Rates

Slight Drop In Front-End Yields After Weaker Than Expected PPI, NY Fed Business Conditions Index

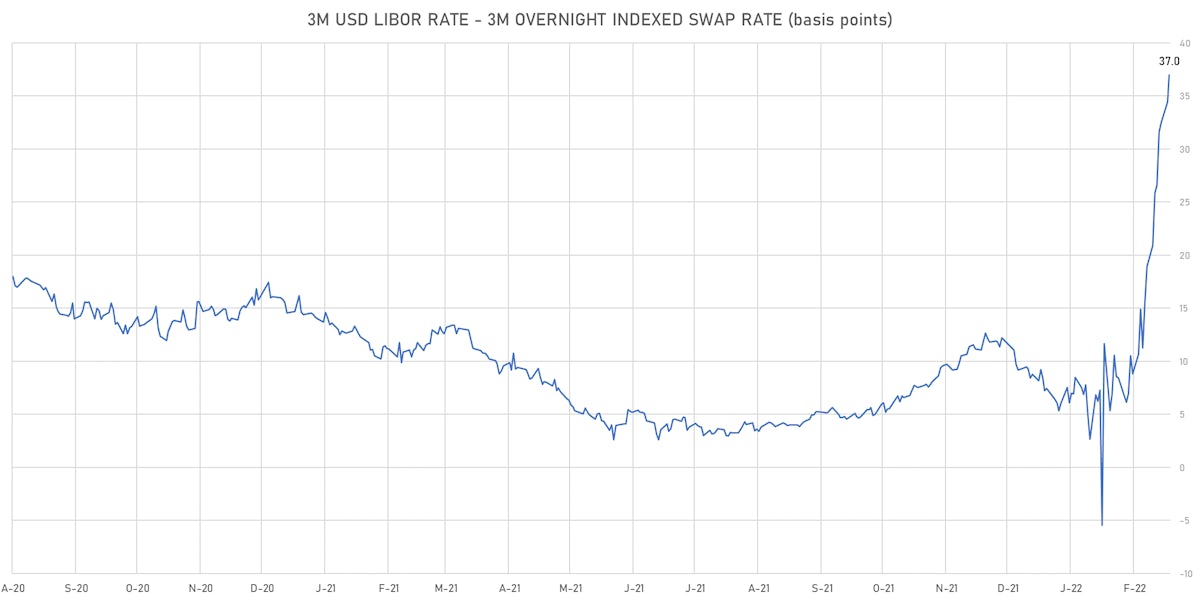

As the Fed finally gets to raising rates, Jim Reid (Deutsche Bank) points out that since the end of Bretton Woods every single hiking cycle came with a financial crisis somewhere in the world (vague but worth keeping an eye on, especially with the current tension in LIBOR-OIS)

Published ET

Fed Funds Rate Hiking Cycles And Financial Crises | Source: Deutsche Bank

QUICK US SUMMARY

- 3-Month USD LIBOR +3.1bp today, now at 0.9160%; 3-Month OIS +0.6bp at 0.5465%

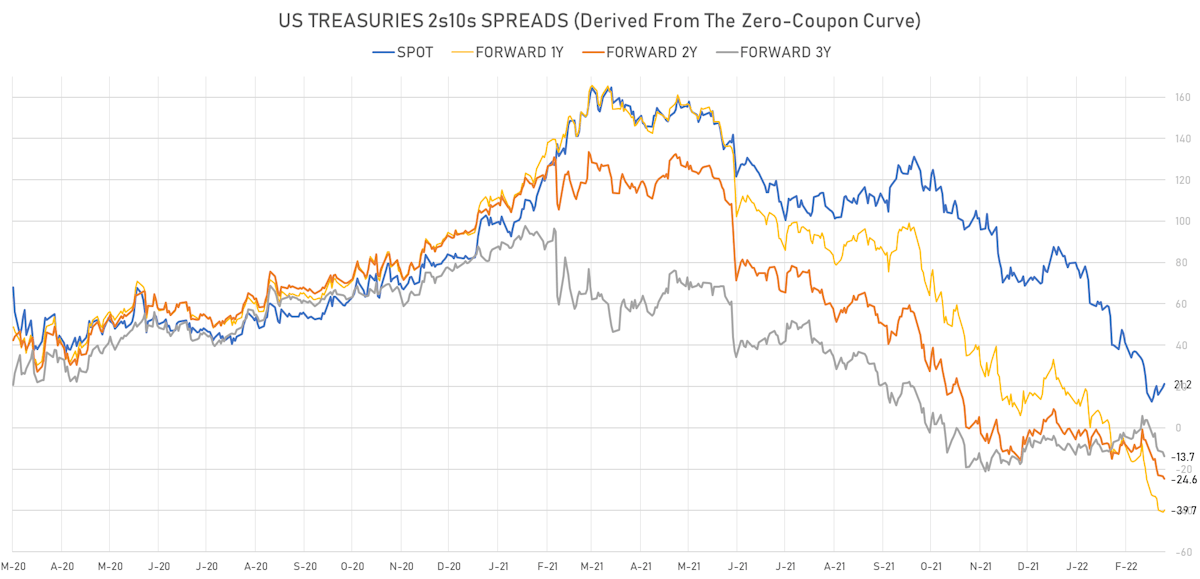

- The treasury yield curve steepened, with the 1s10s spread widening 3.6 bp, now at 94.3 bp (YTD change: -18.9bp)

- 1Y: 1.2041% (down 2.8 bp)

- 2Y: 1.8491% (down 1.4 bp)

- 5Y: 2.1051% (up 1.0 bp)

- 7Y: 2.1606% (up 0.7 bp)

- 10Y: 2.1473% (up 0.7 bp)

- 30Y: 2.4830% (up 0.3 bp)

- US treasury curve spreads: 3m2Y at 137.7bp (down -6.4bp today), 2s5s at 25.6bp (up 2.2bp), 5s10s at 4.2bp (down -0.5bp), 10s30s at 33.6bp (down -0.4bp)

- Treasuries butterfly spreads: 1s5s10s at -87.2bp (down -2.8bp), 5s10s30s at 29.1bp (up 0.3bp)

- TIPS 1Y breakeven inflation at 5.76% (down -10.5bp); 2Y at 4.59% (down -8.7bp); 5Y at 3.40% (down -7.4bp); 10Y at 2.86% (down -9.6bp); 30Y at 2.51% (down -9.1bp)

- US 5-Year TIPS Real Yield: +8.3 bp at -1.3810%; 10-Year TIPS Real Yield: +10.3 bp at -0.7040%; 30-Year TIPS Real Yield: +9.5 bp at -0.0260%

US MACRO RELEASES MOSTLY SOFTER THAN EXPECTED TODAY

- Chain Store Sales, Johnson Redbook Index, yoy% index, Change Y/Y for W 12 Mar (Redbook Research) at 12.60 % (vs 13.10 % prior)

- Net flows total, Current Prices for Jan 2022 (U.S. Dept. Treas.) at 294.20 Bln USD (vs -52.40 Bln USD prior)

- Net foreign acquisition of long-term securities, Current Prices for Jan 2022 (U.S. Dept. Treas.) at 65.40 Bln USD (vs 101.90 Bln USD prior)

- Net purchases (net long-term capital inflows), total, Current Prices for Jan 2022 (U.S. Dept. Treas.) at 58.80 Bln USD (vs 114.50 Bln USD prior)

- Net purchases of U.S. treasury bonds & notes, total net foreign purchases, Current Prices for Jan 2022 (U.S. Dept. Treas.) at 74.40 Bln USD (vs 44.20 Bln USD prior)

- New York Fed, General Business Condition for Mar 2022 (FED, NY) at -11.80 (vs 3.10 prior), below consensus estimate of 7.00

- PPI ex Food/Energy/Trade MM, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.20 % (vs 0.90 % prior)

- PPI ex Food/Energy/Trade YY, Change Y/Y, Price Index for Feb 2022 (BLS, U.S Dep. Of Lab) at 6.60 % (vs 6.90 % prior)

- Producer Prices, Final demand less foods and energy, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.20 % (vs 0.80 % prior), below consensus estimate of 0.60 %

- Producer Prices, Final demand less foods and energy, Change Y/Y for Feb 2022 (BLS, U.S Dep. Of Lab) at 8.40 % (vs 8.30 % prior), below consensus estimate of 8.70 %

- Producer Prices, Final demand, Change P/P for Feb 2022 (BLS, U.S Dep. Of Lab) at 0.80 % (vs 1.00 % prior), below consensus estimate of 0.90 %

- Producer Prices, Final demand, Change Y/Y for Feb 2022 (BLS, U.S Dep. Of Lab) at 10.00 % (vs 9.70 % prior), below consensus estimate of 10.00 %

GLOBAL MACRO RELEASES

- Canada, Housing Starts, All areas for Feb 2022 (CMHC, Canada) at 247.30 k (vs 230.80 k prior), above consensus estimate of 238.00 k

- Euro Zone, Financial Account, Assets, Official reserve assets, all currencies except national currency, Current Prices for Feb 2022 (ECB) at 1,091.82 Bln EUR (vs 1,056.84 Bln EUR prior)

- Finland, Official reserve assets, Current Prices for Feb 2022 (Bank of Finland) at 14,821.00 Mln EUR (vs 14,811.00 Mln EUR prior)

- France, HICP, Change Y/Y, Price Index for Feb 2022 (INSEE, France) at 4.20 % (vs 4.10 % prior), above consensus estimate of 4.10 %

- France, HICP, Final, Change P/P, Price Index for Feb 2022 (INSEE, France) at 0.90 % (vs 0.80 % prior), above consensus estimate of 0.80 %

- Germany, ZEW, Current Economic Situation, Germany, balance for Mar 2022 (ZEW, Germany) at -21.40 (vs -8.10 prior), above consensus estimate of -22.50

- Germany, ZEW, Economic Expectations, Germany, balance for Mar 2022 (ZEW, Germany) at -39.30 (vs 54.30 prior), below consensus estimate of 10.00

- Indonesia, Trade Balance, Current Prices for Feb 2022 (Statistics Indonesia) at 3.82 Bln USD (vs 0.93 Bln USD prior), above consensus estimate of 1.66 Bln USD

- Japan, Exports, Change Y/Y for Feb 2022 (MoF, Japan) at 19.10 % (vs 9.60 % prior), below consensus estimate of 21.00 %

- Japan, Imports, Change Y/Y for Feb 2022 (MoF, Japan) at 34.00 % (vs 39.60 % prior), above consensus estimate of 28.00 %

- Japan, Trade Balance, Current Prices for Feb 2022 (MoF, Japan) at -668.30 Bln JPY (vs -2191.10 Bln JPY prior), below consensus estimate of -112.60 Bln JPY

- New Zealand, Milk Auction, Average Price, Constant Prices for W 15 Mar (GlobalDairy Trade) at 5,039.00 USD (vs 5,065.00 USD prior)

- Poland, CPI, Change P/P, Price Index for Feb 2022 (CSO, Poland) at -0.30 % (vs 0.00 % prior), above consensus estimate of -0.40 %

- Poland, CPI, Change Y/Y, Price Index for Feb 2022 (CSO, Poland) at 8.50 % (vs 0.00 % prior), above consensus estimate of 8.10 %

- United Kingdom, Unemployment, Claimant count, Absolute change for Feb 2022 (ONS, United Kingdom) at -48.10 k (vs -31.90 k prior)

- United Kingdom, Unemployment, Rate, All aged 16 and over, ILO for Jan 2022 (ONS, United Kingdom) at 3.90 % (vs 4.10 % prior), below consensus estimate of 4.00 %

US FORWARD RATES

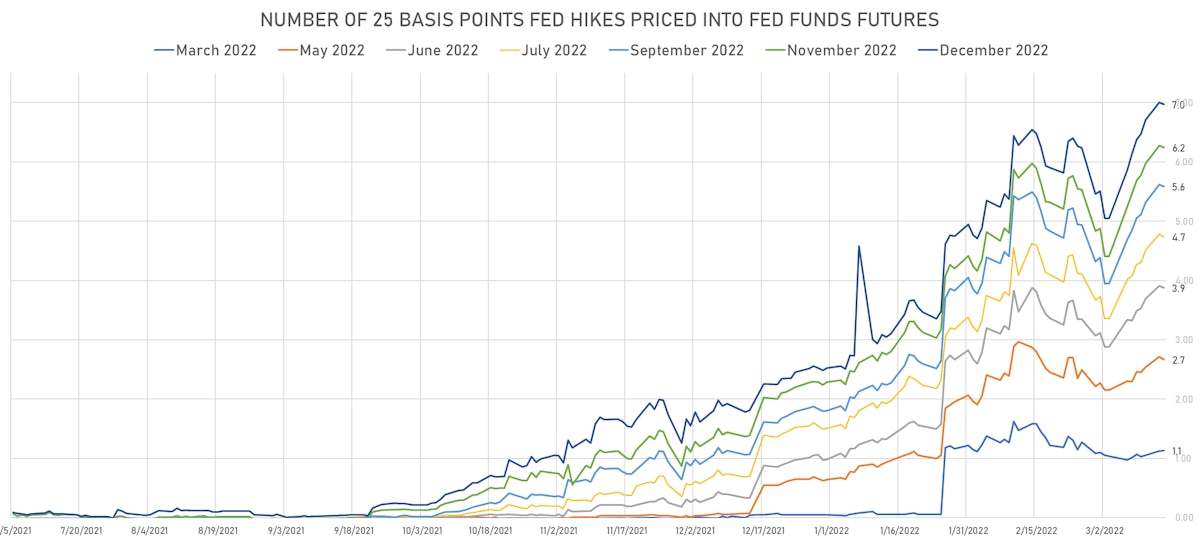

- Fed Funds futures now price in 28.3bp of Fed hikes by the end of March 2022, 66.7bp (2.67 x 25bp hikes) by the end of May 2022, and price in 6.97 hikes by the end of December 2022

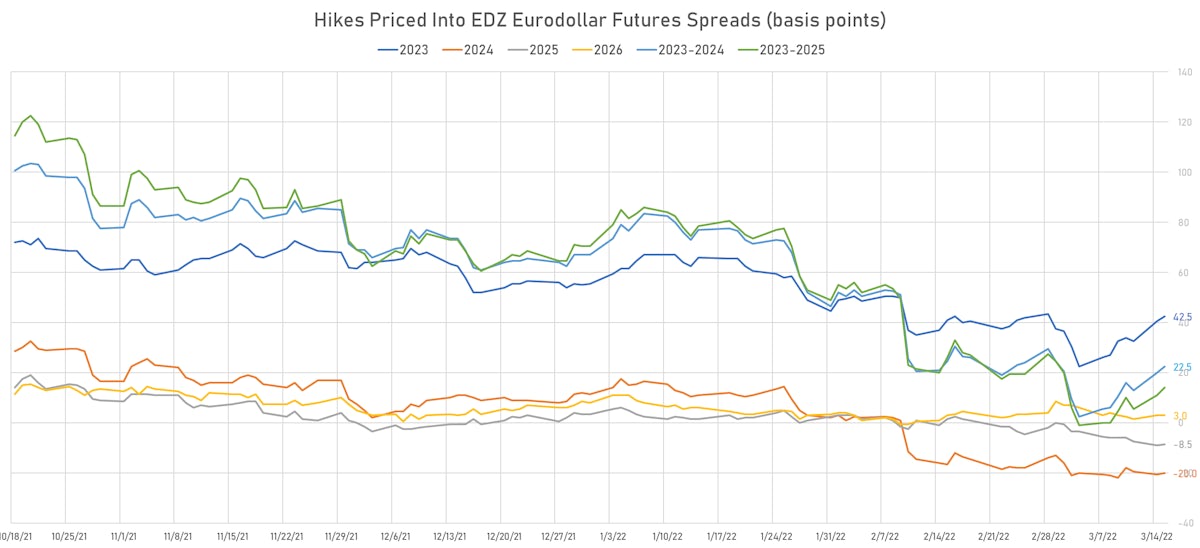

- 3-month Eurodollar futures (EDZ) spreads price in 42.5 bp of hikes in 2023 (equivalent to 1.7 x 25 bp hikes), up 2.0 bp today, and -20.0 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

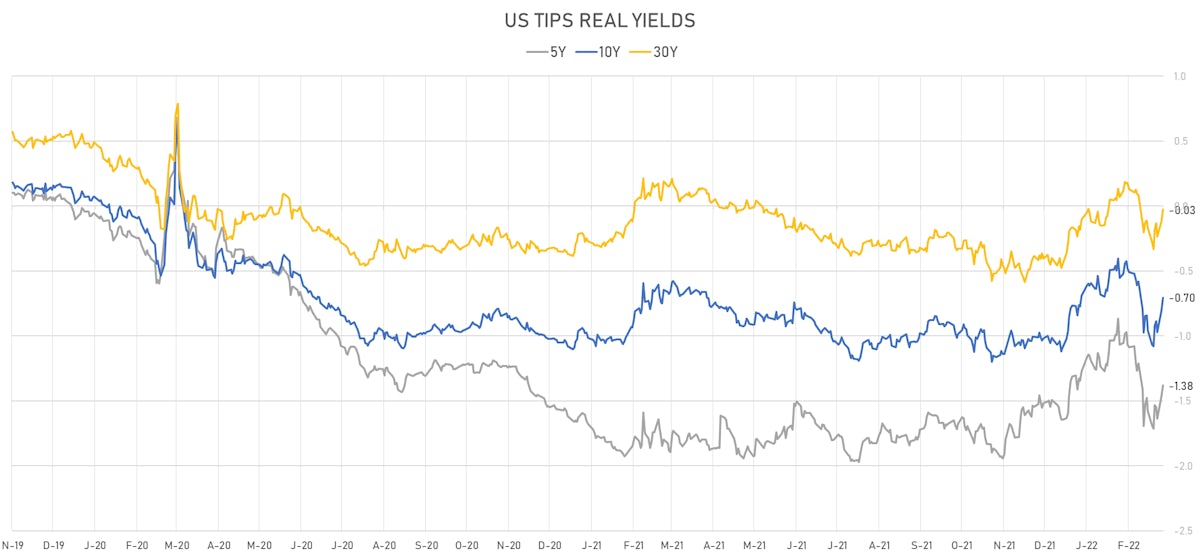

US INFLATION & REAL RATES

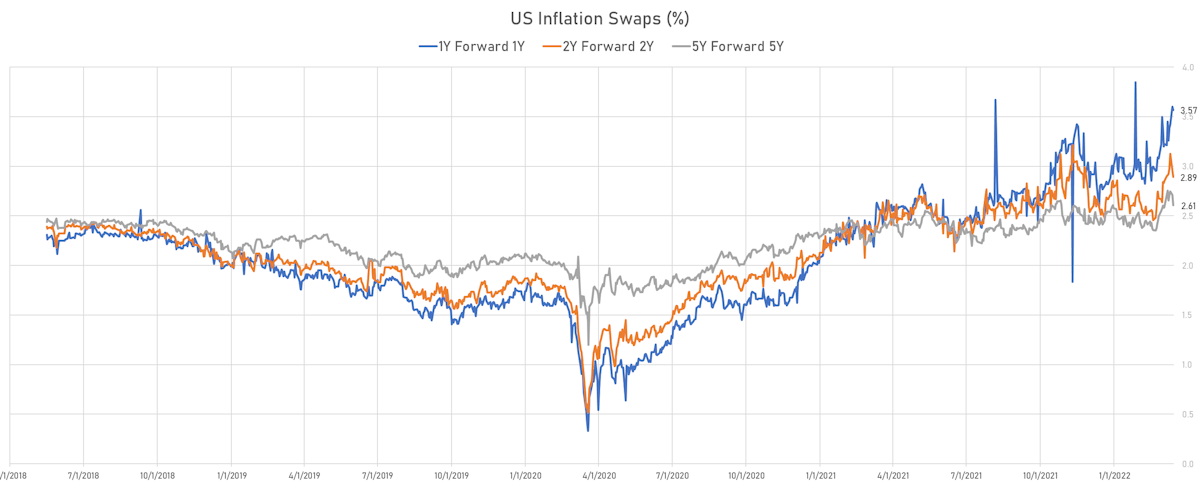

- TIPS 1Y breakeven inflation at 5.76% (down -10.5bp); 2Y at 4.59% (down -8.7bp); 5Y at 3.40% (down -7.4bp); 10Y at 2.86% (down -9.6bp); 30Y at 2.51% (down -9.1bp)

- 6-month spot US CPI swap down -10.9 bp to 5.762%, with a flattening of the forward curve

- US Real Rates: 5Y at -1.3810%, +8.3 bp today; 10Y at -0.7040%, +10.3 bp today; 30Y at -0.0260%, +9.5 bp today

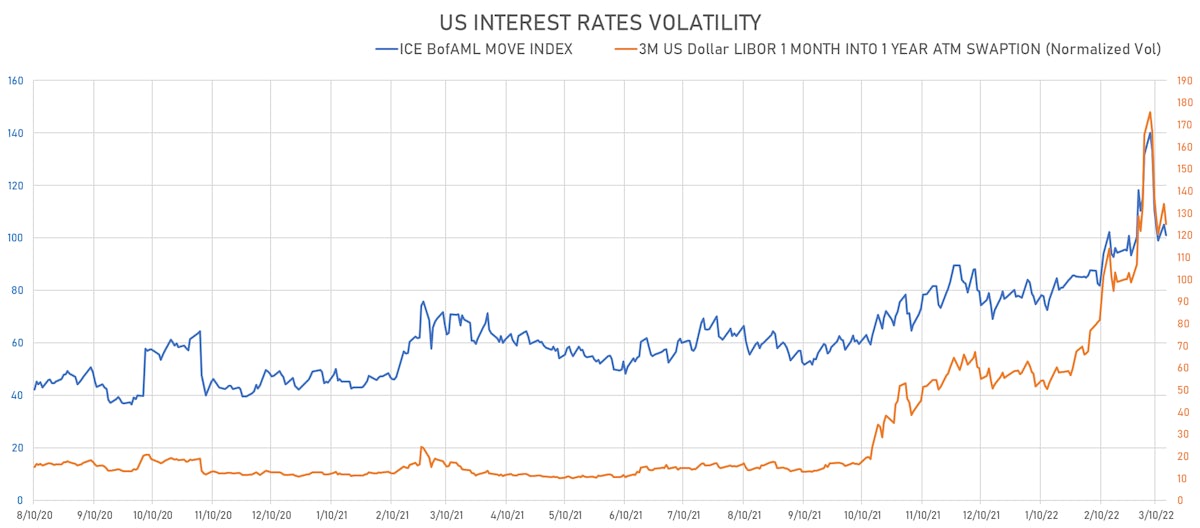

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -9.2 vols at 125.0 normals

- 3-Month LIBOR-OIS spread up 2.5 bp at 37.0 bp (12-months range: -5.5-37.0 bp)

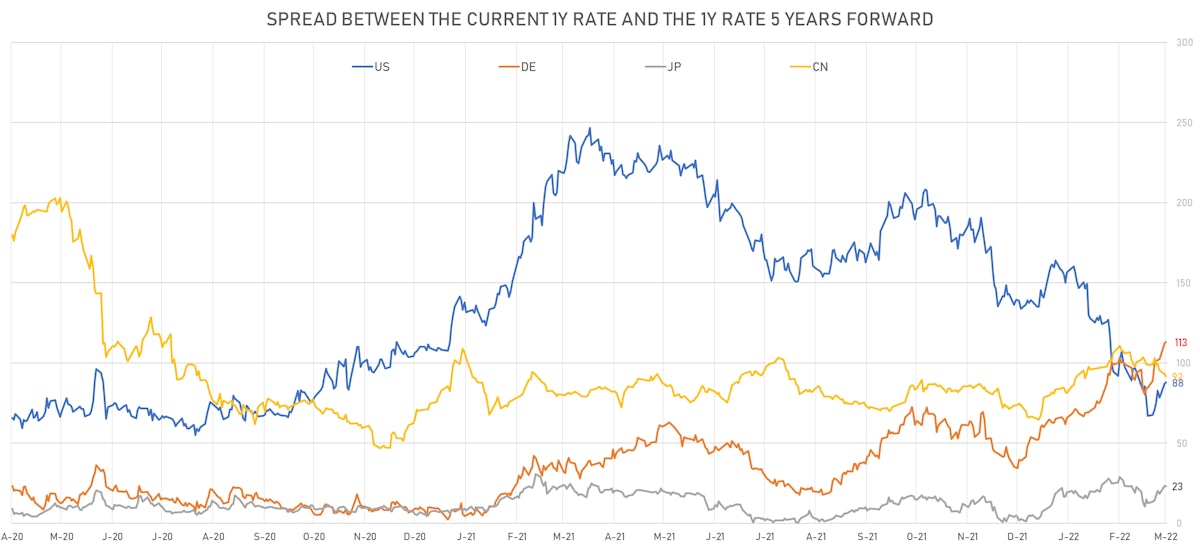

KEY INTERNATIONAL RATES

- Germany 5Y: 0.022% (down -7.3 bp); the German 1Y-10Y curve is 6.2 bp flatter at 97.4bp (YTD change: +54.0 bp)

- Japan 5Y: 0.045% (up 1.5 bp); the Japanese 1Y-10Y curve is 0.7 bp steeper at 27.4bp (YTD change: +10.9 bp)

- China 5Y: 2.545% (up 6.9 bp); the Chinese 1Y-10Y curve is 0.6 bp flatter at 67.1bp (YTD change: +16.1 bp)

- Switzerland 5Y: 0.057% (down -5.9 bp); the Swiss 1Y-10Y curve is 6.1 bp steeper at 98.8bp (YTD change: +40.8 bp)