Rates

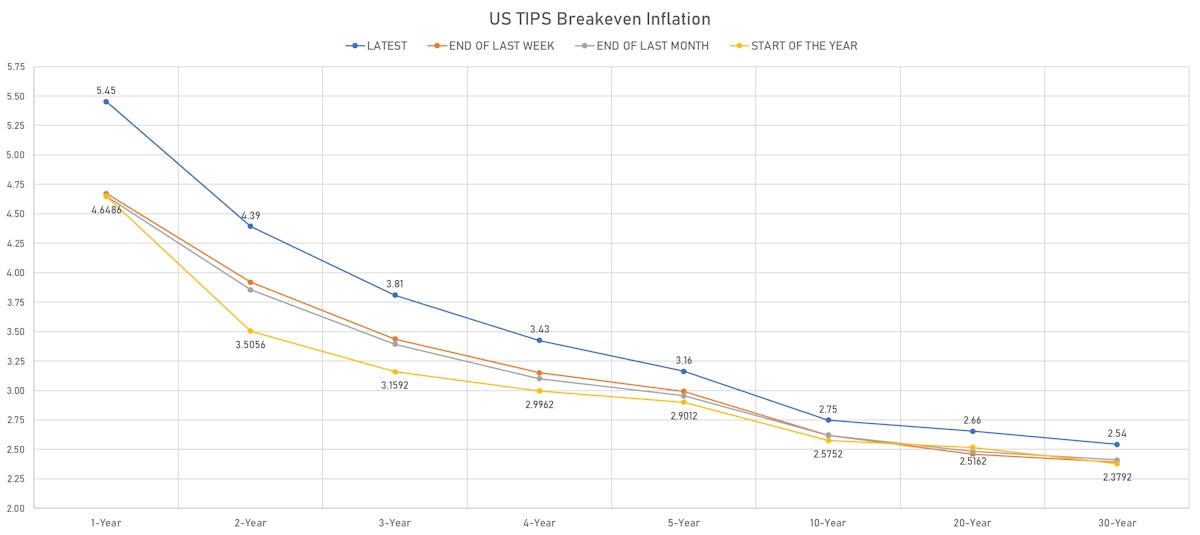

US Breakevens Jumped At The Front End Of The Curve This Week, With The CPI Surprise Today Bringing The Spot 2s10s Treasury Spread Close To Inversion

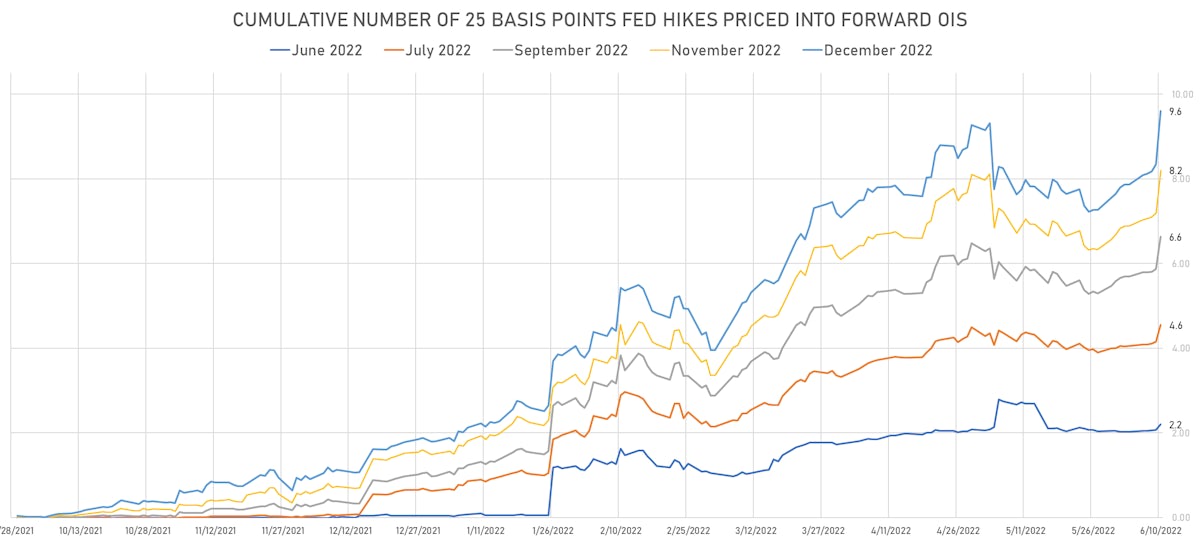

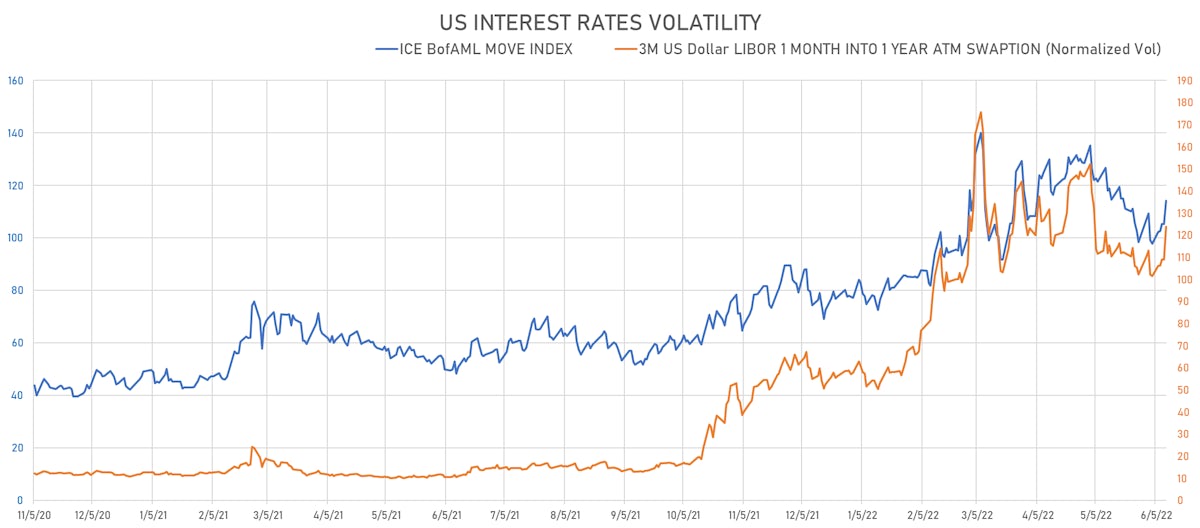

Pricing of Fed hikes in money markets jumped, as did rates volatility: 50 basis points are now priced for the September FOMC, while the November meeting seems to be the new battleground for a possible slowdown of the hiking pace to 25bp

Published ET

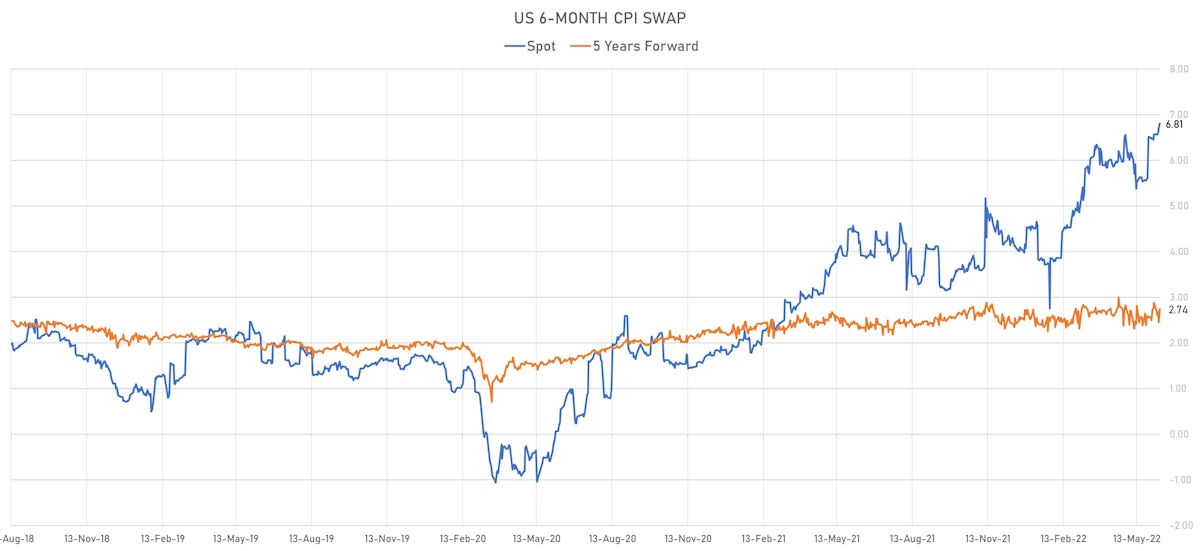

US 6-Month CPI Swap Spot & 5Y Forward | Sources: ϕpost, Refinitiv data

WEEKLY US RATES SUMMARY

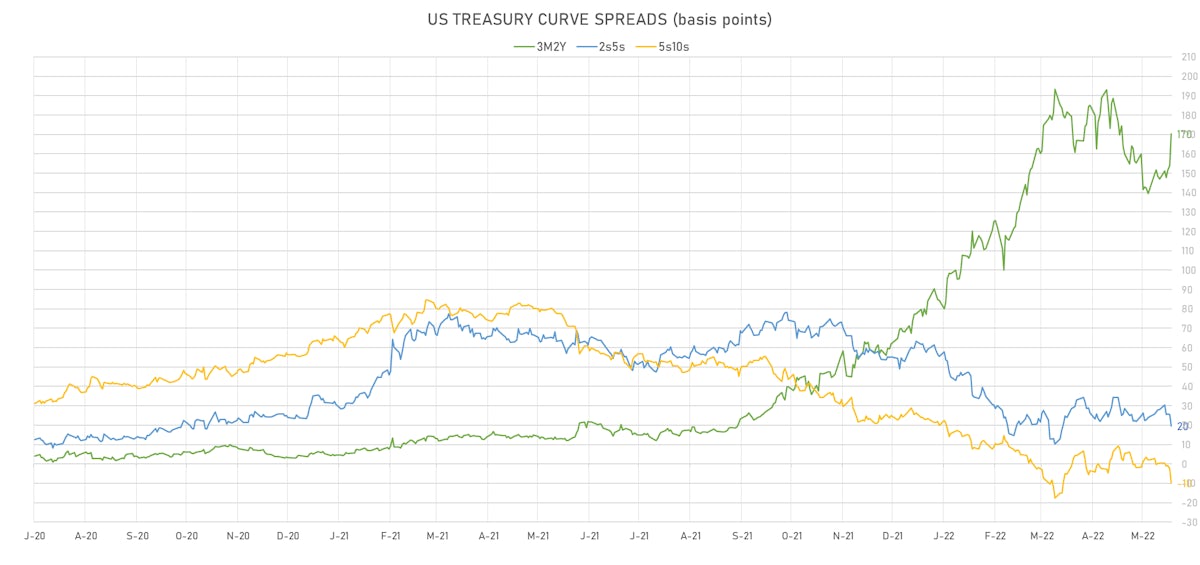

- The treasury yield curve flattened, with the 1s10s spread tightening -13.8 bp, now at 66.1 bp (YTD change: -47.1bp)

- 1Y: 2.5030% (up 36.2 bp)

- 2Y: 3.0663% (up 41.1 bp)

- 5Y: 3.2629% (up 32.7 bp)

- 7Y: 3.2460% (up 27.2 bp)

- 10Y: 3.1640% (up 22.4 bp)

- 30Y: 3.2016% (up 10.7 bp)

- US treasury curve spreads: 3m2Y at 170.4bp (up 23.3bp this week), 2s5s at 19.7bp (down -8.4bp), 5s10s at -9.9bp (down -10.2bp), 10s30s at 3.8bp (down -11.8bp)

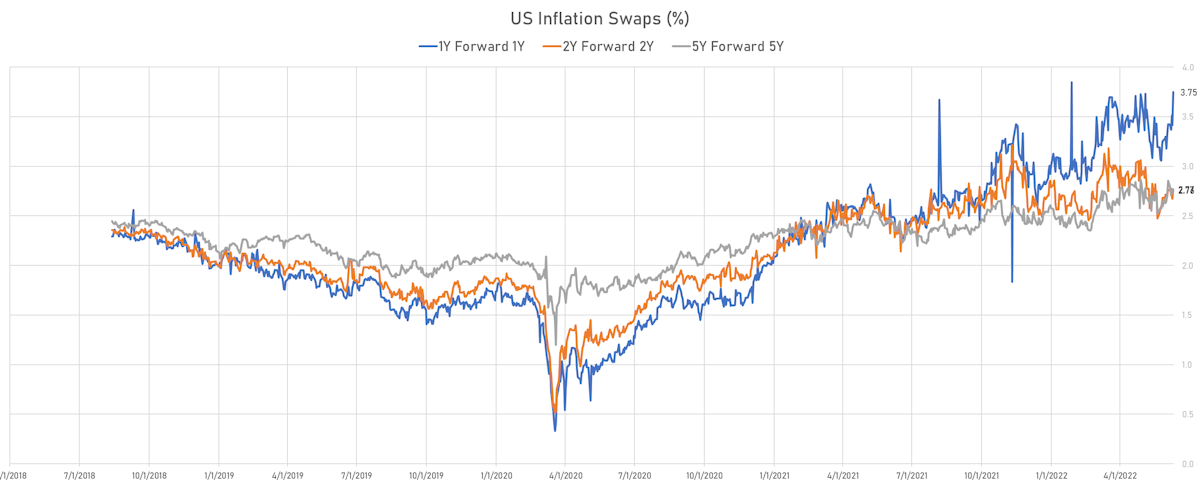

- TIPS 1Y breakeven inflation at 5.45% (up 78.0bp); 2Y at 4.39% (up 47.4bp); 5Y at 3.16% (up 17.1bp); 10Y at 2.75% (up 12.7bp); 30Y at 2.54% (up 15.2bp)

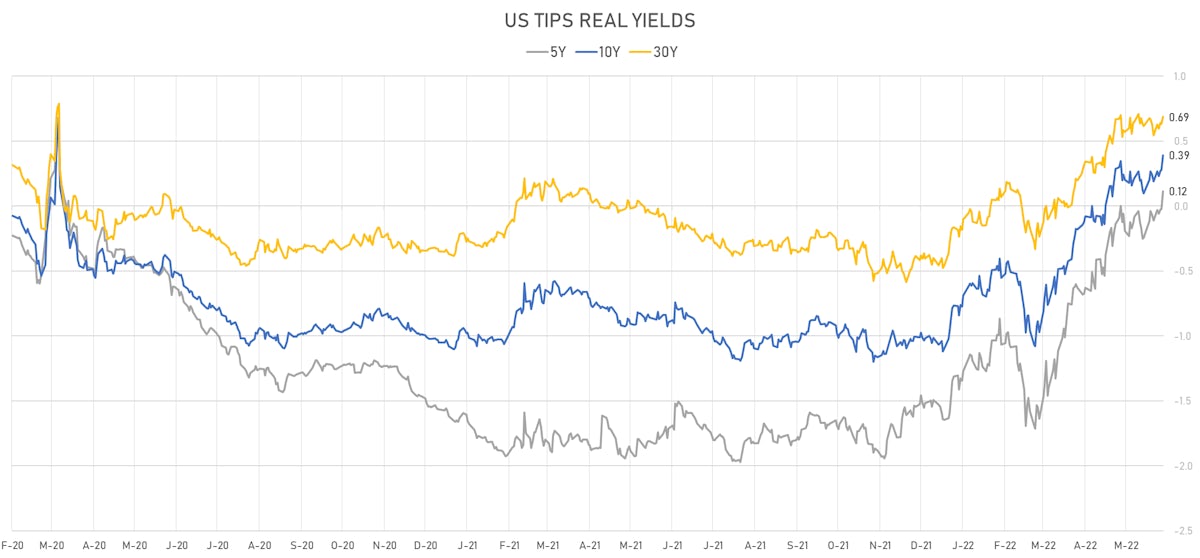

- US 5-Year TIPS Real Yield: +22.7 bp at 0.1150%; 10-Year TIPS Real Yield: +20.4 bp at 0.3920%; 30-Year TIPS Real Yield: +14.6 bp at 0.6870%

MACRO OUTLOOK & FOMC PREVIEW

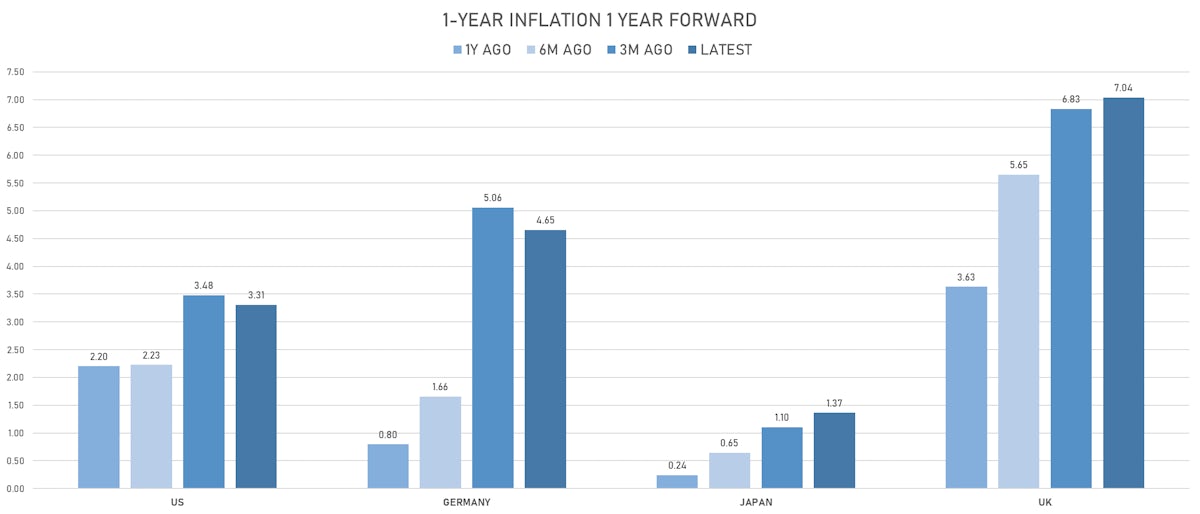

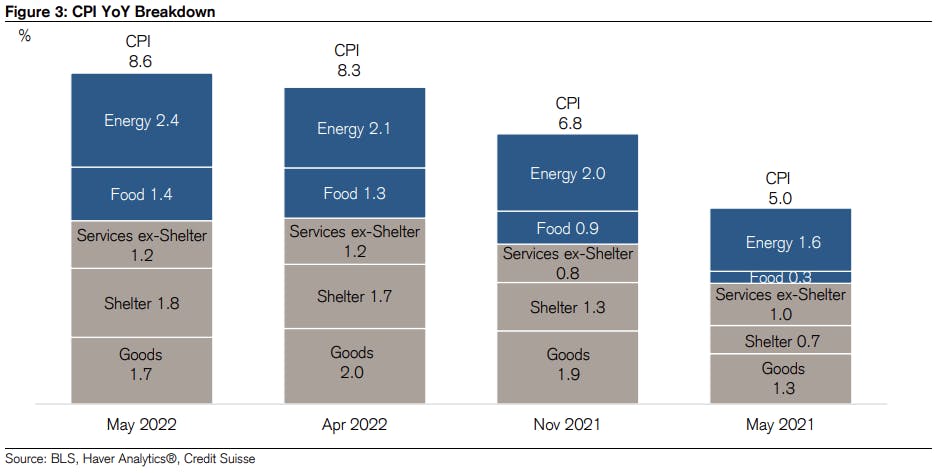

- The CPI is at a 40-year high, with a big surprise in the sticky category of shelter inflation

- Autos prices are still rising, with a lack of production, delaying further the normalization in durable goods

- With the average gasoline price above $5 for the first time ever, it was not a real surprise to see weakness in the Michigan University Consumer Sentiment survey

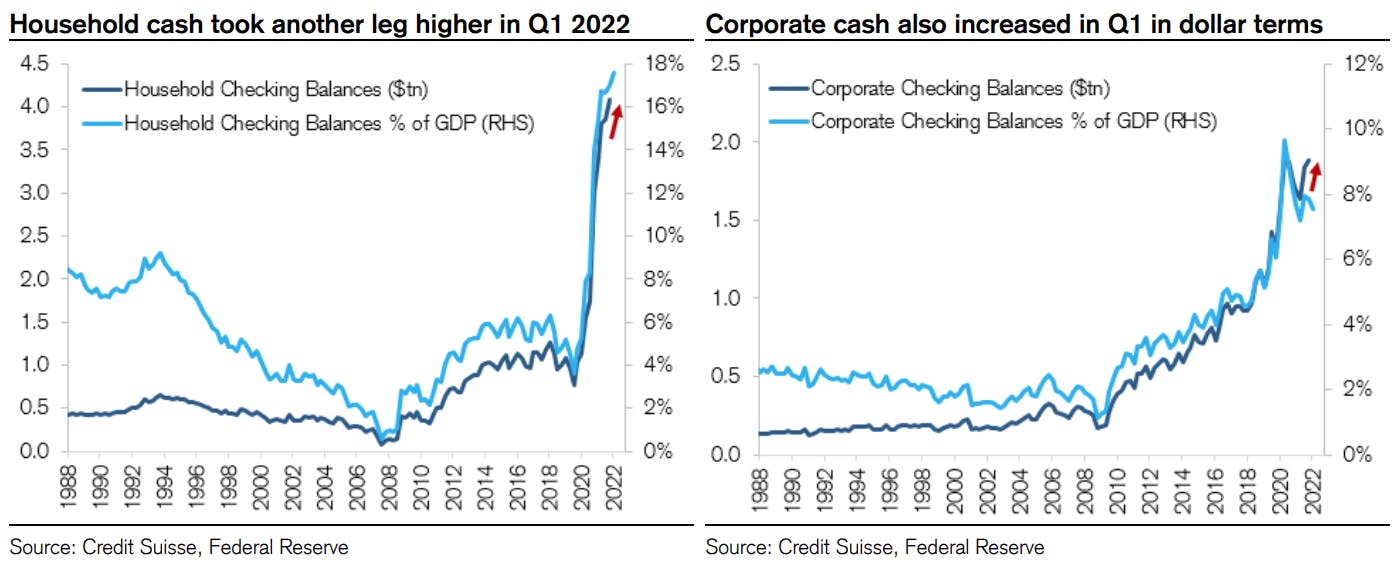

- Fed Z1 data shows households and corporations continue to hoard record cash balances, which might explain why consumer sentiment and spending are not in sync

- In this context, some (including Barclays Capital today) are calling for the Fed to raise the Fed Funds rates by 75bp at the FOMC next week

- The more likely outcome is that we will see 3 consecutive 50 bp hikes in June, July, September, as the Fed is solely focused on inflation and the data is unlikely to warrant a slowdown to a 25bp pace by then

- It would be useful to see the Fed clarify the data points and thresholds that they would need to see before slowing the pace of rate hikes

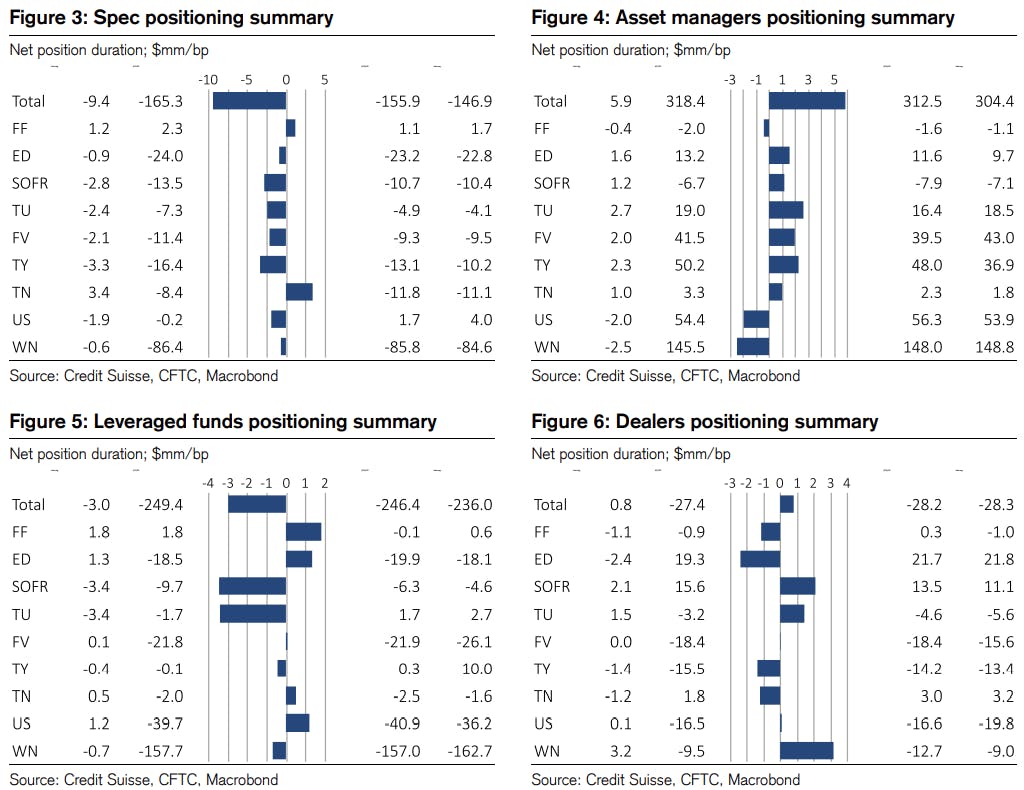

WEEKLY CFTC NET DURATION POSITIONING DATA

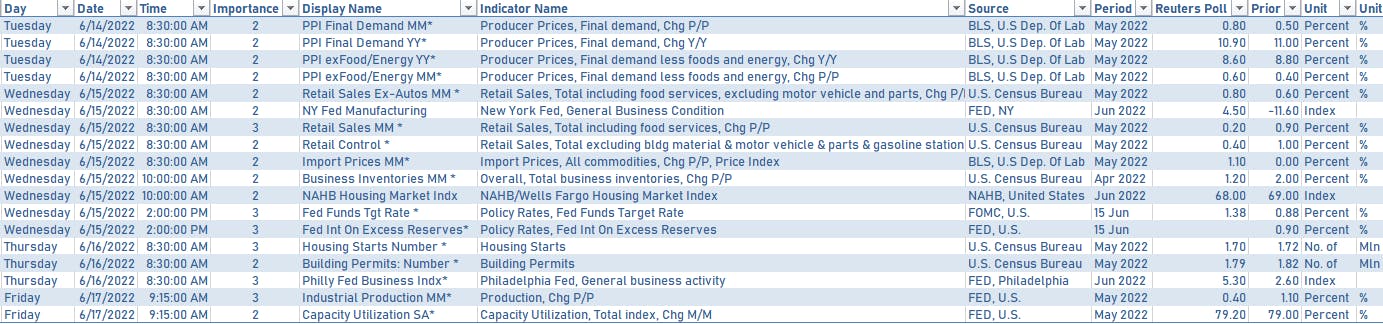

WEEK AHEAD FOR US MACRO RELEASES

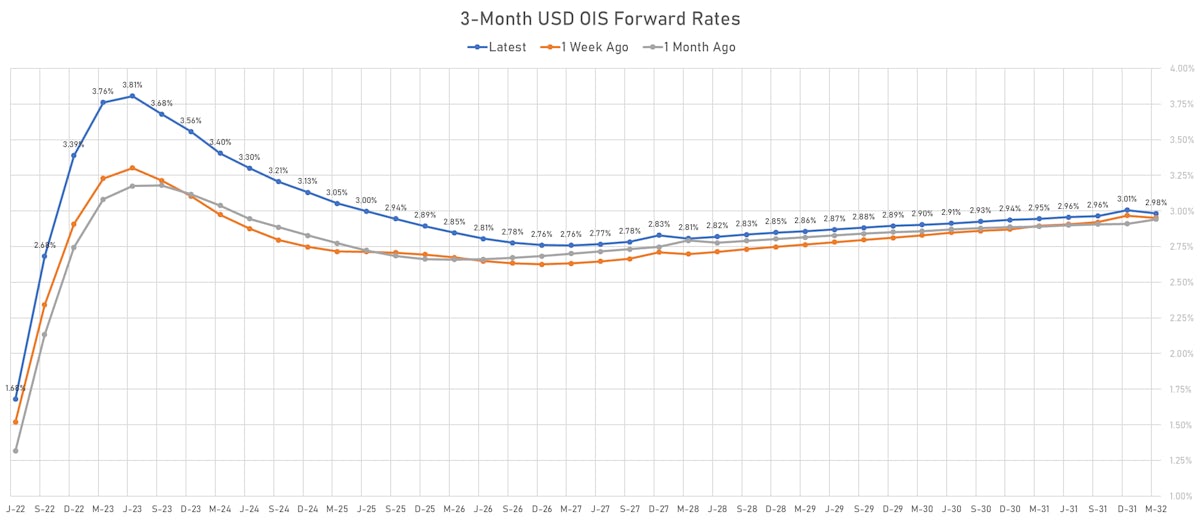

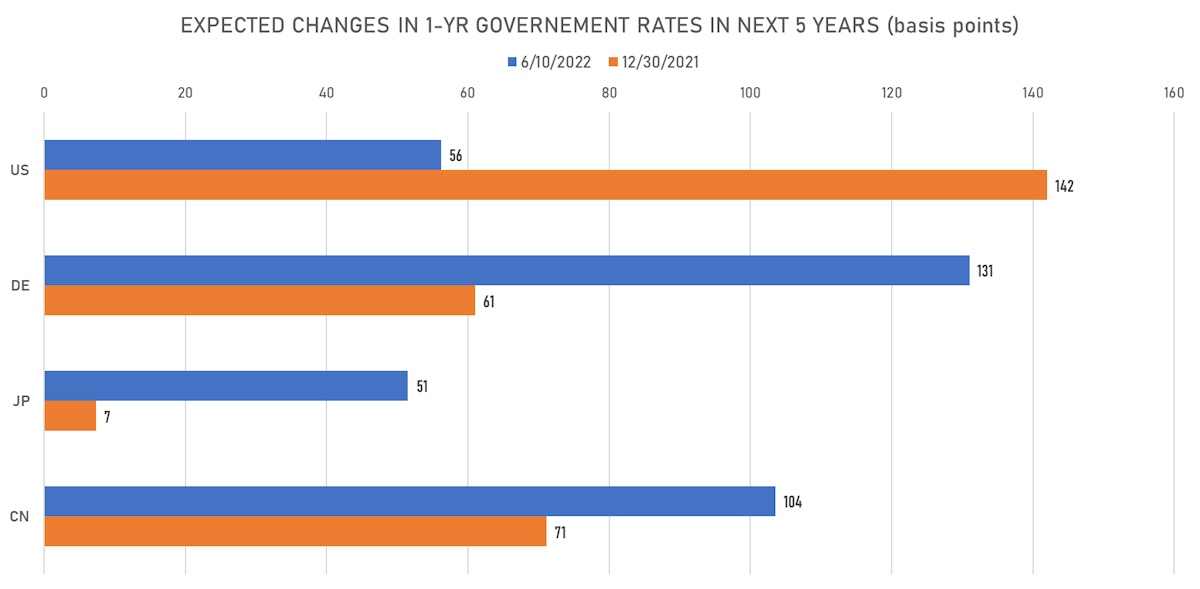

US FORWARD RATES

- Fed Funds futures now price in 55.0bp of Fed hikes by the end of June 2022, 113.8bp (4.6 x 25bp hikes) by the end of July 2022, and price in 9.6 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 8.5 bp of hikes in 2023 (equivalent to 0.3 x 25 bp hikes), unchanged today, and -26.0 bp of hikes in 2024 (equivalent to -1.0 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 5.45% (up 36.2bp); 2Y at 4.39% (up 23.3bp); 5Y at 3.16% (up 5.6bp); 10Y at 2.75% (up 0.8bp); 30Y at 2.54% (down -2.0bp)

- 6-month spot US CPI swap up 9.3 bp to 6.809%, with a flattening of the forward curve

- US Real Rates: 5Y at 0.1150%, +13.7 bp today; 10Y at 0.3920%, +11.3 bp today; 30Y at 0.6870%, +5.7 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 14.8 vols at 123.7 normals

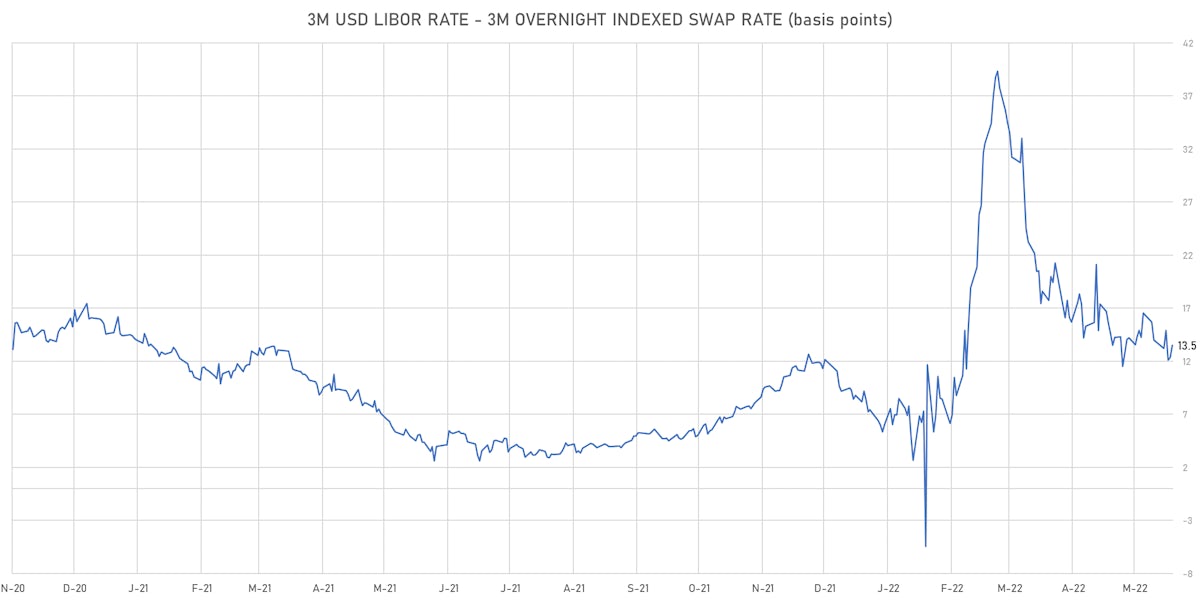

- 3-Month LIBOR-OIS spread up 1.1 bp at 13.5 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.318% (up 10.9 bp); the German 1Y-10Y curve is 2.6 bp steeper at 122.7bp (YTD change: -42.4 bp)

- Japan 5Y: 0.002% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.8 bp steeper at 35.1bp (YTD change: -15.9 bp)

- China 5Y: 2.566% (up 0.3 bp); the Chinese 1Y-10Y curve is 0.1 bp flatter at 80.1bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.746% (up 10.2 bp); the Swiss 1Y-10Y curve is 7.1 bp steeper at 92.7bp (YTD change: -55.6 bp)