Rates

Fed Credibility Increases: Rates Markets Price In Higher Likelihood For Narrow Path To Controlling Inflation Without Creating A Recession

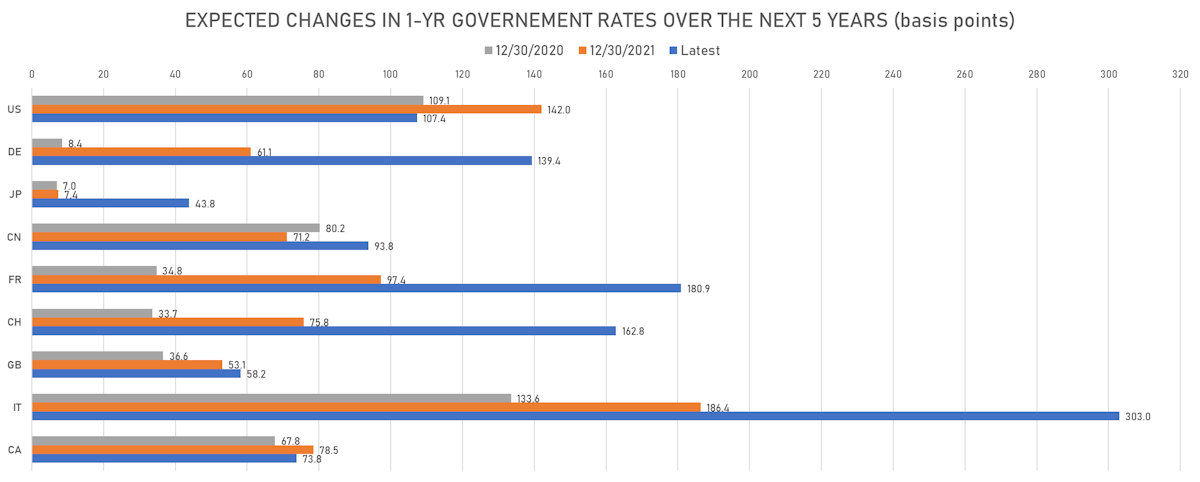

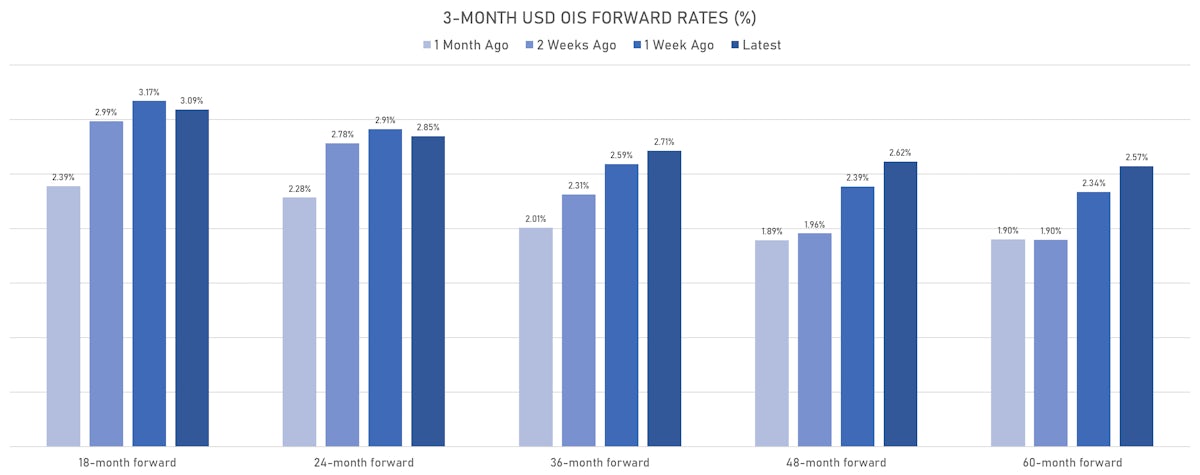

The inversion of the US forward OIS curve has faded to a substantial extent, led by a sharp increase in 5Y-forward 3M rates, with the front end of the curve pretty stable and more fully priced

Published ET

Recent Changes Of 3-Month USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

DAILY US SUMMARY

- 3-Month USD LIBOR +1.8bp today, now at 1.0620%; 3-Month USD OIS unchanged at 0.8500%

- The treasury yield curve steepened, with the 1s10s spread widening 5.5 bp, now at 109.5 bp (YTD change: -3.7bp)

- 1Y: 1.7317% (up 7.0 bp)

- 2Y: 2.4539% (up 9.1 bp)

- 5Y: 2.7847% (up 12.5 bp)

- 7Y: 2.8398% (up 12.5 bp)

- 10Y: 2.8265% (up 12.5 bp)

- 30Y: 2.9177% (up 10.7 bp)

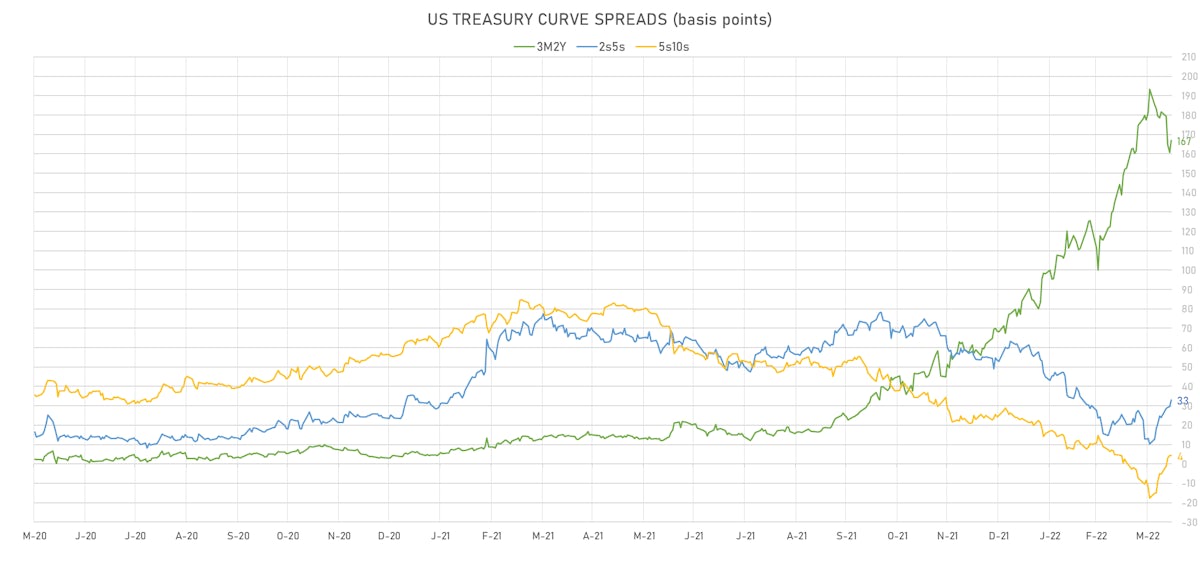

- US treasury curve spreads: 3m2Y at 166.9bp (up 6.2bp today), 2s5s at 33.1bp (up 3.4bp), 5s10s at 4.2bp (down 0.0bp), 10s30s at 9.1bp (down -1.9bp)

- Treasuries butterfly spreads: 1s5s10s at -103.7bp (down -8.1bp), 5s10s30s at 4.0bp (down -2.1bp)

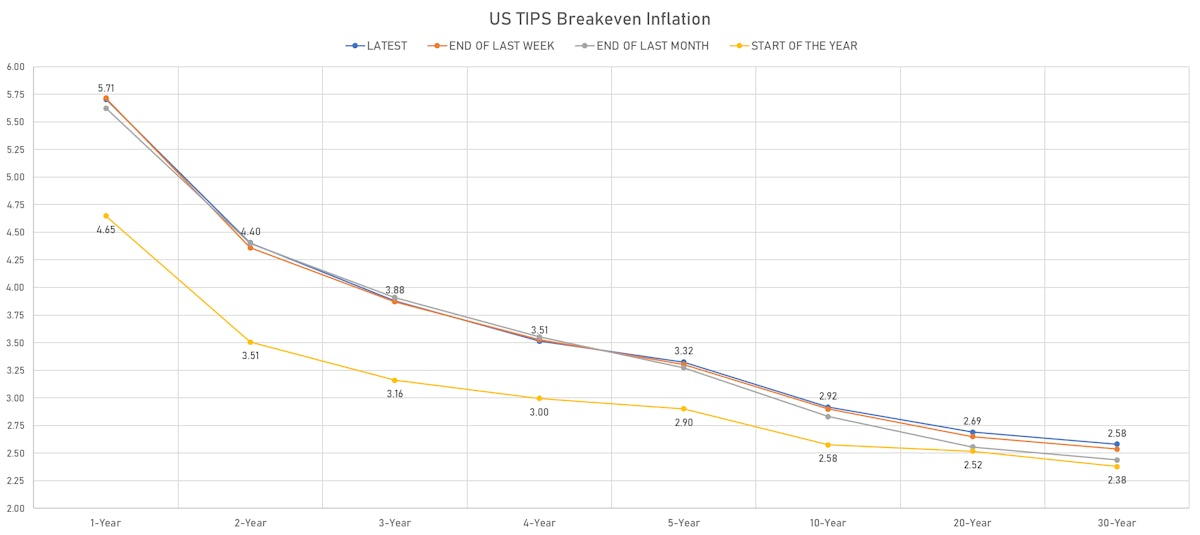

- TIPS 1Y breakeven inflation at 5.71% (down -1.7bp); 2Y at 4.40% (up 6.8bp); 5Y at 3.32% (up 8.7bp); 10Y at 2.92% (up 8.3bp); 30Y at 2.58% (up 8.3bp)

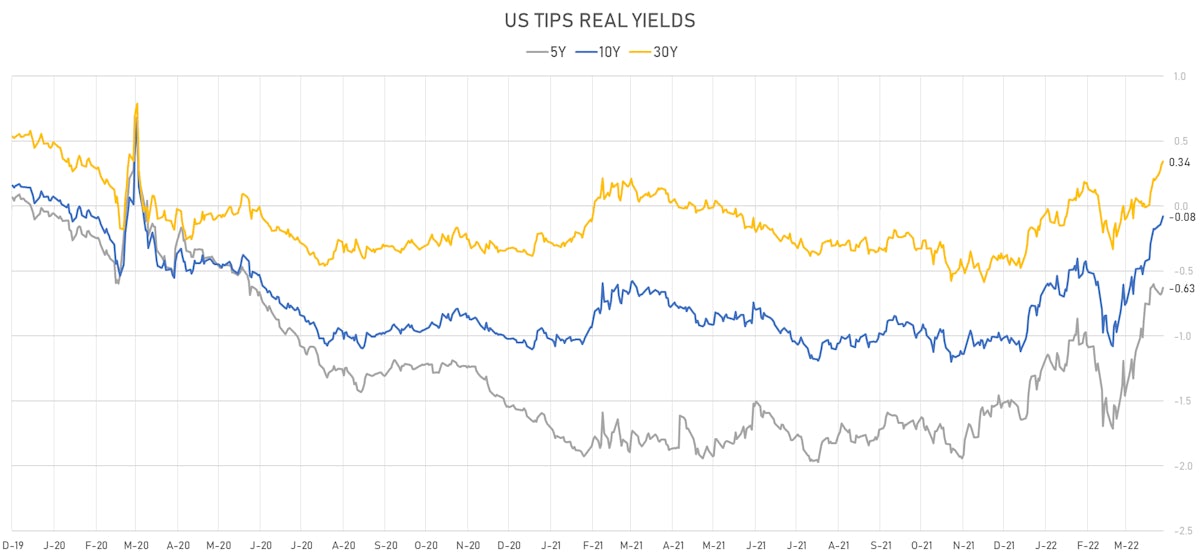

- US 5-Year TIPS Real Yield: +4.2 bp at -0.6300%; 10-Year TIPS Real Yield: +4.1 bp at -0.0790%; 30-Year TIPS Real Yield: +2.4 bp at 0.3430%

US MACRO RELEASES

- Export Prices, All commodities, Change P/P, Price Index for Mar 2022 (BLS, U.S Dep. Of Lab) at 4.50 % (vs 3.00 % prior), above consensus estimate of 2.20 %

- Import Prices, All commodities, Change P/P, Price Index for Mar 2022 (BLS, U.S Dep. Of Lab) at 2.60 % (vs 1.40 % prior), above consensus estimate of 2.30 %

- Jobless Claims, National, Continued for W 02 Apr (U.S. Dept. of Labor) at 1.48 Mln (vs 1.52 Mln prior), below consensus estimate of 1.50 Mln

- Jobless Claims, National, Initial for W 09 Apr (U.S. Dept. of Labor) at 185.00 k (vs 166.00 k prior), above consensus estimate of 171.00 k

- Jobless Claims, National, Initial, four week moving average for W 09 Apr (U.S. Dept. of Labor) at 172.25 k (vs 170.00 k prior)

- Overall, Total business inventories, Change P/P for Feb 2022 (U.S. Census Bureau) at 1.50 % (vs 1.10 % prior), above consensus estimate of 1.30 %

- Retail Sales, Total excluding bldg material & motor vehicle & parts & gasoline station & food svc, Change P/P for Mar 2022 (U.S. Census Bureau) at -0.10 % (vs -1.20 % prior), below consensus estimate of 0.20 %

- Retail Sales, Total excluding motor vehicle dealers and gasoline station, Change P/P for Mar 2022 (U.S. Census Bureau) at 0.20 % (vs -0.40 % prior)

- Retail Sales, Total including food services, Change P/P for Mar 2022 (U.S. Census Bureau) at 0.50 % (vs 0.30 % prior), below consensus estimate of 0.60 %

- Retail Sales, Total including food services, excluding motor vehicle and parts, Change P/P for Mar 2022 (U.S. Census Bureau) at 1.10 % (vs 0.20 % prior), above consensus estimate of 1.00 %

- University of Michigan, Current Conditions Index-prelim, Volume Index for Apr 2022 (UMICH, Survey) at 68.10 (vs 67.20 prior), above consensus estimate of 68.00

- 1 Year Inflation Expectations (median), preliminary for Apr 2022 (UMICH, Survey) at 5.40 % (vs 5.40 % prior)

- University of Michigan, Total-prelim, Change Y/Y for Apr 2022 (UMICH, Survey) at 3.00 % (vs 3.00 % prior)

- University of Michigan, Total-prelim, Volume Index for Apr 2022 (UMICH, Survey) at 64.10 (vs 54.30 prior), above consensus estimate of 54.20

- University of Michigan, Total-prelim, Volume Index for Apr 2022 (UMICH, Survey) at 65.70 (vs 59.40 prior), above consensus estimate of 59.00

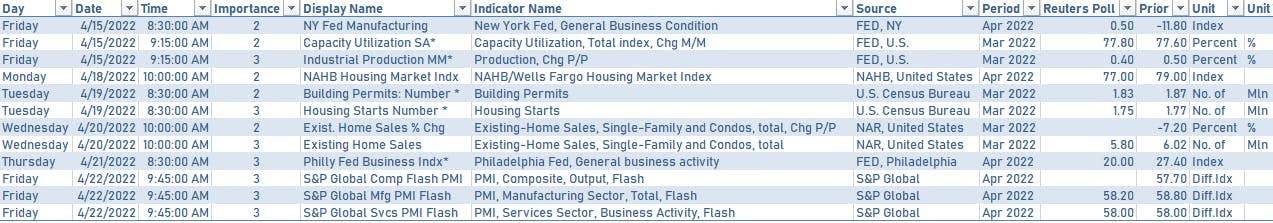

US MACRO RELEASES IN WEEK AHEAD

US FORWARD RATES

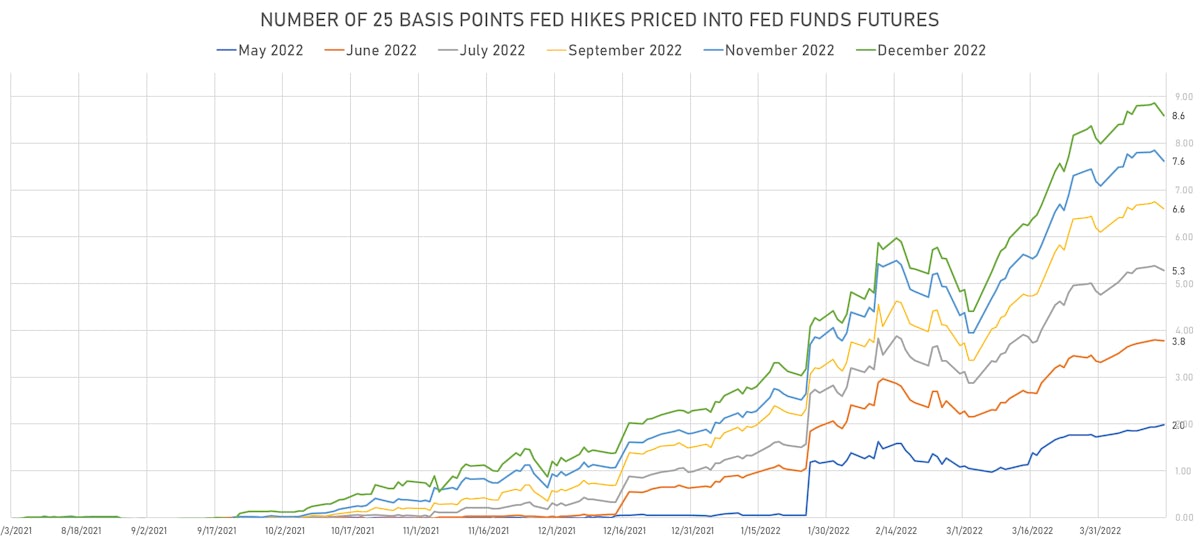

- Fed Funds futures now price in 49.5bp of Fed hikes by the end of May 2022, 94.5bp (3.8 x 25bp hikes) by the end of June 2022, and price in 8.6 hikes by the end of December 2022

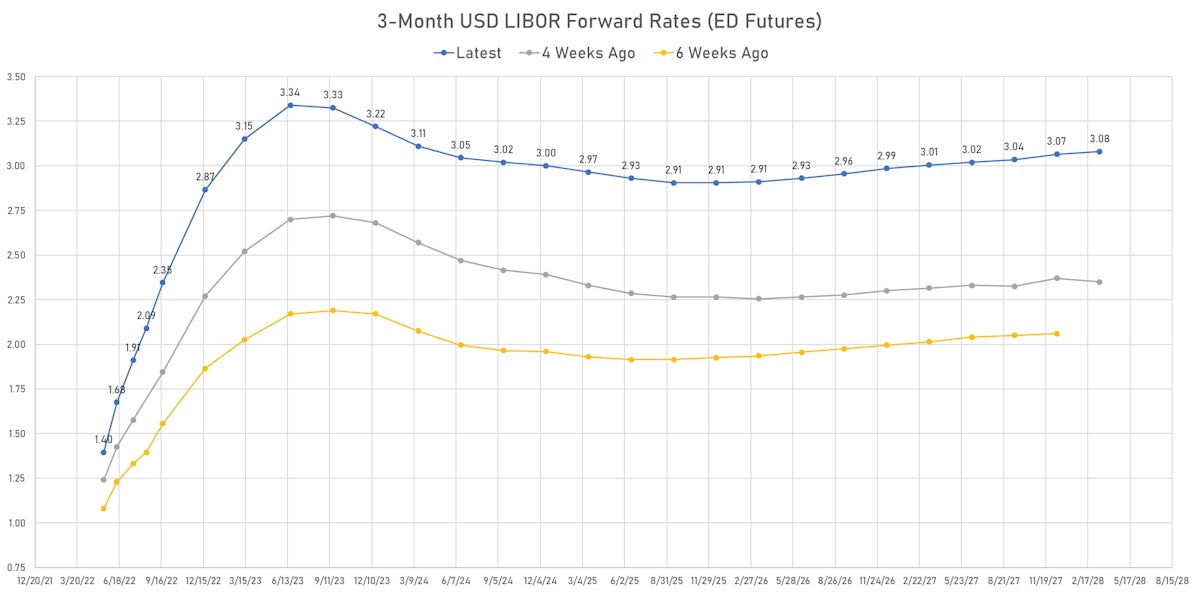

- 3-month Eurodollar futures (EDZ) spreads price in 35.5 bp of hikes in 2023 (equivalent to 1.4 x 25 bp hikes), up 3.0 bp today, and -22.0 bp of hikes in 2024 (equivalent to -0.9 x 25 bp hikes)

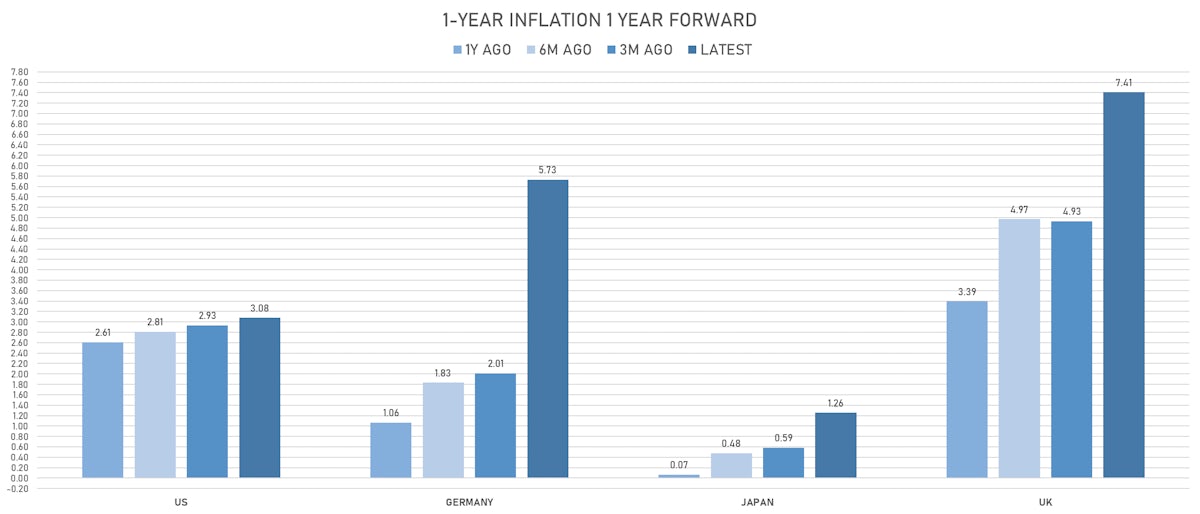

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.71% (down -1.7bp); 2Y at 4.40% (up 6.8bp); 5Y at 3.32% (up 8.7bp); 10Y at 2.92% (up 8.3bp); 30Y at 2.58% (up 8.3bp)

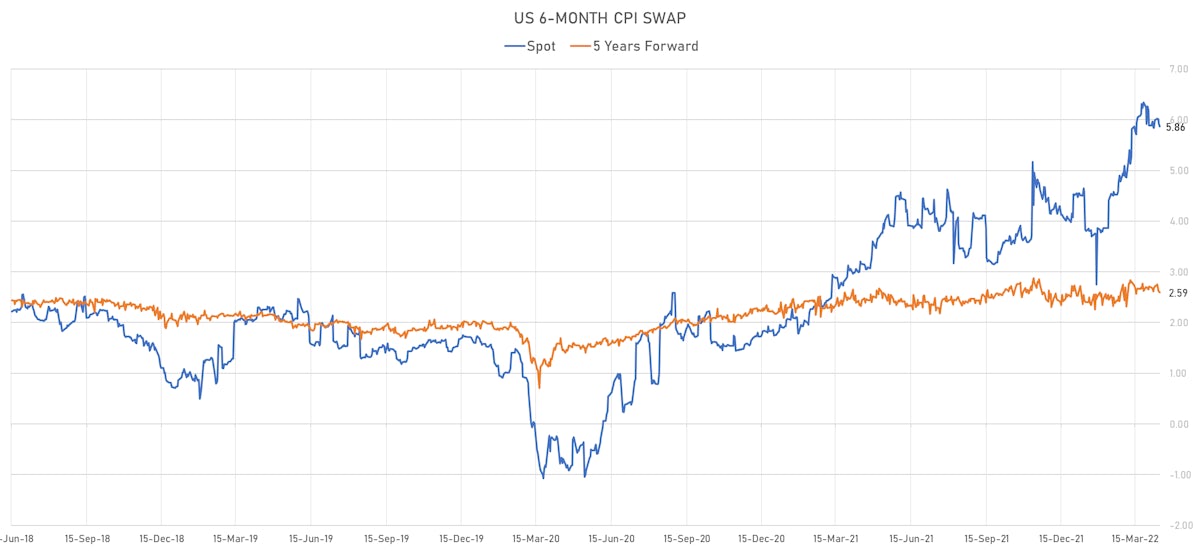

- 6-month spot US CPI swap down -6.1 bp to 5.863%, with a flattening of the forward curve

- US Real Rates: 5Y at -0.6300%, +4.2 bp today; 10Y at -0.0790%, +4.1 bp today; 30Y at 0.3430%, +2.4 bp today

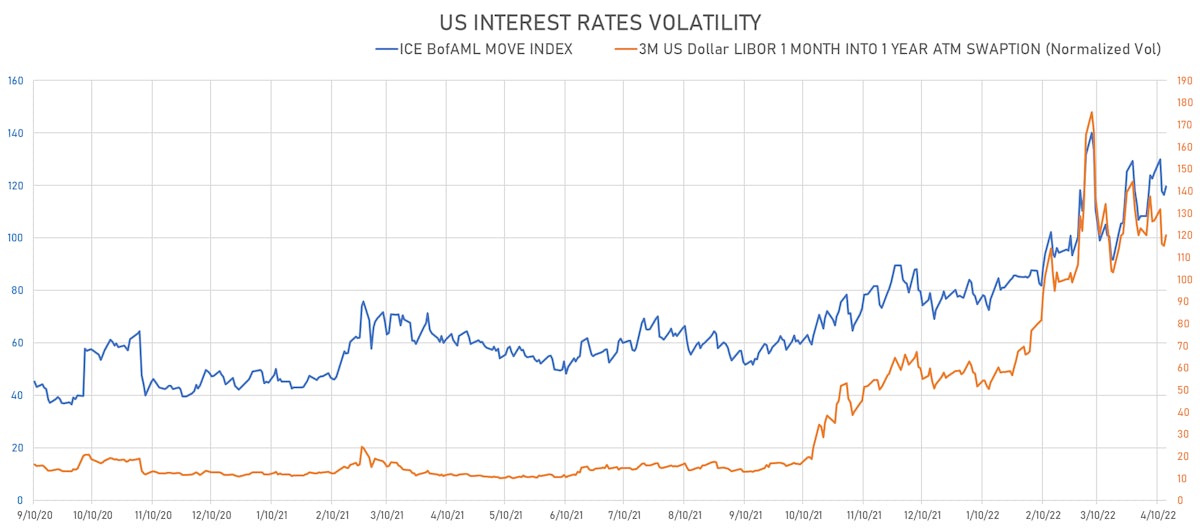

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 4.8 vols at 120.0 normals

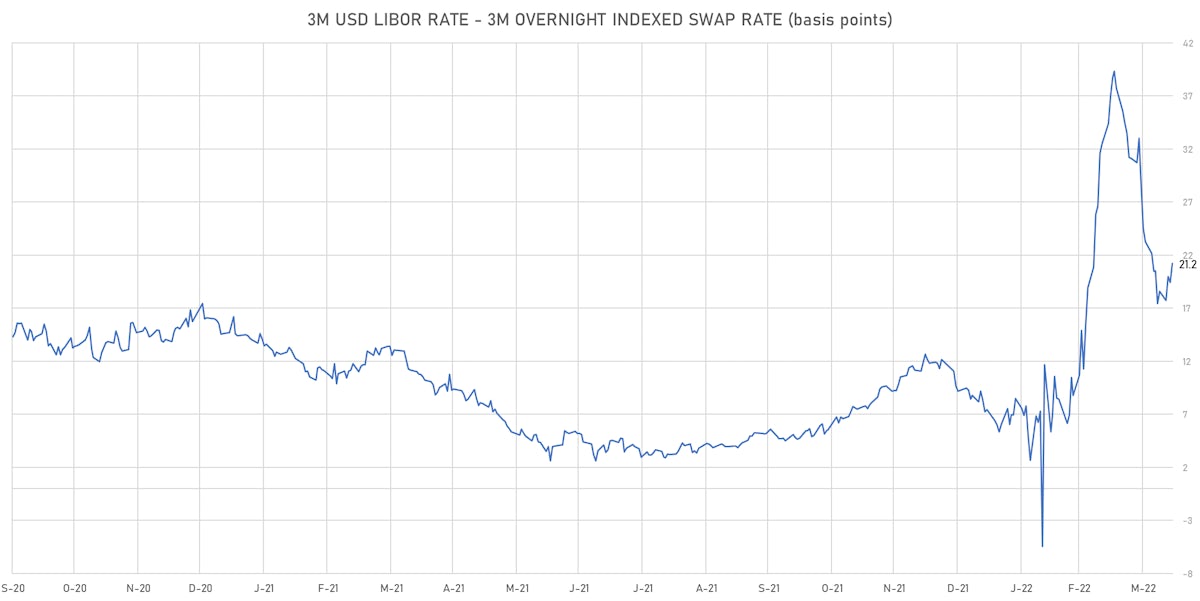

- 3-Month LIBOR-OIS spread up 1.8 bp at 21.2 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.588% (up 2.7 bp); the German 1Y-10Y curve is 6.4 bp steeper at 118.1bp (YTD change: -42.4 bp)

- Japan 5Y: 0.025% (down -0.1 bp); the Japanese 1Y-10Y curve is 0.4 bp flatter at 32.2bp (YTD change: -15.9 bp)

- China 5Y: 2.516% (down -0.6 bp); the Chinese 1Y-10Y curve is 2.5 bp steeper at 76.2bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.439% (up 0.4 bp); the Swiss 1Y-10Y curve is 4.4 bp steeper at 136.2bp (YTD change: -55.1 bp)