Rates

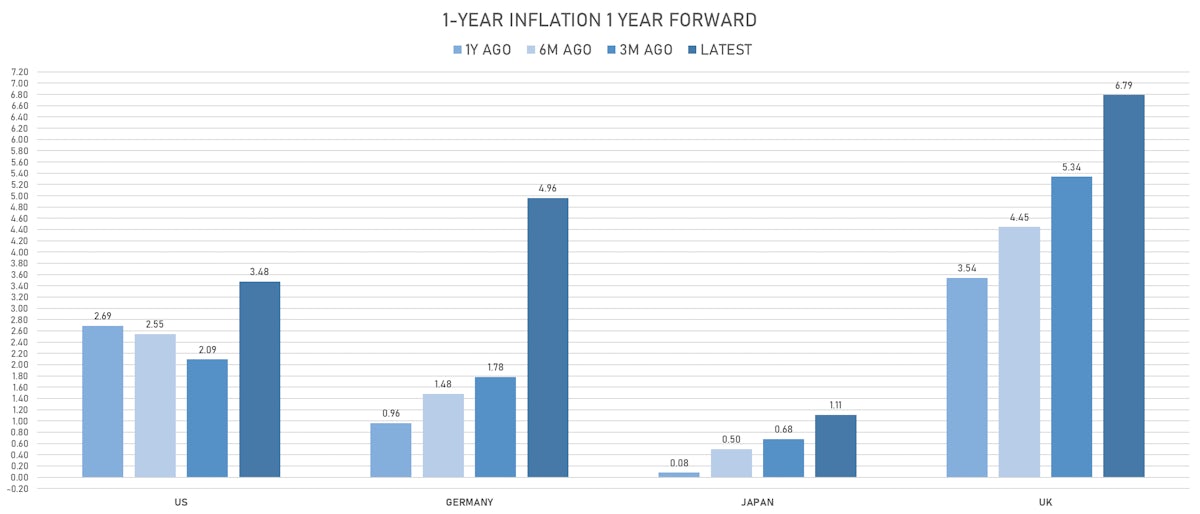

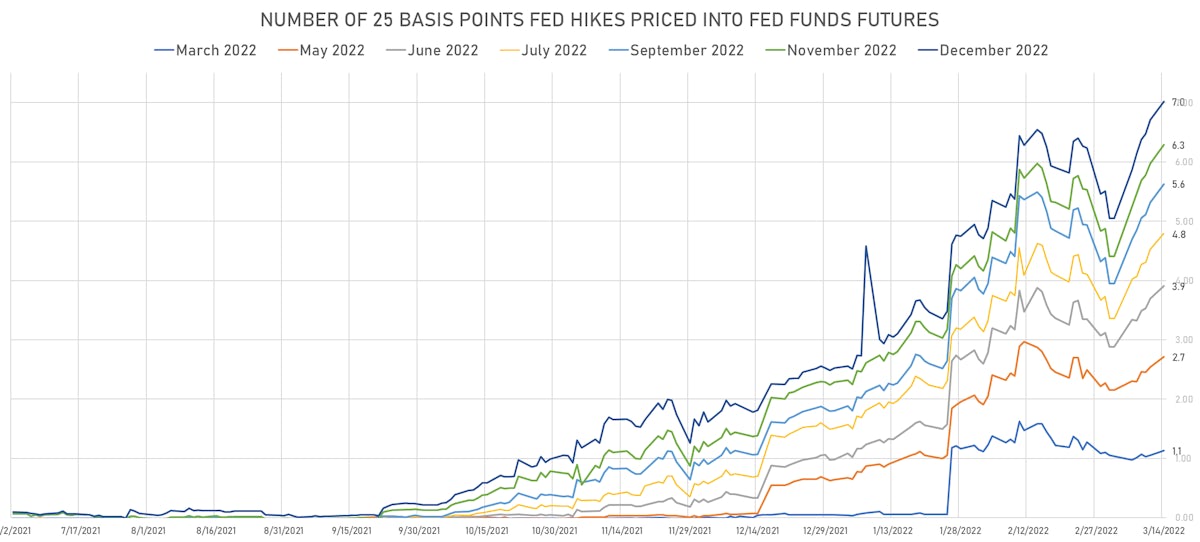

Significant Rise In Front-End Yields, With Fed Funds Futures Now Pricing In Over Seven 25bp Hikes This Year

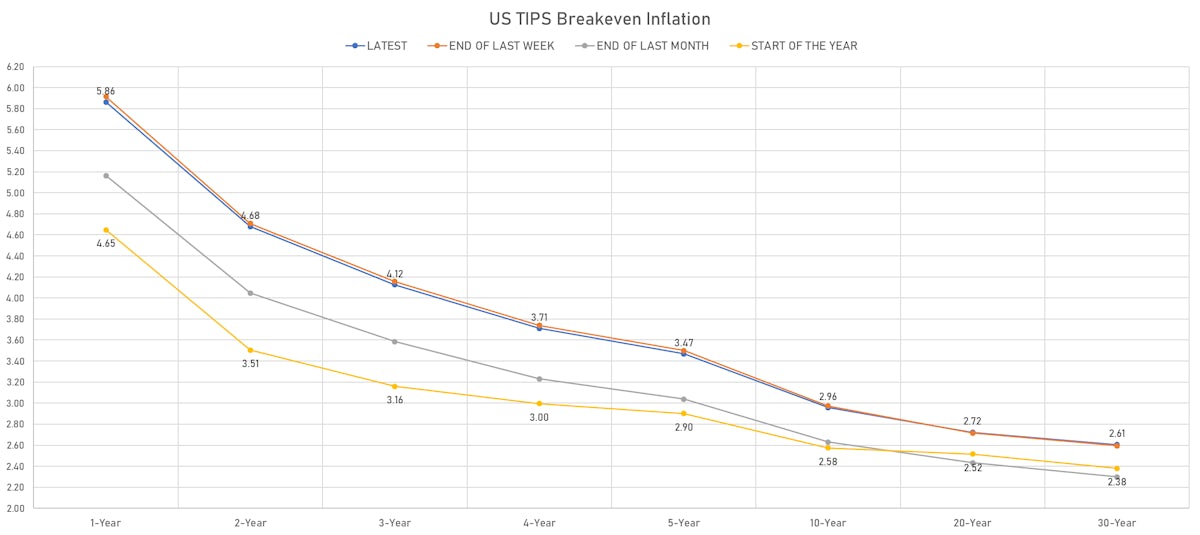

Breakevens have been coming down over the last couple of sessions, in line with the drop in the prices of commodities most impacted by the war (TTF natural gas, palladium, crude oil, etc.)

Published ET

2022 Fed Hikes Implied From Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

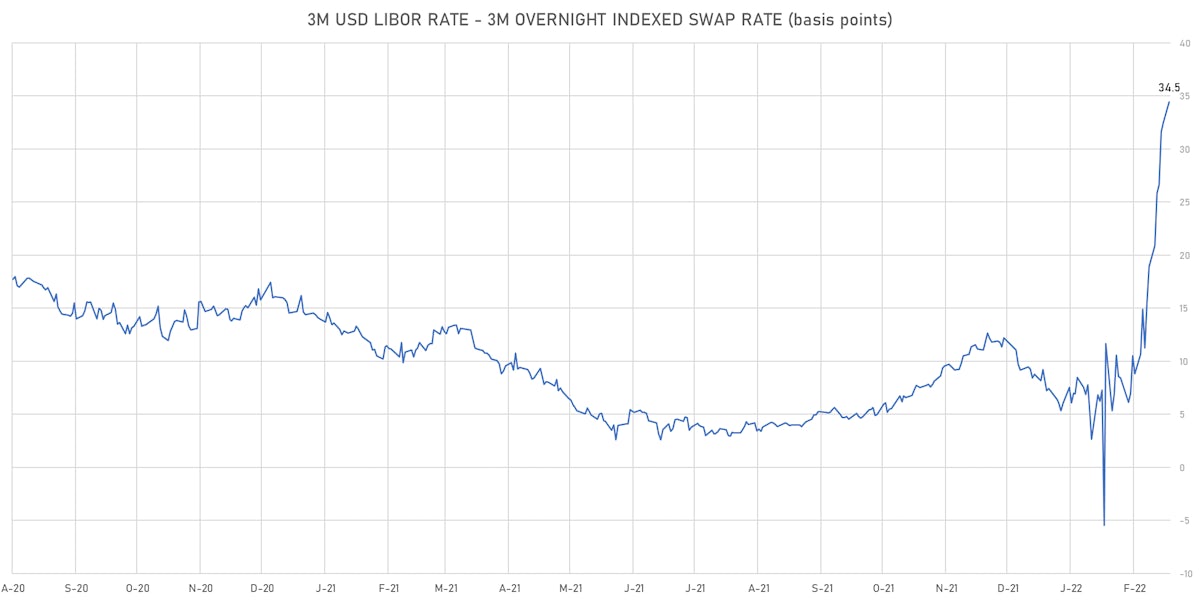

- 3-Month USD LIBOR +5.9bp today, now at 0.8850%; 3-Month OIS +4.0bp at 0.5405%

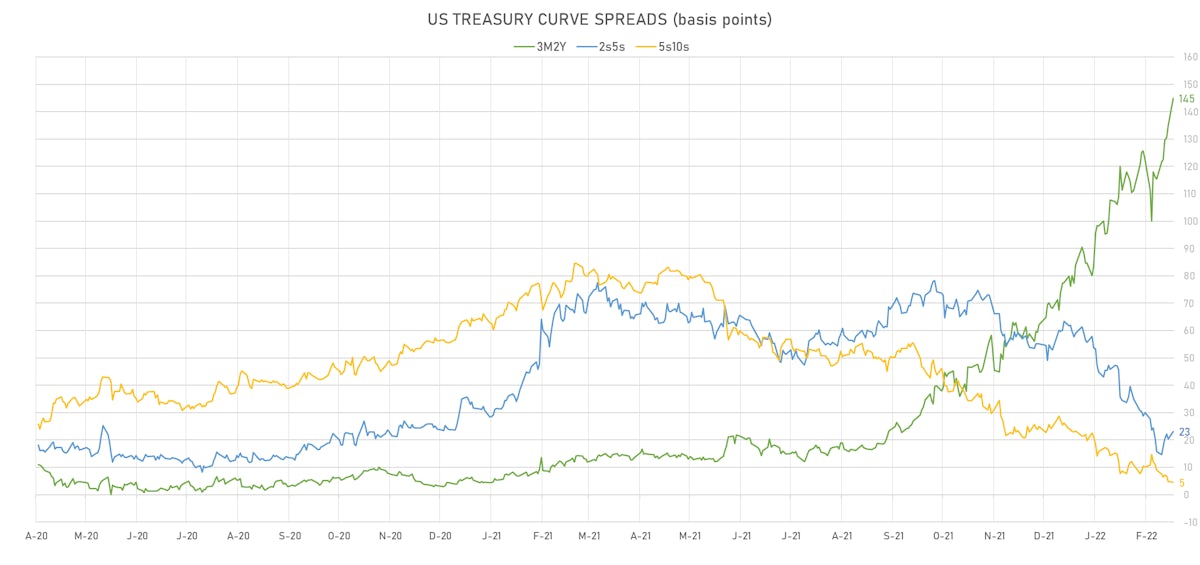

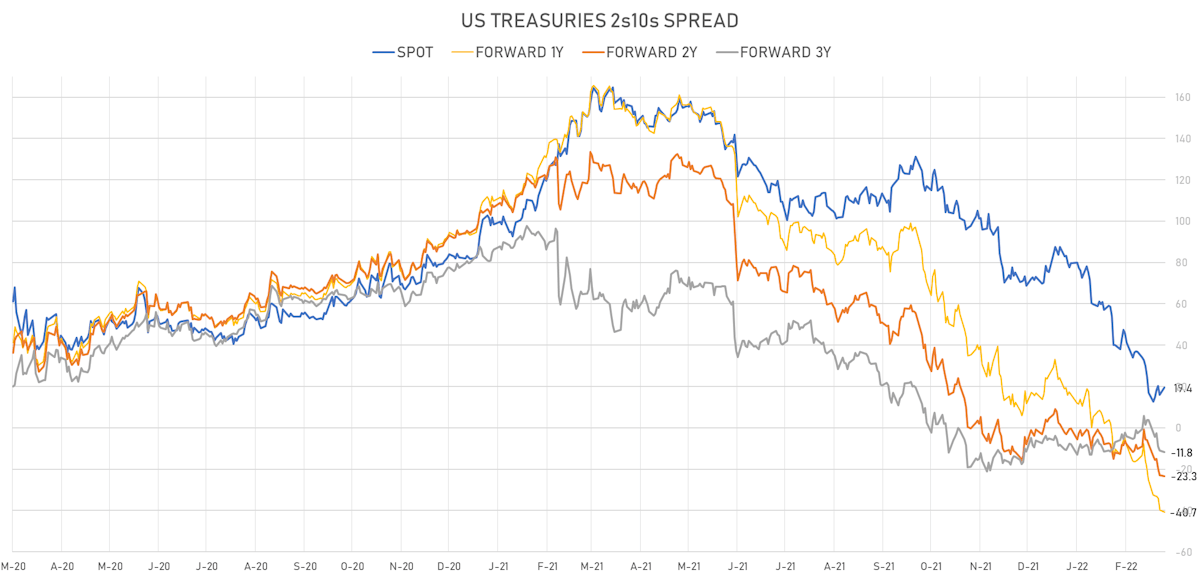

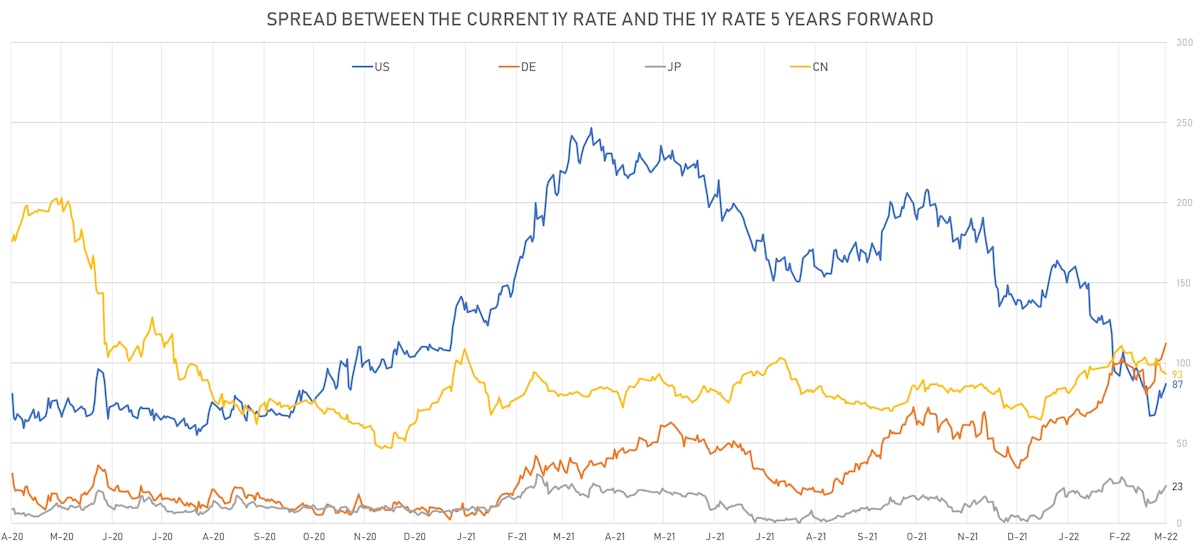

- The treasury yield curve steepened, with the 1s10s spread widening 8.0 bp, now at 91.6 bp (YTD change: -21.6bp)

- 1Y: 1.2247% (up 6.5 bp)

- 2Y: 1.8640% (up 11.9 bp)

- 5Y: 2.0958% (up 14.7 bp)

- 7Y: 2.1532% (up 15.4 bp)

- 10Y: 2.1410% (up 14.5 bp)

- 30Y: 2.4799% (up 12.7 bp)

- US treasury curve spreads: 3m2Y at 144.9bp (up 9.9bp today), 2s5s at 23.2bp (up 2.8bp), 5s10s at 4.5bp (down -0.2bp), 10s30s at 33.9bp (down -1.8bp)

- Treasuries butterfly spreads: 1s5s10s at -84.4bp (down -7.4bp), 5s10s30s at 28.8bp (down -1.7bp)

- TIPS 1Y breakeven inflation at 5.86% (down -5.2bp); 2Y at 4.68% (down -2.9bp); 5Y at 3.47% (down -3.1bp); 10Y at 2.96% (down -1.6bp); 30Y at 2.61% (up 1.1bp)

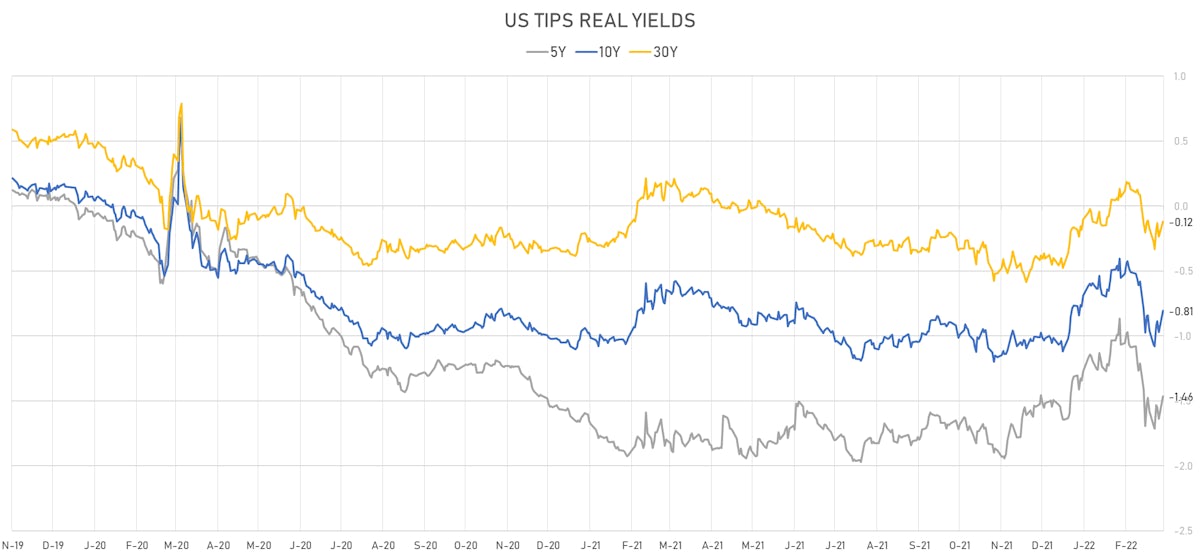

- US 5-Year TIPS Real Yield: +17.3 bp at -1.4640%; 10-Year TIPS Real Yield: +16.2 bp at -0.8070%; 30-Year TIPS Real Yield: +11.6 bp at -0.1210%

GLOBAL MACRO RELEASES

- Czech Republic, Retail Sales, Retail trade (incl. retail sale of automotive fuel), Change Y/Y for Jan 2022 (CSU, Czech Rep) at 9.60 % (vs 3.30 % prior), above consensus estimate of 9.00 %

- India, CPI, Rural and urban, General, Change Y/Y, Price Index for Feb 2022 (MOSPI, India) at 6.07 % (vs 6.01 % prior), above consensus estimate of 5.93 %

- India, Wholesale Prices, Change Y/Y, Price Index for Feb 2022 (Econ Adviser, India) at 13.11 % (vs 12.96 % prior), above consensus estimate of 12.10 %

- Romania, CPI, All Items, Change Y/Y, Price Index for Feb 2022 (NIS, Romania) at 8.53 % (vs 8.35 % prior), below consensus estimate of 8.95 %

- Russia, Trade Balance, Total, Free On Board, Current Prices for Jan 2022 (Central Bank, Russia) at 21.17 Bln USD (vs 26.72 Bln USD prior)

- Spain, Retail Sales, Turnover, Change Y/Y for Jan 2022 (INE, Spain) at 4.00 % (vs -2.30 % prior)

- Sweden, CPI, All Items, Change P/P, Price Index for Feb 2022 (SCB, Sweden) at 0.90 % (vs -0.50 % prior), above consensus estimate of 0.50 %

- Sweden, CPI, All Items, Change Y/Y, Price Index for Feb 2022 (SCB, Sweden) at 4.30 % (vs 3.70 % prior), above consensus estimate of 3.90 %

- Sweden, CPI, Underlying inflation CPIF, Change P/P, Price Index for Feb 2022 (SCB, Sweden) at 0.90 % (vs -0.50 % prior), above consensus estimate of 0.40 %

- Sweden, CPI, Underlying inflation CPIF, Change Y/Y, Price Index for Feb 2022 (SCB, Sweden) at 4.50 % (vs 3.90 % prior), above consensus estimate of 4.10 %

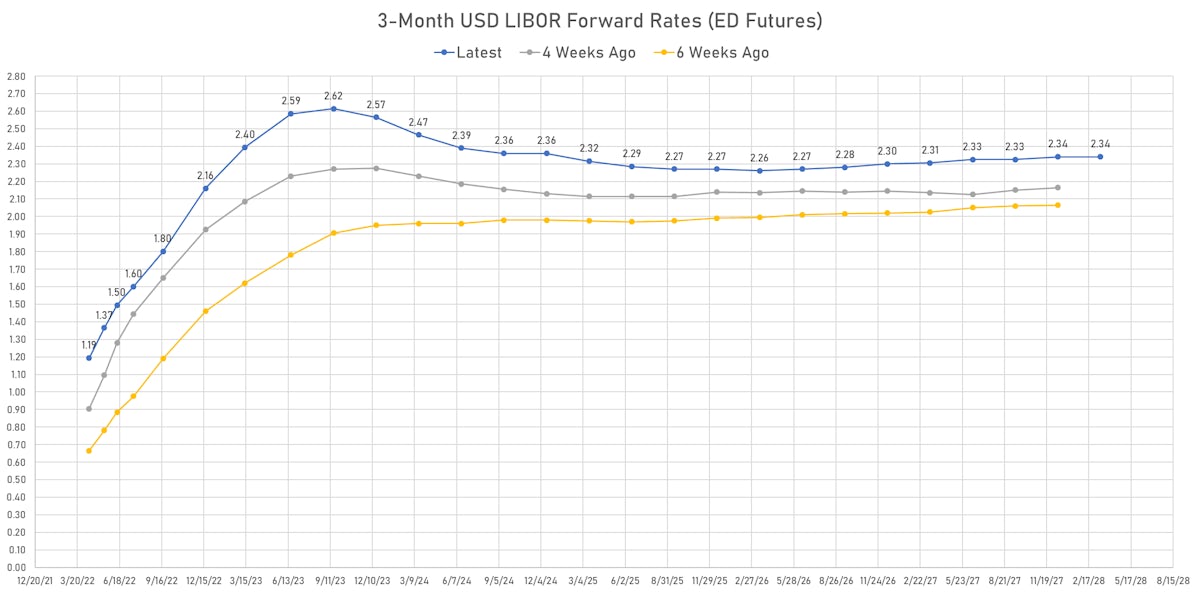

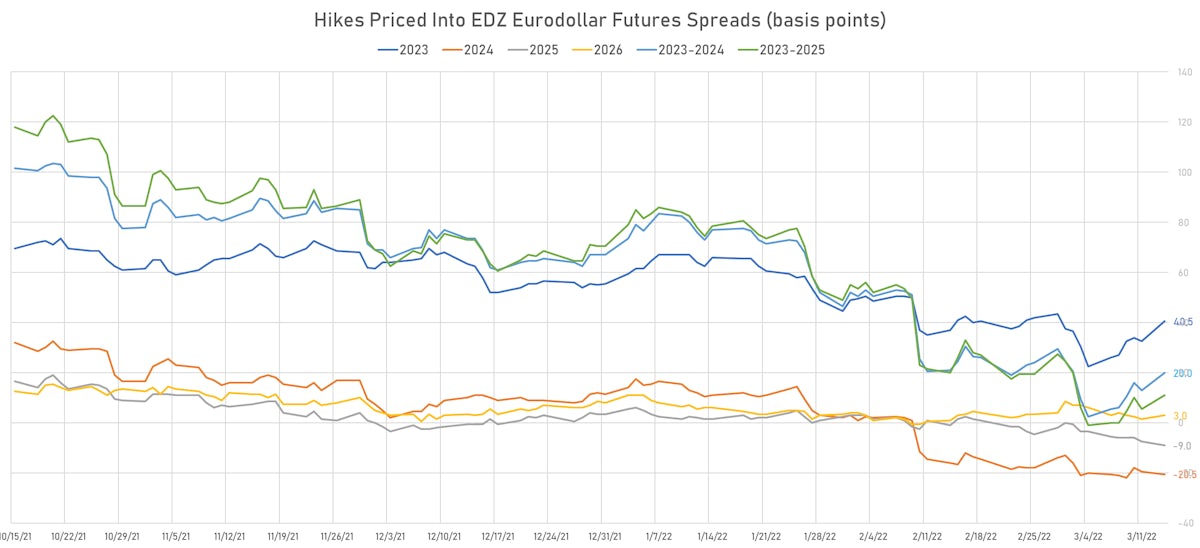

US FORWARD RATES

- Fed Funds futures now price in 28.3bp of Fed hikes by the end of March 2022, 67.9bp (2.71 x 25bp hikes) by the end of May 2022, and price in 7.02 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 40.5 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), up 8.0 bp today, and -20.5 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.86% (down -5.2bp); 2Y at 4.68% (down -2.9bp); 5Y at 3.47% (down -3.1bp); 10Y at 2.96% (down -1.6bp); 30Y at 2.61% (up 1.1bp)

- 6-month spot US CPI swap up 5.7 bp to 5.871%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.4640%, +17.3 bp today; 10Y at -0.8070%, +16.2 bp today; 30Y at -0.1210%, +11.6 bp today

RATES VOLATILITY & LIQUIDITY

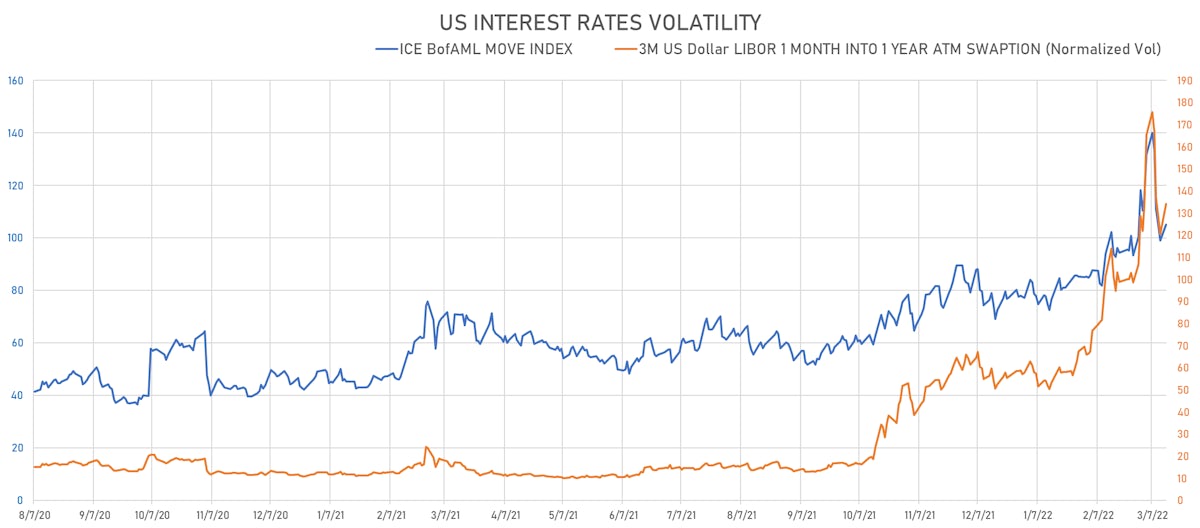

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 13.8 vols at 134.2 normals

- 3-Month LIBOR-OIS spread up 2.0 bp at 34.5 bp (12-months range: -5.5-34.5 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.081% (up 8.5 bp); the German 1Y-10Y curve is 13.3 bp steeper at 102.6bp (YTD change: +60.2 bp)

- Japan 5Y: 0.039% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 28.1bp (YTD change: +10.2 bp)

- China 5Y: 2.476% (down -9.8 bp); the Chinese 1Y-10Y curve is 2.4 bp flatter at 67.7bp (YTD change: +16.7 bp)

- Switzerland 5Y: 0.092% (up 4.4 bp); the Swiss 1Y-10Y curve is 4.6 bp steeper at 91.2bp (YTD change: +34.7 bp)