Rates

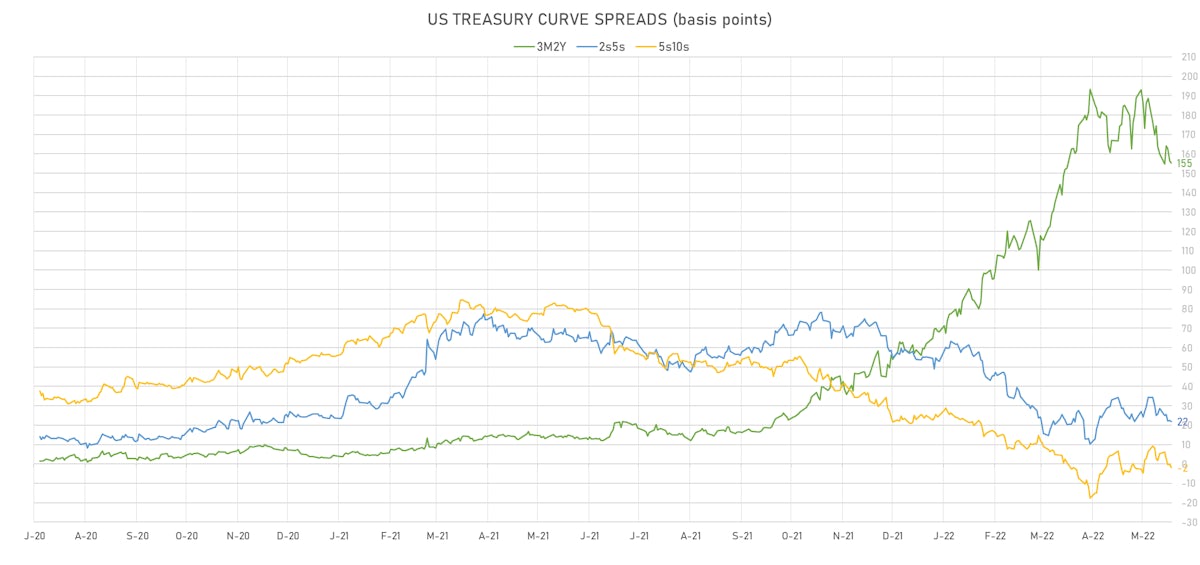

The US Curve Flattened From 2Y Out This Week, With The Front End Staying Well Anchored And 10Y Treasury Yields Coming Down 14bp

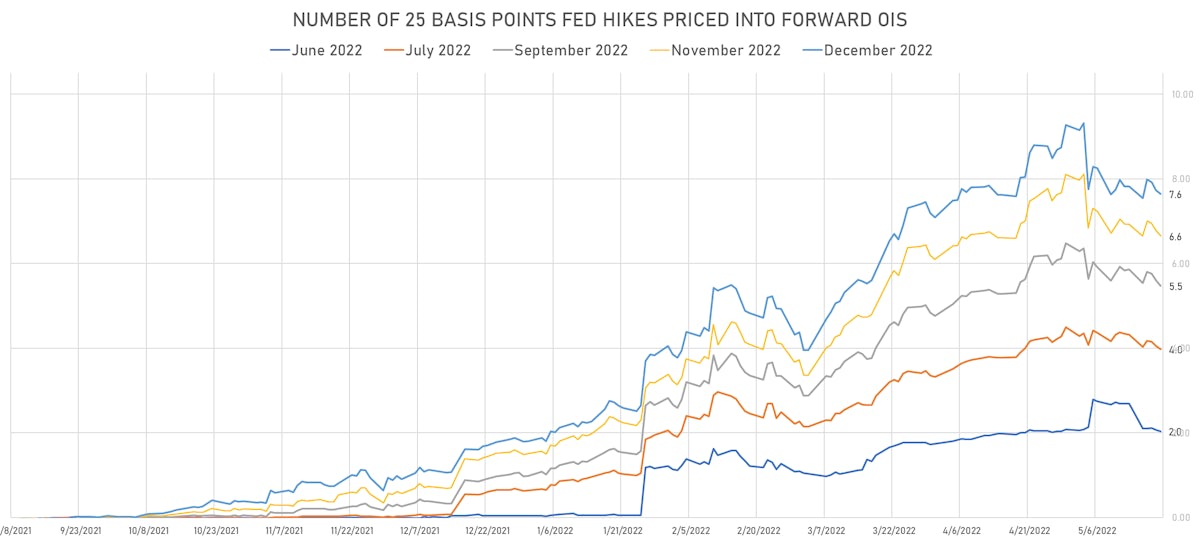

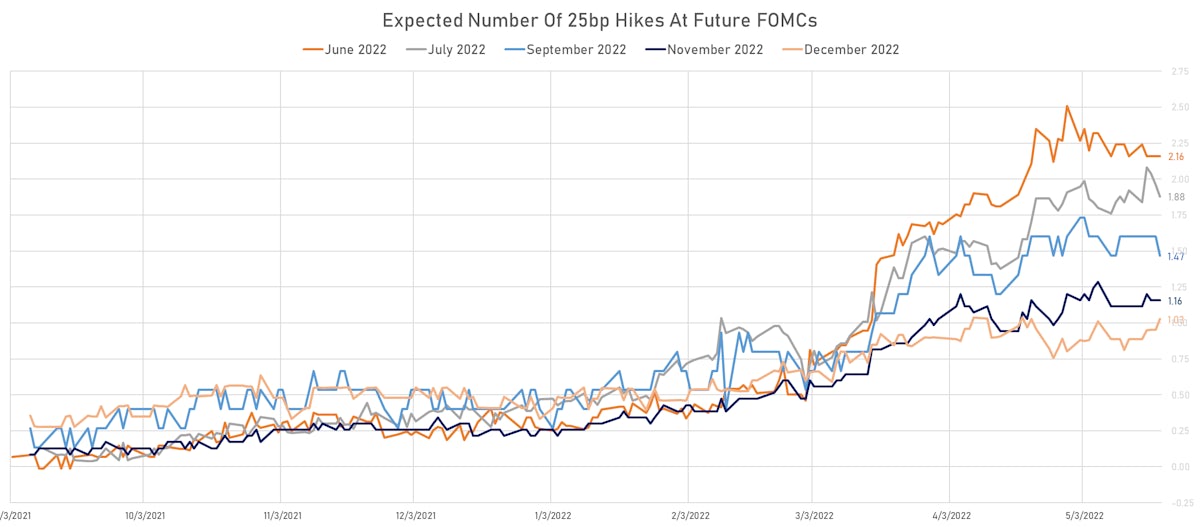

Money markets are still pricing in 50bp hikes for the next 3 FOMCs, with the most uncertainty on the September meeting, which could see the Fed decide to go for 25bp if the economy started to show signs of slowing too rapidly

Published ET

Expected number of hikes at Remaining 2022 FOMCs | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -25.1 bp, now at 73.8 bp (YTD change: -39.4bp)

- 1Y: 2.0496% (up 11.3 bp)

- 2Y: 2.5848% (down 0.2 bp)

- 5Y: 2.8052% (down 6.8 bp)

- 7Y: 2.8212% (down 11.6 bp)

- 10Y: 2.7874% (down 13.8 bp)

- 30Y: 2.9924% (down 9.5 bp)

- US treasury curve spreads: 3m2Y at 155.3bp (down -4.7bp this week), 2s5s at 22.0bp (down -6.7bp), 5s10s at -1.8bp (down -6.9bp), 10s30s at 20.5bp (up 4.4bp)

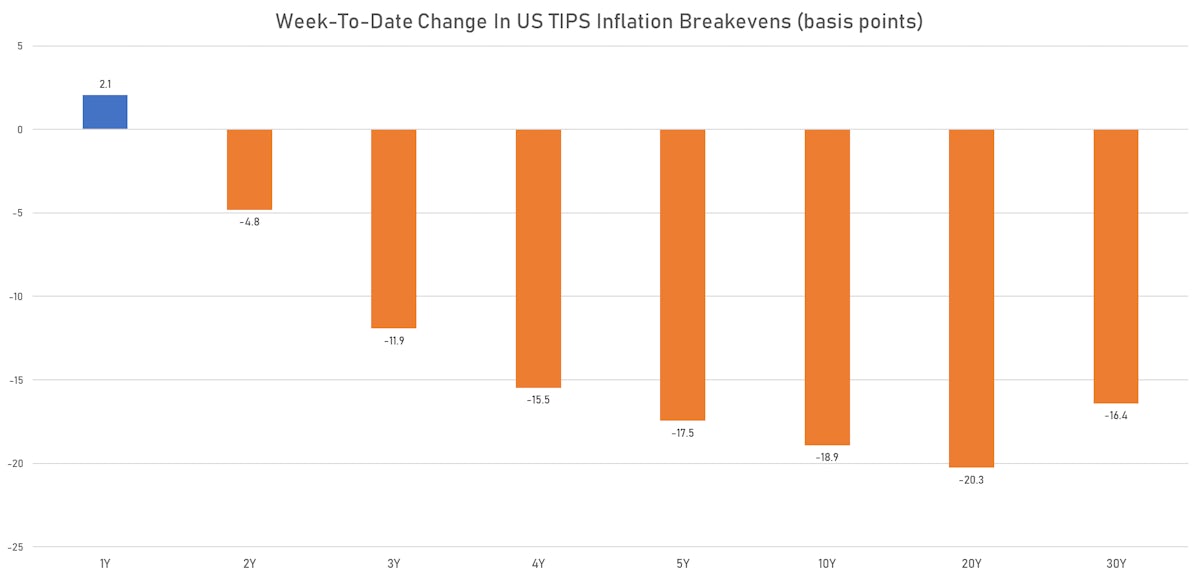

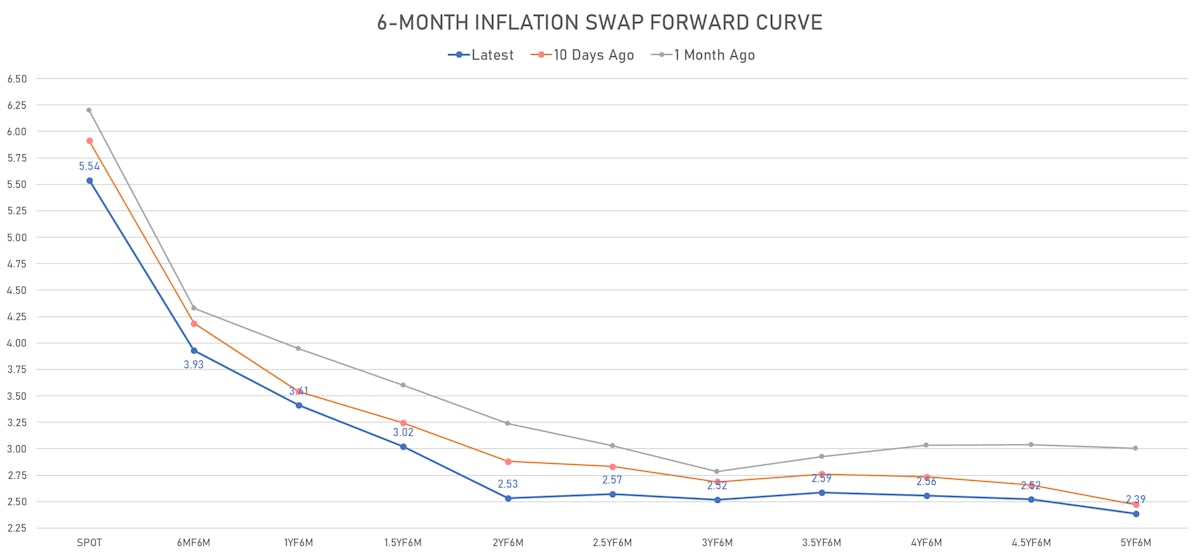

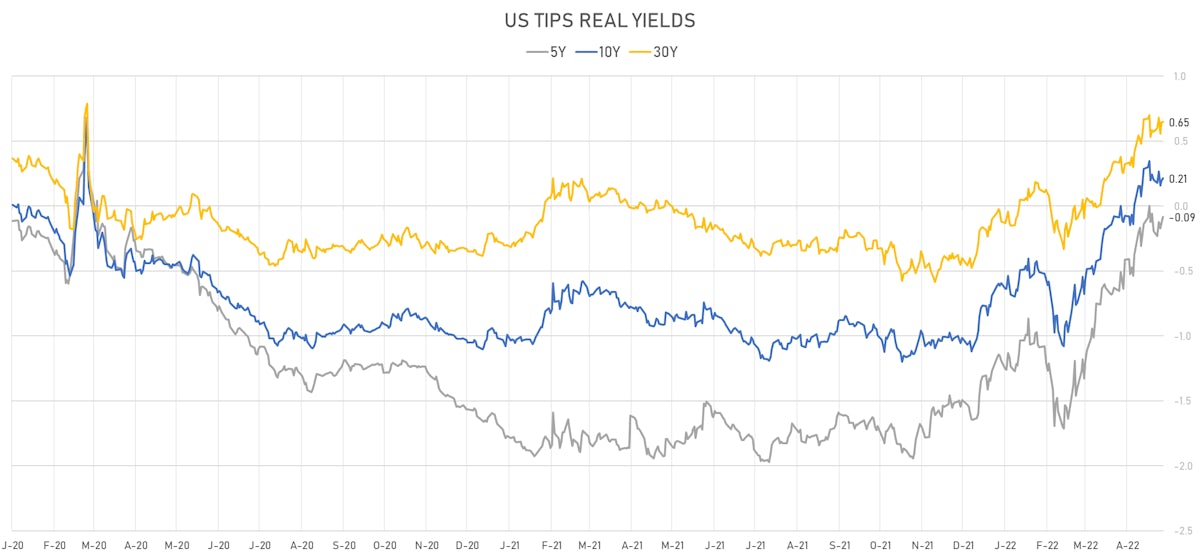

- TIPS 1Y breakeven inflation at 4.71% (up 2.1bp); 2Y at 3.90% (down -4.8bp); 5Y at 2.90% (down -17.5bp); 10Y at 2.60% (down -18.9bp); 30Y at 2.38% (down -16.4bp)

- US 5-Year TIPS Real Yield: +10.5 bp at -0.0850%; 10-Year TIPS Real Yield: +1.2 bp at 0.2120%; 30-Year TIPS Real Yield: +7.8 bp at 0.6480%

MARKET OUTLOOK

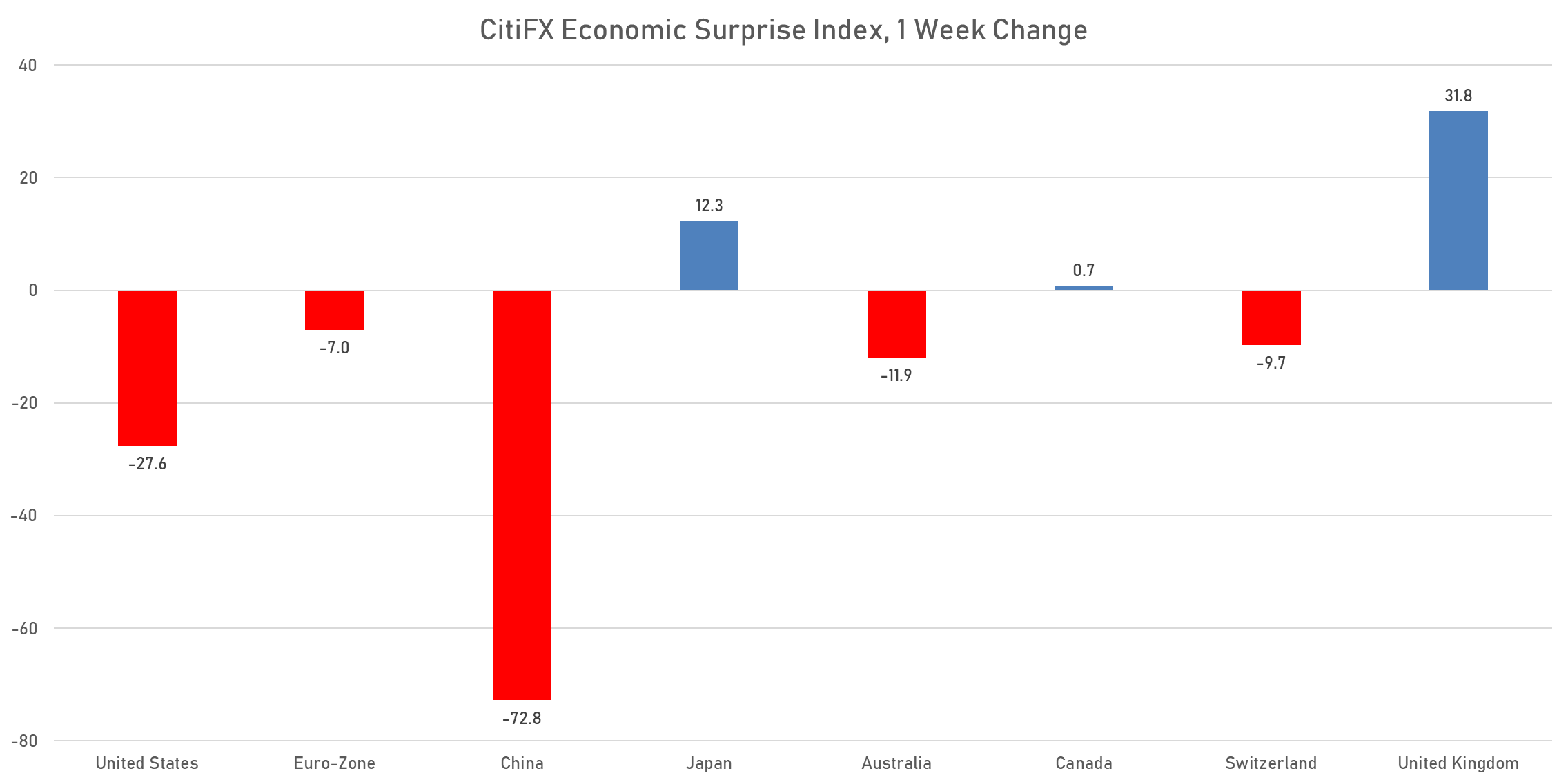

- US TIPS inflation breakevens are coming down faster than their real yields are rising, with key economic releases coming on the lighter side of expectations, fanning fears of an early recession

- The Financial Conditions Index is up roughly 250bp since November (when financial conditions were the easiest ever)

- There is still a huge amount of uncertainty, which won't be resolved until we have more clarity on the deceleration of inflation.

- Having said that, the US could still avoid a recession: the current level of tightening (and forward rates pricing) would lead to GDP growth underperforming potential growth by about by 1.5%from 4Q22 (i.e. GDP growth running at about 1%)

- In Europe, the market expects 25bp in July from the ECB, with 50bp likely a step too far for the first hike

- Considering the focus of the ECB on inflation, we expect the German curve to bear flatten

- In the UK, where the BoE is placing more emphasis on jobs than inflation, we could see the curve steepen

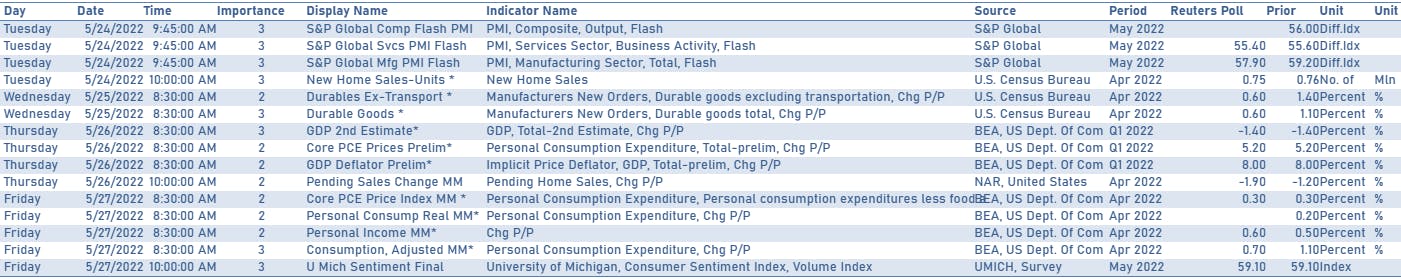

US ECONOMIC RELEASES IN THE WEEK AHEAD

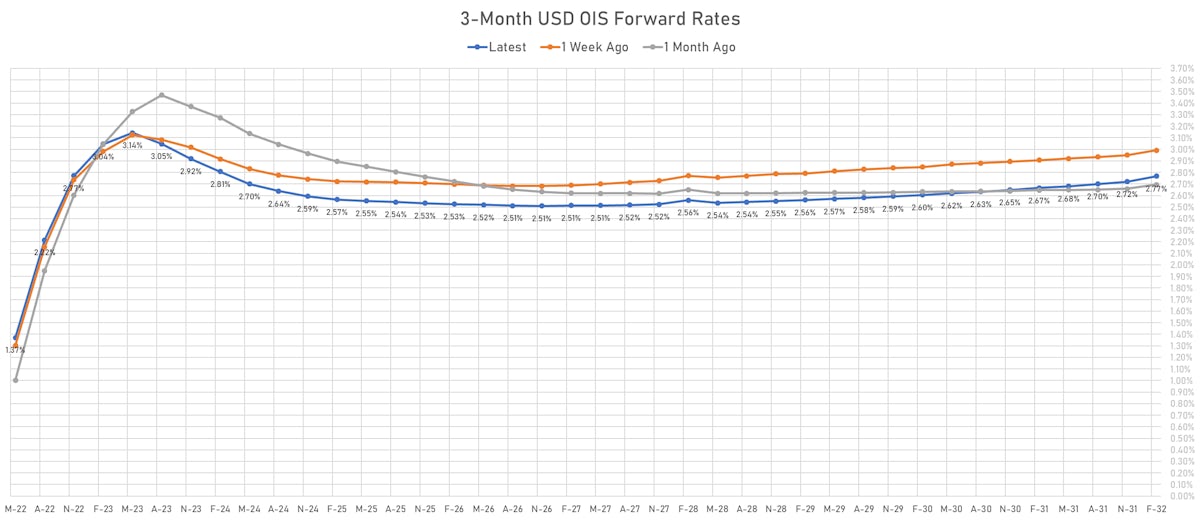

US FORWARD RATES

- Fed Funds futures now price in 51.0bp of Fed hikes at the June 2022 (96% probability of a 50bp hike), 99.5bp (4.0 x 25bp hikes) by the end of July 2022, and price in 7.6 hikes by the end of December 2022 (for a total of 10.6 hikes for the year)

- 3-month Eurodollar futures (EDZ) spreads price in -7.0 bp of hikes in 2023 (equivalent to -0.3 x 25 bp hikes), down -5.0 bp today, and -19.0 bp of hikes in 2024 (equivalent to -0.8 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 4.71% (down -4.7bp); 2Y at 3.90% (down -5.7bp); 5Y at 2.90% (down -7.8bp); 10Y at 2.60% (down -8.0bp); 30Y at 2.38% (down -5.9bp)

- 6-month spot US CPI swap down -8.9 bp to 5.536%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.0850%, +4.6 bp today; 10Y at 0.2120%, +1.7 bp today; 30Y at 0.6480%, +0.3 bp today

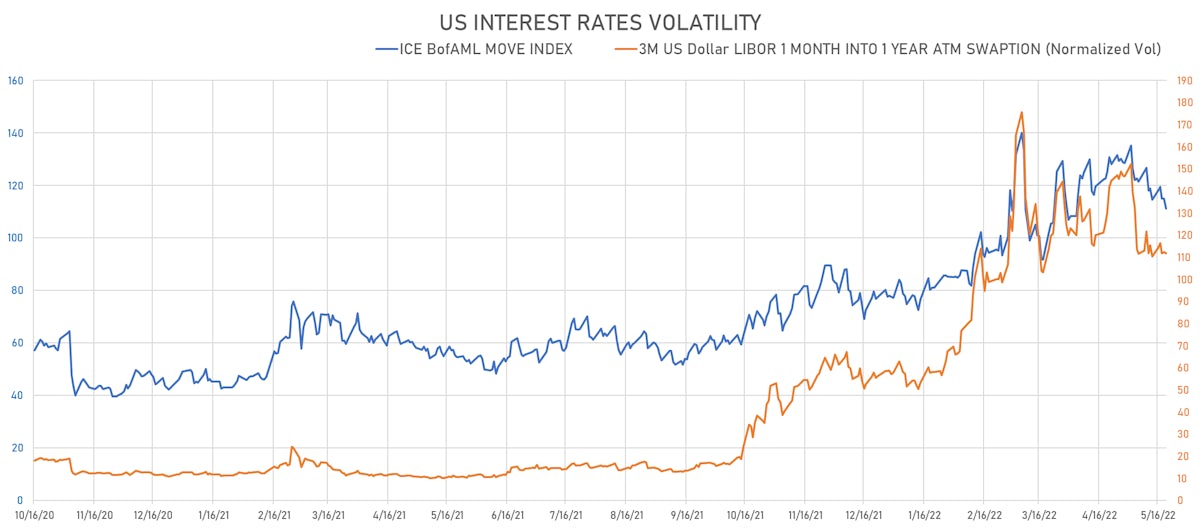

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.4 vols at 111.8 normals

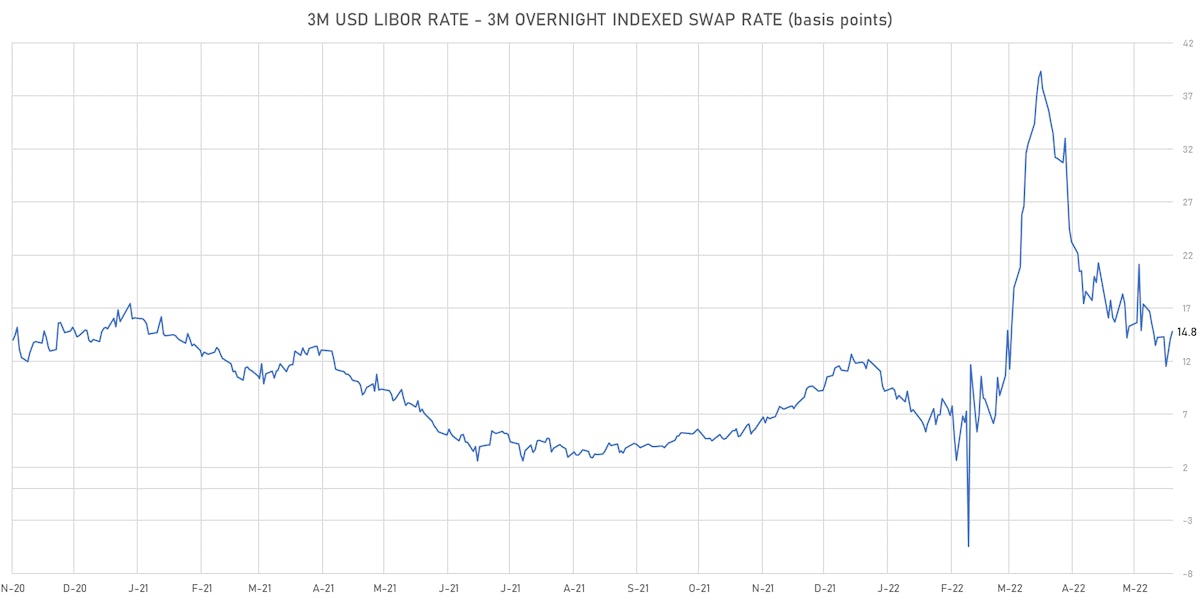

- 3-Month LIBOR-OIS spread up 0.8 bp at 14.8 bp (18-months range: -5.5 to 39.3 bp)

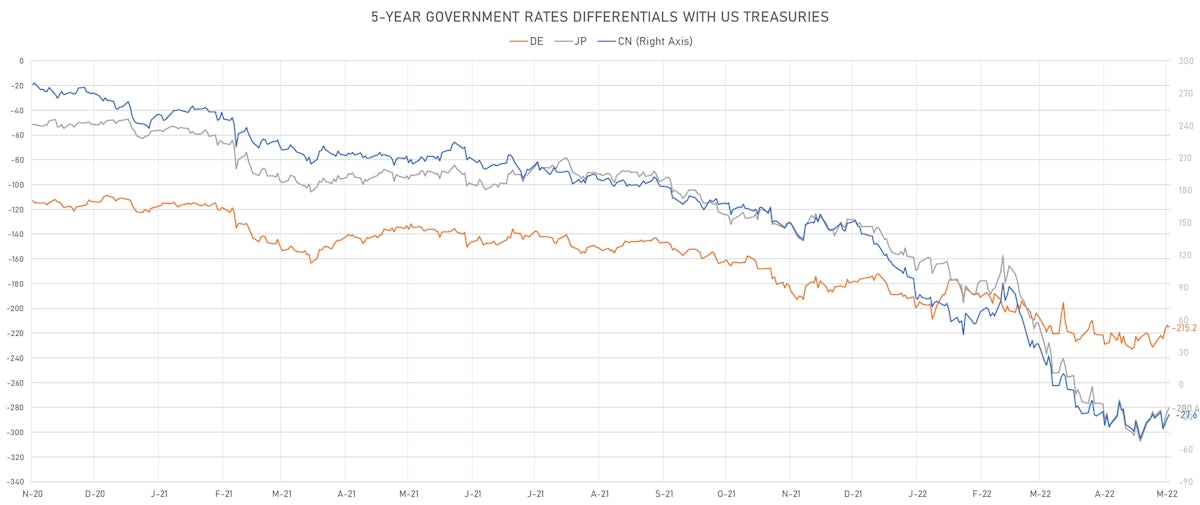

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.663% (down -2.6 bp); the German 1Y-10Y curve is 0.2 bp steeper at 98.0bp (YTD change: -42.6 bp)

- Japan 5Y: 0.017% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 33.6bp (YTD change: -15.9 bp)

- China 5Y: 2.547% (up 0.3 bp); the Chinese 1Y-10Y curve is 1.6 bp steeper at 77.9bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.277% (up 0.6 bp); the Swiss 1Y-10Y curve is 0.8 bp steeper at 87.9bp (YTD change: -55.6 bp)