Rates

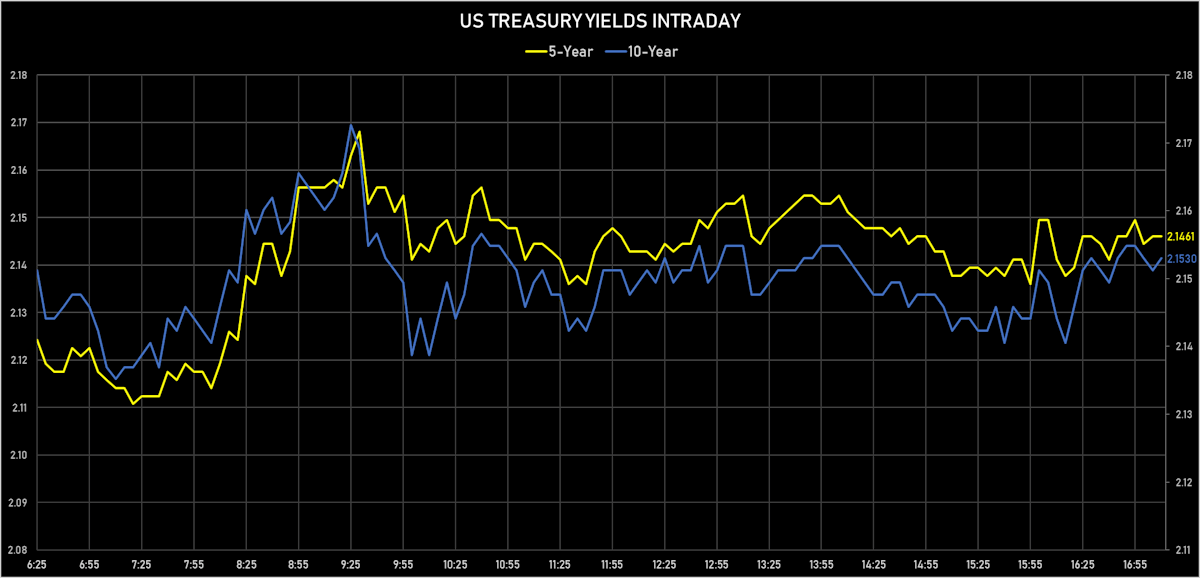

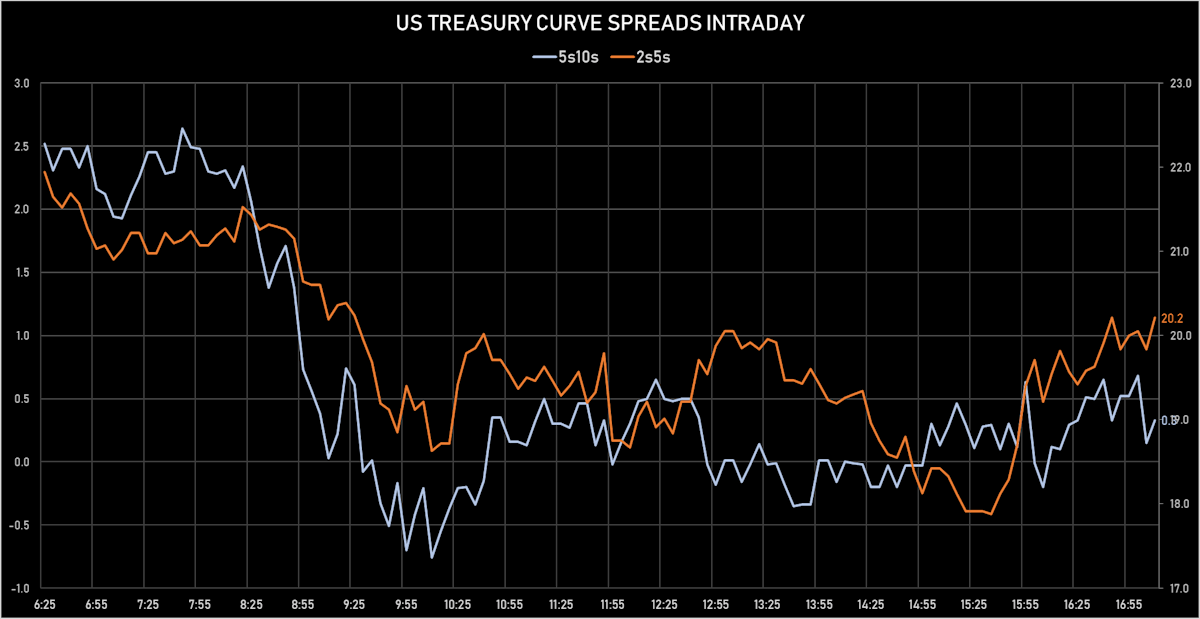

Modest Rise In Yields At The Front End Of The US Treasury Curve, With Flattening Further Down; 5s10s Spread Closed The Week At Just 0.6bp

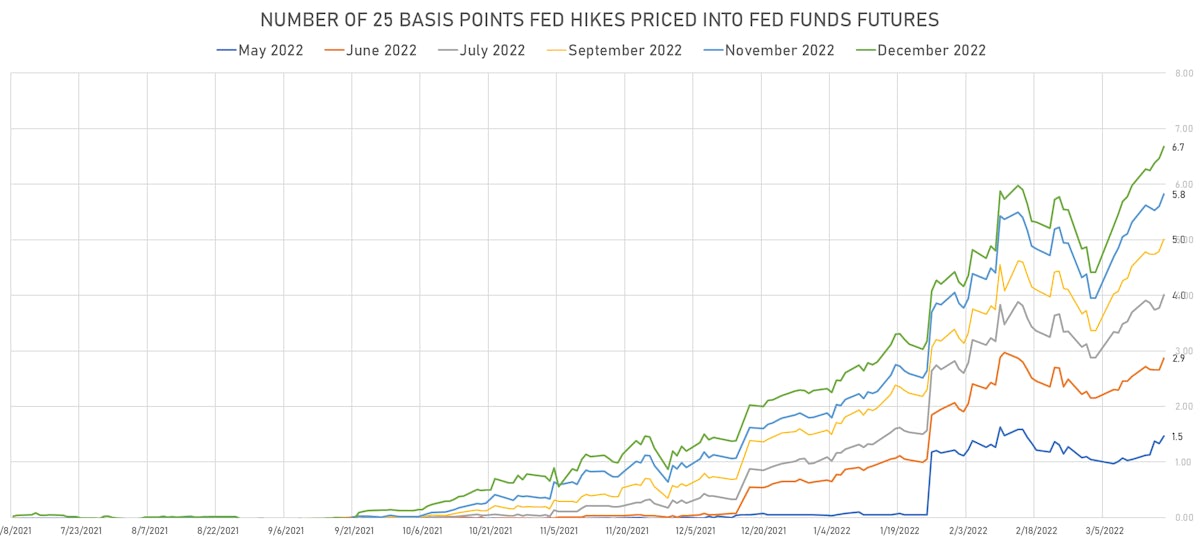

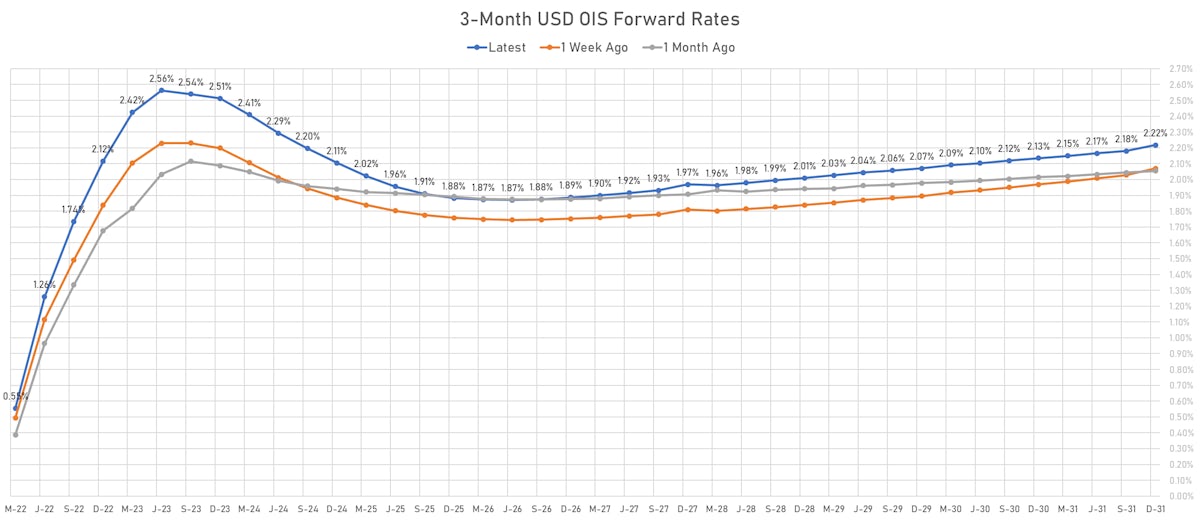

Minneapolis Fed President Kashkari thinks the neutral Fed Funds rate is likely 2% (below the Fed's published number), which matches the estimates of sell-siders like Morgan Stanley's Ellen Zentner; if that is correct, forward markets now expect neutral to be reached by the end of the year

Published ET

3-Month USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

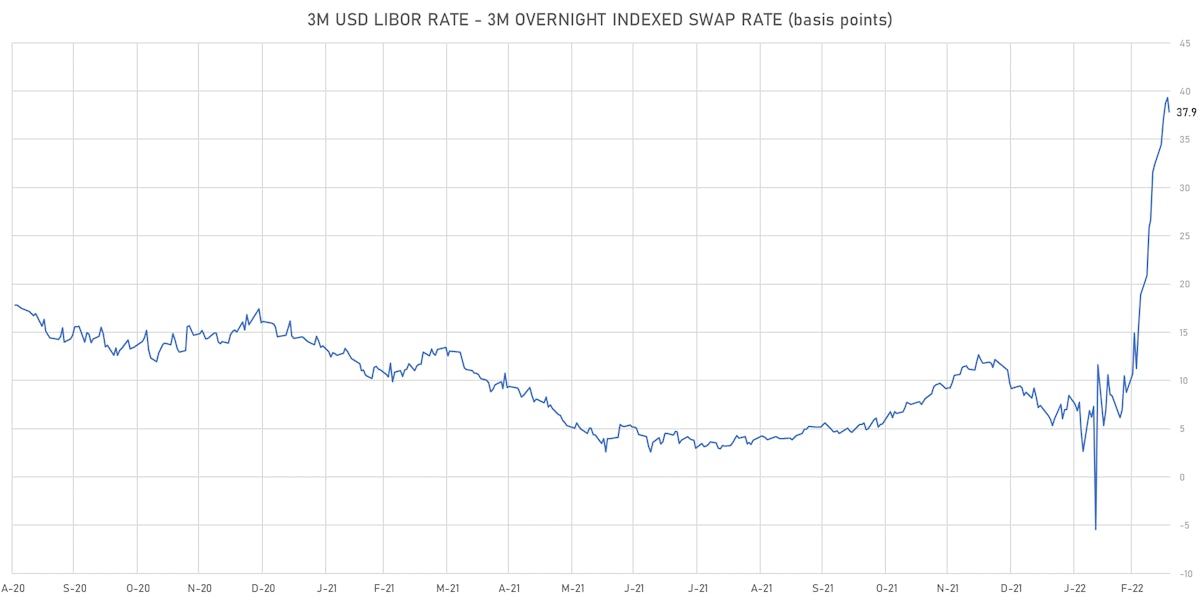

- 3-Month USD LIBOR +0.6bp today, now at 0.9340%; 3-Month OIS +2.1bp at 0.5555%

- The treasury yield curve flattened, with the 1s10s spread tightening -1.1 bp, now at 94.6 bp (YTD change: -18.6bp)

- 1Y: 1.2052% (down 0.3 bp)

- 2Y: 1.9413% (up 2.6 bp)

- 5Y: 2.1453% (up 0.4 bp)

- 7Y: 2.1784% (down 0.8 bp)

- 10Y: 2.1512% (down 1.4 bp)

- 30Y: 2.4199% (down 4.0 bp)

- US treasury curve spreads: 3m2Y at 153.4bp (up 1.4bp today), 2s5s at 20.4bp (down -2.1bp), 5s10s at 0.6bp (down -1.8bp), 10s30s at 26.9bp (down -2.6bp)

- Treasuries butterfly spreads: 1s5s10s at -95.7bp (down -3.2bp), 5s10s30s at 25.8bp (down -0.6bp)

- TIPS 1Y breakeven inflation at 5.88% (down -3.6bp); 2Y at 4.69% (down -4.3bp); 5Y at 3.45% (down -5.1bp); 10Y at 2.90% (down -3.7bp); 30Y at 2.52% (down -5.1bp)

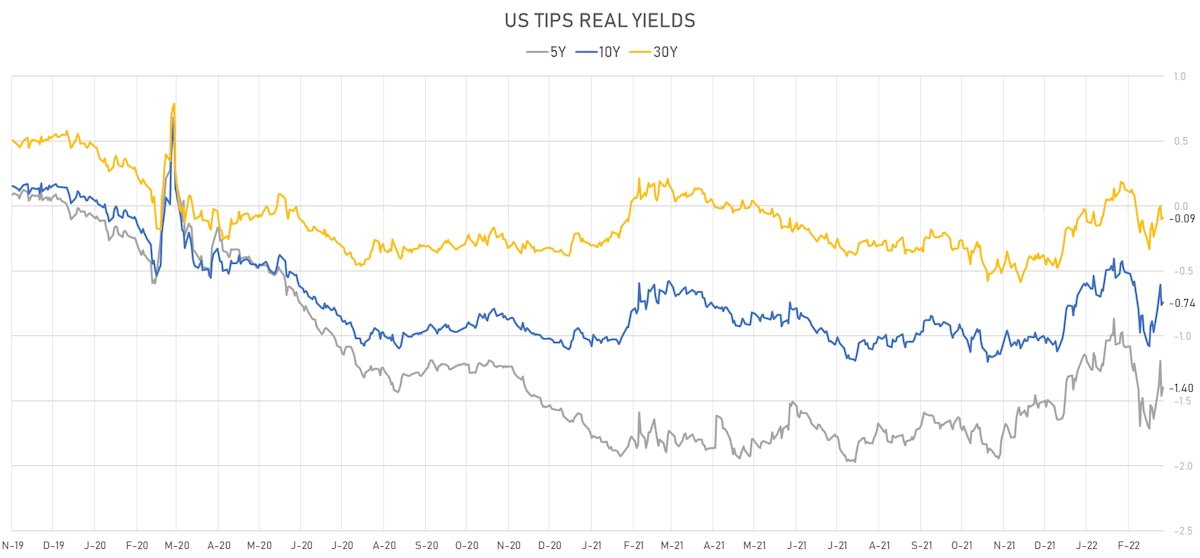

- US 5-Year TIPS Real Yield: +6.3 bp at -1.3960%; 10-Year TIPS Real Yield: +2.2 bp at -0.7410%; 30-Year TIPS Real Yield: +1.0 bp at -0.0930%

US MACRO RELEASES

- Existing-Home Sales, Single-Family and Condos, total for Feb 2022 (NAR, United States) at 6.02 Mln (vs 6.50 Mln prior), below consensus estimate of 6.10 Mln

- Existing-Home Sales, Single-Family and Condos, total, Change P/P for Feb 2022 (NAR, United States) at -7.20 % (vs 6.70 % prior)

- Leading Index, Change P/P for Feb 2022 (The Conference Board) at 0.30 % (vs -0.30 % prior), below consensus estimate of 0.30 %

US FORWARD RATES

- Fed Funds futures now price in 36.7bp of Fed hikes by the end of May 2022, 71.8bp (2.87 x 25bp hikes) by the end of June 2022, and price in 7.27 hikes by the end of February 2023

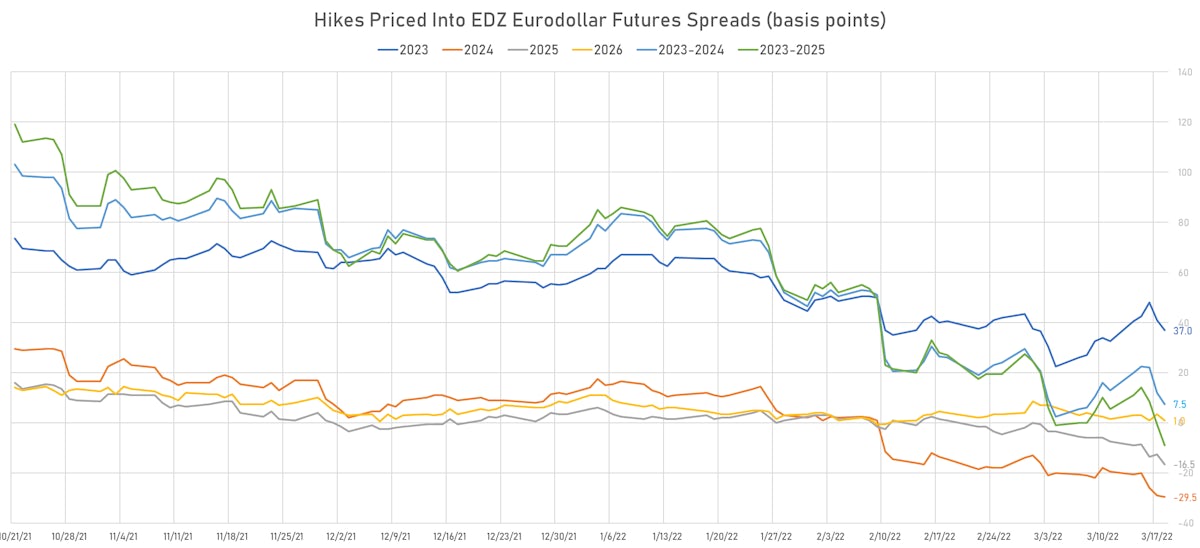

- 3-month Eurodollar futures (EDZ) spreads price in 37 bp of hikes in 2023 (equivalent to 1.5 x 25 bp hikes), down -4.0 bp today, and -29.5 bp of hikes in 2024 (equivalent to -1.2 x 25 bp hikes)

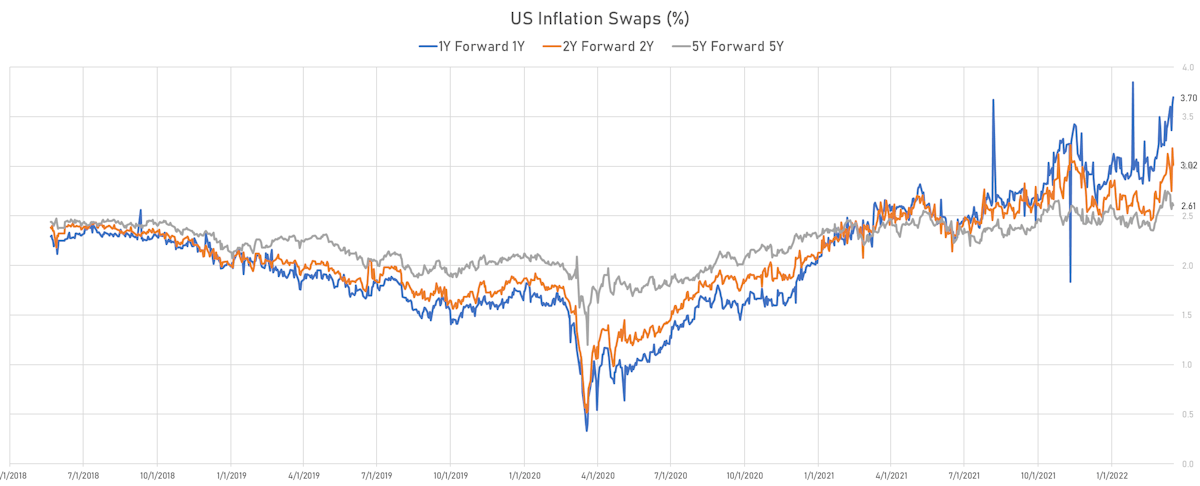

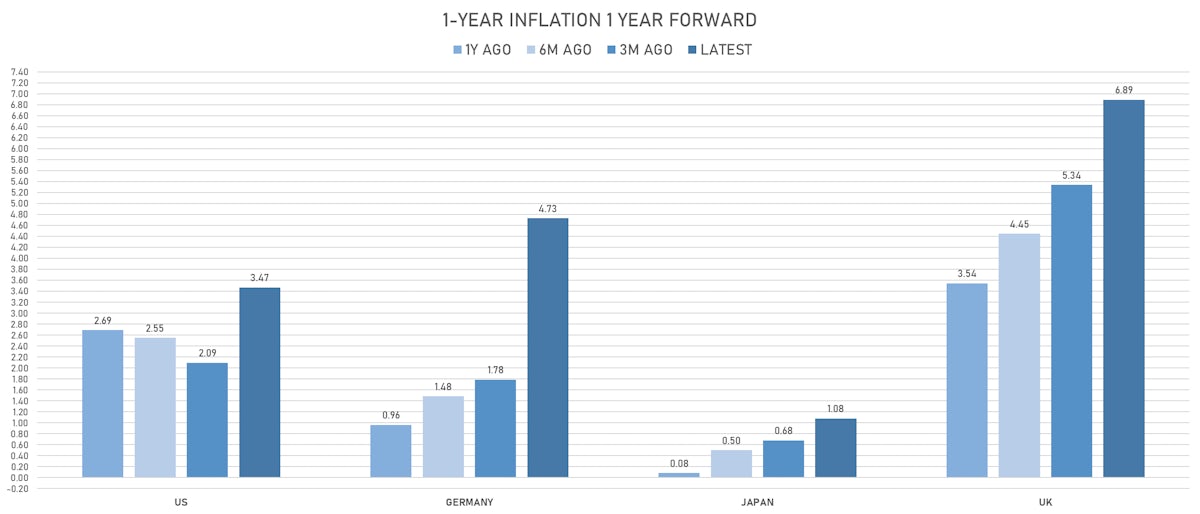

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.88% (down -3.6bp); 2Y at 4.69% (down -4.3bp); 5Y at 3.45% (down -5.1bp); 10Y at 2.90% (down -3.7bp); 30Y at 2.52% (down -5.1bp)

- 6-month spot US CPI swap up 9.7 bp to 6.054%, with a steepening of the forward curve

- US Real Rates: 5Y at -1.3960%, +6.3 bp today; 10Y at -0.7410%, +2.2 bp today; 30Y at -0.0930%, +1.0 bp today

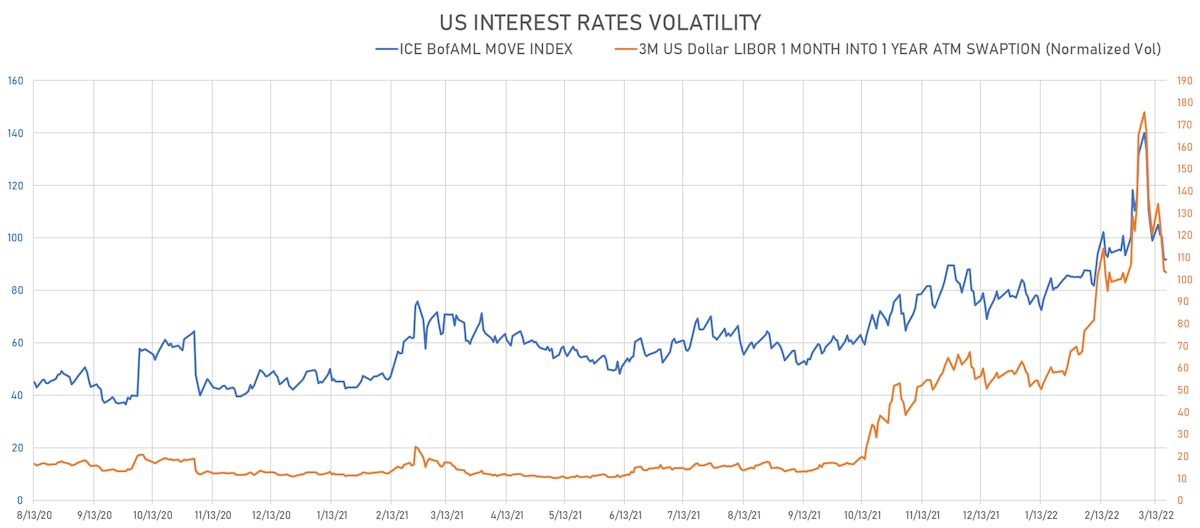

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.8 vols at 103.1 normals

- 3-Month LIBOR-OIS spread down -1.5 bp at 37.9 bp (12-months range: -5.5-39.3 bp)

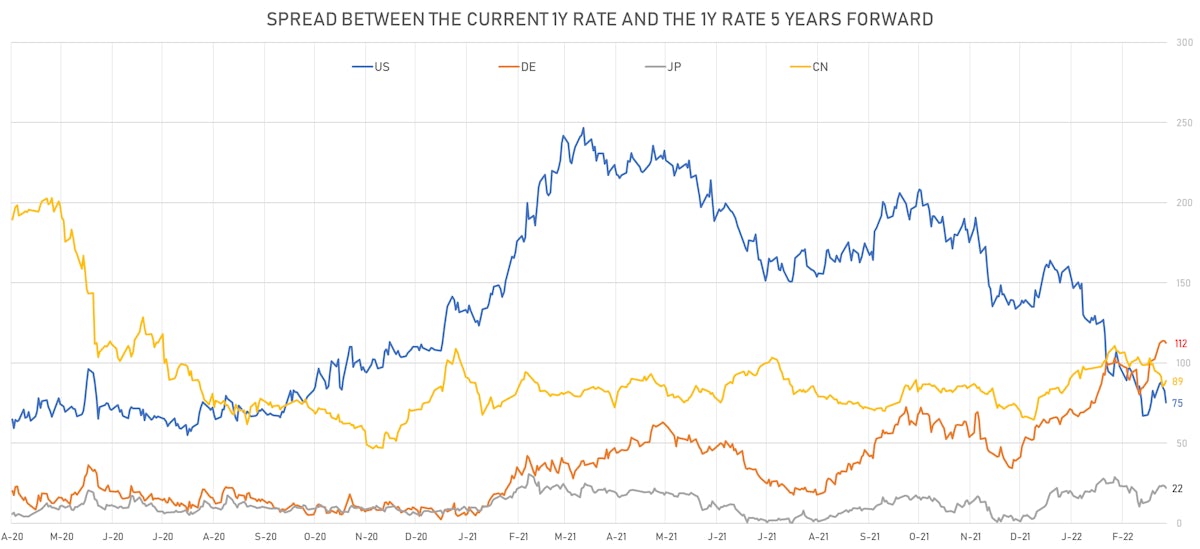

KEY INTERNATIONAL RATES

- Germany 5Y: 0.087% (down -3.4 bp); the German 1Y-10Y curve is 3.6 bp flatter at 97.3bp (YTD change: +54.1 bp)

- Japan 5Y: 0.042% (up 0.1 bp); the Japanese 1Y-10Y curve is unchanged at 27.6bp (YTD change: +10.2 bp)

- China 5Y: 2.536% (up 0.4 bp); the Chinese 1Y-10Y curve is 1.1 bp flatter at 63.3bp (YTD change: +12.3 bp)

- Switzerland 5Y: 0.034% (down -2.9 bp); the Swiss 1Y-10Y curve is 2.6 bp flatter at 99.2bp (YTD change: +44.7 bp)