Rates

Massive Volatility Across The Rates Complex This Week With Announcements From The Fed, ECB, BoJ; US Curve Flattens Further As Data Mostly Disappoints

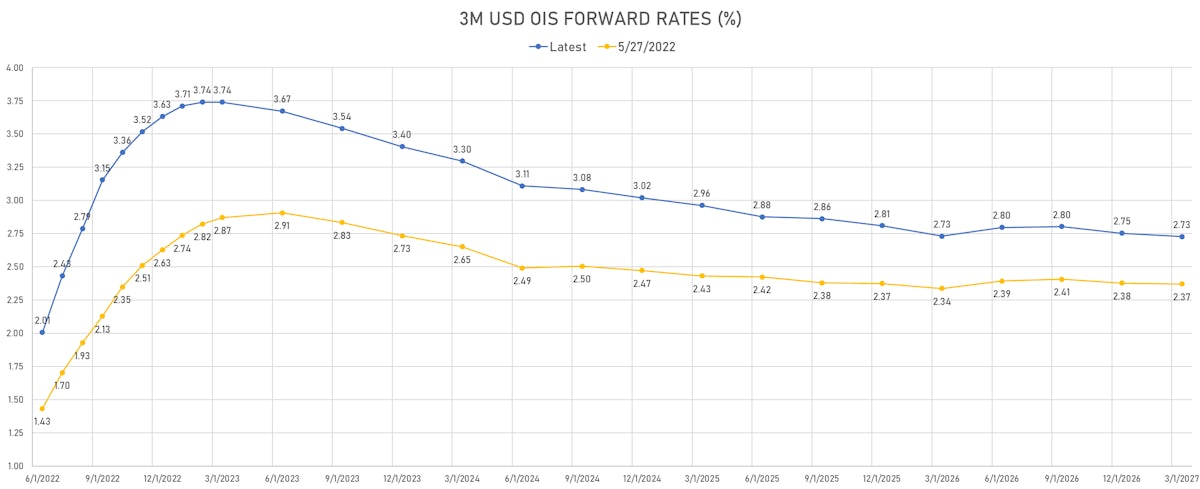

Money markets in the US are now very confident that 75bp will be realized at the July FOMC, with probably 50bp hikes in both September and November, and 25bp in December; some banks (like Goldman Sachs) think Fed hikes will be done by the end of this year, as the tightening in financial conditions has increased the likelihood of a hard landing and recession next year

Published ET

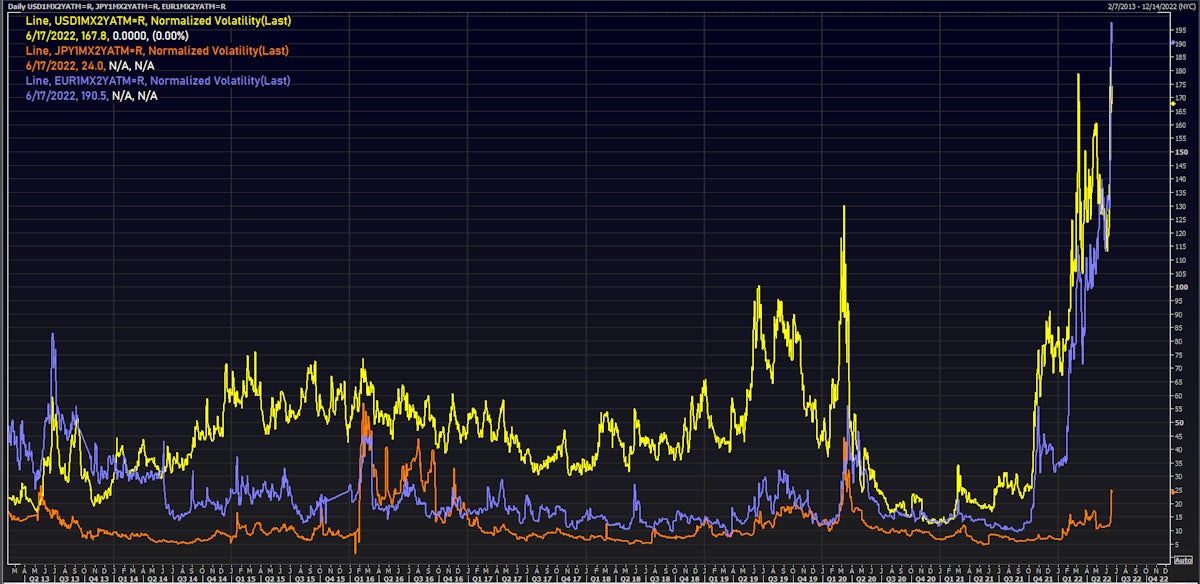

USD, JPY, EUR Swaptions Volatility | Source: Refinitiv

WEEKLY US RATES SUMMARY

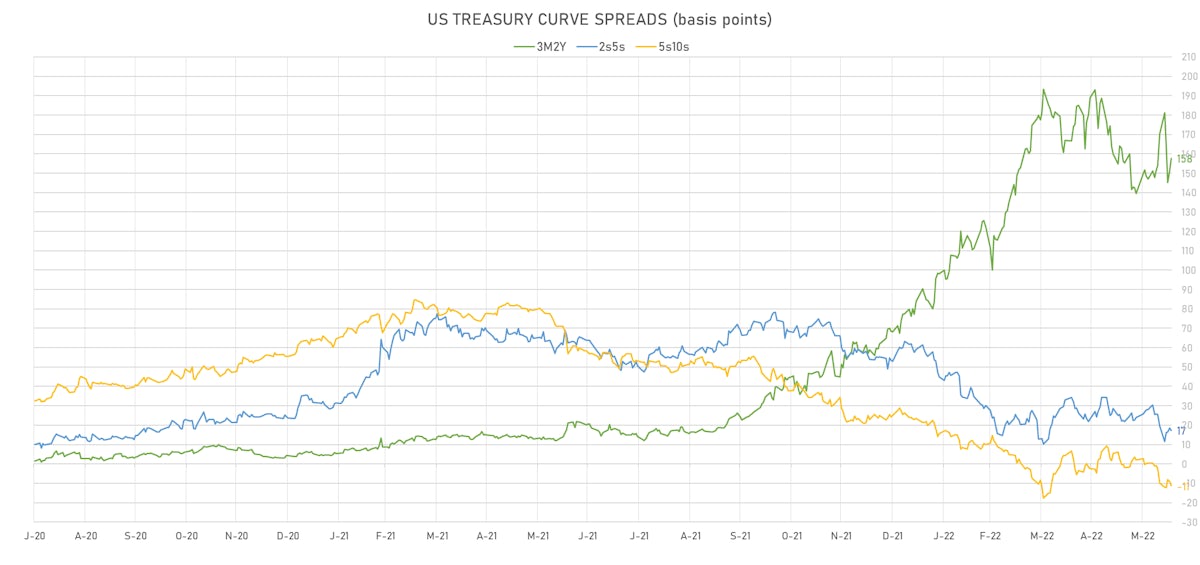

- The treasury yield curve flattened, with the 1s10s spread tightening -28.1 bp, now at 38.0 bp (YTD change: -75.2bp)

- 1Y: 2.8496% (up 34.7 bp)

- 2Y: 3.1680% (up 10.2 bp)

- 5Y: 3.3419% (up 7.9 bp)

- 7Y: 3.3301% (up 8.4 bp)

- 10Y: 3.2294% (up 6.5 bp)

- 30Y: 3.2808% (up 7.9 bp)

- US treasury curve spreads: 3m2Y at 157.7bp (down -12.7bp this week), 2s5s at 17.4bp (down -2.5bp), 5s10s at -11.2bp (down -1.5bp), 10s30s at 5.1bp (up 1.3bp)

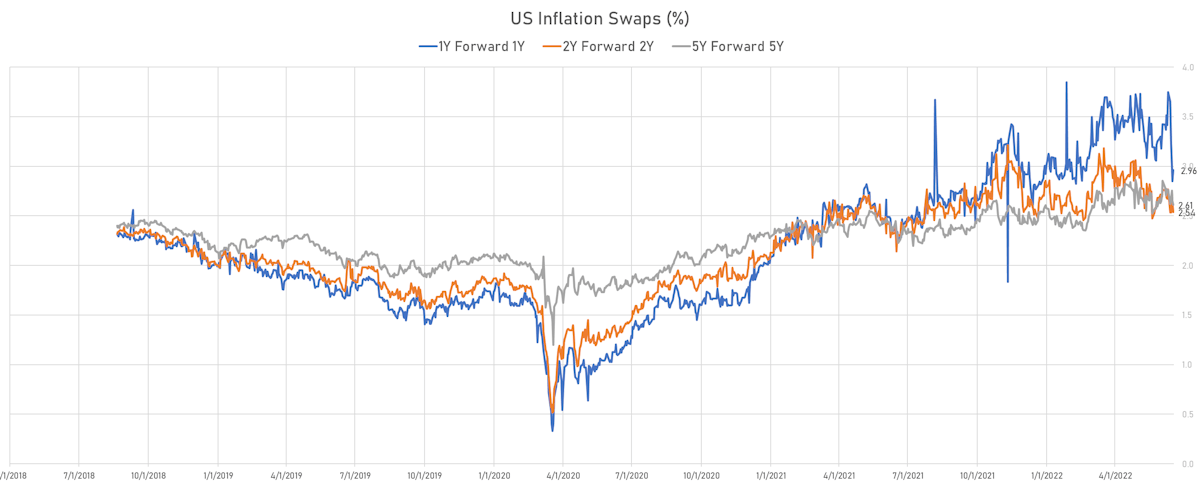

- TIPS 1Y breakeven inflation at 5.01% (down -44.5bp); 2Y at 3.84% (down -55.1bp); 5Y at 2.83% (down -33.2bp); 10Y at 2.55% (down -19.5bp); 30Y at 2.45% (down -9.1bp)

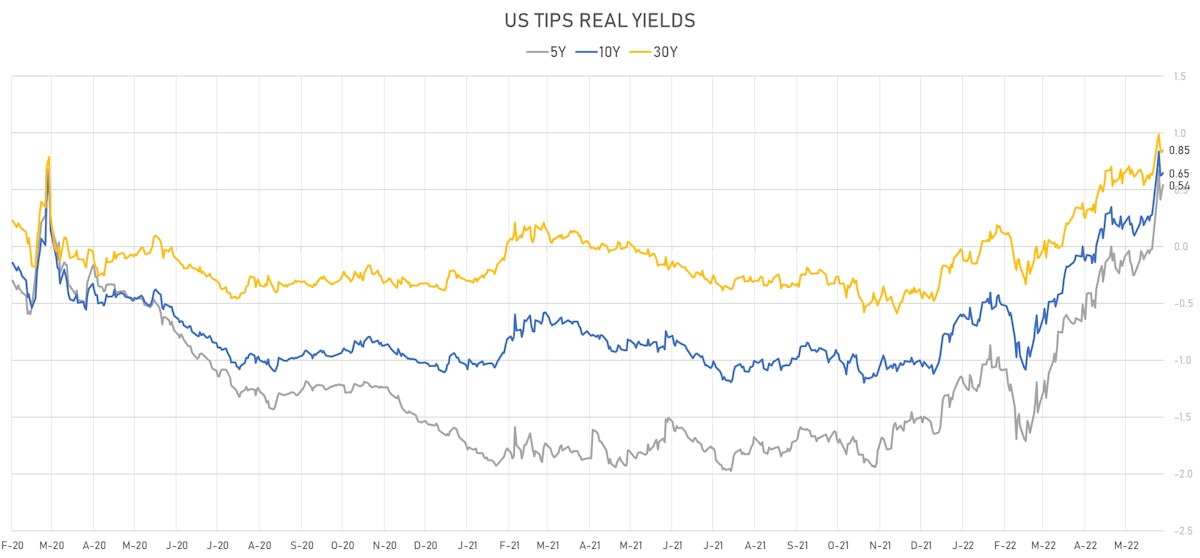

- US 5-Year TIPS Real Yield: +42.8 bp at 0.5430%; 10-Year TIPS Real Yield: +25.6 bp at 0.6480%; 30-Year TIPS Real Yield: +16.4 bp at 0.8510%

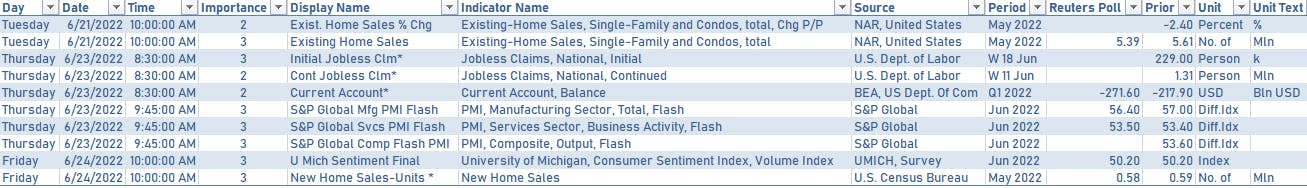

US MACRO RELEASES TODAY

- Capacity Utilization, Total index, Change M/M for May 2022 (FED, U.S.) at 79.00 % (vs 79.00 % prior), below consensus estimate of 79.20 %

- Production, Change P/P for May 2022 (FED, U.S.) at 0.20 % (vs 1.10 % prior), below consensus estimate of 0.40 %

- Leading Index, Change P/P for May 2022 (The Conference Board) at -0.40 % (vs -0.30 % prior), in line with consensus

- Production, Manufacturing, Total (SIC), Change P/P for May 2022 (FED, U.S.) at -0.10 % (vs 0.80 % prior), below consensus estimate of 0.30 %

US MACRO RELEASES IN THE WEEK AHEAD

- Focus next week will be the latest University of Michigan sentiment survey

- Fed chairman Powell will be on Capitol Hill on Wednesday and Thursday, appearing before congressional panels

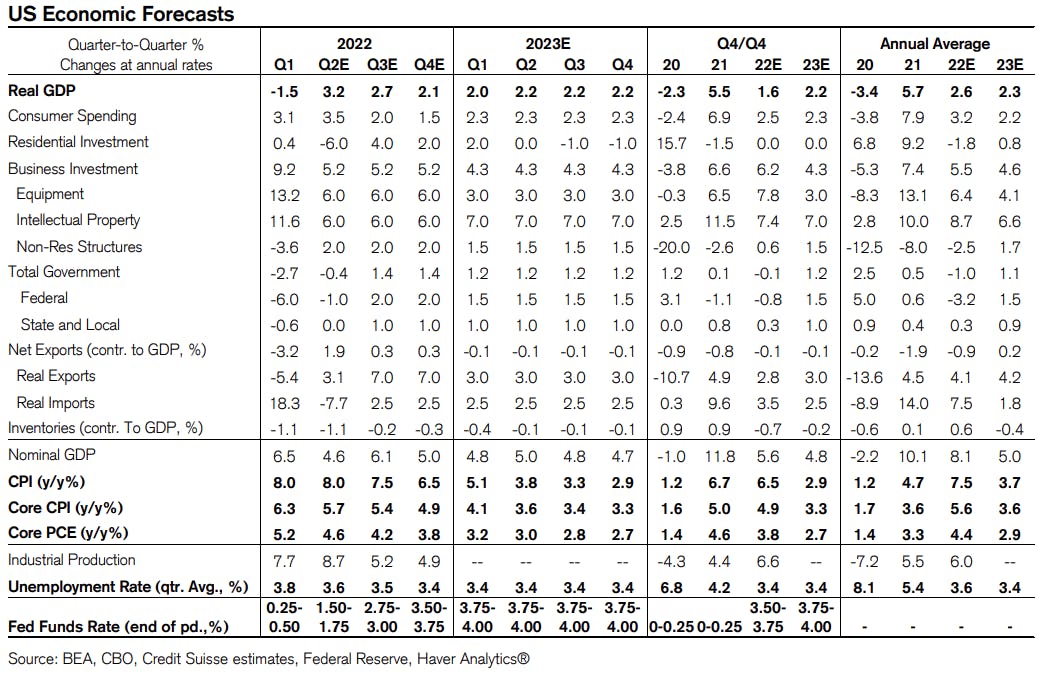

LATEST US ECONOMIC FORECASTS (CREDIT SUISSE)

MACRO OUTLOOK

- Taking into account the drop in asset prices, financial conditions have now tightened as much as during Covid and the great financial crisis, and both times were followed by recessions

- Money markets see rates peaking much higher and sooner than before (1Q23 at the latest), as the Fed is now solely interested in fighting inflation, though it's unclear whether a Fed put is off the table or just way out of the money

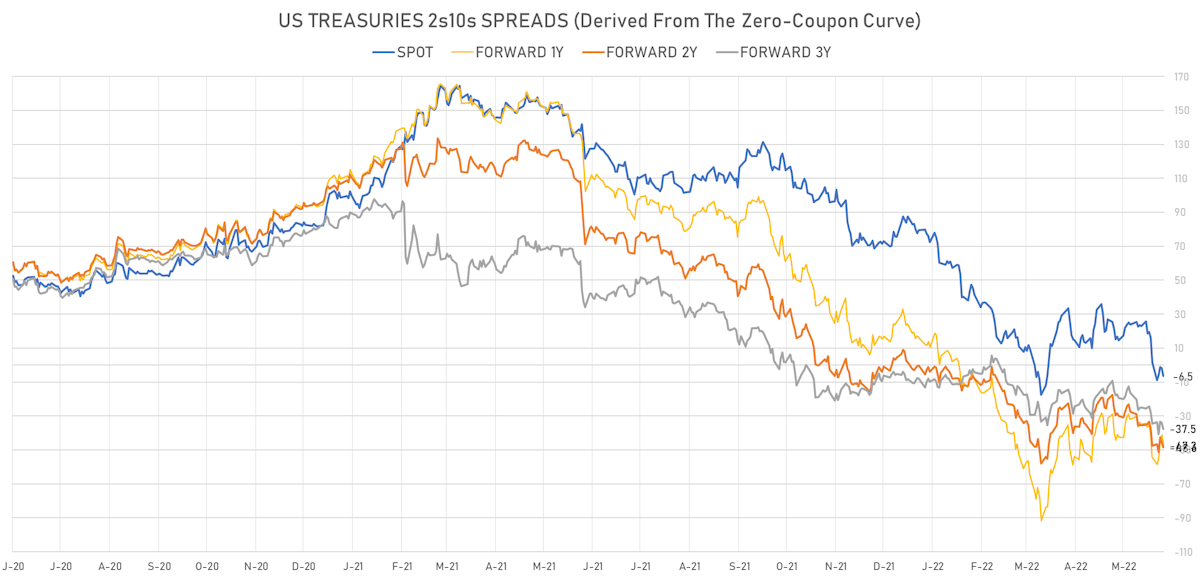

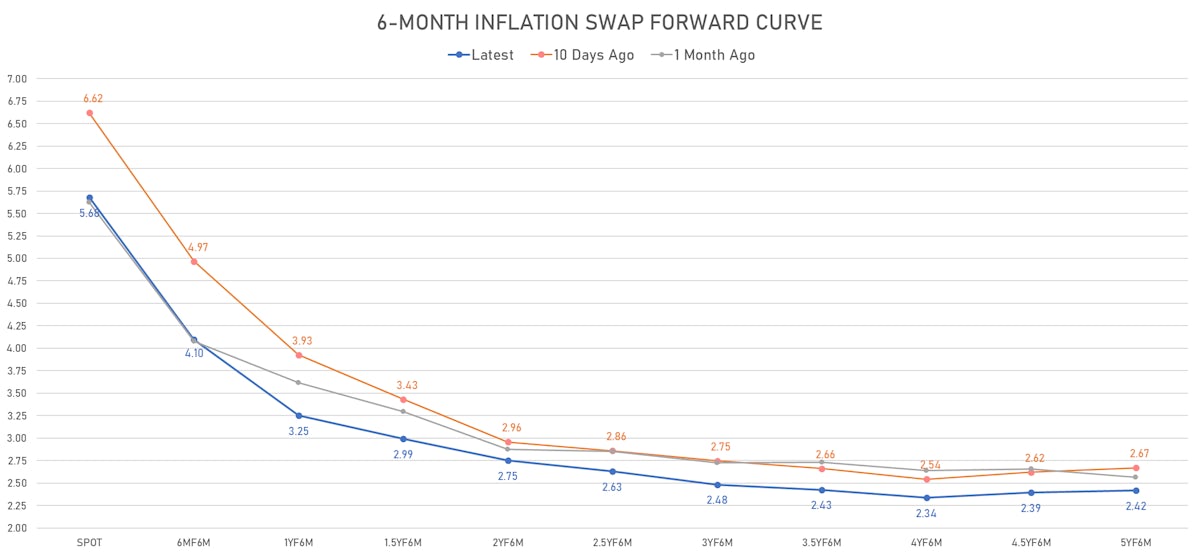

- The deeper inversion of the forward curve reflects the higher likelihood of a US recession next year, with the need for the Fed to reverse course

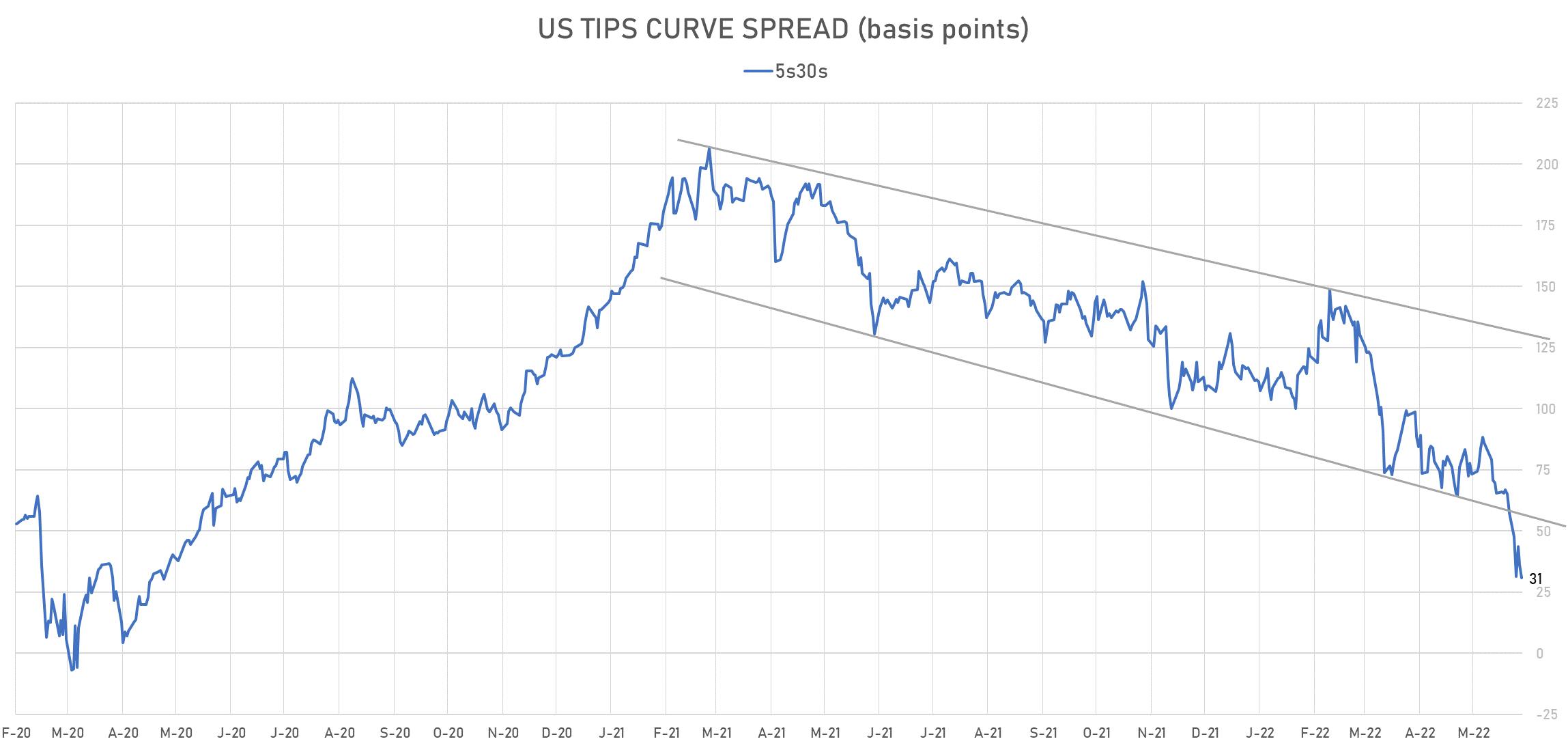

- The real yield curve (real 5s30s spread) has flattened considerably, which is also a good market indicator of how little real GDP growth the market expects

US FORWARD RATES

- Fed Funds futures now price in 69.2bp of Fed hikes by the end of July 2022, and 129.9bp (5.2 x 25bp hikes) by the end of September 2022

- 3-month Eurodollar futures (EDZ) spreads price in -26.5 bp of hikes in 2023 (equivalent to 1.1 x 25 bp rate cut), up 12.5 bp today, and -32.0 bp of hikes in 2024 (equivalent to 1.3 x 25 bp rate cut)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 5.01% (down -30.7bp); 2Y at 3.84% (down -12.4bp); 5Y at 2.83% (down -1.8bp); 10Y at 2.55% (up 1.5bp); 30Y at 2.45% (up 0.9bp)

- 6-month spot US CPI swap down -8.4 bp to 5.679%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.5430%, +7.6 bp today; 10Y at 0.6480%, +2.0 bp today; 30Y at 0.8510%, +2.3 bp today

RATES VOLATILITY & LIQUIDITY TODAY

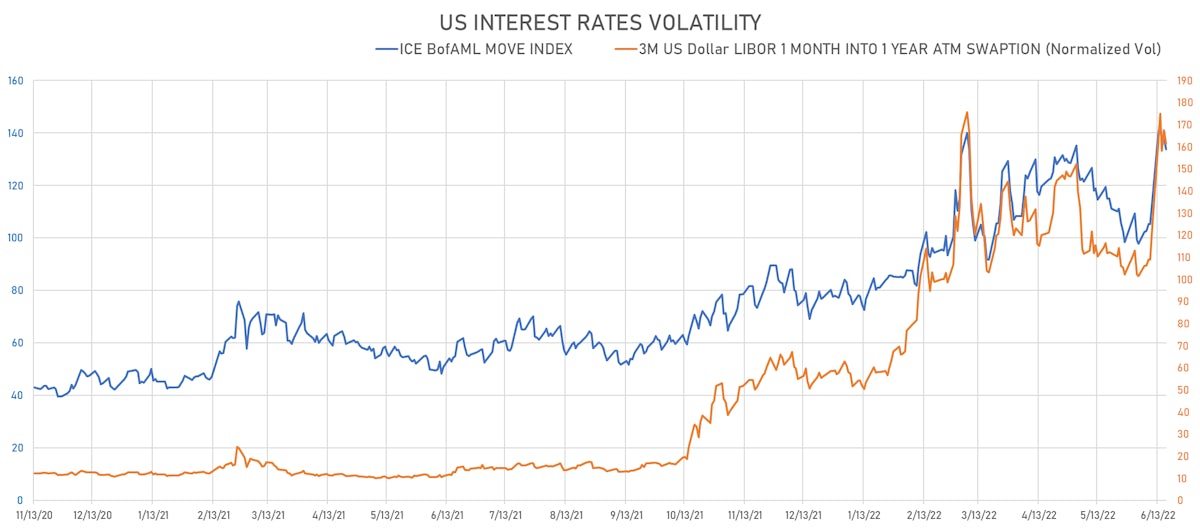

- USD rates implied volatility (USD 1 Month by 1 Year ATM swaption) down -6.2 vols at 161.3 normals

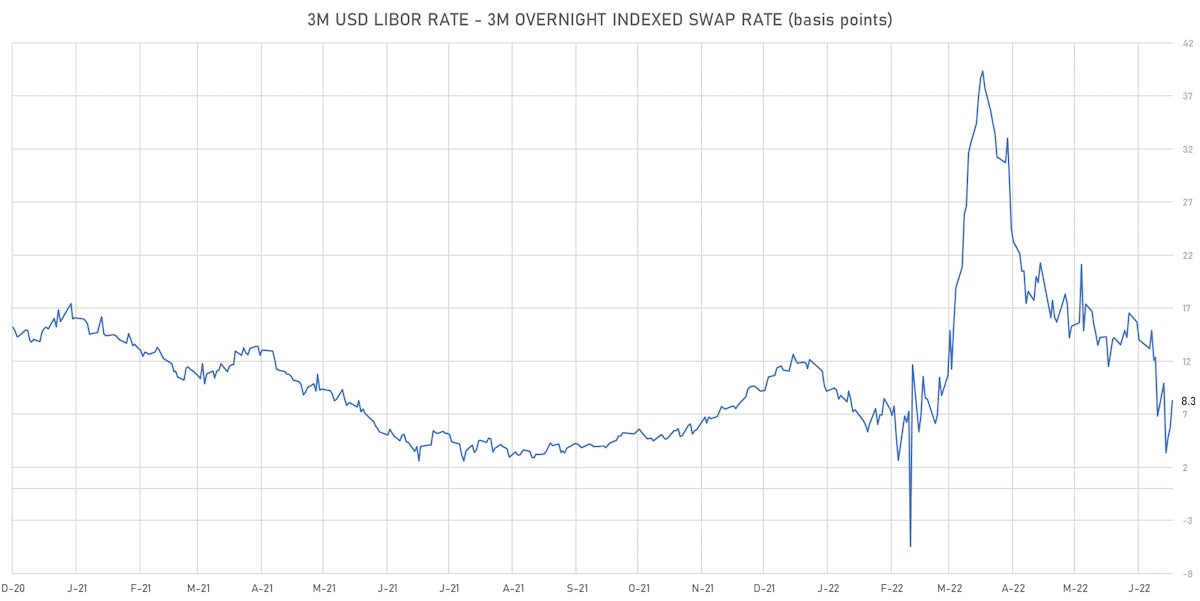

- 3-Month LIBOR-OIS spread up 2.6 bp at 8.3 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.455% (down -6.3 bp); the German 1Y-10Y curve is 1.8 bp flatter at 118.4bp (YTD change: -42.4 bp)

- Japan 5Y: 0.145% (up 1.0 bp); the Japanese 1Y-10Y curve is 3.7 bp flatter at 48.5bp (YTD change: -15.9 bp)

- China 5Y: 2.576% (down -0.9 bp); the Chinese 1Y-10Y curve is 0.3 bp steeper at 80.6bp (YTD change: -50.2 bp)

- Switzerland 5Y: 1.028% (down -10.3 bp); the Swiss 1Y-10Y curve is 3.5 bp flatter at 109.6bp (YTD change: -55.4 bp)