Rates

Higher Yields, Flatter Curve Across Rates This Week, As US Economy Continues To Show Strength

Although the US CPI data next week is likely to show a sharp deceleration, the Fed indicated this week its preference for a 75bp hike at the next FOMC, which drove volatility lower and asset prices higher

Published ET

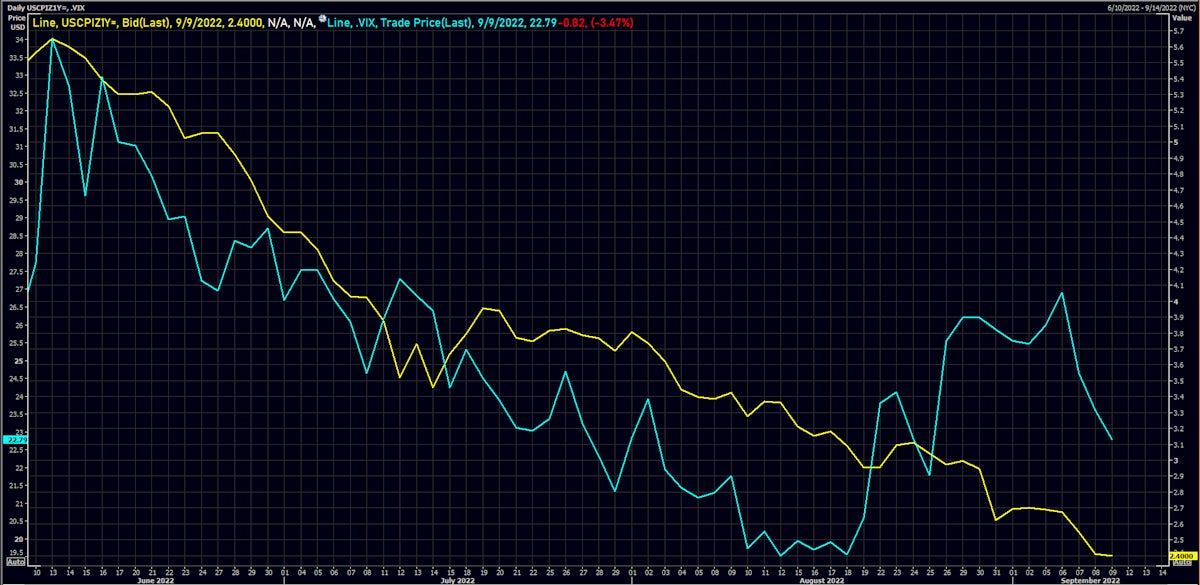

Impact of the WSJ Leak Across Asset Classes: Lower Short-Term Inflation Expectations an Equity Vols | Source: Refinitiv

US COMMENTARY

- Ahead of the FOMC blackout, the Fed decided to leak again its decision to the Wall Street Journal, making it very clear that a 75bp hike was coming at the next meeting

- It's unclear why the Fed finds it appropriate to use such a conduit to provide guidance, but the meaning of the message probably goes something like this: they need to go for 75bp but they think (or they already know) that the CPI data on Tuesday will decelerate faster than expected, which could lead money markets to reprice the September FOMC hike towards 50bp

- Now, having said that, there are several issues with the approach:

- It's highly confusing: Fed officials have been saying ad nauseam that decisions are data dependent, and they no longer want to provide forward guidance, and yet time and again they leak their decision ahead of the meeting to the WSJ

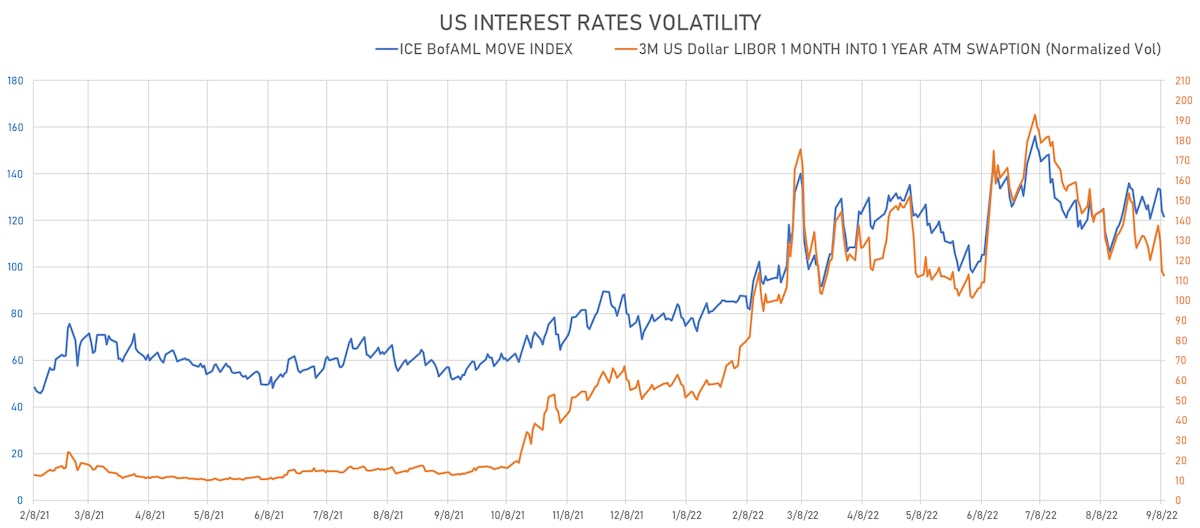

- It's counterproductive: rates volatility goes down, as the market doesn't have to position around different FOMC outcomes. And that carries over to other asset classes, leading to higher prices and looser financial conditions, which is exactly the opposite of what the Fed wants.

- The result was as expected on Wednesday after the WSJ publication: short rates went up but the yield curve flattened, rates volatility and the USD fell, credit spreads tightened and equities rose, leading to looser FCI.

- People who were on the other side of the fence (like Jefferies' Aneta Markowska) came out with research reports saying they now "thought" the Fed would opt for 75bp. And there is nothing wrong with that: you need to mark your views to reality, but the Fed's communication strategy is still a disaster.

- As Zoltan Pozsar pointed out a few months ago, higher volatility is your friend when you're trying to tighten financial conditions rapidly. The Fed should encourage volatility by talking less and keeping people guessing.

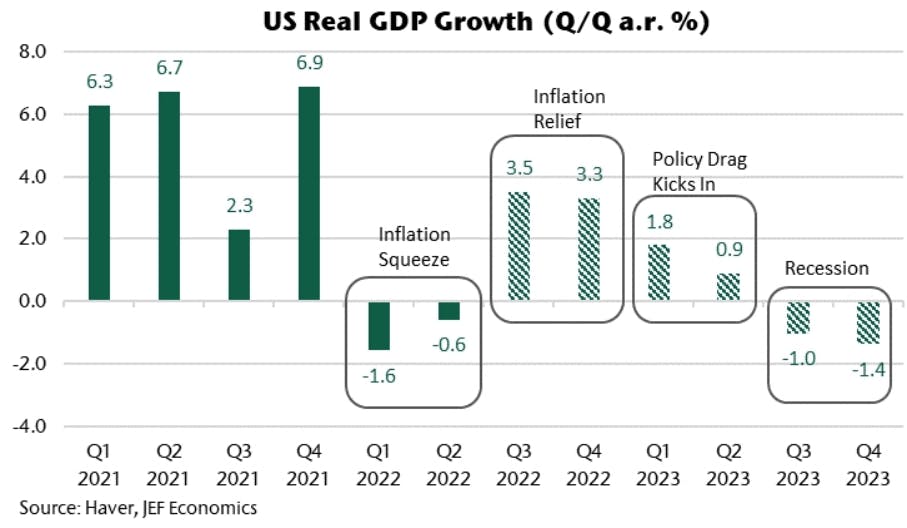

- Despite the political headwind, the Fed needs to be clear that slowing down inflation will have to come from a weaker labor market, through a significantly higher unemployment rate, which has never been achieved outside of a recession

- Aneta Markowska: "The Fed needs to see below-trend GDP growth if it has any chance of returning to 2% inflation. Instead, we believe growth is on track to accelerate sharply in 2H to a 3-3.5% range. Household balance sheets are too strong, nominal income is too strong, and now, declining energy prices are boosting consumers' purchasing power, which is likely to increase demand for non-energy goods and services at a time when the Fed is trying to push it down. (..) Given the typical policy lags, the drag from this year's tightening will begin to kick in early next year, at which point we expect data and earnings to start surprising on the downside. The drag, coupled with deepening labor market constraints, will squeeze margins, unleashing a full-blown layoff cycle around the third quarter. In our view, the Fed is unlikely to cut rates until core inflation falls below 3% or unemployment reaches 5%, and those conditions are unlikely to be met until early 2024. This means that the next recession will extend well into 2024; we expect it to last 4-5 quarters."

WEEKLY US RATES SUMMARY

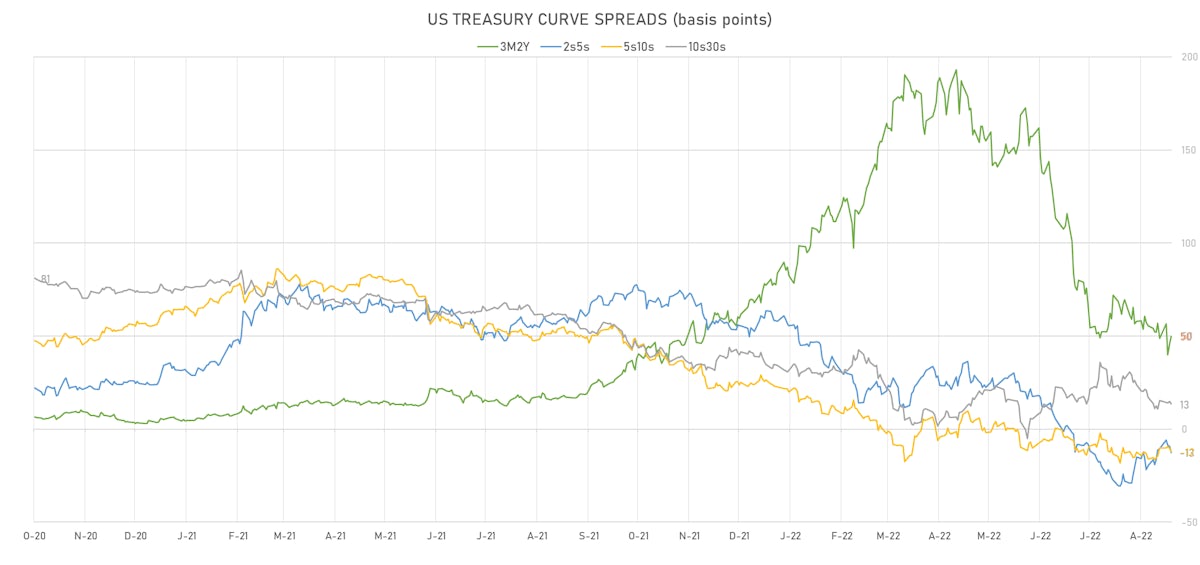

- The treasury yield curve flattened, with the 1s10s spread tightening -10.9 bp, now at -33.0 bp (YTD change: -146.2bp)

- 1Y: 3.6446% (up 22.9 bp)

- 2Y: 3.5617% (up 16.8 bp)

- 5Y: 3.4361% (up 13.9 bp)

- 7Y: 3.4015% (up 12.5 bp)

- 10Y: 3.3145% (up 12.0 bp)

- 30Y: 3.4483% (up 10.1 bp)

- US treasury curve spreads: 3m2Y at 49.7bp (up 2.5bp this week), 2s5s at -12.6bp (down -2.8bp), 5s10s at -12.2bp (down -1.9bp), 10s30s at 13.4bp (down -1.9bp)

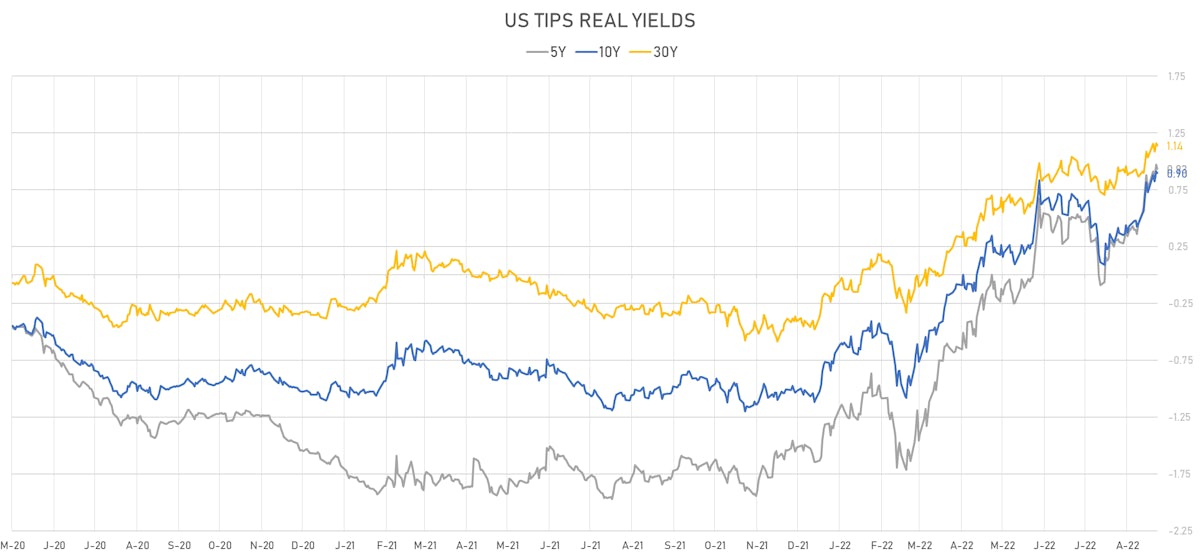

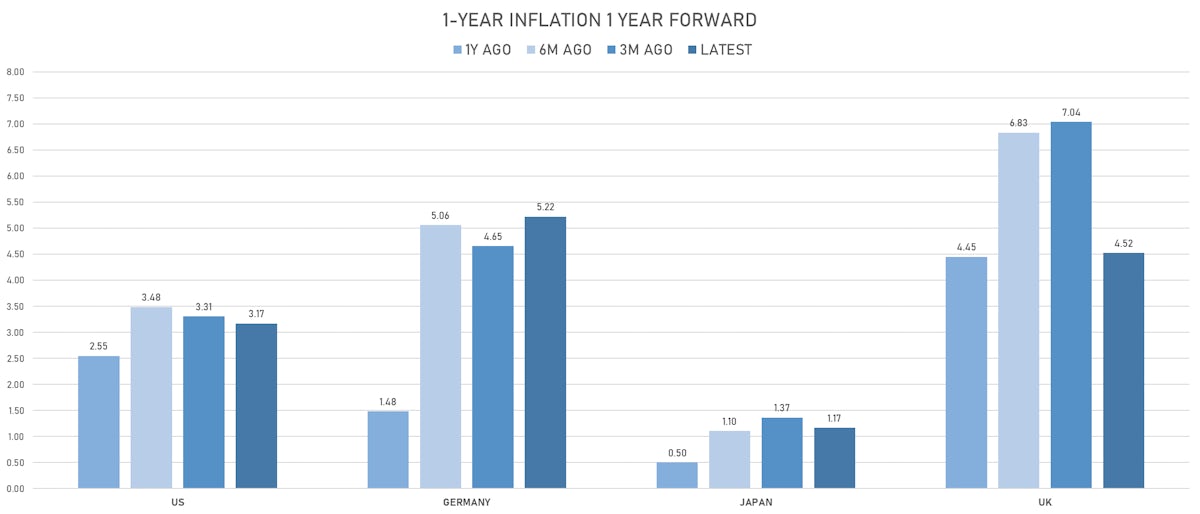

- TIPS 1Y breakeven inflation at 1.90% (down -20.2bp); 2Y at 2.53% (down -5.2bp); 5Y at 2.63% (down -4.9bp); 10Y at 2.44% (down -4.4bp); 30Y at 2.36% (down -0.7bp)

- US 5-Year TIPS Real Yield: +5.3 bp at 0.9340%; 10-Year TIPS Real Yield: +7.9 bp at 0.8950%; 30-Year TIPS Real Yield: +5.7 bp at 1.1400%

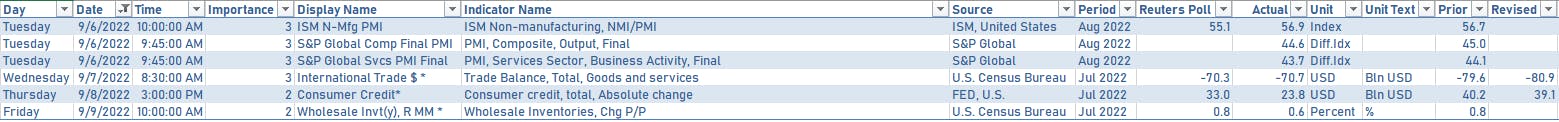

US MACRO RELEASES OVER THE PAST WEEK

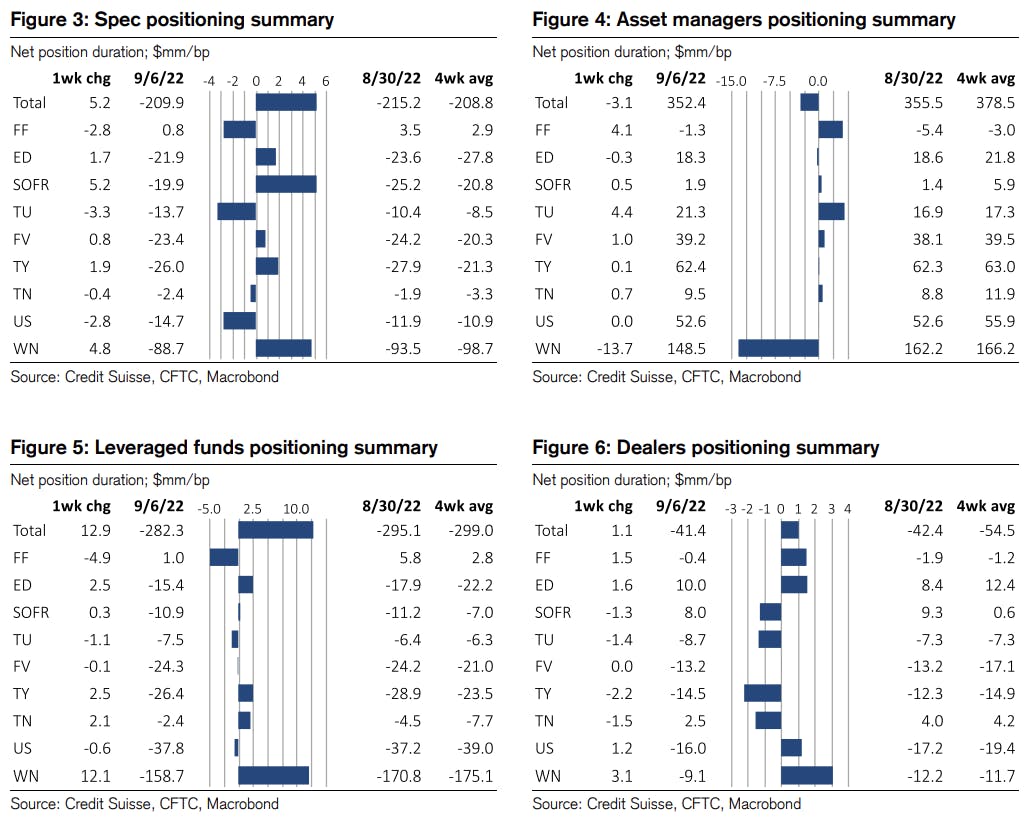

CFTC WEEKLY NET DURATION POSITIONING

US ECONOMIC RELEASES IN THE WEEK AHEAD

- The focus next week will be on the CPI on Tuesday, retail sales and industrial production on Thursday, and UMich sentiment on Friday

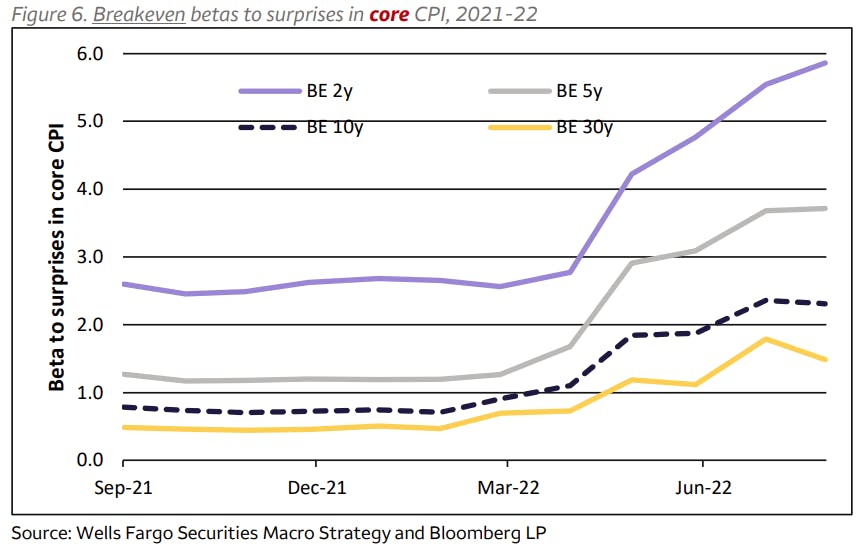

- Of note: if market positioning is in line with consensus estimates, a lower-than-expected CPI would bring yields down at the front end of the curve. Wells Fargo analysts point out that "The 2yr breakeven’s trailing 12-month beta is about 6bps per 0.1% miss in core CPI"

US TREASURY COUPON-BEARING AUCTIONS NEXT WEEK

- Three auctions will raise $91 bn, including $62.8 bn in new cash

- $41bn in 3Y notes at 11:30AM on Monday

- $32bn in 10Y notes at 1:00PM on Monday

- $18bn in 30Y bonds at 1:00PM on Tuesday

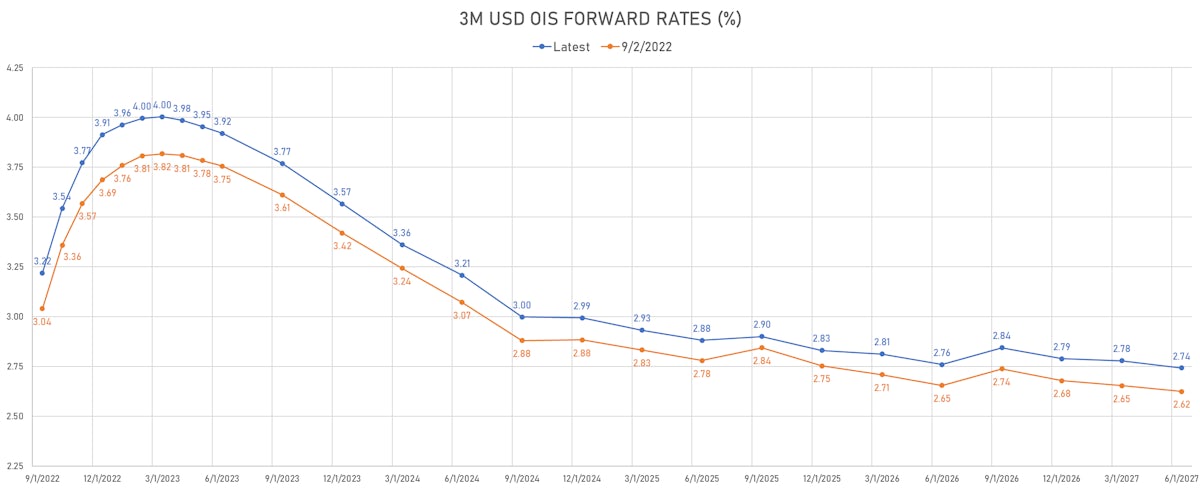

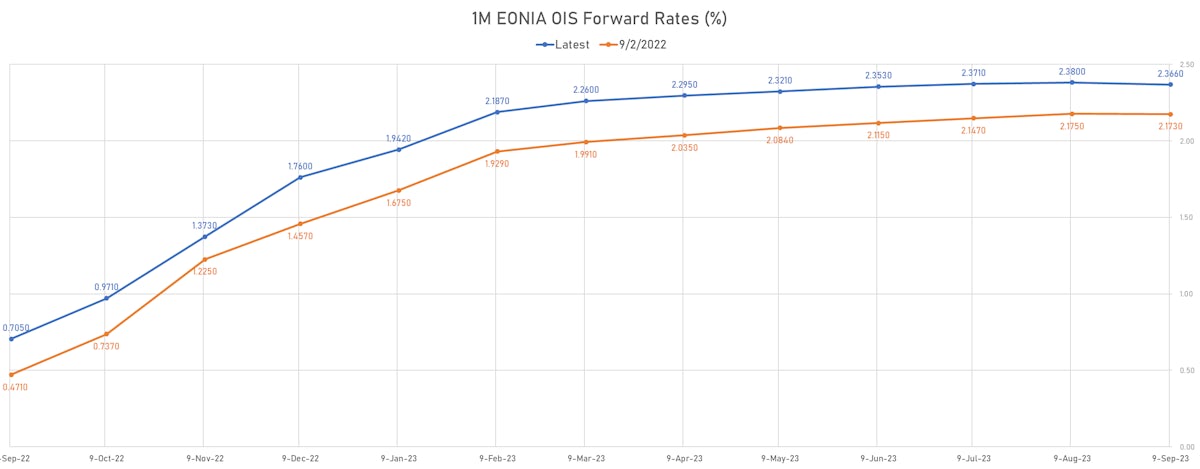

US FORWARD RATES

- Fed Funds futures now price in 72.8bp of Fed hikes by the end of September 2022 (91% probability of a 75bp hike), 125.8bp (5.0 x 25bp hikes) by the end of November 2022, and 6.2 hikes by the end of December 2022

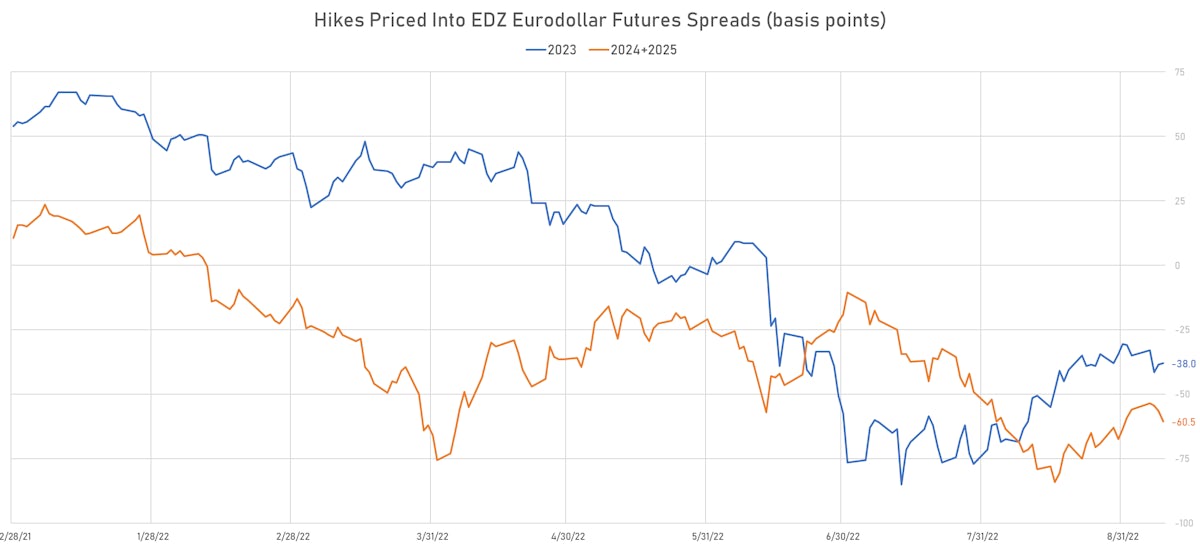

- 3-month Eurodollar futures (EDZ) spreads still price in 38.0 bp of cuts in 2023 (equivalent to 1.5 x 25 bp cut), up 0.5 bp today, and 49.5 bp of cuts in 2024 (equivalent to 2.0 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.90% (up 19.6bp); 2Y at 2.53% (up 10.1bp); 5Y at 2.63% (up 5.0bp); 10Y at 2.44% (up 1.0bp); 30Y at 2.36% (down -1.1bp)

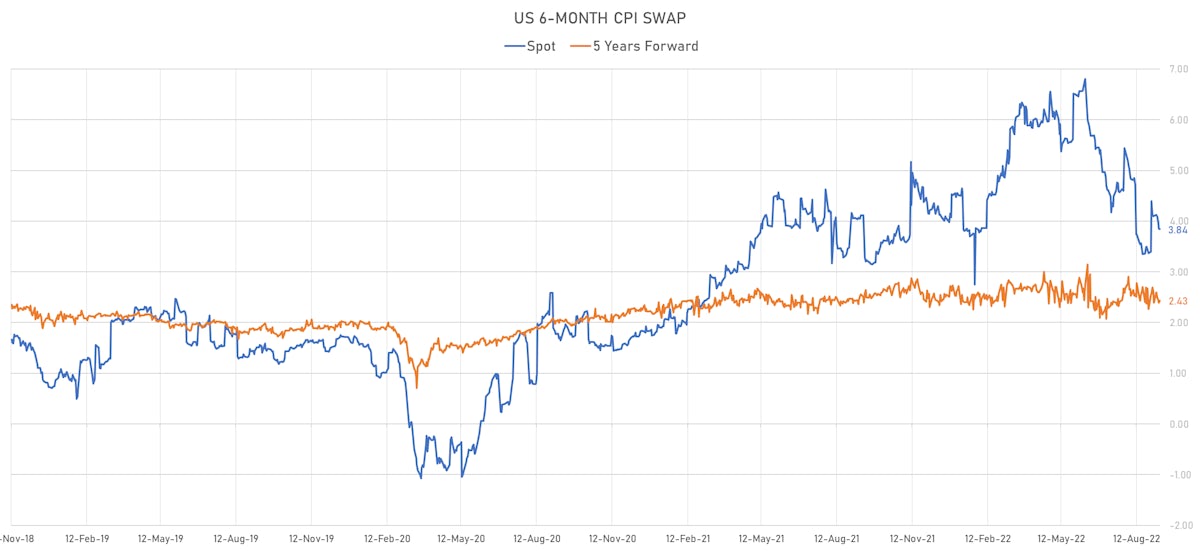

- 6-month spot US CPI swap down -1.0 bp to 3.841%, with a flattening of the forward curve

- US Real Rates: 5Y at 0.9340%, -3.5 bp today; 10Y at 0.8950%, -1.8 bp today; 30Y at 1.1400%, -1.7 bp today

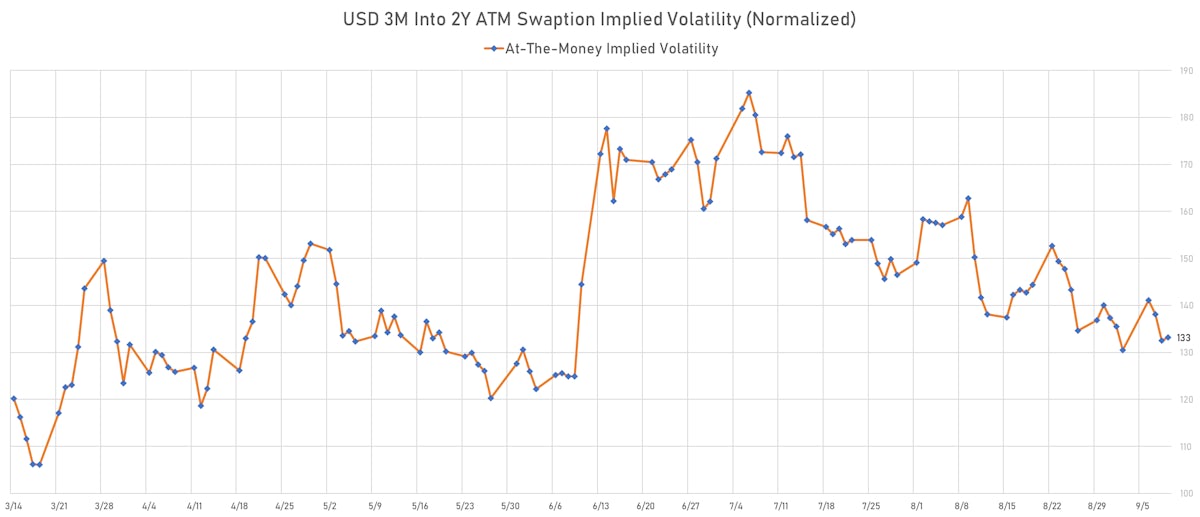

RATES VOLATILITY & LIQUIDITY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -2.4 vols at 112.4 normals

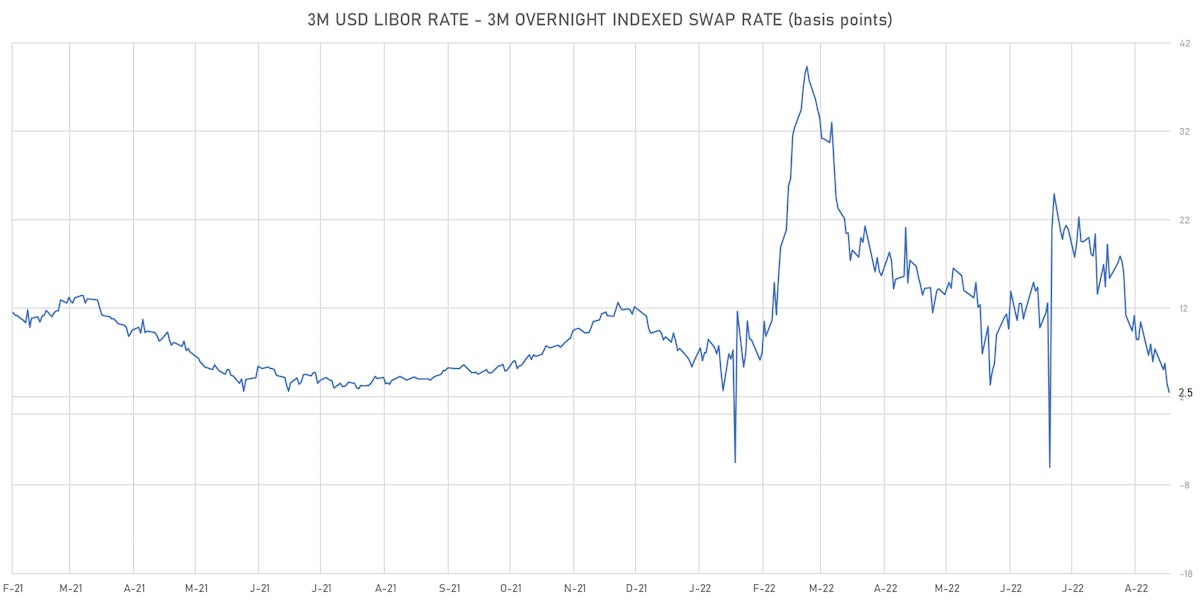

- 3-Month LIBOR-OIS spread down -1.0 bp at 2.5 bp (18-months range: -6.0 to 39.3 bp)

KEY INTERNATIONAL RATES

- Germany 5Y: 1.547% (down -1.5 bp); the German 1Y-10Y curve is 13.0 bp flatter at 72.8bp (YTD change: -42.9 bp)

- Japan 5Y: 0.049% (up 1.7 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 38.9bp (YTD change: -15.8 bp)

- China 5Y: 2.412% (up 2.3 bp); the Chinese 1Y-10Y curve is 1.5 bp flatter at 90.5bp (YTD change: -50.1 bp)

- Switzerland 5Y: 0.831% (up 7.3 bp); the Swiss 1Y-10Y curve is 1.3 bp flatter at -20.1bp (YTD change: -56.7 bp)