Rates

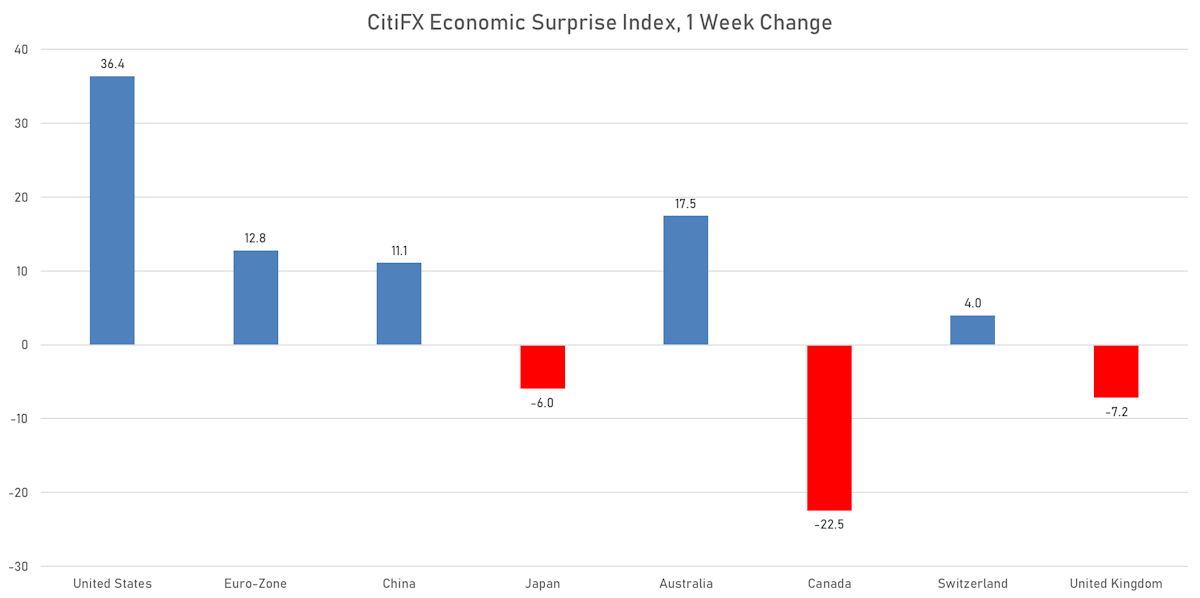

Very Strong Employment Data Lifts Yields And Flattens The Curve To End A Week Marked By Positive Economic Surprises

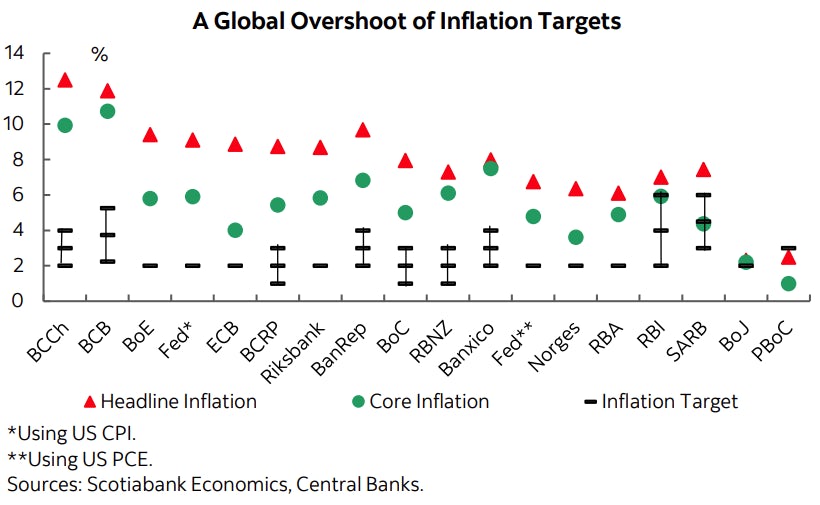

The narrative last week, driven by the Fed, of a possible recession and a pivot towards a more balanced policy fell on its face this week: economic data came in stronger than expected, which brought higher real yields on the realization that inflation is still very much the focal point

Published ET

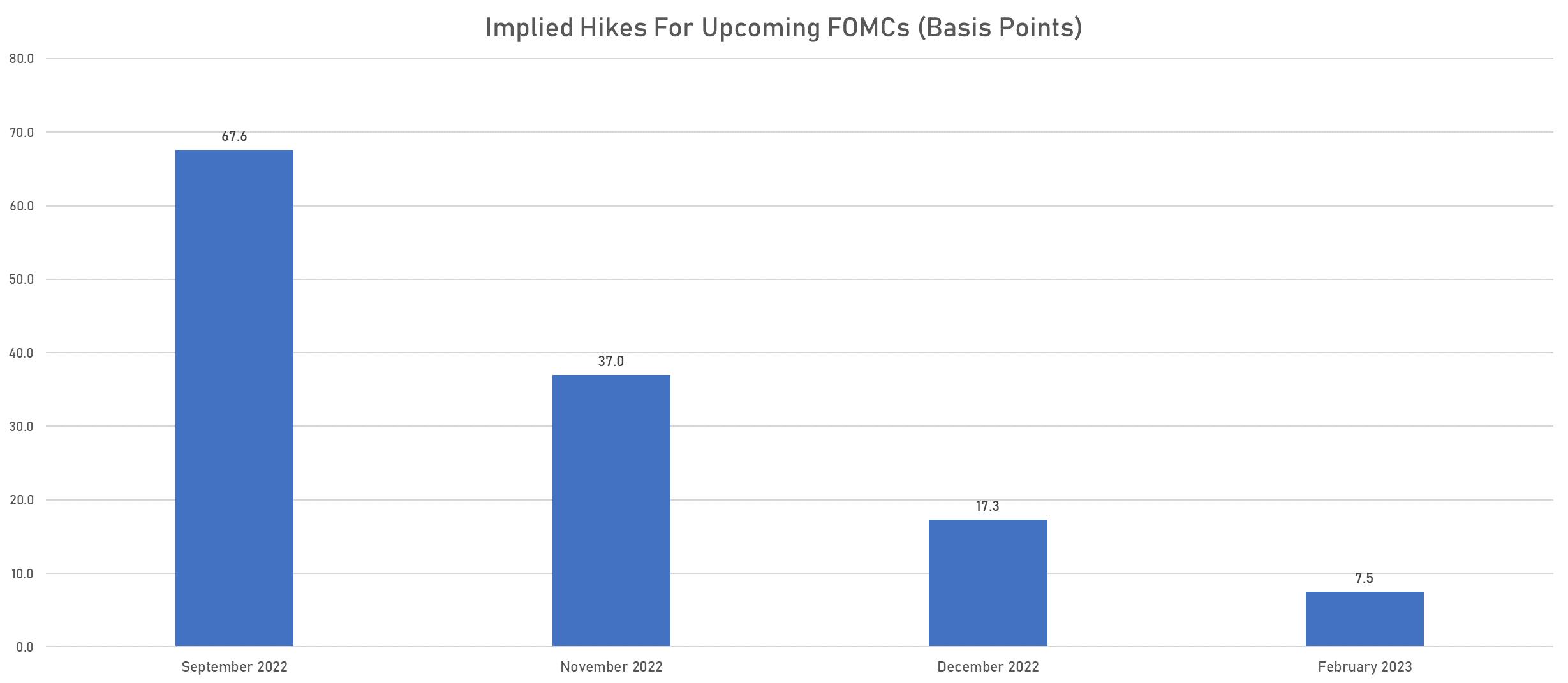

Rate Hikes Expected At The September FOMC (in basis points) | Source: Refinitiv

US RATES OUTLOOK

- The September FOMC pricing flipped this week, with now 70% probability of a 75bp hike. After the strong jobs report, JP Morgan said 75 bp in September "looks likely", while Goldman Sachs and Jefferies continue to see 50 bp as the most likely outcome.

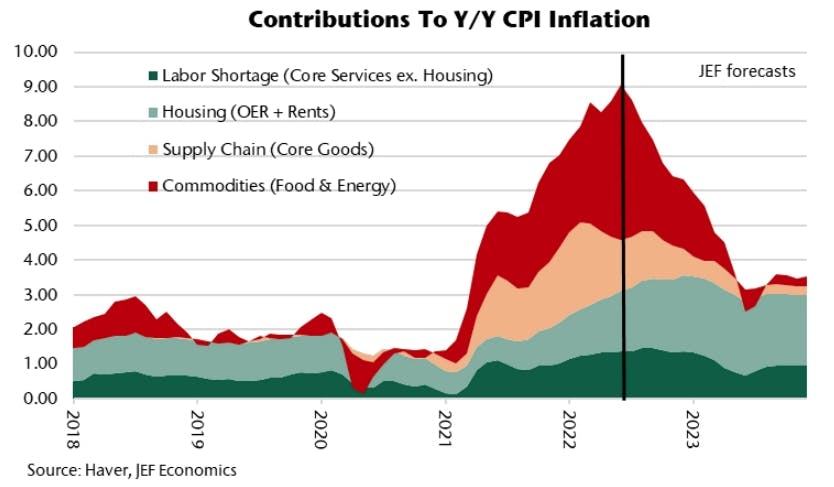

- Aneta Markowska (Jefferies): "To be clear, we still believe that there is a persistent component to inflation, stemming from housing and labor shortages, which will not be resolved any time soon. We expect these two forces to put a floor under core CPI around 4%. But, two other key sources of inflation - commodity prices and supply chain issues - are vanishing right in front of our eyes, and will cause headline inflation to slow sharply in the next 3-6 months. This should still allow the Fed to slow the pace of hikes to 50 bps at the September meeting. Admittedly, the risk of a 75 bp hike increased after the sizzling payroll report, but we see downside risk for next week's CPI, which should remove the urgency to move fast. A tight labor market argues for a higher terminal rate, but not necessarily for faster hikes. The decision to upsize the last two hikes was driven by rising inflation expectations, which have since moved down decisively. Given the sharp declines in energy prices, it is unlikely that expectations move up again."

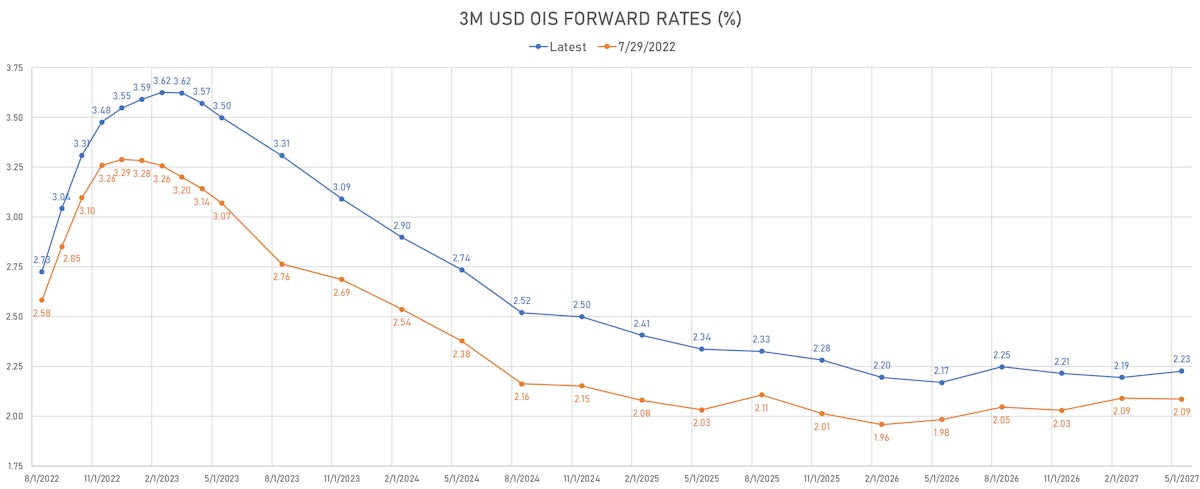

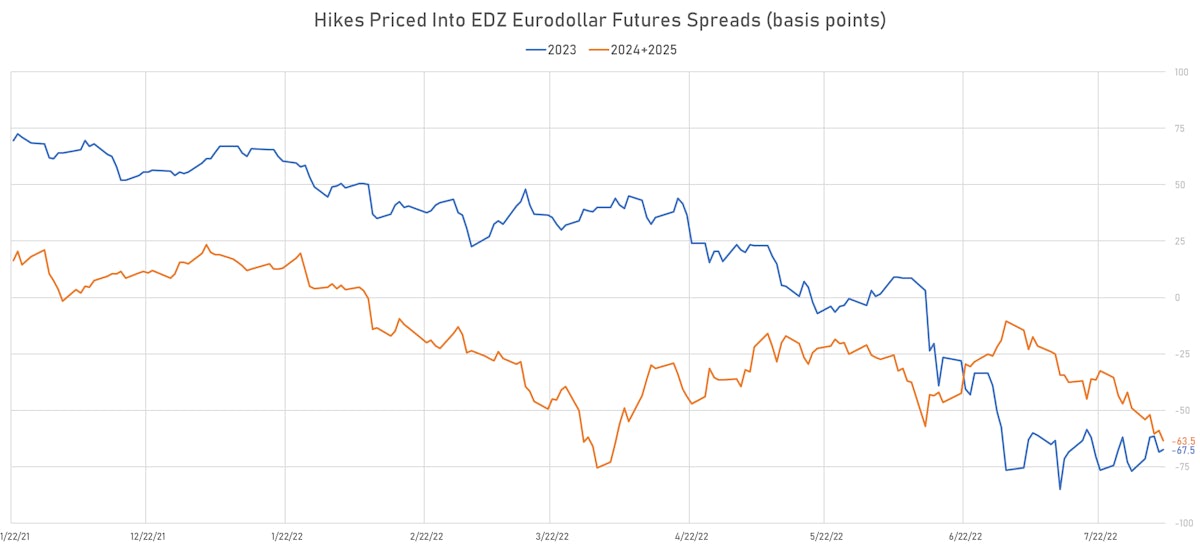

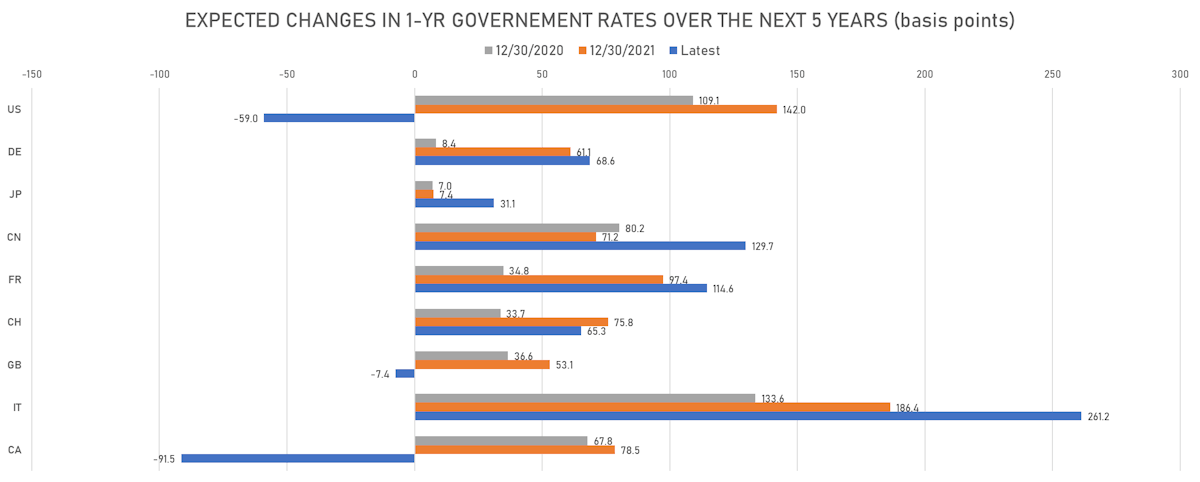

- The 2023 forward curve inversion continues to puzzle us (and many other market participants) considering how high inflation is, and how unlikely the Fed is to cut rates next year (especially in the first half). More a view about spreads than outrights.

- In preparation for the CPI print next week, a comment from Wells Fargo: "The 2Y note’s betas top 5bp per 0.1% miss in core CPI for the first time in years. The high betas poise the front end for a very choppy day if the consensus is off the mark again."

RECENT FED COMMUNICATION HAS BEEN EXTREMELY CONFUSING

- Post-FOMC Jay Powell (27 July): "Now we are at neutral, at some point it will be appropriate to slow down"

- 29 July: Larry Summers (not a Fed member) dunks on Powell's neutral talk, calling it "analytically indefensible. There is no conceivable way that a 2.5% interest rate, in an economy inflating like this, is anywhere near neutral."

- Mary Daly (August 2): "We're not even up to neutral right now," she said on a Twitter talk with Reuters, saying the short-run neutral rate is different from the FOMC's views on the long-run rate around 2.5%.

- James Bullard (August 3) “We still have some ways to go here to get to restrictive monetary policy.”

- Loretta Mester (August 4) “Rates continue to rise this year and into next year, through the first half and maybe by then we pause and then we can start bringing them back down. But it’s very hard to project out that far.”

- Adding to the confusion were the regular leaks to the Wall Street Journal, as if that was an appropriate way to provide policy guidance.

- At this point, it might be worth asking whether the Fed should just stop talking: no communication would be more effective than the illogical and disjointed recent utterances of its members

WEEKLY US RATES SUMMARY

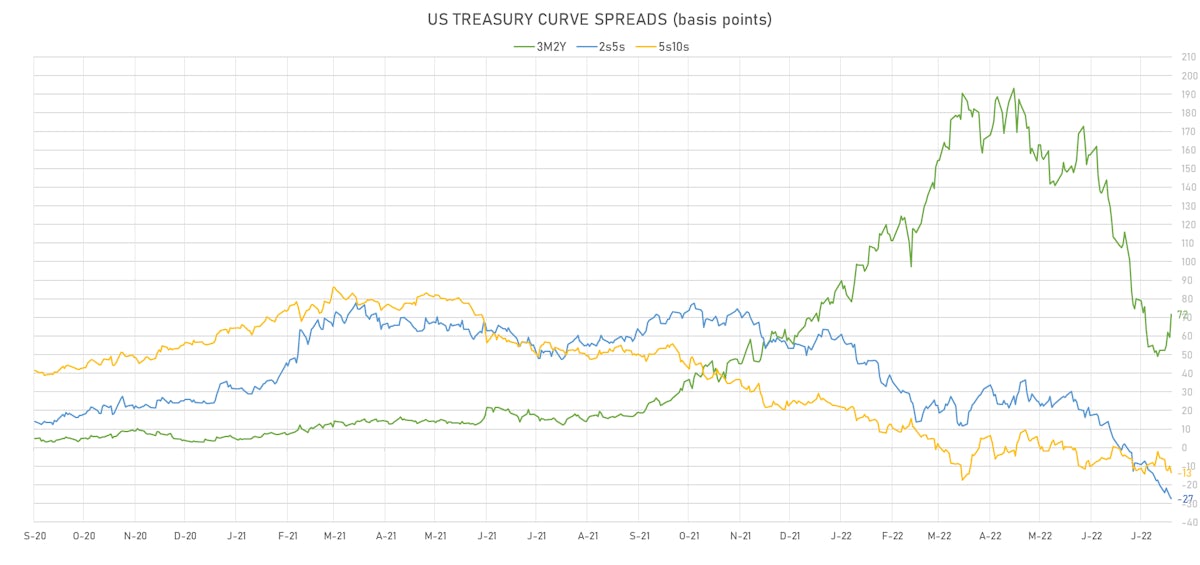

- The treasury yield curve flattened, with the 1s10s spread tightening -12.9 bp, now at -42.0 bp (YTD change: -155.2bp)

- 1Y: 3.2456% (up 29.8 bp)

- 2Y: 3.2278% (up 33.9 bp)

- 5Y: 2.9564% (up 27.6 bp)

- 7Y: 2.9001% (up 21.2 bp)

- 10Y: 2.8259% (up 16.9 bp)

- 30Y: 3.0658% (up 5.5 bp)

- US treasury curve spreads: 3m2Y at 68.3bp (up 17.3bp this week), 2s5s at -27.1bp (down -6.3bp), 5s10s at -13.1bp (down -10.7bp), 10s30s at 24.0bp (down -11.3bp)

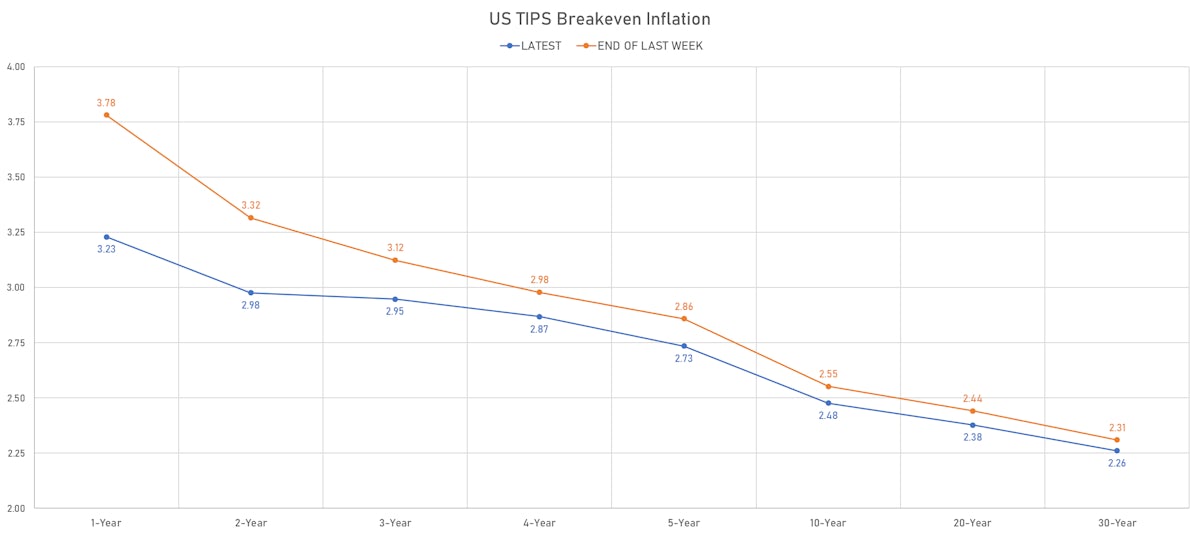

- TIPS 1Y breakeven inflation at 3.23% (down -55.1bp); 2Y at 2.98% (down -34.0bp); 5Y at 2.73% (down -12.4bp); 10Y at 2.48% (down -7.6bp); 30Y at 2.26% (down -4.9bp)

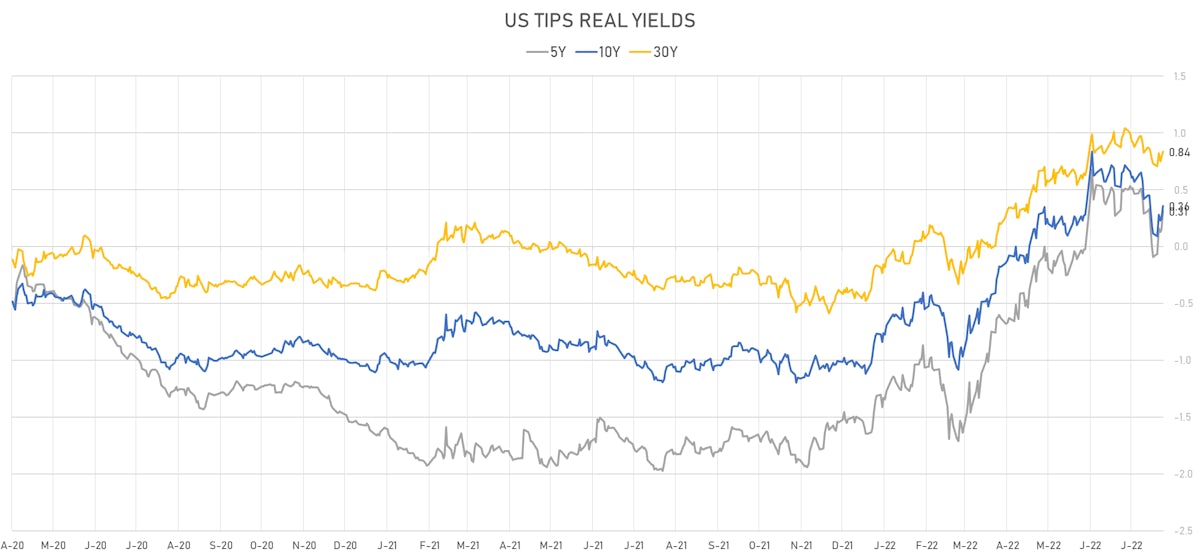

- US 5-Year TIPS Real Yield: +40.2 bp at 0.3120%; 10-Year TIPS Real Yield: +24.4 bp at 0.3580%; 30-Year TIPS Real Yield: +10.6 bp at 0.8370%

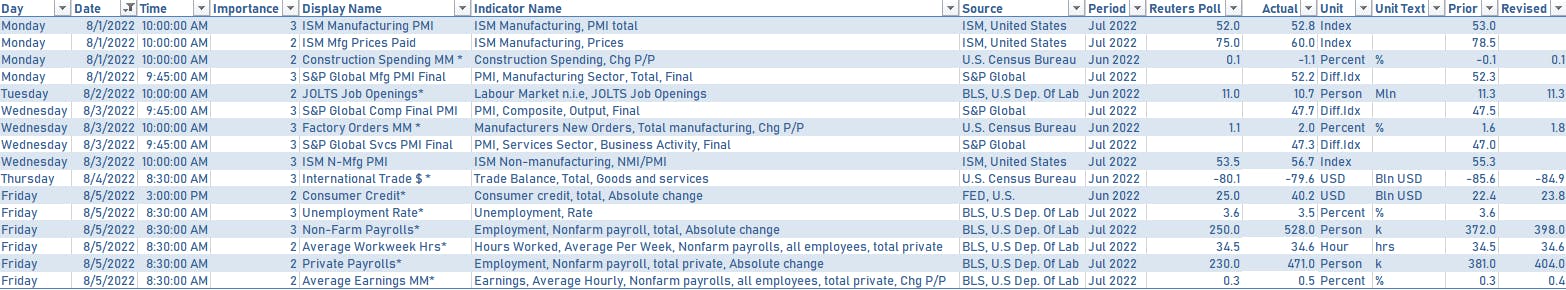

US DATA RELEASES IN THE PAST WEEK

FED SPEAKERS IN THE WEEK AHEAD

- Wednesday 11:00AM: Chicago Fed President Evans will discuss the economic and monetary policy outlook during an event at Drake University in Des Moines, IA.

- Wednesday 2:00PM: Minneapolis Fed President Kashkari will take part in a discussion on whether the US is headed for stagflation hosted by the Aspen Economic Strategy Group.

- Thursday 7:30PM: San Francisco Fed President Daly will speak in an interview on Bloomberg Television.

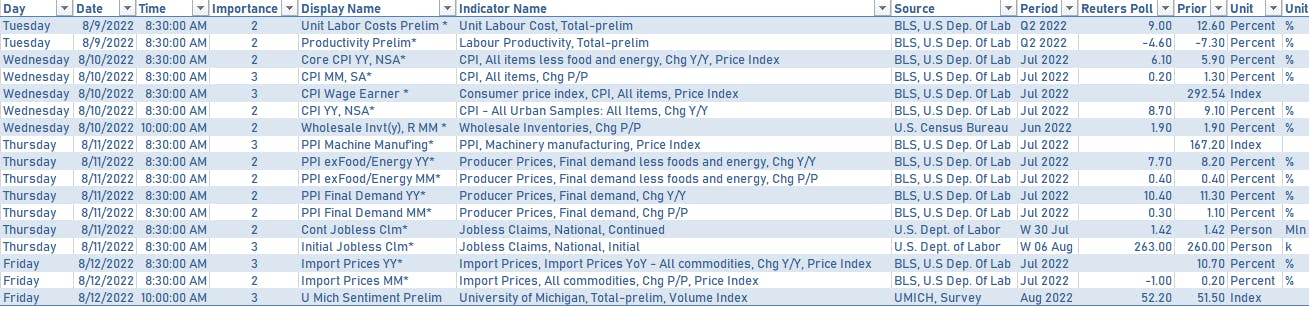

US DATA RELEASES IN THE WEEK AHEAD

- The market focus next week will be on July CPI and August University of Michigan sentiment

- Credit Suisse comment on the CPI: "a report in-line with our estimate, especially with some goods inflation slowdown, should help solidify the forecast that core inflation has peaked. There will be another CPI report ahead of the September FOMC meeting, but without another upside surprise, the case for a 50bp rate hike (vs. 75bp) should be stronger."

US TREASURY AUCTIONS IN THE WEEK AHEAD

- Tuesday: $42 bn in 3Y notes

- Wednesday: $35 bn in 10Y notes

- Thursday: $21 bn in 30Y bonds

- Total of $98 bn, with $43.9 bn in new cash

US FORWARD RATES

- Fed Funds futures now price in 67.6bp of Fed hikes by the end of September 2022, 104.6bp (4.2 x 25bp hikes) by the end of November 2022, and 4.9 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 67.5 bp of rate cuts in 2023 (equivalent to 2.7 x 25 bp cuts), down 1.0 bp today, and 48.5 bp of cuts in 2024 (equivalent to 1.9 x 25 bp cuts)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 3.23% (down -13.0bp); 2Y at 2.98% (down -5.0bp); 5Y at 2.73% (down -0.4bp); 10Y at 2.48% (up 2.0bp); 30Y at 2.26% (up 3.5bp)

- 6-month spot US CPI swap down -3.8 bp to 4.827%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.3120%, +16.5 bp today; 10Y at 0.3580%, +11.4 bp today; 30Y at 0.8370%, +5.4 bp today

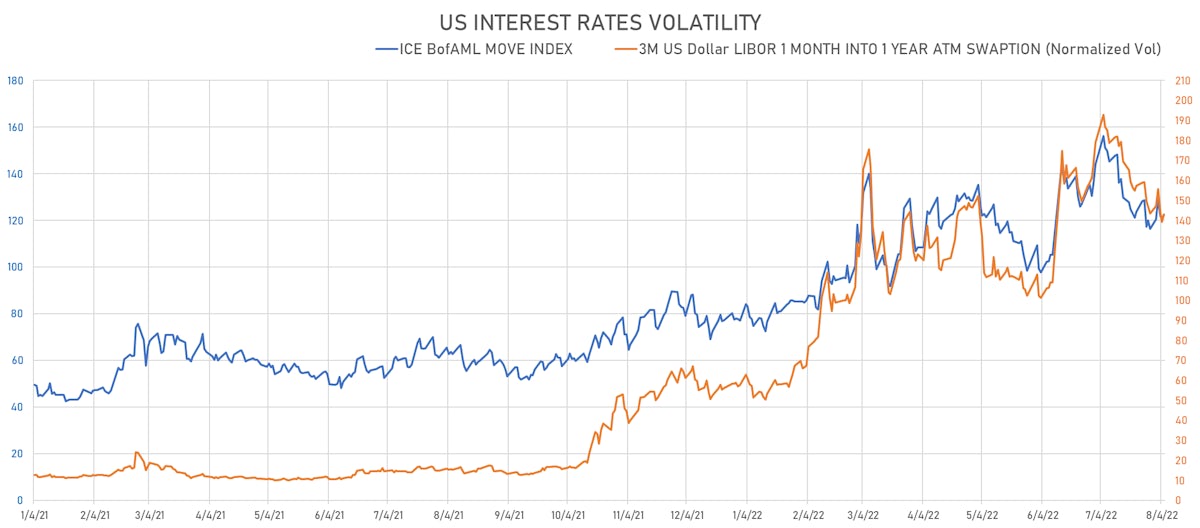

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.6 vols at 142.8 normals

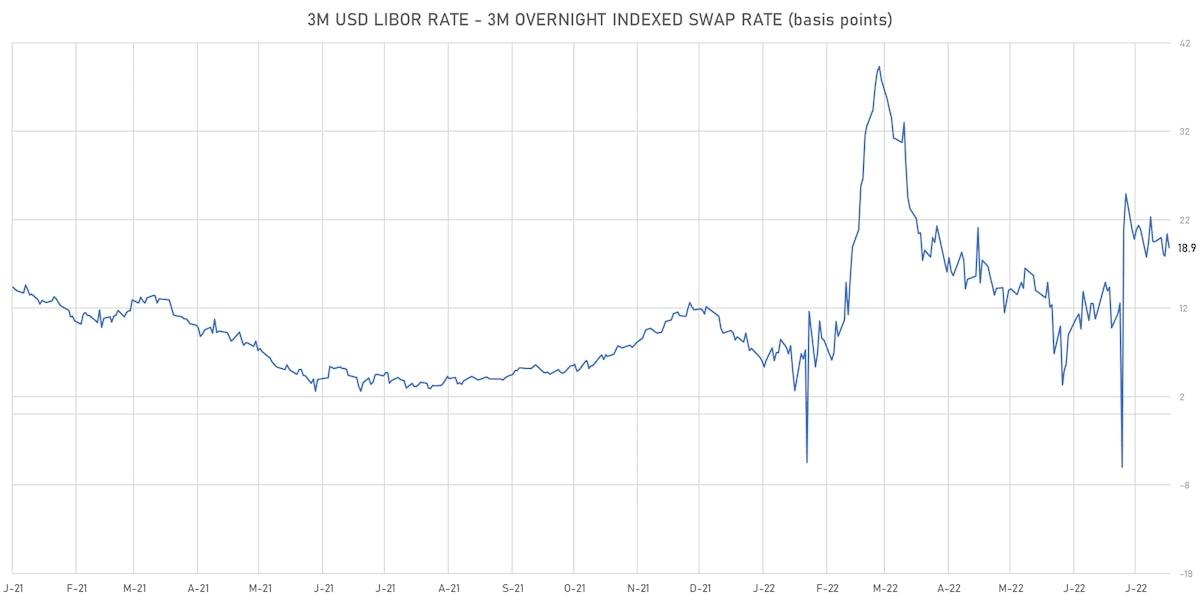

- 3-Month LIBOR-OIS spread down -1.5 bp at 18.9 bp (18-months range: -6.0 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.709% (up 17.0 bp); the German 1Y-10Y curve is 8.1 bp steeper at 48.9bp (YTD change: -43.1 bp)

- Japan 5Y: -0.033% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 30.9bp (YTD change: -15.9 bp)

- China 5Y: 2.470% (up 3.2 bp); the Chinese 1Y-10Y curve is 1.1 bp flatter at 115.3bp (YTD change: -49.8 bp)

- Switzerland 5Y: 0.313% (up 14.8 bp); the Swiss 1Y-10Y curve is 14.1 bp steeper at -5.8bp (YTD change: -56.6 bp)