Rates

Another Volatile Week For Rates, With The Belly Of The Curve Up 11 bp Into The Weekend

With the May FOMC just around the corner, we preview the outcome and set out why we think forward rates should continue to adjust higher, as elevated inflation could be more durable than currently expected

Published ET

Additional Fed Hikes This Year Priced Into Fed Funds Futures | Sources: ϕpost, Refinitiv data

QUICK US SUMMARY

- 3-Month USD LIBOR +6.4bp today, now at 1.3500%; 3-Month OIS +4.5bp at 1.1890%

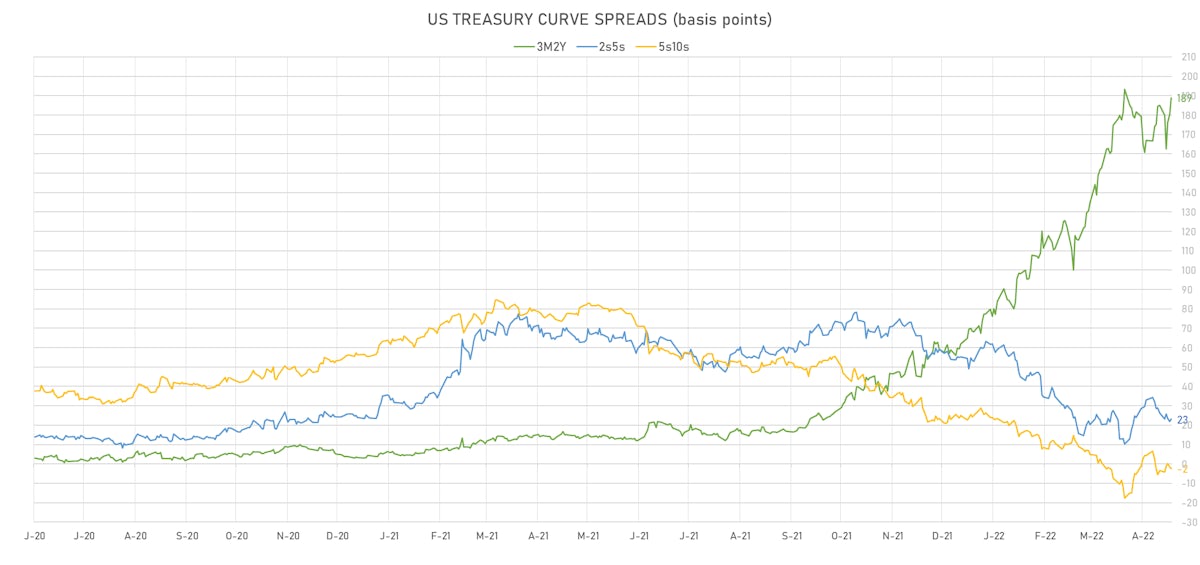

- The treasury yield curve steepened, with the 1s10s spread widening 1.2 bp, now at 86.5 bp (YTD change: -26.7bp)

- 1Y: 2.0712% (up 9.4 bp)

- 2Y: 2.7299% (up 10.2 bp)

- 5Y: 2.9609% (up 11.4 bp)

- 7Y: 2.9828% (up 11.2 bp)

- 10Y: 2.9365% (up 10.5 bp)

- 30Y: 2.9950% (up 9.4 bp)

- US treasury curve spreads: 3m2Y at 189.0bp (up 8.6bp today), 2s5s at 23.1bp (up 1.2bp), 5s10s at -2.4bp (down -0.9bp), 10s30s at 5.9bp (down -1.2bp)

- Treasuries butterfly spreads: 1s5s10s at -93.0bp (down -3.9bp), 5s10s30s at 7.5bp (down -0.6bp)

- TIPS 1Y breakeven inflation at 4.96% (down -14.1bp); 2Y at 4.37% (down -7.7bp); 5Y at 3.35% (down -5.0bp); 10Y at 3.02% (down -3.1bp); 30Y at 2.59% (down -1.8bp)

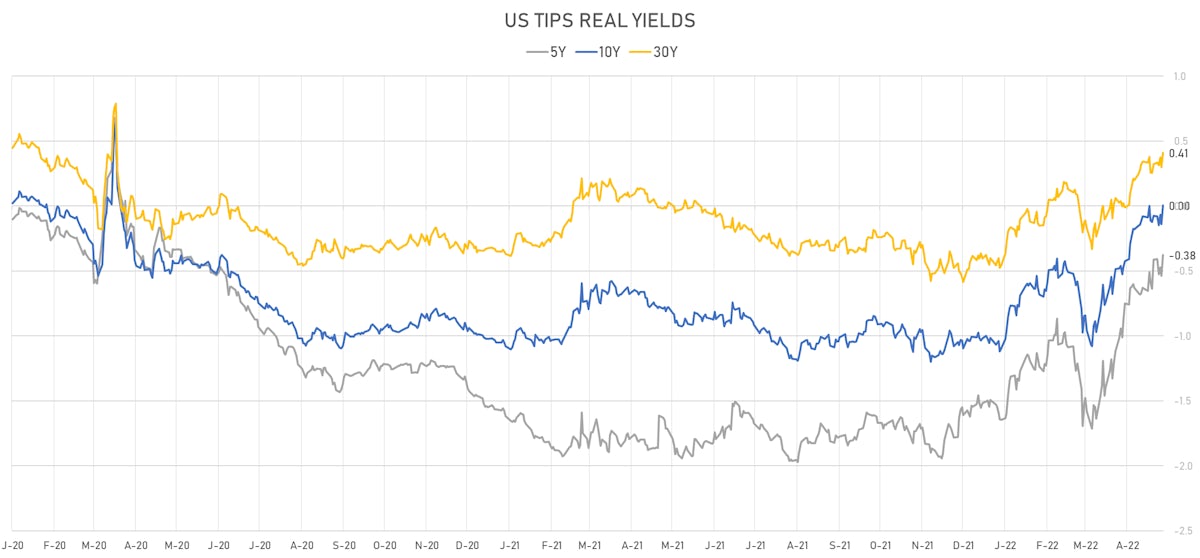

- US 5-Year TIPS Real Yield: +16.3 bp at -0.3760%; 10-Year TIPS Real Yield: +14.3 bp at 0.0040%; 30-Year TIPS Real Yield: +11.2 bp at 0.4110%

US MACRO RELEASES

- Change P/P for Mar 2022 (BEA, US Dept. Of Com) at 0.50 % (vs 0.50 % prior), above consensus estimate of 0.40 %

- Chicago PMI, Total Business Barometer for Apr 2022 (MNI Indicators) at 56.40 (vs 62.90 prior), below consensus estimate of 62.00

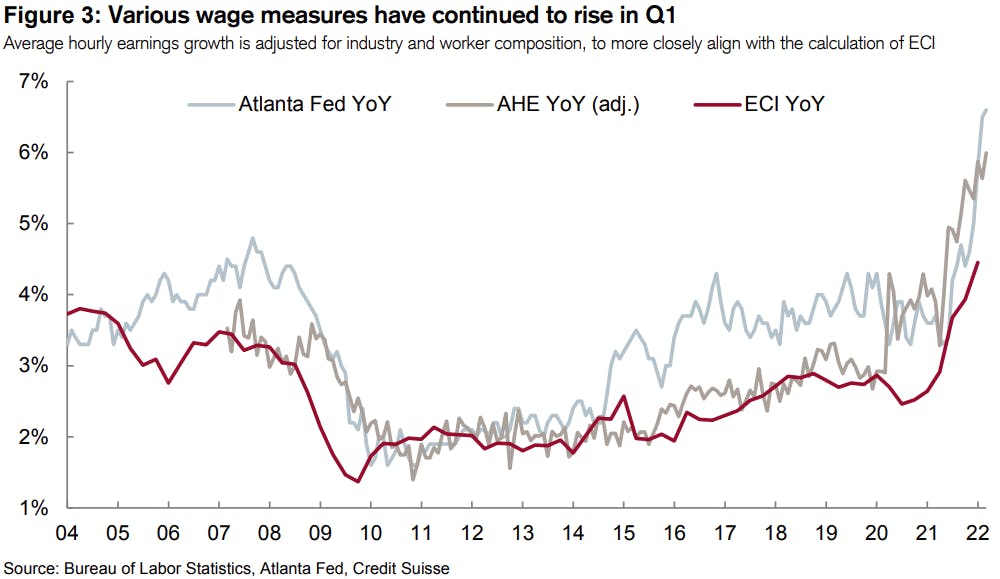

- Labour Cost, Employment cost index, benefit costs, Change P/P for Q1 2022 (BLS, U.S Dep. Of Lab) at 1.80 % (vs 0.90 % prior)

- Labour Cost, Employment cost index, total compensation, Change P/P for Q1 2022 (BLS, U.S Dep. Of Lab) at 1.40 % (vs 1.00 % prior), above consensus estimate of 1.10 %

- Labour Cost, Employment cost index, wages and salaries, Change P/P for Q1 2022 (BLS, U.S Dep. Of Lab) at 1.20 % (vs 1.10 % prior)

- Personal Consumption Expenditure, Change P/P for Mar 2022 (BEA, US Dept. Of Com) at 0.20 % (vs -0.40 % prior)

- Personal Consumption Expenditure, Change P/P for Mar 2022 (BEA, US Dept. Of Com) at 0.90 % (vs 0.60 % prior)

- Personal Consumption Expenditure, Change P/P for Mar 2022 (BEA, US Dept. Of Com) at 1.10 % (vs 0.20 % prior), above consensus estimate of 0.70 %

- Personal Consumption Expenditure, Change Y/Y for Mar 2022 (BEA, US Dept. Of Com) at 6.60 % (vs 6.40 % prior)

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change P/P for Mar 2022 (BEA, US Dept. Of Com) at 0.30 % (vs 0.40 % prior), in line with consensus

- Personal Consumption Expenditure, Personal consumption expenditures less food and energy, Change Y/Y for Mar 2022 (BEA, US Dept. Of Com) at 5.20 % (vs 5.40 % prior), below consensus estimate of 5.30 %

- Personal Consumption Expenditure, Total, trimmed mean inflation rate (1-month annualized), Change M/M for Mar 2022 (Fed Reserve, Dallas) at 3.10 % (vs 4.00 % prior)

- University of Michigan, 5 Year Inflation Expectations (median), Change Y/Y for Apr 2022 (UMICH, Survey) at 3.00 % (vs 3.00 % prior)

- University of Michigan, 1 Year Inflation Expectations (median) for Apr 2022 (UMICH, Survey) at 5.40 % (vs 5.40 % prior)

- University of Michigan, Consumer Expectations Index, Volume Index for Apr 2022 (UMICH, Survey) at 62.50 (vs 64.10 prior)

- University of Michigan, Consumer Sentiment Index, Volume Index for Apr 2022 (UMICH, Survey) at 65.20 (vs 65.70 prior), below consensus estimate of 65.70

- University of Michigan, Current Conditions Index, Volume Index for Apr 2022 (UMICH, Survey) at 69.40 (vs 68.10 prior)

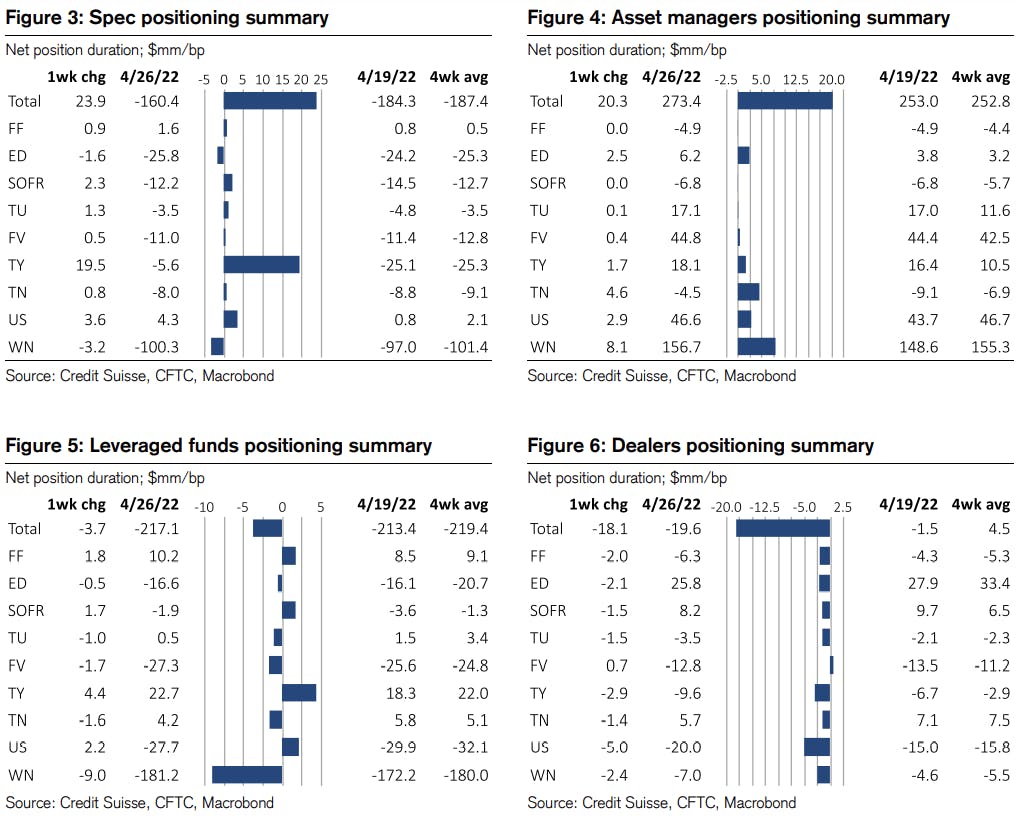

WEEKLY CFTC NET DURATION POSITIONING UPDATE

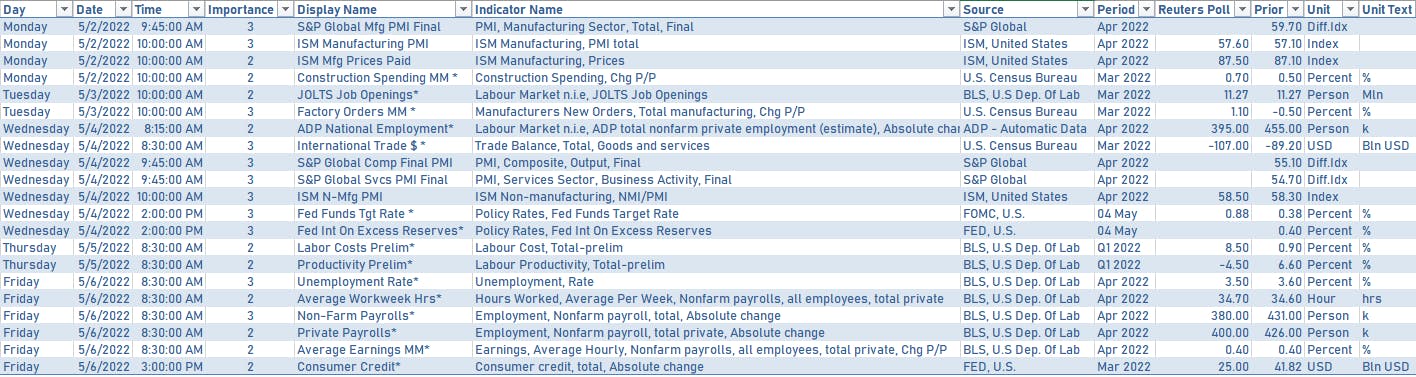

US MACRO RELEASES IN THE WEEK AHEAD

MAY 2022 FOMC PREVIEW

- There is no doubt that the Fed will hike by 50 basis points on Wednesday, something they have made abundantly clear in their recent communication

- The committee and the policy statement are also expected to announce when the balance sheet runoff will start (likely in June)

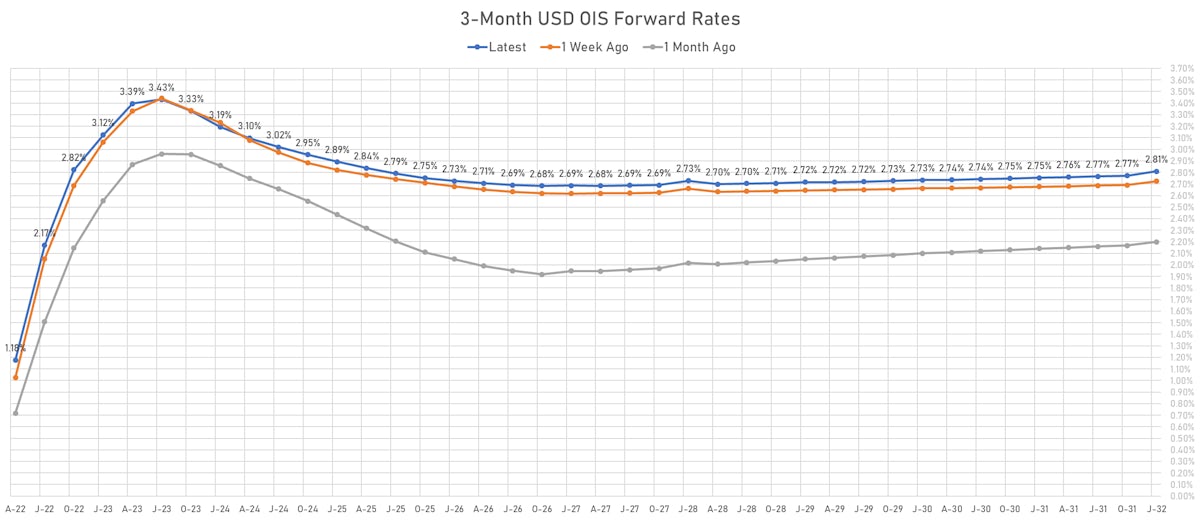

- Considering how far behind the Fed currently is (Fed funds rate < CPI by a long shot), it's likely they'll want to be at least in line with market pricing (if not more hawkish)

- The front end of the curve didn't change much this week and the market expects 10 more hikes this year (for a total of 11 hikes), with 4 straight 50-bp hikes (May, June, July, September), and two 25-bp hikes (November, December)

- In a nutshell, we see 3 main modal scenarios for the economy:

- no recession, Fed keeps hiking, albeit more slowly from late 2022

- recession in late 2023 / early 2024: Fed stops hikes and waits to see inflation normalize

- deep recession in 2023: Fed cuts rates from late 2023 as growth takes precedence over price stability concerns

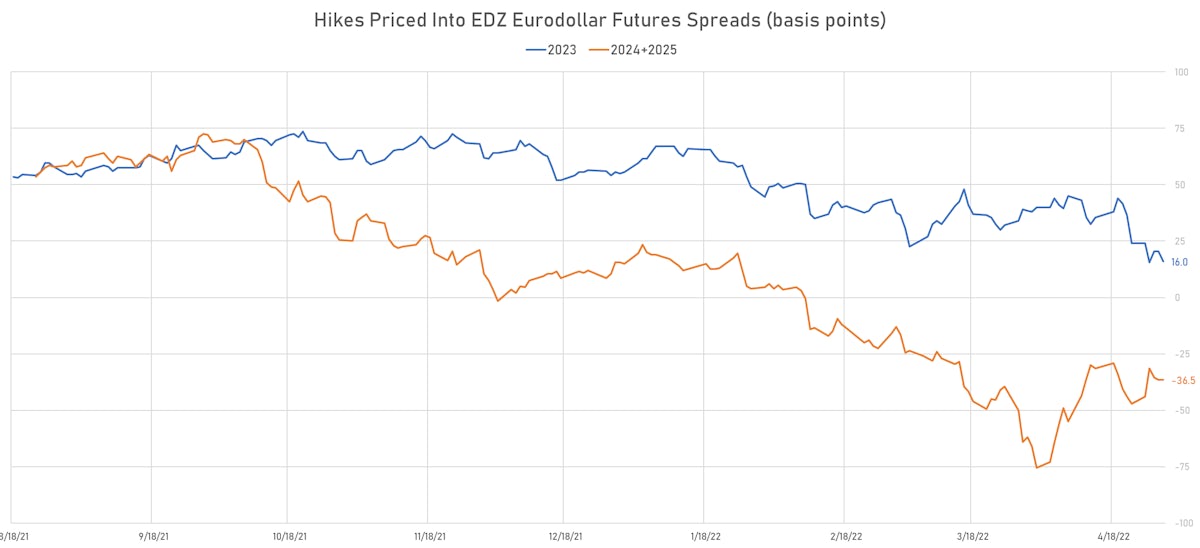

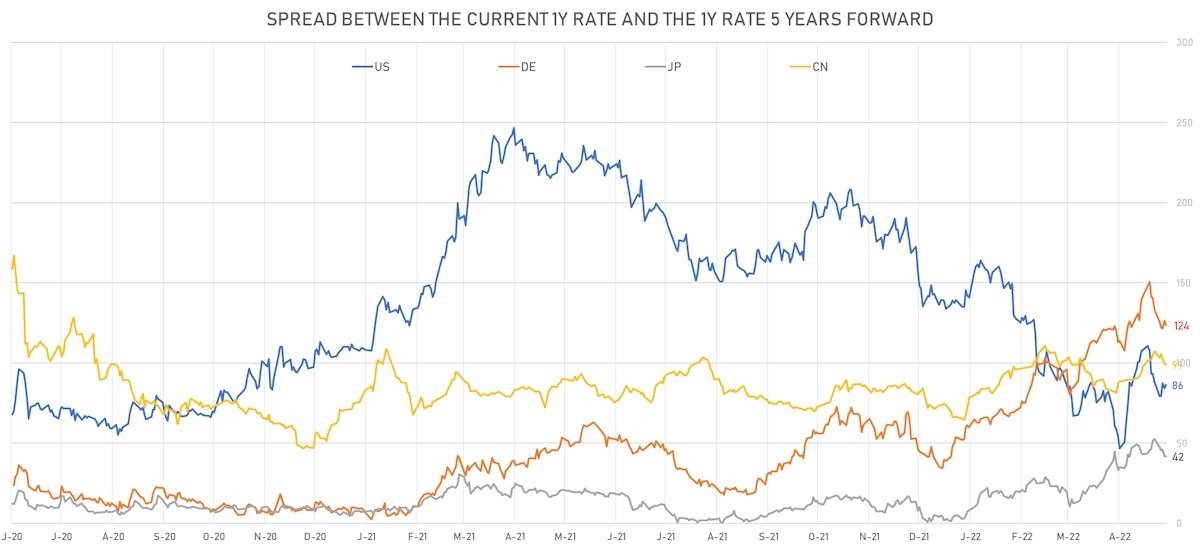

- Looking beyond 2022, it feels like markets are putting too much weight on the 3rd scenario, with less than 1 hike priced into 2023 Eurodollar futures and an inverted forward curve from 2024

- In our view, scenario 2 is more likely, with inflationary pressures remaining high for a longer period, which would force the Fed to keep a balanced policy (growth + price stability) of going through a series of starts and stops in the hiking cycle (but no rate cuts)

- If that is correct, there is an opportunity for investors to play a continued reversal of the forward inversion (probably more in delta-1 products than options, considering the current levels of implied vols in rates), with a slower and longer hiking cycle, and higher terminal rates (matching higher-for-longer inflation)

US FORWARD RATES

- Fed Funds futures now price in 52.0bp of Fed hikes by the end of May 2022, 112.3bp (4.5 x 25bp hikes) by the end of June 2022, and price in 10.1 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 16 bp of hikes in 2023 (equivalent to 0.6 x 25 bp hikes), down -4.5 bp today, and -23.0 bp of hikes in 2024 (close to 1 x 25 bp rate cut)

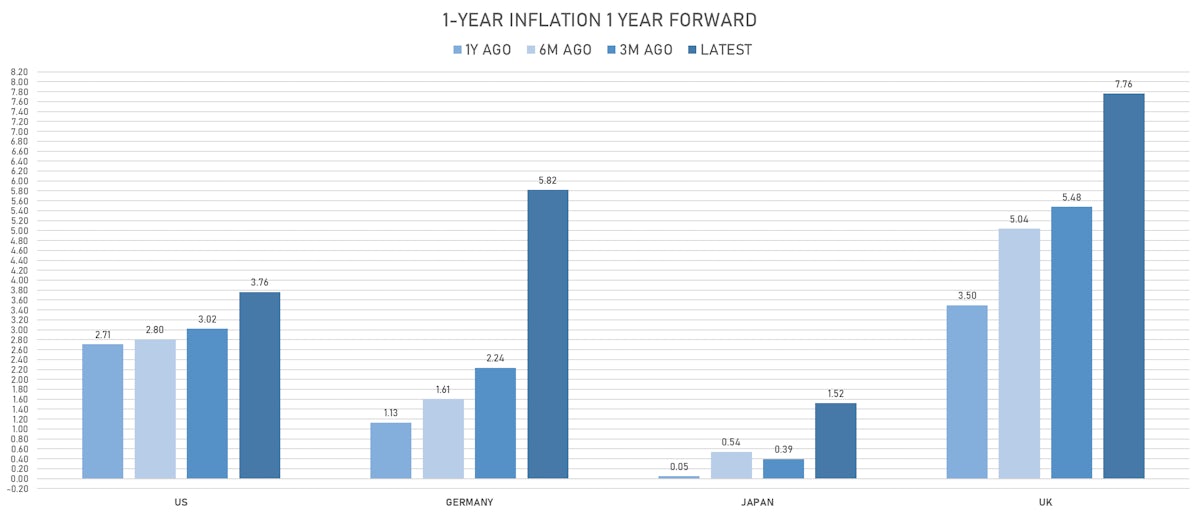

US INFLATION & REAL RATES

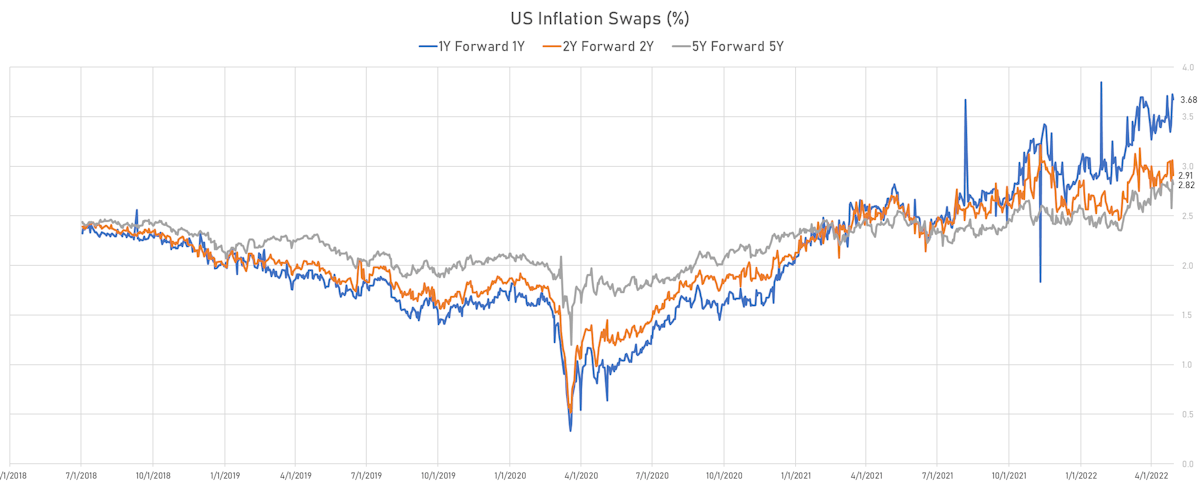

- TIPS 1Y breakeven inflation at 4.96% (down -14.1bp); 2Y at 4.37% (down -7.7bp); 5Y at 3.35% (down -5.0bp); 10Y at 3.02% (down -3.1bp); 30Y at 2.59% (down -1.8bp)

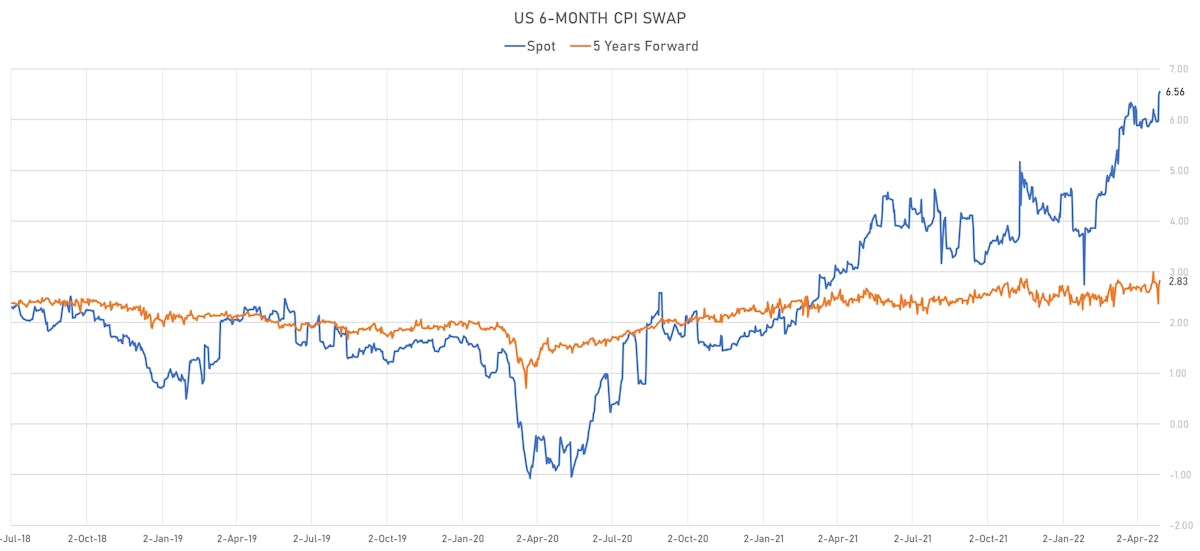

- 6-month spot US CPI swap up 6.1 bp to 6.558%, with a flattening of the forward curve

- US Real Rates: 5Y at -0.3760%, +16.3 bp today; 10Y at 0.0040%, +14.3 bp today; 30Y at 0.4110%, +11.2 bp today

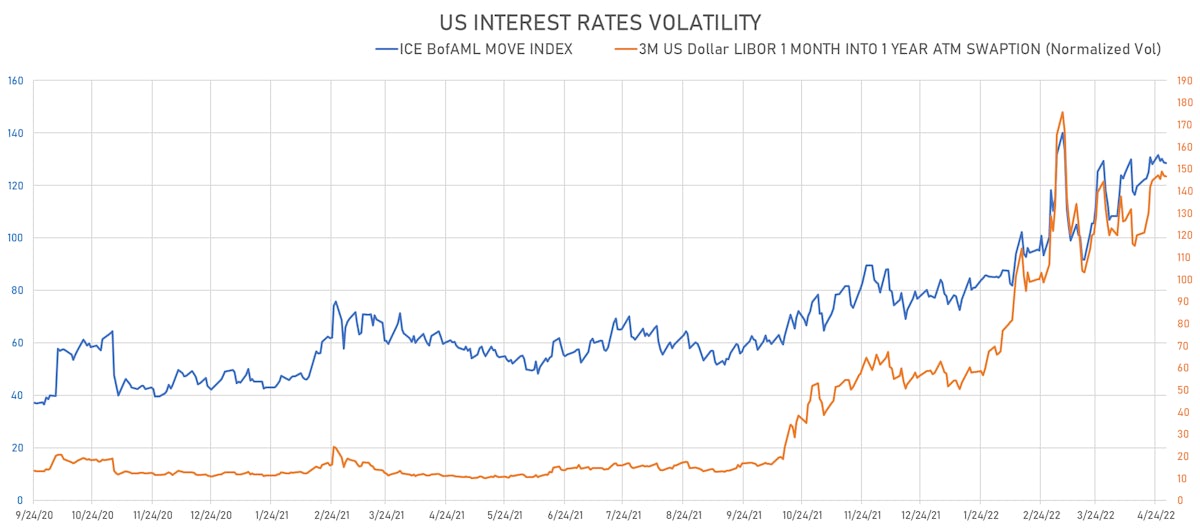

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.4 vols at 146.5 normals

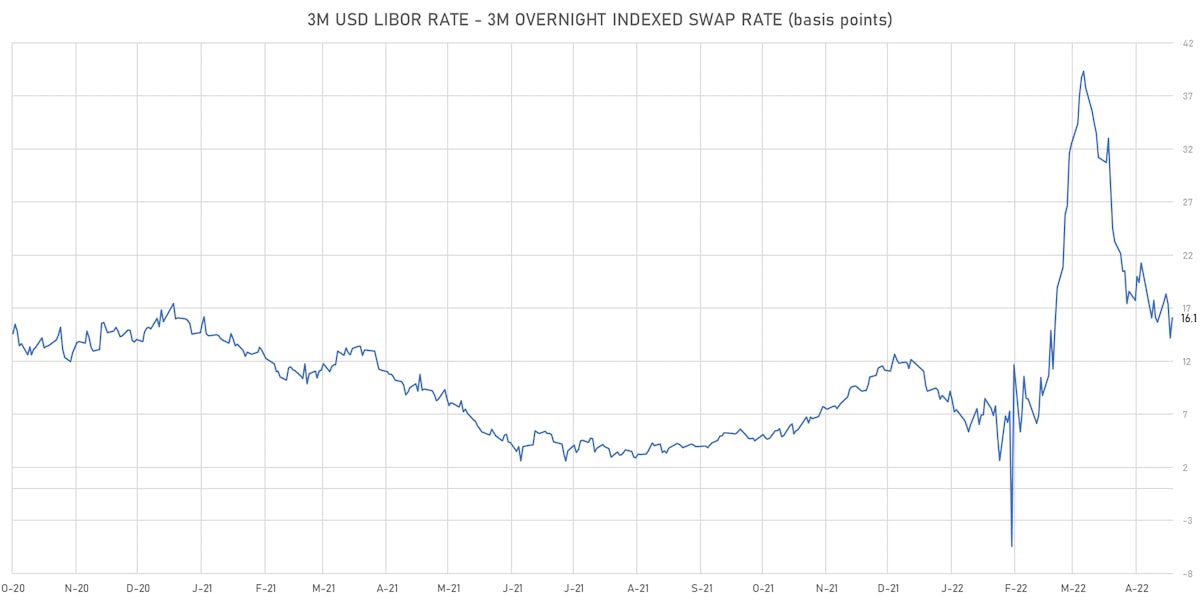

- 3-Month LIBOR-OIS spread up 1.9 bp at 16.1 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.676% (up 4.8 bp); the German 1Y-10Y curve is 7.1 bp flatter at 115.6bp (YTD change: -42.4 bp)

- Japan 5Y: 0.004% (down -0.6 bp); the Japanese 1Y-10Y curve is 2.3 bp flatter at 29.5bp (YTD change: -15.9 bp)

- China 5Y: 2.626% (down -0.8 bp); the Chinese 1Y-10Y curve is 0.2 bp flatter at 69.3bp (YTD change: -50.3 bp)

- Switzerland 5Y: 0.490% (up 3.7 bp); the Swiss 1Y-10Y curve is 4.0 bp flatter at 123.5bp (YTD change: -55.3 bp)