Rates

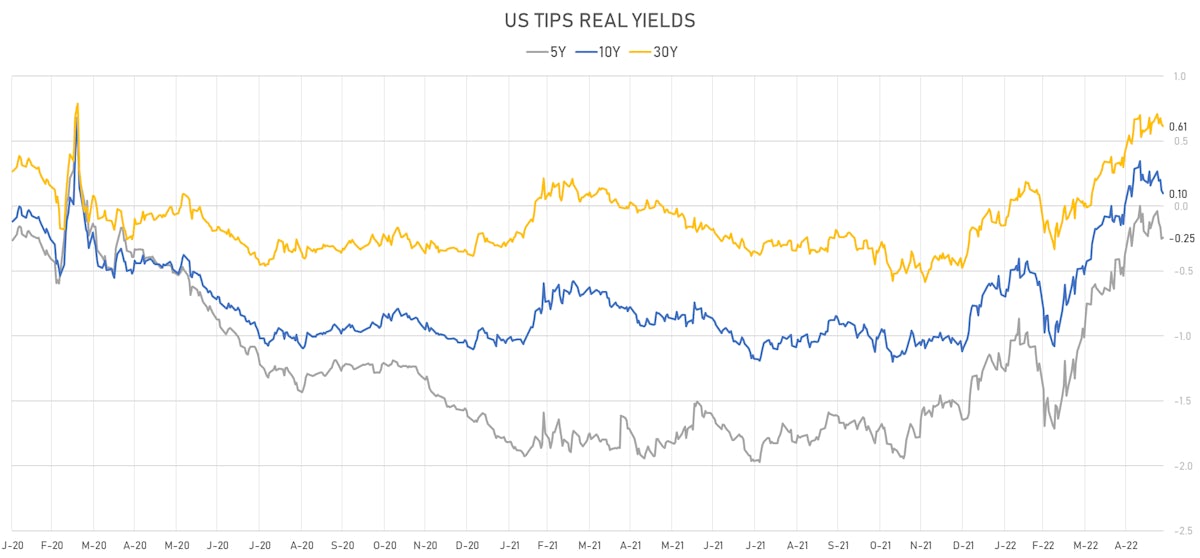

The US Treasury Curve Bull Steepened This Week, Driven By Lower Real Yields, While Breakevens Rose Slightly

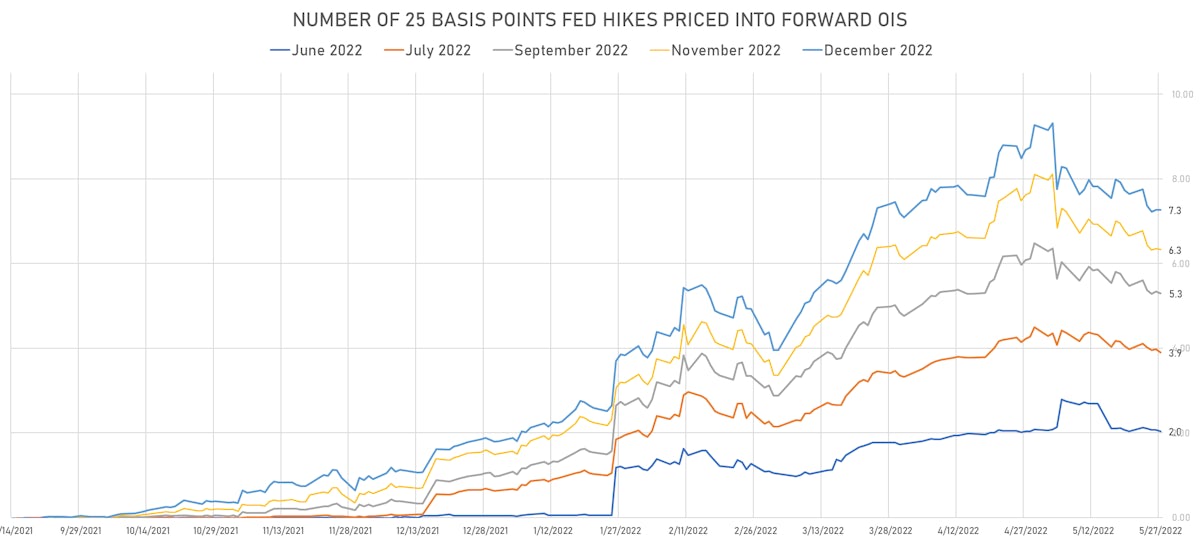

The worry about a possible US economic recession took 9bp out of December '22 Fed funds pricing over the past week, with the September FOMC now significantly skewed towards 25bp (from 50bp a month ago); Goldman Sachs still puts the probability of a recession in the next couple of years at 35%

Published ET

US TIPS Real Yields | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

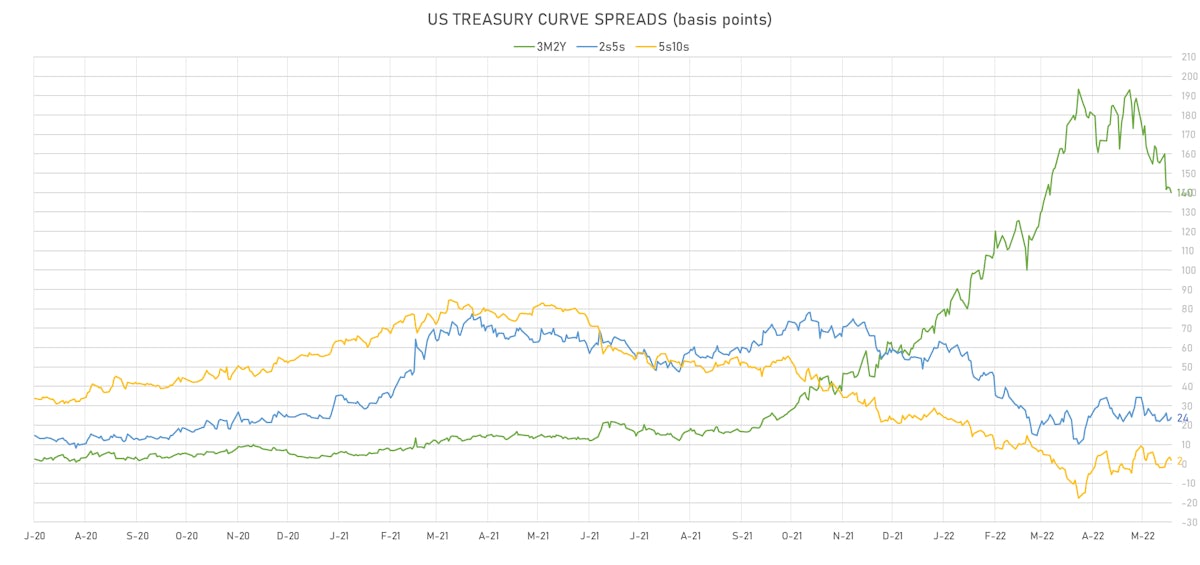

- The treasury yield curve steepened, with the 1s10s spread widening 2.2 bp, now at 76.0 bp (YTD change: -37.2bp)

- 1Y: 1.9824% (down 6.7 bp)

- 2Y: 2.4819% (down 10.3 bp)

- 5Y: 2.7226% (down 8.3 bp)

- 7Y: 2.7680% (down 5.3 bp)

- 10Y: 2.7423% (down 4.5 bp)

- 30Y: 2.9707% (down 2.2 bp)

- US treasury curve spreads: 3m2Y at 140.1bp (down -15.2bp this week), 2s5s at 24.1bp (up 2.0bp), 5s10s at 2.0bp (up 3.7bp), 10s30s at 22.8bp (up 2.3bp)

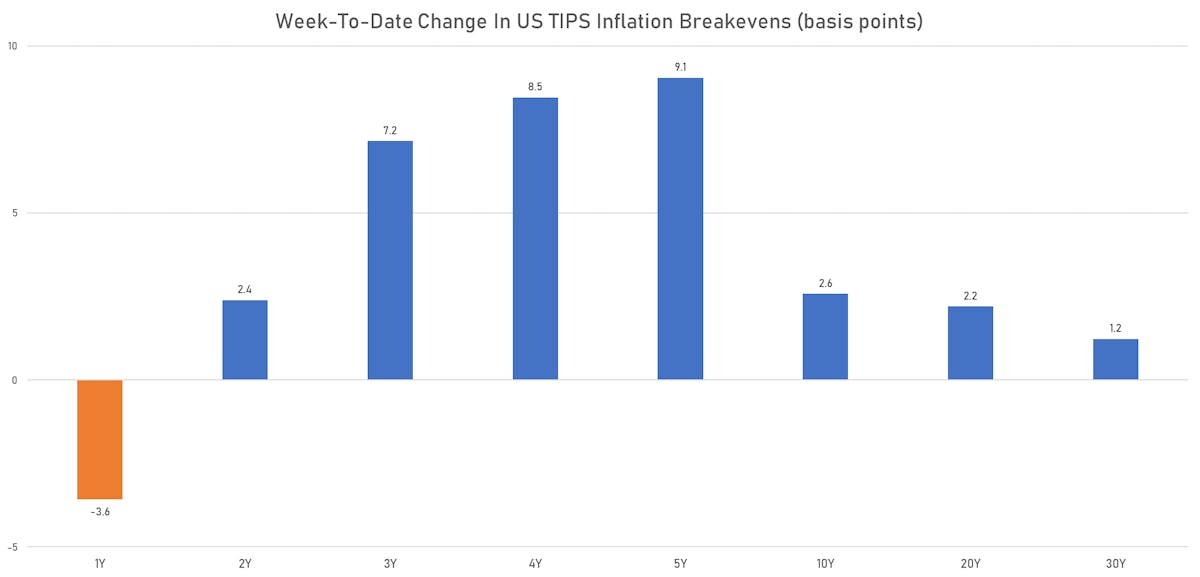

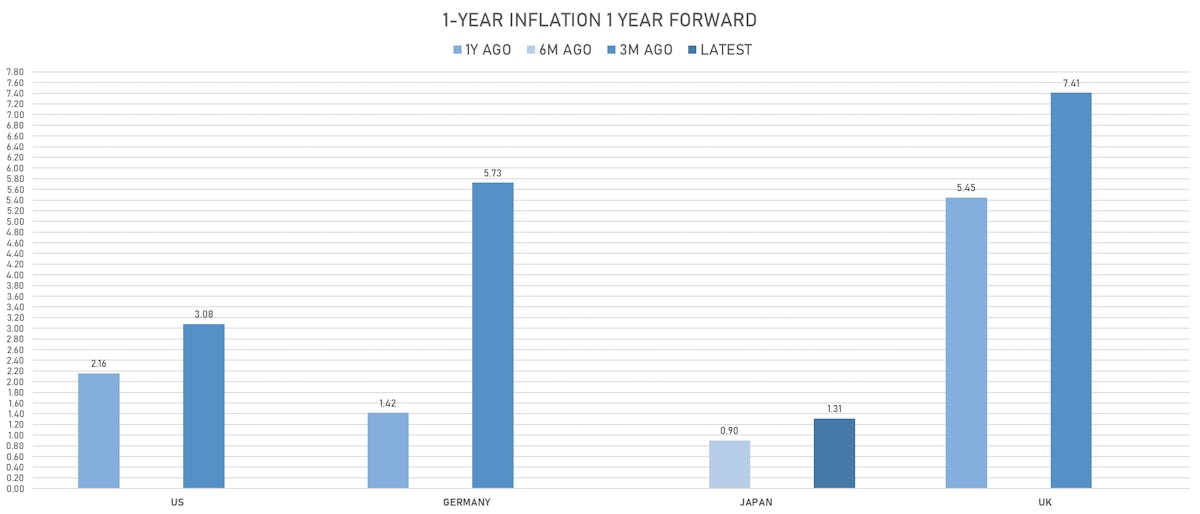

- TIPS 1Y breakeven inflation at 4.67% (down -3.6bp); 2Y at 3.92% (up 2.4bp); 5Y at 2.99% (up 9.1bp); 10Y at 2.62% (up 2.6bp); 30Y at 2.39% (up 1.2bp)

- US 5-Year TIPS Real Yield: -16.1 bp at -0.2460%; 10-Year TIPS Real Yield: -11.6 bp at 0.0960%; 30-Year TIPS Real Yield: -3.4 bp at 0.6140%

MEANINGFUL RECENT MARKET DEVELOPMENTS

A few interesting things have been happening concurrently this month:

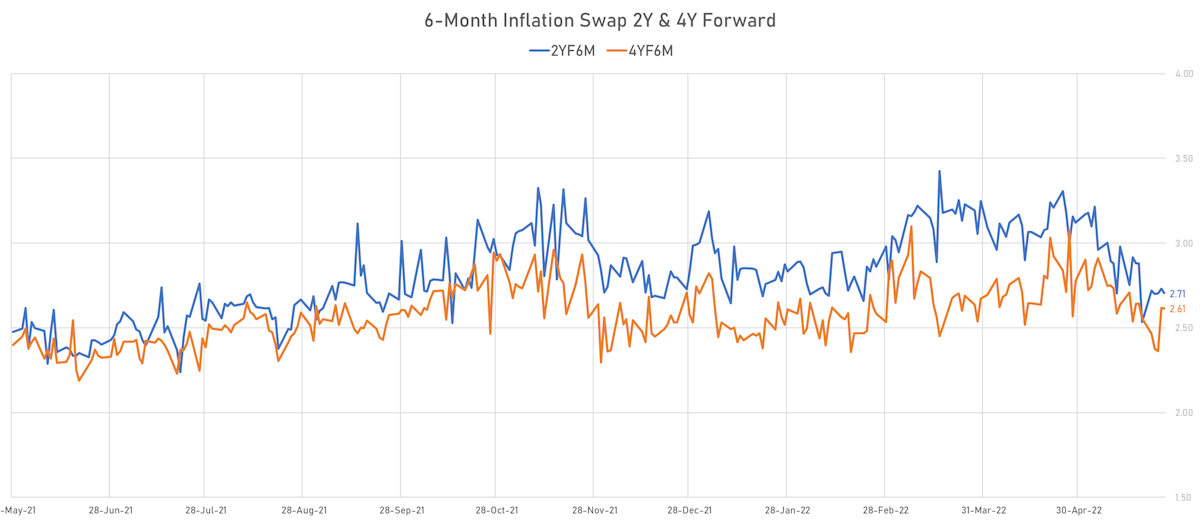

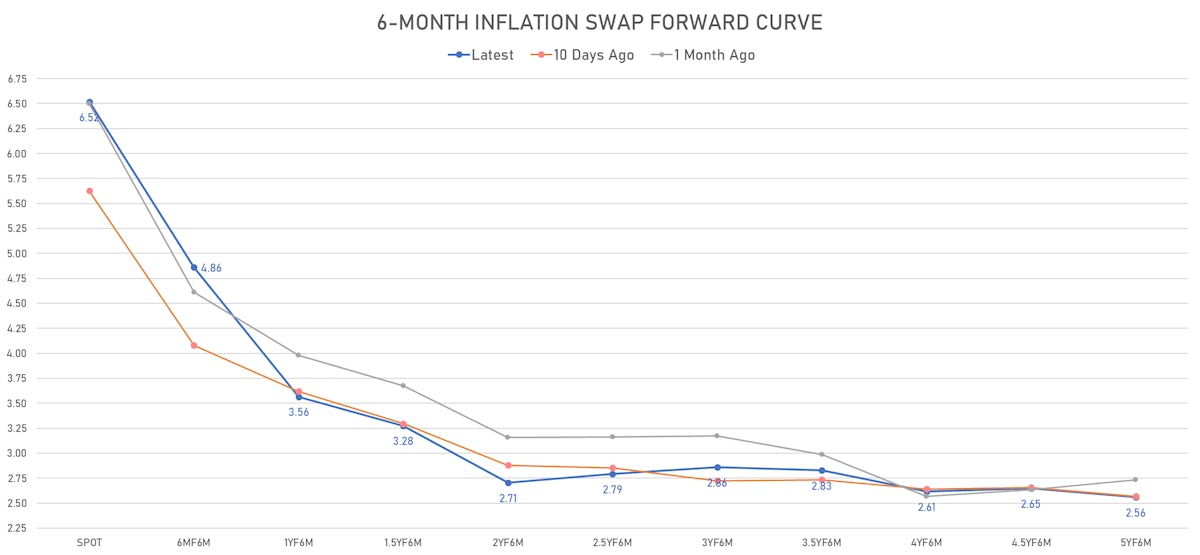

- The Fed has regained market credibility in terms of its ability to control inflation expectations; that has led to a strong downward repricing in TIPS breakevens, which saw a slight reversal this week

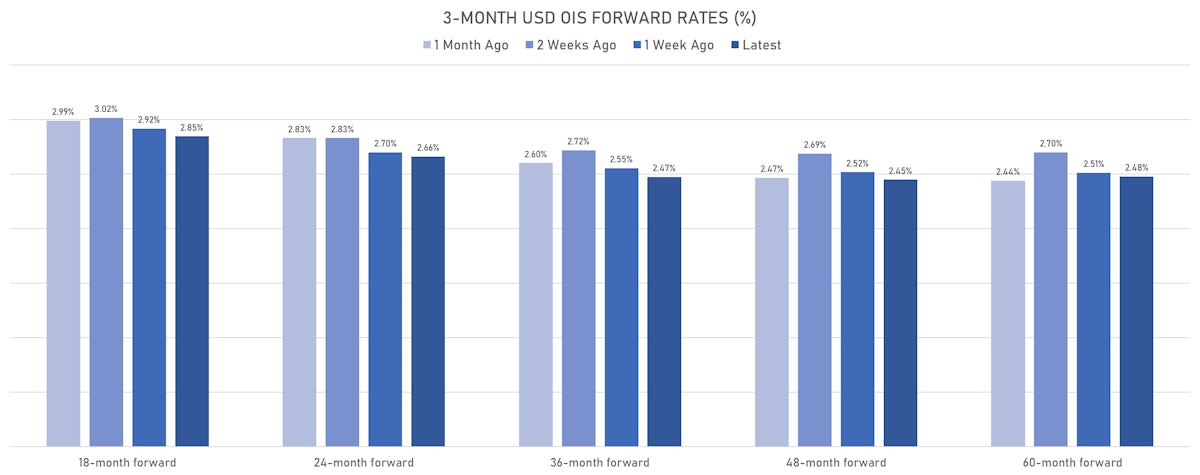

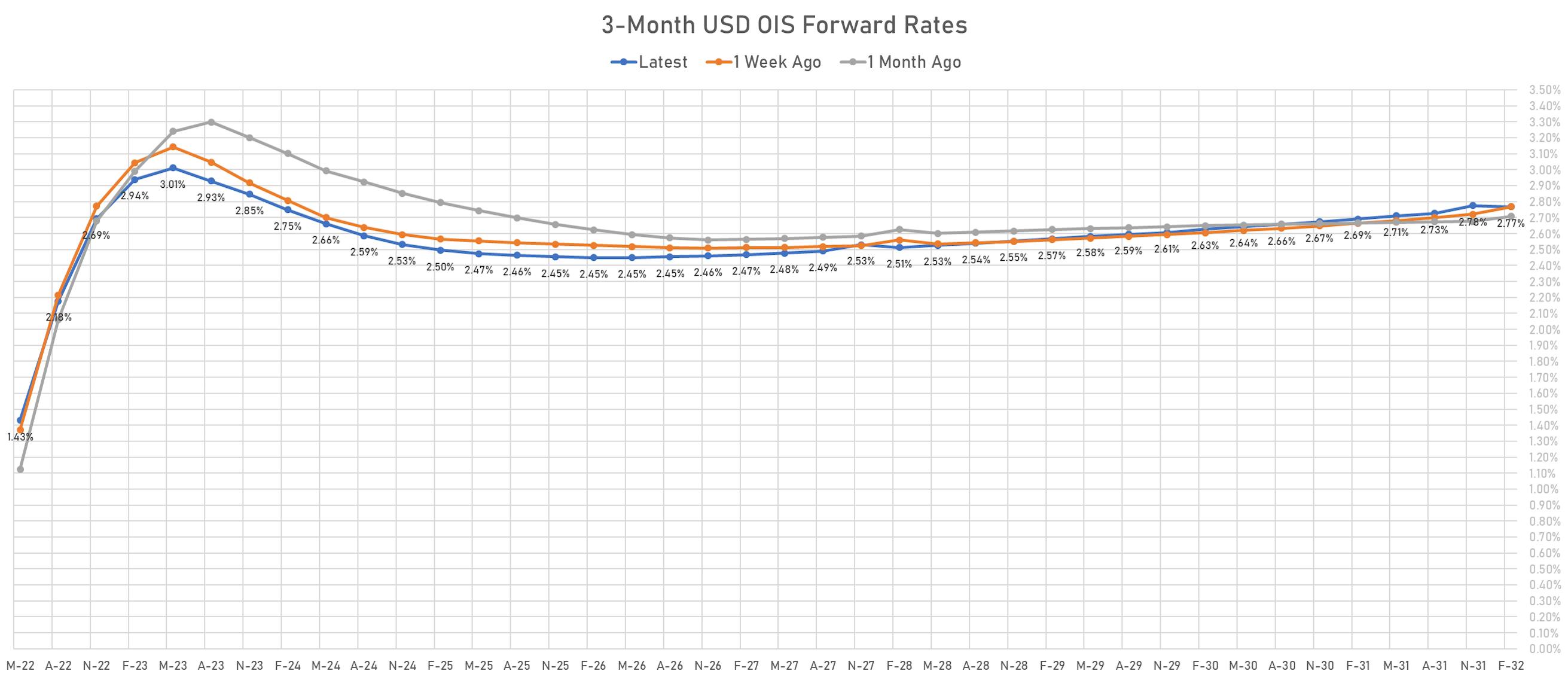

- The market has started focusing its attention on a possible recession, rather than the single focus on inflation we saw earlier this year; that has translated into forward money market rates peaking earlier than before (1Q2023 vs 2Q2023), and a lower terminal rate, projecting a flattening bias toward the curve

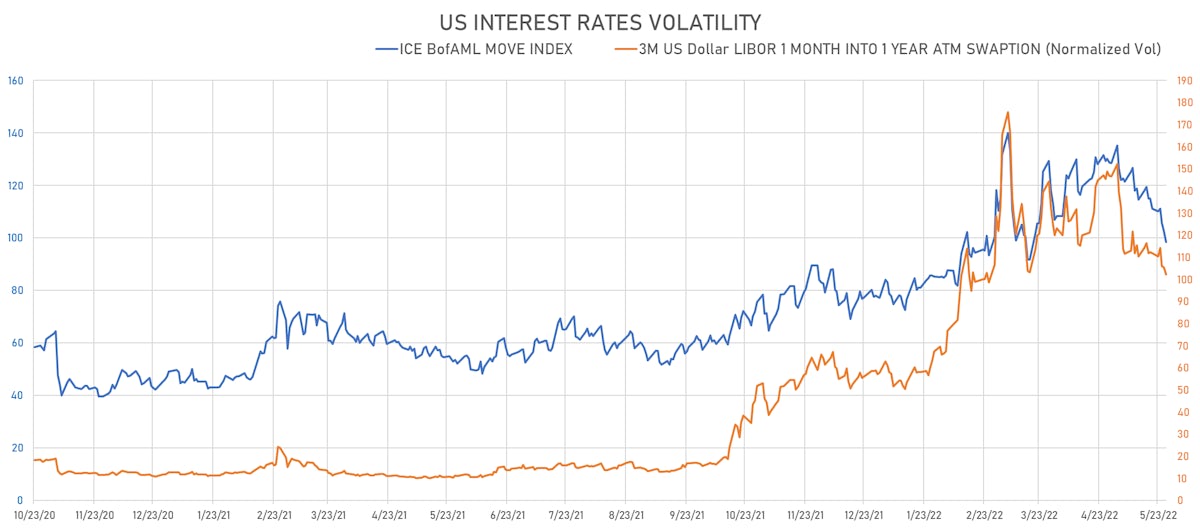

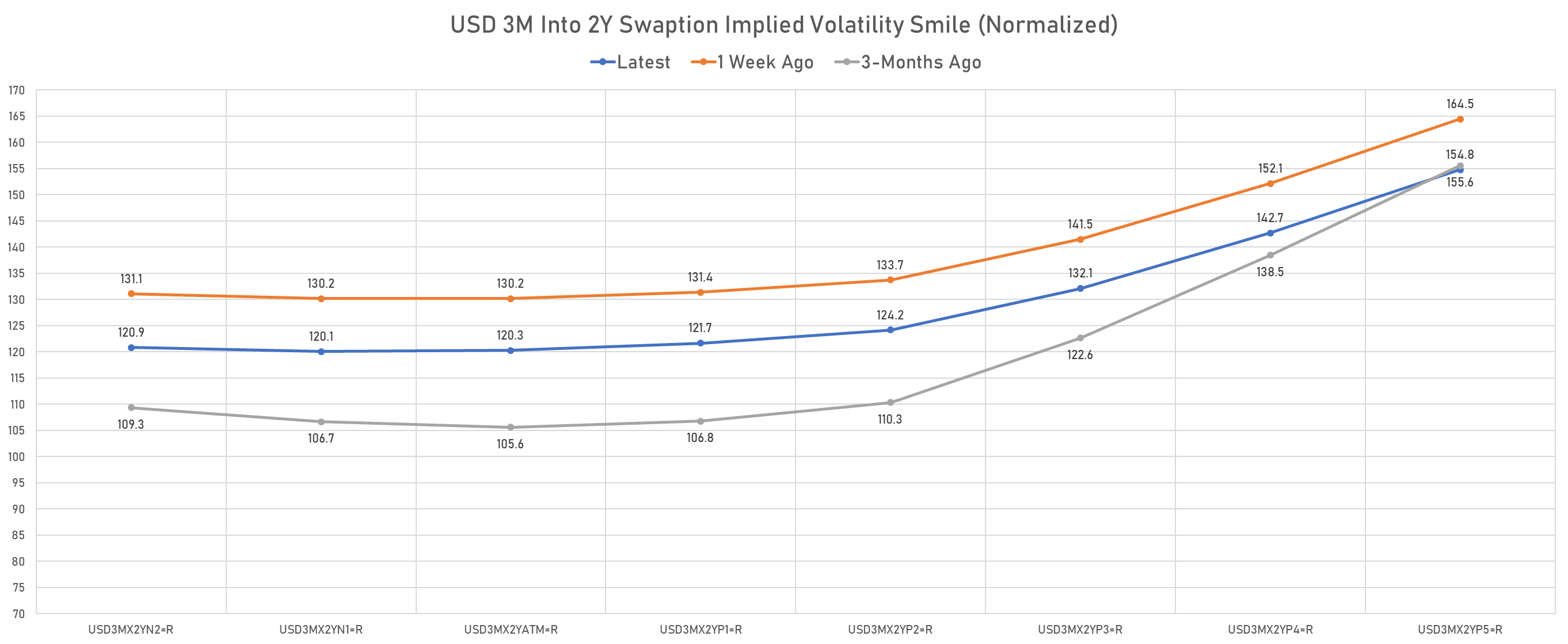

- Volatilities across the surface came down as the Fed and the market are now in sync: for now, unless we see inflation data coming hotter than expected, the Fed is pretty happy with the current market pricing. In the absence of an exogenous shock, it should be a relatively quiet summer for rates.

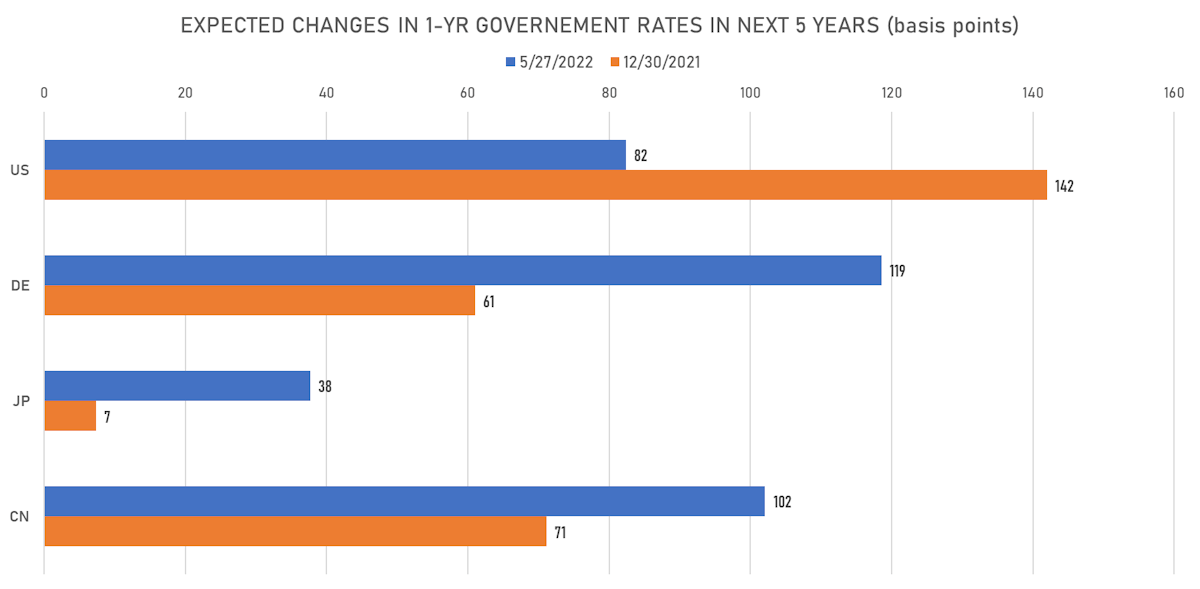

- Expectations around the total number of Fed rate hikes have diminished, while ECB rate hikes expectations have risen; the concomitant moves have helped put a floor on the EURUSD slide

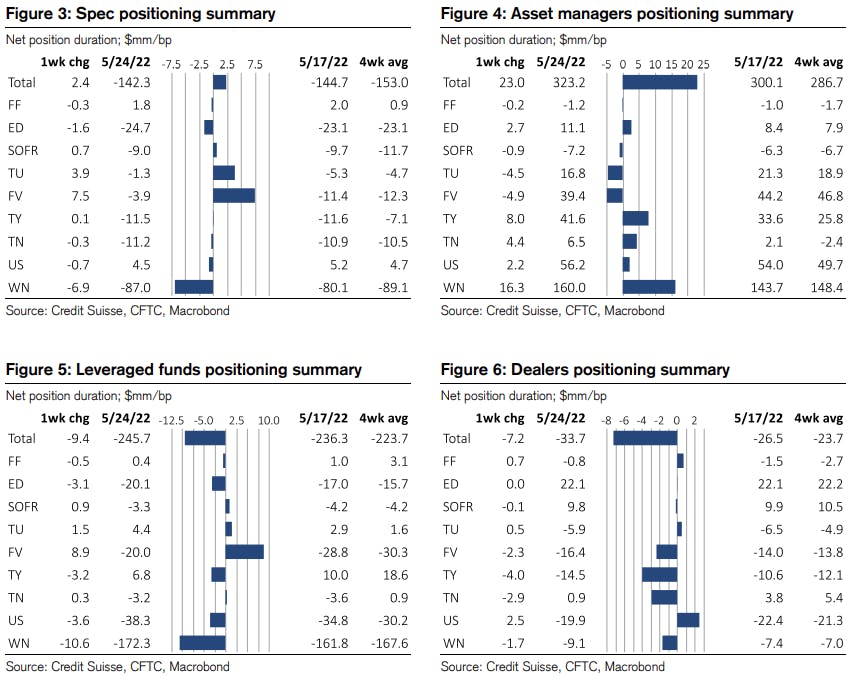

WEEKLY CTFC NET DURATION POSITIONING

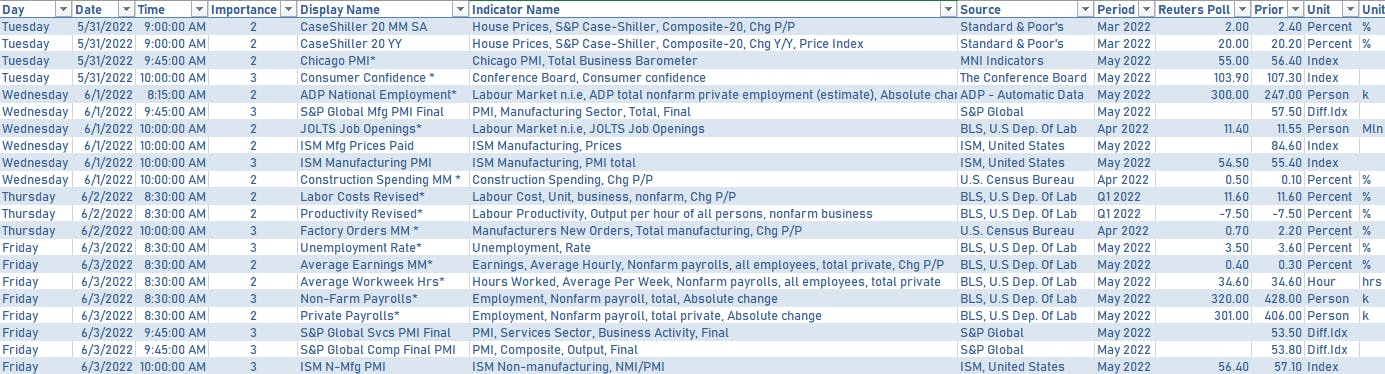

US ECONOMIC RELEASES IN THE WEEK AHEAD

US FORWARD RATES

- Fed Funds futures now price in 51.0bp of Fed hikes by the end of June 2022, 97.5bp (3.9 x 25bp hikes) by the end of July 2022, and price in 7.3 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in -0.5 bp of hikes in 2023 (i.e. no hike in '23), and -18.5 bp of hikes in 2024 (equivalent to 0.7 x 25 bp rate cut)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 4.67% (down -7.1bp); 2Y at 3.92% (down -0.7bp); 5Y at 2.99% (up 2.2bp); 10Y at 2.62% (up 3.9bp); 30Y at 2.39% (up 1.8bp)

- 6-month spot US CPI swap up 89.9 bp to 6.515%, with a steepening of the forward curve

- US Real Rates: 5Y at -0.2460%, +0.5 bp today; 10Y at 0.0960%, -2.4 bp today; 30Y at 0.6140%, -1.9 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -3.1 vols at 102.3 normals

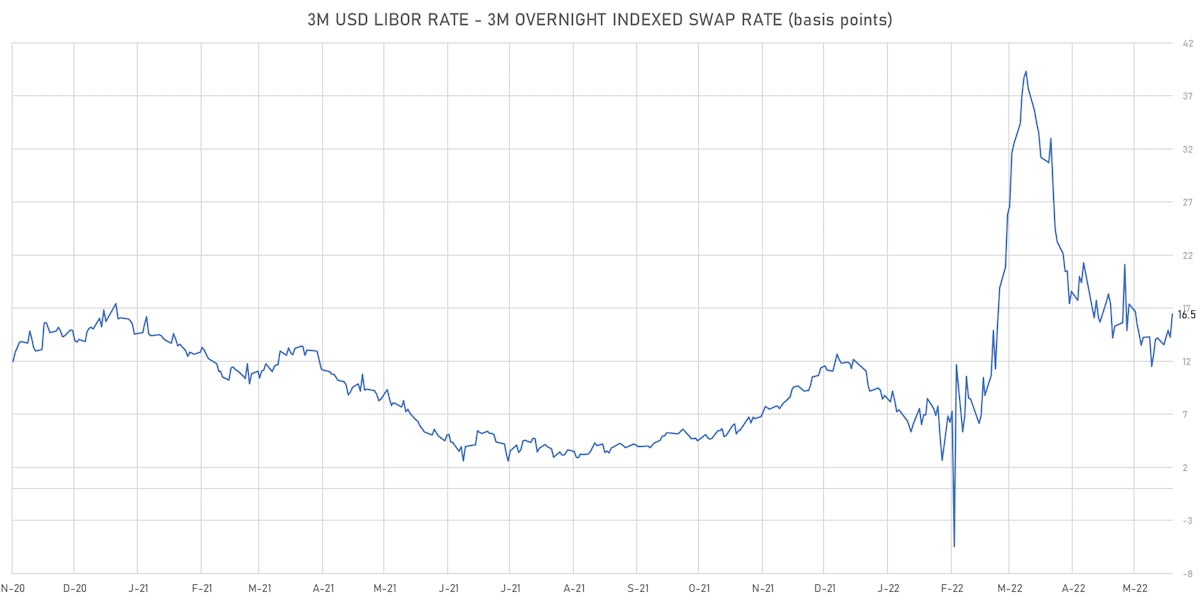

- 3-Month LIBOR-OIS spread up 2.2 bp at 16.5 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.674% (down -1.7 bp); the German 1Y-10Y curve is 5.7 bp flatter at 101.1bp (YTD change: -42.6 bp)

- Japan 5Y: 0.002% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 31.3bp (YTD change: -15.9 bp)

- China 5Y: 2.483% (down -0.5 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 77.9bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.290% (up 3.8 bp); the Swiss 1Y-10Y curve is 1.1 bp flatter at 88.2bp (YTD change: -55.6 bp)