Rates

Front End Yields Rise, Driven By Breakevens, While The Curve Continues To Bear Flatten

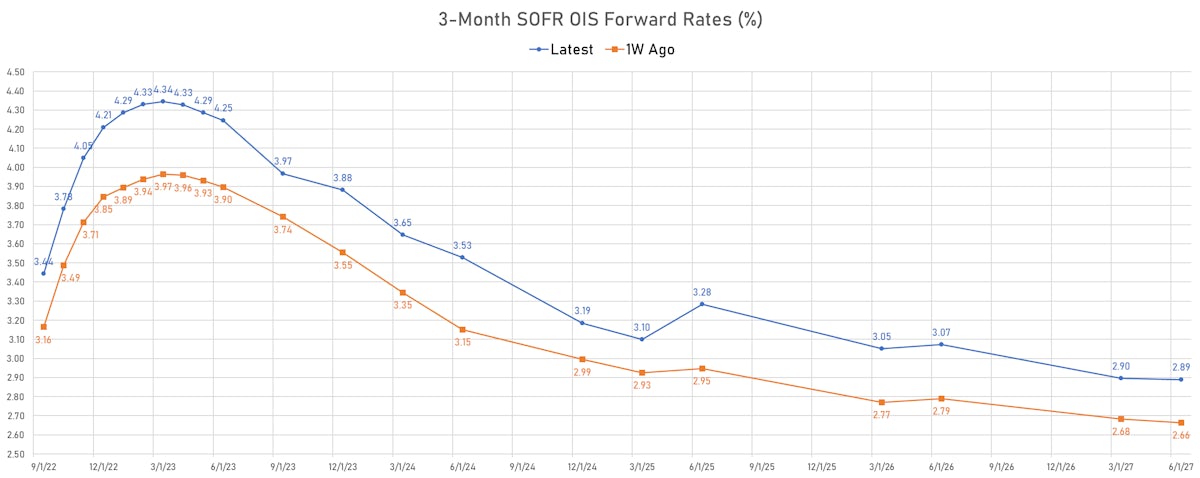

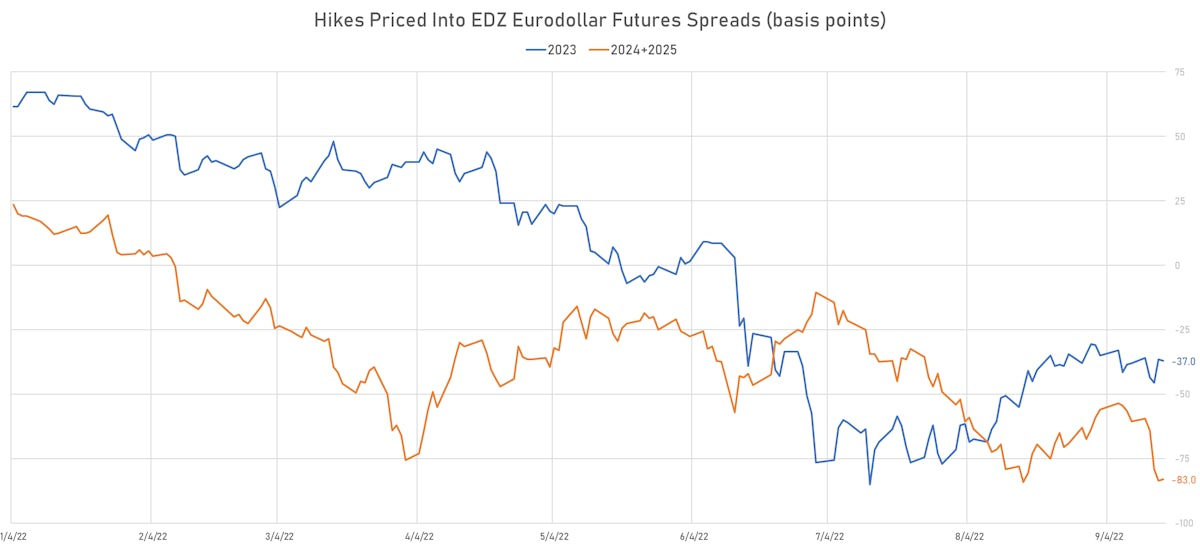

Despite the Fed's "higher for longer" messaging, money markets still price in rate cuts next year after peaking in March 2023 (EDZ23-EDH23 spread at -42bp), something Powell will no doubt have to address at his FOMC press conference

Published ET

Eurodollar futures spreads | Source: Refinitiv

US OUTLOOK AND SEPTEMBER FOMC PREVIEW

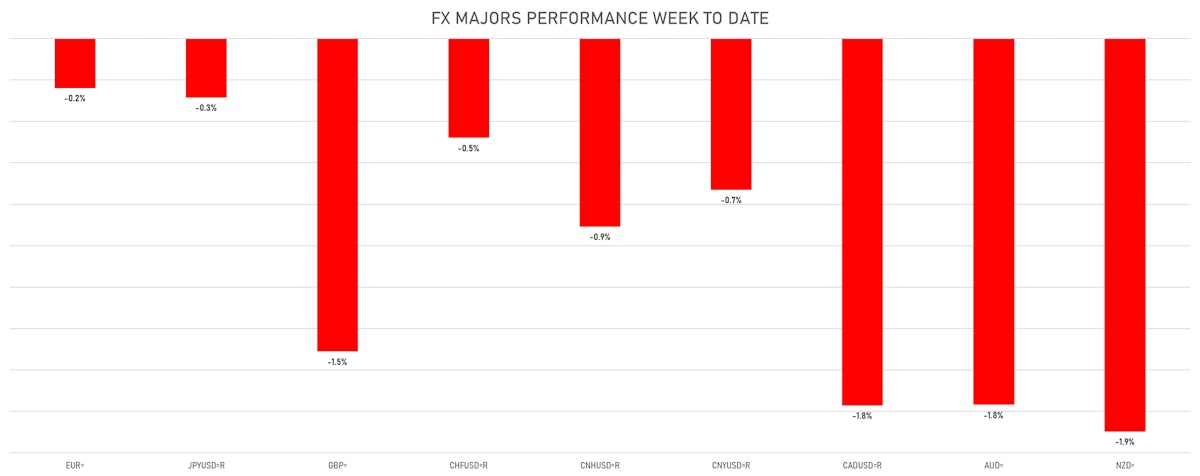

- Financial conditions have tightened drastically since the CPI data on Tuesday: higher rates, higher trade-weighted dollar, lower equities, lower credit

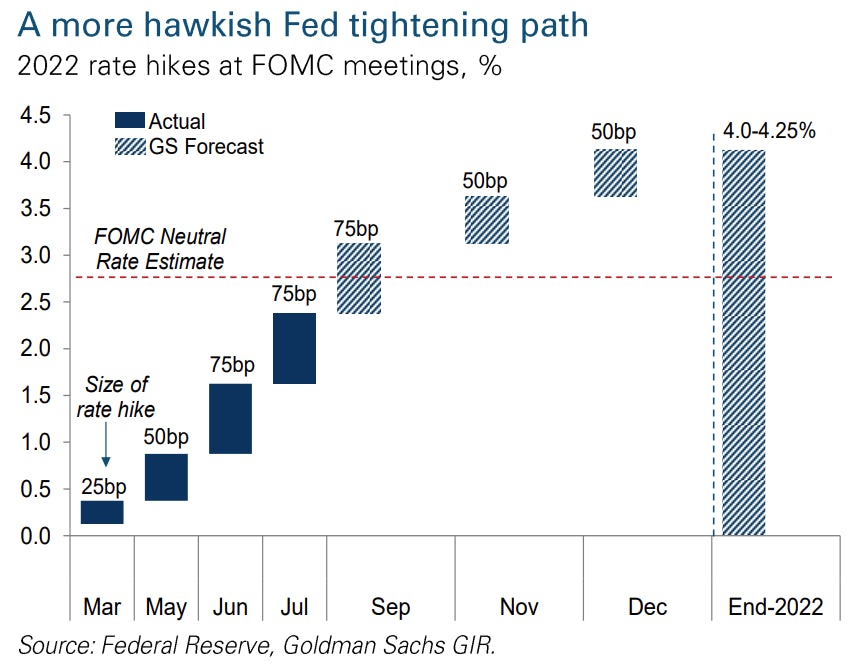

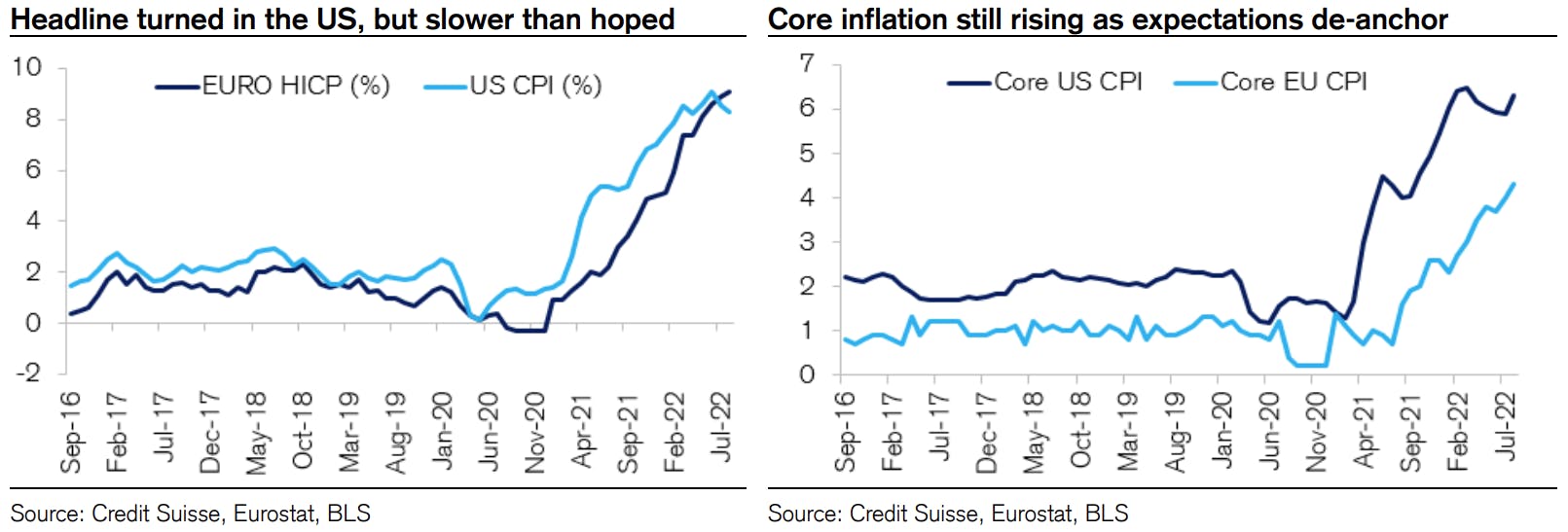

- The hot CPI data and stronger than expected growth have led sell-side economists to raise their terminal rates forecasts

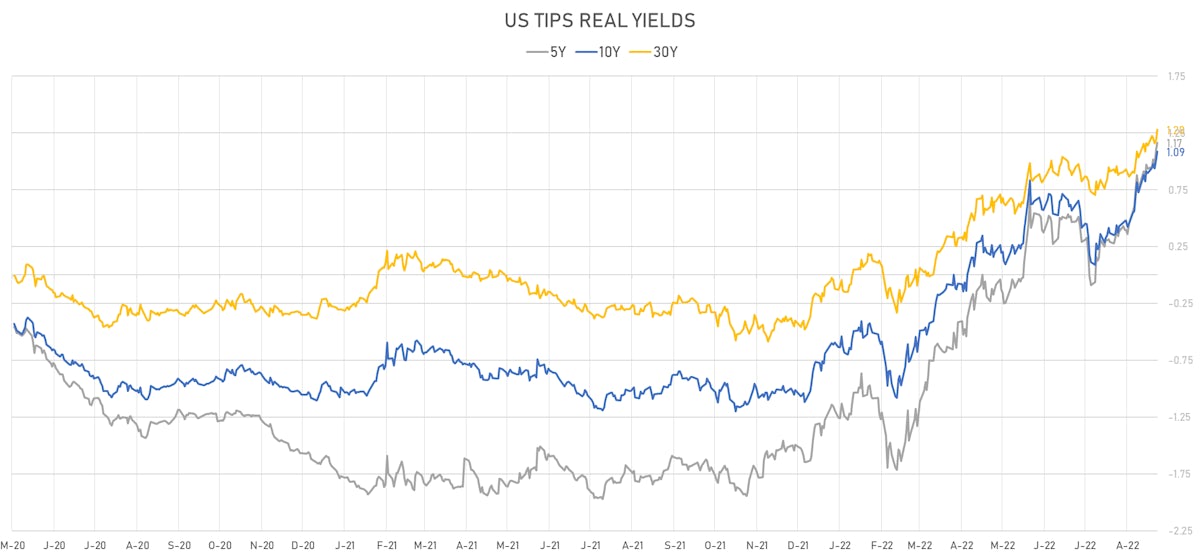

- Recession pricing is increasing, as evidenced by a deeper forward rates inversion (EDZ25-EDH23 now at -125bp) and a collapse in the slope of the US TIPS curve (5s30s real yields spread now at just 8bp)

- The FOMC outcome should provide very few surprises, with a 75bp hike well telegraphed. The market has priced a non-zero probability of a 100bp hike, because of necessary risk management positioning, but such a move by the Fed would be seen as panicky.

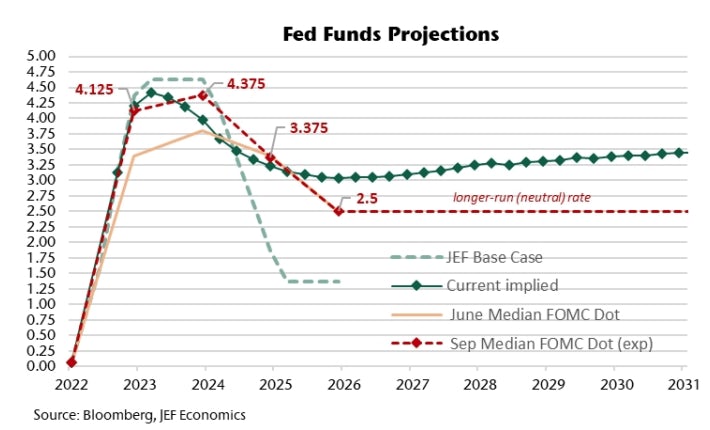

- The more interesting thing will be to look at the revised dot plot, which the Fed will use to reinforce the "higher for longer" theme

- Powell's press conference should also lean against market pricing and hammer home that rate cuts next year are exceedingly unlikely

- At this point, many market participants are struggling to see a soft landing for the US economy, and the debate is more along the lines of "how deep a recession do we need to have"

- Dominic Wilson (Goldman Sachs) is on the optimistic side but quantified well the possible outcomes: "A critical debate has emerged between those who think that the current high inflation problem can be resolved without a recession and those who think a sustained rise in the unemployment rate will be needed. We think both views are legitimately part of the distribution of potential outcomes, so it is useful to try to understand how different the market picture would be if the more pessimistic view were to materialize:

- Moderate scenario (unemployment rate needs to rise to 5%): S&P 500 would need to fall a little less than 15%, US 5-year bond yields rise by roughly 90bp relative to what we would expect under our own forecast, and the trade-weighted USD would rise by a further 4% - S&P 500 below 3400 and 5-year yields around 4.5%.

- More severe scenario (unemployment rate needs to rise to 6%): 27% lower in S&P 500, ~180bp higher in US 5-year bond yields, and 8% higher for the trade-weighted USD: S&P 500 just below 2900 and 5-year yields around 5.4%

The cumulative FCI tightening and equity declines implied by those estimates for the entire episode would be large by the standard of prior monetary policy-driven corrections, but not unprecedented. But the basic story is simple. If only a significant recession—and a sharper Fed response to deliver it—will tame inflation, then the downside to both equities and government bonds could still be substantial, even after the damage that we have already seen."

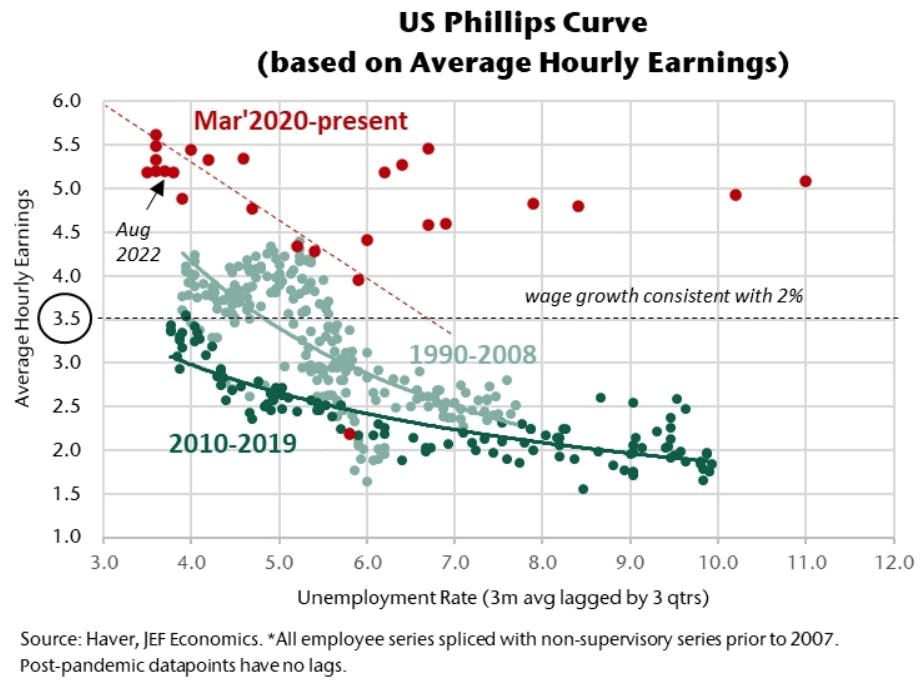

- Aneta Markowska (Jefferies) is more pessimistic and thinks the NAIRU is currently above 6%: "Although the Fed will extend its forecast horizon out to 2025, we see little value in the 2024/25 projections, which are based on an unrealistic assumption of a 4% NAIRU. This is the only way the Fed can paint a soft landing scenario, since the unemployment rate has never increased by more than 0.5% without inducing a recession. So, the SEP will probably show unemployment rising from 3.5% to 4% by 2024, which in turn brings inflation back to 2% by 2025. We believe the current NAIRU is significantly higher - likely north of 6% - which makes it virtually impossible to return to 2% inflation without inducing a recession. To get there, the Fed needs to slow wage growth to 3.5% or less (assuming productivity of 1.5%), and given the current shape of the Phillips curve, that corresponds to 6-7% unemployment."

WEEKLY US RATES SUMMARY

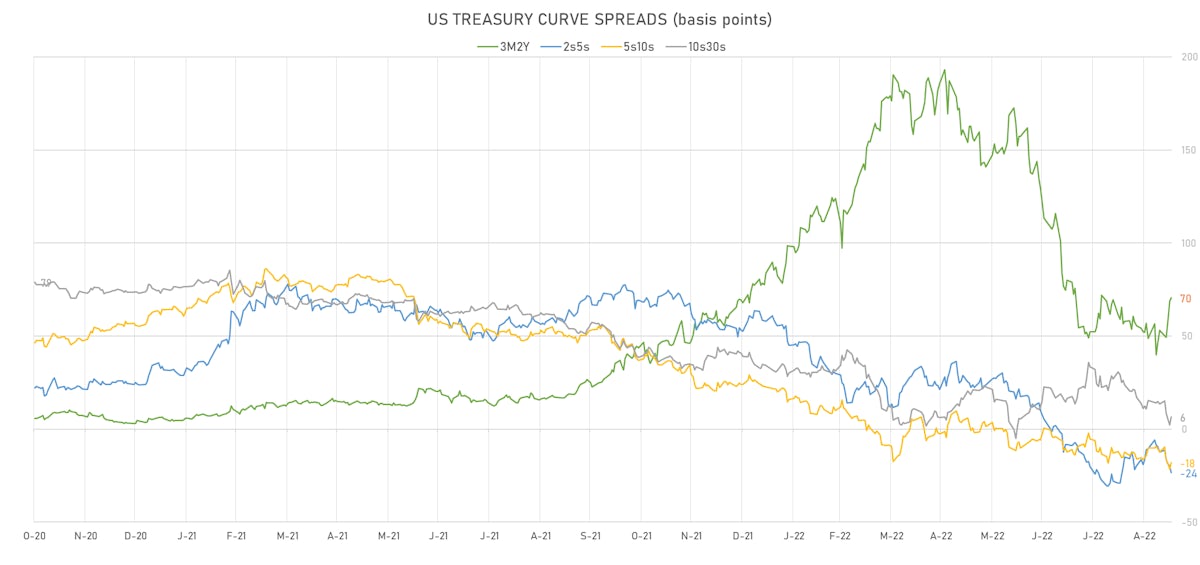

- The treasury yield curve flattened, with the 1s10s spread tightening -16.5 bp, now at -49.5 bp (YTD change: -162.7bp)

- 1Y: 3.9492% (up 30.5 bp)

- 2Y: 3.8703% (up 30.9 bp)

- 5Y: 3.6353% (up 19.9 bp)

- 7Y: 3.5682% (up 16.7 bp)

- 10Y: 3.4543% (up 14.0 bp)

- 30Y: 3.5186% (up 7.0 bp)

- US treasury curve spreads: 3m2Y at 70.2bp (up 20.6bp this week), 2s5s at -23.5bp (down -10.9bp), 5s10s at -18.1bp (down -5.9bp), 10s30s at 6.4bp (down -7.0bp)

- TIPS 1Y breakeven inflation at 2.27% (up 36.9bp); 2Y at 2.63% (up 10.0bp); 5Y at 2.55% (down -8.3bp); 10Y at 2.39% (down -5.1bp); 30Y at 2.30% (down -6.6bp)

- US 5-Year TIPS Real Yield: +23.1 bp at 1.1650%; 10-Year TIPS Real Yield: +19.0 bp at 1.0850%; 30-Year TIPS Real Yield: +13.6 bp at 1.2760%

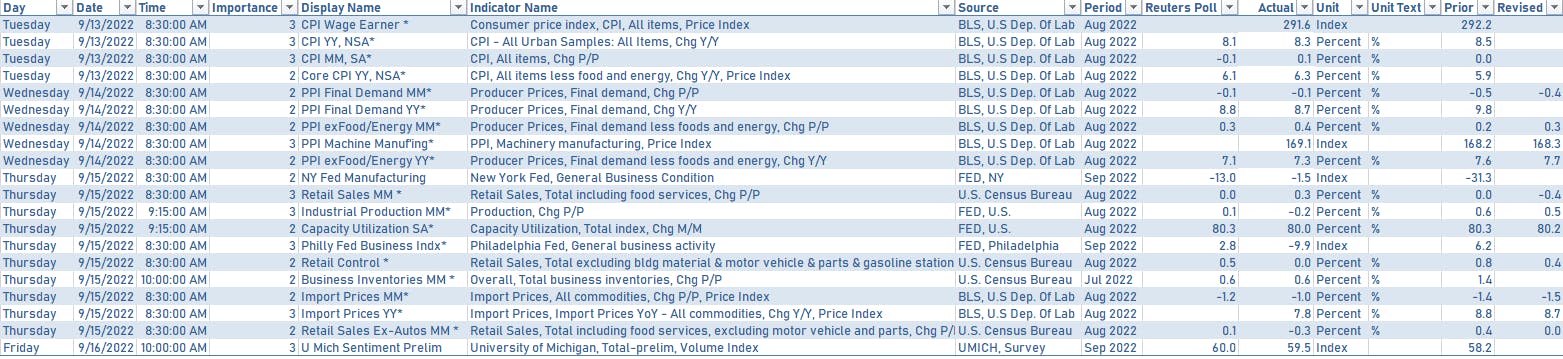

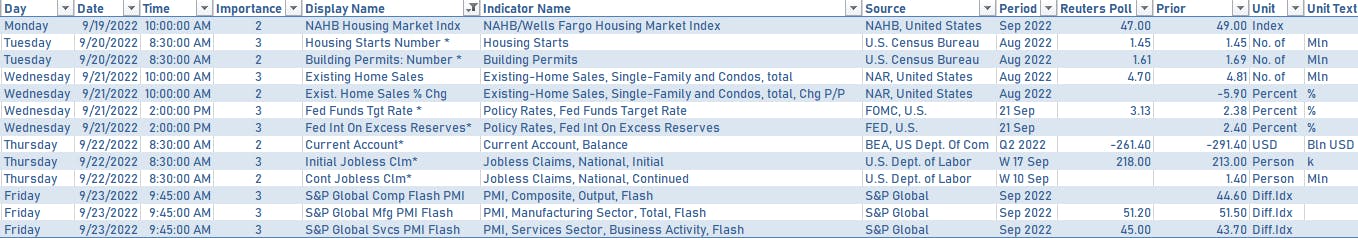

US ECONOMIC DATA OVER THE PAST WEEK

US DATA RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday at 1:00PM: $12bn 20Y bond reopening

- Thursday at 1:00PM: $15bn 10Y TIPS reopening

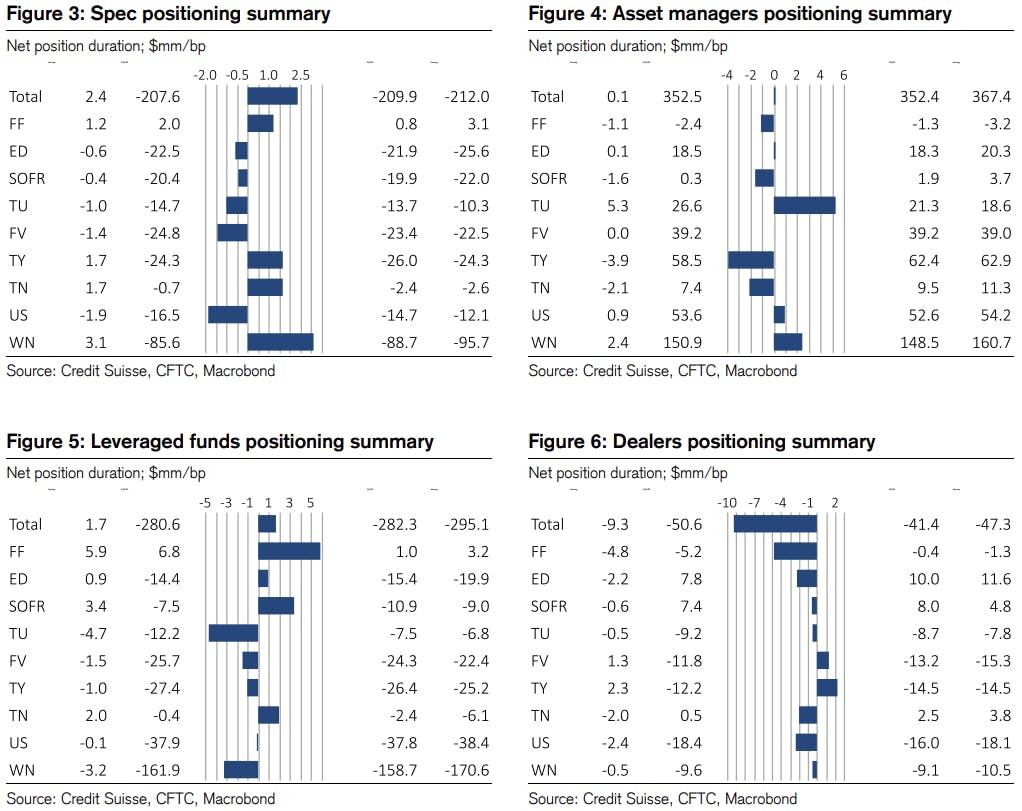

WEEKLY CFTC NET DURATION POSITIONING

US FORWARD RATES TODAY

- Fed Funds futures now price in 79.8bp of Fed hikes by the end of September 2022, 146.7bp (5.9 x 25bp hikes) by the end of November 2022, and 7.4 hikes by the end of December 2022

- 3-month Eurodollar futures (EDZ) spreads price in -37.0 bp of hikes in 2023 (equivalent to -1.5 x 25 bp hikes), down -0.5 bp today, and -64.0 bp of hikes in 2024 (equivalent to -2.6 x 25 bp hikes)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.27% (down -3.5bp); 2Y at 2.63% (down -7.1bp); 5Y at 2.55% (down -8.6bp); 10Y at 2.39% (down -6.0bp); 30Y at 2.30% (down -3.3bp)

- 6-month spot US CPI swap down -13.0 bp to 2.531%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.1650%, +5.8 bp today; 10Y at 1.0850%, +6.6 bp today; 30Y at 1.2760%, +8.4 bp today

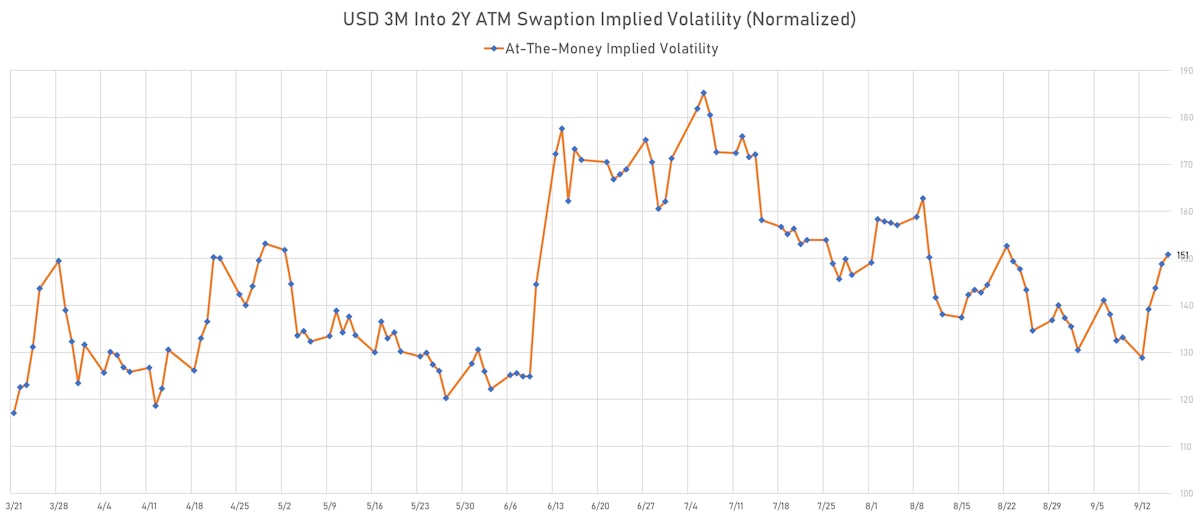

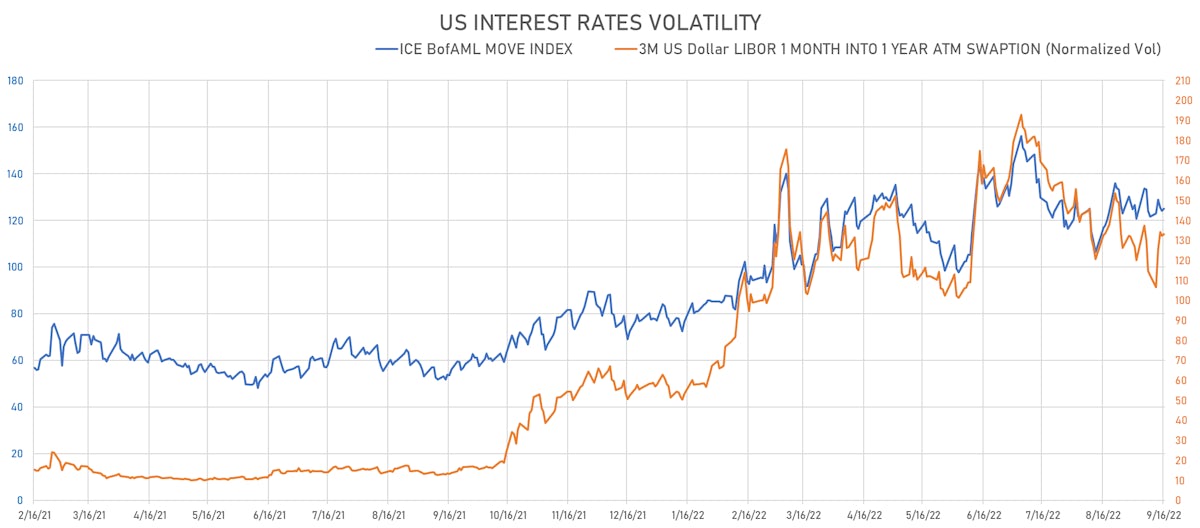

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.8 vols at 133.1 normals

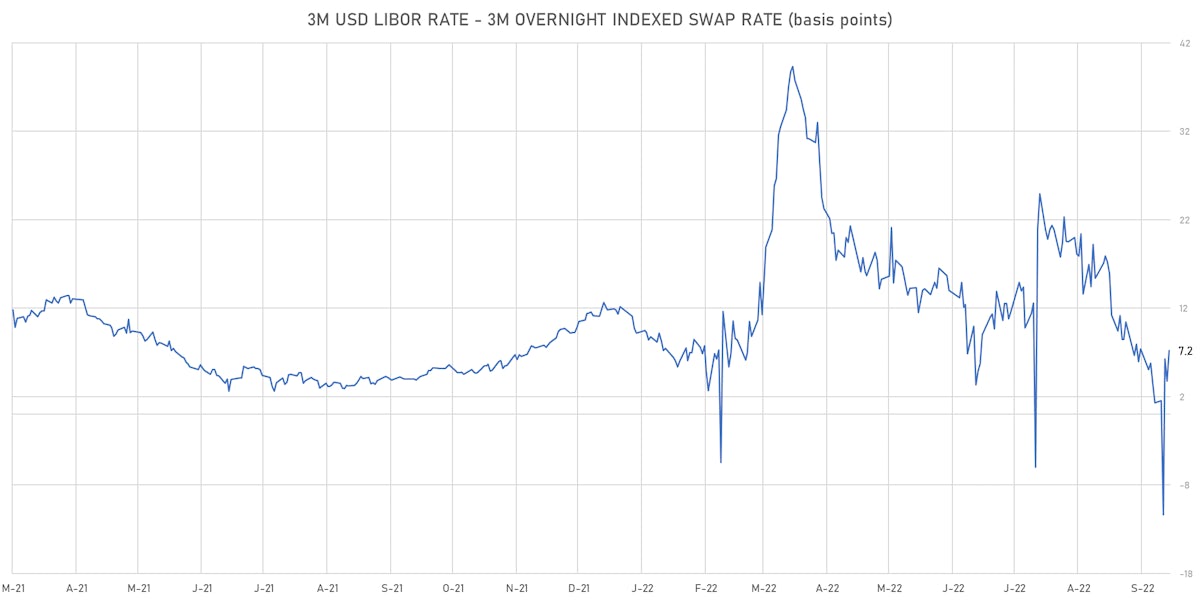

- 3-Month LIBOR-OIS spread up 3.5 bp at 7.2 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

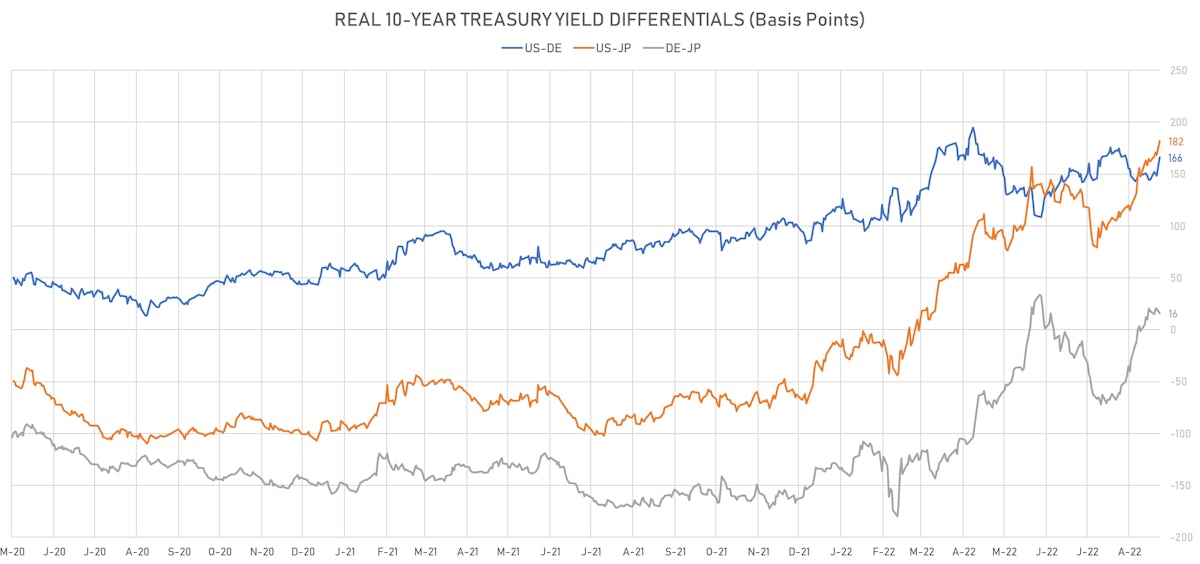

- Germany 5Y: 1.625% (up 2.7 bp); the German 1Y-10Y curve is 5.4 bp flatter at 56.7bp (YTD change: -43.0 bp)

- Japan 5Y: 0.055% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.0 bp flatter at 40.4bp (YTD change: -15.8 bp)

- China 5Y: 2.455% (up 1.5 bp); the Chinese 1Y-10Y curve is 0.6 bp flatter at 87.5bp (YTD change: -50.1 bp)

- Switzerland 5Y: 1.087% (up 10.7 bp); the Swiss 1Y-10Y curve is 4.7 bp steeper at -27.1bp (YTD change: -56.8 bp)