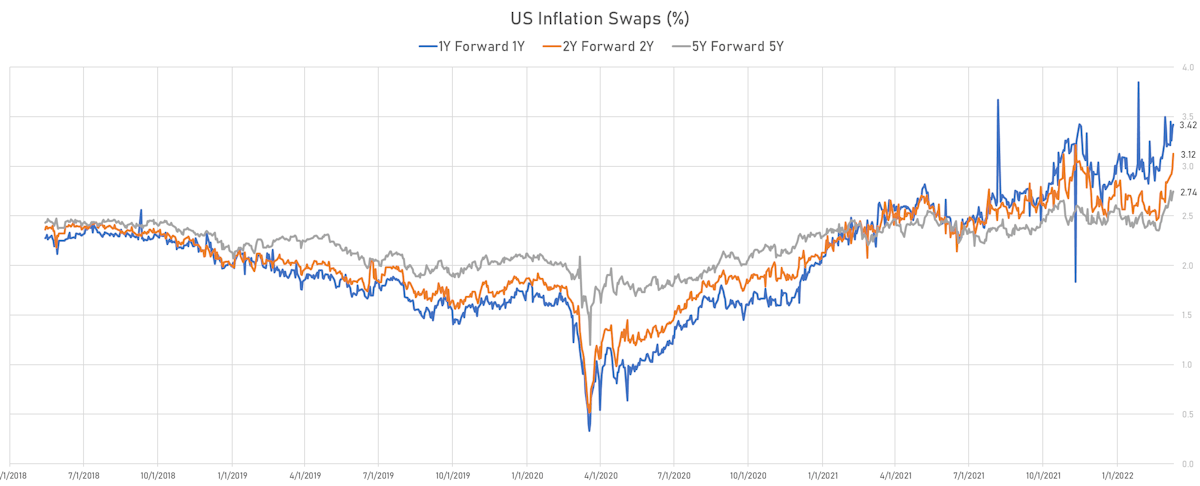

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.91% (up 27.2bp); 2Y at 4.71% (up 25.4bp); 5Y at 3.50% (up 11.9bp); 10Y at 2.97% (up 8.6bp); 30Y at 2.59% (up 8.8bp)

- 6-month spot US CPI swap up 54.4 bp to 5.814%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.6370%, -8.6 bp today; 10Y at -0.9690%, -8.3 bp today; 30Y at -0.2370%, -10.7 bp today

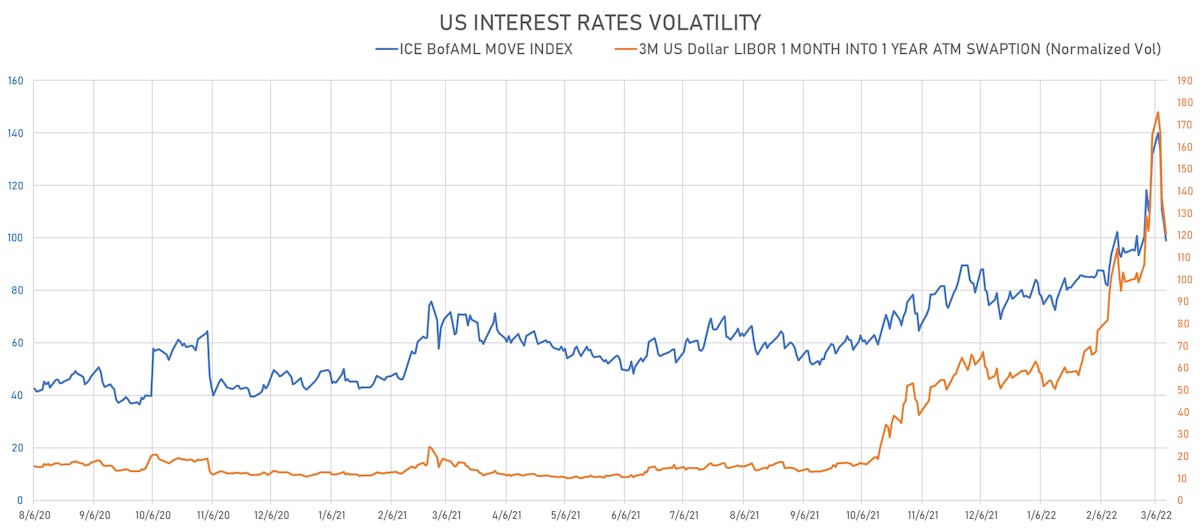

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -8.4 vols at 120.4 normals

- 3-Month LIBOR-OIS spread up 3.6 bp at 35.2 bp (12-months range: -5.5-35.2 bp)

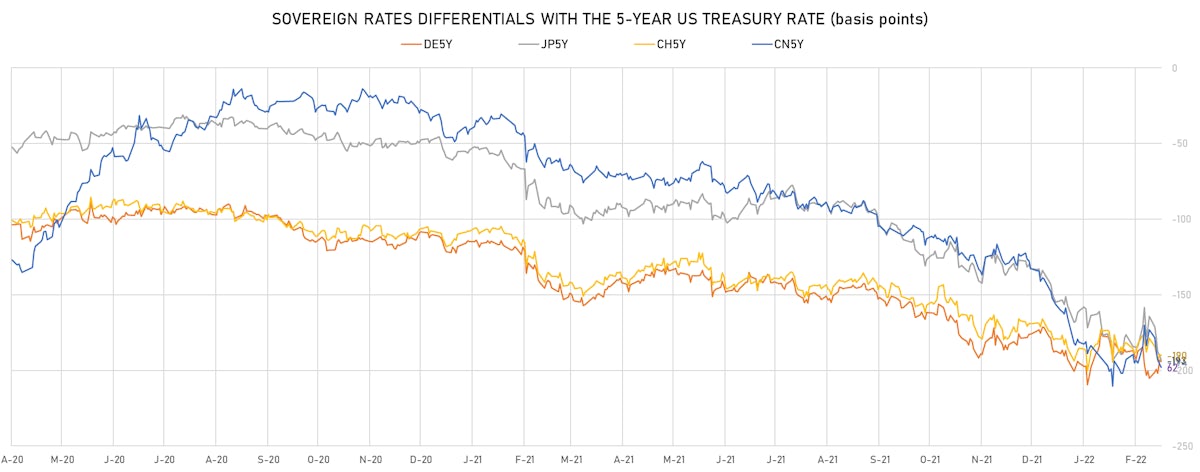

KEY INTERNATIONAL RATES

- Germany 5Y: -0.016% (up 1.4 bp); the German 1Y-10Y curve is unchanged at 87.6bp (YTD change: +46.9 bp)

- Japan 5Y: 0.021% (unchanged); the Japanese 1Y-10Y curve is 0.5 bp flatter at 25.6bp (YTD change: +9.7 bp)

- China 5Y: 2.574% (up 0.1 bp); the Chinese 1Y-10Y curve is 3.7 bp flatter at 70.1bp (YTD change: +19.1 bp)

- Switzerland 5Y: 0.048% (up 1.9 bp); the Swiss 1Y-10Y curve is 12.3 bp flatter at 86.6bp (YTD change: +30.1 bp)