Rates

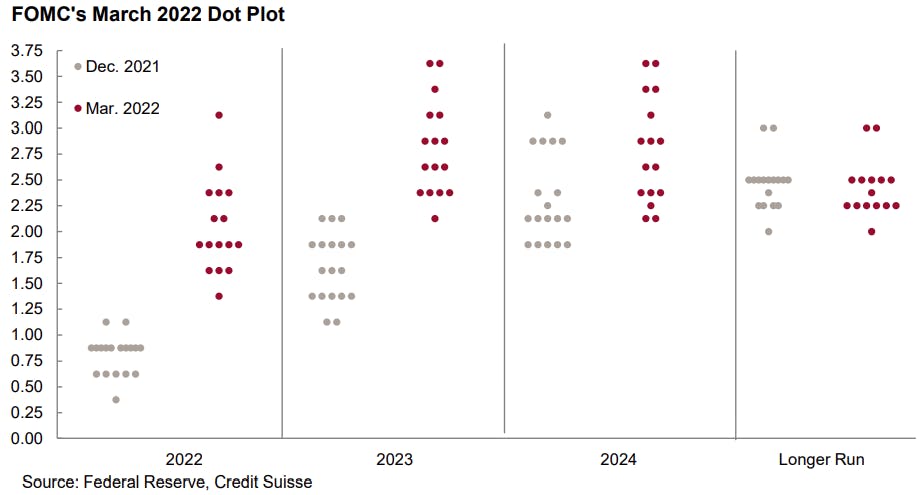

FOMC Wrap-Up: The Fed Mark Their Views To Market, With A Revised Dot Plot Showing A Median Of 7 Hikes This Year

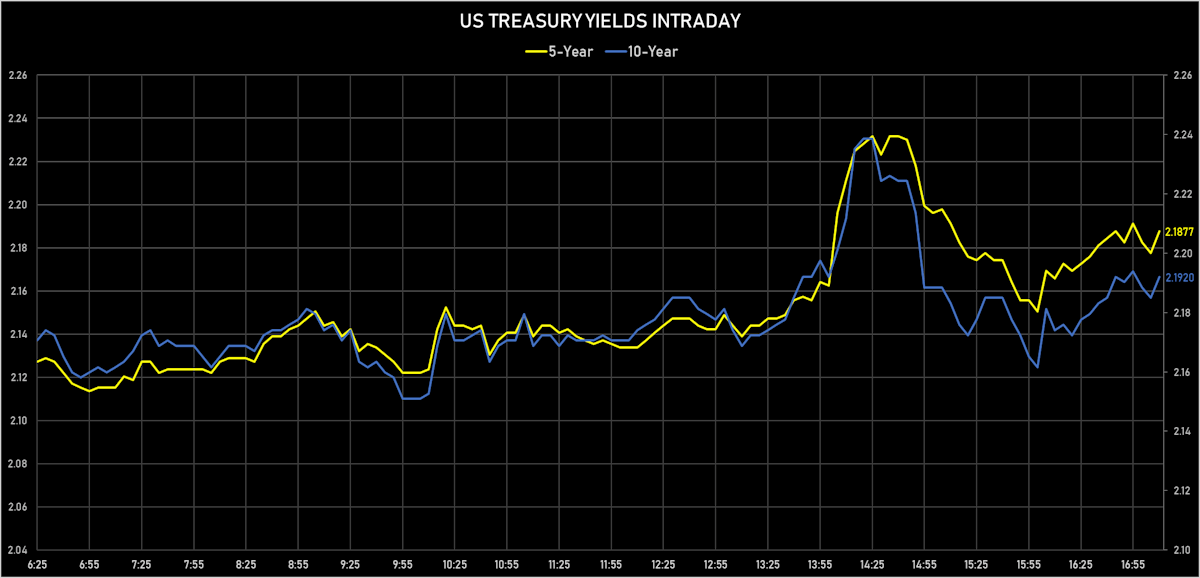

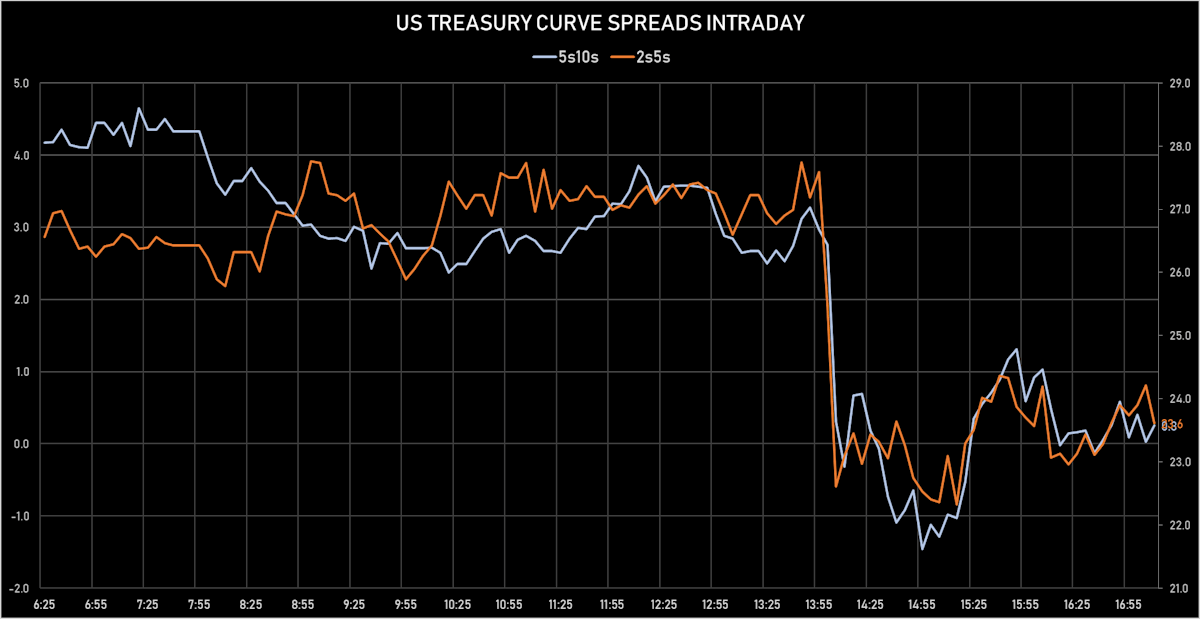

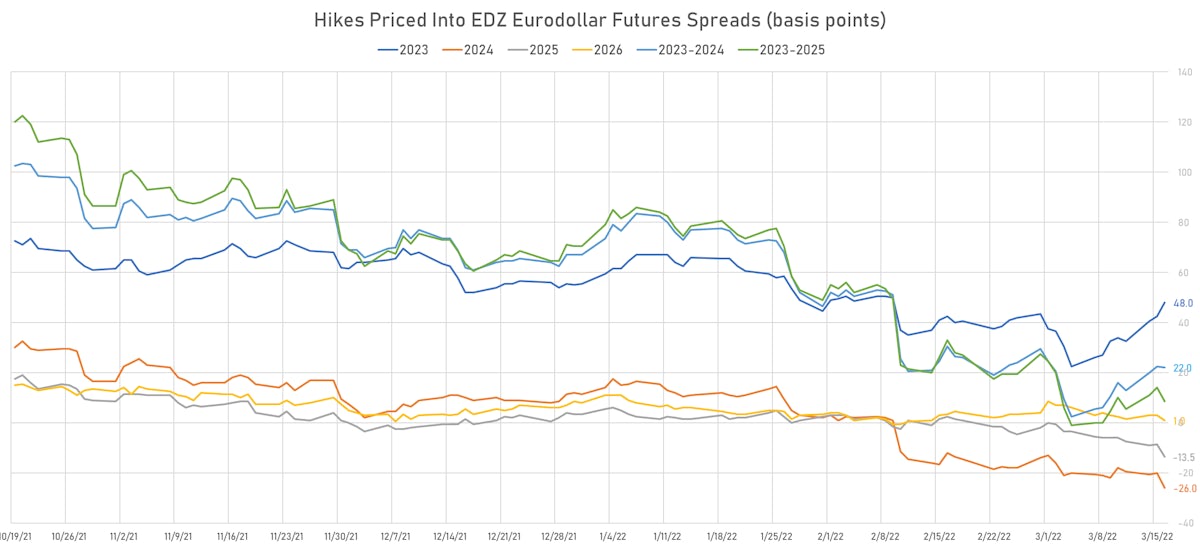

The US Treasury curve continued to bear flatten, with higher real yields and lower breakevens, and the inversion in forward rates got wider: the market now expects 2 rate cuts between September 2023 and December 2025

Published ET

3M USD OIS Forwards and 3M Eurodollar Futures spreads both showing about 50bp of rate cuts between 2023 and 2025 | Source: Refinitiv

QUICK US SUMMARY

- 3-Month USD LIBOR +3.2bp today, now at 0.9480%; 3-Month OIS -2.6bp at 0.5210%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.4 bp, now at 95.4 bp (YTD change: -17.9bp)

- 1Y: 1.2376% (up 5.7 bp)

- 2Y: 1.9462% (up 9.7 bp)

- 5Y: 2.1860% (up 8.1 bp)

- 7Y: 2.2242% (up 6.4 bp)

- 10Y: 2.1911% (up 4.3 bp)

- 30Y: 2.4619% (down 2.1 bp)

- US treasury curve spreads: 3m2Y at 148.4bp (up 9.7bp today), 2s5s at 24.0bp (down -1.6bp), 5s10s at 0.5bp (down -3.6bp), 10s30s at 27.1bp (down -6.4bp)

- Treasuries butterfly spreads: 1s5s10s at -97.9bp (down -10.7bp), 5s10s30s at 25.7bp (down -3.4bp)

- TIPS 1Y breakeven inflation at 5.54% (down -22.2bp); 2Y at 4.41% (down -18.0bp); 5Y at 3.29% (down -10.4bp); 10Y at 2.81% (down -5.3bp); 30Y at 2.47% (down -4.5bp)

- US 5-Year TIPS Real Yield: +19.0 bp at -1.1910%; 10-Year TIPS Real Yield: +9.8 bp at -0.6060%; 30-Year TIPS Real Yield: +2.5 bp at -0.0010%

US MACRO RELEASES

- Export Prices, All commodities, Change P/P, Price Index for Feb 2022 (BLS, U.S Dep. Of Lab) at 3.00 % (vs 2.90 % prior), above consensus estimate of 1.60 %

- Import Prices, All commodities, Change P/P, Price Index for Feb 2022 (BLS, U.S Dep. Of Lab) at 1.40 % (vs 2.00 % prior), below consensus estimate of 1.50 %

- MBA Mortgage Applications Survey composite index, weekly percentage change, Change P/P for W 11 Mar (MBA, USA) at -1.20 % (vs 8.50 % prior)

- Mortgage applications, market composite index for W 11 Mar (MBA, USA) at 496.50 (vs 502.50 prior)

- Mortgage applications, market composite index, purchase for W 11 Mar (MBA, USA) at 269.50 (vs 267.60 prior)

- Mortgage applications, market composite index, refinancing for W 11 Mar (MBA, USA) at 1,778.30 (vs 1,829.70 prior)

- Mortgage Lending Rates, FRM 30-Year Contract Rate (MBA Sourced) for W 11 Mar (MBA, USA) at 4.27 % (vs 4.09 % prior)

- NAHB/Wells Fargo Housing Market Index for Mar 2022 (NAHB, United States) at 79.00 (vs 82.00 prior), below consensus estimate of 81.00

- Overall, Total business inventories, Change P/P for Jan 2022 (U.S. Census Bureau) at 1.10 % (vs 2.10 % prior), in line with consensus

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Feb 2022 (U.S. Census Bureau) at -1.20 % (vs 4.80 % prior), below consensus estimate of 0.40 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Feb 2022 (U.S. Census Bureau) at -0.40 % (vs 3.80 % prior)

- Retail Sales, Total including food services, Change P/P for Feb 2022 (U.S. Census Bureau) at 0.30 % (vs 3.80 % prior), below consensus estimate of 0.40 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Feb 2022 (U.S. Census Bureau) at 0.20 % (vs 3.30 % prior), below consensus estimate of 0.90 %

MARCH 2022 FOMC WRAPUP

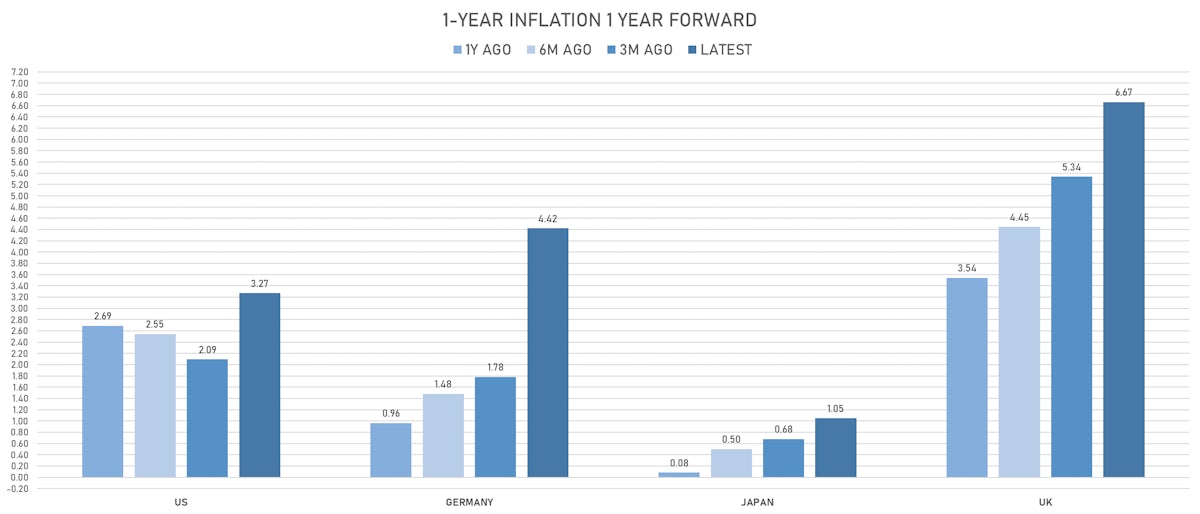

- The median expectation for core PCE inflation in 2022 was raised to 4.1%, up from 2.7% at the December meeting

- The median estimate of the neutral rate was lowered slightly to 2.375%, taking into account a possible growth slowdown

- Balance sheet reduction will occur soon, with an announcement likely at the May meeting, with Powell stating that the pace would be faster than prior QT

- The Fed has a difficult situation to juggle with, and they seem willing to risk a recession to kill inflation: in the press conference, Powell said again that price stability is a pre-condition for a strong expansion

- The fact that the dot plot shows rates above where the Fed's long-term neutral is (which may be too high vs Wall Street estimates) means the Fed realizes rate cuts will be necessary down the road

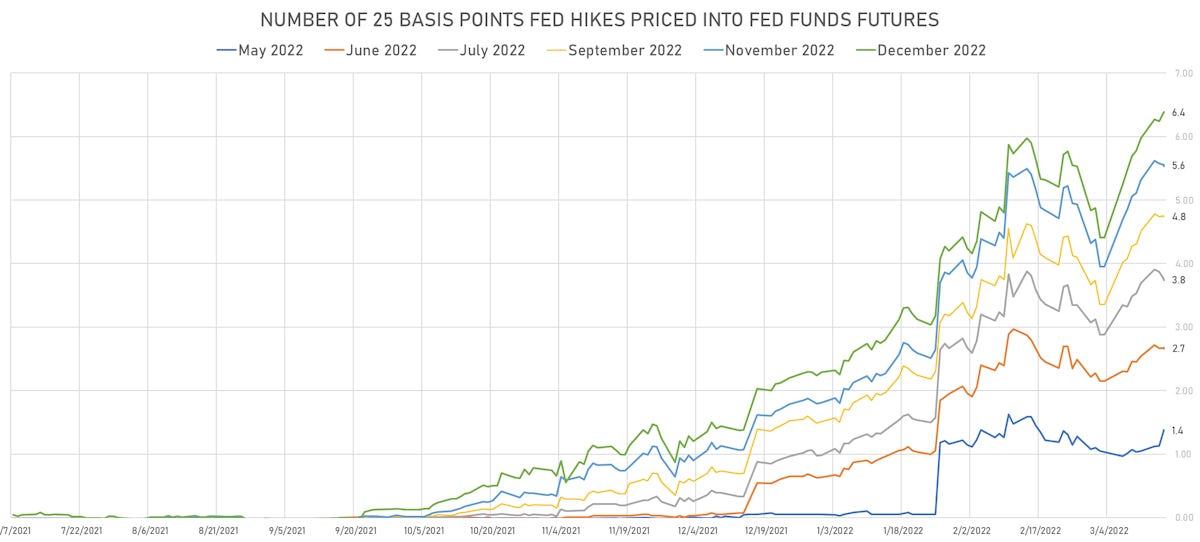

- Eurodollar futures and OIS forwards continue to price in a recession and rate cuts starting towards the end of 2023

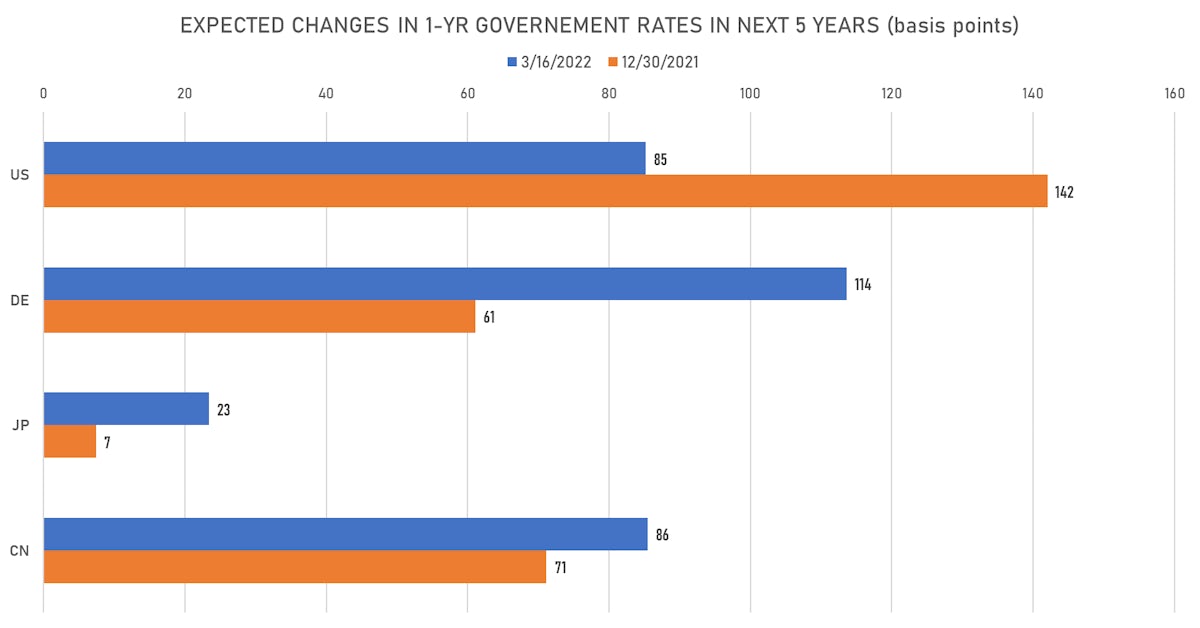

US FORWARD RATES

- Fed Funds futures now price in 34.4bp of Fed hikes by the end of May 2022, 66.8bp (2.67 x 25bp hikes) by the end of June 2022, and price in a total of 6.4 more hikes by the end of December 2022 (Fed Funds rate expected to be at 1.94% at the end of the year)

- 3-month Eurodollar futures (EDZ) spreads price in 48 bp of hikes in 2023 (equivalent to 1.9 x 25 bp hikes), up 5.5 bp today, and -26.0 bp of hikes in 2024 (equivalent to -1.0 x 25 bp hikes)

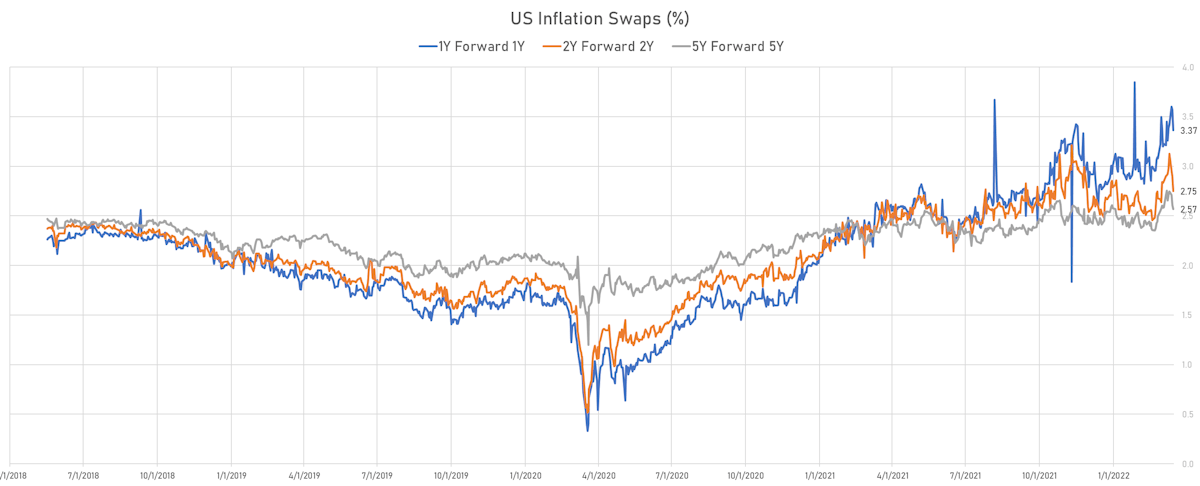

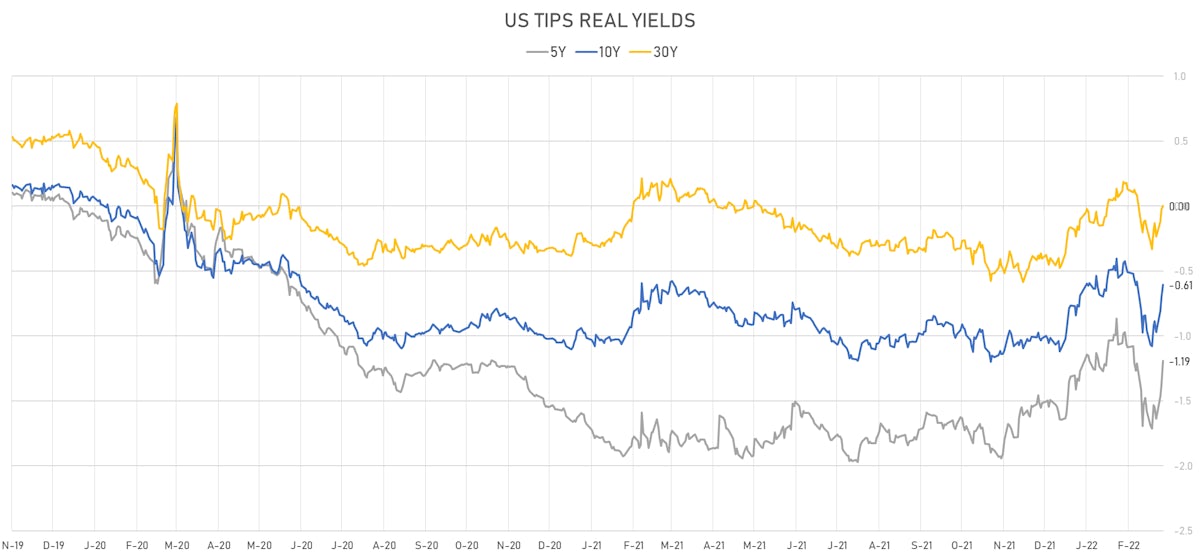

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.54% (down -22.2bp); 2Y at 4.41% (down -18.0bp); 5Y at 3.29% (down -10.4bp); 10Y at 2.81% (down -5.3bp); 30Y at 2.47% (down -4.5bp)

- 6-month spot US CPI swap down -5.3 bp to 5.709%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.1910%, +19.0 bp today; 10Y at -0.6060%, +9.8 bp today; 30Y at -0.0010%, +2.5 bp today

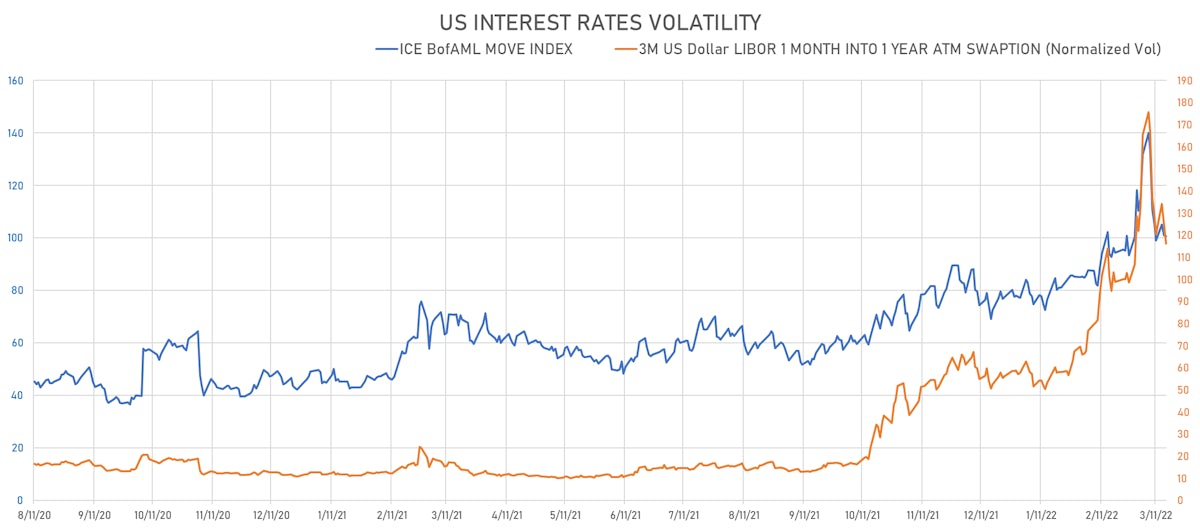

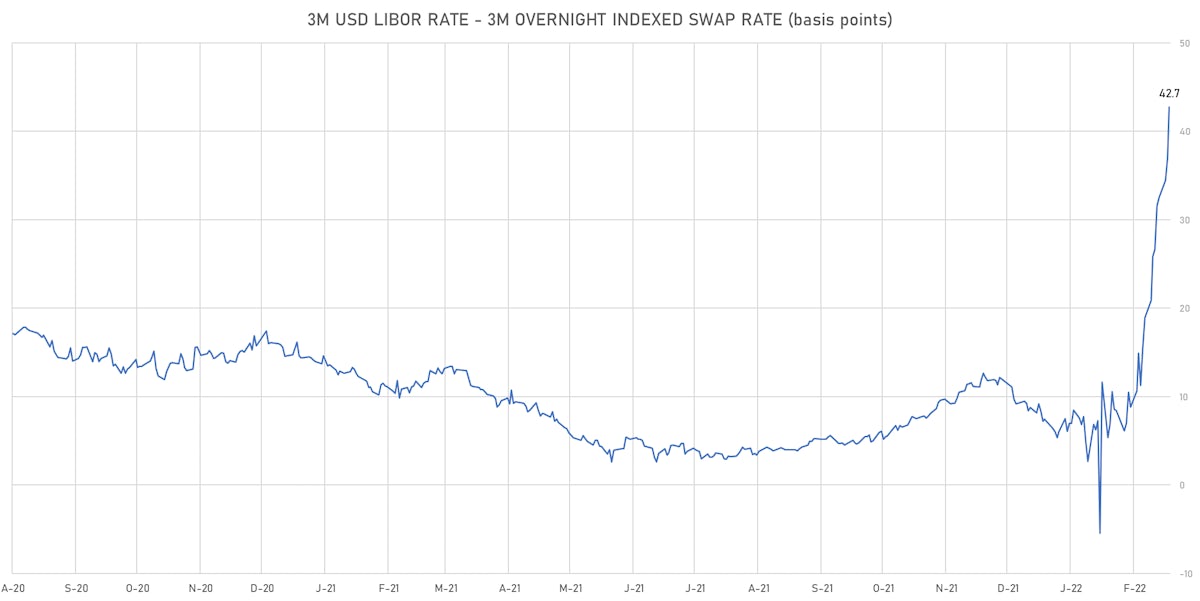

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -8.8 vols at 116.2 normals

- 3-Month LIBOR-OIS spread up 5.7 bp at 42.7 bp (12-months range: -5.5-42.7 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.101% (up 8.3 bp); the German 1Y-10Y curve is 6.2 bp steeper at 103.1bp (YTD change: +60.2 bp)

- Japan 5Y: 0.037% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.8 bp flatter at 27.6bp (YTD change: +10.1 bp)

- China 5Y: 2.558% (up 1.3 bp); the Chinese 1Y-10Y curve is 3.8 bp flatter at 63.3bp (YTD change: +12.3 bp)

- Switzerland 5Y: 0.073% (up 4.0 bp); the Swiss 1Y-10Y curve is 12.4 bp steeper at 108.5bp (YTD change: +53.2 bp)