Rates

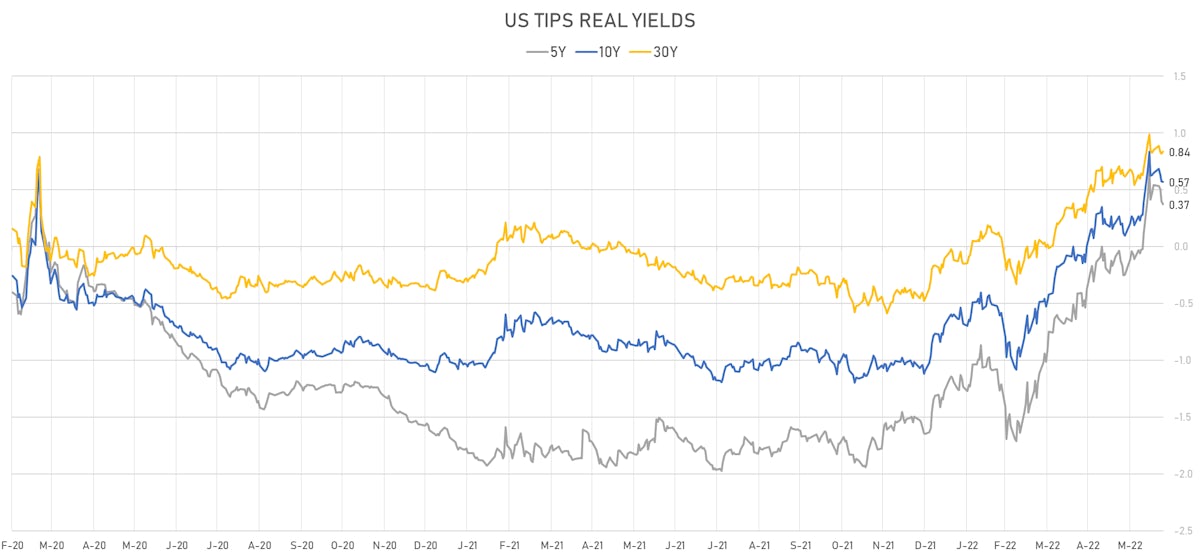

US Front-End Yields Fell This Week, Mostly Driven By Lower Inflation Breakevens, While The 5s30s Spread In Real Yields Rose

Deutsche Bank and Jefferies both see a US recession as inevitable, but starting in the second half of 2023, while Goldman Sachs now sees a 50% chance of a recession over the next 24 months

Published ET

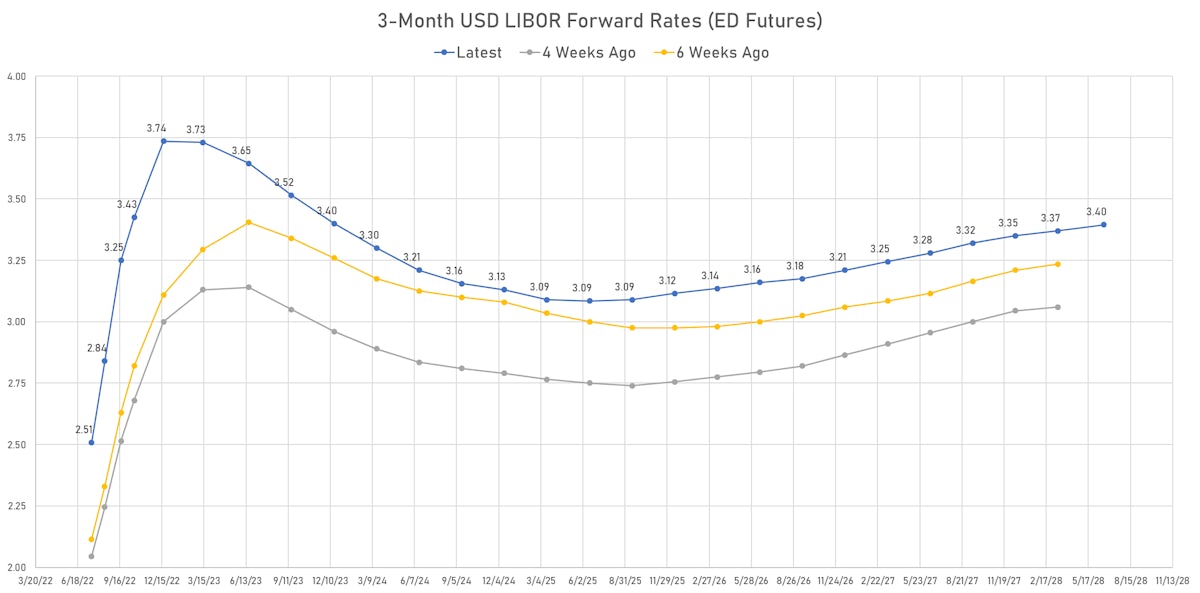

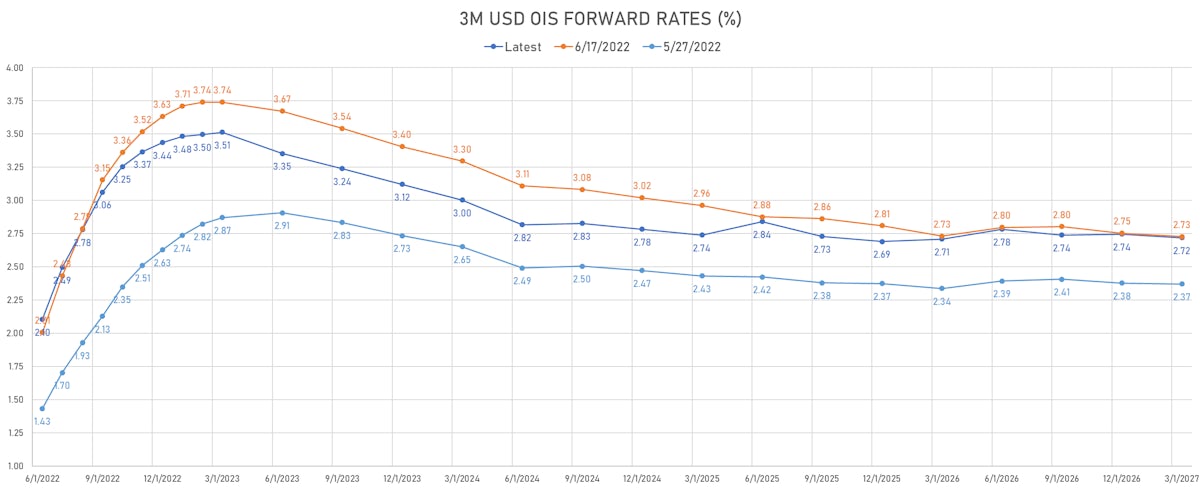

Recent Changes In The 3-Month USD OIS Forward Rates Curve | Sources: ϕpost, Refinitiv data

WEEKLY MOVES IN US TREASURIES

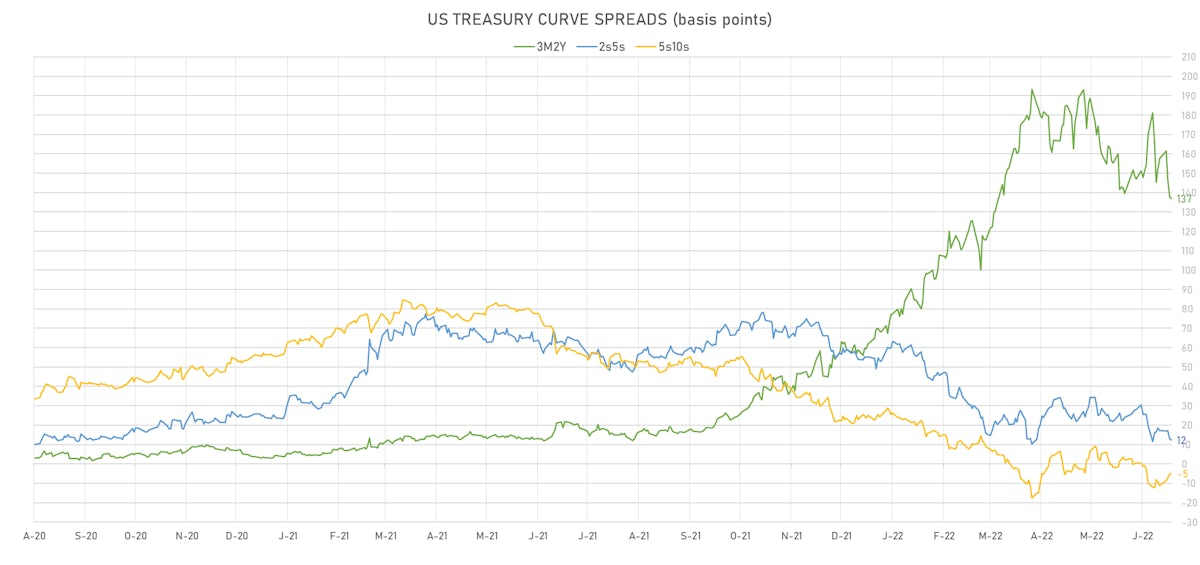

- A sizable flattening at the front end of the curve (3m/2Y), with the 2s10s spread largely unchanged (+1.5bp)

- 1Y: 2.7588% (down 9.1 bp)

- 2Y: 3.0622% (down 10.6 bp)

- 5Y: 3.1858% (down 15.6 bp)

- 7Y: 3.2020% (down 12.8 bp)

- 10Y: 3.1367% (down 9.3 bp)

- 30Y: 3.2640% (down 1.7 bp)

- US treasury curve spreads: 3m2Y at 137.1bp (down -20.6bp this week), 2s5s at 12.4bp (down -4.9bp), 5s10s at -4.9bp (up 6.4bp), 10s30s at 12.7bp (up 7.7bp)

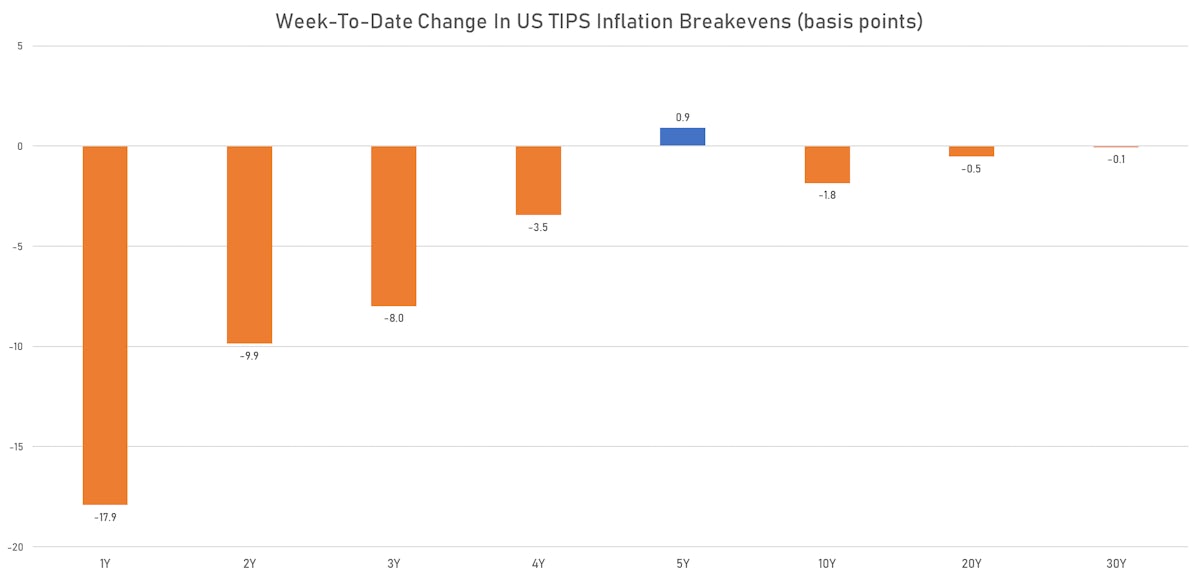

- TIPS 1Y breakeven inflation at 4.83% (down -17.9bp); 2Y at 3.74% (down -9.9bp); 5Y at 2.84% (up 0.9bp); 10Y at 2.54% (down -1.8bp); 30Y at 2.45% (down -0.1bp)

- US 5-Year TIPS Real Yield: -9.5 bp at 0.3720%; 10-Year TIPS Real Yield: -5.9 bp at 0.5690%; 30-Year TIPS Real Yield: +0.8 bp at 0.8360%

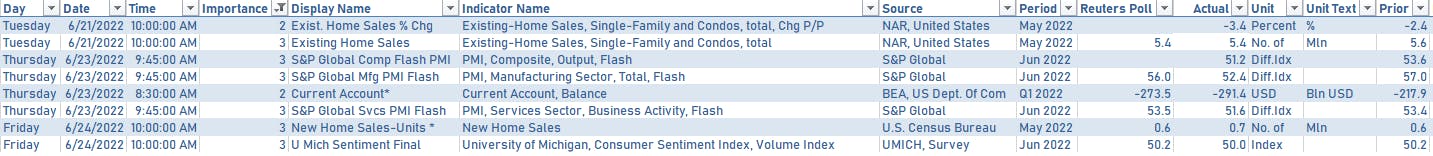

US MACRO RELEASES IN THE PAST WEEK

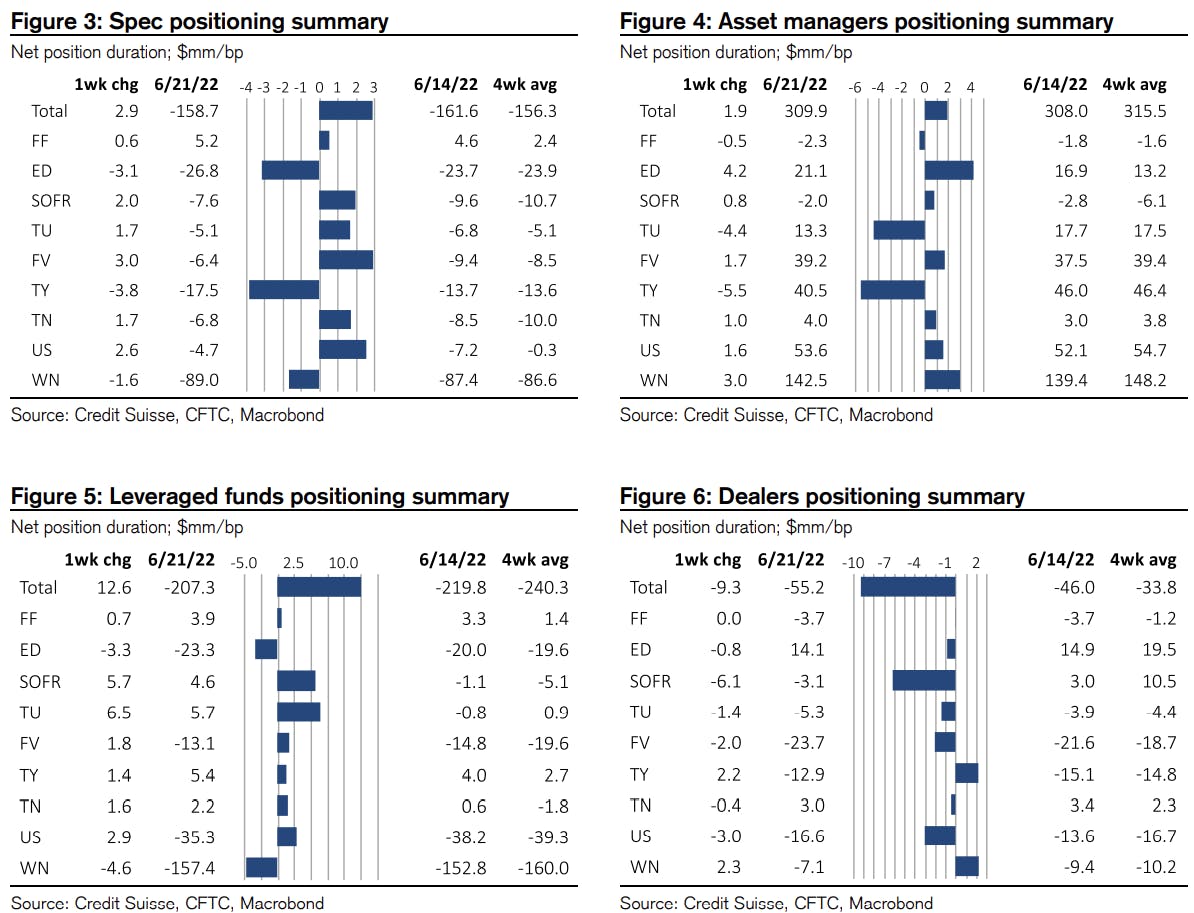

WEEKLY CFTC NET DURATION POSITIONING

US ECONOMIC OUTLOOK

- No sign of recession this year: the spread between the 10Y US Treasury yield and the effective fed funds rate is still far from inversion, and the shortest historical period between inversion and recession was 10 months

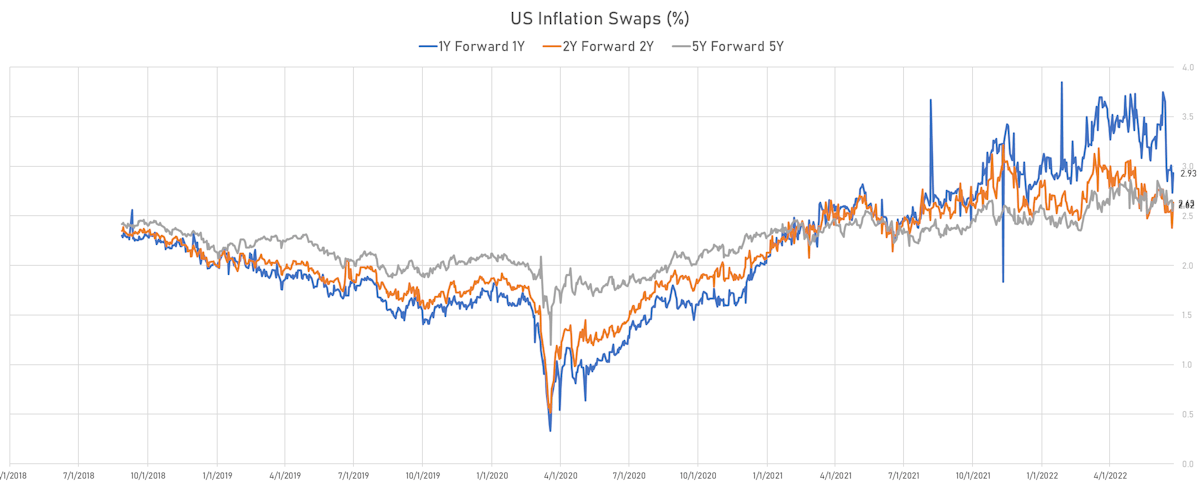

- The current level of inflation is very high, but longer-term inflation expectations, as priced in forward-starting swaps, are staying well anchored

- Having said that, the tightness of the labor market, as well as trillions in excess household cash balances, will make it hard for inflation to decline as quickly as the Fed would like it to

- Rates should stay elevated for longer than the market currently expects, with risk skewed to the upside: some sell-side trading desks are recommending U2/H3 steepeners

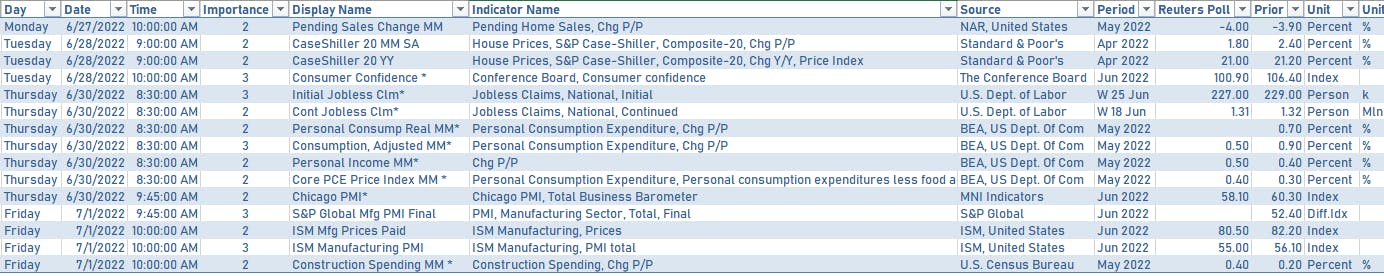

US RELEASES IN THE WEEK AHEAD

TREASURY SUPPLY NEXT WEEK

- $46 bn 2-year notes at 11:30AM on Monday

- $47 bn 5-year notes at 1:00PM on Monday

- $40 bn 7-year notes at 1:00PM on Tuesday.

FED SPEAKING CALENDAR

- Tuesday 12:30PM -- San Francisco Fed President Daly will be interviewed by LinkedIn's chief economist.

- Wednesday 9:30AM -- Fed Chair Powell will speak on a policy panel with ECB President Lagarde, BOE Governor Bailey, and BIS head Carstens on "Challenges for monetary policy in a rapidly changing world" at the ECB's Forum on Central Banking in Sintra, Portugal.

- Wednesday 11:30AM -- Cleveland Fed President Mester will take part in a panel discussion during the ECB's annual policy forum in Sintra, Portugal.

- Wednesday 1:05PM -- St. Louis Fed President Bullard will deliver pre-recorded introductory remarks at a virtual community development event

US FORWARD RATES

- Fed Funds futures now price in 68.0bp of Fed hikes by the end of July 2022, 125.8bp (5.0 x 25bp hikes) by the end of September 2022, and price in 7.2 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 33.5 bp of rate cuts in 2023 (1.3 x 25 bp), up 9.5 bp today, and -27.0 bp in 2024 (1.1 x 25 bp)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 4.83% (up 7.4bp); 2Y at 3.74% (up 6.5bp); 5Y at 2.84% (up 7.2bp); 10Y at 2.54% (up 5.3bp); 30Y at 2.45% (up 3.9bp)

- 6-month spot US CPI swap up 2.8 bp to 5.451%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.3720%, -2.7 bp today; 10Y at 0.5690%, -0.5 bp today; 30Y at 0.8360%, +2.1 bp today

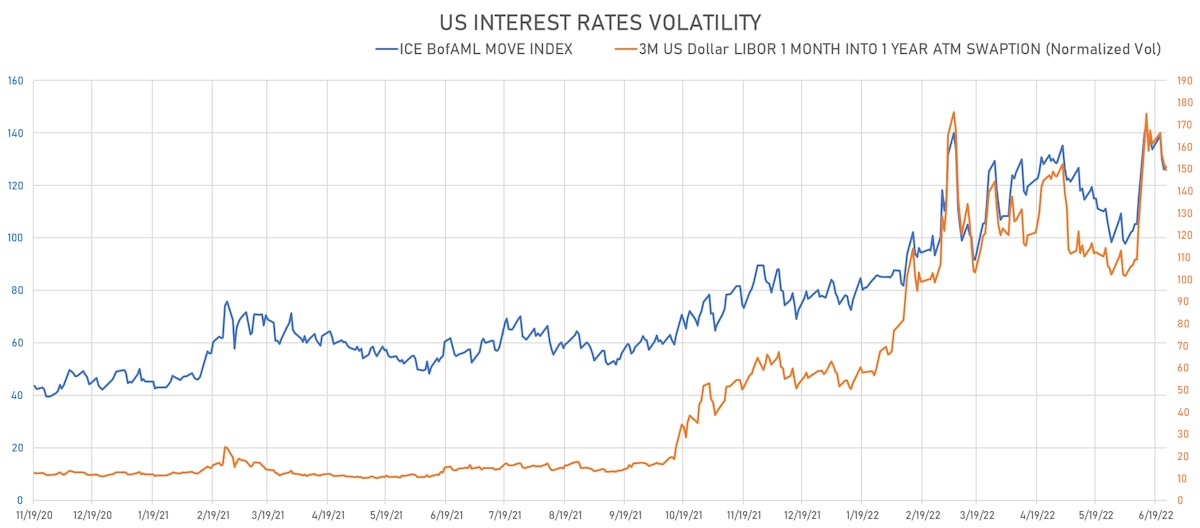

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.9 vols at 149.5 normals

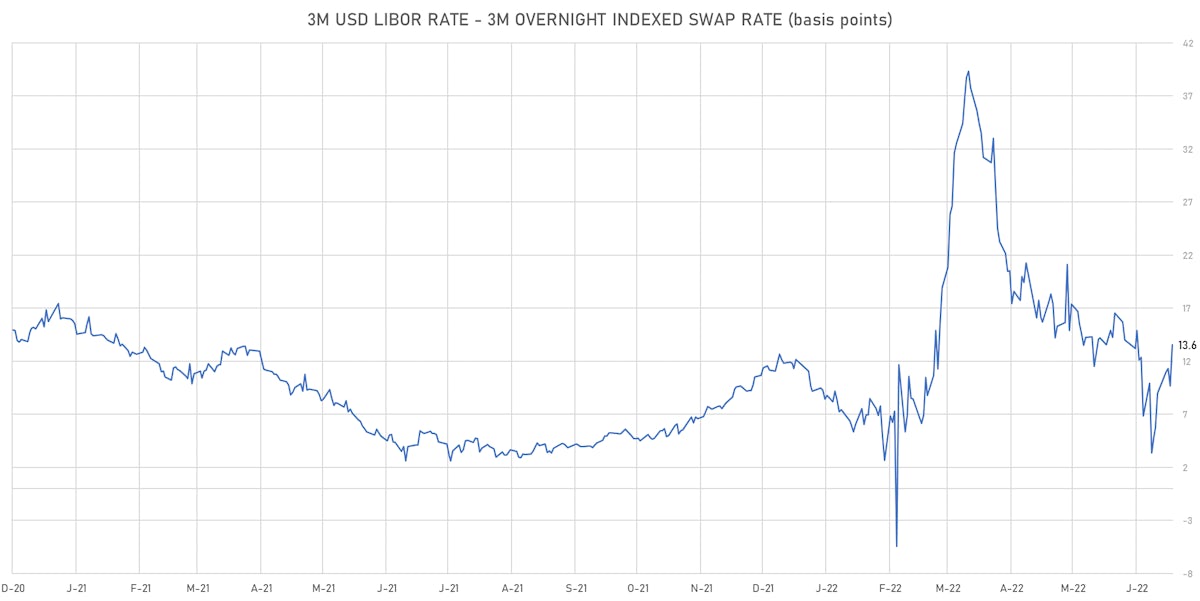

- 3-Month LIBOR-OIS spread up 3.9 bp at 13.6 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES

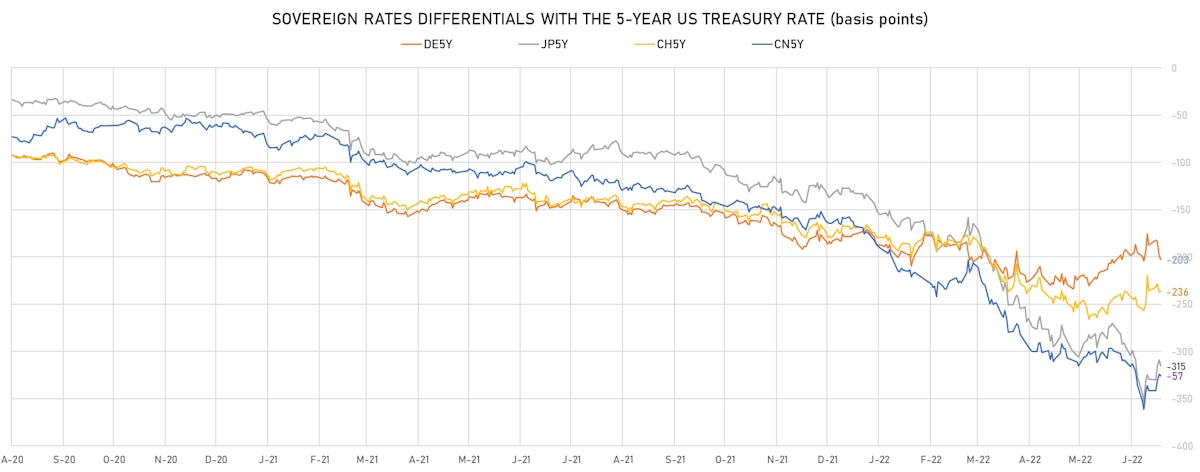

- Germany 5Y: 1.154% (up 0.4 bp); the German 1Y-10Y curve is 3.0 bp steeper at 94.5bp (YTD change: -42.7 bp)

- Japan 5Y: 0.040% (down -1.5 bp); the Japanese 1Y-10Y curve is 1.0 bp flatter at 34.0bp (YTD change: -15.9 bp)

- China 5Y: 2.616% (up 2.4 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 85.1bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.824% (up 5.4 bp); the Swiss 1Y-10Y curve is 16.3 bp steeper at 78.5bp (YTD change: -55.7 bp)