Rates

Slight Steepening In The US Treasury Curve This Week, Driven By Higher Breakevens, Higher Real Yields

The decent US macro data and reopening of Shanghai this week pushed markets to refocus their attention on central bank tightening, after spending the previous weeks pricing the risk of an imminent economic recession

Published ET

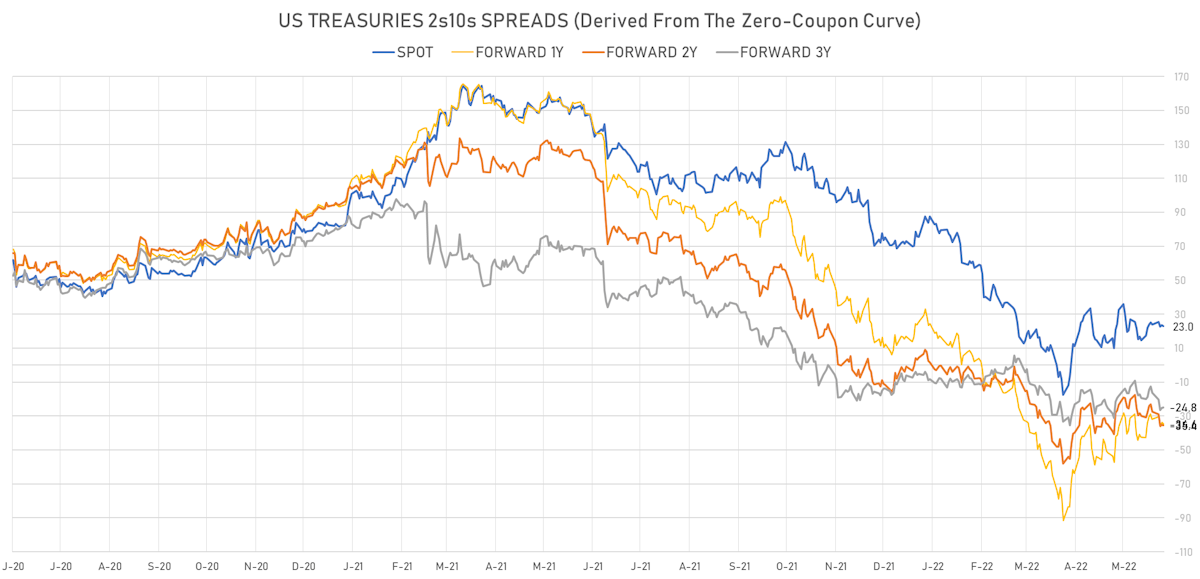

US Treasuries 2s10s Spread Spot & Forwards | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

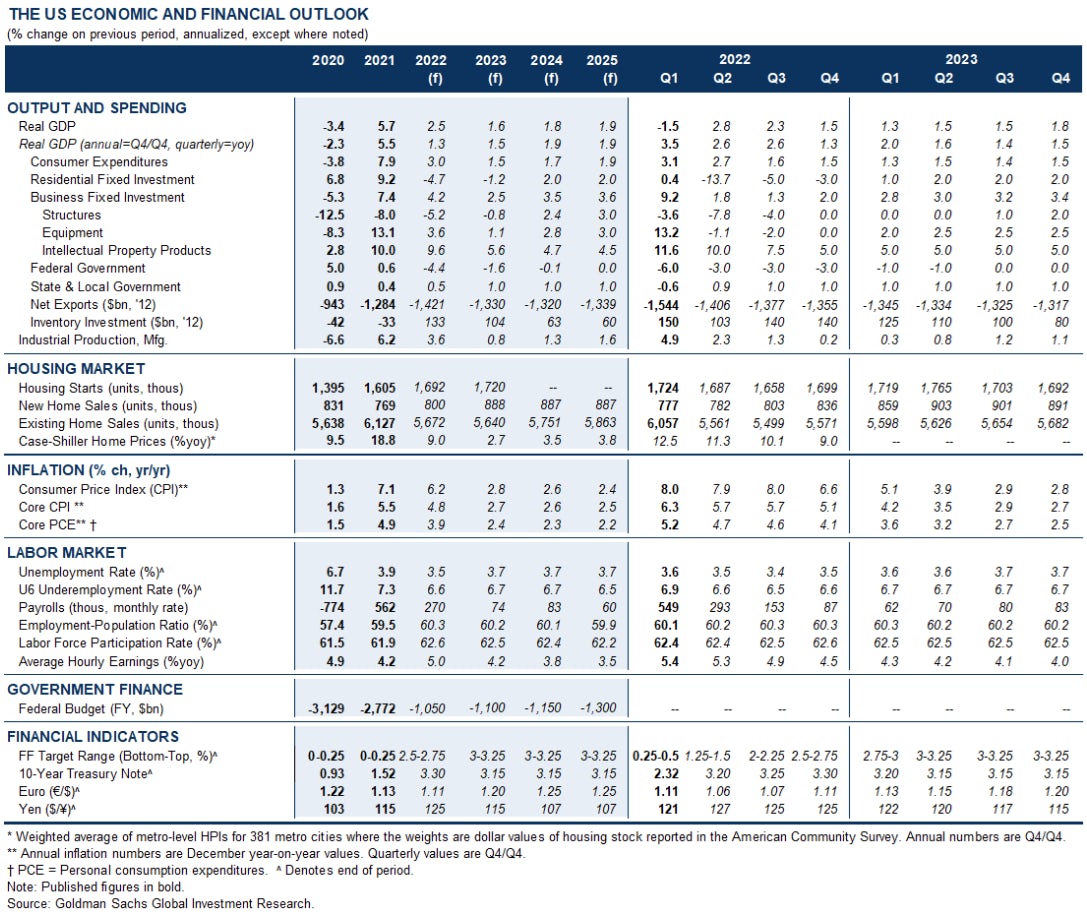

- The treasury yield curve steepened, with the 1s10s spread widening 3.9 bp, now at 79.9 bp (YTD change: -33.4bp)

- 1Y: 2.1411% (up 15.9 bp)

- 2Y: 2.6555% (up 17.4 bp)

- 5Y: 2.9363% (up 21.4 bp)

- 7Y: 2.9745% (up 20.7 bp)

- 10Y: 2.9396% (up 19.7 bp)

- 30Y: 3.0941% (up 12.3 bp)

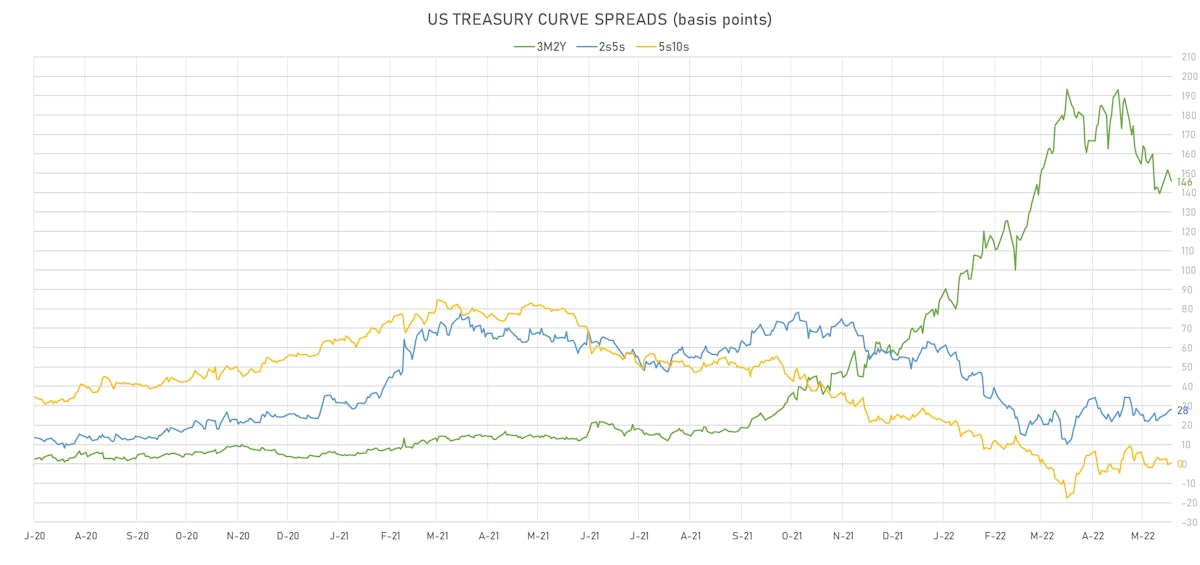

- US treasury curve spreads: 3m2Y at 145.9bp (up 6.3bp this week), 2s5s at 28.1bp (up 4.2bp), 5s10s at 0.3bp (down -1.6bp), 10s30s at 15.5bp (down -7.4bp)

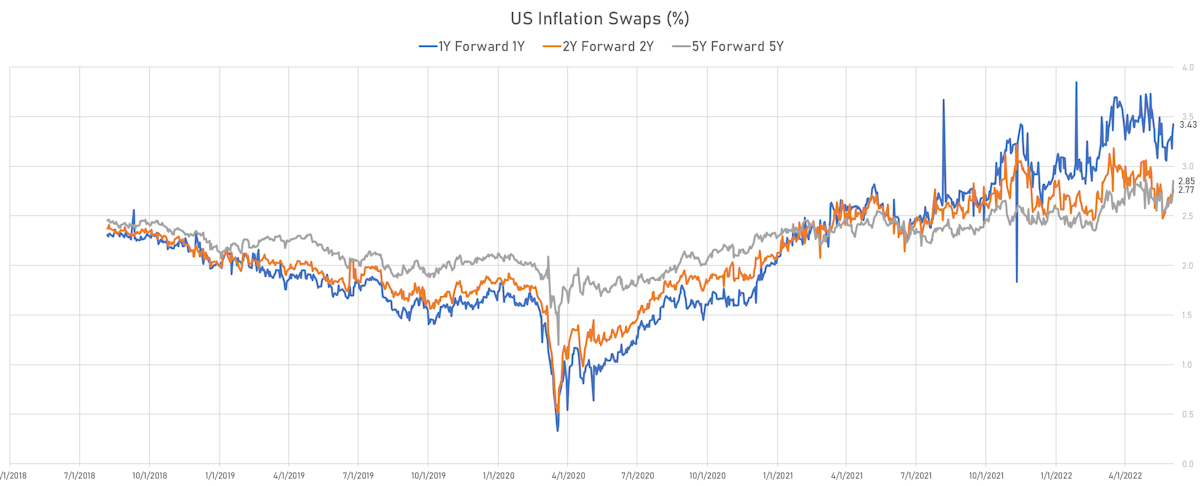

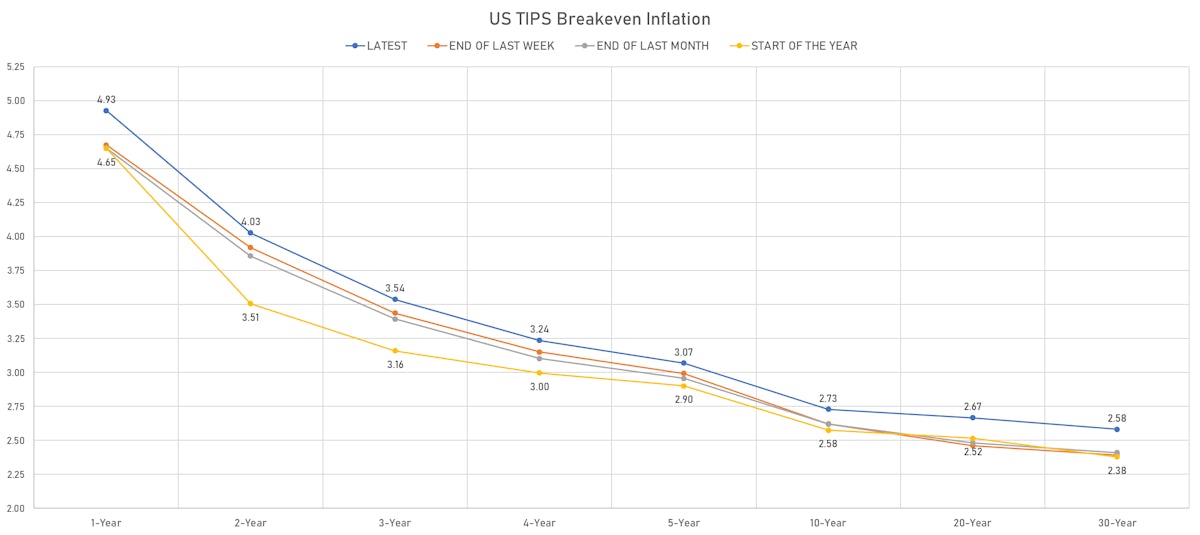

- TIPS 1Y breakeven inflation at 4.93% (up 25.3bp); 2Y at 4.03% (up 10.7bp); 5Y at 3.07% (up 7.6bp); 10Y at 2.73% (up 10.7bp); 30Y at 2.58% (up 19.1bp)

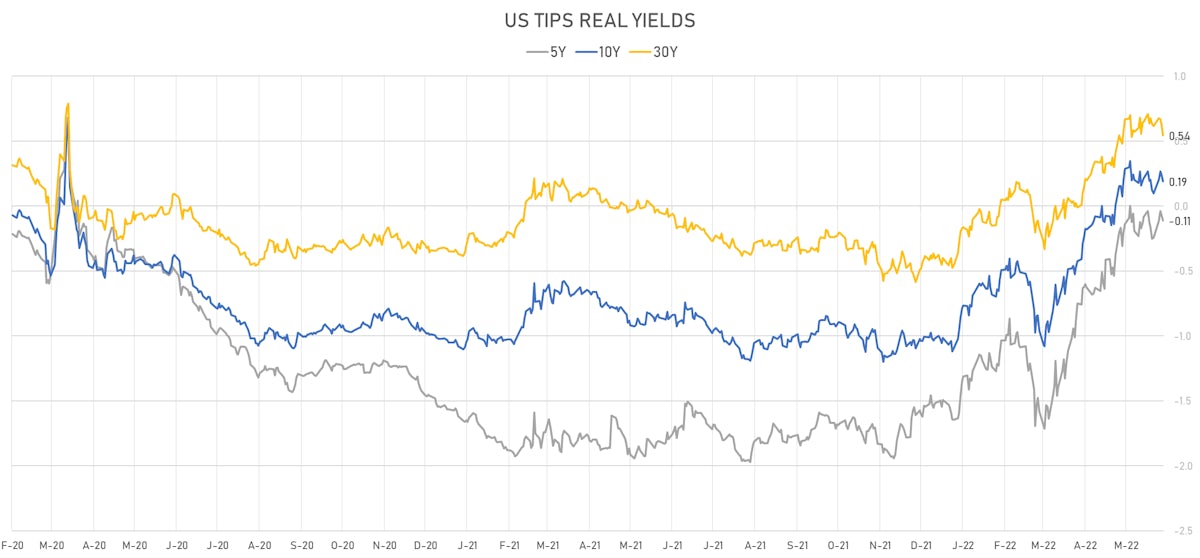

- US 5-Year TIPS Real Yield: +13.9 bp at -0.1120%; 10-Year TIPS Real Yield: +6.8 bp at 0.1880%; 30-Year TIPS Real Yield: -9.2 bp at 0.5410%

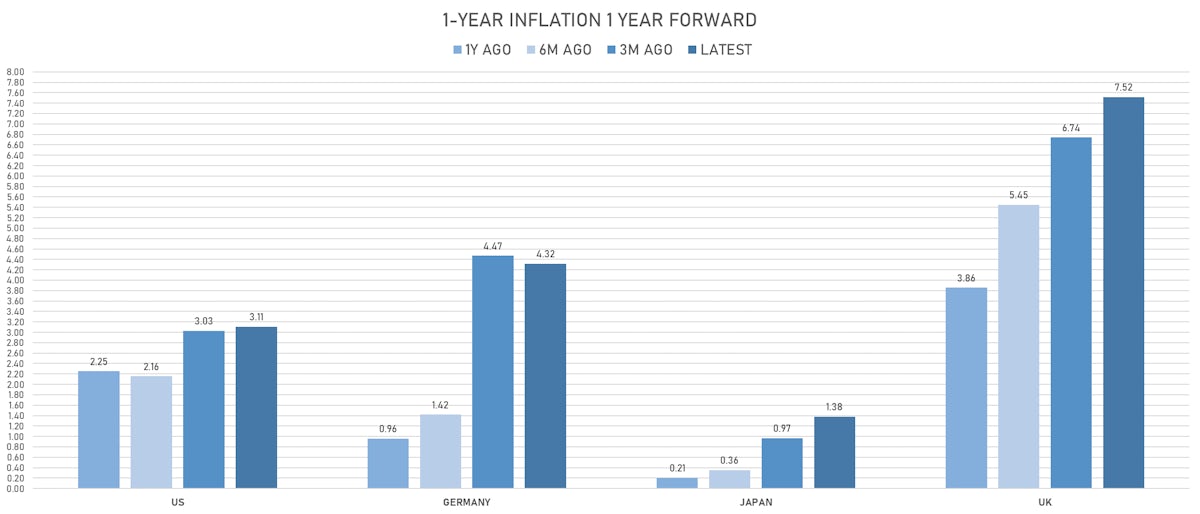

MACRO OUTLOOK

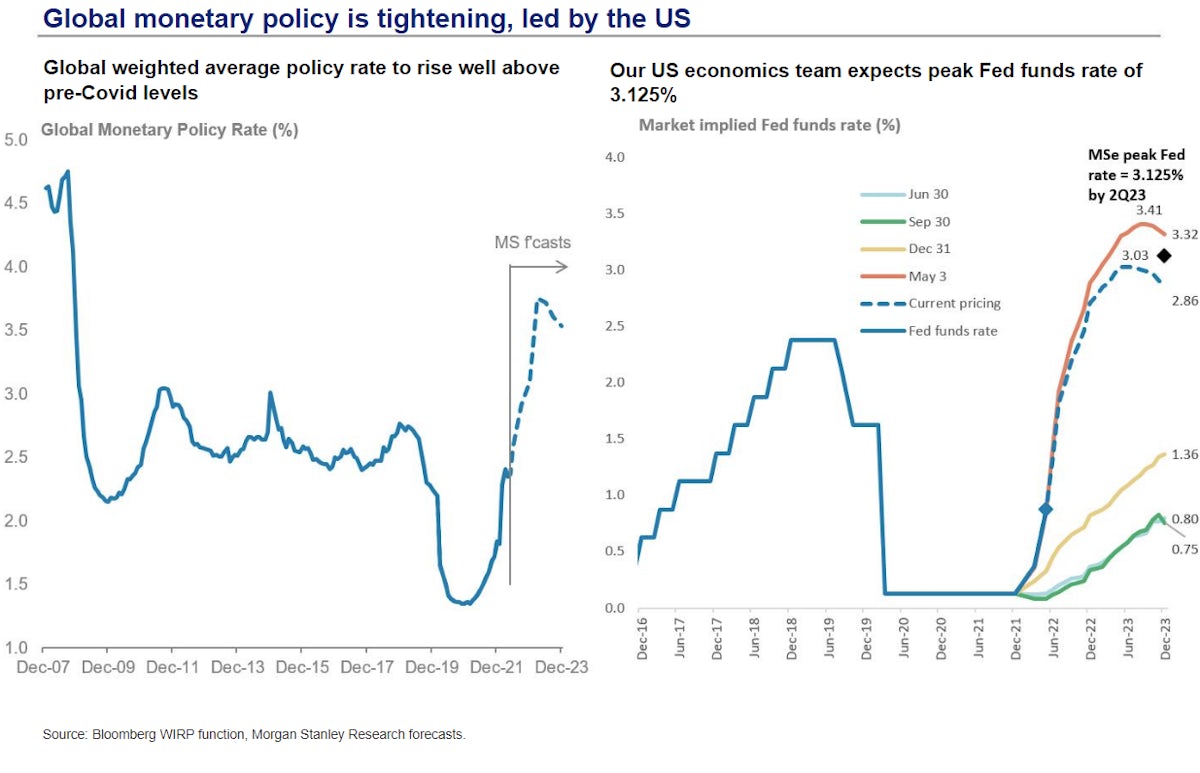

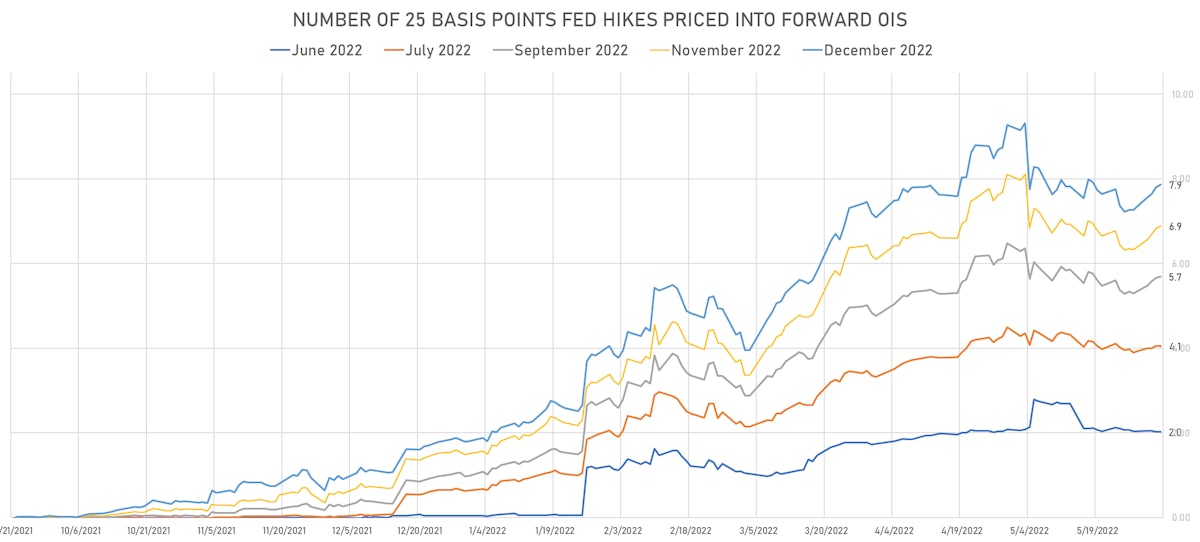

- Fed Funds pricing indicates that the Fed will hike by 50bp in both June and July, with the September FOMC now more likely to see a 25bp hike

- But the lack of macro clarity, especially around wage growth in the services sector, should keep short-term rates volatility high going into the summer period

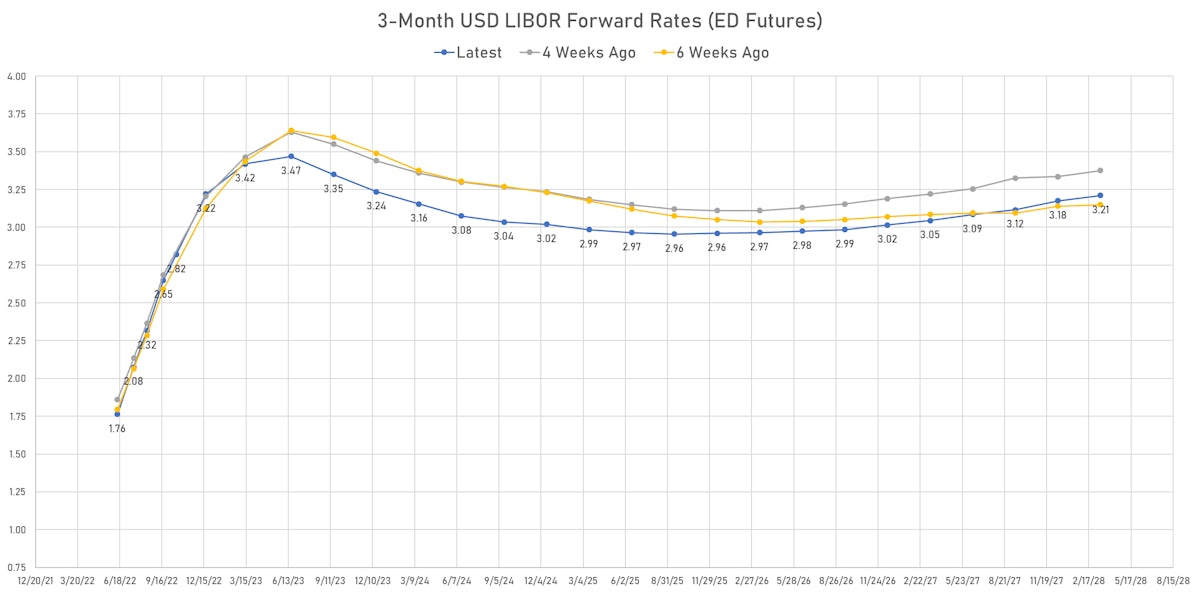

- Investment banks Goldman Sachs and Morgan Stanley both expect the Fed to reach its terminal rate during 2Q 2023 at 3.125%, in line with market pricing

- Moves in TIPS, with higher real yields and higher breakevens, are a sign that if push comes to shove and central banks are forced to make a binary choice, they will choose to live with a higher level of inflation rather than cause a recession

US FORWARD RATES

- Fed Funds futures now price in 50.8bp of Fed hikes by the end of June 2022, 101.3bp (4.1 x 25bp hikes) by the end of July 2022, and price in 7.9 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 1.5 bp of hikes in 2023 (equivalent to 0.1 x 25 bp hikes), up 1.0 bp today, and -21.5 bp of hikes in 2024 (equivalent to -0.9 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 4.93% (up 8.9bp); 2Y at 4.03% (up 6.6bp); 5Y at 3.07% (up 7.2bp); 10Y at 2.73% (up 8.3bp); 30Y at 2.58% (up 10.4bp)

- 6-month spot US CPI swap up 11.0 bp to 6.563%, with a flattening of the forward curve

- US Real Rates: 5Y at -0.1120%, -4.5 bp today; 10Y at 0.1880%, -5.3 bp today; 30Y at 0.5410%, -8.9 bp today

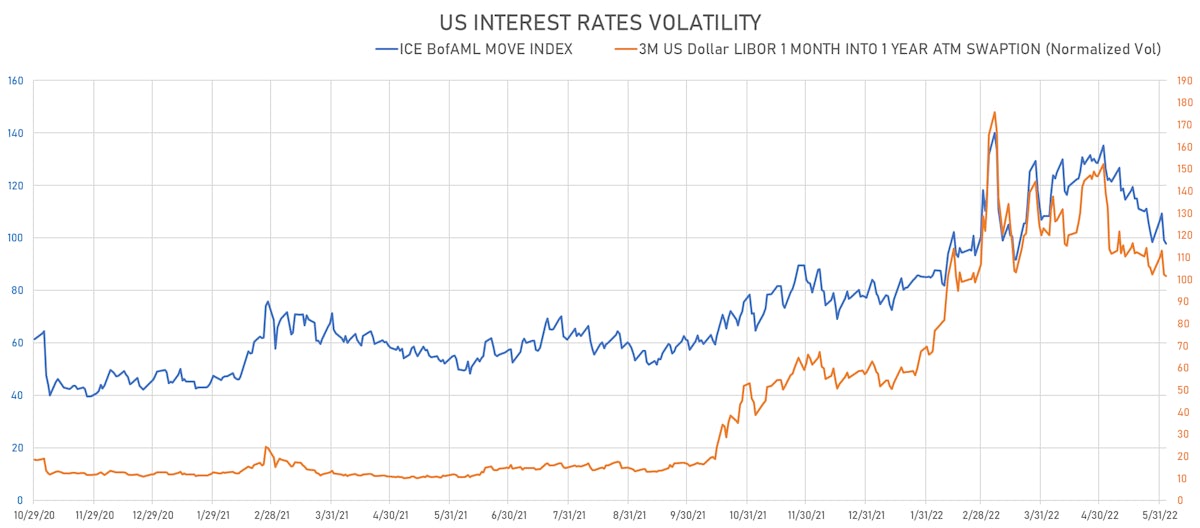

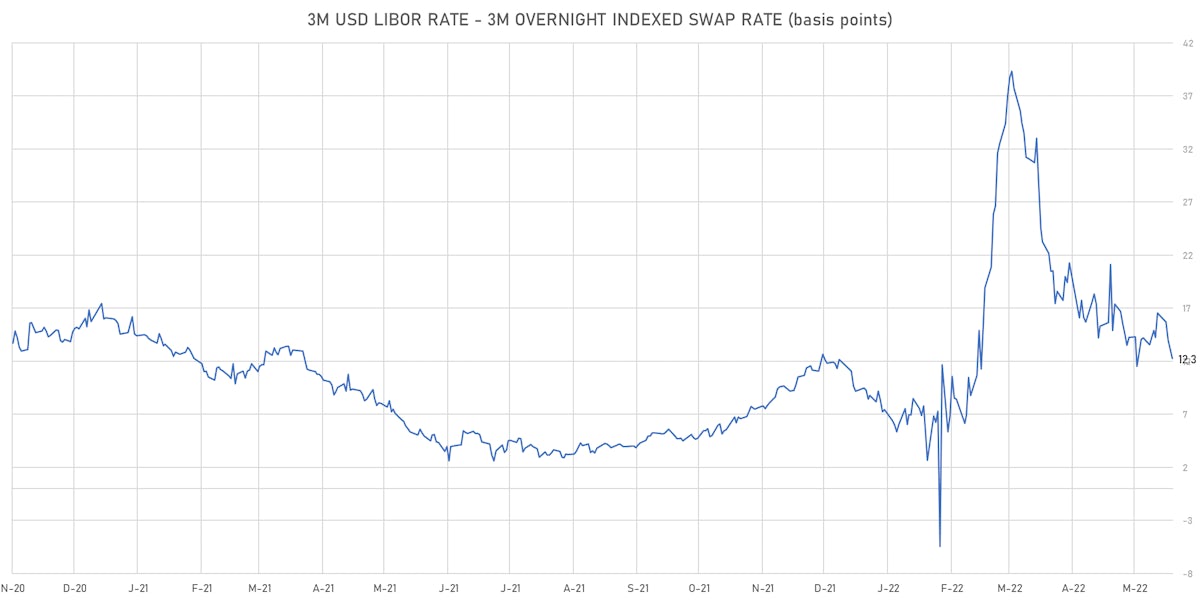

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -0.9 vols at 101.4 normals

- 3-Month LIBOR-OIS spread down -1.7 bp at 12.3 bp (18-months range: -5.5 to 39.3 bp)

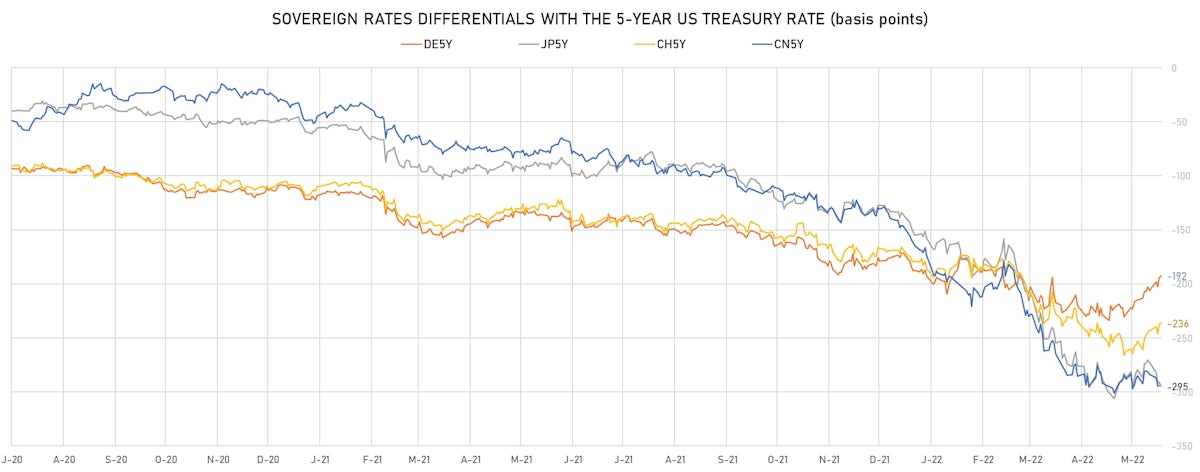

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.012% (up 4.7 bp); the German 1Y-10Y curve is 1.7 bp steeper at 115.8bp (YTD change: -42.4 bp)

- Japan 5Y: -0.002% (down -0.9 bp); the Japanese 1Y-10Y curve is 0.8 bp flatter at 32.6bp (YTD change: -15.9 bp)

- China 5Y: 2.551% (up 0.3 bp); the Chinese 1Y-10Y curve is 0.6 bp steeper at 81.6bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.576% (up 4.4 bp); the Swiss 1Y-10Y curve is 0.4 bp steeper at 110.3bp (YTD change: -55.4 bp)