Rates

Dramatic Increase In Rates Volatility Into Independence Day Weekend, As Weak Economic Data Pushes Forward Rates To Price In 3 Rate Cuts In 2023

US money markets are now trading below the Fed's dots by the end of the year, with a shortened hiking cycle and rate cuts starting early 2023; the very front end is still holding up, with 75% probability of a 75bp hike in July, but it will be a bad omen for the Fed's hiking policy if the market now makes a push for 50bp in July

Published ET

US Forward Rates Now Price In 3 Rate Cuts In 2023 | Source: Refinitiv

US RATES OUTLOOK

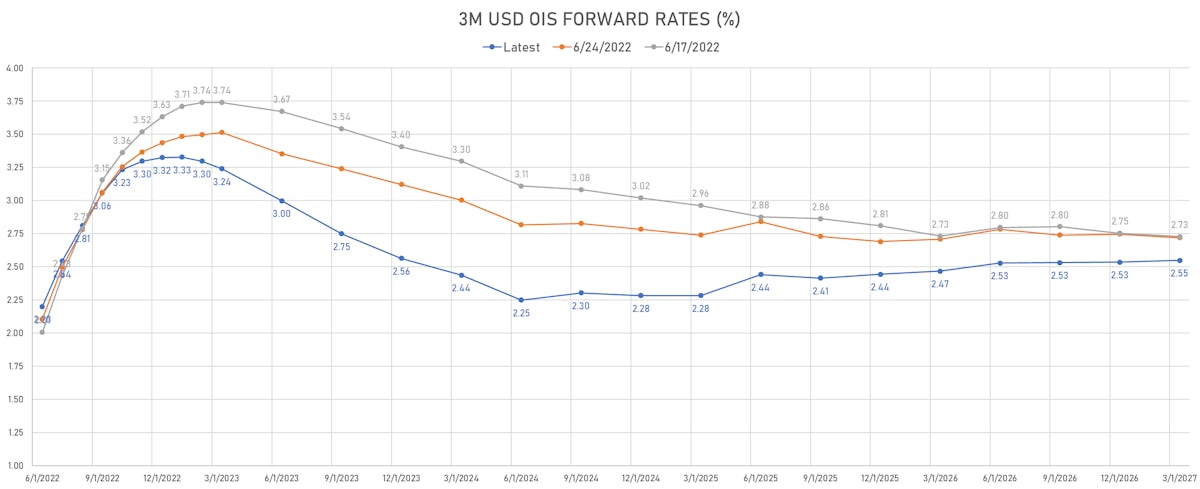

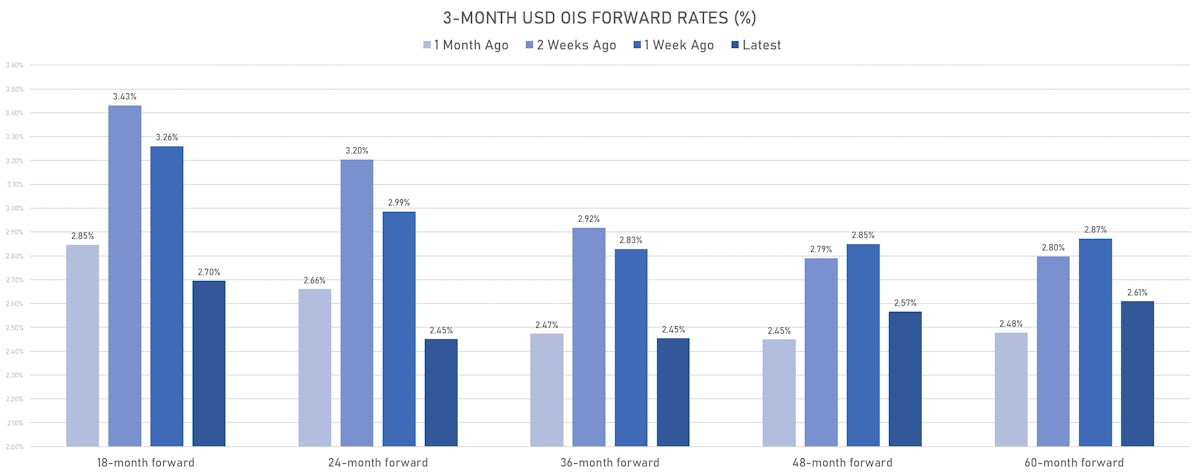

- The inversion of the US forward curve looks excessive: the 19bp drop in the 3M eurodollar EDZ3/Z2 spread on Friday puts 3 rate cuts on the table for 2023

- Although the Atlanta Fed Q2 GDPNow closed the week at -2.1% (vs -1.0% on June 30), the labor market is extremely strong, which makes inflation likely to stay higher for longer

- If the Federal Reserve wants to restore its credibility, it's hard to see a path that leads to Fed Funds being cut in 1Q 2023, when inflation is likely to still be well above target

- That means the terminal rate should be significantly above 4.00%, not at 3.35% (now down about 70bp from its mid-June peak)

- Looking at a key leading indicator, the spread between 10Y treasury yields and the overnight Fed Funds rate is at 131bp, far above inversion (historically, recessions start about 10 months after the spread inverts)

- We expect to see continued volatility in 2H 2022, with no shortage of potential geopolitical risks: Russia could shut off natural gas supply to Europe (Nordstream 1 maintenance shutdown taking place in a couple of weeks), NATO could move troops and weapons to Sweden and Finland, China could make a move on Taiwan

WEEKLY US RATES SUMMARY

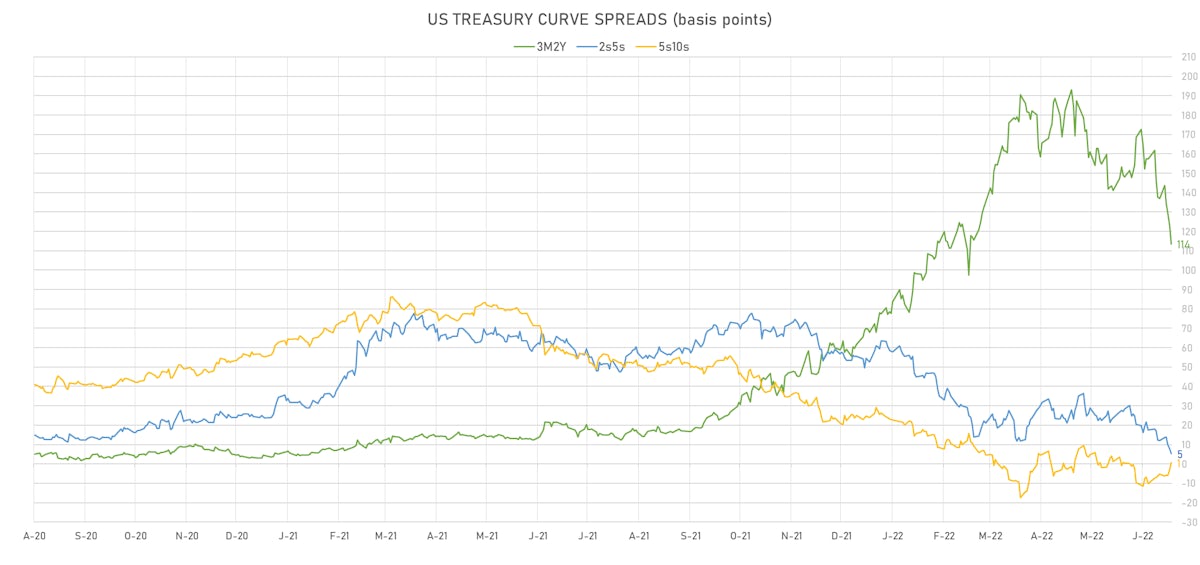

- The treasury yield curve flattened, with the 1s10s spread tightening -21.0 bp, now at 16.8 bp (YTD change: -96.4bp)

- 1Y: 2.7207% (down 3.8 bp)

- 2Y: 2.8380% (down 22.4 bp)

- 5Y: 2.8834% (down 30.2 bp)

- 7Y: 2.9276% (down 27.4 bp)

- 10Y: 2.8885% (down 24.8 bp)

- 30Y: 3.1139% (down 15.0 bp)

- US treasury curve spreads: 3m2Y at 113.5bp (down -23.5bp this week), 2s5s at 4.5bp (down -7.7bp), 5s10s at 0.5bp (up 5.5bp), 10s30s at 22.5bp (up 9.7bp)

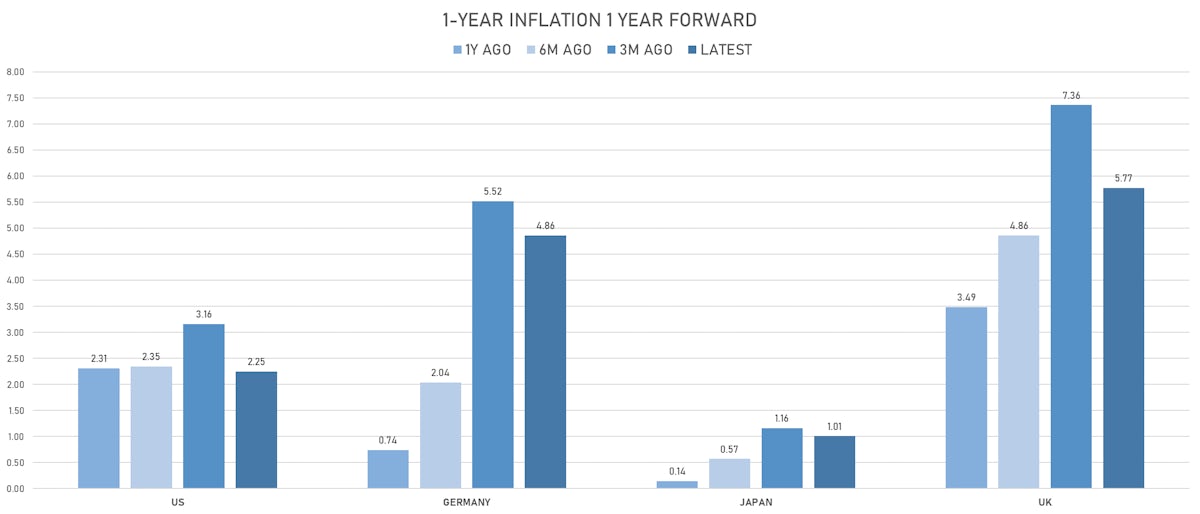

- TIPS 1Y breakeven inflation at 4.41% (down -59.7bp); 2Y at 3.34% (down -50.3bp); 5Y at 2.64% (down -19.5bp); 10Y at 2.32% (down -23.7bp); 30Y at 2.23% (down -22.5bp)

- US 5-Year TIPS Real Yield: -9.9 bp at 0.2730%; 10-Year TIPS Real Yield: -3.1 bp at 0.5380%; 30-Year TIPS Real Yield: +7.4 bp at 0.9100%

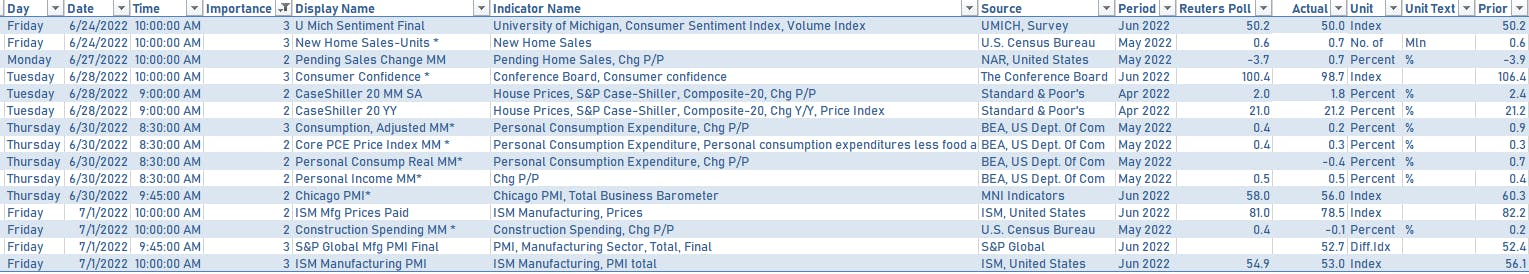

US MACRO RELEASES LAST WEEK

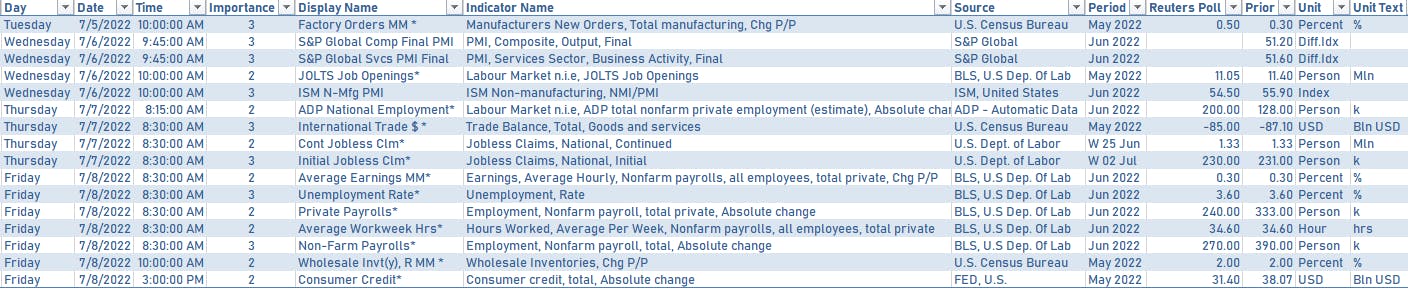

US MACRO RELEASES IN THE WEEK AHEAD

- June employment data on Friday

- June 14-15 FOMC Meeting will be released at 2:00PM on Wednesday

FED SPEAKERS

- Wednesday 9:00AM: New York Fed President Williams will make opening and closing remarks at a virtual event on bank culture hosted by the New York Fed.

- Thursday 1:00PM: Fed Governor Waller will be interviewed during a virtual NABE event.

- Thursday 1:00PM: St. Louis Fed President Bullard will discuss the US economy and monetary policy during a luncheon event hosted by the Little Rock Regional Chamber.

- Friday 11:00AM: New York Fed President Williams will speak at an event hosted by the University of Puerto Rico

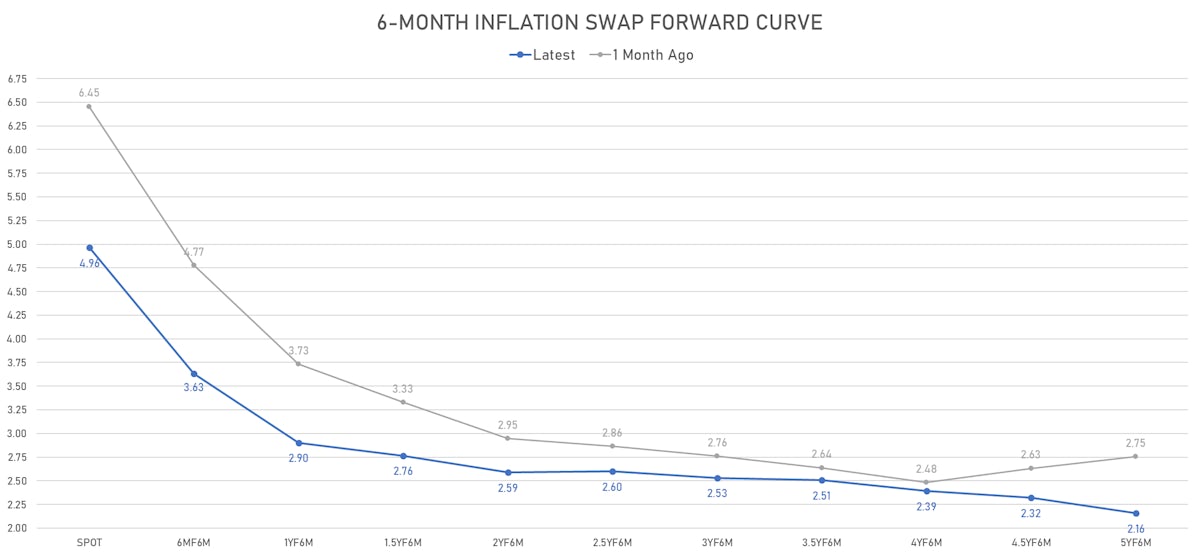

US FORWARD RATES

- Fed Funds futures now price in 68.5bp of Fed hikes by the end of July 2022, 123.7bp (4.9 x 25bp hikes) by the end of September 2022, and price in 6.9 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 76.5 bp of rate cuts in 2023 (equivalent to 3.1 x 25 bp cuts), up 19.0 bp today, and 25.5 bp of cuts in 2024

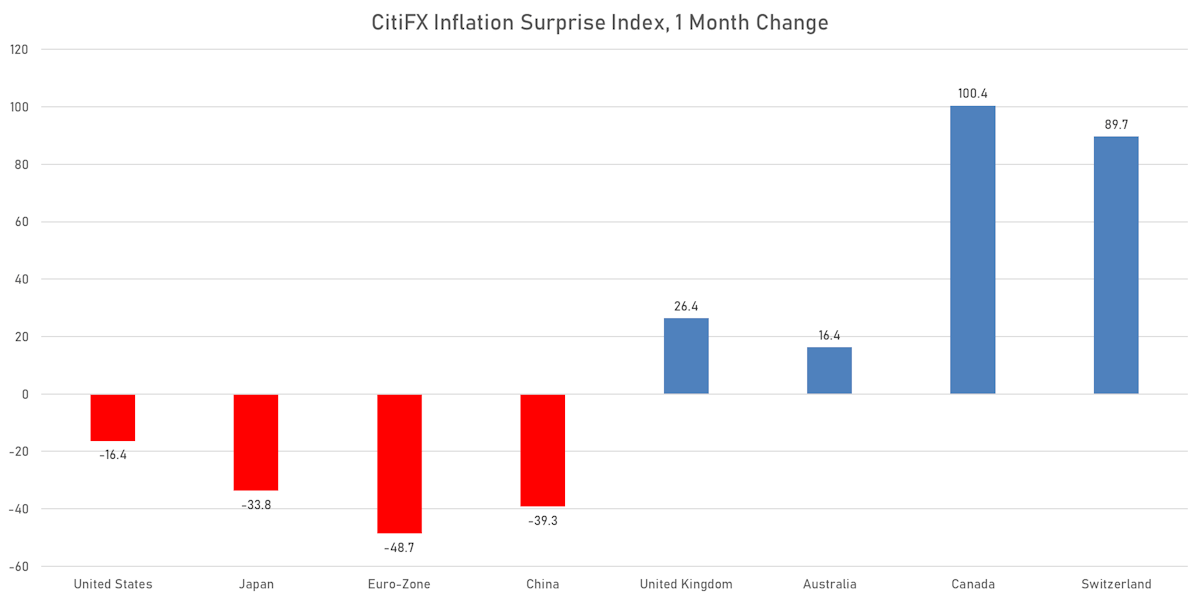

US INFLATION & REAL RATES

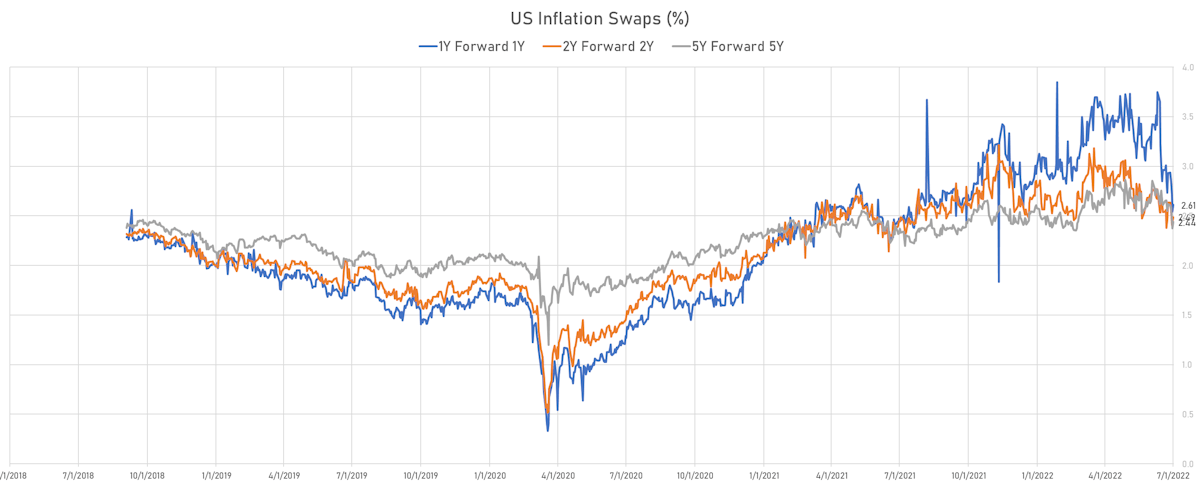

- TIPS 1Y breakeven inflation at 4.41% (up 4.4bp); 2Y at 3.34% (up 7.5bp); 5Y at 2.64% (up 4.0bp); 10Y at 2.32% (up 2.6bp); 30Y at 2.23% (up 2.8bp)

- 6-month spot US CPI swap down -23.9 bp to 4.965%, with a flattening of the forward curve

- US Real Rates: 5Y at 0.2730%, -19.9 bp today; 10Y at 0.5380%, -15.2 bp today; 30Y at 0.9100%, -9.8 bp today

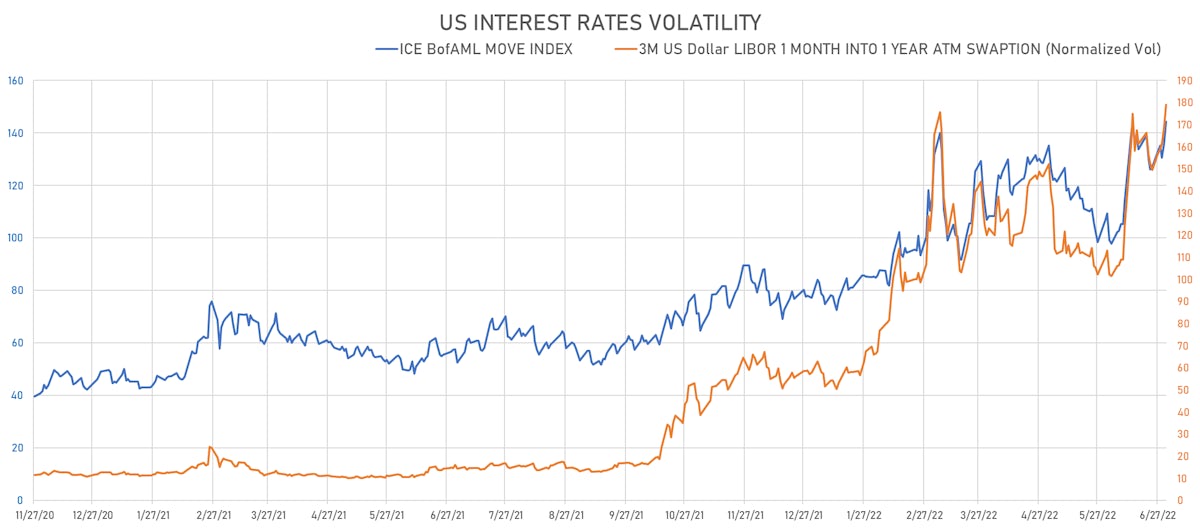

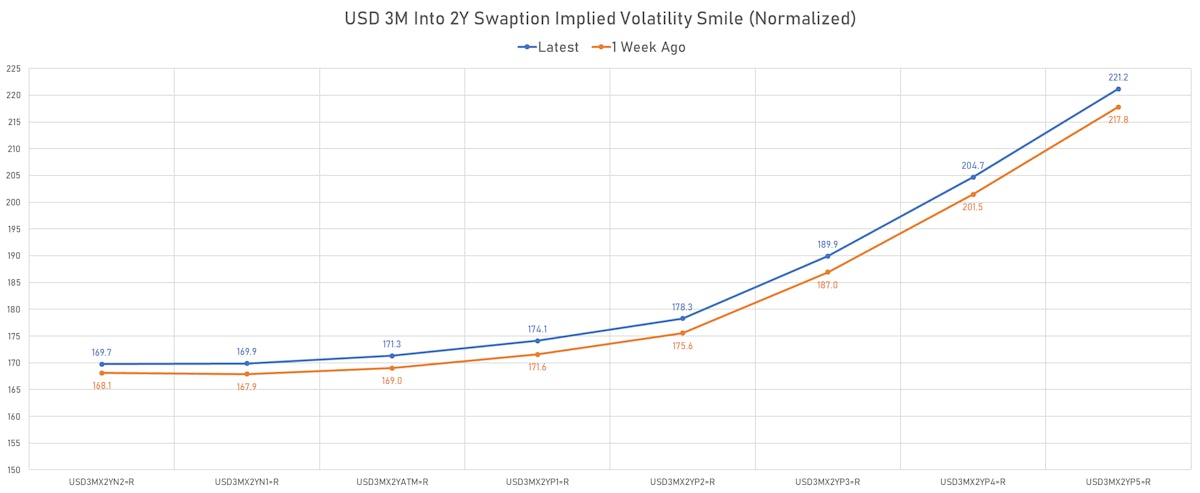

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 10.9 vols at 179.1 normals

- 3-Month LIBOR-OIS spread down -0.8 bp at 10.0 bp (18-months range: -5.5 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

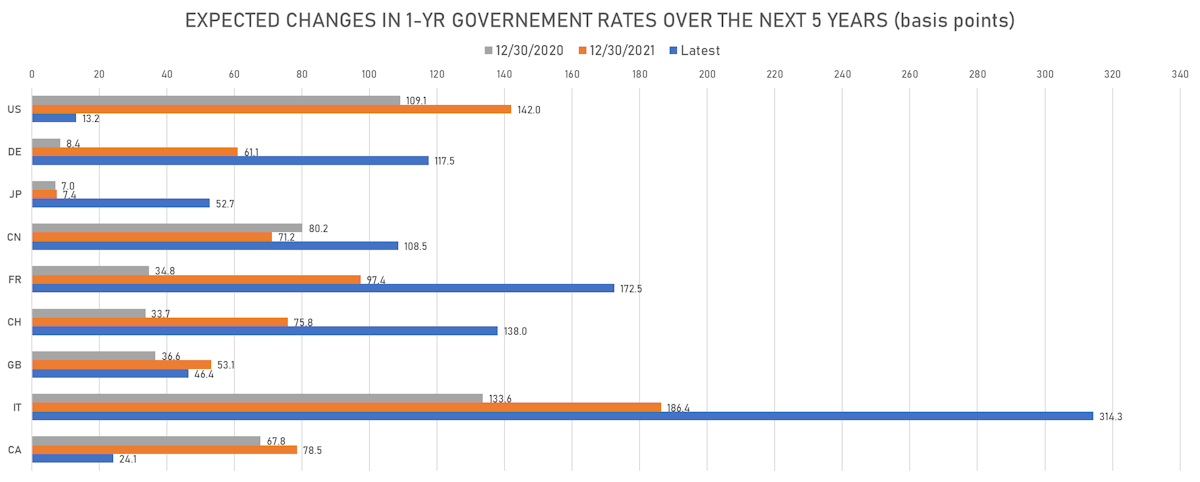

- Germany 5Y: 0.933% (down -18.0 bp); the German 1Y-10Y curve is 5.5 bp flatter at 87.1bp (YTD change: -42.7 bp)

- Japan 5Y: 0.010% (down -1.3 bp); the Japanese 1Y-10Y curve is 1.0 bp flatter at 31.5bp (YTD change: -15.9 bp)

- China 5Y: 2.628% (down -0.8 bp); the Chinese 1Y-10Y curve is 1.5 bp steeper at 92.5bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.415% (down -10.3 bp); the Swiss 1Y-10Y curve is 16.7 bp flatter at 42.9bp (YTD change: -56.1 bp)