Rates

Important FOMC Coming On Wednesday As Inflation Stays High While Growth Has Been Trending Weaker Lately

The Fed has been resolute in its commitment to tame inflation, while the market has recently been pricing in a possible change in the Fed's reaction function (towards more balance between inflation and growth)

Published ET

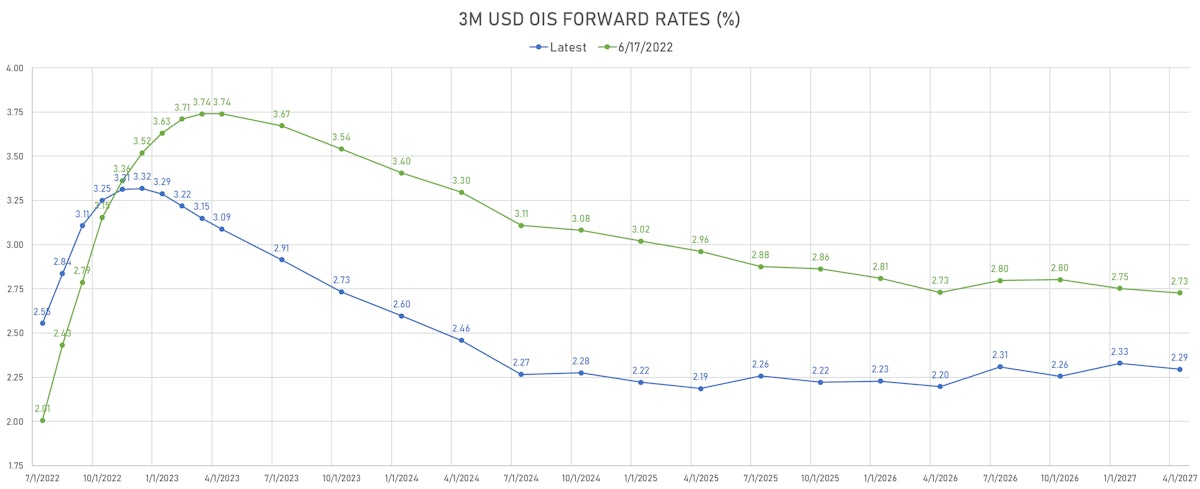

3-Month USD OIS Forward Rates | Sources: ϕpost, Refinitiv data

OUTLOOK GOING INTO THE JULY FOMC

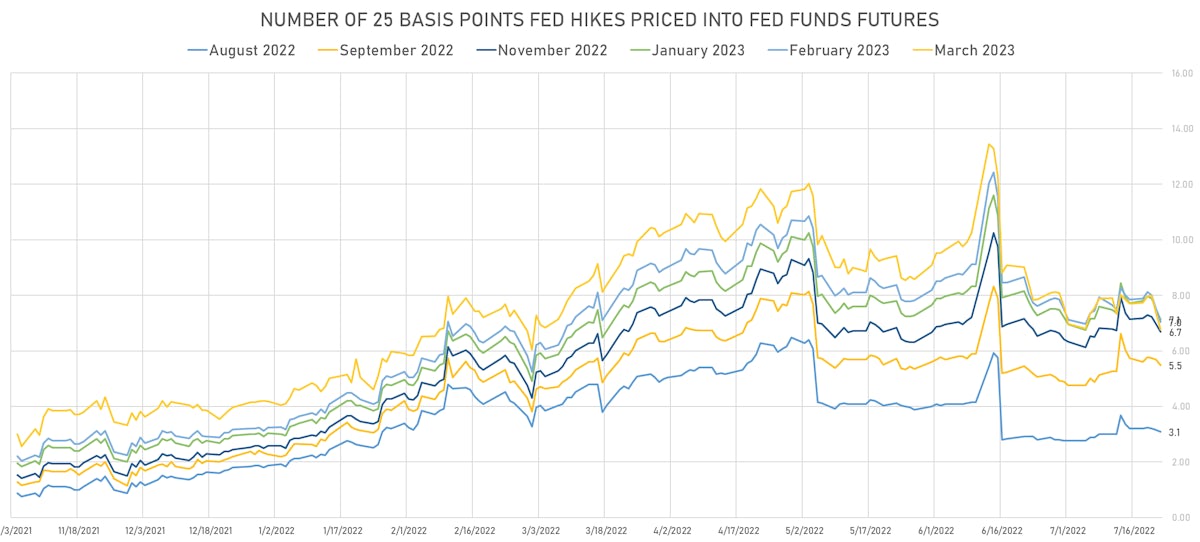

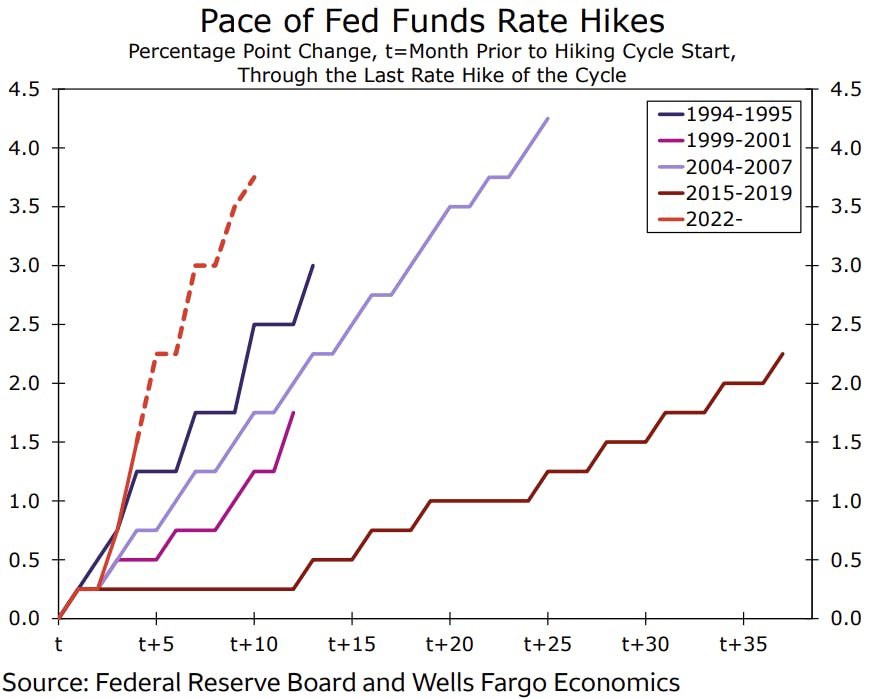

- It is now almost certain that the Fed will announce another 75bp hike on Wednesday, with Fed speakers all aligned at that level before the start of the quiet period last week. The current pace of hikes is by far the steepest since the Volcker years

- The forward rates curve has come down drastically since the June FOMC: the market now expects hikes to be done this year, with a terminal range of 3.25%-3.50% for the Fed funds rate

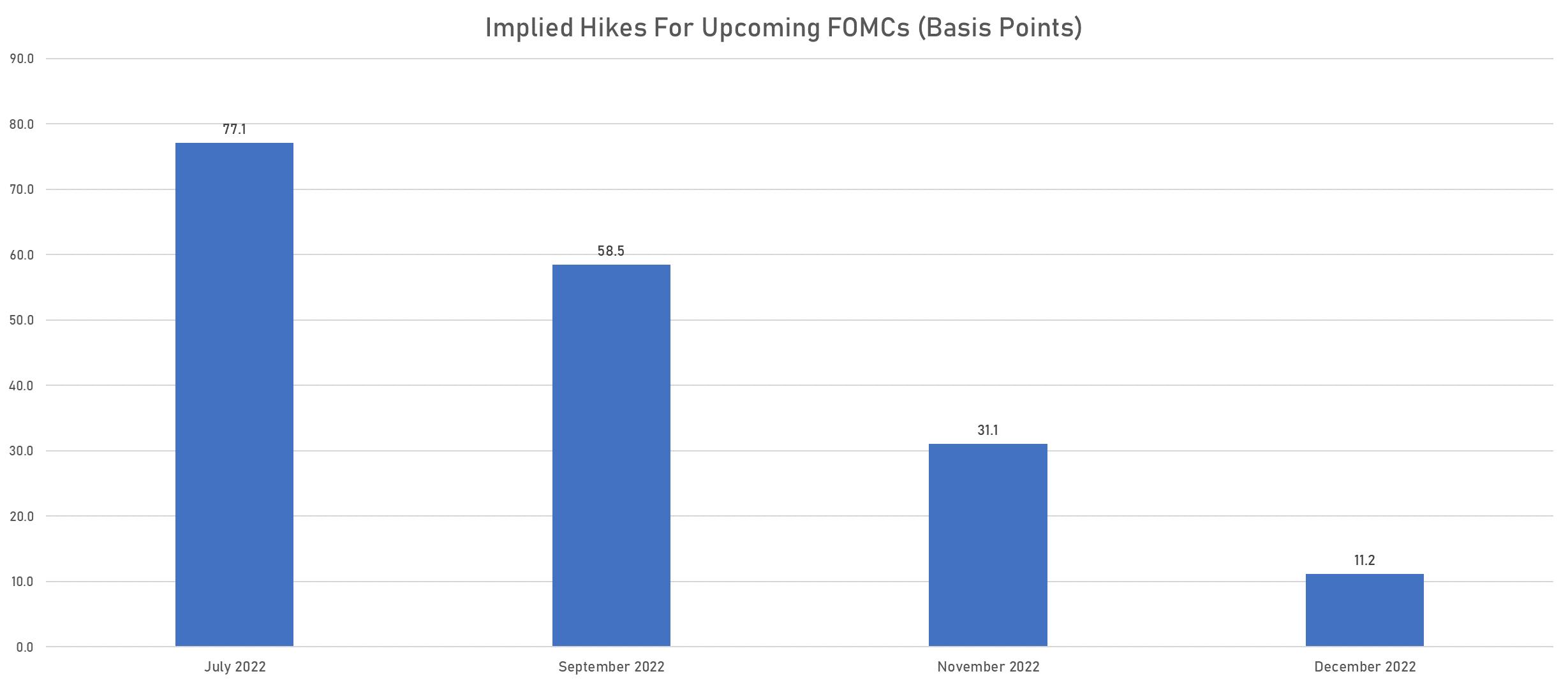

- The focus will be on whether the Fed sees a need for a third straight 75bp hike in September, with the market currently pricing 58bp in September, 31bp in November and just 11bp in December.

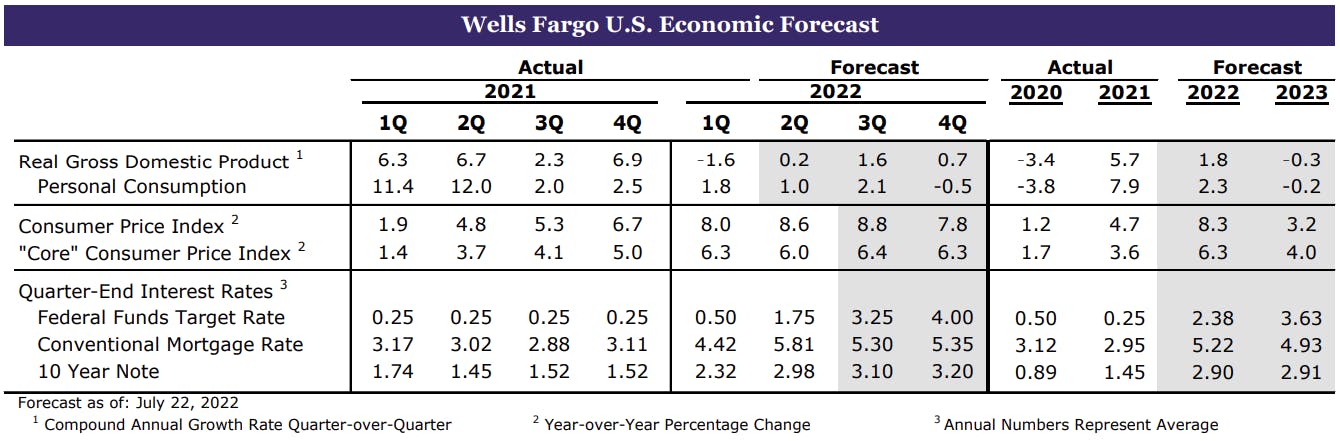

- As inflationary pressures have broadened, the core CPI is not expected to come back down quickly: Jefferies forecasts 5.8% at the end of 2022 and 4.2% at the end of 2023, while Wells Fargo sees 6.3% at the end of 2022 and 4.0% at the end of 2023.

- In this context, and with the Fed's single focus being inflation, it's hard to see the hiking cycle end this year, although the market has definitely priced a change in the Fed's reaction function placing more weight on a possible recession (more balanced and aligned with the Fed's long term dual mandate)

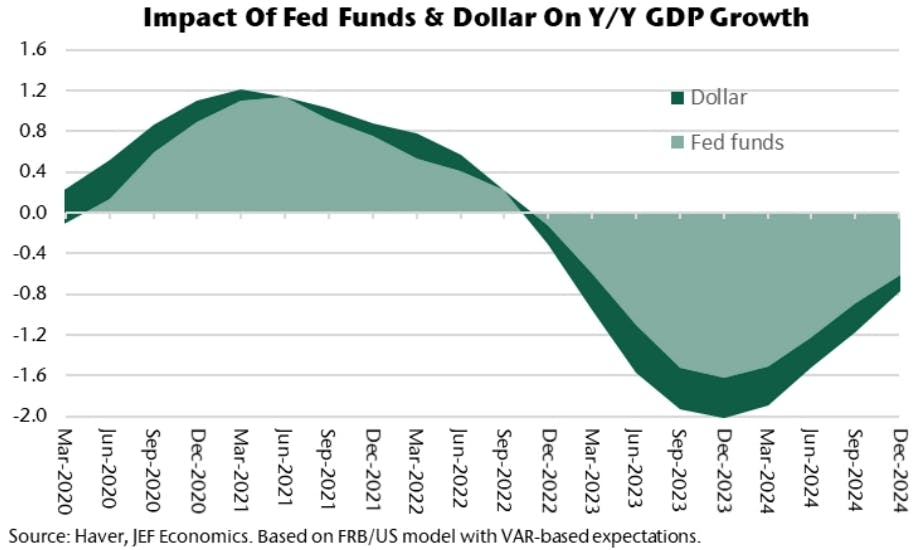

- One thing that could tilt the Fed towards 50bp from September is the strength of the dollar, which is acting as a form of policy tightening.

- According to Jefferies' chief economist Aneta Markowska: "the trade-weighted dollar has appreciated by nearly 3% since the last FOMC meeting, which is equivalent to a ~20bp increase in the funds rate. Put differently, the dollar has effectively delivered another rate hike over the past 6 weeks, which takes pressure off the Fed. (..) Assuming the fed funds rate gets to 4% by March 2023 (our base case), we estimate that policy will knock off 1.6% from 2023 growth"

WEEKLY US RATES SUMMARY

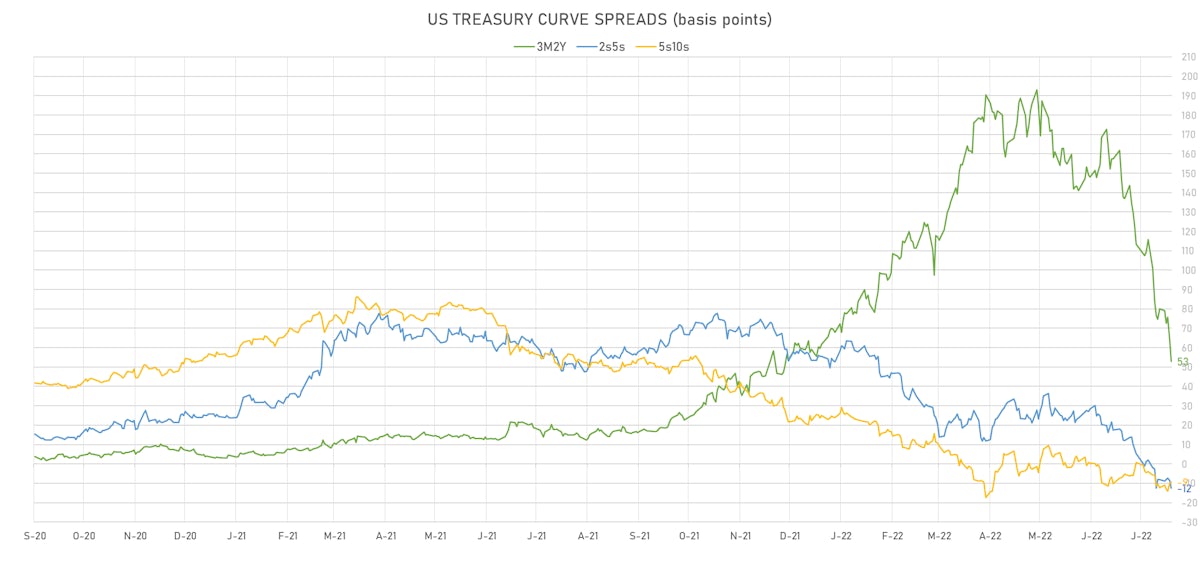

- The treasury yield curve flattened, with the 1s10s spread tightening -10.2 bp, now at -24.2 bp (YTD change: -137.4bp)

- 1Y: 2.9940% (down 7.3 bp)

- 2Y: 2.9700% (down 15.9 bp)

- 5Y: 2.8464% (down 20.0 bp)

- 7Y: 2.8350% (down 19.2 bp)

- 10Y: 2.7522% (down 17.5 bp)

- 30Y: 2.9737% (down 11.7 bp)

- US treasury curve spreads: 3m2Y at 53.0bp (down -27.0bp this week), 2s5s at -12.4bp (down -4.1bp), 5s10s at -9.4bp (up 2.4bp), 10s30s at 22.2bp (up 5.6bp)

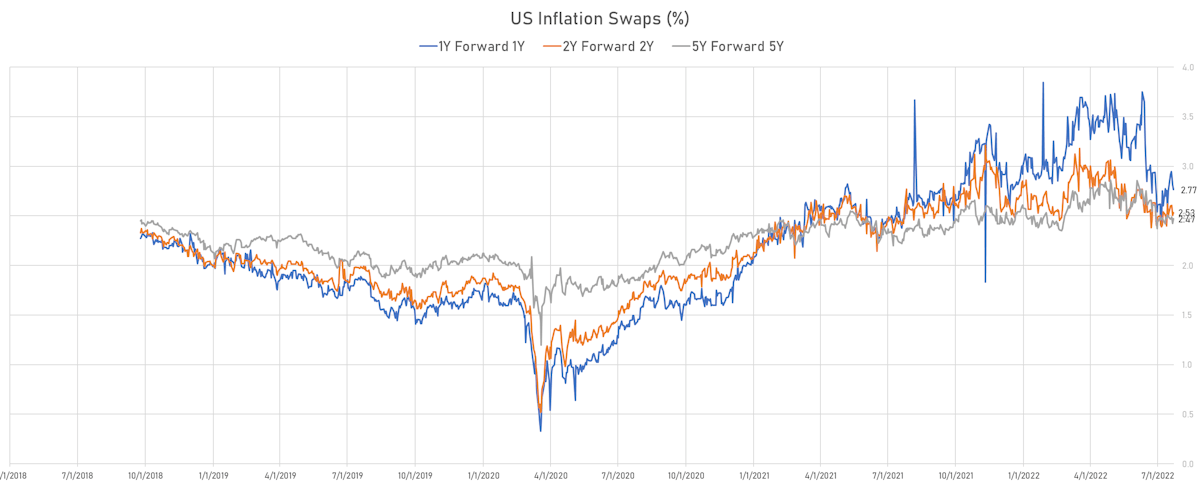

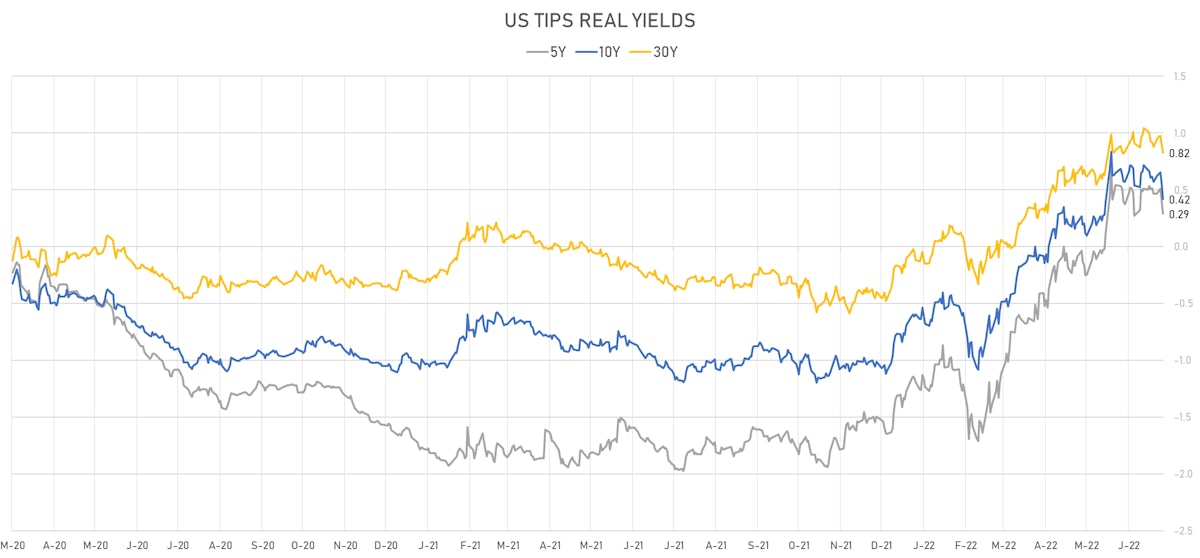

- TIPS 1Y breakeven inflation at 3.60% (up 10.9bp); 2Y at 3.15% (up 11.1bp); 5Y at 2.62% (up 0.8bp); 10Y at 2.27% (down -5.3bp); 30Y at 2.18% (down -6.0bp)

- US 5-Year TIPS Real Yield: -17.5 bp at 0.2900%; 10-Year TIPS Real Yield: -15.2 bp at 0.4160%; 30-Year TIPS Real Yield: -5.4 bp at 0.8240%

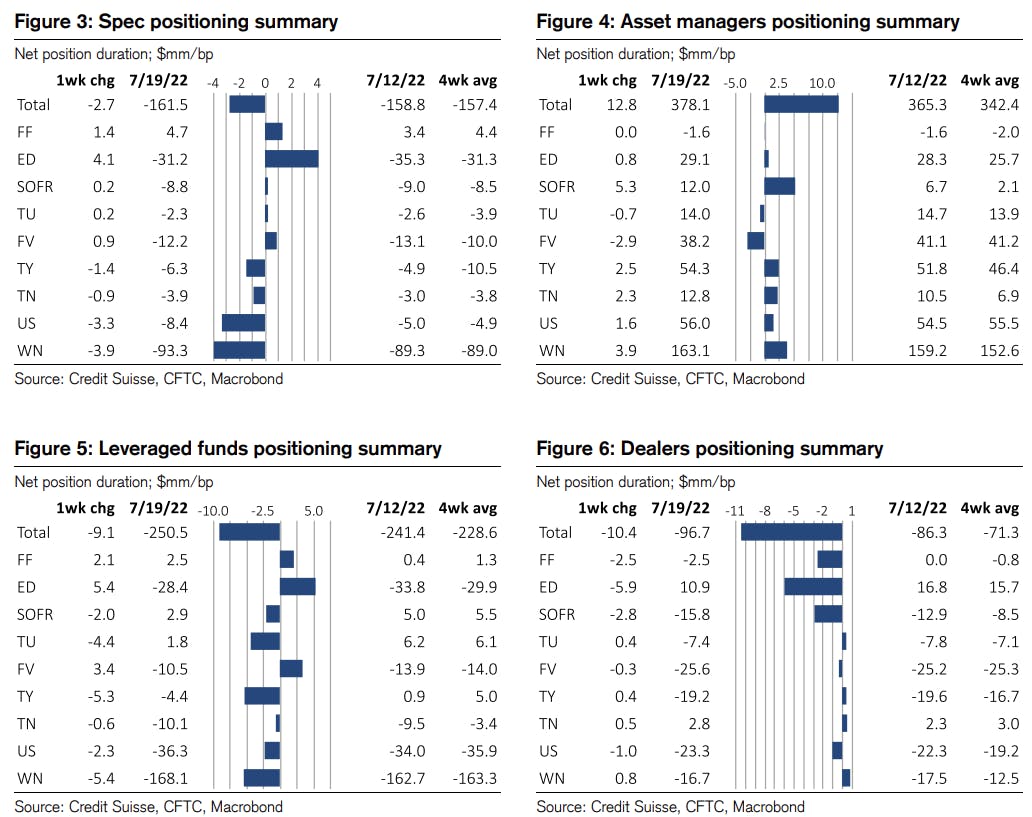

WEEKLY CFTC NET DURATION POSITIONING

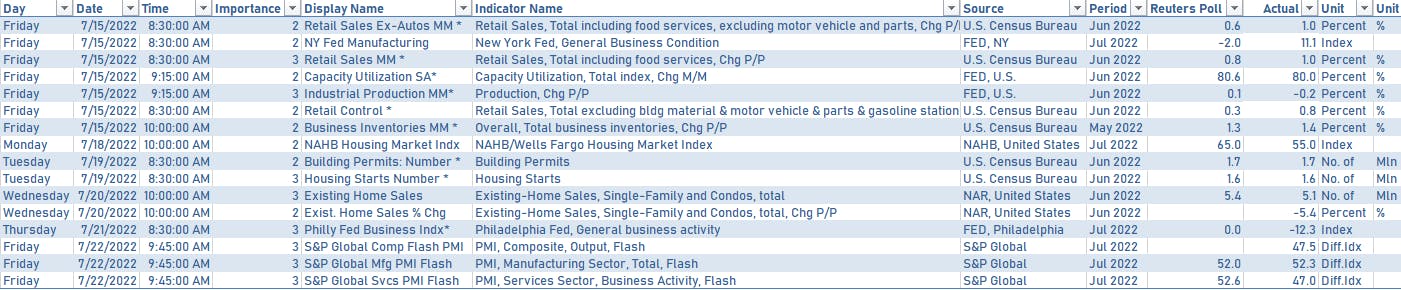

US MACRO RELEASES IN THE PAST WEEK

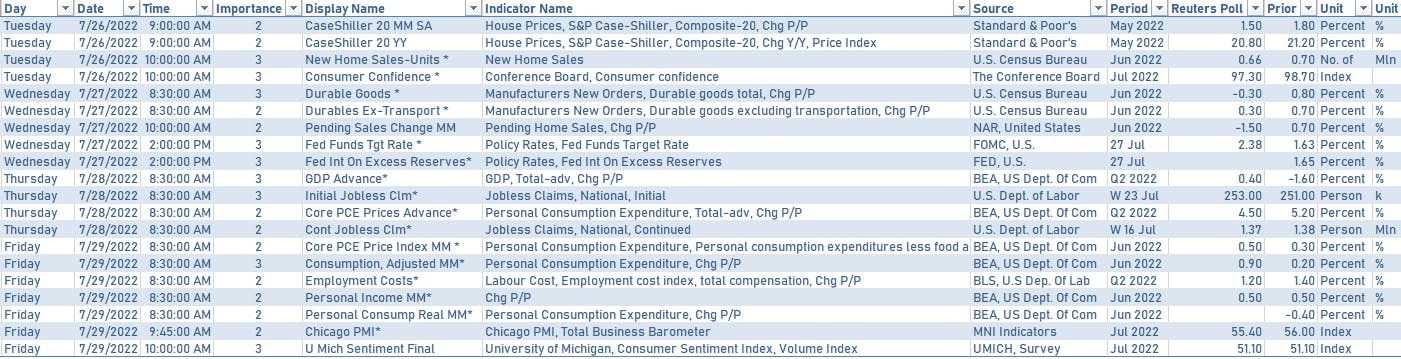

US MACRO RELEASES IN THE WEEK AHEAD

- The calendar this week is going to be quite busy, with the first estimate of Q2 GDP, the June personal income and spending data, as well as consumer confidence measures from the University of Michigan and the Conference Board

US TREASURY AUCTIONS IN THE WEEK AHEAD

- $45 bn in 2Y notes at 1:00PM on Monday

- $46 bn in 5Y notes at 1:00PM on Tuesday

- $24 bn in 2Y FRN at 11:30AM on Wednesday

- $38 bn in 7Y notes at 1:00PM on Thursday

US FORWARD RATES

- Fed Funds futures now price in 77.1bp of Fed hikes by the end of July 2022, 135.6bp (5.4 x 25bp hikes) by the end of September 2022, and price in 7.1 hikes by the end of December 2022

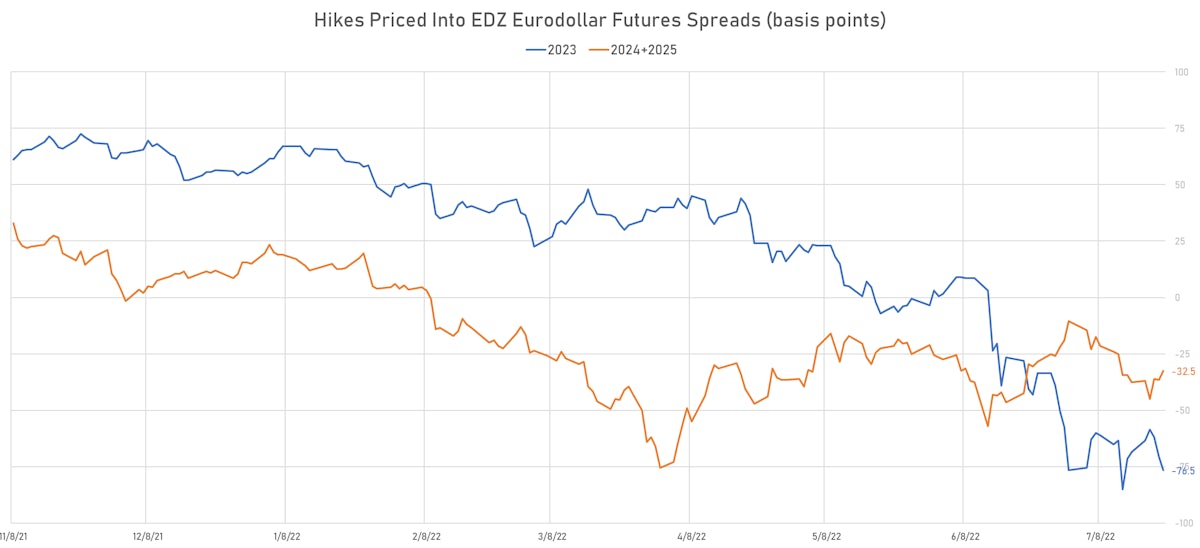

- 3-month Eurodollar futures (EDZ) spreads price in -76.5 bp of hikes in 2023 (equivalent to -3.1 x 25 bp hikes), down -6.0 bp today, and -35.0 bp of hikes in 2024 (equivalent to -1.4 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.60% (down -11.9bp); 2Y at 3.15% (down -5.1bp); 5Y at 2.62% (down -0.6bp); 10Y at 2.27% (down -0.1bp); 30Y at 2.18% (up 1.0bp)

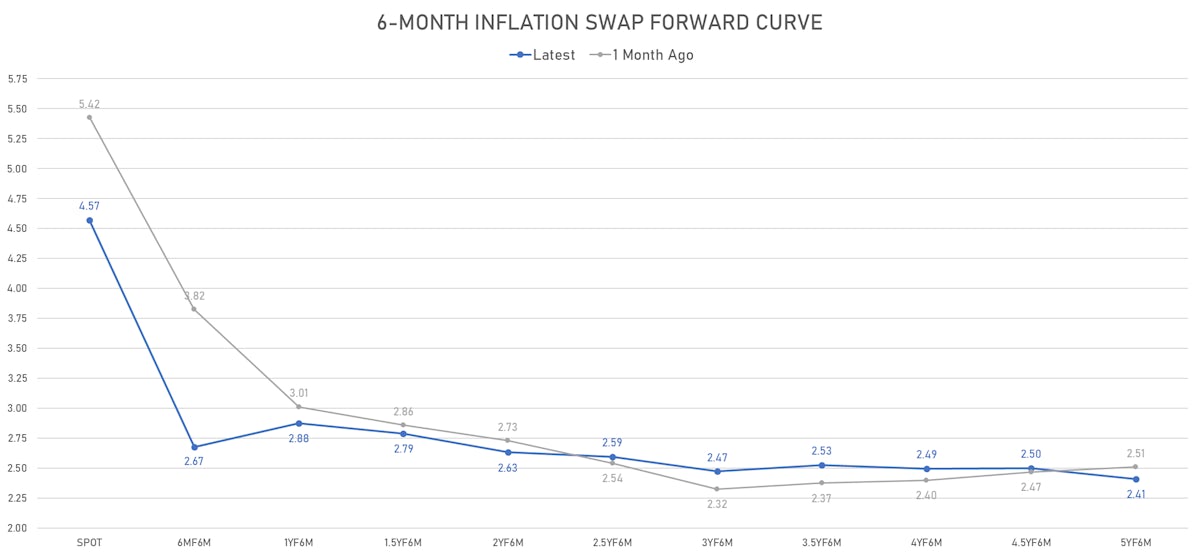

- 6-month spot US CPI swap down -1.9 bp to 4.568%, with a flattening of the forward curve

- US Real Rates: 5Y at 0.2900%, -13.4 bp today; 10Y at 0.4160%, -15.8 bp today; 30Y at 0.8240%, -8.5 bp today

RATES VOLATILITY & LIQUIDITY TODAY

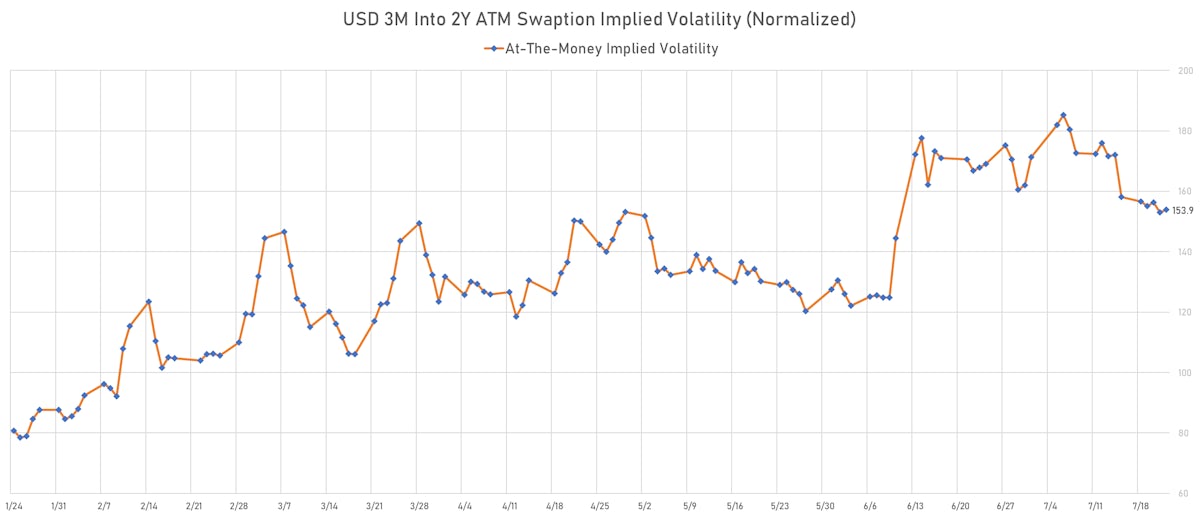

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 2.4 vols at 157.3 normals

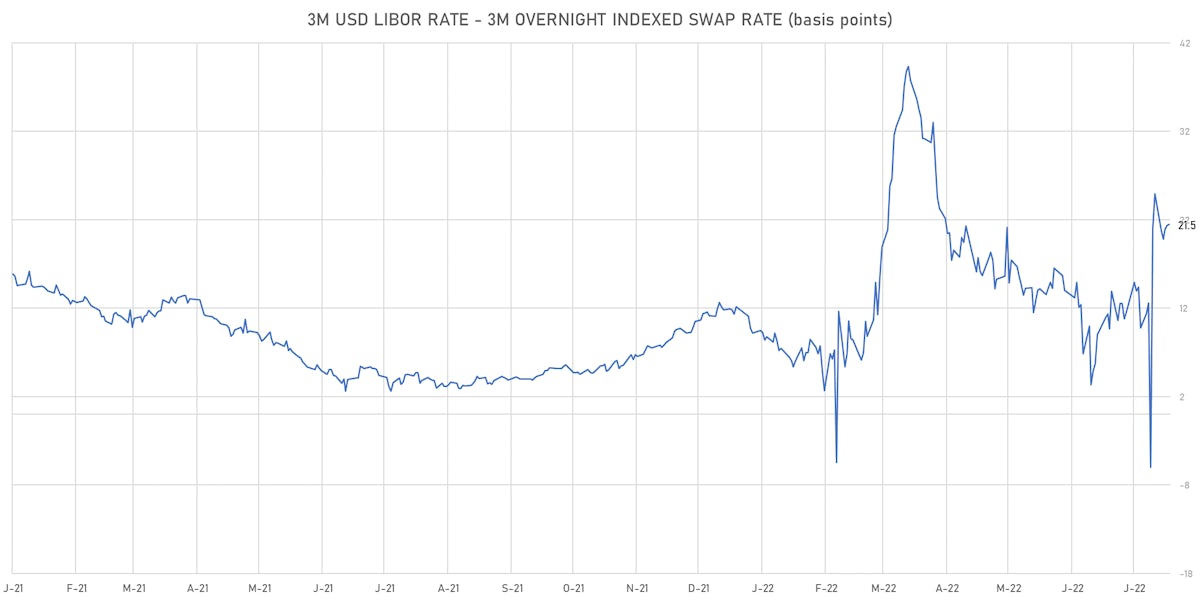

- 3-Month LIBOR-OIS spread up 0.1 bp at 21.5 bp (18-months range: -6.0 to 39.3 bp)

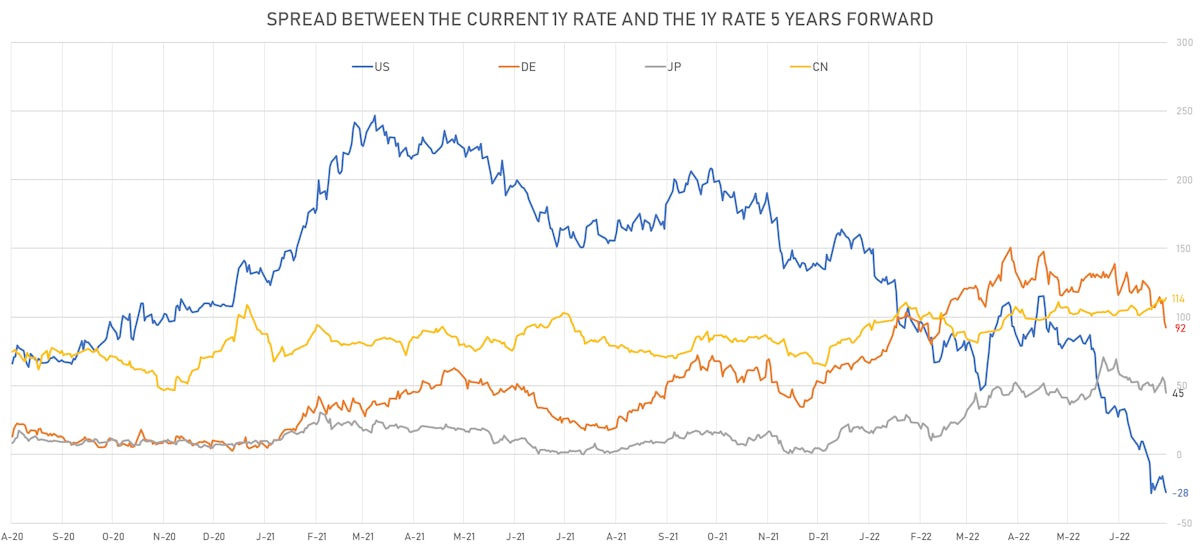

KEY INTERNATIONAL RATES

- Germany 5Y: 0.780% (down -27.0 bp); the German 1Y-10Y curve is 5.9 bp flatter at 63.6bp (YTD change: -43.0 bp)

- Japan 5Y: 0.010% (down -1.3 bp); the Japanese 1Y-10Y curve is 2.2 bp flatter at 36.0bp (YTD change: -15.8 bp)

- China 5Y: 2.545% (up 1.6 bp); the Chinese 1Y-10Y curve is 1.5 bp steeper at 103.5bp (YTD change: -50.0 bp)

- Switzerland 5Y: 0.316% (down -18.2 bp); the Swiss 1Y-10Y curve is 11.9 bp flatter at 10.1bp (YTD change: -56.4 bp)