Rates

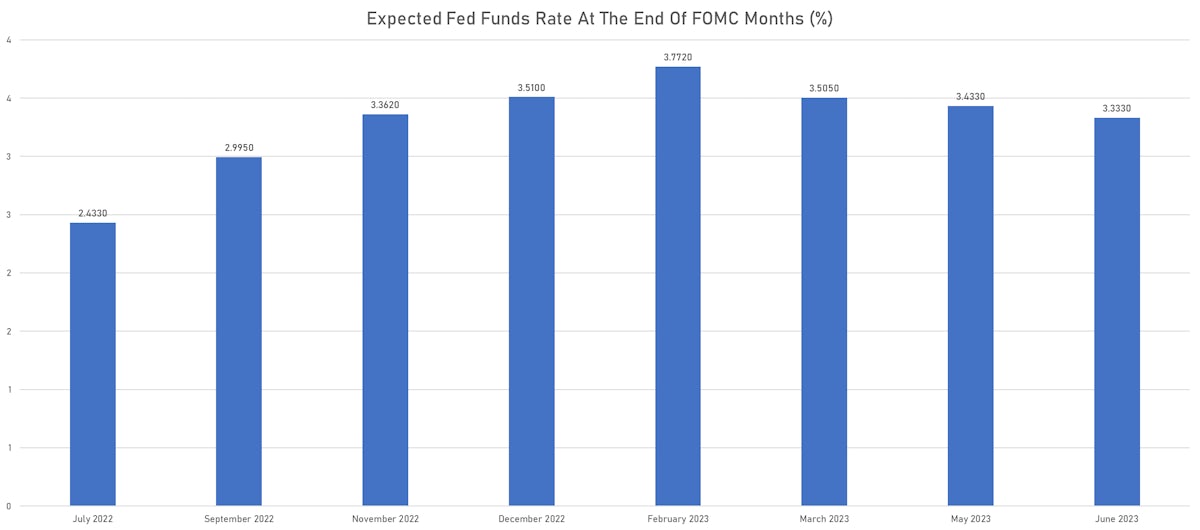

Fed Speakers Bring July Hike Expectations Back Towards 75bp After CPI Scare Put 100bp Firmly In Play

The most worrying aspect of the inflation print was its breadth, and the reluctance of governors to accelerate the pace of hikes further (to 100bp increments) means that the Fed will likely have to hike for longer than the market currently expects (hard to see them being done by the end of the year)

Published ET

August 2022 Fed Funds Futures Implied Yield Over The Past 10 Days | Source: Refinitiv

WEEKLY US RATES SUMMARY

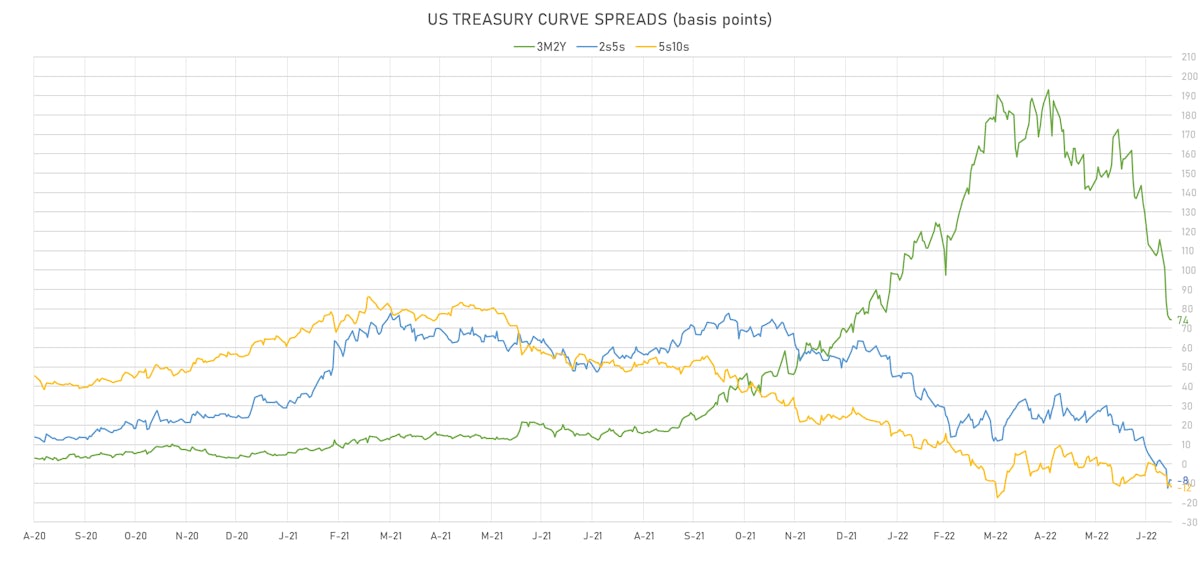

- The treasury yield curve flattened, with the 1s10s spread tightening -30.9 bp, now at -14.0 bp (YTD change: -127.2bp)

- 1Y: 3.0668% (up 15.7 bp)

- 2Y: 3.1295% (up 2.8 bp)

- 5Y: 3.0460% (down 7.5 bp)

- 7Y: 3.0271% (down 12.1 bp)

- 10Y: 2.9272% (down 15.2 bp)

- 30Y: 3.0904% (down 16.1 bp)

- US treasury curve spreads: 3m2Y at 74.5bp (down -41.4bp this week), 2s5s at -8.4bp (down -10.1bp), 5s10s at -11.9bp (down -7.8bp), 10s30s at 16.3bp (down -0.7bp)

- TIPS 1Y breakeven inflation at 3.49% (down -26.6bp); 2Y at 3.04% (down -18.5bp); 5Y at 2.61% (down -1.9bp); 10Y at 2.33% (down -0.7bp); 30Y at 2.24% (up 0.8bp)

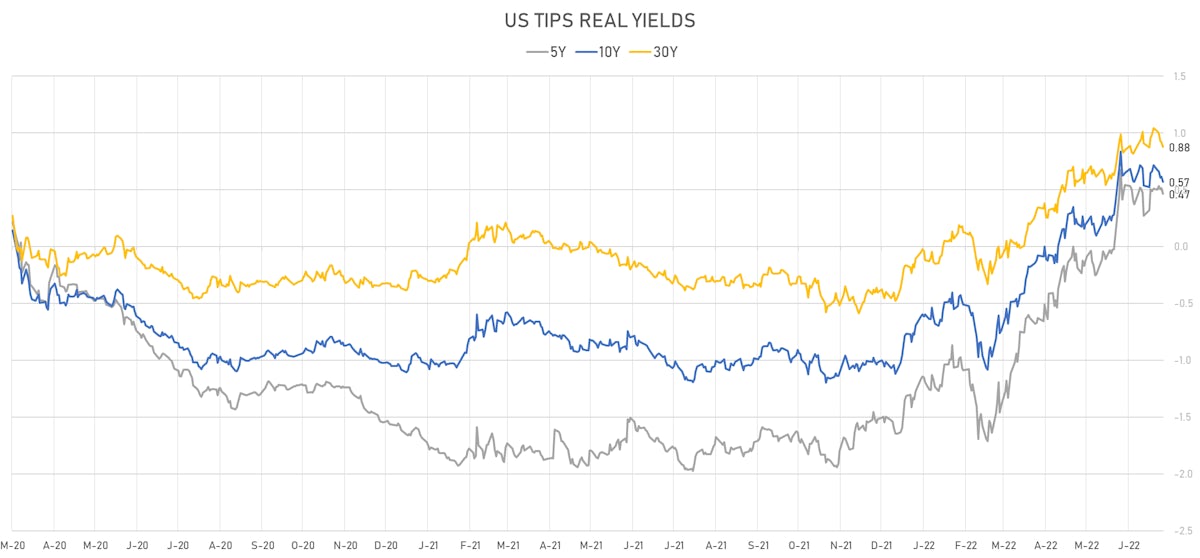

- US 5-Year TIPS Real Yield: -4.6 bp at 0.4650%; 10-Year TIPS Real Yield: -14.6 bp at 0.5680%; 30-Year TIPS Real Yield: -16.2 bp at 0.8780%

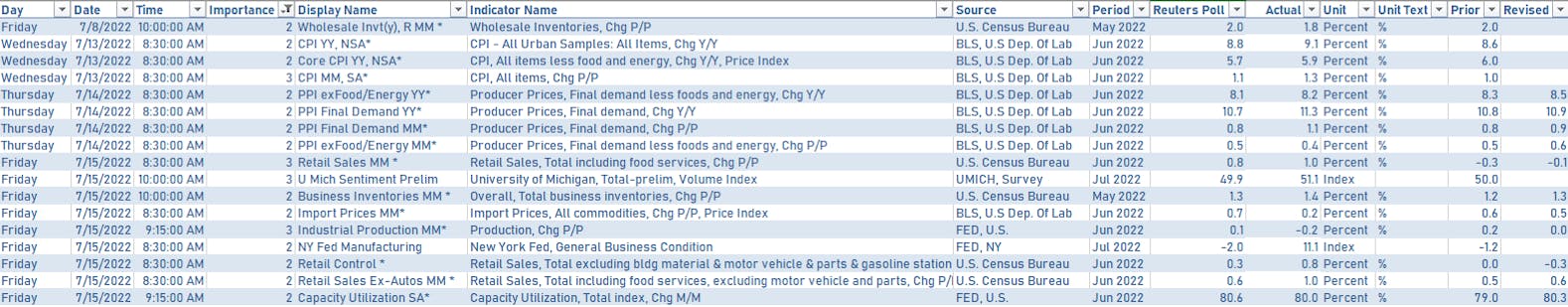

US MACRO RELEASES IN THE PAST WEEK

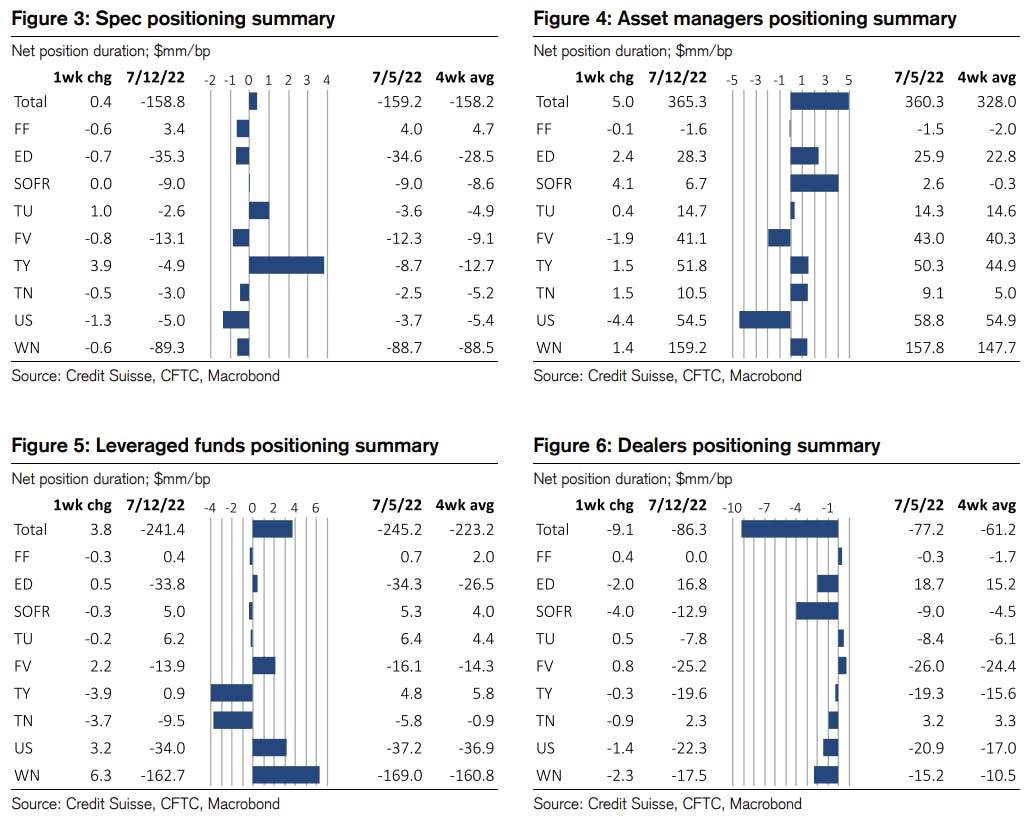

WEEKLY CFTC NET DURATION POSITIONING

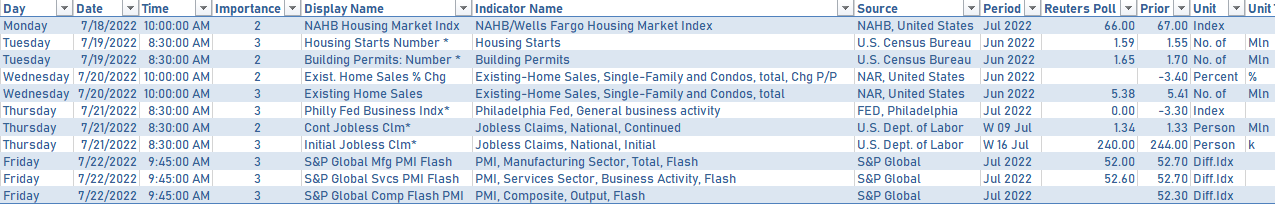

US MACRO WEEK AHEAD

- Light data calendar, with a focus on June housing starts and existing home sales

US COUPON-BEARING TREASURY AUCTIONS IN THE WEEK AHEAD

- Wednesday 20 July: $14 bn 20Y reopening

- Thursday 21 July: $17 bn 10Y TIPS

FED SPEAK NEXT WEEK

- We're back in the quiet period ahead of the next FOMC and won't hear from policymakers until Powell's press conference at 2.30PM on Wednesday 27 July

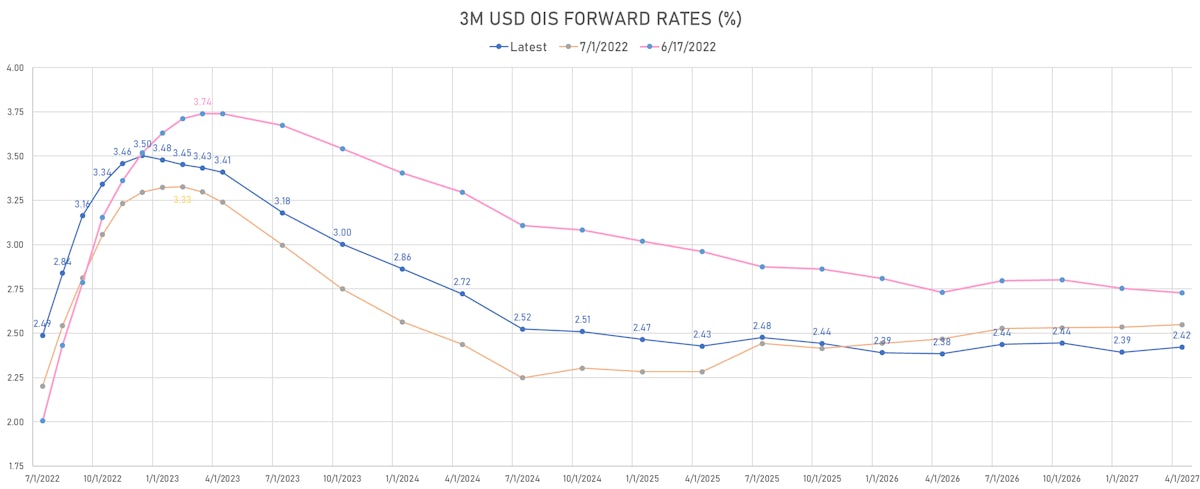

US FORWARD RATES

- Fed Funds futures now price in 84.8bp of Fed hikes by the end of July 2022, 141.4bp (5.7 x 25bp hikes) by the end of September 2022, and price in 7.7 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in -68.5 bp of hikes in 2023 (equivalent to -2.7 x 25 bp hikes), up 3.0 bp today, and -35.5 bp of hikes in 2024 (equivalent to -1.4 x 25 bp hikes)

US INFLATION & REAL RATES

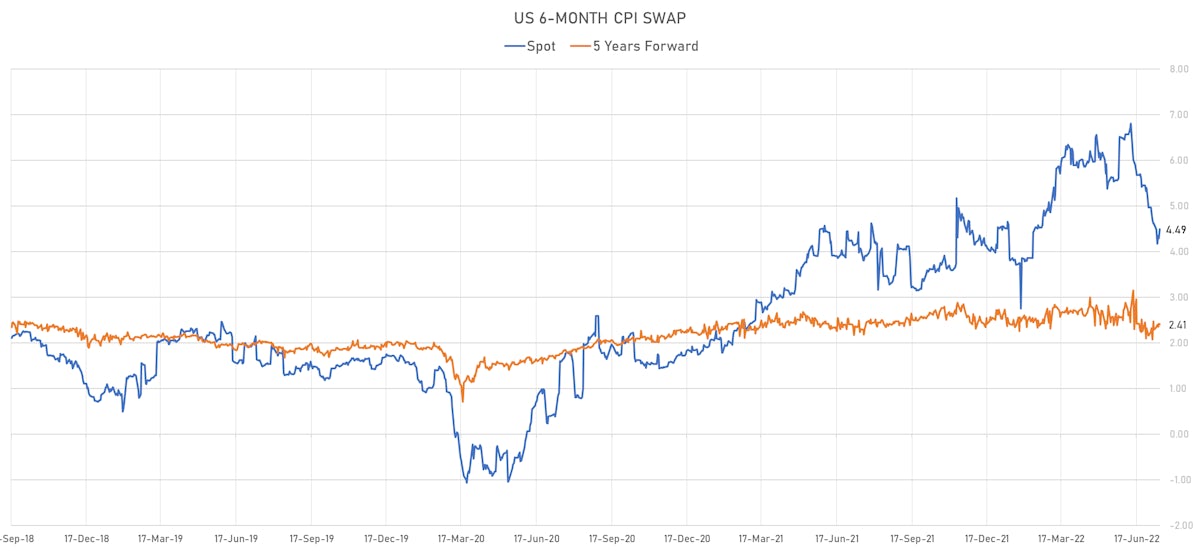

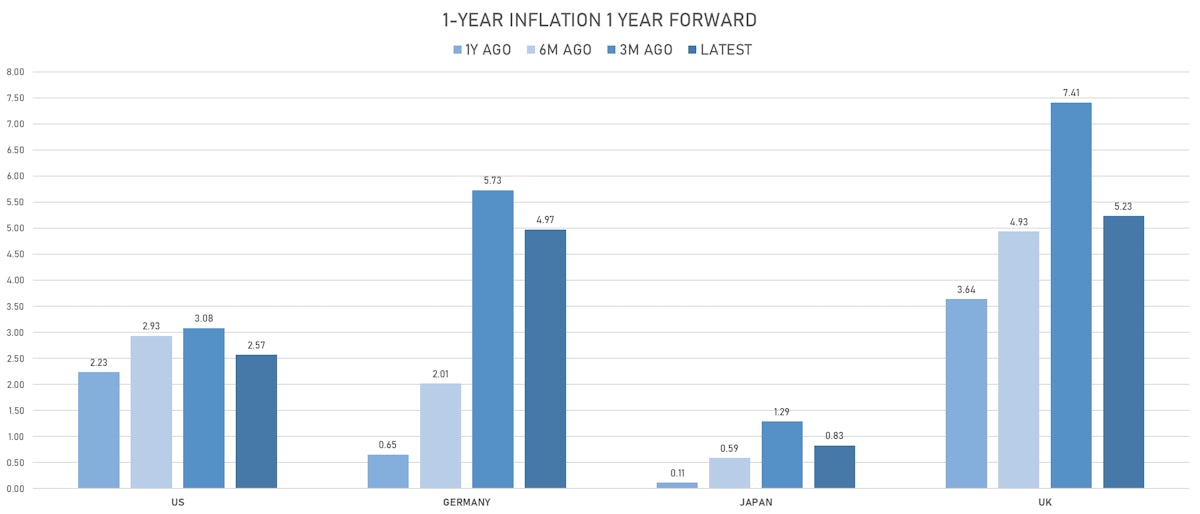

- TIPS 1Y breakeven inflation at 3.49% (up 22.0bp); 2Y at 3.04% (up 11.3bp); 5Y at 2.61% (up 3.6bp); 10Y at 2.33% (up 1.9bp); 30Y at 2.24% (up 2.3bp)

- 6-month spot US CPI swap up 20.0 bp to 4.493%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.4650%, -5.0 bp today; 10Y at 0.5680%, -4.8 bp today; 30Y at 0.8780%, -3.9 bp today

RATES VOLATILITY & LIQUIDITY

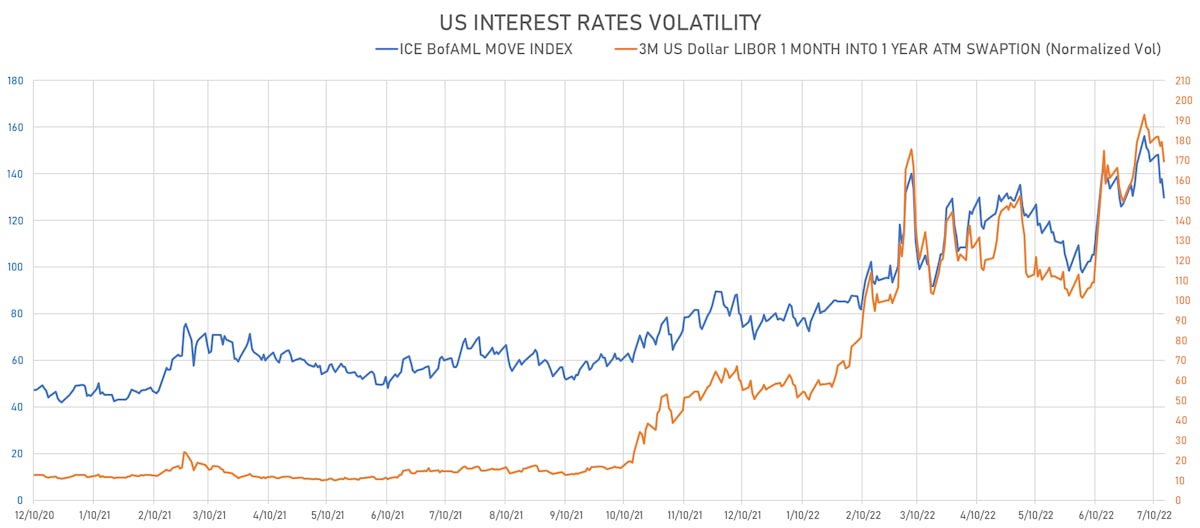

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -9.8 vols at 169.4 normals

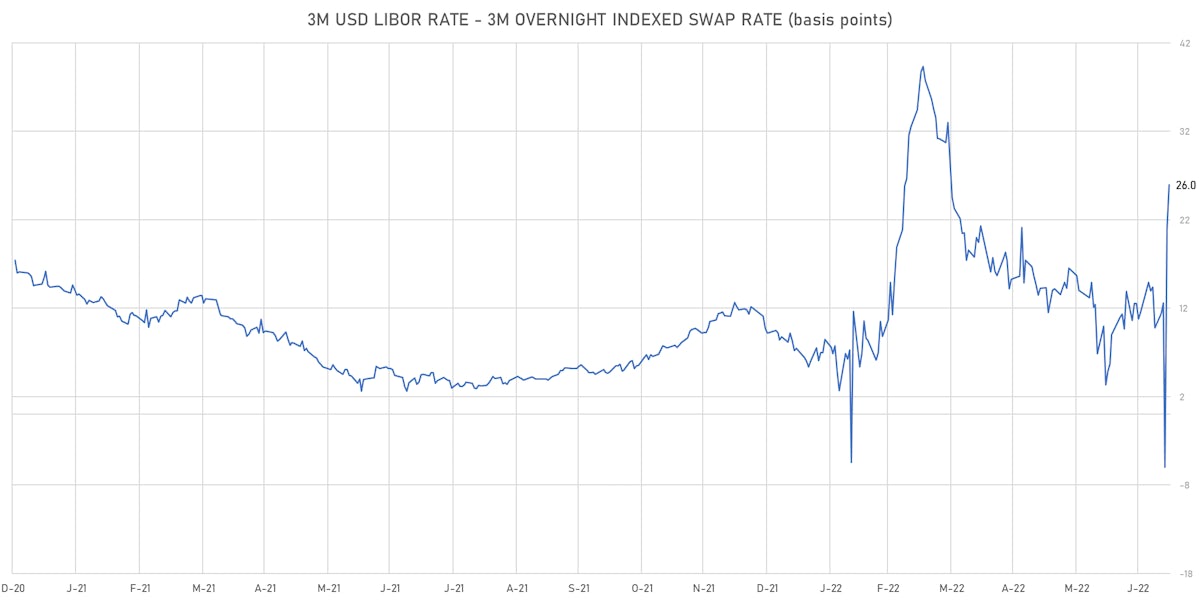

- 3-Month LIBOR-OIS spread up 5.0 bp at 26.0 bp (18-months range: -6.0 to 39.3 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 0.839% (down -4.5 bp); the German 1Y-10Y curve is 17.8 bp steeper at 91.3bp (YTD change: -42.7 bp)

- Japan 5Y: 0.040% (down -0.3 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 34.5bp (YTD change: -15.9 bp)

- China 5Y: 2.566% (down -0.9 bp); the Chinese 1Y-10Y curve is 2.3 bp steeper at 96.2bp (YTD change: -50.0 bp)

- Switzerland 5Y: 0.392% (down -0.2 bp); the Swiss 1Y-10Y curve is 2.9 bp flatter at 23.4bp (YTD change: -56.3 bp)