Rates

US Treasuries Bull Flattened This Week, Mostly Driven By Lower Breakevens As Fear Of Recession Beat Down Inflationary Concerns

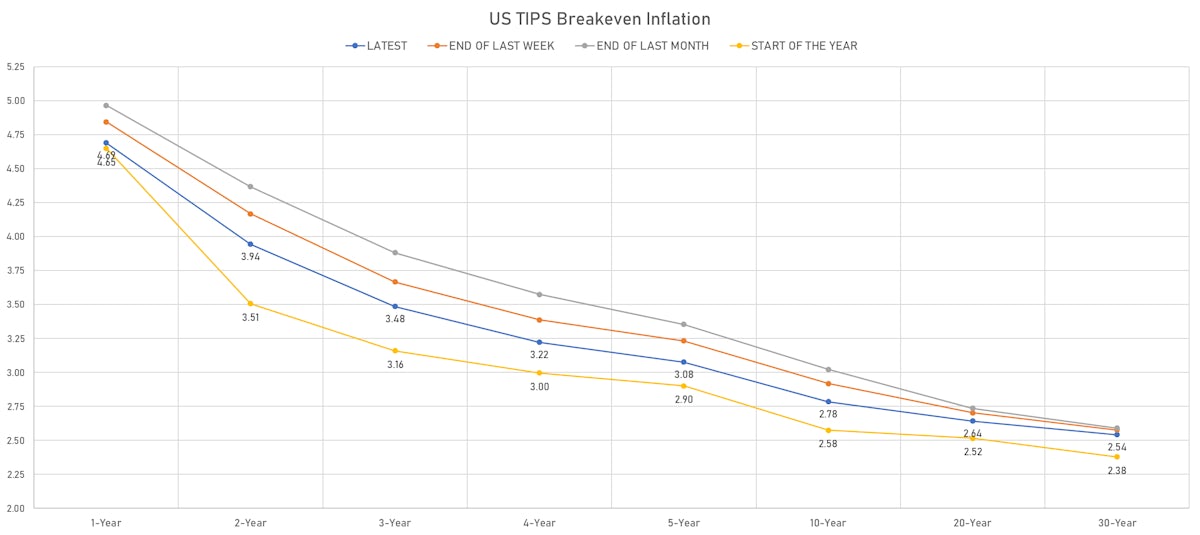

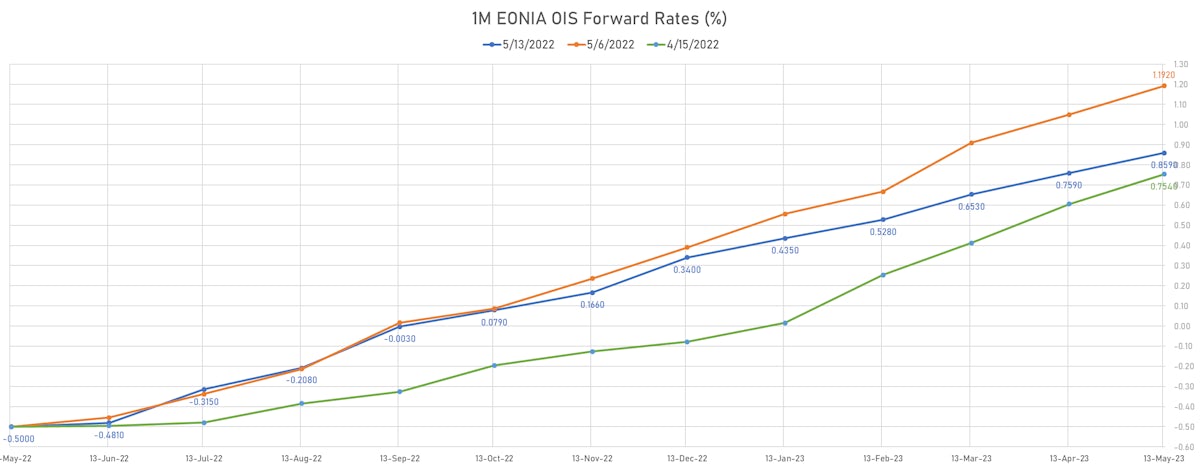

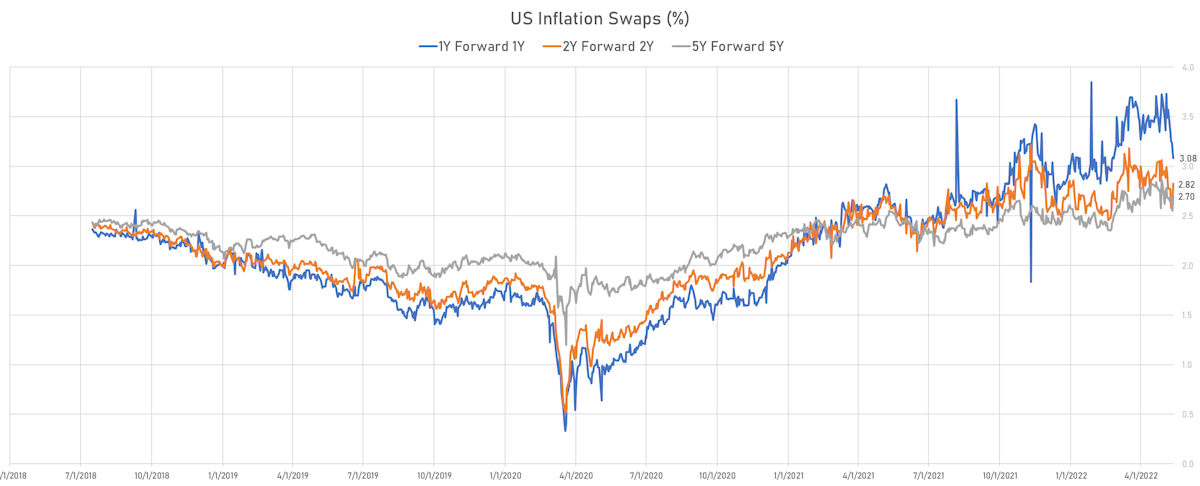

It is worth noting that short-term inflationary pressures are falling while longer-term expectations are settling higher, with an overall flattening of the inflation curve

Published ET

US Forward-Starting Inflation Swaps | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -16.1 bp, now at 98.9 bp (YTD change: -14.4bp)

- 1Y: 1.9371% (down 5.4 bp)

- 2Y: 2.5873% (down 14.7 bp)

- 5Y: 2.8733% (down 20.5 bp)

- 7Y: 2.9368% (down 21.6 bp)

- 10Y: 2.9258% (down 21.5 bp)

- 30Y: 3.0873% (down 14.9 bp)

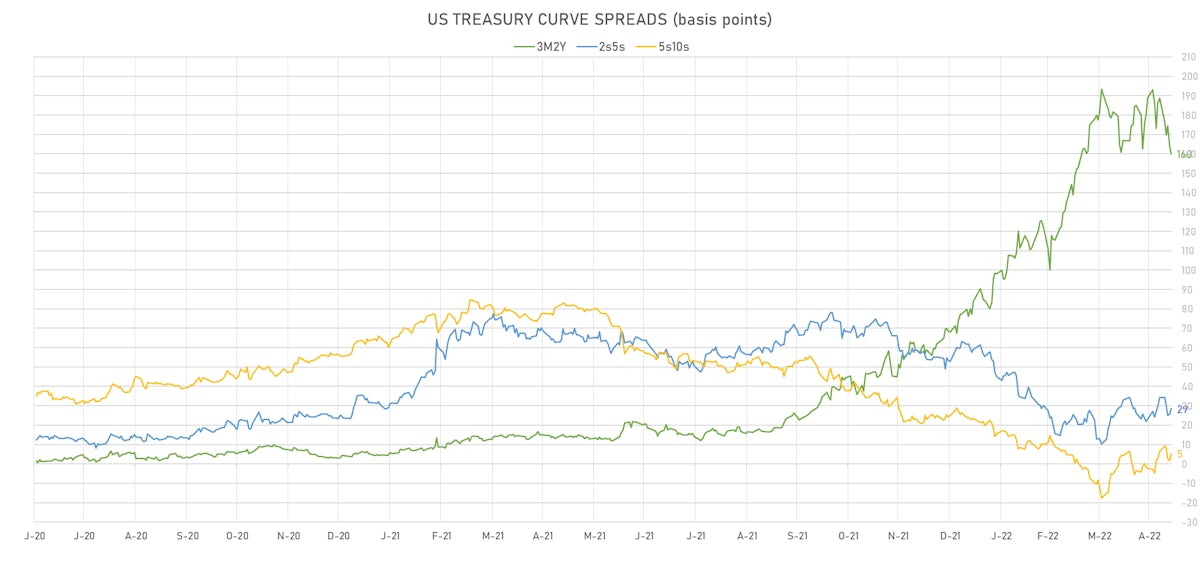

- US treasury curve spreads: 3m2Y at 160.0bp (down -28.7bp this week), 2s5s at 28.6bp (down -5.8bp), 5s10s at 5.3bp (down -0.9bp), 10s30s at 16.2bp (up 6.6bp)

- TIPS 1Y breakeven inflation at 4.69% (down -15.5bp); 2Y at 3.94% (down -22.3bp); 5Y at 3.08% (down -15.5bp); 10Y at 2.78% (down -13.4bp); 30Y at 2.54% (down -3.3bp)

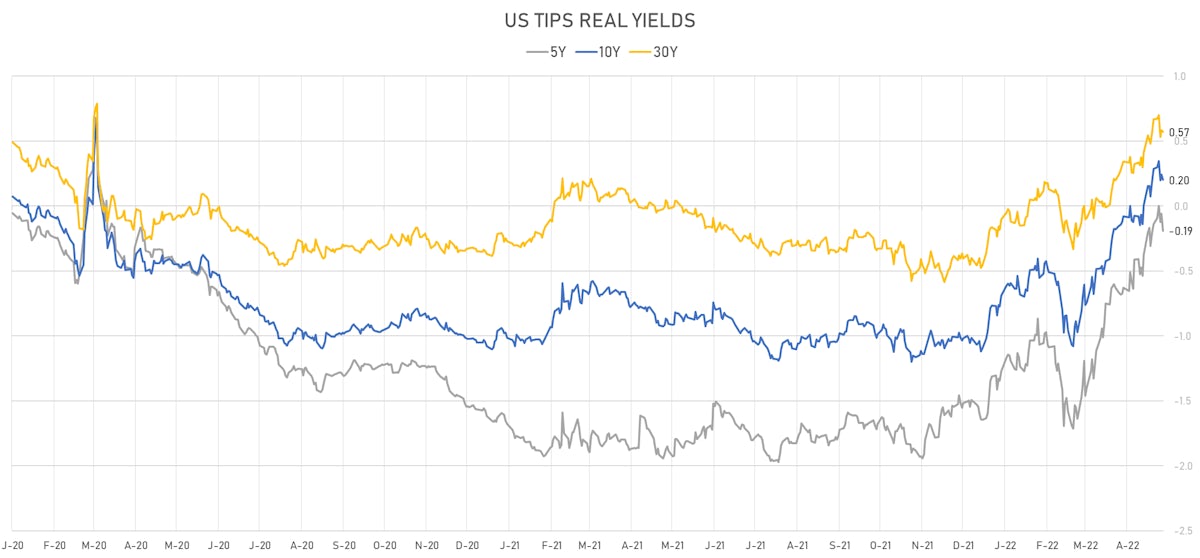

- US 5-Year TIPS Real Yield: -5.2 bp at -0.1900%; 10-Year TIPS Real Yield: -8.4 bp at 0.2000%; 30-Year TIPS Real Yield: -9.7 bp at 0.5700%

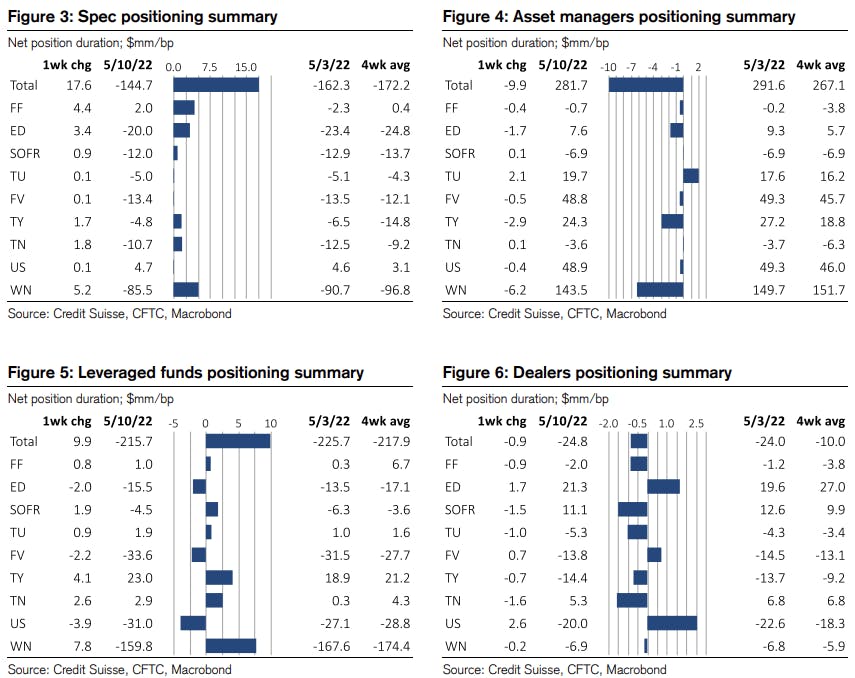

WEEKLY CFTC NET DURATION POSITIONING UPDATE

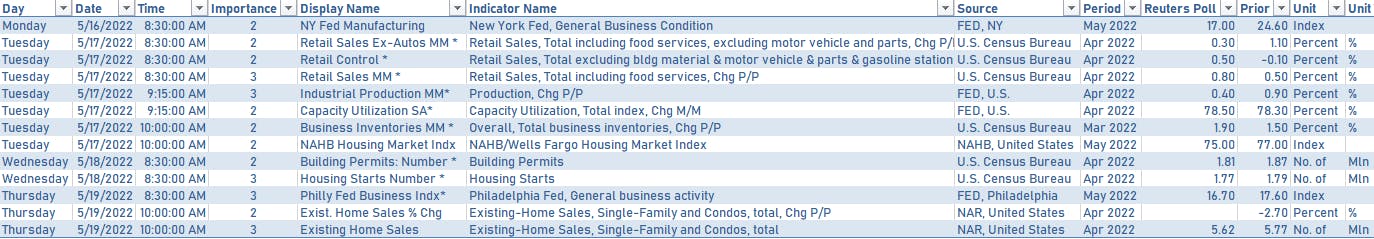

US MACRO RELEASES IN THE WEEK AHEAD

- Focus next week will be on retail sales, industrial production, housing starts, and existing home sales data

- Scheduled speeches of FOMC voting members: Williams on Monday morning (8.55am EST), Harker and Mester on Tuesday afternoon (2.30PM EST), and Harker again on Wednesday (4pm EST)

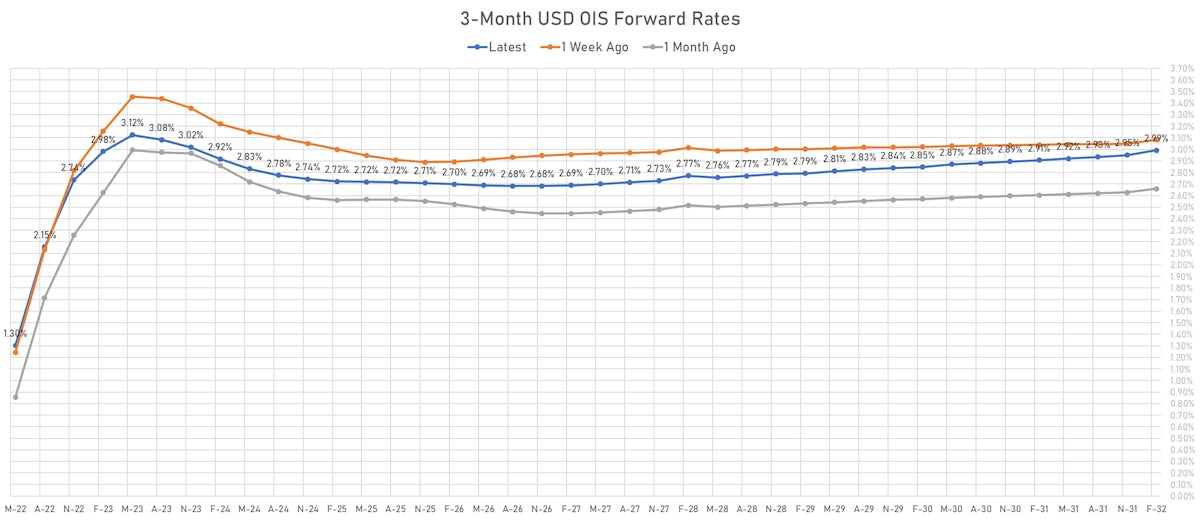

US FORWARD RATES

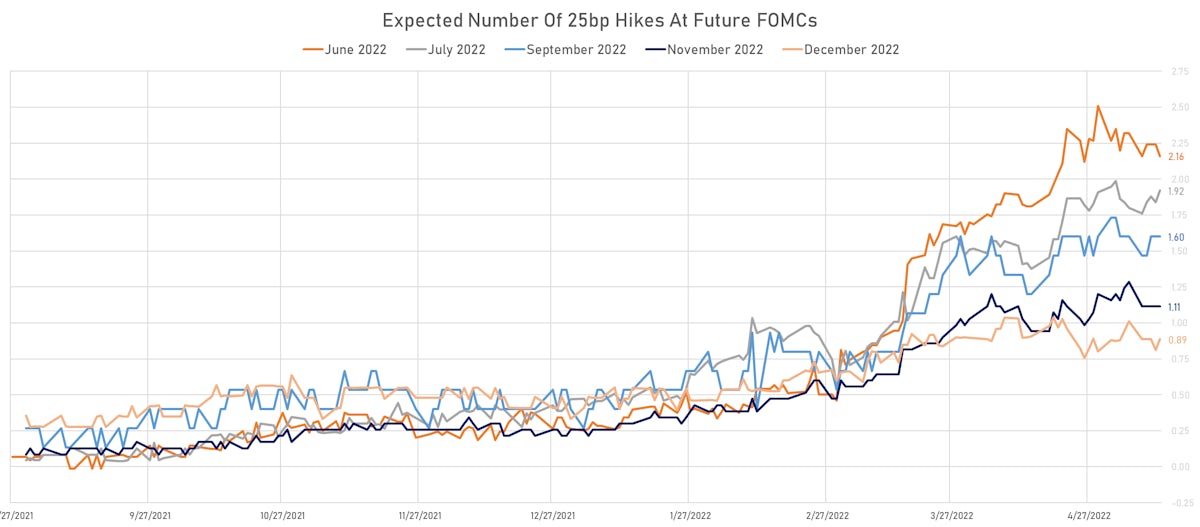

- Money markets continue to expect 2 hikes in June, 2 hikes in July, probably 2 hikes in September, and then 1 hike in both November and December to end the year in the 275-300bp range

- 3-month Eurodollar futures (EDZ) spreads now price in only 5.0 bp of hikes in 2023 (equivalent to 0.2 x 25 bp hikes), down -0.5 bp today, and -14.5 bp of hikes in 2024 (equivalent to 0.6 x 25 bp rate cut)

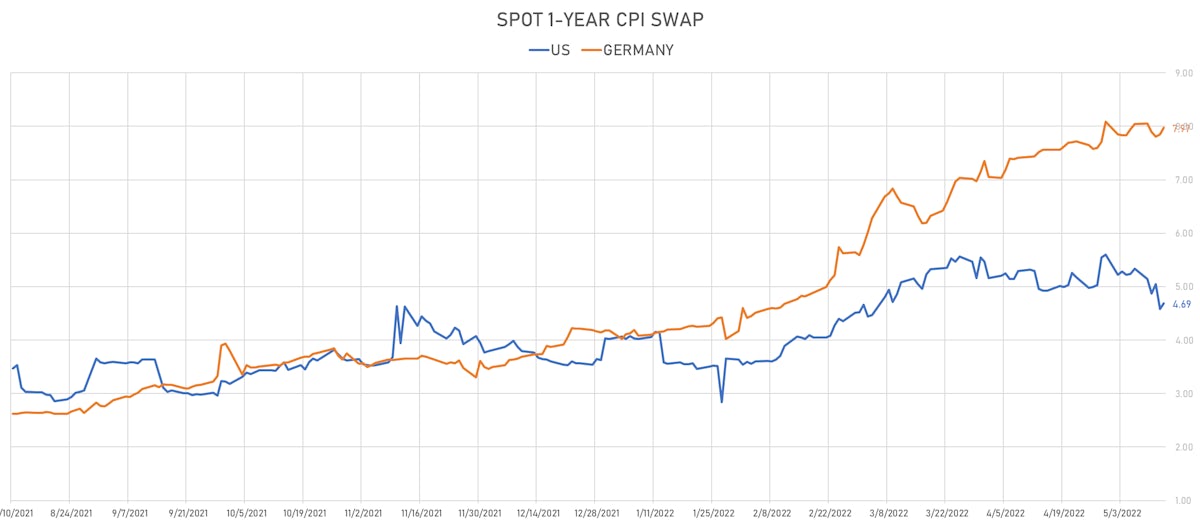

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 4.69% (up 18.1bp); 2Y at 3.94% (up 15.1bp); 5Y at 3.08% (up 16.7bp); 10Y at 2.78% (up 11.0bp); 30Y at 2.54% (up 10.0bp)

- 6-month spot US CPI swap up 14.8 bp to 5.519%, with a flattening of the forward curve

- US Real Rates: 5Y at -0.1900%, -13.1 bp today; 10Y at 0.2000%, -4.2 bp today; 30Y at 0.5700%, -1.4 bp today

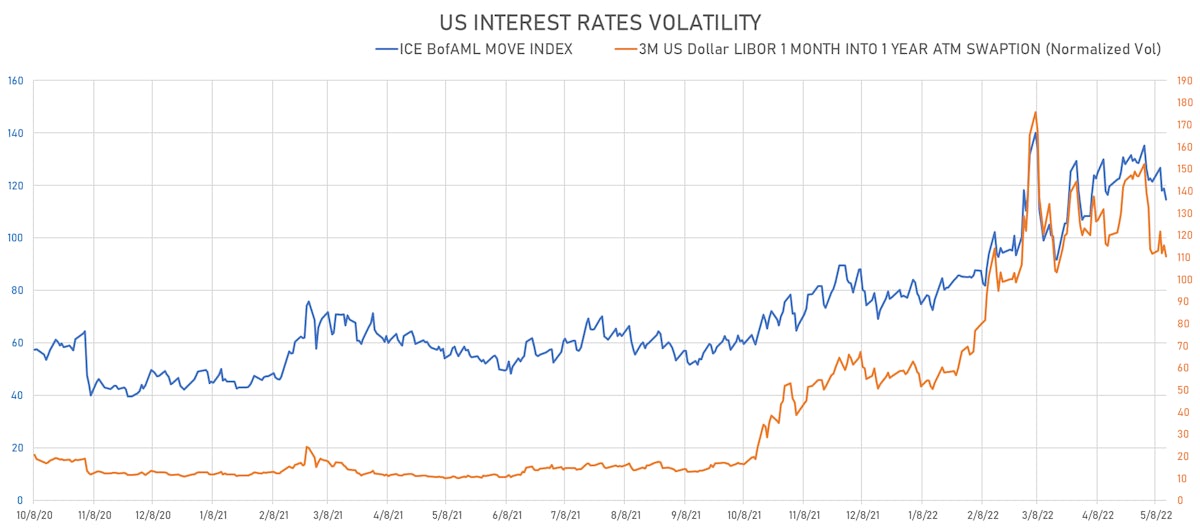

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -5.1 vols at 110.3 normals

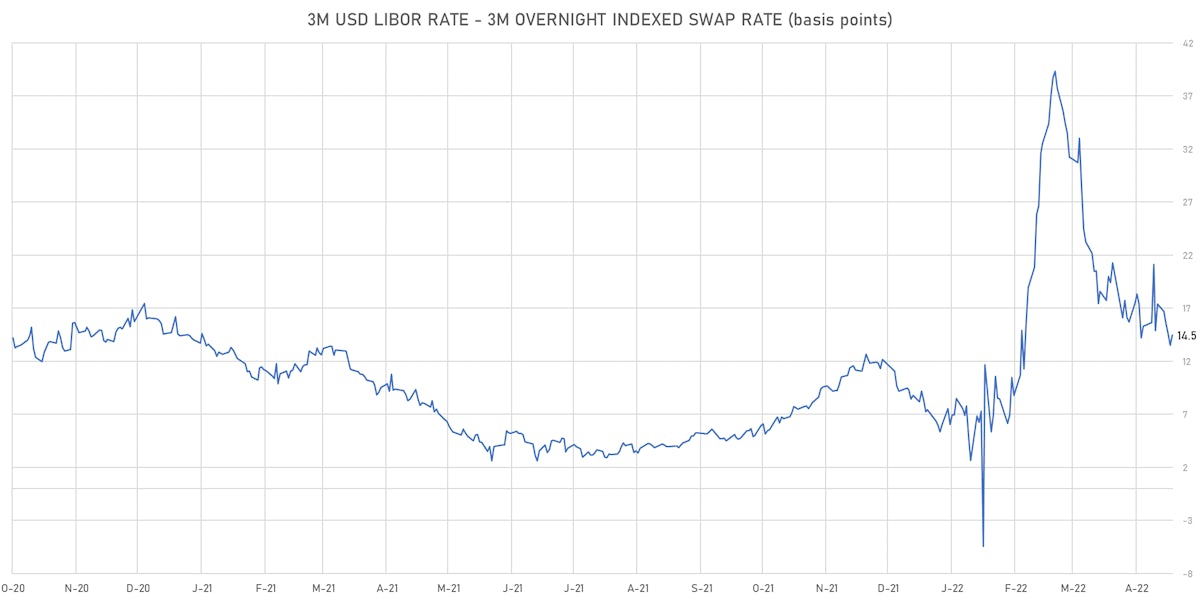

- 3-Month LIBOR-OIS spread up 1.0 bp at 14.5 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.593% (up 6.3 bp); the German 1Y-10Y curve is 4.5 bp steeper at 117.7bp (YTD change: -42.4 bp)

- Japan 5Y: 0.010% (down -0.6 bp); the Japanese 1Y-10Y curve is unchanged at 32.7bp (YTD change: -15.9 bp)

- China 5Y: 2.581% (down -0.7 bp); the Chinese 1Y-10Y curve is 2.0 bp steeper at 72.3bp (YTD change: -50.3 bp)

- Switzerland 5Y: 0.255% (up 7.8 bp); the Swiss 1Y-10Y curve is 5.3 bp flatter at 98.5bp (YTD change: -55.5 bp)