Rates

The Fed Delivered What The Market Expected With A Slightly Dovish Tilt, As Powell Took 75bp Off The Table

That was followed by curve steepening and tightening of financial conditions over the next sessions, as the market now expects a higher terminal rate; with the Fed's firm tone around inflation, we should see 3 more 50bp hikes until September, followed by 25 bp hikes into year end

Published ET

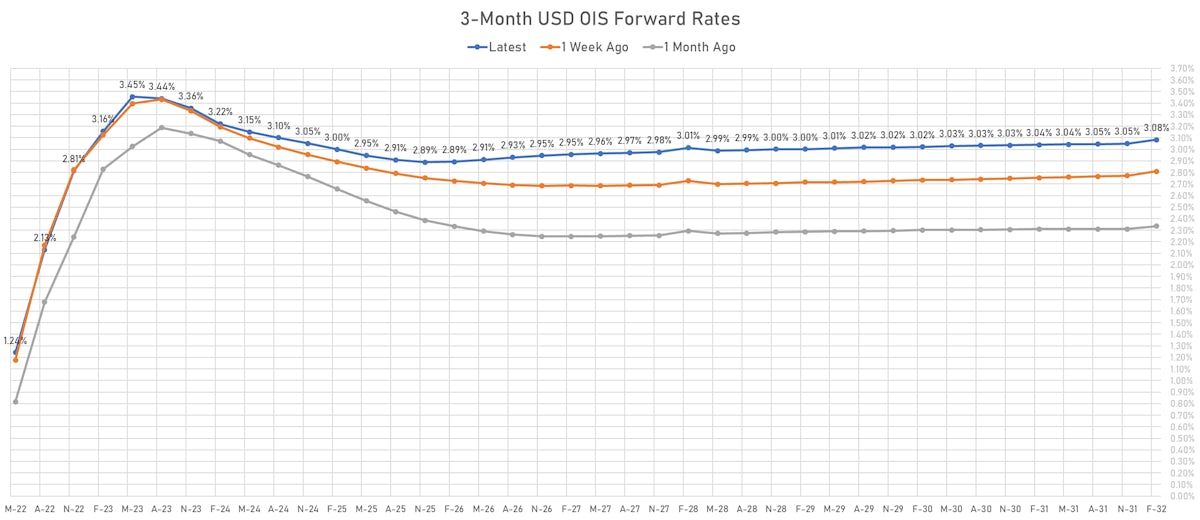

2025-2023 Spreads In 3-Month Forward Rates | Source: Refinitiv

WEEKLY US RATES SUMMARY

1) The yield curve steepened

- The 1s10s Treasuries spread widened 28.4 bp, now at 114.9 bp (YTD change: +1.7bp)

- 1Y: 1.9911% (down 8.0 bp)

- 2Y: 2.7339% (up 0.4 bp)

- 5Y: 3.0782% (up 11.7 bp)

- 7Y: 3.1526% (up 17.0 bp)

- 10Y: 3.1404% (up 20.4 bp)

- 30Y: 3.2367% (up 24.2 bp)

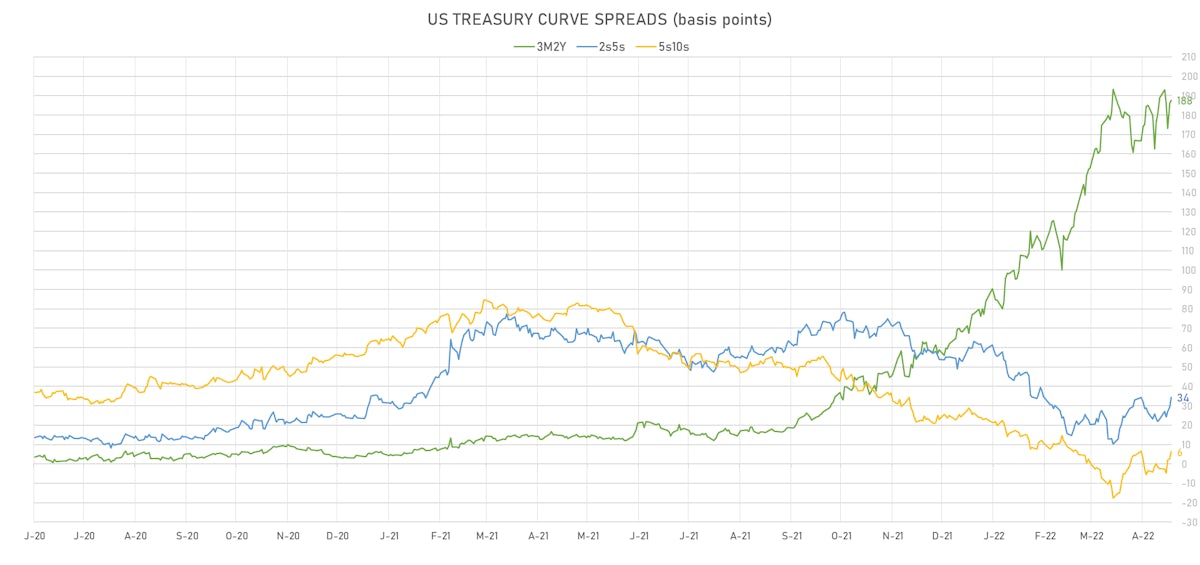

- US treasury curve spreads: 3m2Y at 187.6bp (down -1.3bp this week), 2s5s at 34.4bp (up 11.3bp), 5s10s at 6.2bp (up 8.6bp), 10s30s at 9.6bp (up 3.7bp)

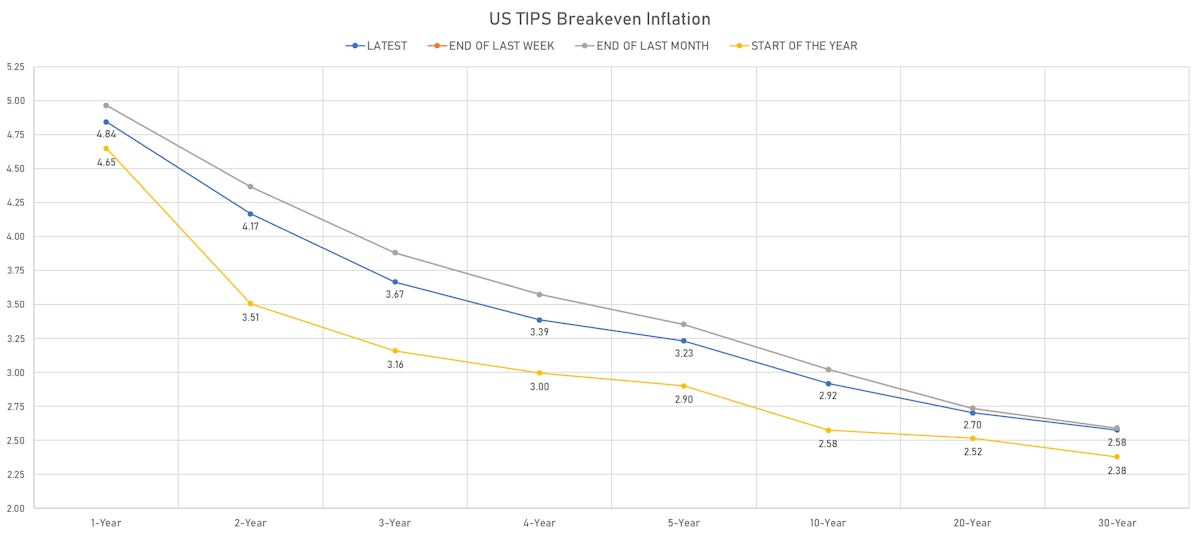

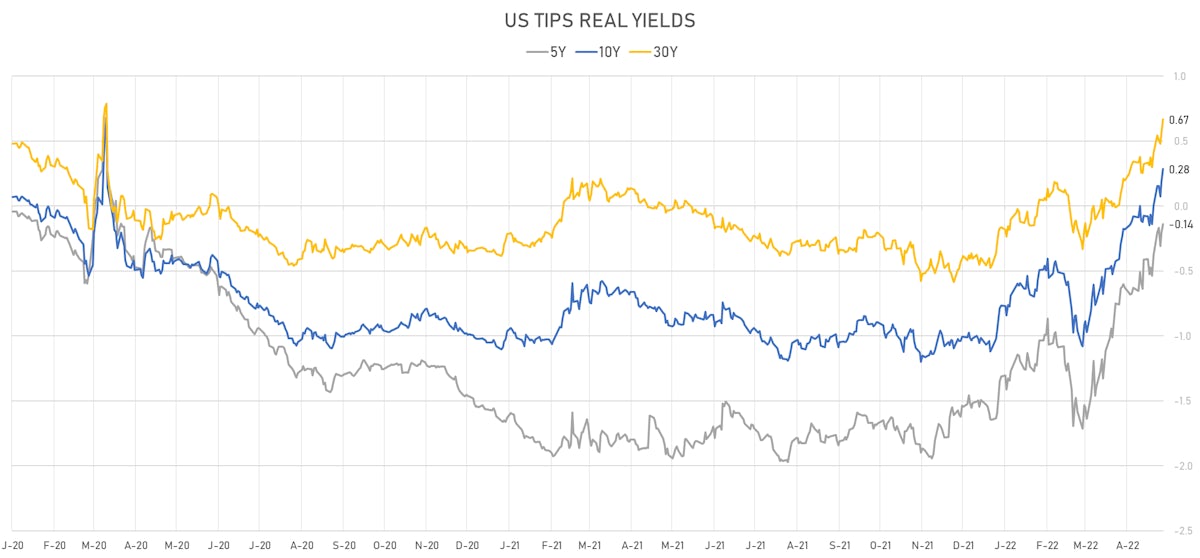

2) Inflation breakevens fell, with a sharp rise in real yields

- TIPS 1Y breakeven inflation at 4.84% (down -12.0bp); 2Y at 4.17% (down -20.1bp); 5Y at 3.23% (down -12.2bp); 10Y at 2.92% (down -10.3bp); 30Y at 2.58% (down -1.4bp)

- US 5-Year TIPS Real Yield: +23.8 bp at -0.1380%; 10-Year TIPS Real Yield: +28.0 bp at 0.2840%; 30-Year TIPS Real Yield: +25.6 bp at 0.6670%

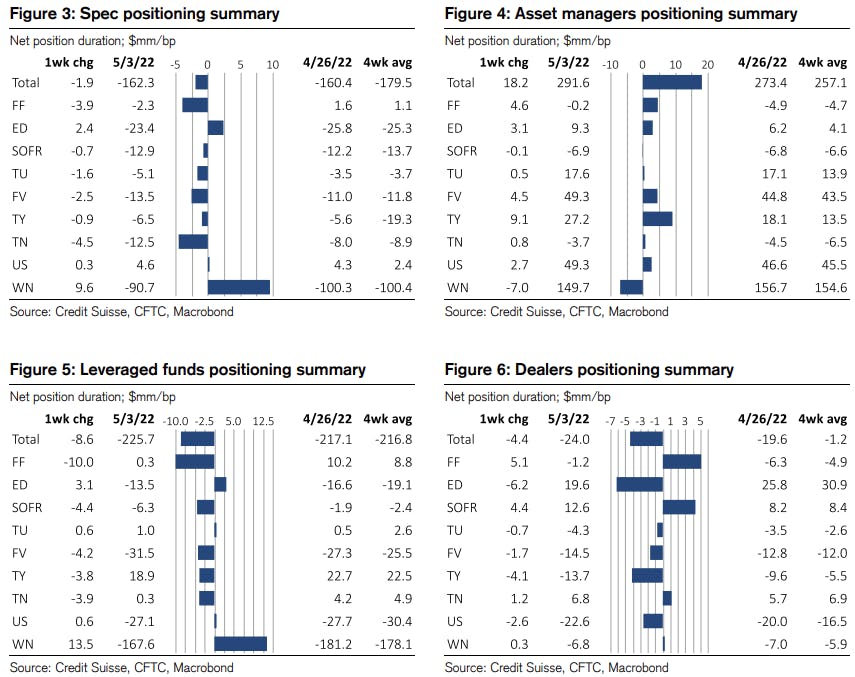

WEEKLY CFTC NET DURATION POSITIONING DATA

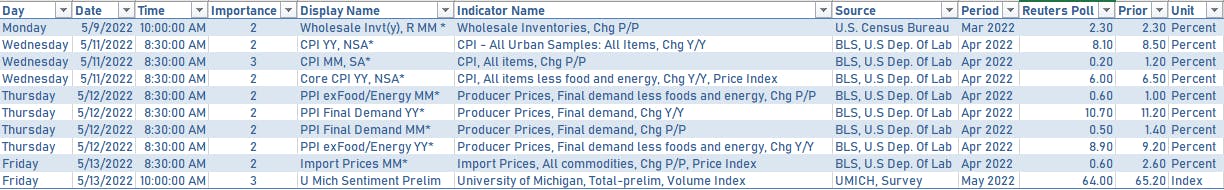

MAJOR US MACRO RELEASES IN THE WEEK AHEAD

US FORWARD RATES TODAY

- Fed Funds futures now price in 68.8bp of Fed hikes by the end of June 2022 (75% probability of a 75bp hike), 109.1bp (4.4 x 25bp hikes) by the end of July 2022, and price in 8.3 hikes by the end of December 2022

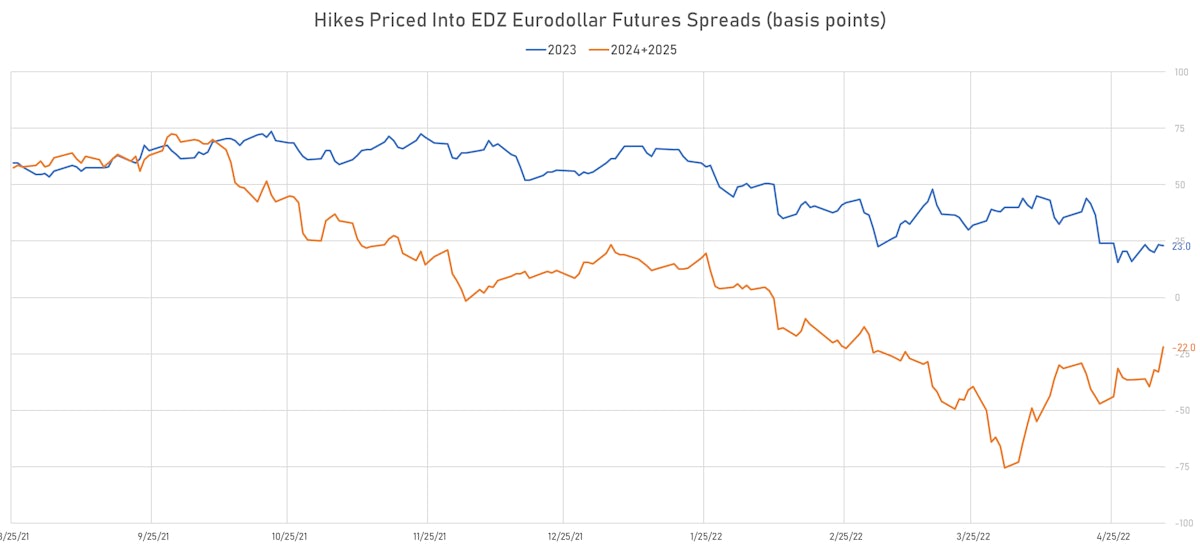

- 3-month Eurodollar futures (EDZ) spreads price in 23 bp of hikes in 2023 (equivalent to 0.9 x 25 bp hikes), down -0.5 bp today, and -16.0 bp of hikes in 2024 (equivalent to 0.6 x 25 bp rate cut)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 4.84% (up 2.8bp); 2Y at 4.17% (up 8.7bp); 5Y at 3.23% (up 0.2bp); 10Y at 2.92% (down -1.7bp); 30Y at 2.58% (up 1.1bp)

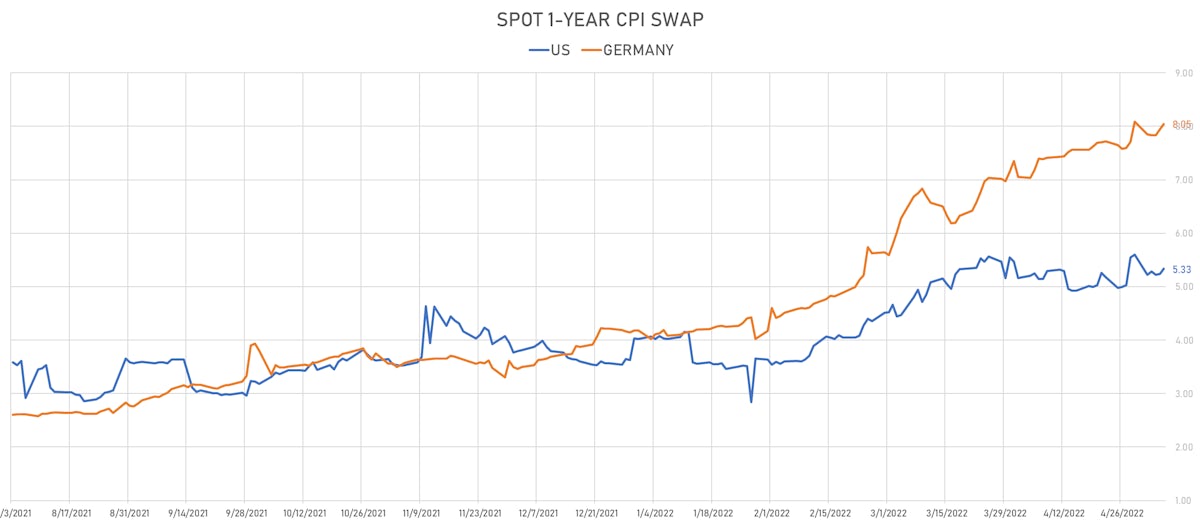

- 6-month spot US CPI swap up 9.5 bp to 6.175%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.1380%, +6.9 bp today; 10Y at 0.2840%, +10.0 bp today; 30Y at 0.6670%, +10.6 bp today

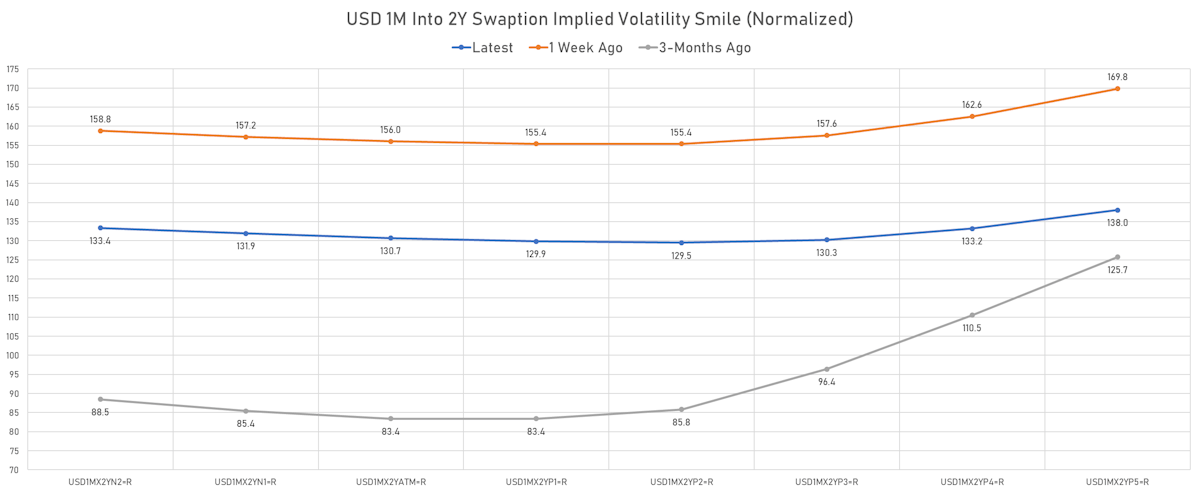

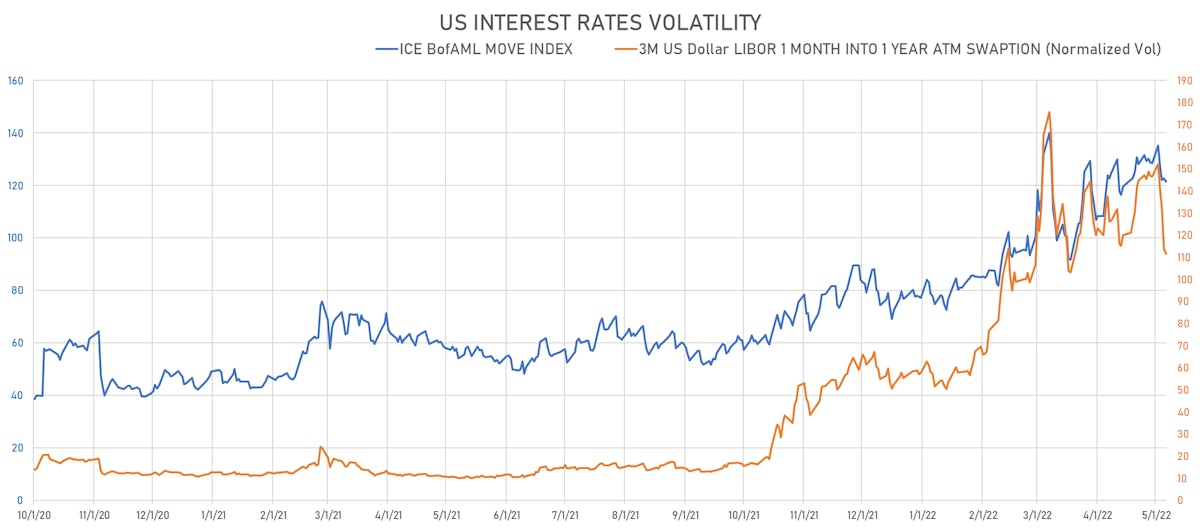

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.2 vols at 111.6 normals

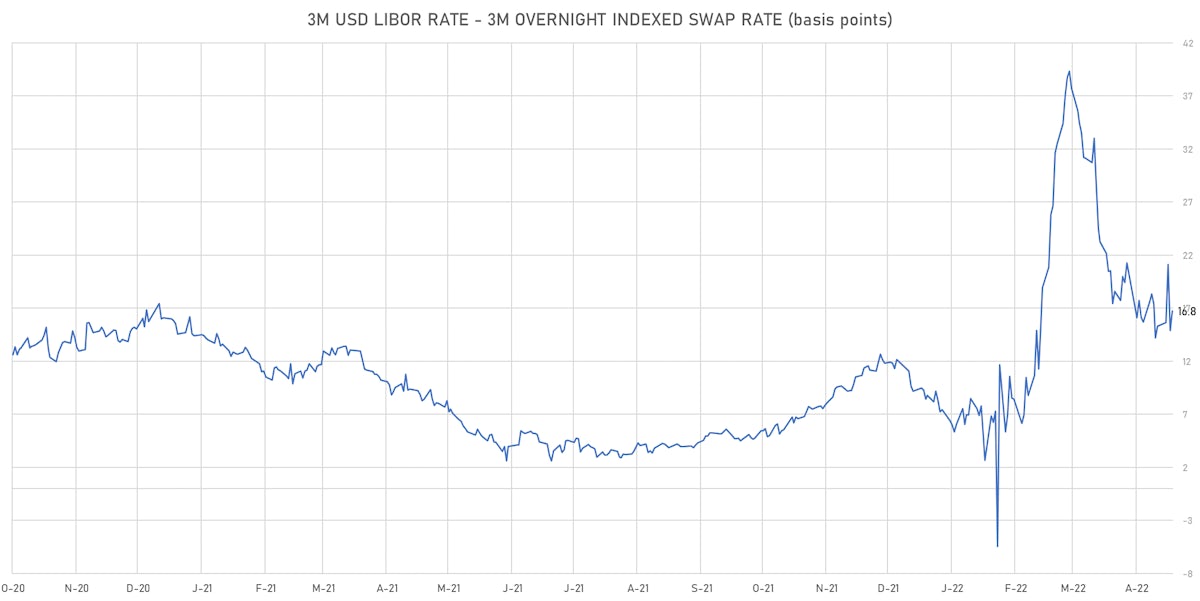

- 3-Month LIBOR-OIS spread up 1.9 bp at 16.8 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.848% (up 9.9 bp); the German 1Y-10Y curve is 4.2 bp steeper at 132.1bp (YTD change: -42.3 bp)

- Japan 5Y: 0.022% (up 0.8 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 32.1bp (YTD change: -15.9 bp)

- China 5Y: 2.640% (up 2.2 bp); the Chinese 1Y-10Y curve is 2.4 bp flatter at 66.9bp (YTD change: -50.3 bp)

- Switzerland 5Y: 0.578% (up 11.4 bp); the Swiss 1Y-10Y curve is 11.3 bp steeper at 130.8bp (YTD change: -55.2 bp)