Rates

Breakevens Keep Falling At The Front End Of The Curve, But UMich Long-Run Inflation Expectations Tick Higher

The much-improved market sentiment and rallies in risky assets are unwinding some of the tightening in financial conditions, an unwelcome development if the Fed wants to win the fight against inflation

Published ET

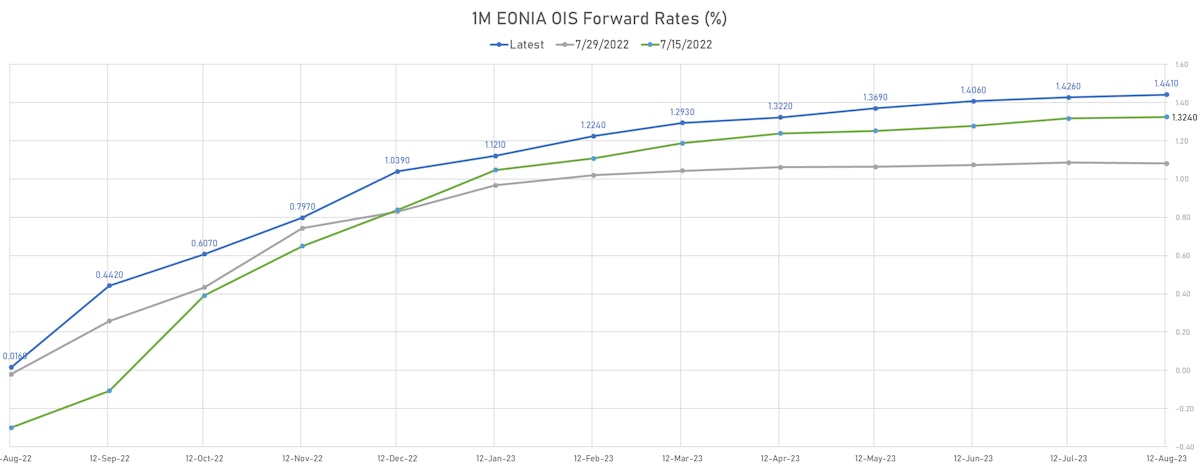

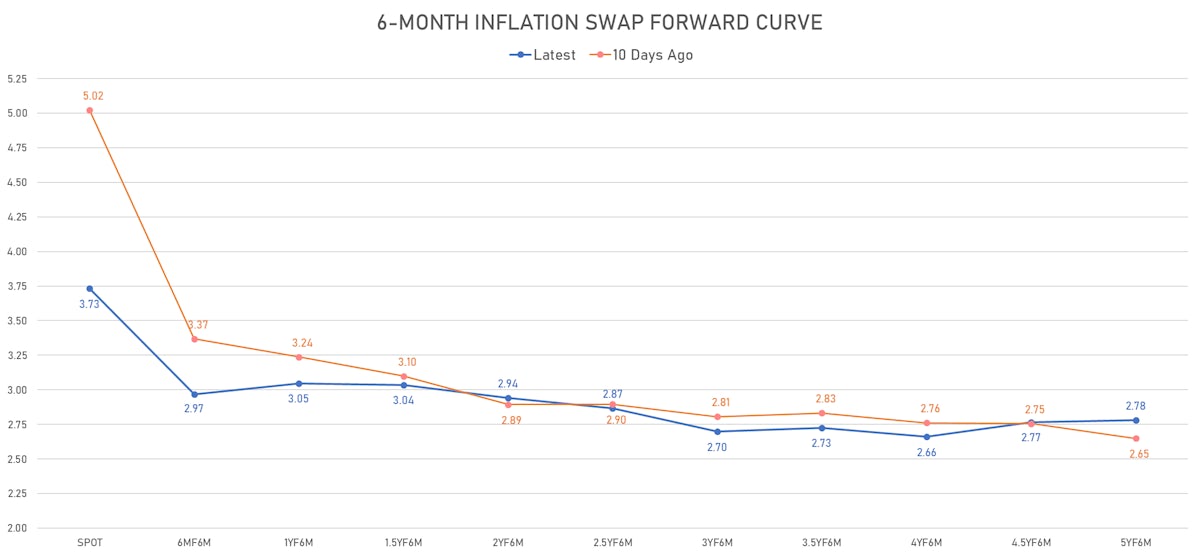

US CPI 6-Month Inflation Swap Forward Curve | Sources: ϕpost, Refinitiv data

US OUTLOOK

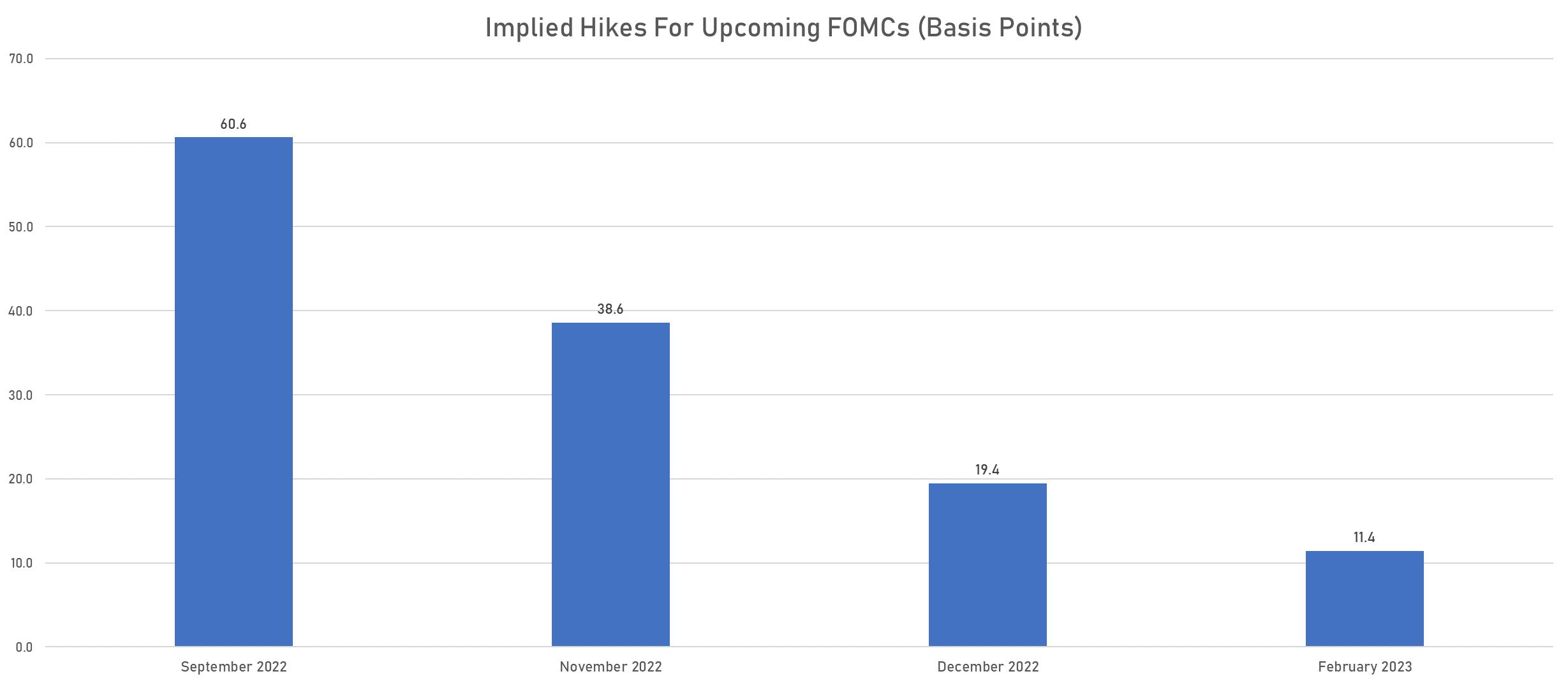

- It's too early to tell whether the Fed will choose another 75 bp hike in September or slow to a 50 bp pace: the market is currently leaning towards 50bp (with a 58% probability), but the decision will depend on the August employment and CPI data to be released next month

- Goldman Sachs, Jefferies still favor 50bp, while Wells Fargo sees 75bp, but it's close to a toss-up at this point

- The rebound in risk assets puts the market in a Goldilocks phase, marked by a decline in both deflationary fears and recession concerns.

- But that is leading to looser financial conditions, which is the opposite of what the Fed wants

- While inflation expectations still seem well anchored, the University of Michigan's long-run inflation expectations index ticked up to 3.0% today (from 2.9%)

- In this context, the Fed cannot let financial conditions get looser until inflation really comes down, meaning they will need to step in and tighten FCIs again: higher rates, wider credit spreads and lower equities ahead

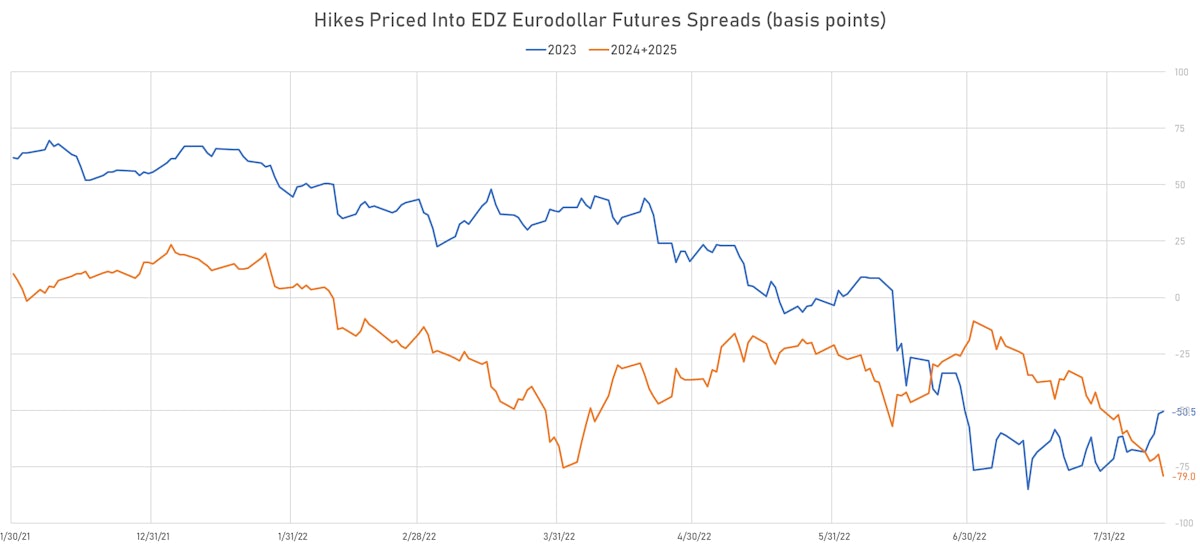

- We continue to see EDZ3-Z2 spread as a good buy, with the inversion still overdone despite the 18bp move this week: the Fed is unlikely to cut rates by 50p next year while core inflation remains well above its target range (with weak productivity growth + a strong labor market)

WEEKLY US RATES SUMMARY

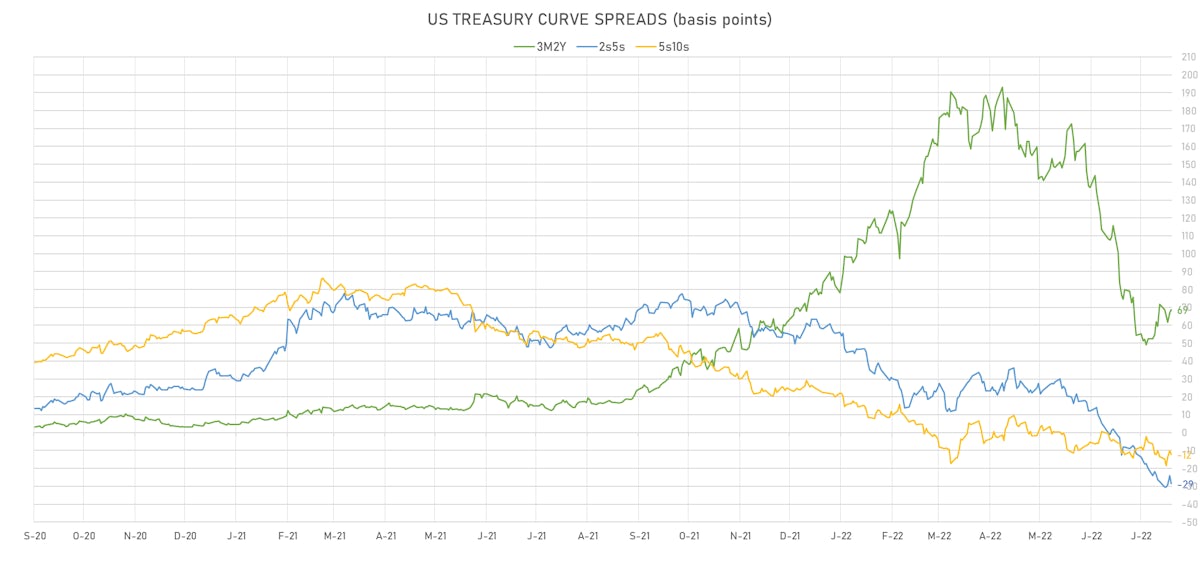

- The treasury yield curve steepened modestly, with the 1s10s spread widening 1.3 bp, now at -40.7 bp (YTD change: -153.9bp)

- 1Y: 3.2473% (up 0.2 bp)

- 2Y: 3.2484% (up 2.1 bp)

- 5Y: 2.9630% (up 0.7 bp)

- 7Y: 2.9126% (up 1.3 bp)

- 10Y: 2.8403% (up 1.4 bp)

- 30Y: 3.1135% (up 4.8 bp)

- US treasury curve spreads: 3m2Y at 68.3bp (unchanged, 2s5s at -28.5bp (down -1.5bp), 5s10s at -12.3bp (up 0.6bp), 10s30s at 27.3bp (up 3.2bp)

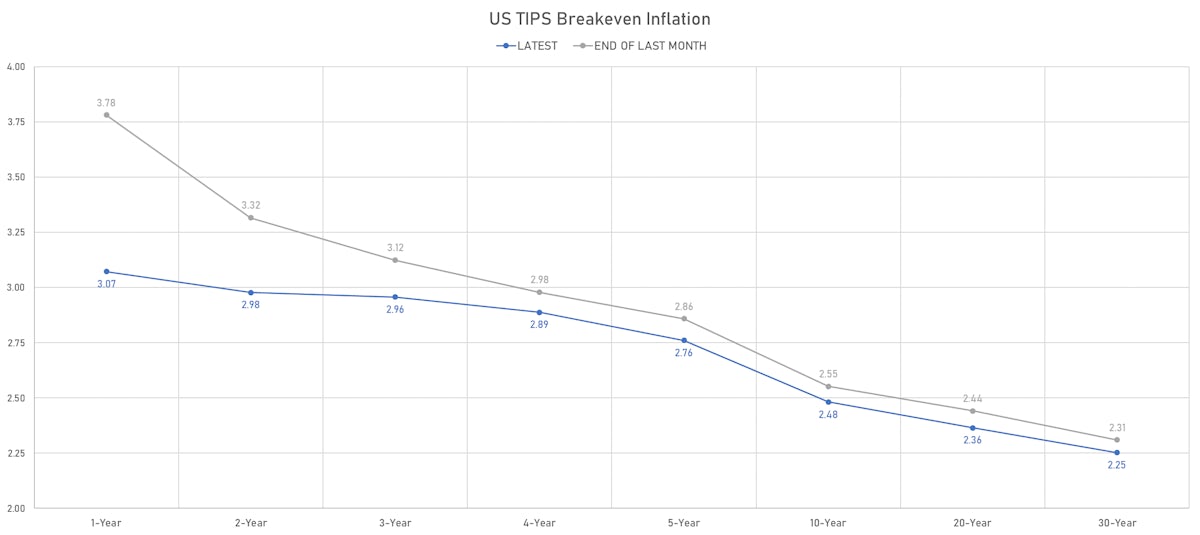

- TIPS 1Y breakeven inflation at 3.07% (down -15.8bp); 2Y at 2.98% (up 0.1bp); 5Y at 2.76% (up 2.6bp); 10Y at 2.48% (up 0.5bp); 30Y at 2.25% (down -0.8bp)

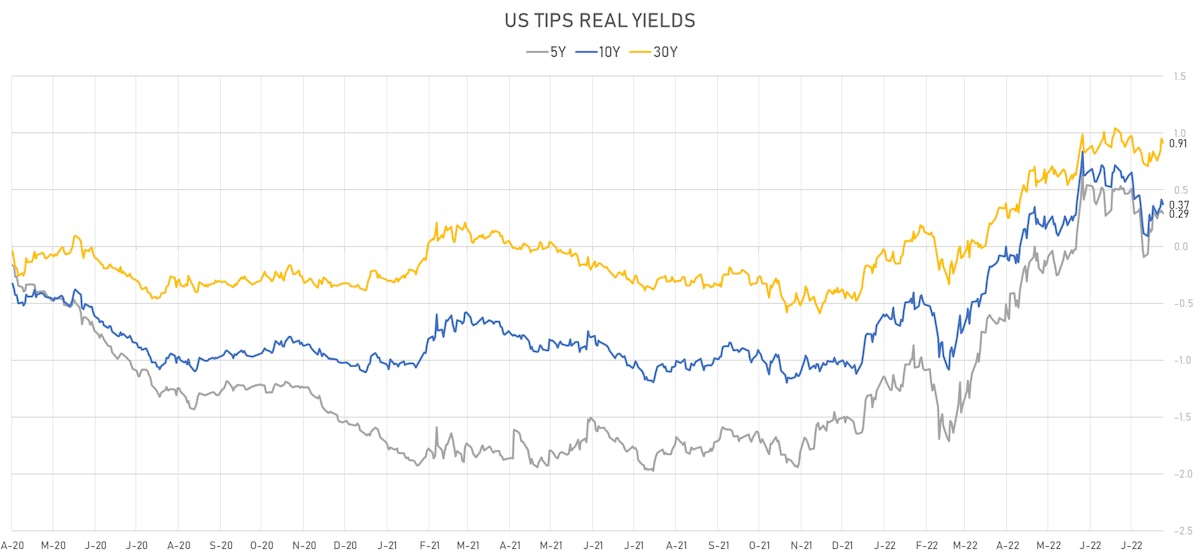

- US 5-Year TIPS Real Yield: -2.0 bp at 0.2920%; 10-Year TIPS Real Yield: +1.2 bp at 0.3700%; 30-Year TIPS Real Yield: +7.4 bp at 0.9110%

US MACRO RELEASES IN THE PAST WEEK

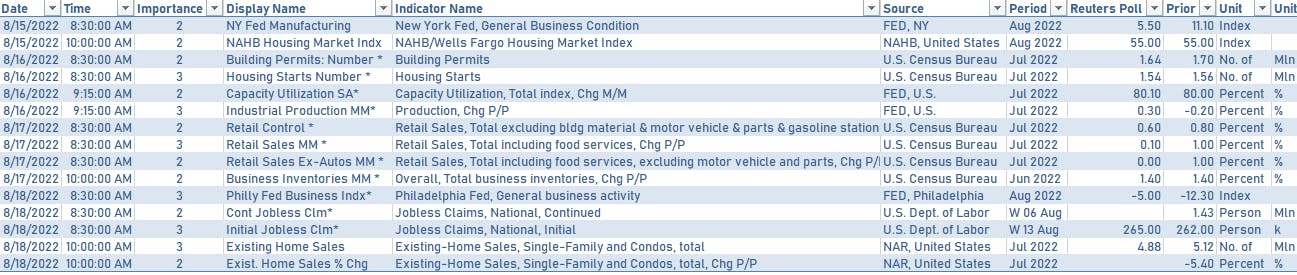

US MACRO RELEASES IN THE WEEK AHEAD

- The market focus next week will be on July retail sales, industrial production, housing data, as well as the minutes from the July FOMC meeting

FED SPEAKERS NEXT WEEK

- Thursday 1:20PM: Kansas City Fed President George

- Thursday 1:45PM: Minneapolis Fed President Kashkari

- Friday 9:00AM: Richmond Fed President Barkin

US TREASURY COUPON-BEARING AUCTIONS NEXT WEEK

- Wednesday 17 August: $15bn in 20Y bonds (prior stop at 3.420%, current bid on when-issued at 3.326%)

- Thursday 18 August: $8bn 30Y TIPS reopening (prior stop at 0.195%)

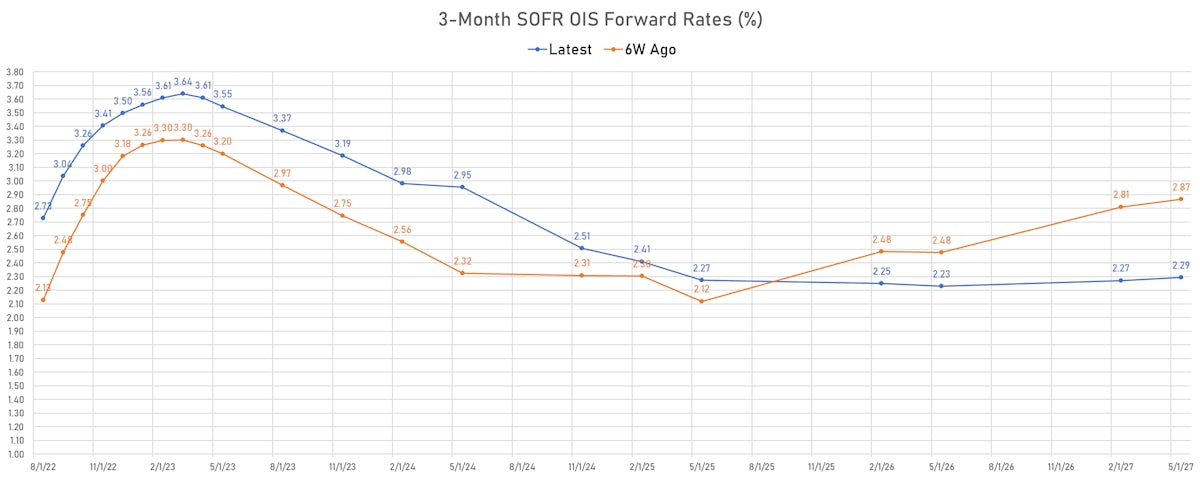

US FORWARD RATES

- Fed Funds futures now price in 60.6bp of Fed hikes by the end of September 2022, 99.2bp (4.0 x 25bp hikes) by the end of November 2022, and 4.7 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 50.5 bp of rate cuts in 2023 (equivalent to 2.0 x 25 bp cuts), up 1.0 bp today, and 59.5 bp of cuts in 2024 (equivalent to 2.4 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.07% (down -10.0bp); 2Y at 2.98% (up 3.2bp); 5Y at 2.76% (down -0.2bp); 10Y at 2.48% (down -0.4bp); 30Y at 2.25% (down -1.4bp)

- 6-month spot US CPI swap down -0.7 bp to 3.733%, with a flattening of the forward curve

- US Real Rates: 5Y at 0.2920%, -2.3 bp today; 10Y at 0.3700%, -4.3 bp today; 30Y at 0.9110%, -3.7 bp today

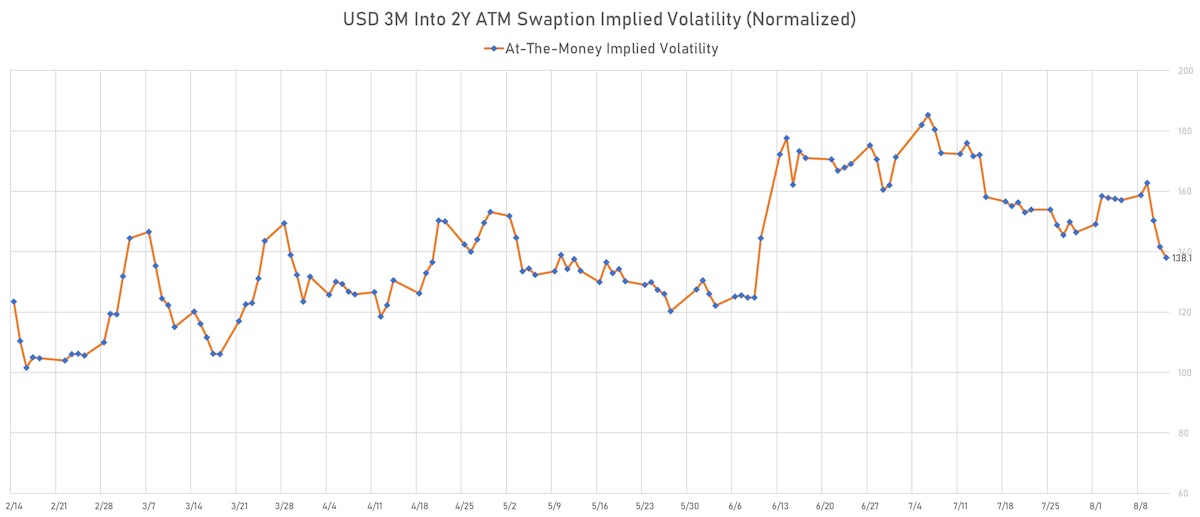

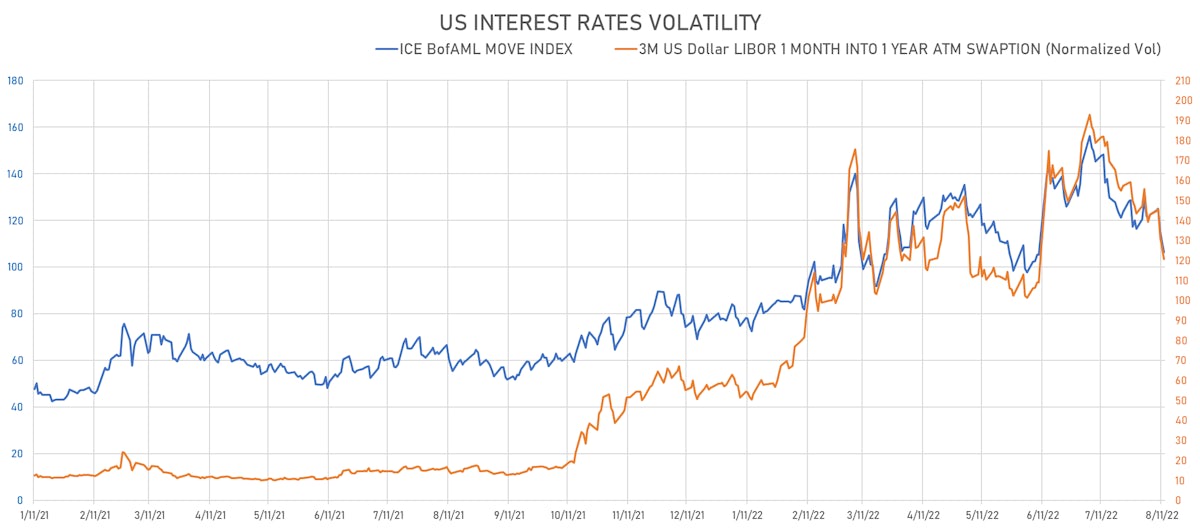

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.5 vols at 120.6 normals

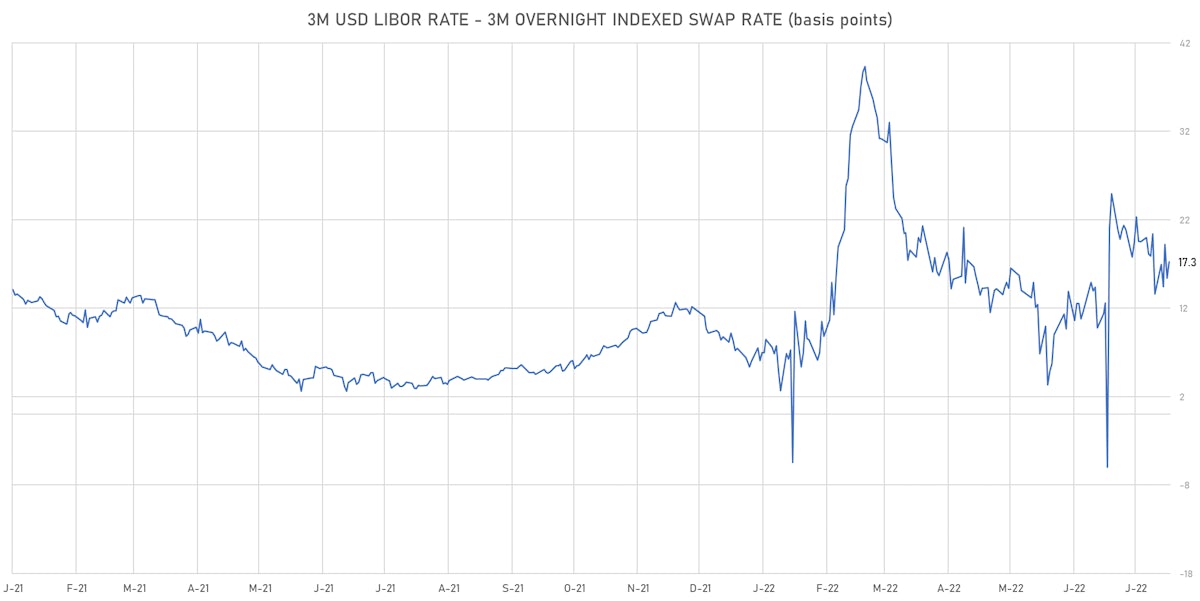

- 3-Month LIBOR-OIS spread up 1.9 bp at 17.3 bp (18-months range: -6.0 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 0.751% (up 3.9 bp); the German 1Y-10Y curve is 0.9 bp steeper at 52.2bp (YTD change: -43.1 bp)

- Japan 5Y: -0.001% (up 0.6 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 32.3bp (YTD change: -15.9 bp)

- China 5Y: 2.488% (down -0.1 bp); the Chinese 1Y-10Y curve is 1.4 bp steeper at 90.3bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.285% (down -0.2 bp); the Swiss 1Y-10Y curve is 0.7 bp flatter at -14.7bp (YTD change: -56.6 bp)