Rates

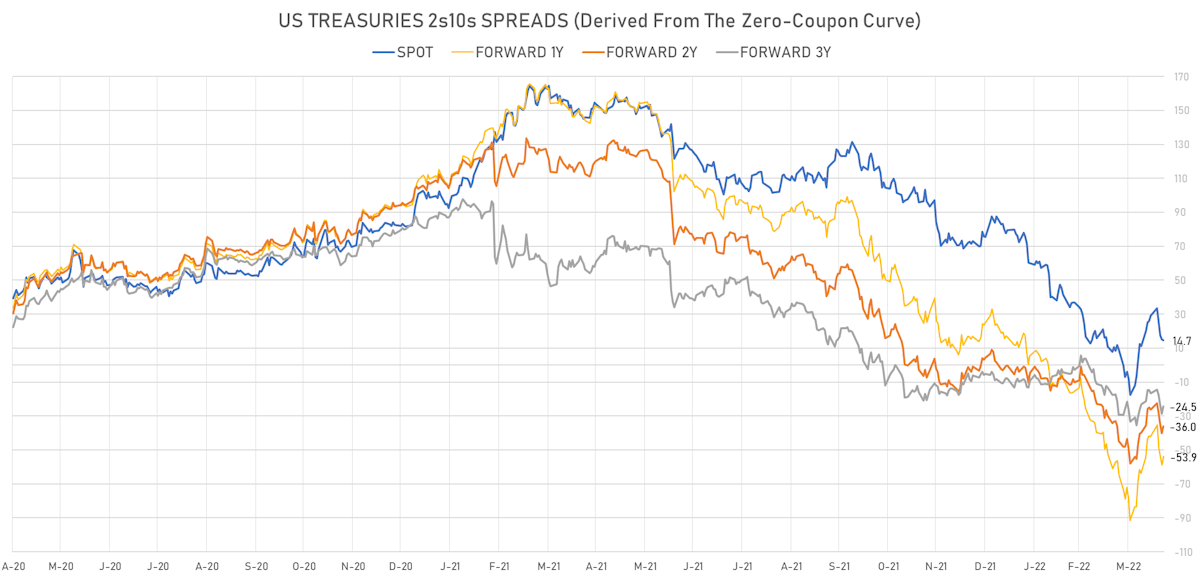

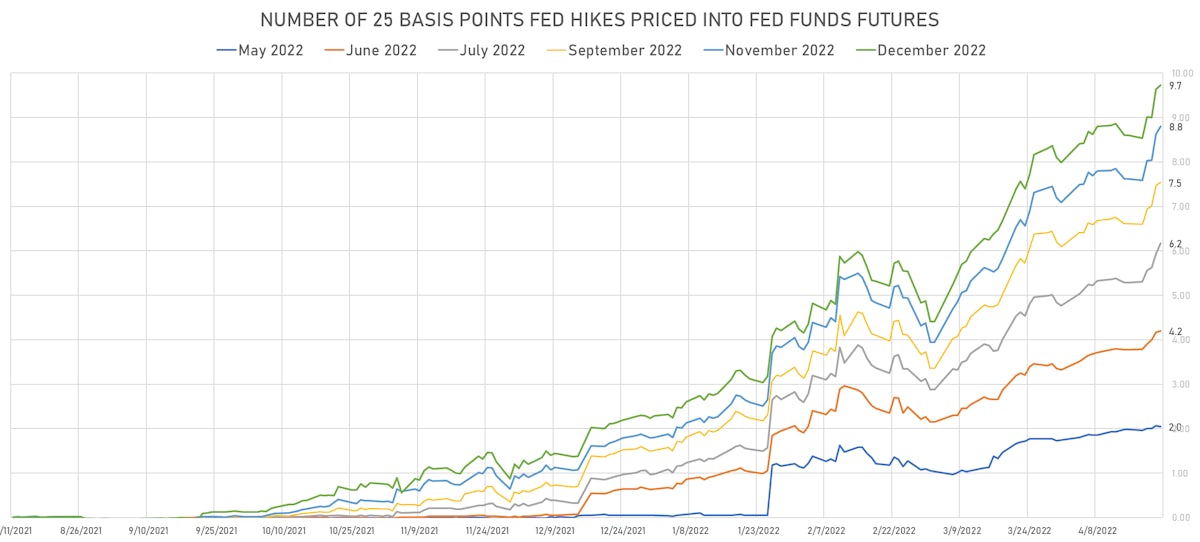

US Yield Curve Flattened This Week, With The Front End Pricing In More Aggressive Fed Tightening This Year

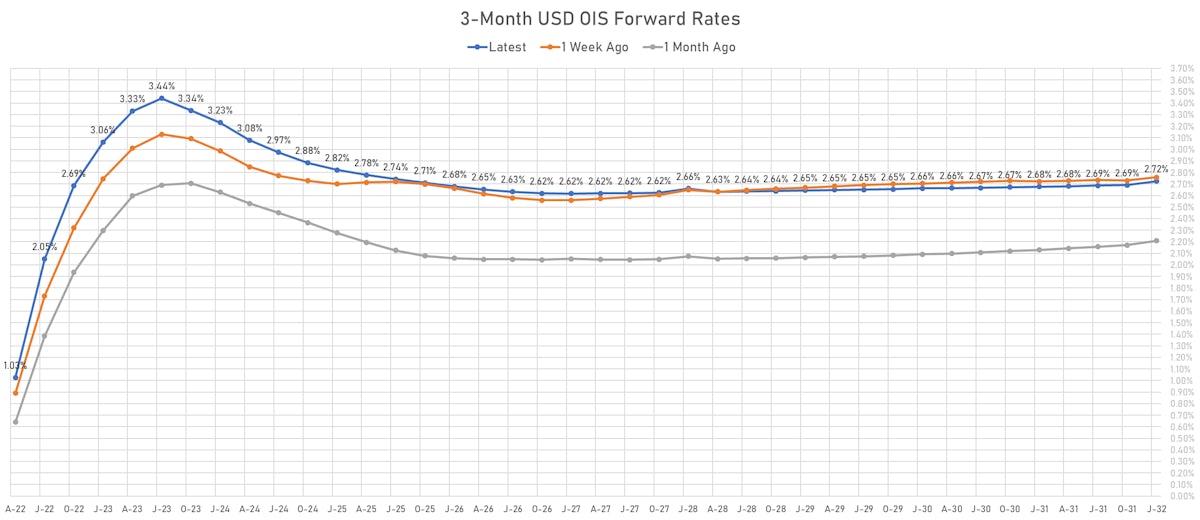

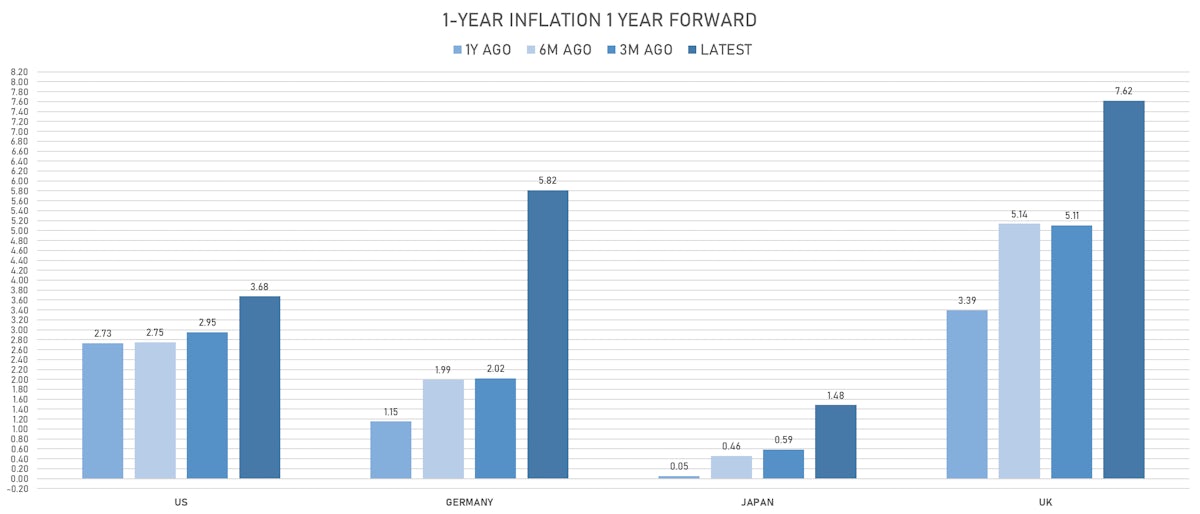

Money markets now expect to see close to 250 basis points in additional hikes this year: 4 consecutive 50bp hikes in May, June, July and September, followed by 25 bp hikes in November and December, thus bringing the overnight rate up to nearly 2.80% by year end

Published ET

Fed Hikes Priced Into Futures Markets | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -22.7 bp, now at 86.8 bp (YTD change: -26.4bp)

- 1Y: 2.0352% (up 30.4 bp)

- 2Y: 2.6767% (up 22.3 bp)

- 5Y: 2.9393% (up 15.5 bp)

- 7Y: 2.9507% (up 11.1 bp)

- 10Y: 2.9035% (up 7.7 bp)

- 30Y: 2.9492% (up 3.1 bp)

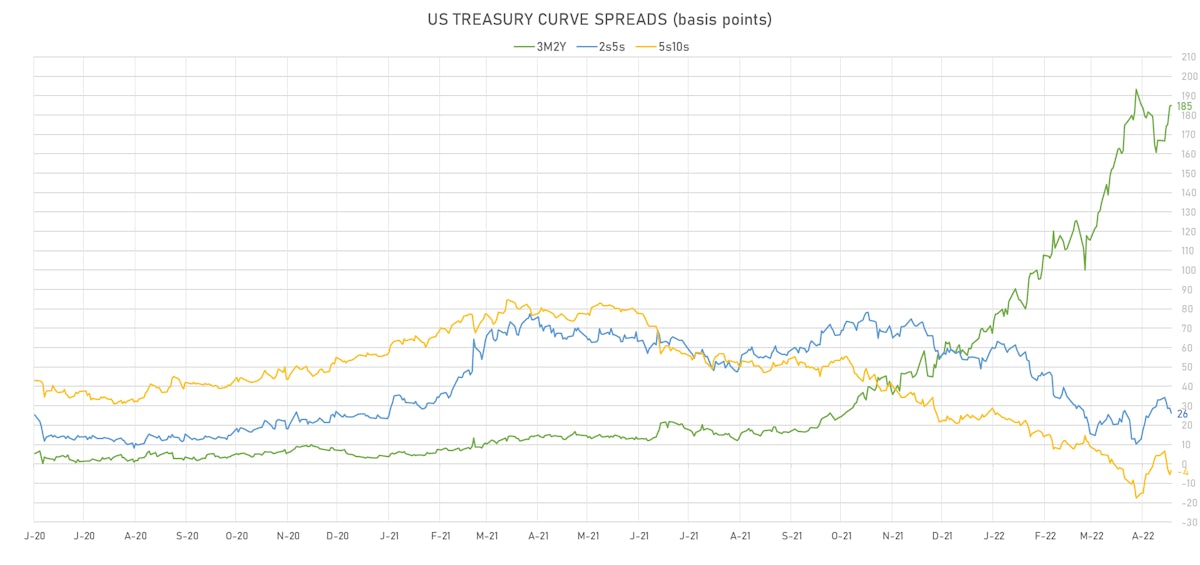

- US treasury curve spreads: 3m2Y at 185.0bp (up 18.1bp this week), 2s5s at 26.3bp (down -6.7bp), 5s10s at -3.6bp (down -7.8bp), 10s30s at 4.6bp (down -4.6bp)

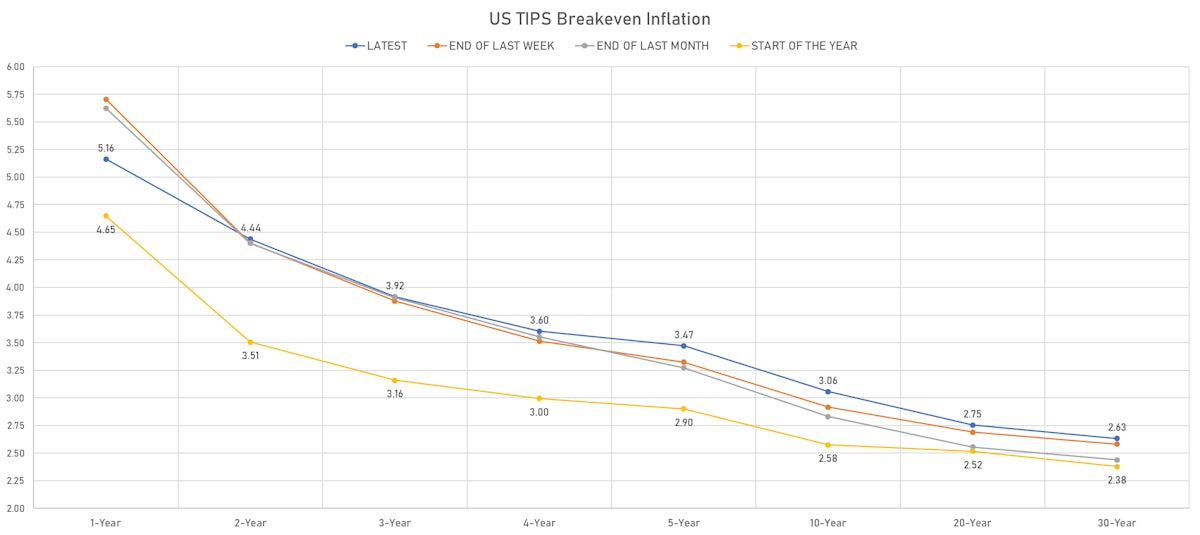

- TIPS 1Y breakeven inflation at 5.16% (down -54.4bp); 2Y at 4.44% (up 3.4bp); 5Y at 3.47% (up 14.7bp); 10Y at 3.06% (up 14.1bp); 30Y at 2.63% (up 5.2bp)

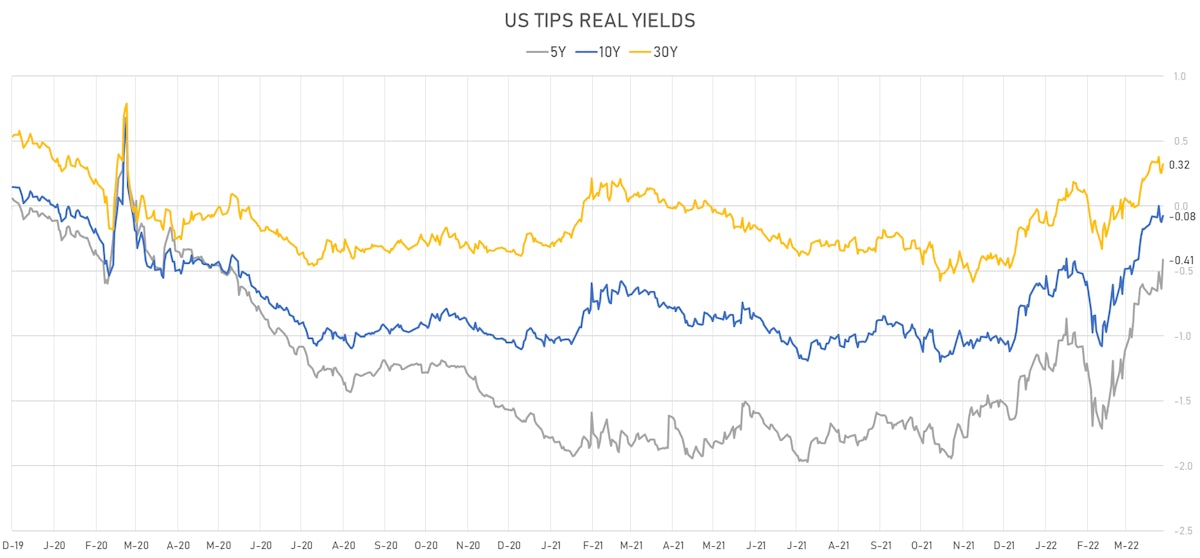

- US 5-Year TIPS Real Yield: +21.6 bp at -0.4140%; 10-Year TIPS Real Yield: +0.4 bp at -0.0750%; 30-Year TIPS Real Yield: -2.1 bp at 0.3220%

MACRO PICTURE

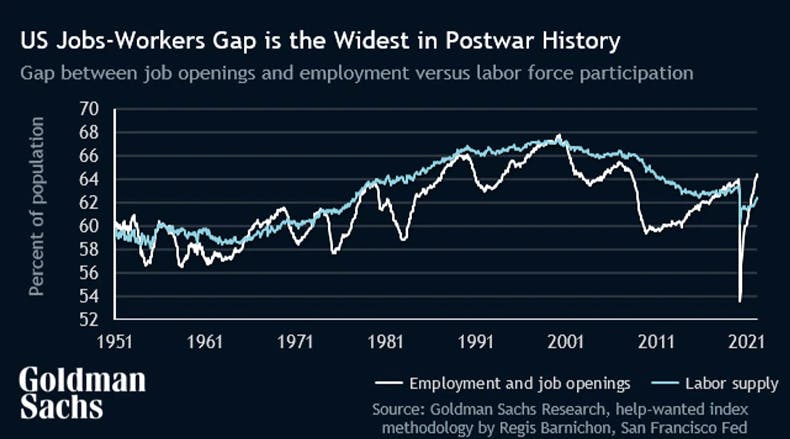

- The big debate remains whether a Fed focused on killing inflation will bring a recession, with considerable uncertainty around both inflation (driven by high energy prices + a record-wide jobs-workers gap), and the growth outlook (fiscal cliff, more supply constraints, war, deglobalization)

- Financial conditions remain very accommodative, with little impact from hikes so far

- In addition, there is no consensus of what the current neutral Fed Funds rate is: some think it could be as low as 2% in a highly levered economy, while others see it above 3% with elevated inflation

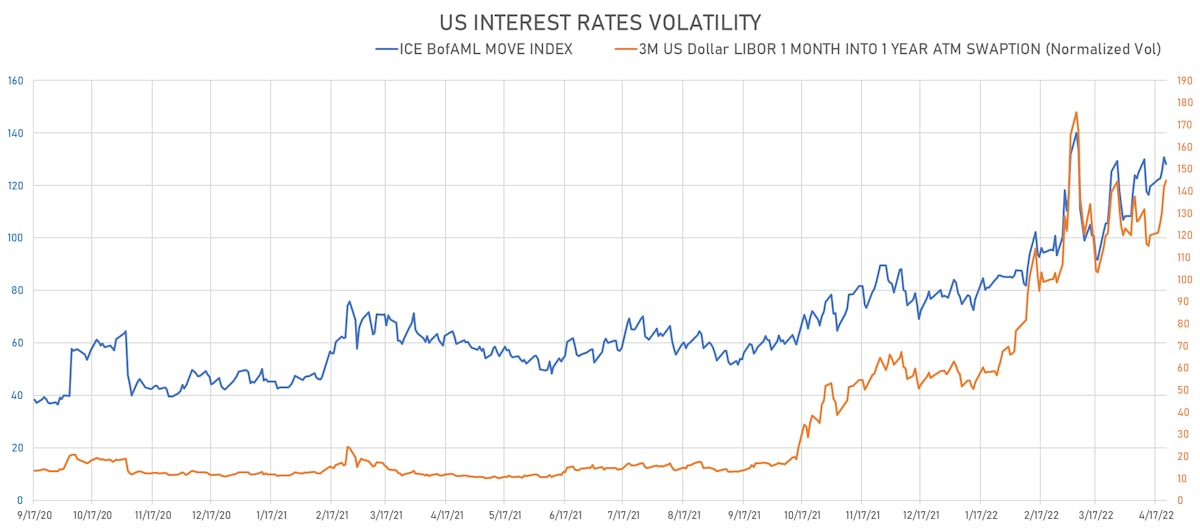

- In these conditions, rates volatility remains extremely high, perhaps too high compared to equity vol (a possible relative value trade)

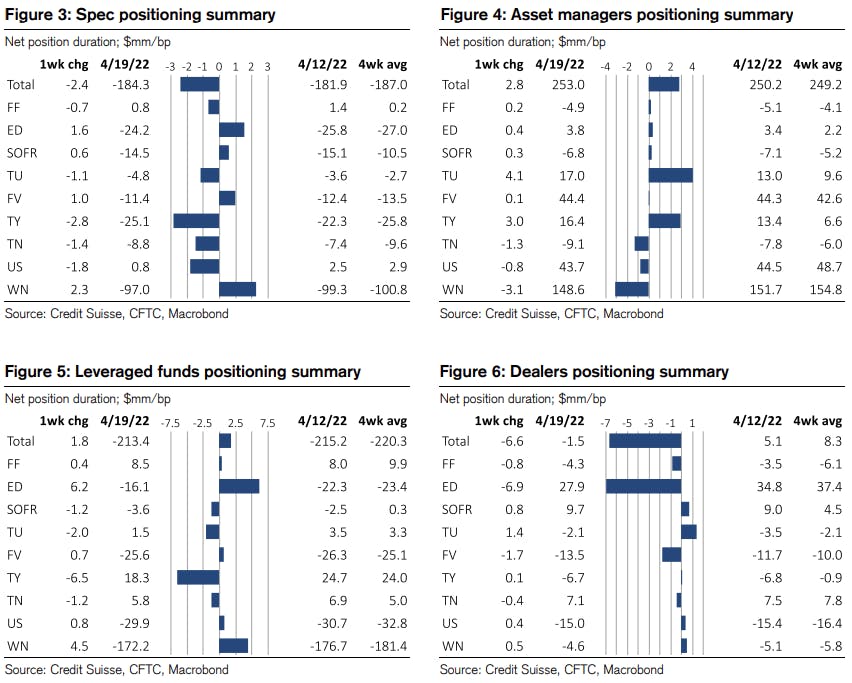

WEEKLY NET DURATION POSITIONING (CFTC COTR)

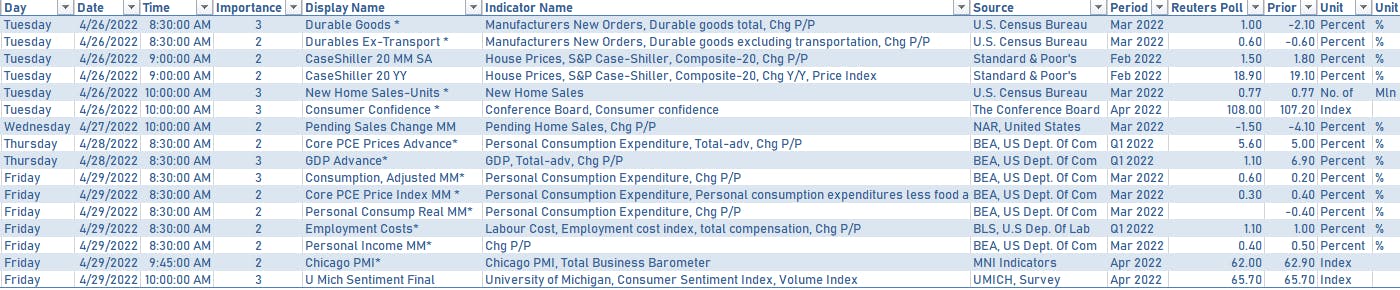

US MACRO RELEASES IN THE WEEK AHEAD

US FORWARD RATES

- Fed Funds futures now price in 51.2bp of Fed hikes by the end of May 2022, 105.0bp (4.2 x 25bp hikes) by the end of June 2022, and price in 9.7 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 24 bp of hikes in 2023 (equivalent to 1.0 x 25 bp hikes), down -12.5 bp today, and -28.5 bp of hikes in 2024 (equivalent to 1.1 x 25 bp rate cut)

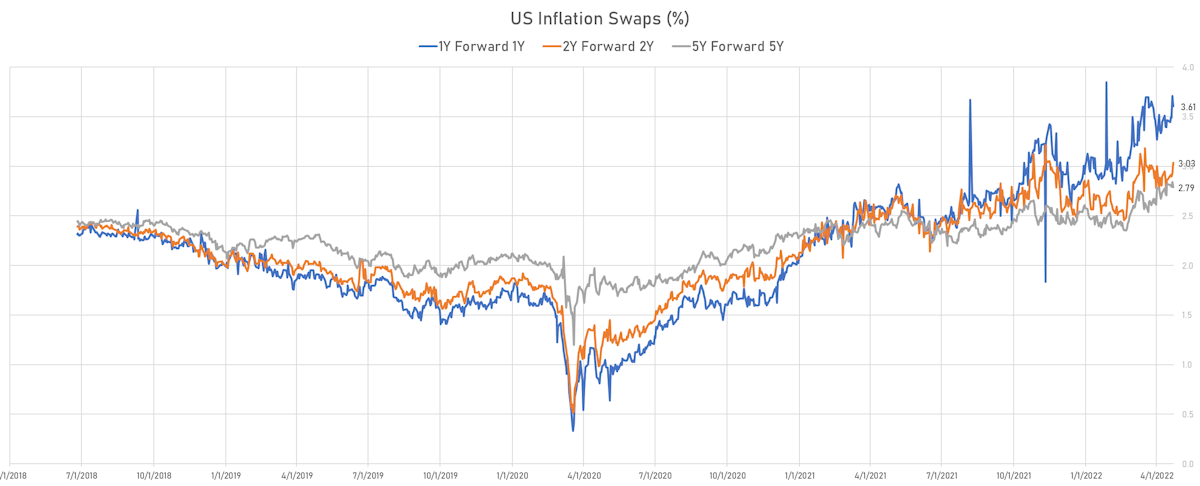

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.16% (down -7.5bp); 2Y at 4.44% (down -5.8bp); 5Y at 3.47% (down -5.0bp); 10Y at 3.06% (down -5.1bp); 30Y at 2.63% (down -4.5bp)

- 6-month spot US CPI swap down -6.6 bp to 6.135%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.4140%, +22.5 bp today; 10Y at -0.0750%, +5.0 bp today; 30Y at 0.3220%, +6.9 bp today

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.9 vols at 144.6 normals

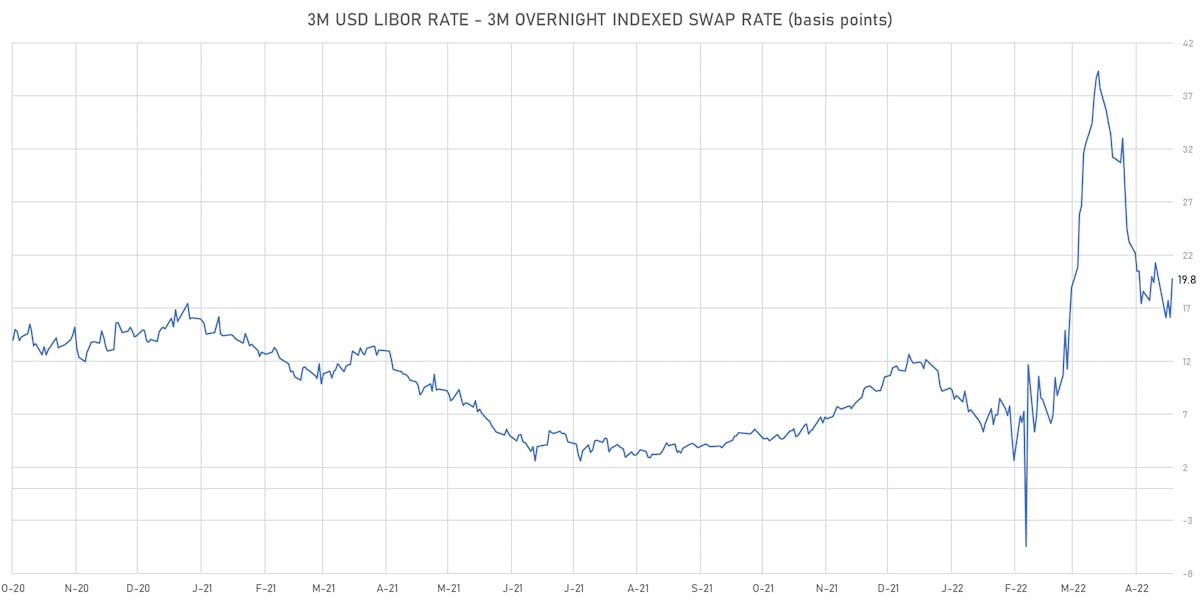

- 3-Month LIBOR-OIS spread up 3.6 bp at 19.8 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES

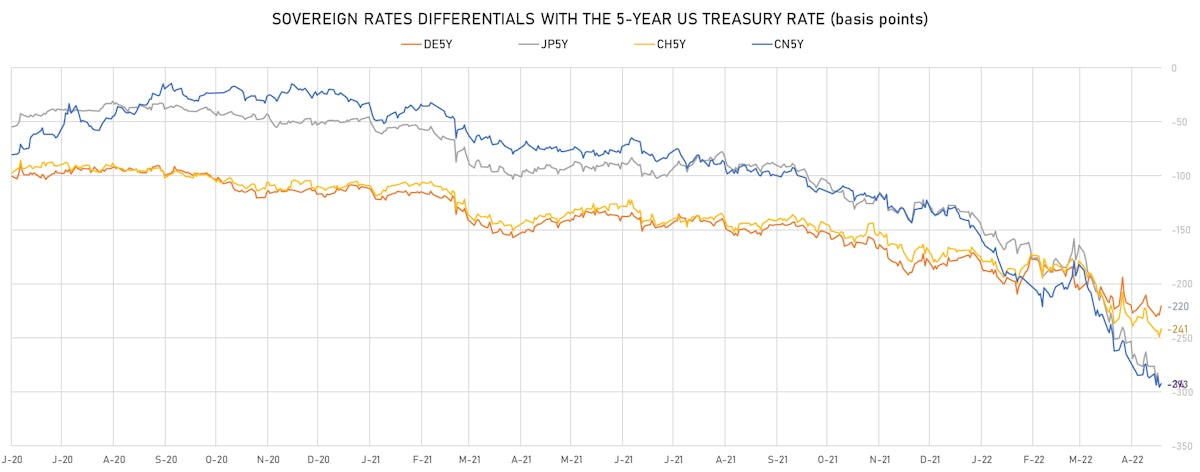

- Germany 5Y: 0.747% (up 6.2 bp); the German 1Y-10Y curve was 3.8 bp steeper today at 128.9bp (YTD change: -42.3 bp)

- Japan 5Y: 0.019% (unchanged); the Japanese 1Y-10Y curve was 0.4 bp flatter at 32.2bp (YTD change: -15.9 bp)

- China 5Y: 2.599% (up 1.5 bp); the Chinese 1Y-10Y curve was 4.2 bp steeper at 91.8bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.529% (up 5.3 bp); the Swiss 1Y-10Y curve was 0.7 bp steeper at 136.5bp (YTD change: -55.1 bp)