Rates

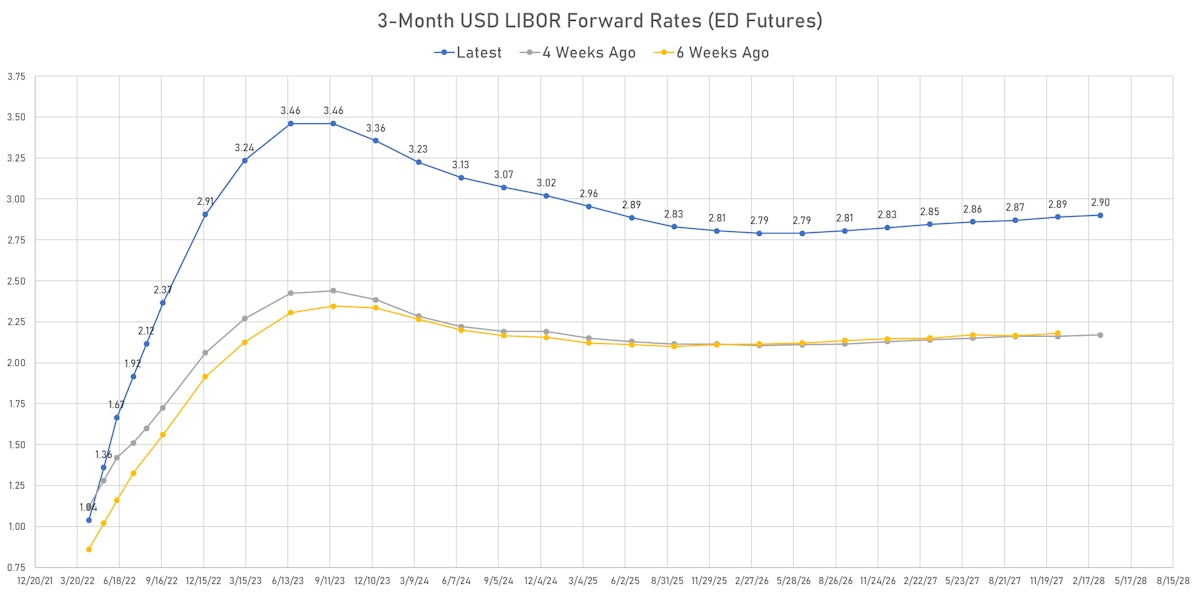

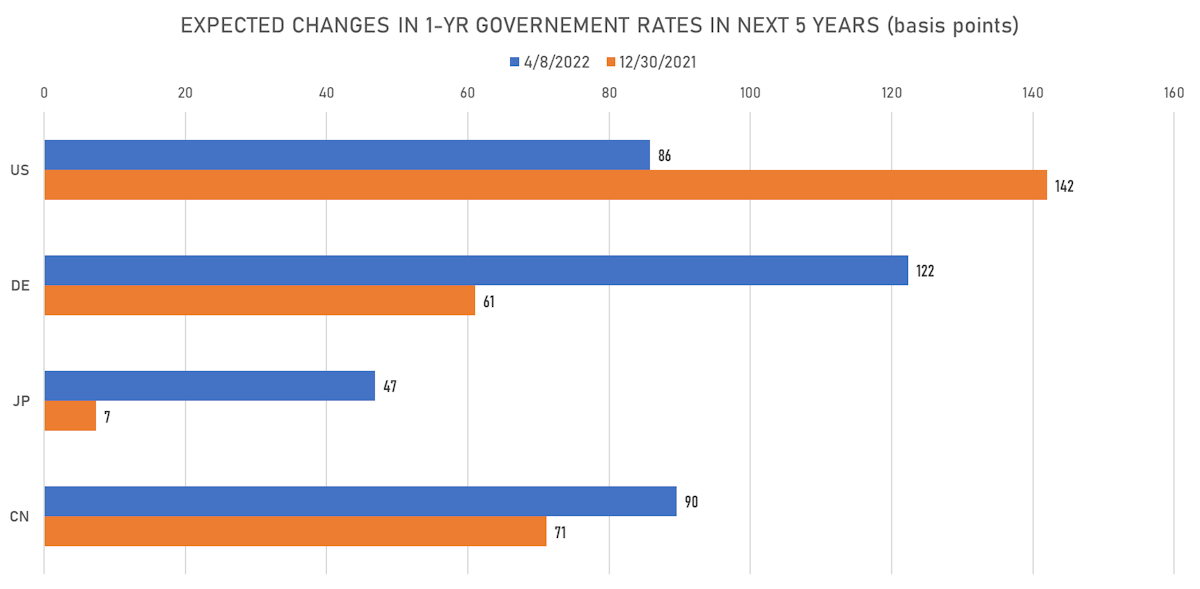

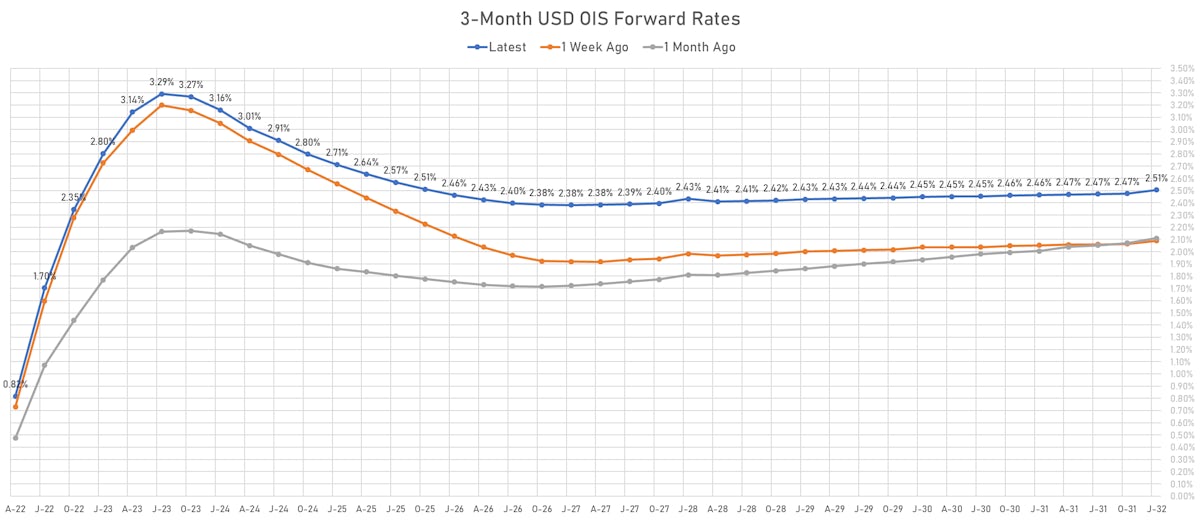

Repricing Of Forward Rates Higher Was The Main Development This Week, With 3M USD OIS 4 Years Forward Up Nearly 50bp, Leading To Curve Steepening

On the sell side, Goldman Sachs contends that "expeditiously" might mean 4 x 50bp hikes until the Fed reaches its neutral rate, although the GS base case is still for 2x50bp followed by 4x25bp this year, and 3x25bp next year

Published ET

3-Month USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 24.3 bp, now at 94.5 bp (YTD change: -18.7bp)

- 1Y: 1.7580% (up 7.1 bp)

- 2Y: 2.5146% (up 5.3 bp)

- 5Y: 2.7538% (up 19.0 bp)

- 7Y: 2.7757% (up 27.0 bp)

- 10Y: 2.7029% (up 31.4 bp)

- 30Y: 2.7202% (up 28.7 bp)

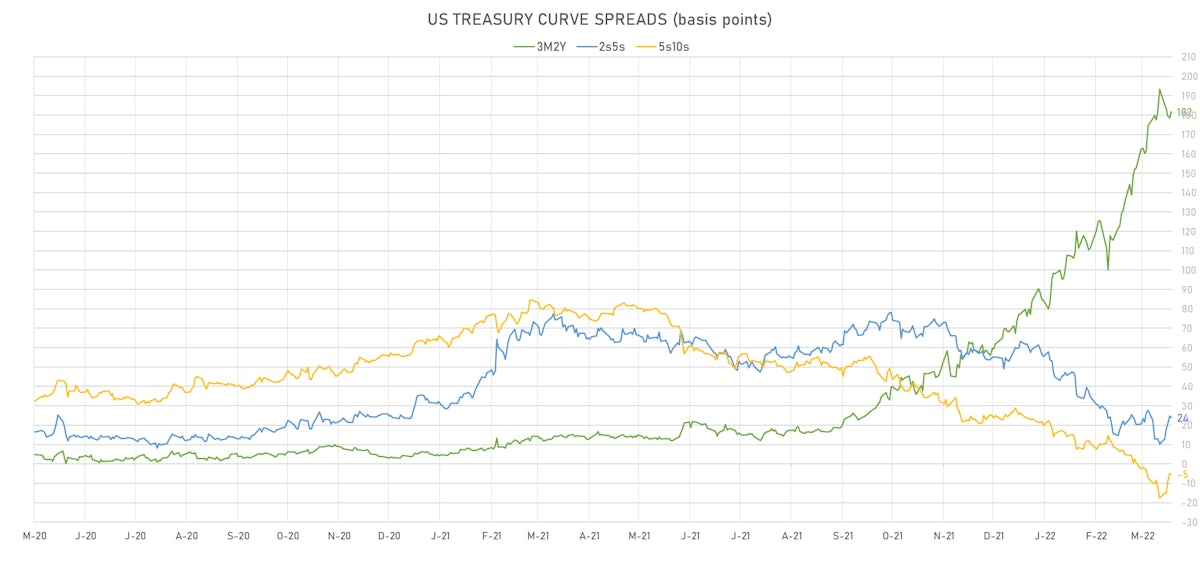

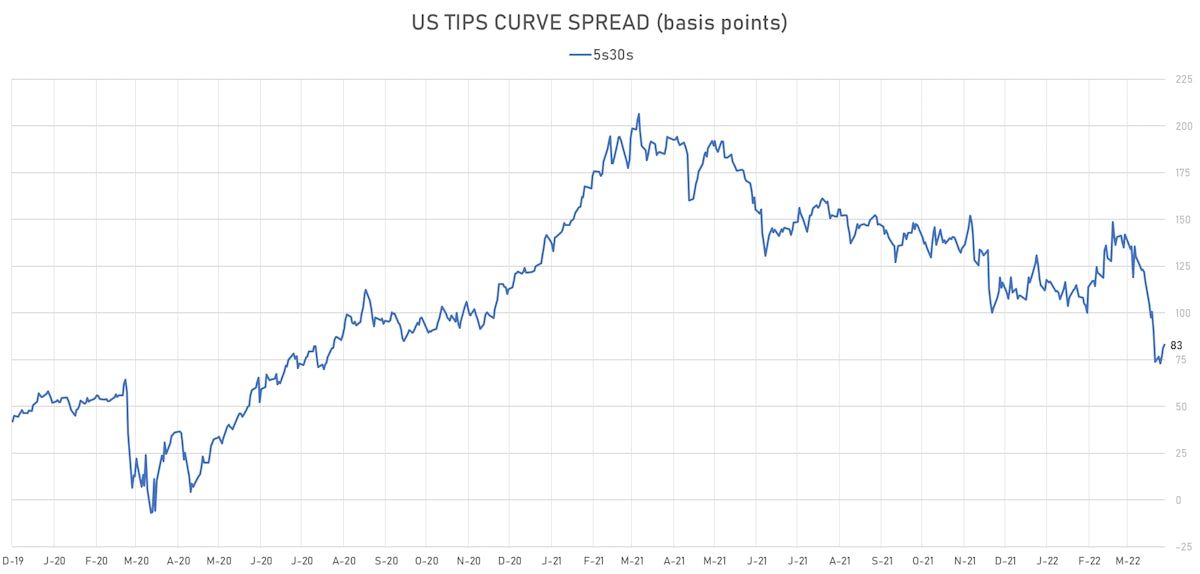

- US treasury curve spreads: 3m2Y at 181.8bp (down -11.7bp this week), 2s5s at 23.9bp (up 13.7bp), 5s10s at -5.1bp (up 12.4bp), 10s30s at 1.7bp (down -2.7bp)

- TIPS 1Y breakeven inflation at 5.72% (up 10.1bp); 2Y at 4.36% (down -3.6bp); 5Y at 3.30% (up 6.5bp); 10Y at 2.90% (up 7.6bp); 30Y at 2.54% (up 8.5bp)

- US 5-Year TIPS Real Yield: +12.0 bp at -0.6300%; 10-Year TIPS Real Yield: +24.4 bp at -0.1790%; 30-Year TIPS Real Yield: +21.2 bp at 0.1990%

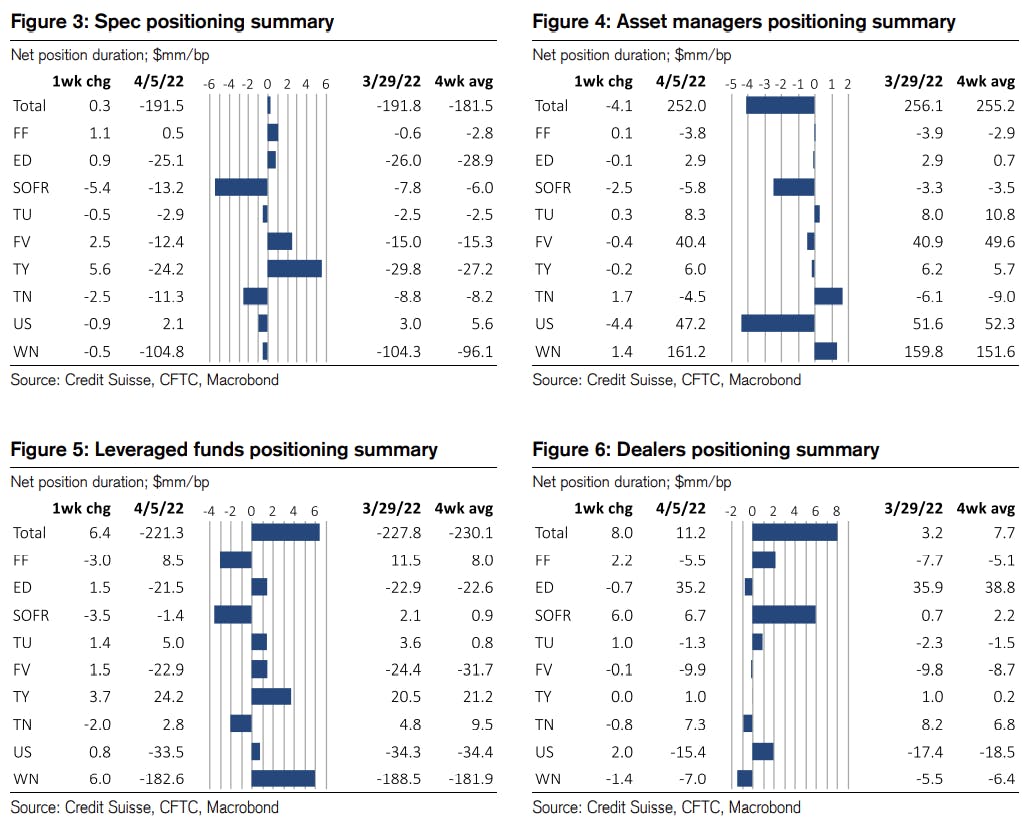

WEEKLY CFTC NET DURATION POSITIONING UPDATE

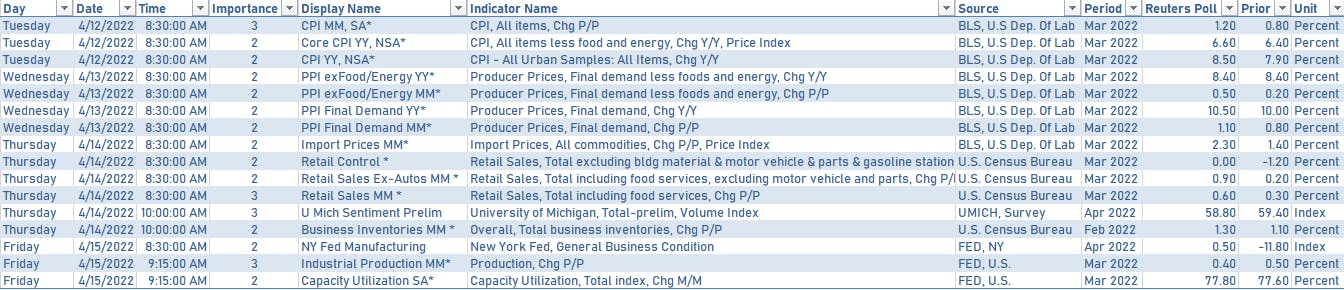

US WEEK AHEAD

- Main releases this week will be the CPI on Tuesday, PPI on Wednesday, retail sales on Thursday and industrial production on Friday

- Coupon-bearing Treasury auctions: 3Y on Monday, 10Y on Tuesday and 30Y on Wednesday

- The Fed's Mester and Harker will both make speeches on Thursday afternoon

US FORWARD RATES

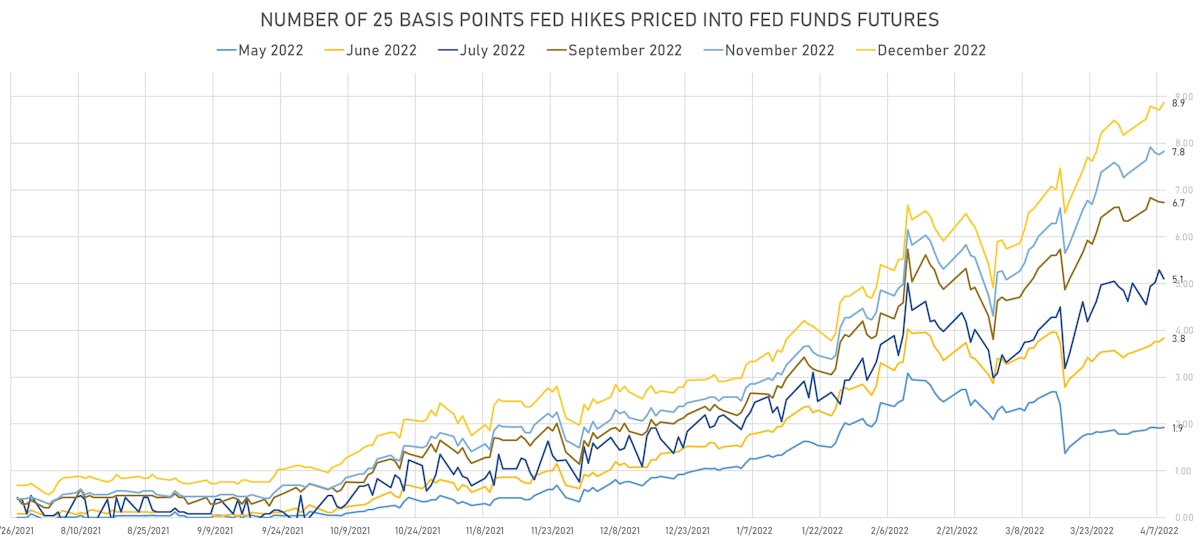

- Fed Funds futures now price in 46.4bp of Fed hikes by the end of May 2022, 92.9bp (3.7 x 25bp hikes) by the end of June 2022, and price in 8.8 hikes by the end of December 2022

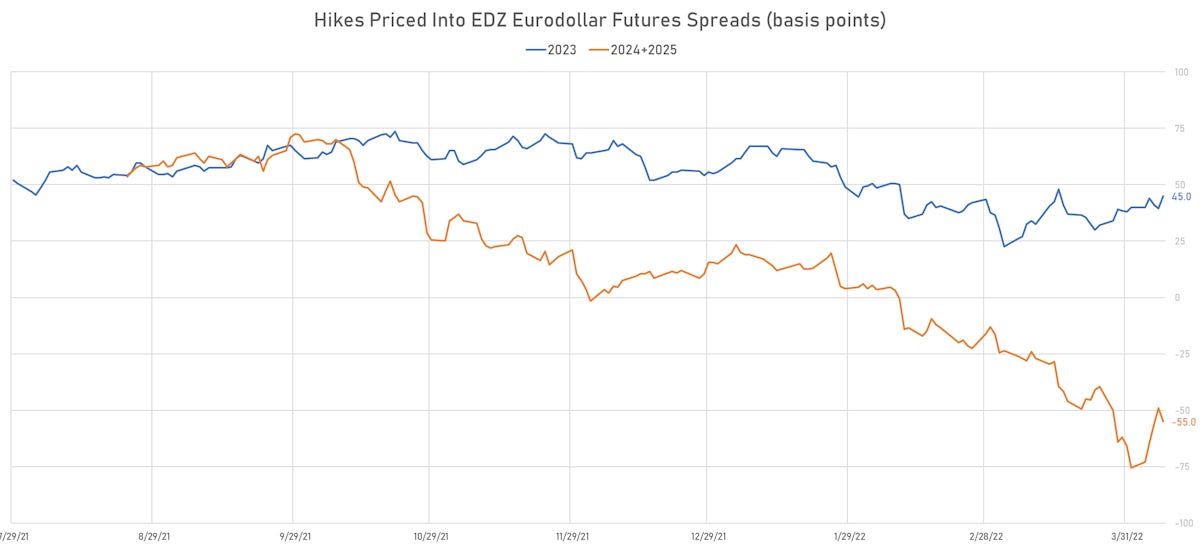

- 3-month Eurodollar futures (EDZ) spreads price in 45 bp of hikes in 2023 (equivalent to 1.8 x 25 bp hikes), up 5.5 bp today, and -33.5 bp of hikes in 2024 (equivalent to -1.3 x 25 bp hikes)

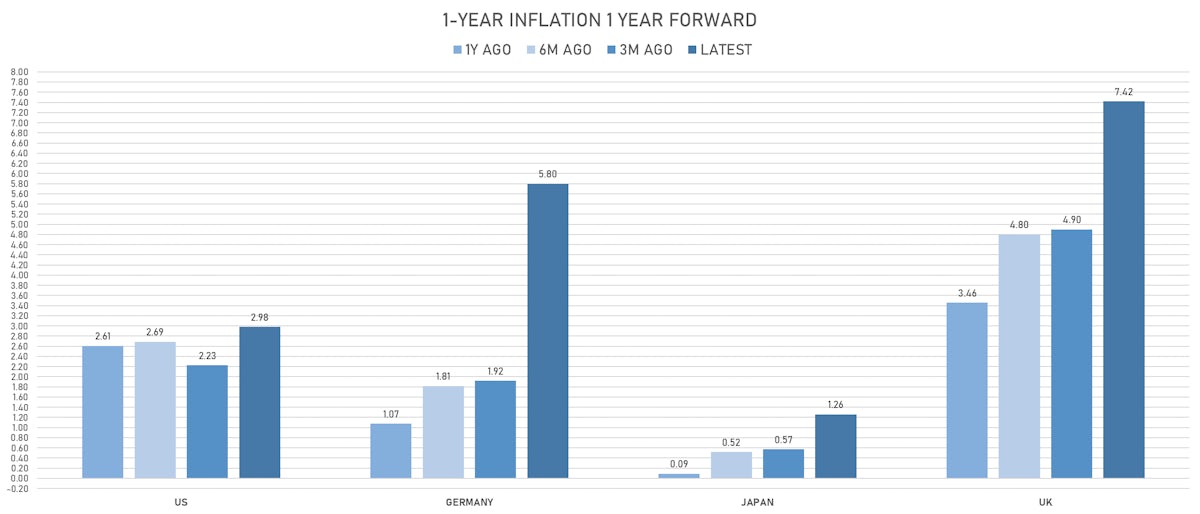

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.72% (up 17.3bp today); 2Y at 4.36% (up 10.6bp); 5Y at 3.30% (up 7.1bp); 10Y at 2.90% (up 4.7bp); 30Y at 2.54% (up 5.5bp)

- 6-month spot US CPI swap up 15.2 bp today to 5.992%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.6300%, -2.8 bp today; 10Y at -0.1790%, -0.5 bp; 30Y at 0.1990%, -0.9 bp

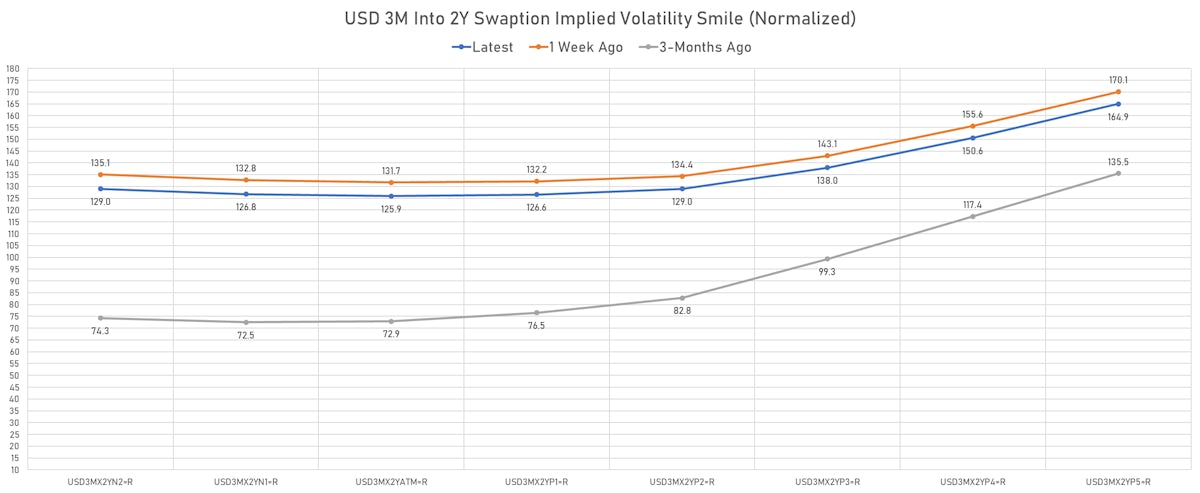

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.4 vols at 126.7 normals, still extremely high on a historical basis

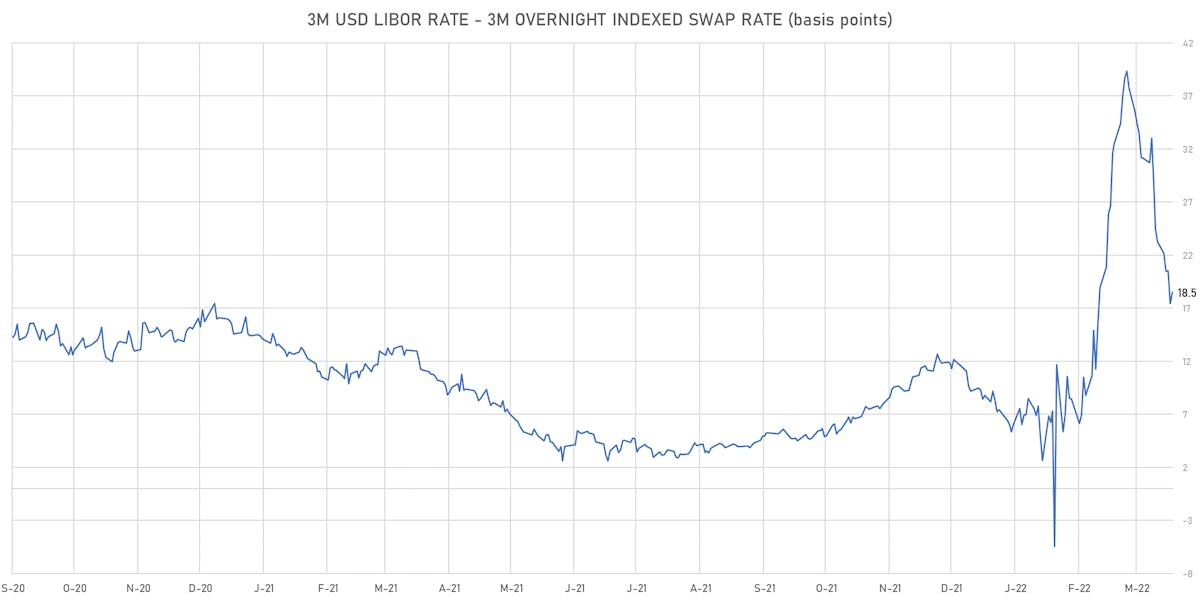

- 3-Month LIBOR-OIS spread up 1.1 bp at 18.5 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.539% (up 5.8 bp); the German 1Y-10Y curve is 2.5 bp steeper at 115.5bp (YTD change: -42.5 bp)

- Japan 5Y: 0.017% (down -1.4 bp); the Japanese 1Y-10Y curve is 2.2 bp steeper at 33.1bp (YTD change: -15.9 bp)

- China 5Y: 2.504% (up 0.5 bp); the Chinese 1Y-10Y curve is 0.2 bp steeper at 71.0bp (YTD change: -50.3 bp)

- Switzerland 5Y: 0.456% (up 8.5 bp); the Swiss 1Y-10Y curve is 3.9 bp steeper at 126.5bp (YTD change: -55.2 bp)