Rates

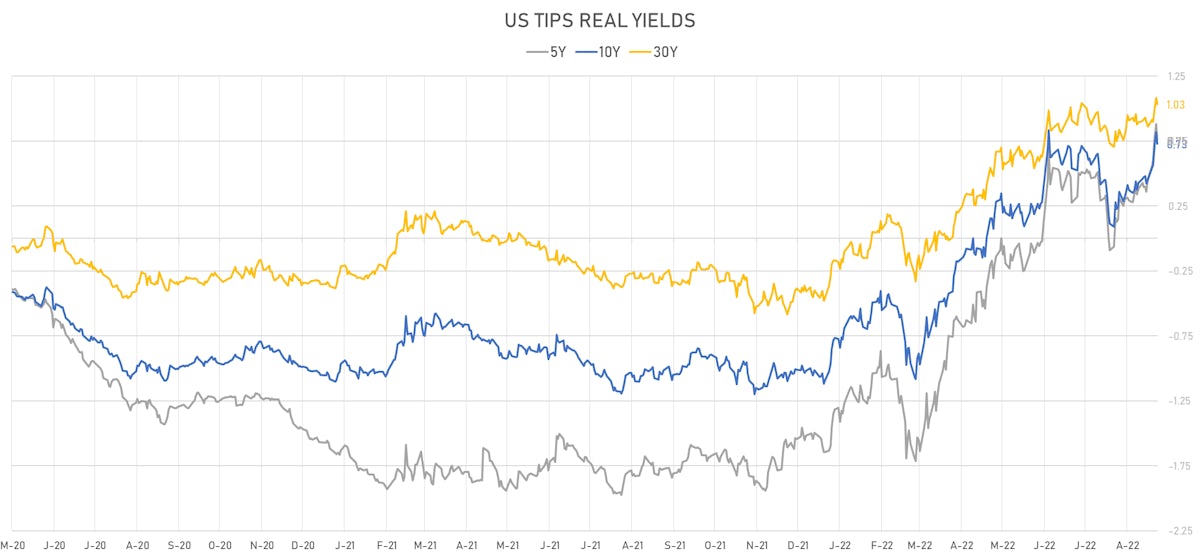

US Treasury Curve Bear Steepened This Week On The Back Of Lower Breakevens And Higher Real Yields

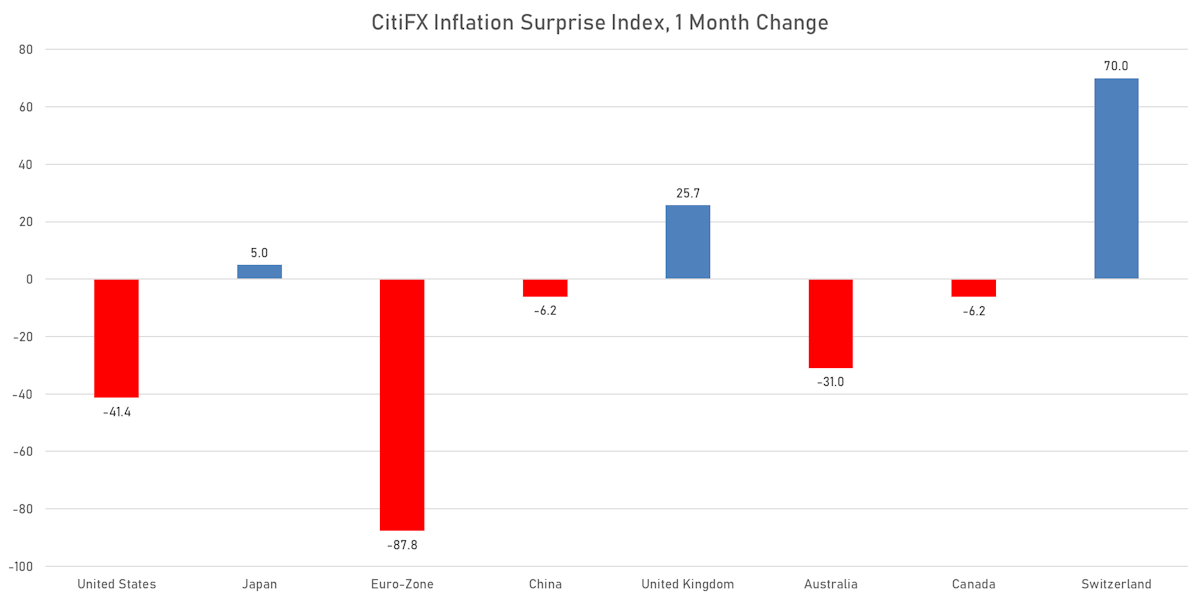

Having been outhiked by the Fed, foreign central banks are under pressure to act and FX markets are forcing their hands to be more hawkish: the ECB will likely go for 75bp at their next meeting and the BoE might opt for 100bp to restore its credibility

Published ET

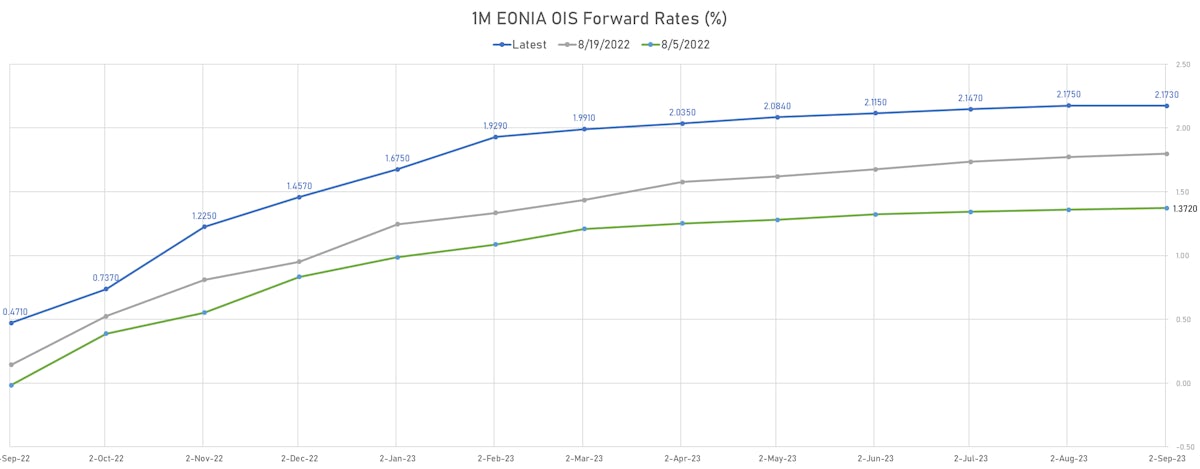

1-Month EONIA OIS Forward Rates Curve | Sources: ϕpost, Refinitiv data

US OUTLOOK

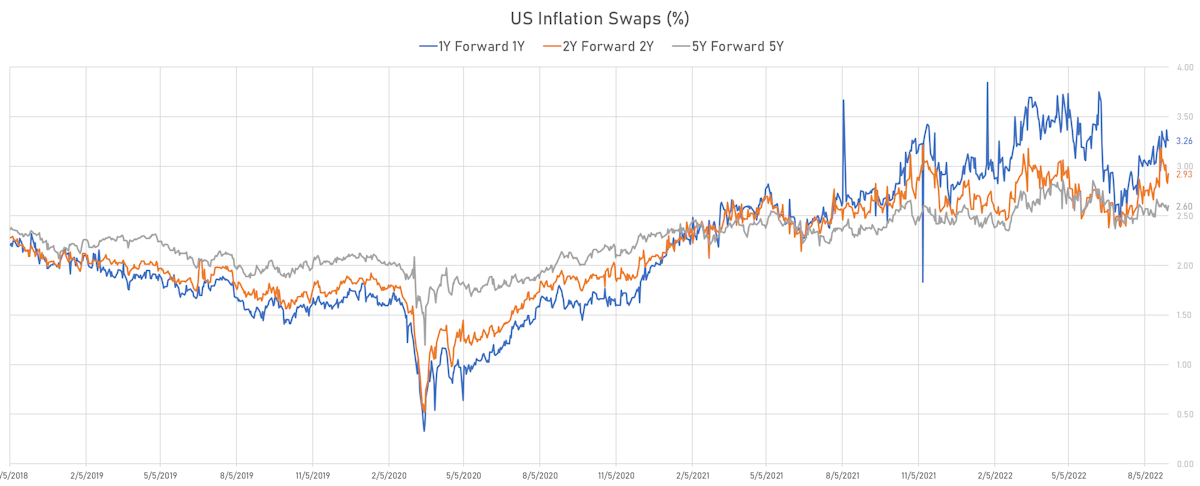

- Inflation expectations have come down at the front end of the curve, with refined crude products like gasoline seeing sharp drops in prices

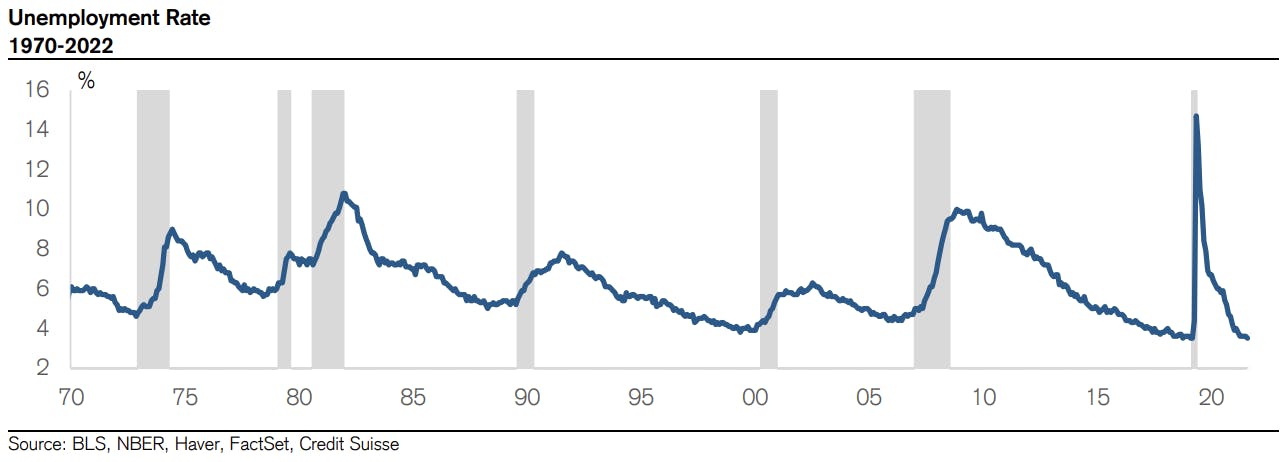

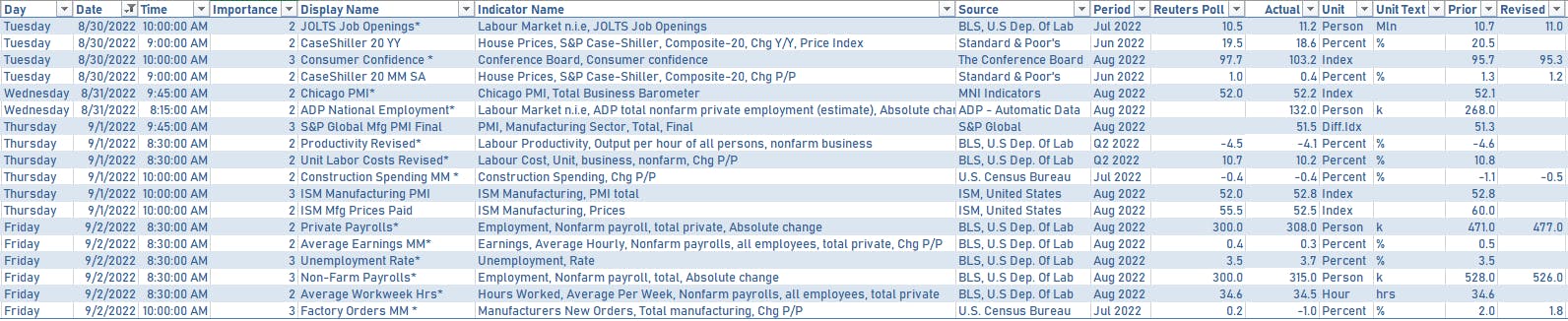

- We saw mixed economic data this week, with a definite soft-landing flavor: the demand momentum in the labor market is still very strong, but wage growth is coming down + the labor participation and unemployment rates are starting to rise

- Based on the latest data, key economists (perhaps most notably Jan Hatzius at GS and Aneta Markowska at Jefferies) think 50bp is the most likely outcome from the September FOMC

- The market disagrees and currently prices in close to 69bp, equivalent to a 75% probability of a 75bp hike this month

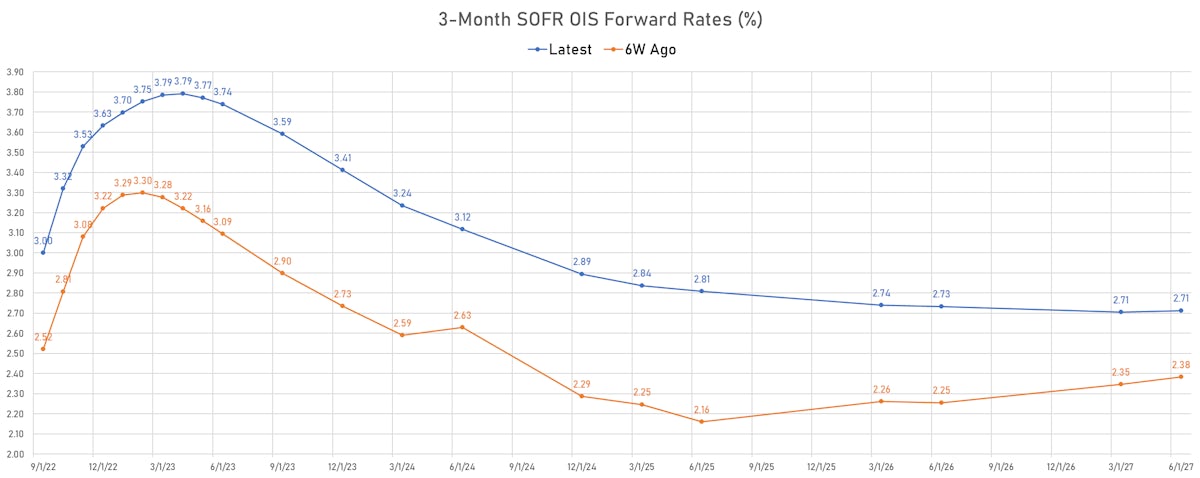

- Regardless of the next FOMC decision, the message from the Fed at Jackson Hole is that the terminal rate should be higher even if the pace slows down to 50bp per meeting

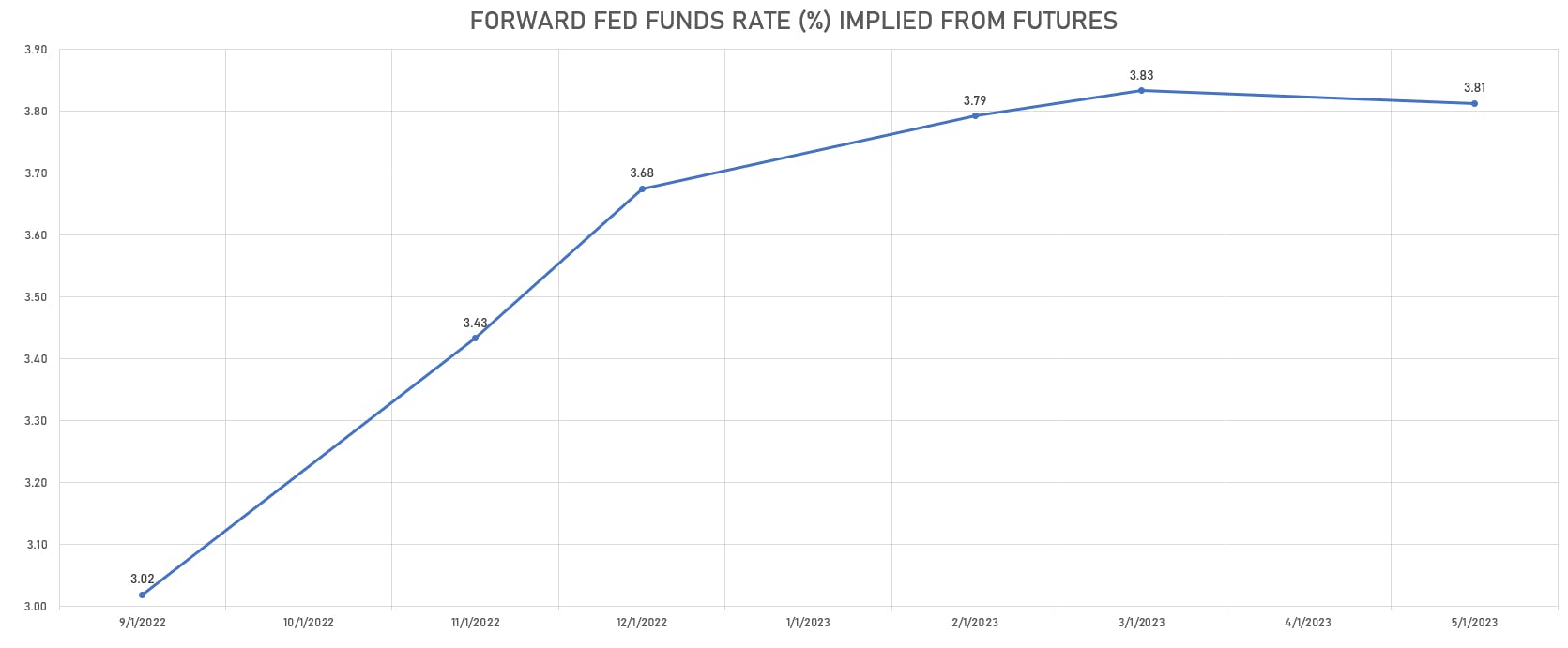

- A terminal rate of 4.25% in 1Q23 a possible outcome if (as we believe) economic momentum keeps inflation higher than the Fed wants going into 2023. Having said that, the market currently prices in a peak of 3.83% in 1Q23.

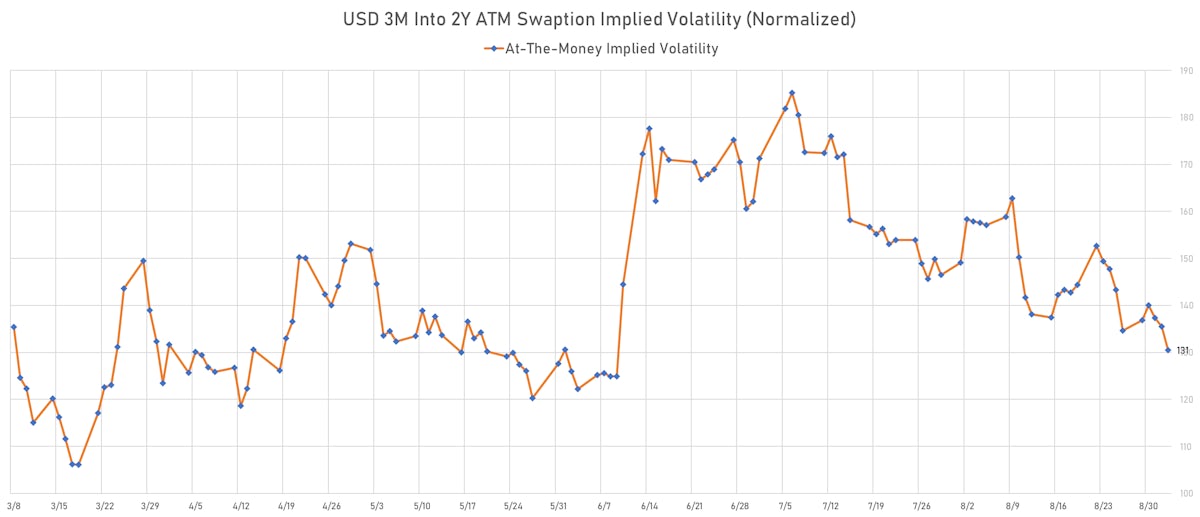

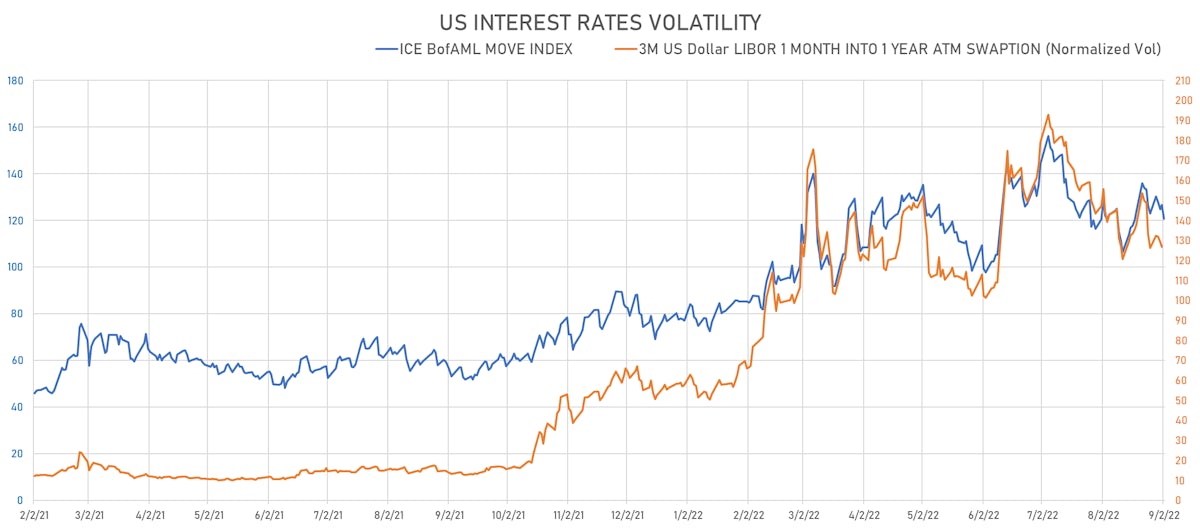

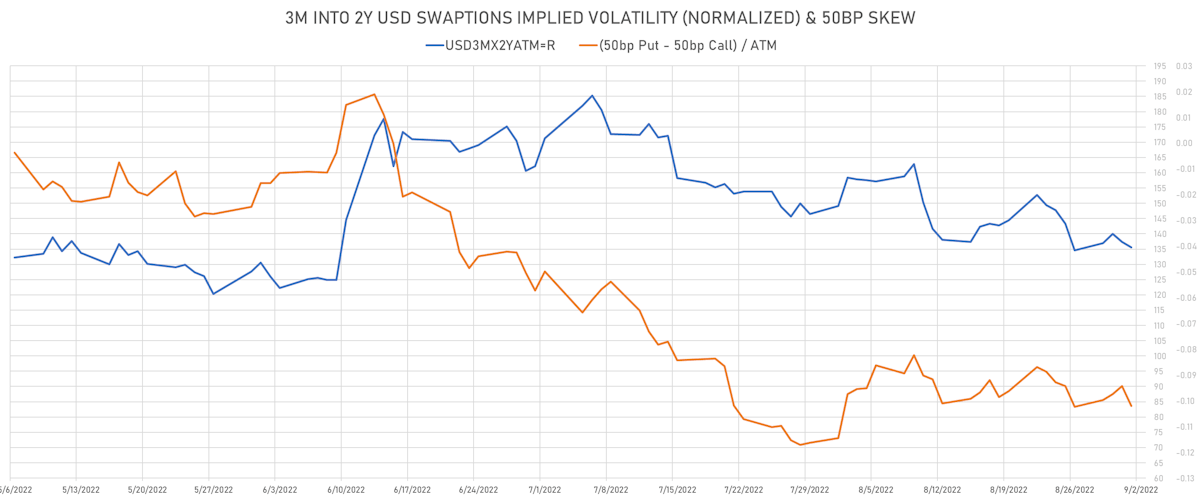

- Rates volatility is continuing to fall, particularly at the front end, as the market anticipates a slowdown in the pace of Fed hikes.

- In the short-term, a few sell-side strategists are recommending to pay front-end rates and short their (still expensive) implied volatility

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 8.7 bp, now at -22.1 bp (YTD change: -135.3bp)

- 1Y: 3.4152% (up 7.9 bp)

- 2Y: 3.3935% (up 1.3 bp)

- 5Y: 3.2971% (up 10.8 bp)

- 7Y: 3.2762% (up 14.6 bp)

- 10Y: 3.1941% (up 16.6 bp)

- 30Y: 3.3470% (up 16.0 bp)

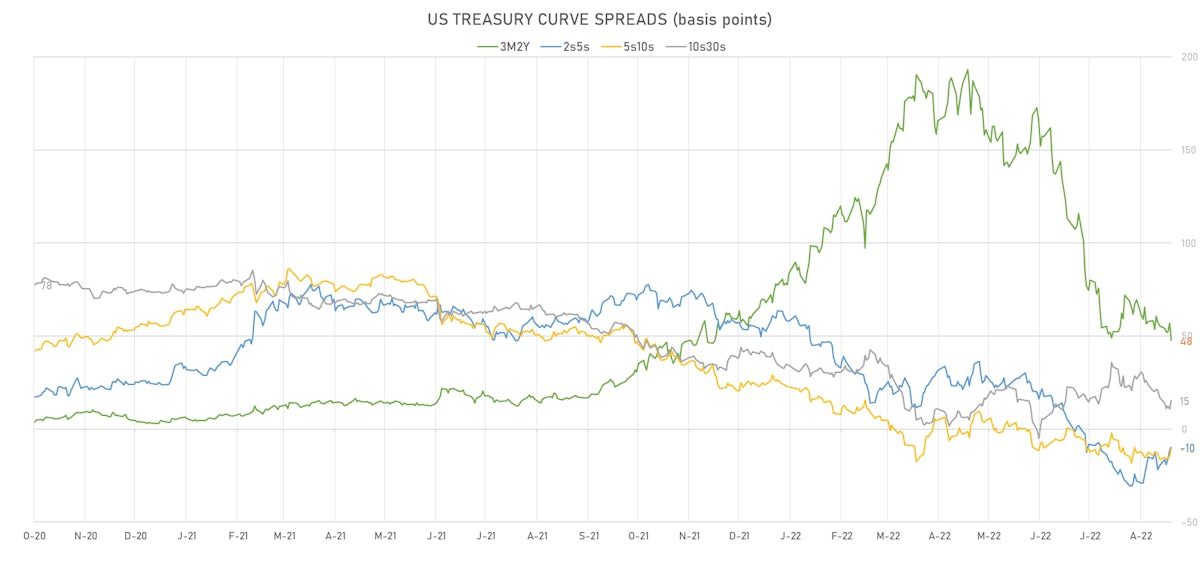

- US treasury curve spreads: 3m2Y at 47.2bp (down -6.6bp this week), 2s5s at -9.6bp (up 9.7bp), 5s10s at -10.3bp (up 6.1bp), 10s30s at 15.3bp (down -0.5bp)

- TIPS 1Y breakeven inflation at 2.11% (down -35.8bp); 2Y at 2.59% (down -37.2bp); 5Y at 2.68% (down -19.2bp); 10Y at 2.48% (down -11.4bp); 30Y at 2.37% (down -1.1bp)

- US 5-Year TIPS Real Yield: +29.5 bp at 0.7530%; 10-Year TIPS Real Yield: +27.6 bp at 0.7290%; 30-Year TIPS Real Yield: +17.0 bp at 1.0330%

MIXED US ECONOMIC DATA OVER THE PAST WEEK

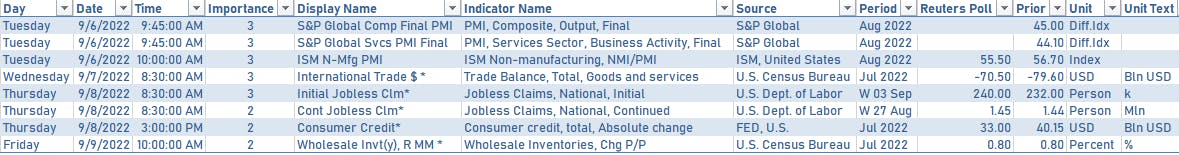

US ECONOMIC DATA IN THE WEEK AHEAD

- Very light data schedule this week after Labor Day

FED SPEAKERS

- Busy schedule ahead of the pre-FOMC blackout period starting next Saturday

- Wednesday 9:00AM: Richmond Fed President Barkin

- Wednesday 10:00AM: Cleveland Fed President Mester

- Wednesday 12:35PM: Fed Vice Chair Brainard

- Wednesday 2:00PM: Fed Vice Chair for Supervision Michael Barr

- Thursday 9:10AM: Fed Chair Powell

- Friday 10:00AM: Chicago Fed President Evans

- Friday 12:00PM: Fed Governor Waller

- Friday 12:00PM: Kansas City Fed President George

US FORWARD RATES

- Fed Funds futures now price in 68.8bp of Fed hikes by the end of September 2022, 117.5bp (4.7 x 25bp hikes) by the end of November 2022, and 5.7 hikes by the end of December 2022

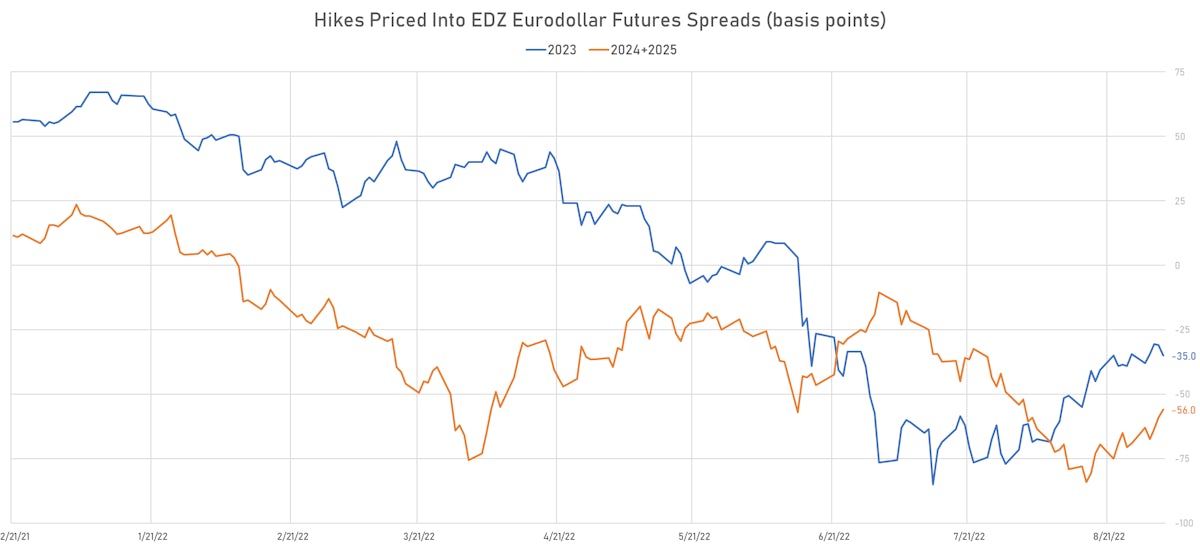

- 3-month Eurodollar futures (EDZ) spreads price in -35.0 bp of hikes in 2023 (equivalent to -1.4 x 25 bp hikes), down -4.0 bp today, and -46.0 bp of hikes in 2024 (equivalent to -1.8 x 25 bp hikes)

US INFLATION & REAL RATES

- TIPS 1Y breakeven inflation at 2.11% (up 9.9bp); 2Y at 2.59% (up 6.8bp); 5Y at 2.68% (up 2.1bp); 10Y at 2.48% (up 2.0bp); 30Y at 2.37% (up 3.5bp)

- 6-month spot US CPI swap up 0.8 bp to 4.108%, with a steepening of the forward curve

- US Real Rates: 5Y at 0.7530%, -12.8 bp today; 10Y at 0.7290%, -8.7 bp today; 30Y at 1.0330%, -5.0 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.7 vols at 120.1 normals

- 3-Month LIBOR-OIS spread up 4.1 bp at 10.1 bp (18-months range: -6.0 to 39.3 bp)

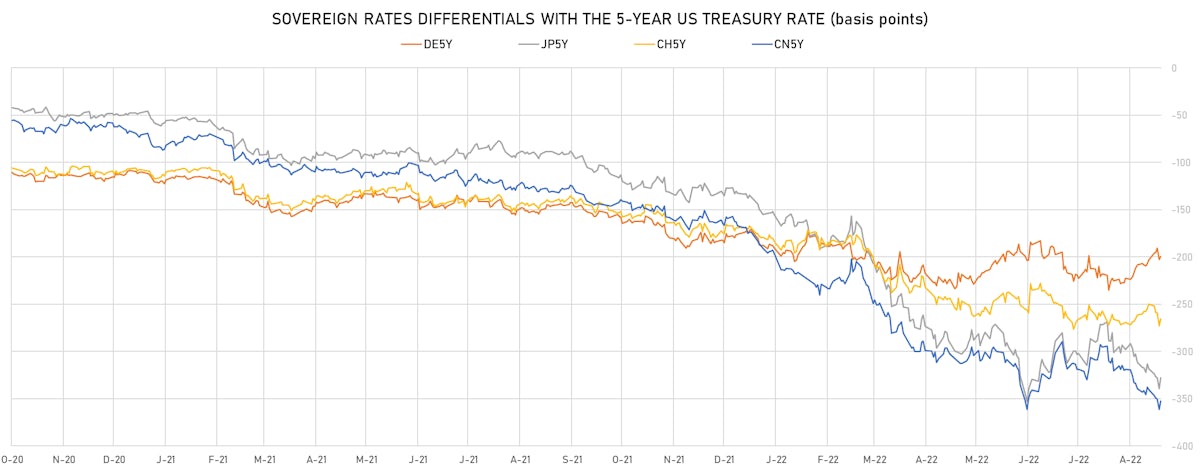

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.306% (down -8.0 bp); the German 1Y-10Y curve is 1.9 bp flatter at 87.6bp (YTD change: -42.7 bp)

- Japan 5Y: 0.022% (up 0.4 bp); the Japanese 1Y-10Y curve is 0.5 bp steeper at 36.8bp (YTD change: -15.8 bp)

- China 5Y: 2.391% (down -0.6 bp); the Chinese 1Y-10Y curve is 1.3 bp steeper at 94.9bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.642% (down -3.8 bp); the Swiss 1Y-10Y curve is 5.1 bp steeper at -15.6bp (YTD change: -56.7 bp)