Rates

US Treasuries 2s10s Spread Inverted This Week, With The Rise In Front-End Cash Yields Met By Additional Rate Cuts Priced Into Forwards

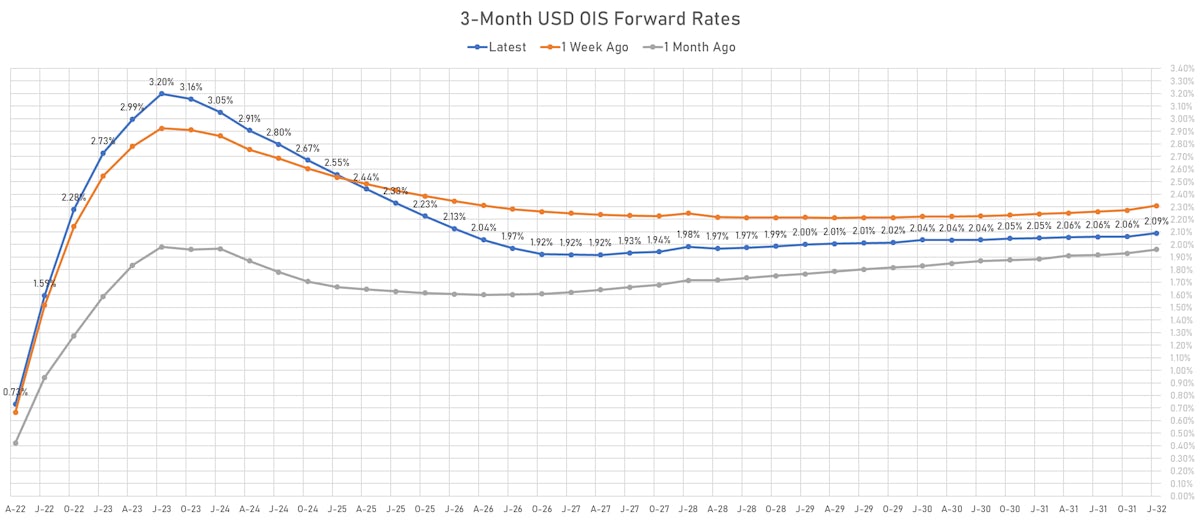

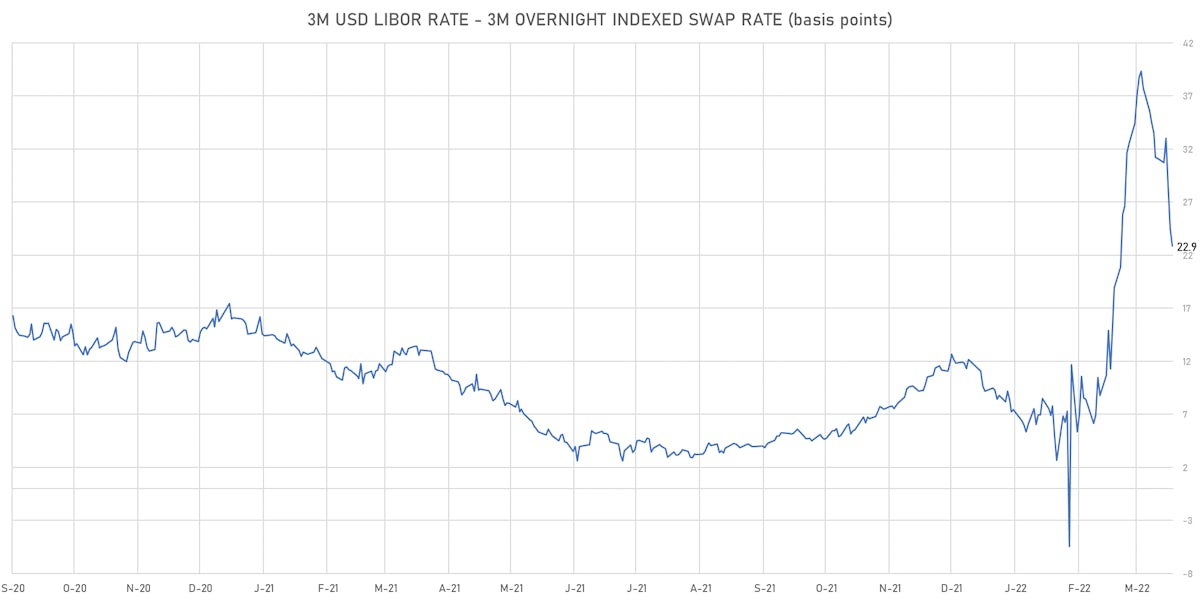

USD LIBOR-OIS basis spreads tightened this week as tensions in funding markets calmed down significantly, but the USD OIS curve now prices in close to 4 rate cuts of 25bp between 2023 and 2025 (a growing forward reversal of the current hiking cycle)

Published ET

Eurodollar EDZ25-EDU23 Spread and USD 3-month OIS 42X45 - 18x21 forward spread | Source: Refinitiv

DAILY US SUMMARY

- 3-Month USD LIBOR unchanged today, now at 0.9620%; 3-Month OIS +1.7bp at 0.7335%

- The treasury yield curve flattened, with the 1s10s spread tightening -3.6 bp, now at 70.2 bp (YTD change: -43.1bp)

- 1Y: 1.6870% (up 8.0 bp)

- 2Y: 2.4615% (up 12.8 bp)

- 5Y: 2.5638% (up 10.1 bp)

- 7Y: 2.5055% (up 6.9 bp)

- 10Y: 2.3886% (up 4.4 bp)

- 30Y: 2.4336% (down 1.8 bp)

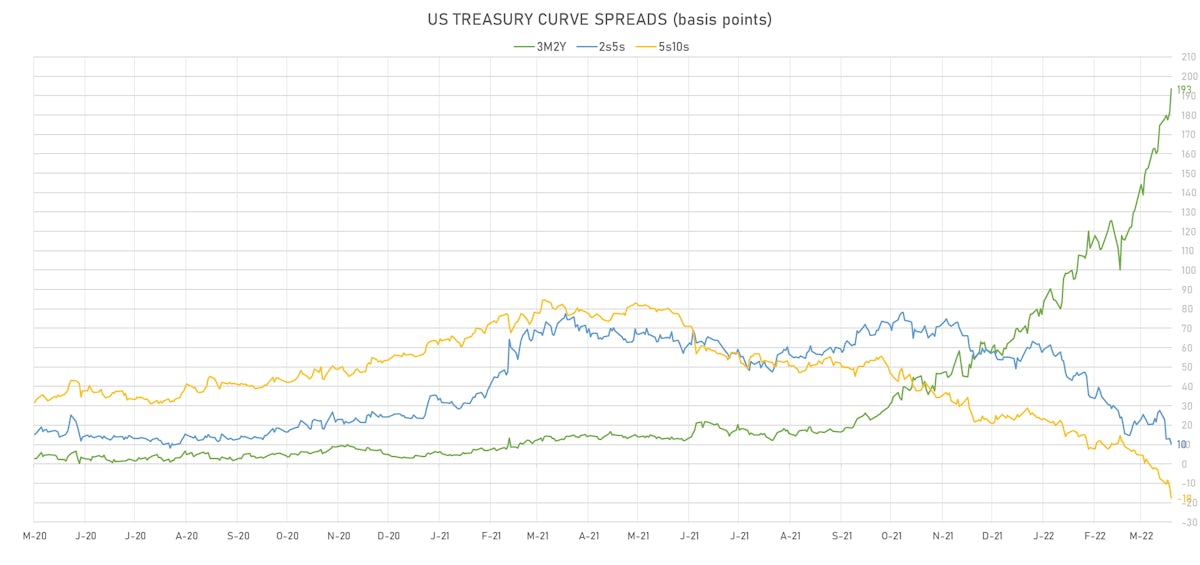

- US treasury curve spreads: 3m2Y at 193.5bp (up 12.0bp today), 2s5s at 10.2bp (down -2.7bp), 5s10s at -17.5bp (down -5.6bp), 10s30s at 4.5bp (down -6.2bp)

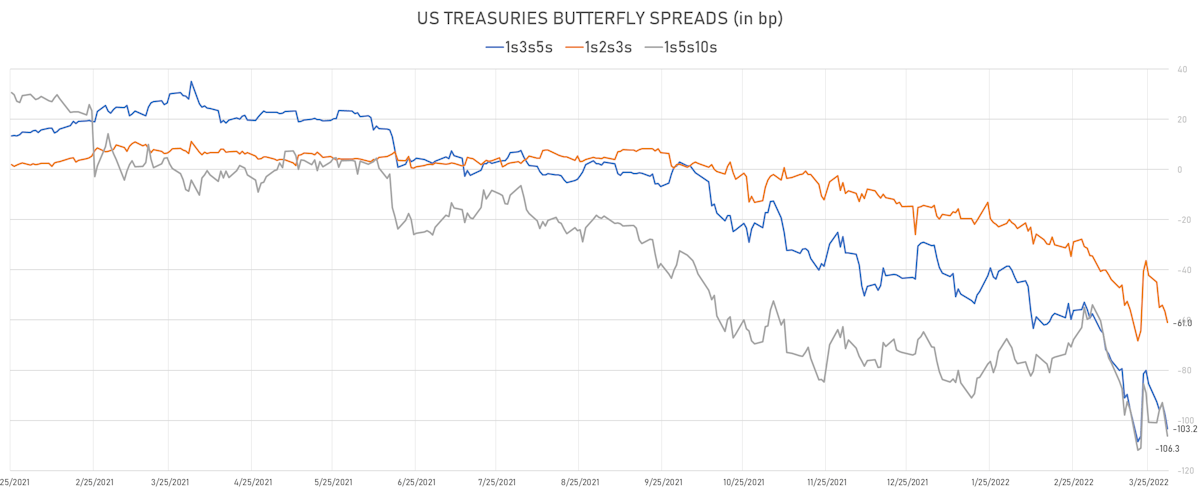

- Treasuries butterfly spreads: 1s5s10s at -106.3bp (down -6.9bp), 5s10s30s at 21.7bp (down -0.8bp)

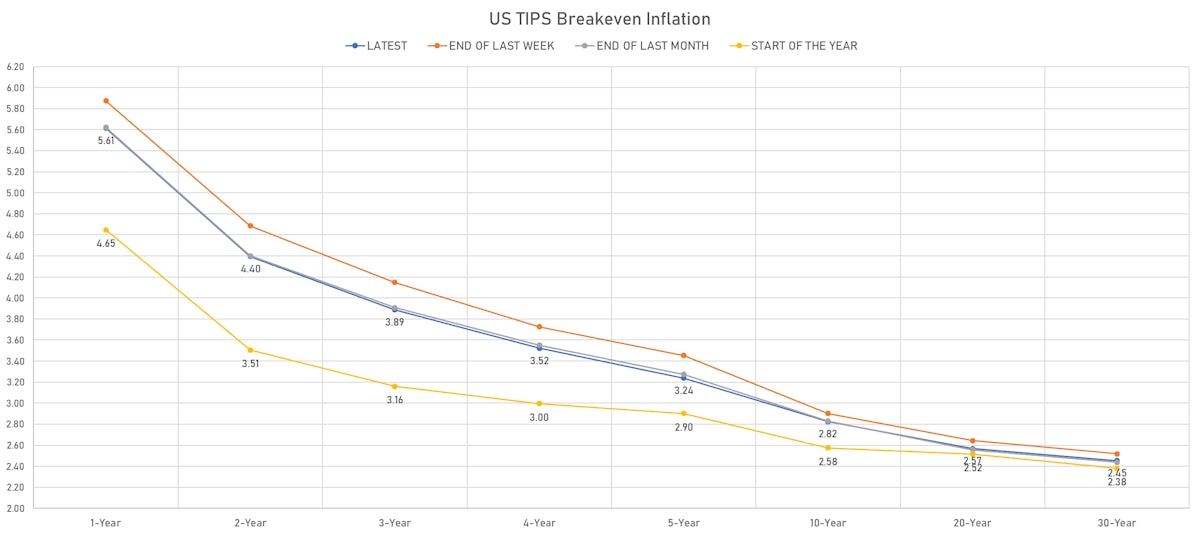

- TIPS 1Y breakeven inflation at 5.61% (down -0.9bp); 2Y at 4.40% (down -0.4bp); 5Y at 3.24% (down -3.6bp); 10Y at 2.82% (down -0.7bp); 30Y at 2.45% (up 1.4bp)

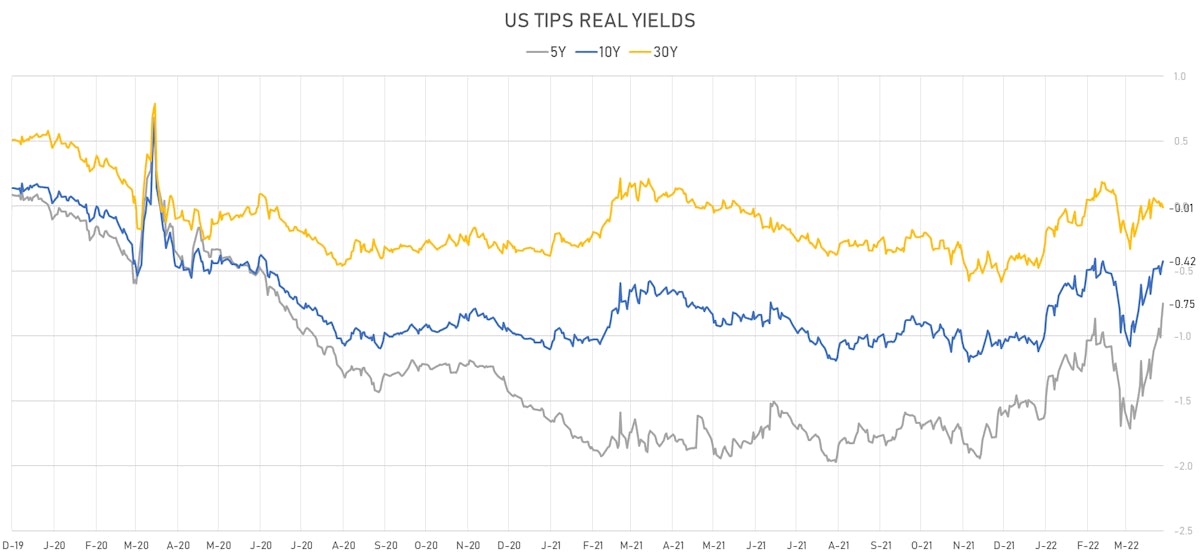

- US 5-Year TIPS Real Yield: +13.8 bp at -0.7500%; 10-Year TIPS Real Yield: +5.1 bp at -0.4230%; 30-Year TIPS Real Yield: -3.2 bp at -0.0130%

US MACRO RELEASES

- Average Earnings YY, Change Y/Y for Mar 2022 (BLS, U.S Dep. Of Lab) at 5.60 % (vs 5.10 % prior), above consensus estimate of 5.50 %

- Civilian participation, total for Mar 2022 (BLS, U.S Dep. Of Lab) at 62.40 % (vs 62.30 % prior)

- Construction Spending, Change P/P for Feb 2022 (U.S. Census Bureau) at 0.50 % (vs 1.30 % prior), below consensus estimate of 1.00 %

- Earnings, Average Hourly, Nonfarm payrolls, all employees, total private, Change P/P for Mar 2022 (BLS, U.S Dep. Of Lab) at 0.40 % (vs 0.00 % prior), in line with consensus

- Employment, Nonfarm payroll, goods-producing, manufacturing, total, Absolute change for Mar 2022 (BLS, U.S Dep. Of Lab) at 38.00 k (vs 36.00 k prior), above consensus estimate of 30.00 k

- Employment, Nonfarm payroll, service-producing, government, Absolute change for Mar 2022 (BLS, U.S Dep. Of Lab) at 5.00 k (vs 24.00 k prior)

- Employment, Nonfarm payroll, total private, Absolute change for Mar 2022 (BLS, U.S Dep. Of Lab) at 426.00 k (vs 654.00 k prior), below consensus estimate of 480.00 k

- Employment, Nonfarm payroll, total, Absolute change for Mar 2022 (BLS, U.S Dep. Of Lab) at 431.00 k (vs 678.00 k prior), below consensus estimate of 490.00 k

- Hours Worked, Average Per Week, Nonfarm payrolls, all employees, total private for Mar 2022 (BLS, U.S Dep. Of Lab) at 34.60 hrs (vs 34.70 hrs prior), below consensus estimate of 34.70 hrs

- ISM Manufacturing, Employment for Mar 2022 (ISM, United States) at 56.30 (vs 52.90 prior)

- ISM Manufacturing, New orders for Mar 2022 (ISM, United States) at 53.80 (vs 61.70 prior)

- ISM Manufacturing, PMI total for Mar 2022 (ISM, United States) at 57.10 (vs 58.60 prior), below consensus estimate of 59.00

- ISM Manufacturing, Prices for Mar 2022 (ISM, United States) at 87.10 (vs 75.60 prior), above consensus estimate of 80.00

- PMI, Manufacturing Sector, Total, Final for Mar 2022 (S&P Global) at 58.80 (vs 58.50 prior)

- Unemployment, Rate for Mar 2022 (BLS, U.S Dep. Of Lab) at 3.60 % (vs 3.80 % prior), below consensus estimate of 3.70 %

- Unemployment, Rate, Special (U-6) for Mar 2022 (BLS, U.S Dep. Of Lab) at 6.90 % (vs 7.20 % prior)

US WEEKLY SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -13.6 bp, now at 70.2 bp (YTD change: -43.1bp)

- 1Y: 1.6870% (up 3.7 bp)

- 2Y: 2.4615% (up 17.9 bp)

- 5Y: 2.5638% (up 0.4 bp)

- 7Y: 2.5055% (down 6.1 bp)

- 10Y: 2.3886% (down 9.8 bp)

- 30Y: 2.4336% (down 16.8 bp)

- US treasury curve spreads: 3m2Y at 193.5bp (up 18.8bp this week), 2s5s at 10.2bp (down -17.4bp), 5s10s at -17.5bp (down -10.3bp), 10s30s at 4.5bp (down -7.0bp)

- TIPS 1Y breakeven inflation at 5.61% (down -67.5bp); 2Y at 4.40% (down -53.5bp); 5Y at 3.24% (down -34.6bp); 10Y at 2.82% (down -16.2bp); 30Y at 2.45% (down -9.6bp)

- US 5-Year TIPS Real Yield: +36.5 bp at -0.7500%; 10-Year TIPS Real Yield: +6.4 bp at -0.4230%; 30-Year TIPS Real Yield: -7.3 bp at -0.0130%

US RELEASES IN THE WEEK AHEAD

US FORWARD RATES

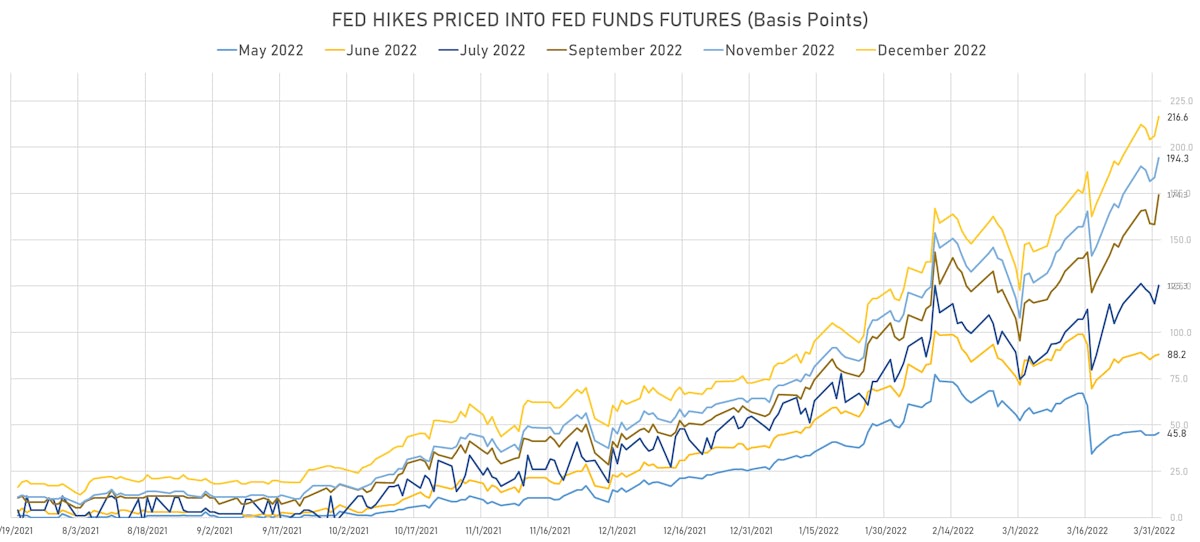

- Fed Funds futures now price in 45.8bp of Fed hikes by the end of May 2022, 88.2bp (3.5 x 25bp hikes) by the end of June 2022, and price in 8.7 hikes by the end of the year (on top of the 25bp in March)

- 3-month Eurodollar futures (EDZ) spreads price in 40 bp of hikes in 2023 (equivalent to 1.6 x 25 bp hikes), up 2.0 bp today, and -37.0 bp of hikes in 2024 (equivalent to -1.5 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 5.61% (down -0.9bp); 2Y at 4.40% (down -0.4bp); 5Y at 3.24% (down -3.6bp); 10Y at 2.82% (down -0.7bp); 30Y at 2.45% (up 1.4bp)

- 6-month spot US CPI swap down -29.6 bp to 5.887%, with a flattening of the forward curve

- US Real Rates: 5Y at -0.7500%, +13.8 bp today; 10Y at -0.4230%, +5.1 bp today; 30Y at -0.0130%, -3.2 bp today

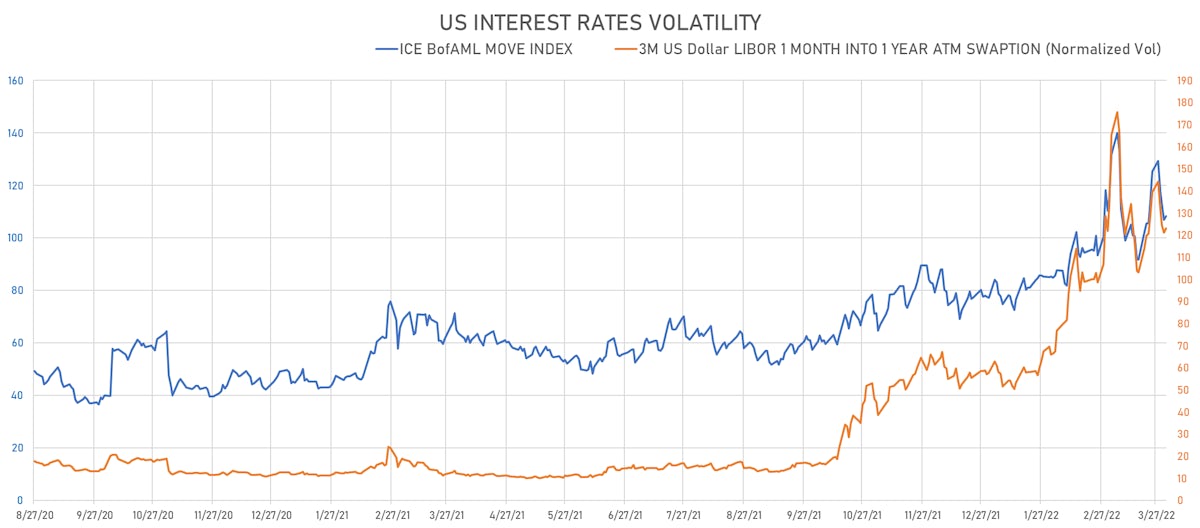

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.9 vols at 123.0 normals

- 3-Month LIBOR-OIS spread down -1.7 bp at 22.9 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.387% (up 2.2 bp); the German 1Y-10Y curve is 0.1 bp flatter at 97.7bp (YTD change: +54.5 bp)

- Japan 5Y: 0.021% (down -1.1 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 29.8bp (YTD change: +12.2 bp)

- China 5Y: 2.541% (down -2.2 bp); the Chinese 1Y-10Y curve is 0.3 bp steeper at 67.3bp (YTD change: +16.3 bp)

- Switzerland 5Y: 0.289% (up 4.1 bp); the Swiss 1Y-10Y curve is 2.2 bp steeper at 120.9bp (YTD change: +62.0 bp)