Rates

Double-Digit Rises In Gasoil, Brent Crude Prices Take US TIPS Breakevens Much Higher, While The Treasury Curve Bull Steepens

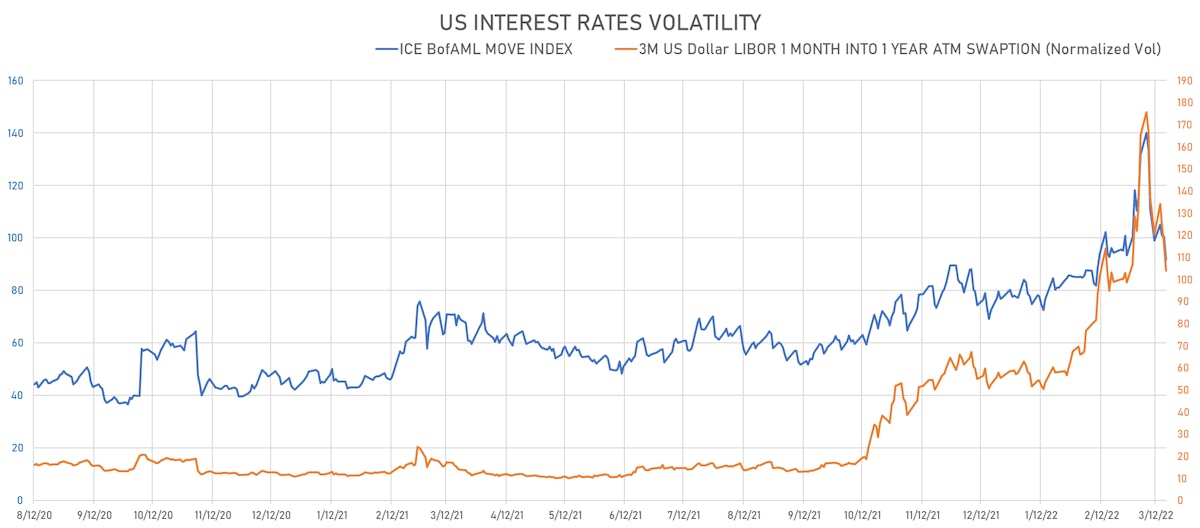

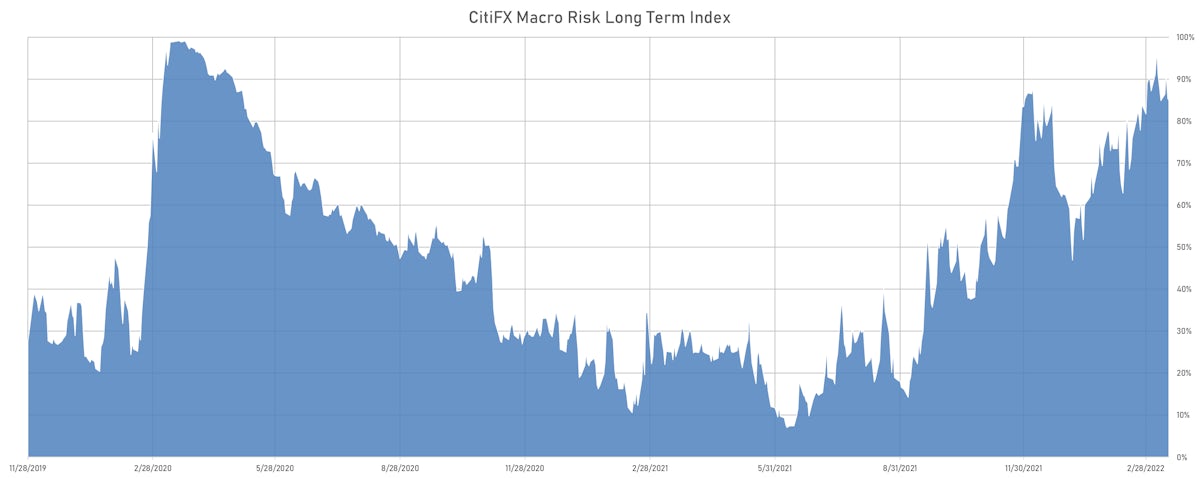

Rates volatility and macro risk indicators have started to recede, although they are still at extraordinary levels compared to a year ago, with 1-month into 1-year USD swaptions still trading at 104 normals

Published ET

CitiFX Long-Term Macro Risk Index | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR -2.0bp today, now at 0.9280%; 3-Month OIS -3.2bp at 0.5295%

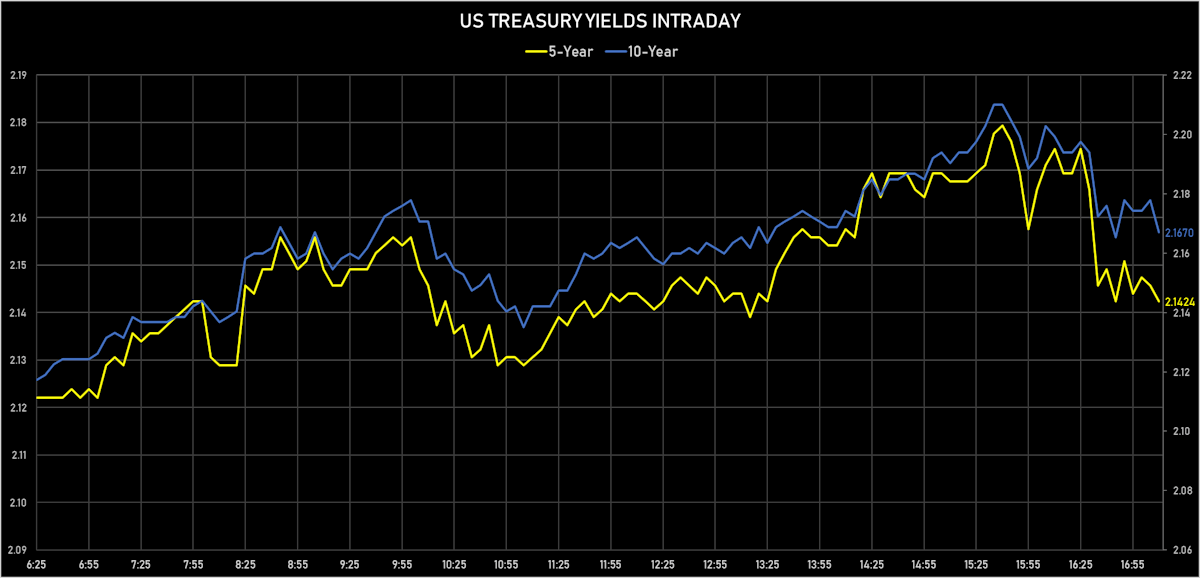

- The treasury yield curve steepened, with the 1s10s spread widening 1.6 bp, now at 95.4 bp (YTD change: -17.9bp)

- 1Y: 1.2117% (down 4.1 bp)

- 2Y: 1.9138% (down 3.2 bp)

- 5Y: 2.1407% (down 4.5 bp)

- 7Y: 2.1867% (down 3.8 bp)

- 10Y: 2.1653% (down 2.5 bp)

- 30Y: 2.4601% (down 0.2 bp)

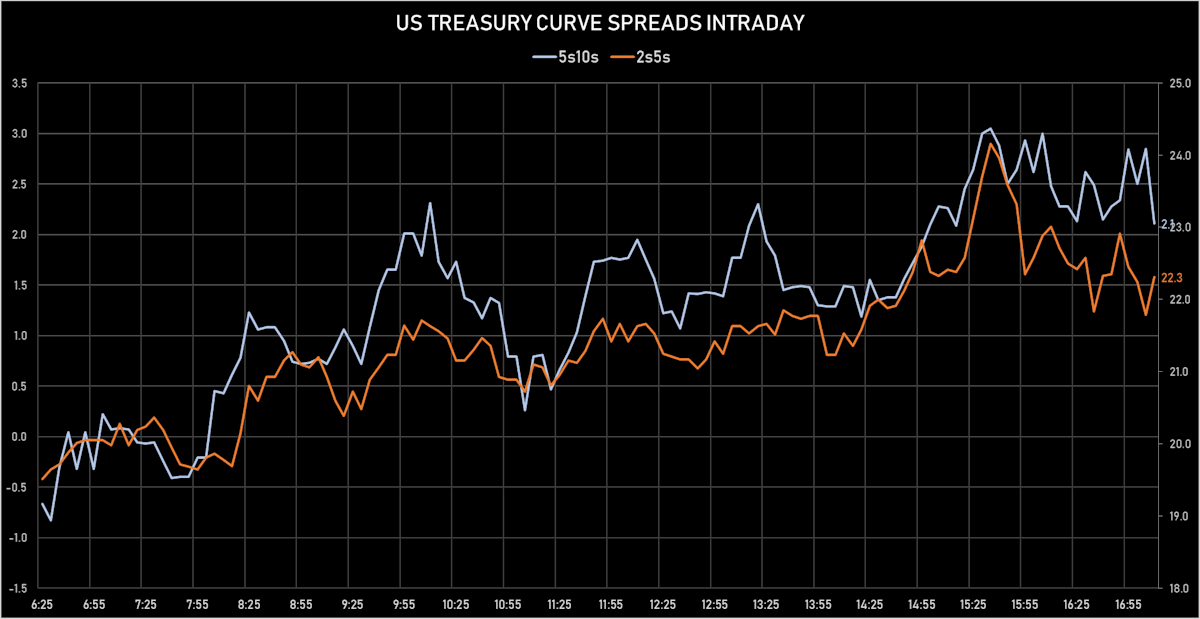

- US treasury curve spreads: 3m2Y at 151.5bp (up 2.6bp today), 2s5s at 22.7bp (down -1.3bp), 5s10s at 2.5bp (up 1.9bp), 10s30s at 29.5bp (up 2.4bp)

- Treasuries butterfly spreads: 1s5s10s at -92.5bp (up 5.4bp today), 5s10s30s at 26.4bp (up 0.7bp)

- TIPS 1Y breakeven inflation at 5.91% (up 37.6bp); 2Y at 4.73% (up 31.8bp); 5Y at 3.50% (up 21.1bp); 10Y at 2.94% (up 13.0bp); 30Y at 2.57% (up 10.0bp)

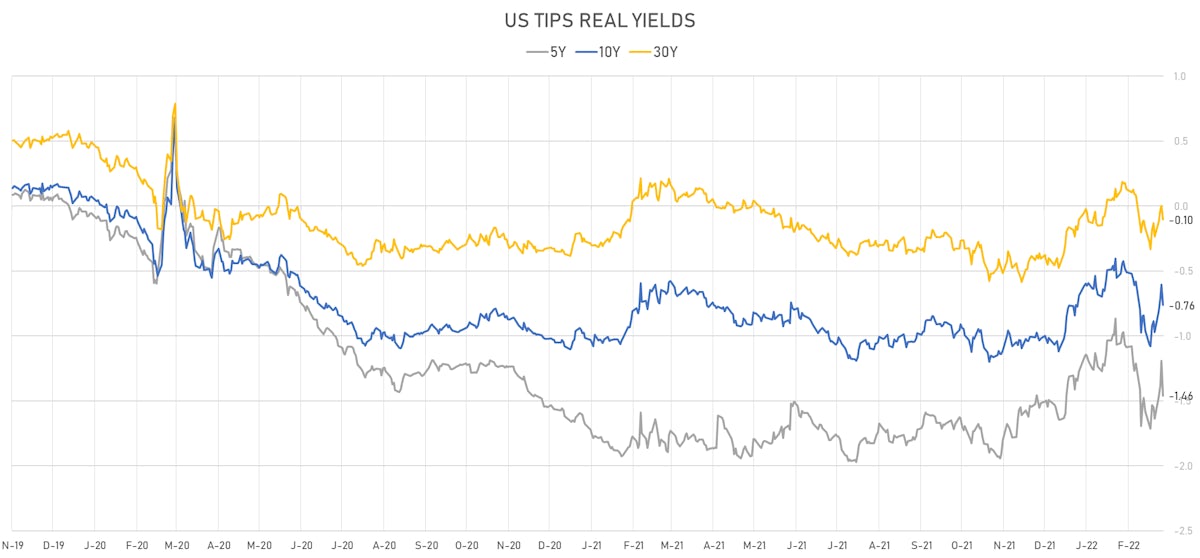

- US 5-Year TIPS Real Yield: -26.8 bp at -1.4590%; 10-Year TIPS Real Yield: -15.7 bp at -0.7630%; 30-Year TIPS Real Yield: -10.2 bp at -0.1030%

US MACRO RELEASES

- Building Permits for Feb 2022 (U.S. Census Bureau) at 1.86 Mln (vs 1.90 Mln prior), above consensus estimate of 1.85 Mln

- Building Permits, Change P/P for Feb 2022 (U.S. Census Bureau) at -1.90 % (vs 0.50 % prior)

- Capacity Utilization, Total index, Change M/M for Feb 2022 (FED, U.S.) at 77.60 % (vs 77.60 % prior), below consensus estimate of 77.80 %

- Housing Starts for Feb 2022 (U.S. Census Bureau) at 1.77 Mln (vs 1.64 Mln prior), above consensus estimate of 1.69 Mln

- Housing Starts, Change P/P for Feb 2022 (U.S. Census Bureau) at 6.80 % (vs -4.10 % prior)

- Jobless Claims, National, Continued for W 05 Mar (U.S. Dept. of Labor) at 1.42 Mln (vs 1.49 Mln prior), below consensus estimate of 1.49 Mln

- Jobless Claims, National, Initial for W 12 Mar (U.S. Dept. of Labor) at 214.00 k (vs 227.00 k prior), below consensus estimate of 220.00 k

- Jobless Claims, National, Initial, four week moving average for W 12 Mar (U.S. Dept. of Labor) at 223.00 k (vs 231.25 k prior)

- Philadelphia Fed, Future capital expenditures for Mar 2022 (FED, Philadelphia) at 24.80 (vs 21.50 prior)

- Philadelphia Fed, Future general business activity for Mar 2022 (FED, Philadelphia) at 22.70 (vs 28.10 prior)

- Philadelphia Fed, General business activity for Mar 2022 (FED, Philadelphia) at 27.40 (vs 16.00 prior), above consensus estimate of 15.00

- Philadelphia Fed, New orders for Mar 2022 (FED, Philadelphia) at 25.80 (vs 14.20 prior)

- Philadelphia Fed, Number of employees for Mar 2022 (FED, Philadelphia) at 38.90 (vs 32.30 prior)

- Philadelphia Fed, Prices paid for Mar 2022 (FED, Philadelphia) at 81.00 (vs 69.30 prior)

- Production, Change P/P for Feb 2022 (FED, U.S.) at 0.50 % (vs 1.40 % prior), in line with consensus

- Production, Manufacturing, Total (SIC), Change P/P for Feb 2022 (FED, U.S.) at 1.20 % (vs 0.20 % prior), above consensus estimate of 0.60 %

GLOBAL MACRO RELEASES

- Australia, Activity, Participation Rate for Feb 2022 (AU Bureau of Stat) at 66.40 % (vs 66.20 % prior), above consensus estimate of 66.30 %

- Australia, Employment, Absolute change for Feb 2022 (AU Bureau of Stat) at 77.40 k (vs 12.90 k prior), above consensus estimate of 37.00 k

- Australia, Unemployment, Rate for Feb 2022 (AU Bureau of Stat) at 4.00 % (vs 4.20 % prior), below consensus estimate of 4.10 %

- Austria, HICP, Change P/P, Price Index for Feb 2022 (Statistics Austria) at 1.30 % (vs 1.30 % prior)

- Austria, HICP, Change Y/Y for Feb 2022 (Statistics Austria) at 5.50 % (vs 5.50 % prior)

- Euro Zone, CPI, Change P/P, Price Index for Feb 2022 (Eurostat) at 0.90 % (vs 0.30 % prior), in line with consensus

- Euro Zone, CPI, Change Y/Y for Feb 2022 (Eurostat) at 5.90 % (vs 5.80 % prior), above consensus estimate of 5.80 %

- Euro Zone, CPI, Total excluding energy, food, alcohol and tobacco, Change Y/Y for Feb 2022 (Eurostat) at 2.70 % (vs 2.70 % prior), in line with consensus

- Euro Zone, HICP, Overall index excluding energy, food, alcohol and tobacco, Change P/P for Feb 2022 (Eurostat) at 0.50 % (vs 0.50 % prior), in line with consensus

- Indonesia, Policy Rates, 7-Day Reverse Repo for Mar 2022 (Bank Indonesia) at 3.50 % (vs 3.50 % prior), in line with consensus

- Indonesia, Policy Rates, Deposit Facility Rate for Mar 2022 (Bank Indonesia) at 2.75 % (vs 2.75 % prior), in line with consensus

- Indonesia, Policy Rates, Lending Facility Rate for Mar 2022 (Bank Indonesia) at 4.25 % (vs 4.25 % prior), in line with consensus

- Japan, CPI, Nationwide, All Items, Change Y/Y for Feb 2022 (MIC, Japan) at 0.90 % (vs 0.50 % prior)

- Japan, CPI, Nationwide, All Items, Less fresh food, Change Y/Y for Feb 2022 (MIC, Japan) at 0.60 % (vs 0.20 % prior), in line with consensus

- Singapore, Exports, Domestic non-oil, Change Y/Y for Feb 2022 (Statistics Singapore) at 9.50 % (vs 17.60 % prior), below consensus estimate of 15.70 %

- Singapore, Exports, Non-oil domestic exports, Change P/P for Feb 2022 (Statistics Singapore) at -2.80 % (vs 5.00 % prior), below consensus estimate of -0.30 %

- Slovakia, HICP, Change P/P, Price Index for Feb 2022 (Stat Office of SR) at 0.80 % (vs 2.80 % prior), in line with consensus

- Slovakia, HICP, Change Y/Y, Price Index for Feb 2022 (Stat Office of SR) at 8.30 % (vs 7.70 % prior), above consensus estimate of 8.20 %

- Turkey, Policy Rates, CBRT OVERNIGHT BORROWING RATE (EP) for Mar 2022 (Central Bank, Turkey) at 12.50 % (vs 12.50 % prior)

- Turkey, Policy Rates, Central Bank 1 Week Repo Lending Rate for Mar 2022 (Central Bank, Turkey) at 14.00 % (vs 14.00 % prior), in line with consensus

- Turkey, Policy Rates, Late Liquidity Window Rate for Mar 2022 (Central Bank, Turkey) at 18.50 % (vs 18.50 % prior)

- Turkey, Policy Rates, Overnight Lending Rate for Mar 2022 (Central Bank, Turkey) at 15.50 % (vs 15.50 % prior)

- United Kingdom, Policy Rates, BOE MPC Vote Cut, Volume for Mar 2022 (Bank of England) at 0 (vs 0 prior), in line with consensus

- United Kingdom, Policy Rates, BOE MPC Vote Hike, Volume for Mar 2022 (Bank of England) at 8 (vs 9 prior), below consensus estimate of 9

- United Kingdom, Policy Rates, BOE MPC Vote Unchanged, Volume for Mar 2022 (Bank of England) at 1 (vs 0 prior), above consensus estimate of 0

- United Kingdom, Policy Rates, Bank Rate for Mar 2022 (Bank of England) at 0.75 % (vs 0.50 % prior), in line with consensus

US FORWARD RATES

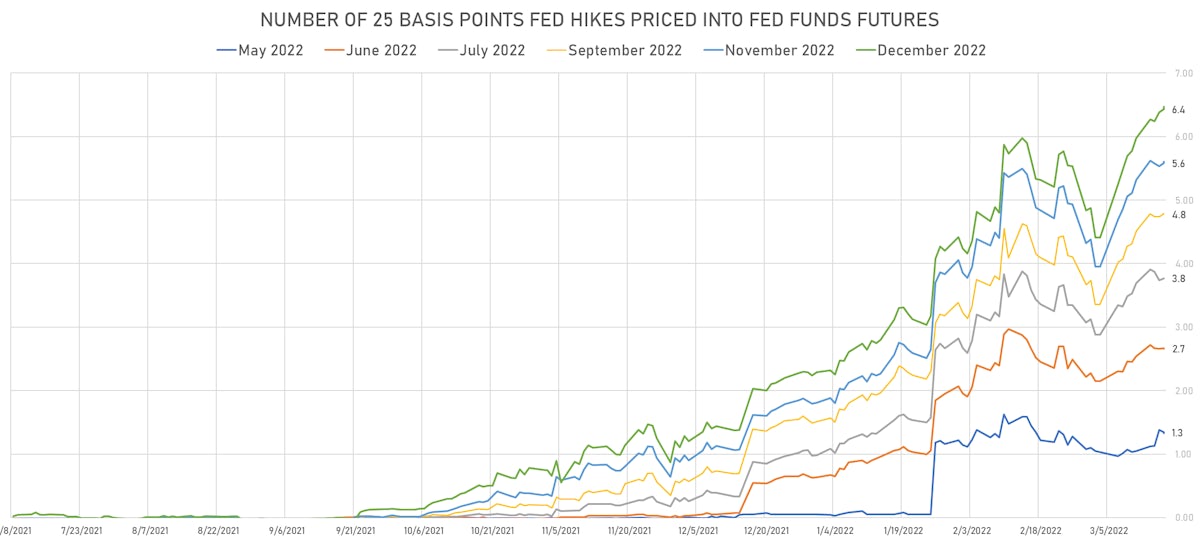

- Fed Funds futures now price in 33.6bp of Fed hikes by the end of May 2022, 66.7bp (2.67 x 25bp hikes) by the end of June 2022, and price in 7.02 hikes by the end of February 2023

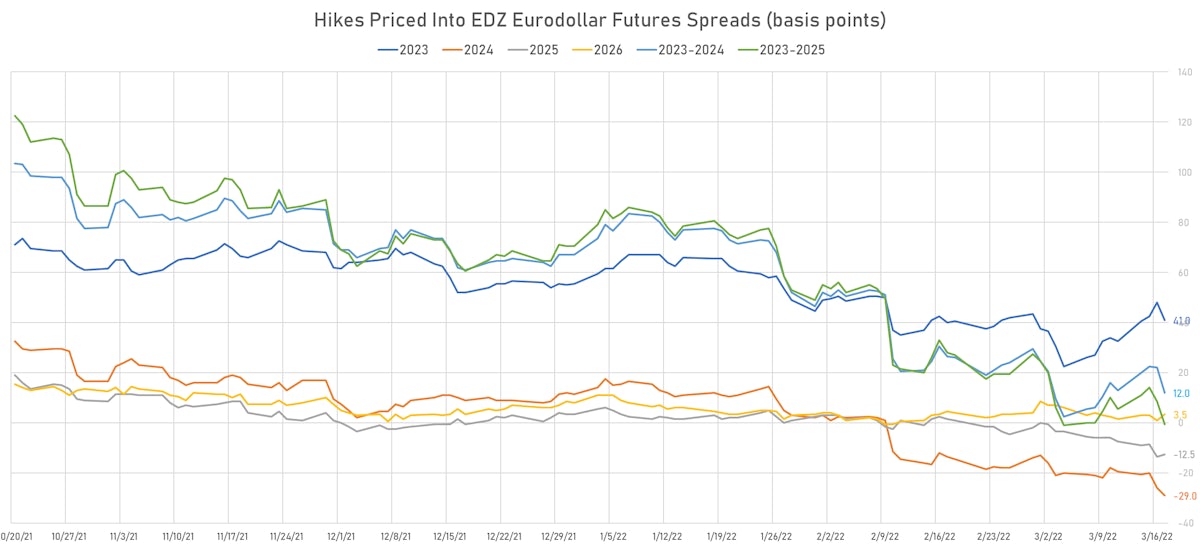

- 3-month Eurodollar futures (EDZ) spreads price in 41 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), down -7.0 bp today, and -29.0 bp of hikes in 2024 (equivalent to -1.2 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.91% (up 37.6bp); 2Y at 4.73% (up 31.8bp); 5Y at 3.50% (up 21.1bp); 10Y at 2.94% (up 13.0bp); 30Y at 2.57% (up 10.0bp)

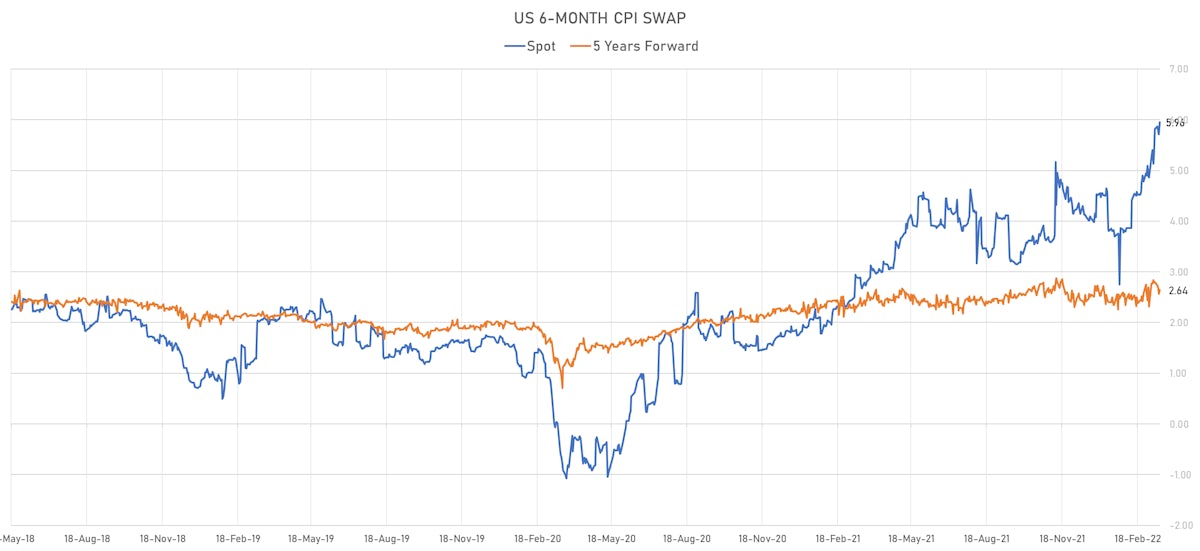

- 6-month spot US CPI swap up 24.8 bp to 5.957%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.4590%, -26.8 bp today; 10Y at -0.7630%, -15.7 bp today; 30Y at -0.1030%, -10.2 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -12.3 vols at 103.9 normals

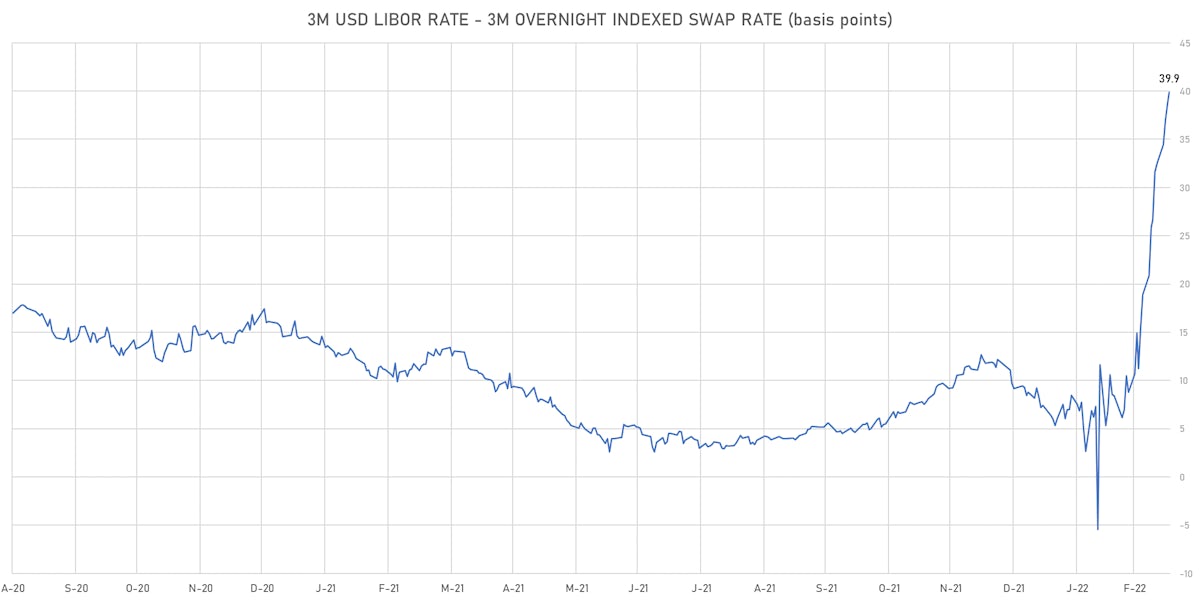

- 3-Month LIBOR-OIS spread up 1.1 bp at 39.9 bp (12-months range: -5.5-39.9 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.109% (up 1.4 bp); the German 1Y-10Y curve is 2.5 bp flatter at 101.2bp (YTD change: +57.7 bp)

- Japan 5Y: 0.035% (unchanged); the Japanese 1Y-10Y curve is 0.1 bp steeper at 26.5bp (YTD change: +10.2 bp)

- China 5Y: 2.532% (down -2.6 bp); the Chinese 1Y-10Y curve is 1.1 bp steeper at 64.4bp (YTD change: +13.4 bp)

- Switzerland 5Y: 0.065% (down -1.0 bp); the Swiss 1Y-10Y curve is 5.9 bp flatter at 103.8bp (YTD change: +47.3 bp)