Rates

Jackson Hole Leads To Hawkish Repricing At The Front End, But Market Still Expects Rate Cuts Next Year

The clarity and brevity of Powell's speech were definite positives, but the Fed continues to place perhaps undue importance on monthly volatile data points to chart its course, when short-term real rates remain far from restrictive

Published ET

Historical Pricing of Hikes (in basis points) at the September 2022 FOMC | Source: Refinitiv

US OUTLOOK

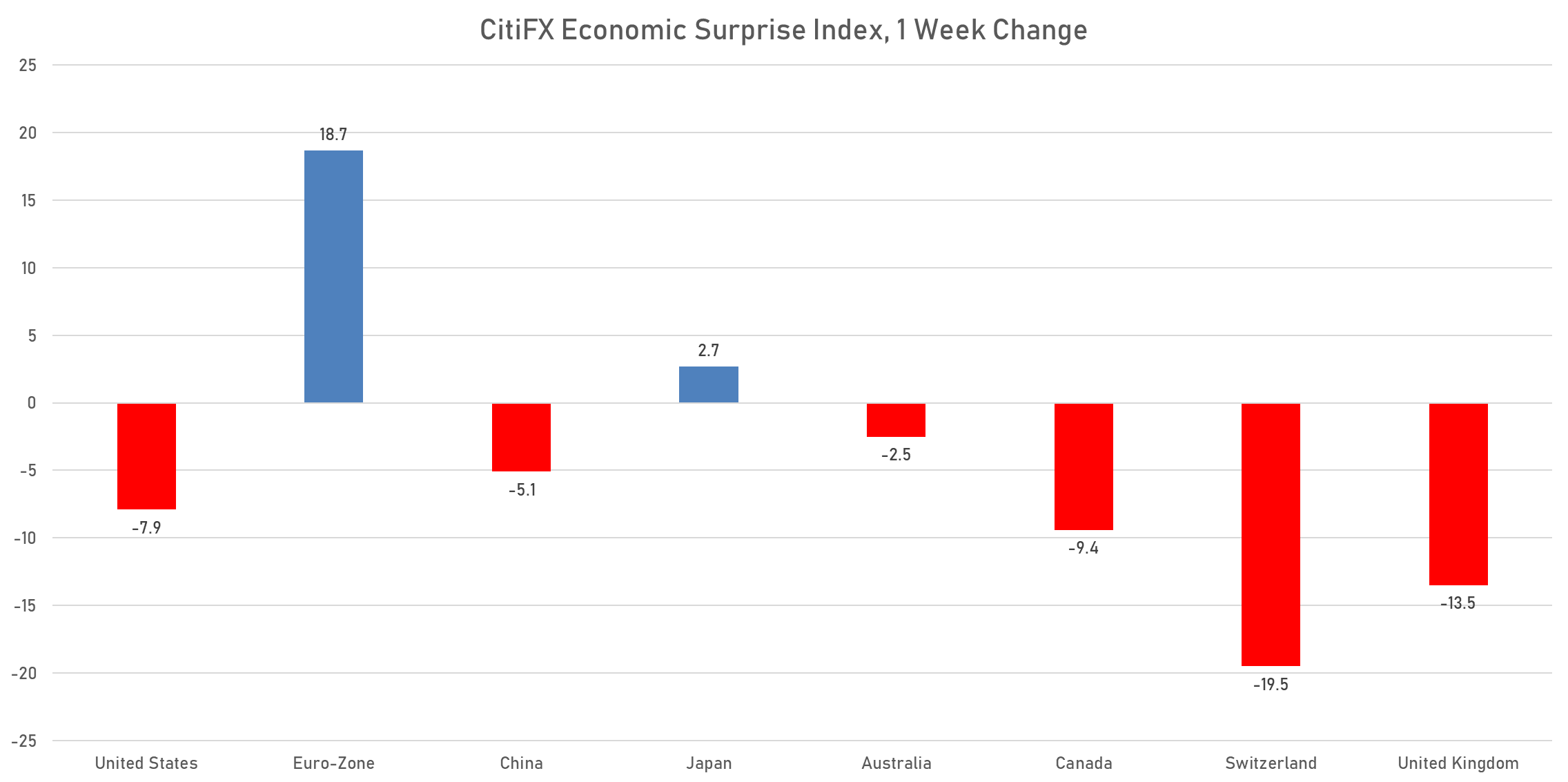

- US economic surprises this week were mostly on the negative side, with the Atlanta Fed Q3 GDPNow at 1.4% on August 24, down from 1.6% on August 17 and 2.5% on August 10

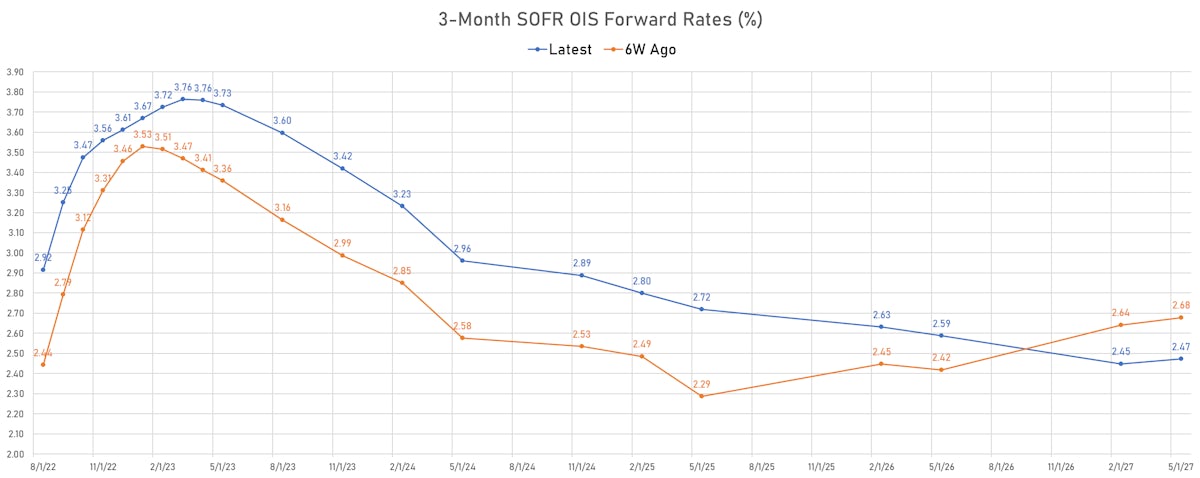

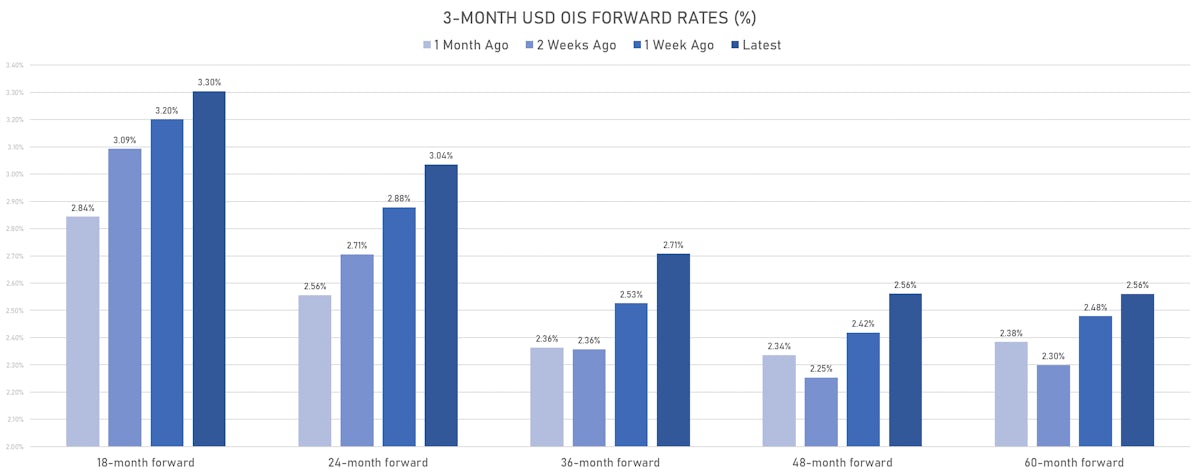

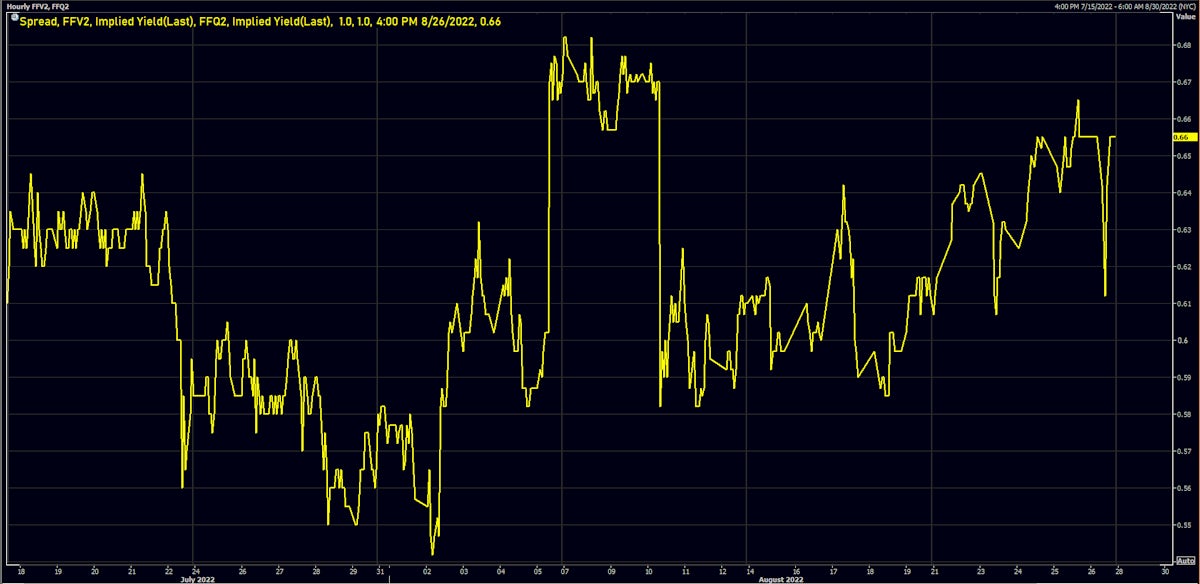

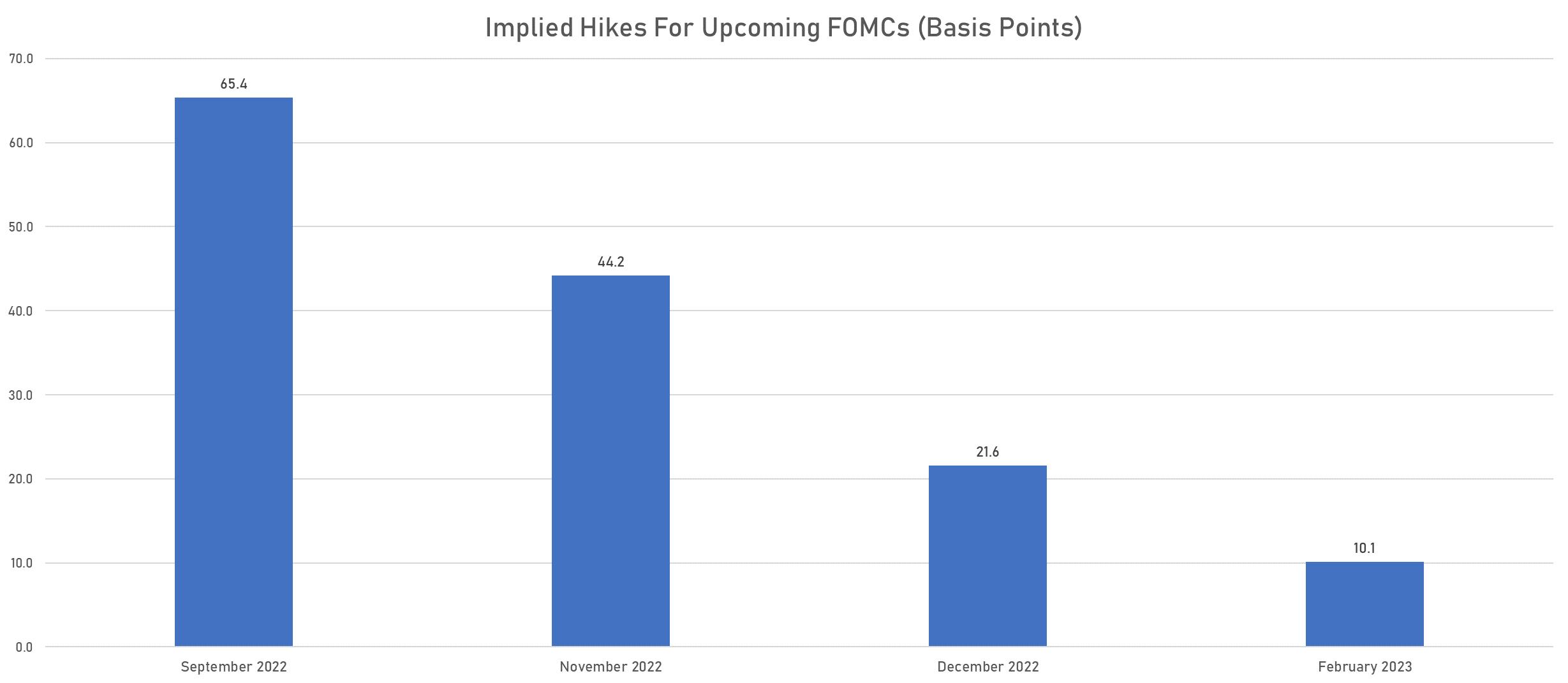

- Fed funds futures currently price in 65bp at the September FOMC (about 60% chance of a 75bp hike) and 131bp by the end of the year; the market implies the funds rate will peak in the second quarter of 2023, then fall about 37bp by the end of 2023.

- The hawkish tone at Jackson Hole was slightly diminished by the Fed's insistance on short-term data dependency to choose its next step (job report next week + CPI report on September 13): "July's increase in the target range was the second 75 basis point increase in as many meetings, and I said then that another unusually large increase could be appropriate at our next meeting. We are now about halfway through the intermeeting period. Our decision at the September meeting will depend on the totality of the incoming data and the evolving outlook."

- But Powell did acknowledge that a weaker labor market / economic pain is needed to get inflation under control: "Restoring price stability will take some time and requires using our tools forcefully to bring demand and supply into better balance. Reducing inflation is likely to require a sustained period of below-trend growth. Moreover, there will very likely be some softening of labor market conditions. While higher interest rates, slower growth, and softer labor market conditions will bring down inflation, they will also bring some pain to households and businesses. These are the unfortunate costs of reducing inflation. But a failure to restore price stability would mean far greater pain."

- Direction of travel for risk assets is likely to be down for a while: as economic and inflation data stay strong, we should see more hawkish central banks, higher interest rates, wider credit spreads and lower equity valuations

- Aneta Markowska: "In our view, the risk of a recession over the next 6-9 months is much lower than perceived. To be clear, we do not believe in a soft landing scenario; we do think that the Fed will ultimately be forced to induce a recession in order to reduce wage growth and push inflation back to 2%. However, taking the economy down will be harder, and will take longer, than expected"

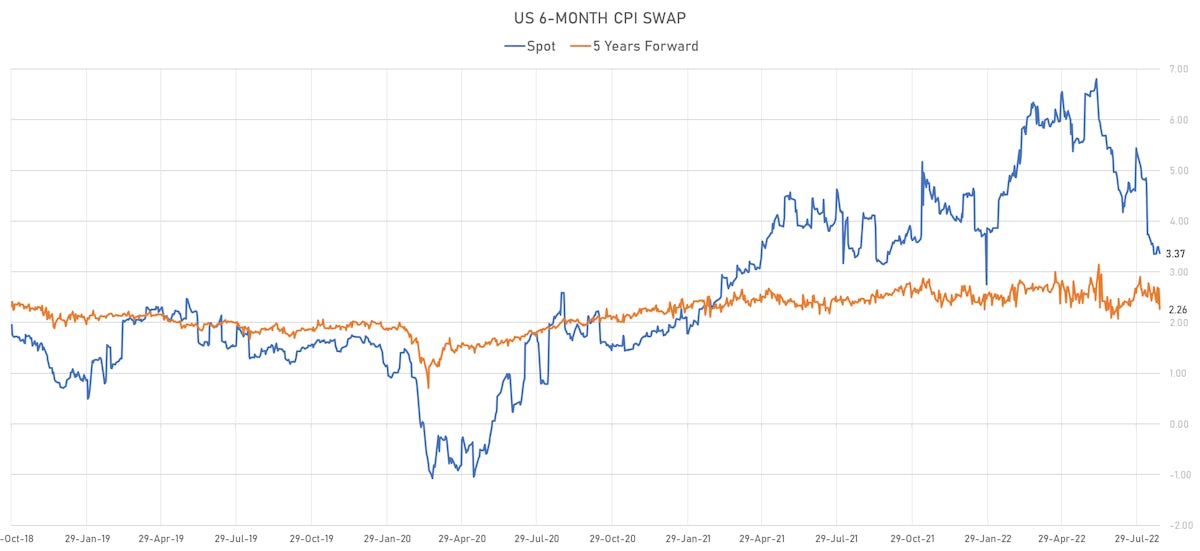

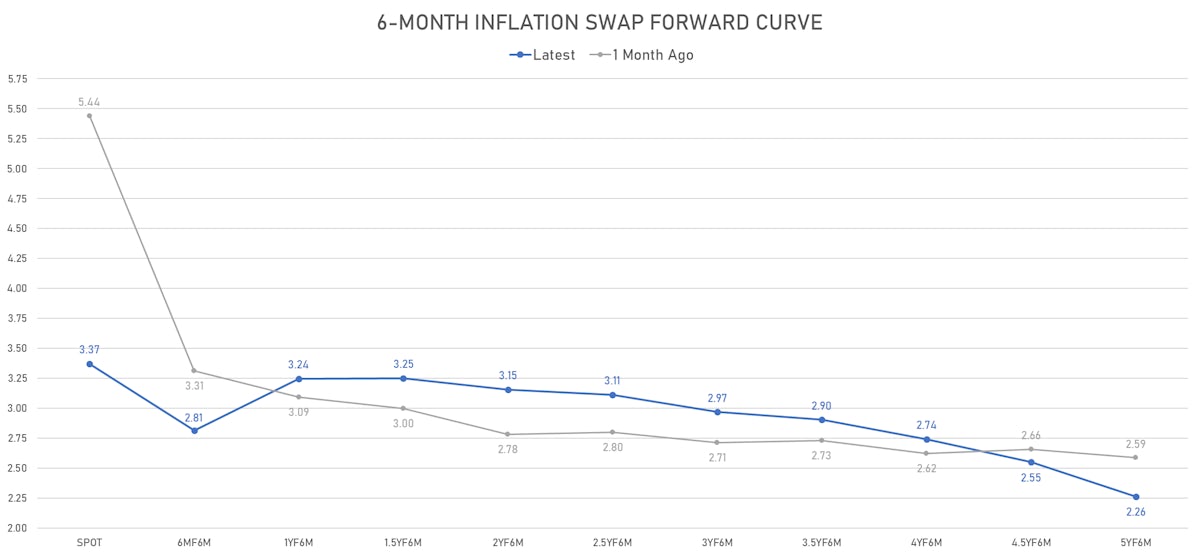

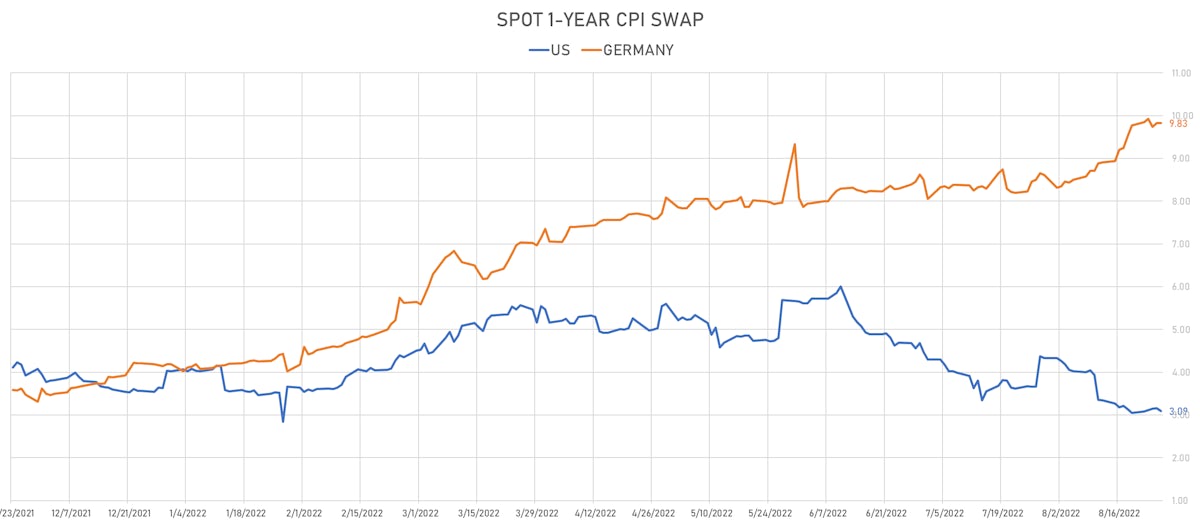

- The recent flattening in the forward inflation curve, coupled with a flatter 5s30s real yields spread reflect heightened market expectations of stagflation (elevated inflation for longer + weaker economic growth)

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -5.5 bp, now at -30.8 bp (YTD change: -144.0bp)

- 1Y: 3.3360% (up 10.9 bp)

- 2Y: 3.3804% (up 14.3 bp)

- 5Y: 3.1889% (up 9.4 bp)

- 7Y: 3.1300% (up 7.6 bp)

- 10Y: 3.0279% (up 5.4 bp)

- 30Y: 3.1875% (down 2.8 bp)

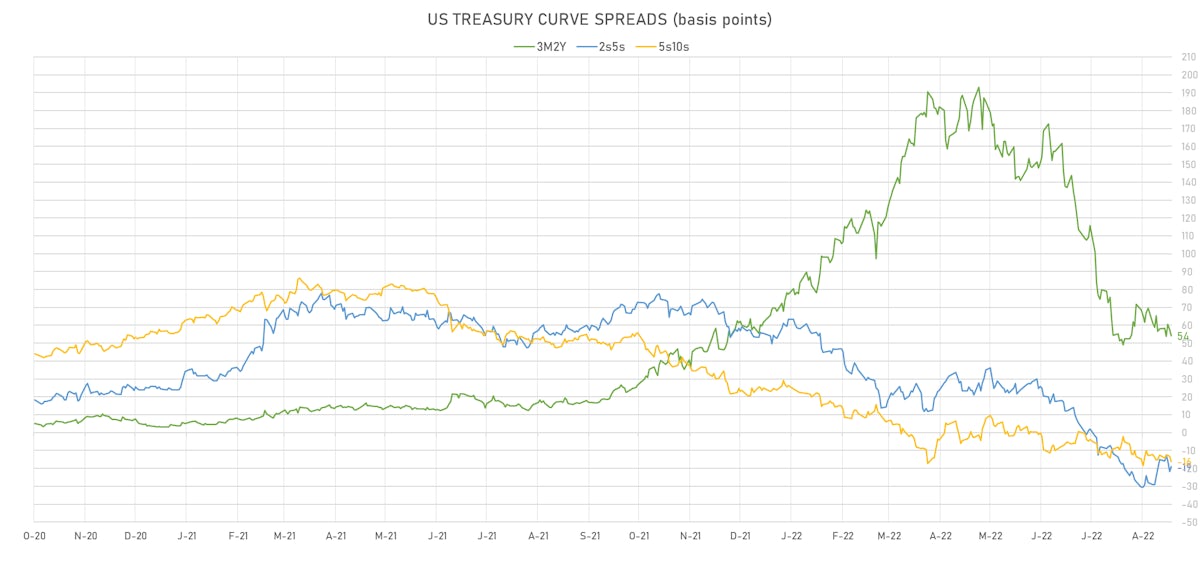

- US treasury curve spreads: 3m2Y at 53.8bp (down -0.9bp this week), 2s5s at -19.2bp (down -5.1bp), 5s10s at -16.1bp (down -4.1bp), 10s30s at 16.0bp (down -8.2bp)

- TIPS 1Y breakeven inflation at 2.46% (down -21.8bp); 2Y at 2.96% (up 10.6bp); 5Y at 2.87% (up 6.4bp); 10Y at 2.59% (up 2.9bp); 30Y at 2.38% (up 0.4bp)

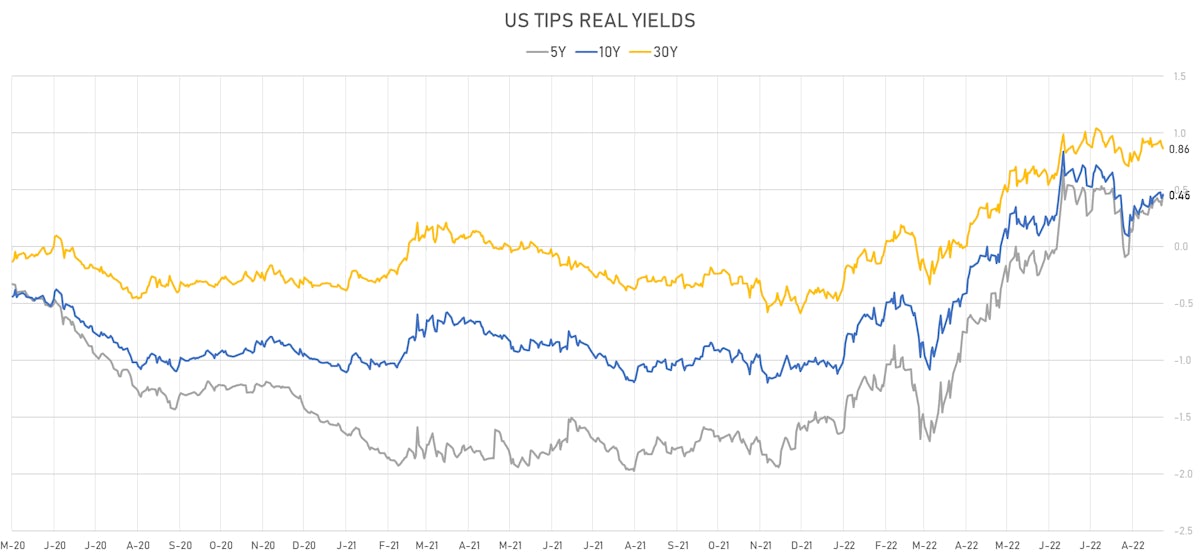

- US 5-Year TIPS Real Yield: +7.5 bp at 0.4580%; 10-Year TIPS Real Yield: +2.6 bp at 0.4530%; 30-Year TIPS Real Yield: -3.0 bp at 0.8630%

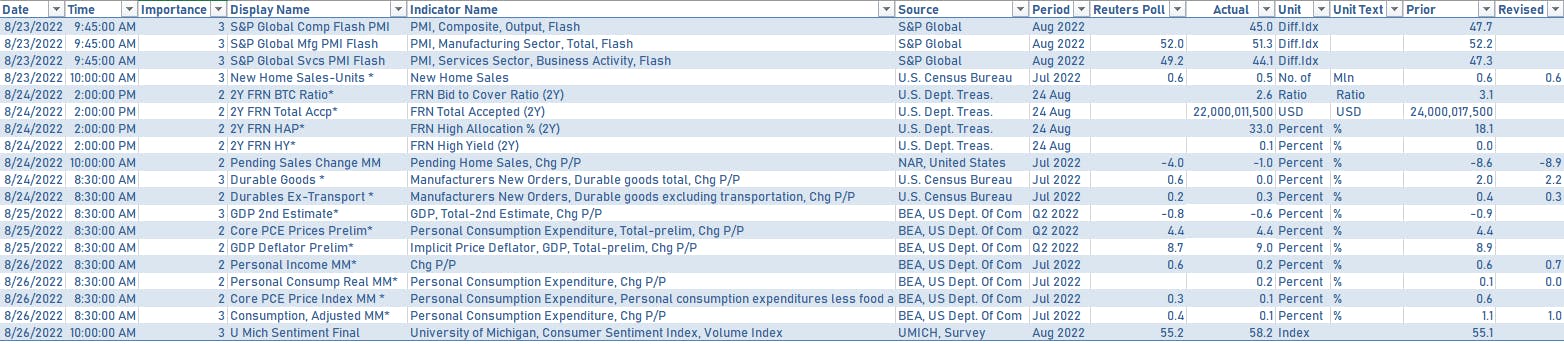

NOTABLE US MACRO RELEASES IN THE PAST WEEK

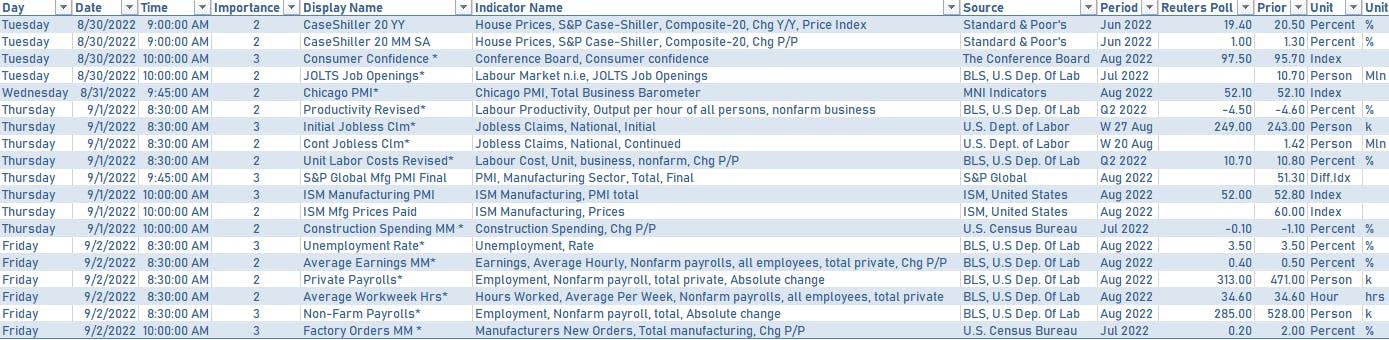

US DATA IN THE WEEK AHEAD

- The market focus next week will be on the August employment report (on Friday), ISM manufacturing (Thursday), Conference Board consumer confidence (Tuesday), and on scheduled remarks from several FOMC voting members

FED SPEAKERS IN THE WEEK AHEAD

- Monday 2:15PM: Vice Chair Brainard will deliver pre-recorded remarks at a FedNow workshop in Chicago

- Tuesday 8:00AM: Richmond Fed President Barkin will discuss the economic outlook during an event hosted by the Huntington Regional Chamber of Commerce at St Mary's Conference Center in Huntington, West Virginia

- Tuesday 11:00AM: NY Fed President Williams will answer questions about the US economic outlook and the steps the central bank has taken to address inflation in online interview with the Wall St. Journal.

- Wednesday 8:00AM: Cleveland Fed President Mester will discuss the outlook for the economy and monetary policy at a breakfast hosted by the Dayton Area Chamber of Commerce.

- Wednesday 6:30PM: Atlanta Fed President Bostic will give remarks and speak in a moderated conversation at the Georgia Fintech Academy about the role of fintech in promoting financial inclusion.

- Thursday 3:30PM: Atlanta Fed President Bostic will give a presentation to students at a Georgia Fintech Academy event

US FORWARD RATES

- Fed Funds futures now price in 65.4bp of Fed hikes by the end of September 2022, 109.6bp (4.4 x 25bp hikes) by the end of November 2022, and 5.2 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in 34.5 bp of rate cuts in 2023 (equivalent to 1.4 x 25 bp cuts), up 4.5 bp today, and 47.5 bp of cuts in 2024 (equivalent to 1.9 x 25 bp cuts)

US INFLATION & REAL YIELDS TODAY

- TIPS 1Y breakeven inflation at 2.46% (down -16.9bp); 2Y at 2.96% (down -13.7bp); 5Y at 2.87% (down -4.9bp); 10Y at 2.59% (down -3.1bp); 30Y at 2.38% (down -1.8bp)

- 6-month spot US CPI swap down -6.4 bp to 3.372%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.4580%, +9.7 bp today; 10Y at 0.4530%, +2.8 bp today; 30Y at 0.8630%, -3.4 bp today

RATES VOLATILITY & LIQUIDITY DAILY

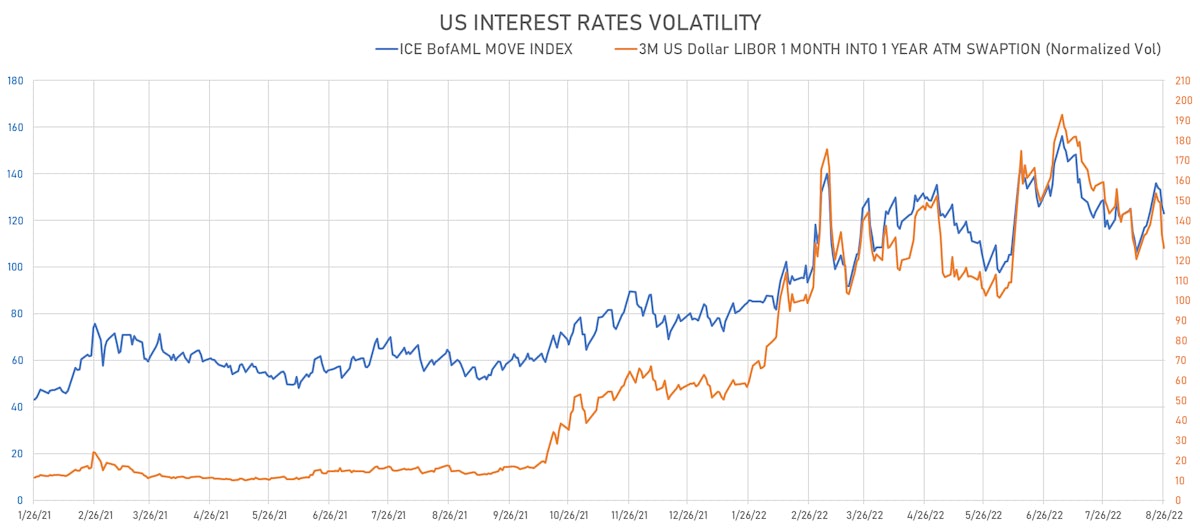

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.9 vols at 126.1 normals

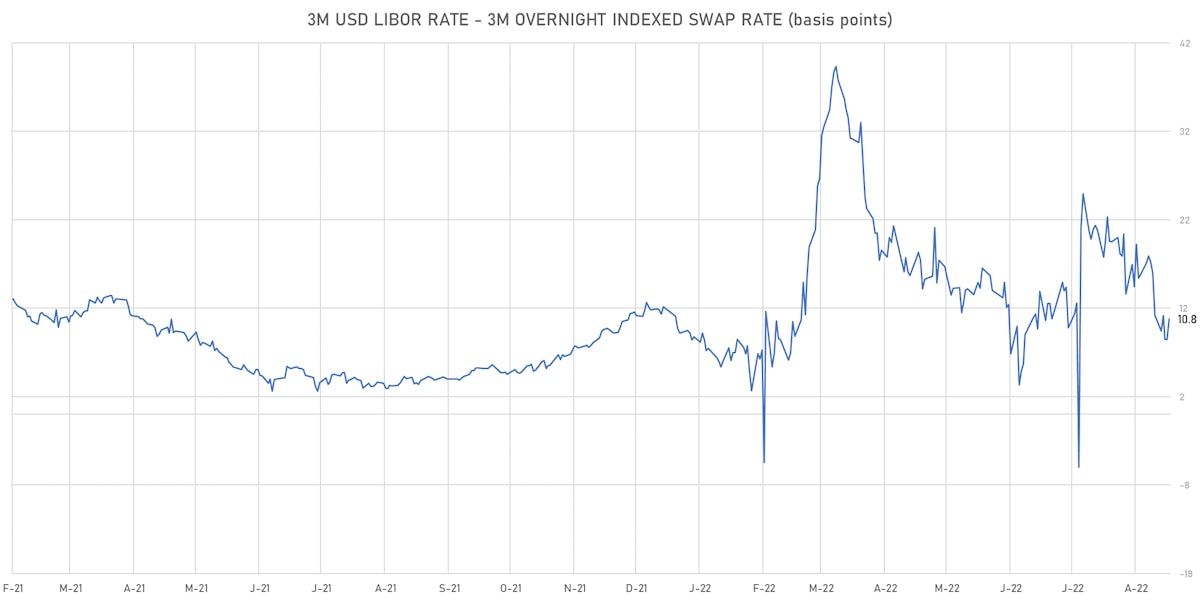

- 3-Month LIBOR-OIS spread up 2.3 bp at 10.8 bp (18-months range: -6.0 to 39.3 bp)

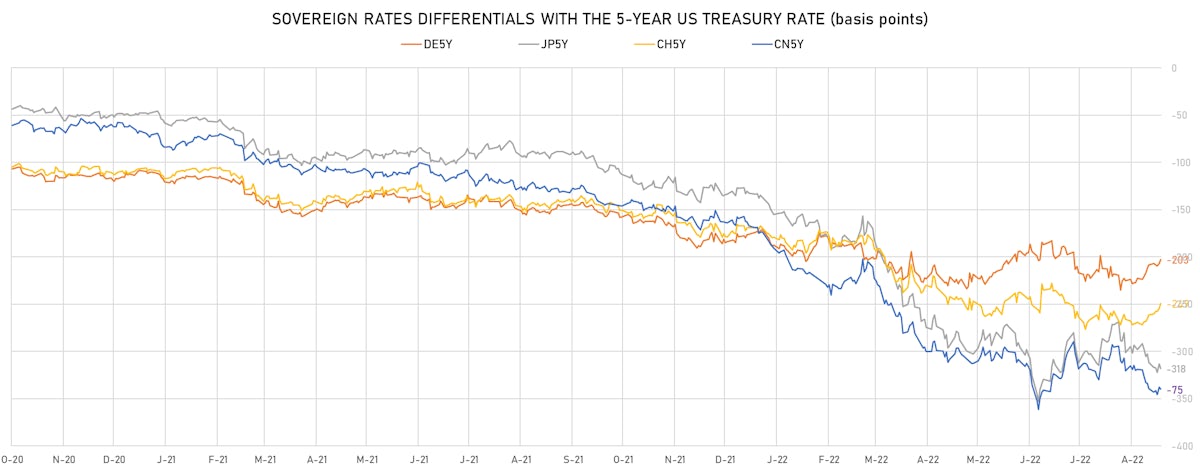

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.177% (up 8.0 bp); the German 1Y-10Y curve is 2.5 bp flatter at 68.7bp (YTD change: -42.9 bp)

- Japan 5Y: 0.014% (down -0.8 bp); the Japanese 1Y-10Y curve is 1.1 bp flatter at 35.3bp (YTD change: -15.8 bp)

- China 5Y: 2.442% (up 0.8 bp); the Chinese 1Y-10Y curve is 1.6 bp flatter at 88.1bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.699% (up 8.5 bp); the Swiss 1Y-10Y curve is 10.1 bp flatter at -0.5bp (YTD change: -56.5 bp)