Rates

Solid US Economic Performance Lead Front-End Rates Higher This Week, Driven By Higher Breakevens

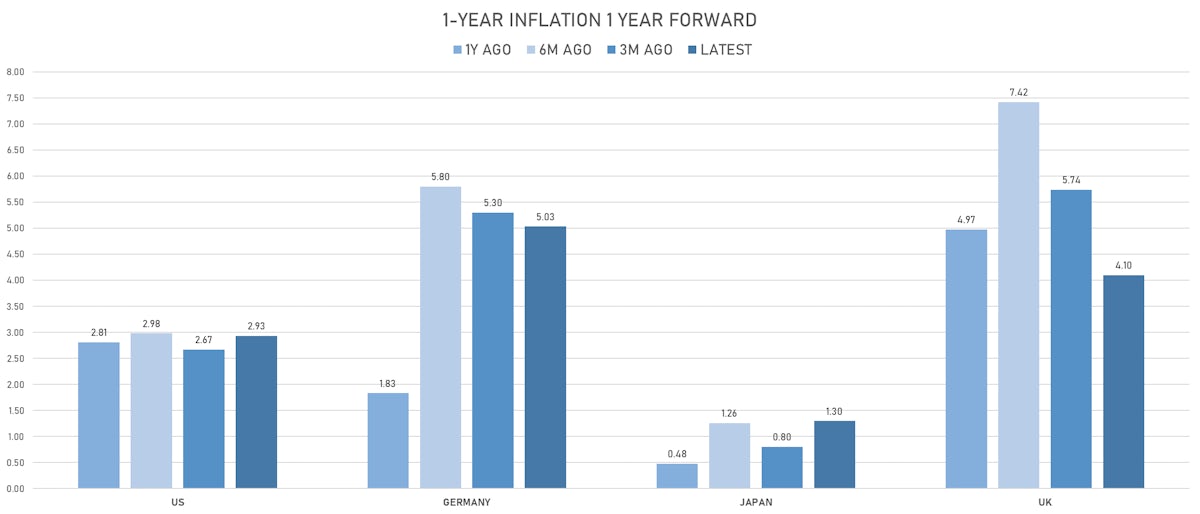

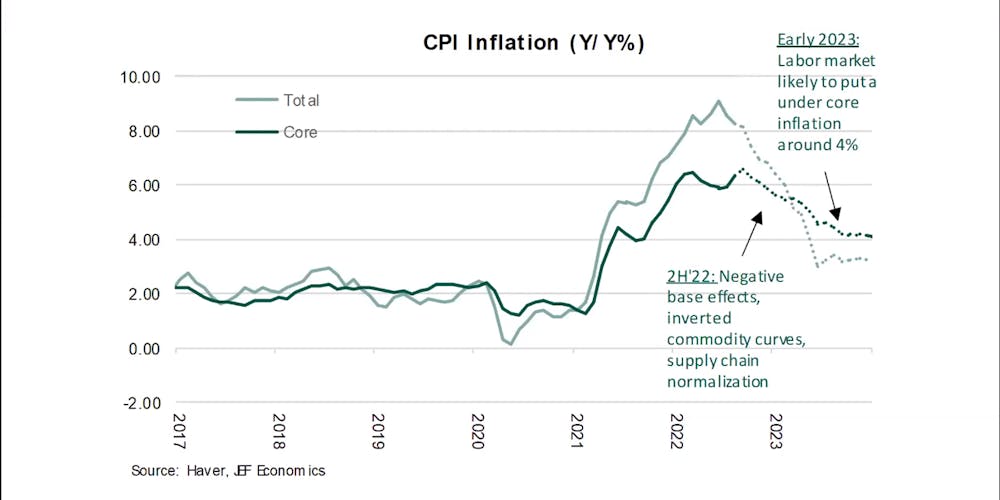

It was a good week for the Fed's soft-landing scenario, as labor demand is cooling without creating unemployment, and the recent UK situation might give the Fed a reason to slow down the pace of hikes, depending on how the CPI data looks next Thursday

Published ET

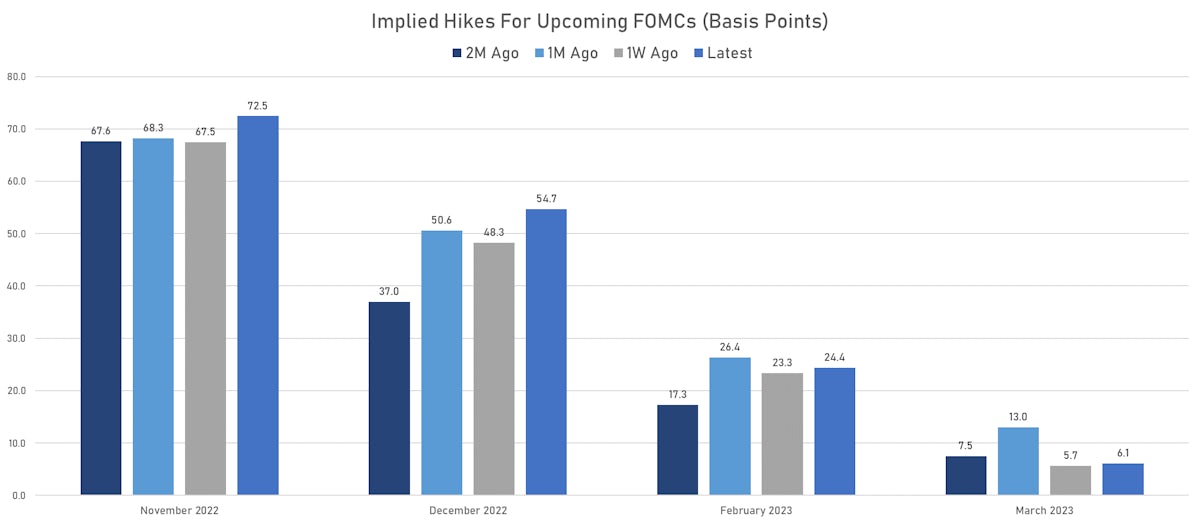

Changes In Market Implied Hikes At Upcoming FOMCs | Sources: ϕpost, Refinitiv data

RATES OUTLOOK

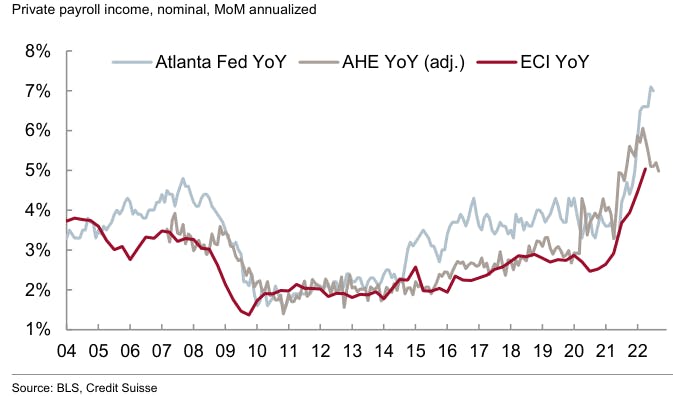

- The September employment report was undoubtedly strong: the unemployment rate dropping to 3.5% was a sign that the labor market is still in some ways moving in the wrong direction, which caused front-end pricing to rise again

- Although there were more positive signs, with wage growth easing and the job-workers gap tightening, adding more than 200k jobs / month is still far too high (the working-age population is growing at less than 50k per month)

- So, in all likelihood, the Fed is on track to hike the Funds rate 75 bp at the November FOMC, in line with market pricing (currently 90% probability of 75bp)

- Obviously, all eyes will be on the CPI next Thursday, which will guide market action for the remainder of the week / month

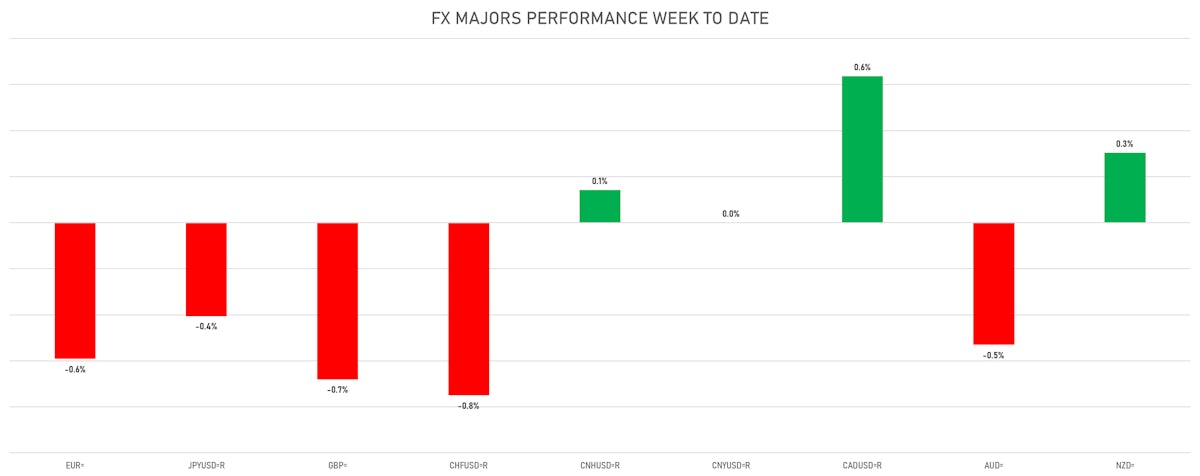

- Looking at rates curves in Euro and Sterling, it feels like the market is pricing in too many hikes: admittedly, both the ECB and the BoE have been behind the curve in tightening financial conditions, but the recent near-death experience in the UK shows how quickly things can get out of hand. We think it's likely that financial stability concerns will counterbalance the need for higher rates, with central banks choosing higher inflation rather than financial crises. If we are correct, the main consequence will be to bring necessary adjustments into the FX realm, with lower EURUSD and Cable.

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -12.1 bp, now at -29.3 bp (YTD change: -142.6bp)

- 1Y: 4.1798% (up 18.0 bp)

- 2Y: 4.3110% (up 4.0 bp)

- 5Y: 4.1476% (up 6.2 bp)

- 7Y: 4.0350% (up 5.7 bp)

- 10Y: 3.8865% (up 5.9 bp)

- 30Y: 3.8471% (up 6.8 bp)

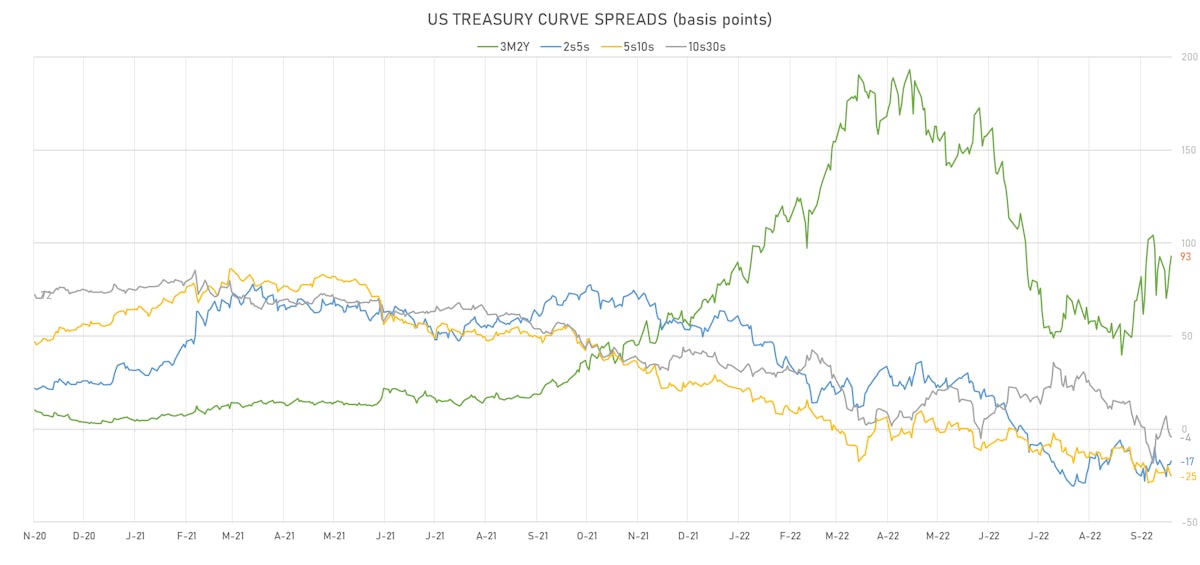

- US treasury curve spreads: 3m2Y at 93.2bp (down -6.1bp this week), 2s5s at -16.3bp (up 2.2bp), 5s10s at -26.1bp (down -0.4bp), 10s30s at -3.9bp (up 1.0bp)

- TIPS 1Y breakeven inflation at 2.56% (up 86.8bp); 2Y at 2.75% (up 57.7bp); 5Y at 2.42% (up 27.7bp); 10Y at 2.29% (up 13.6bp); 30Y at 2.15% (up 7.6bp)

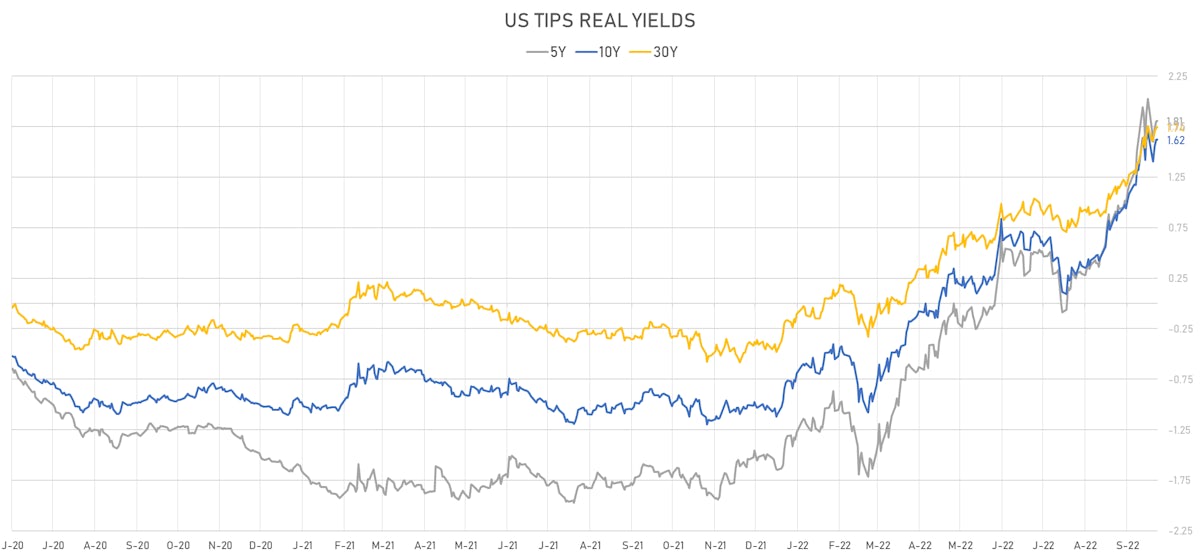

- US 5-Year TIPS Real Yield: -21.9 bp at 1.8060%; 10-Year TIPS Real Yield: -8.3 bp at 1.6200%; 30-Year TIPS Real Yield: -1.0 bp at 1.7440%

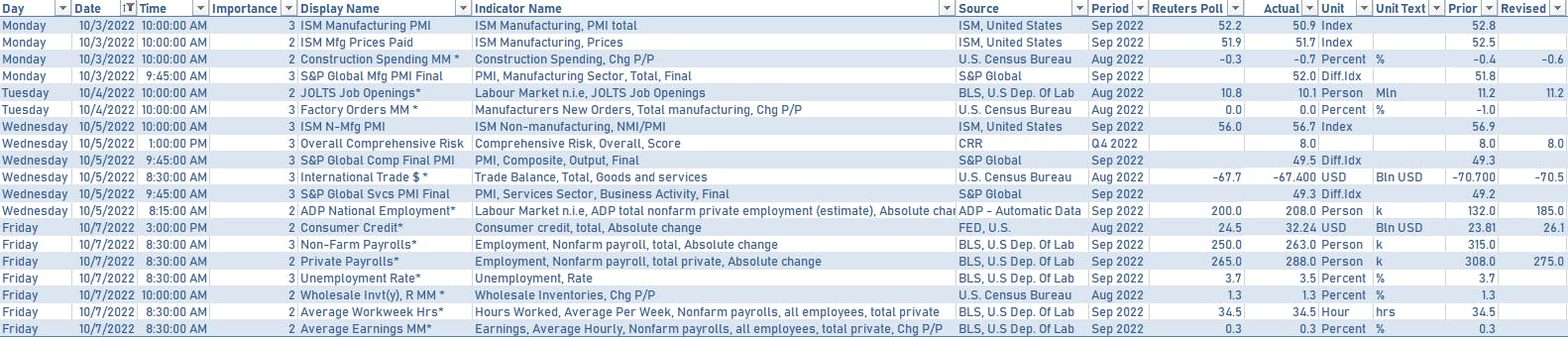

US MACRO RELEASES IN THE PAST WEEK

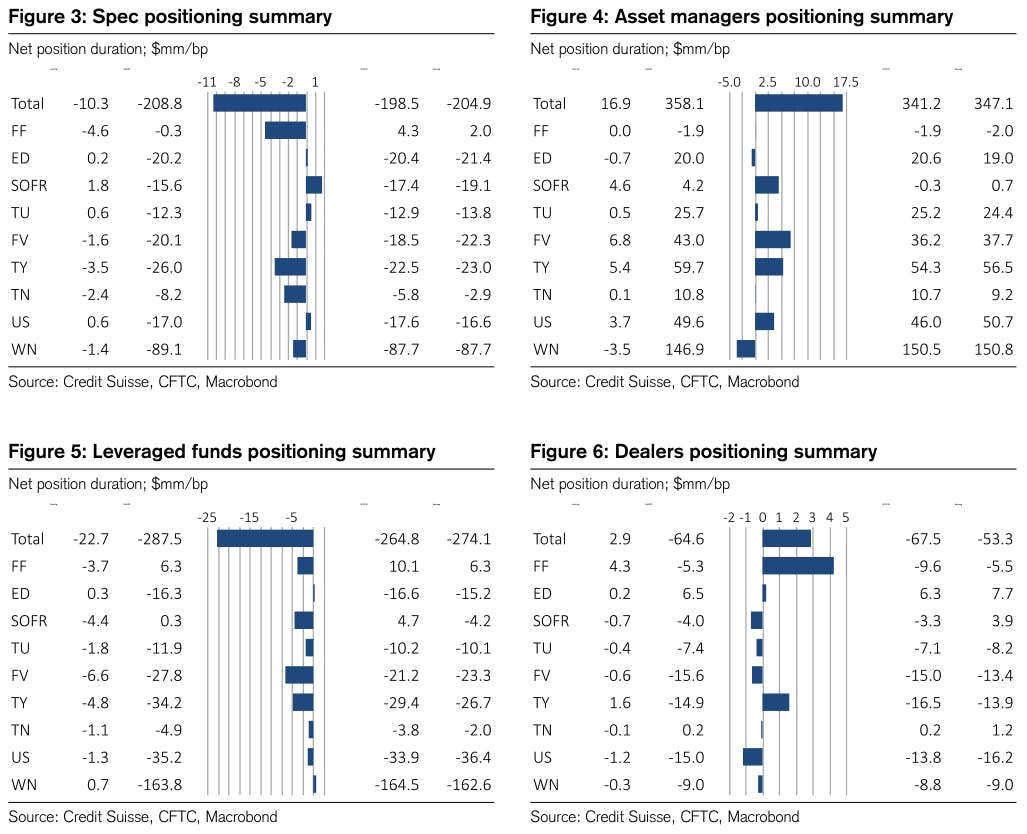

WEEKLY CFTC NET DURATION POSITIONING

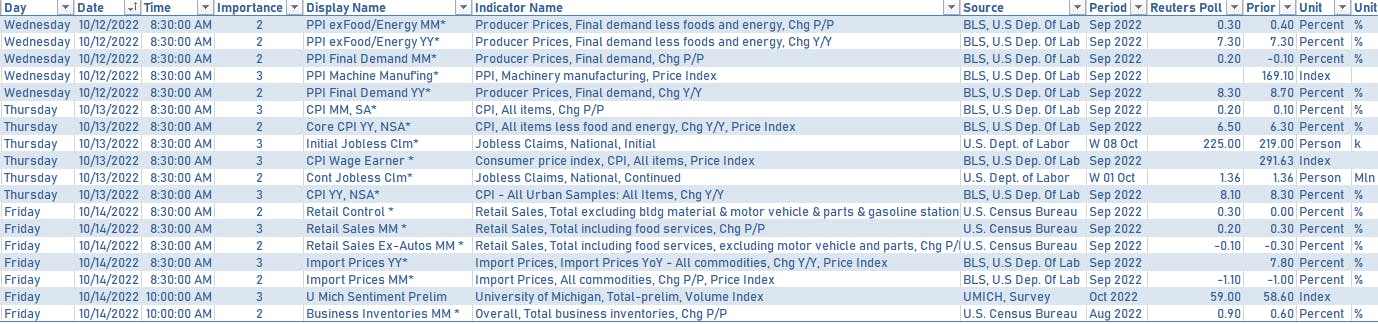

US MACRO RELEASES IN THE WEEK AHEAD

- Most important data point this week will be the latest CPI on Thursday

- The Fed will also release the Minutes of the September FOMC at 2:00PM on Wednesday

US TREASURY AUCTIONS IN THE WEEK AHEAD

- Coupon-bearing auctions will raise $90bn this week, including $52bn in new cash

- Tuesday: $40bn in 3Y notes

- Wednesday: $32 bn in 10Y notes

- Thursday: $18bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- Monday 9:00AM: Chicago Fed President Evans

- Monday 1:00PM: Fed Governor Brainard

- Tuesday 12:00PM: Cleveland Fed President Mester

- Wednesday 10:00AM: Minneapolis Fed President Kashkari

- Wednesday 1:45PM: Fed Vice Chair for Supervision Barr

- Wednesday 6:30PM: Fed Governor Bowman

- Friday 10:00AM: Kansas City Fed President George

- Friday 10:30AM: Fed Governor Cook

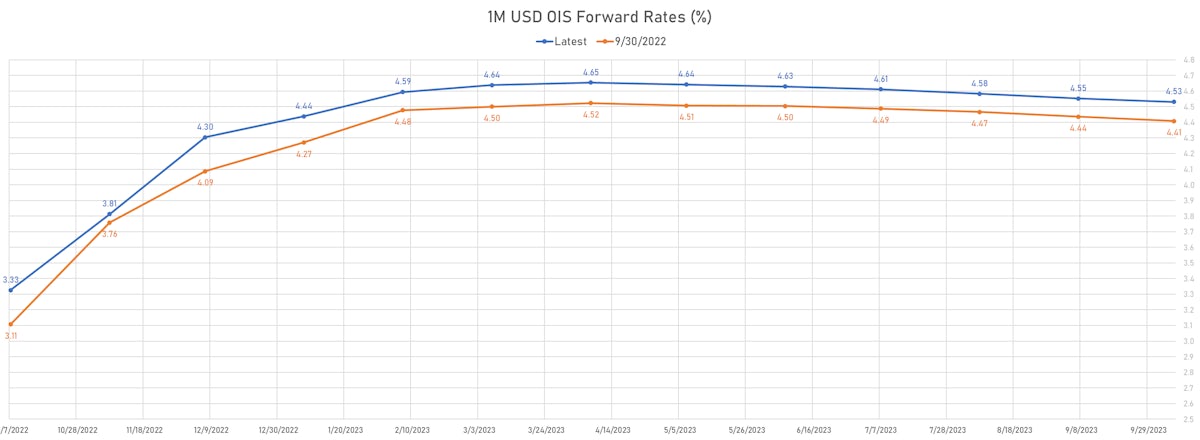

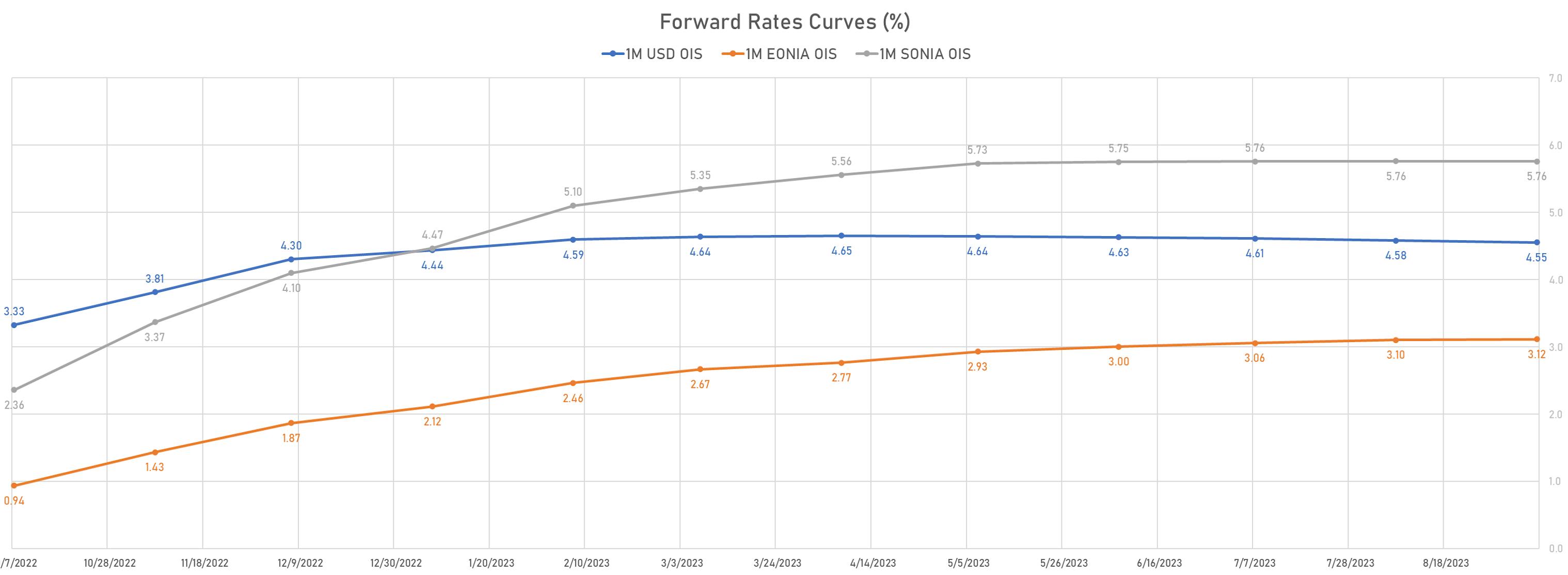

US FORWARD RATES TODAY

- Fed Funds futures now price in 72.5bp of Fed hikes by the end of November 2022, 127.1bp (5.1 x 25bp hikes) by the end of December 2022, and 6.1 hikes by the end of February 2023

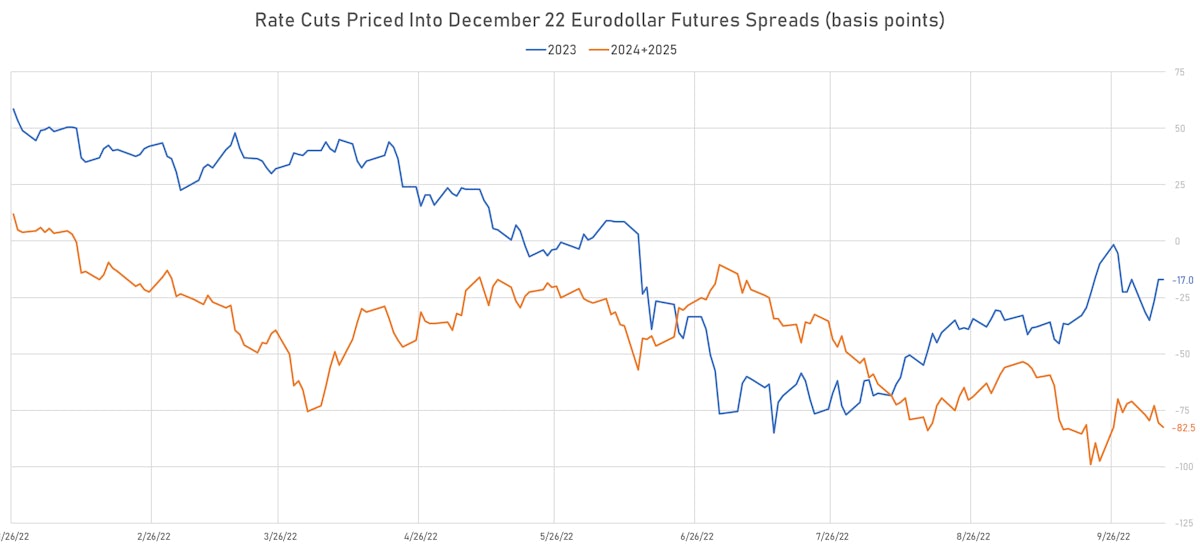

- 3-month Eurodollar futures (EDZ) spreads price in 17.0 bp of rate cuts in 2023 (equivalent to 0.7 x 25 bp cuts), unchanged today, and 62.0 bp of cuts in 2024 (= 2.5 x 25 bp)

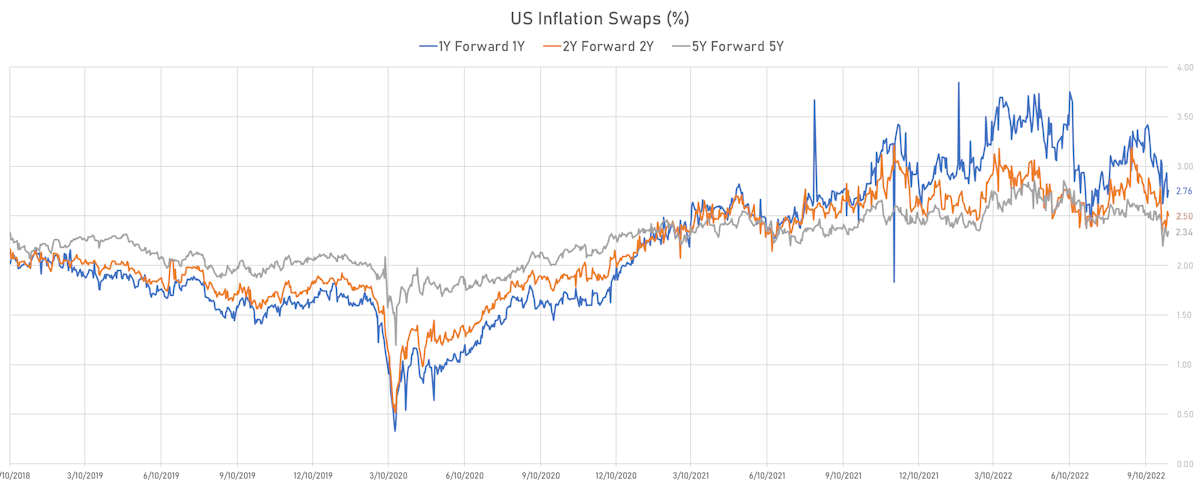

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.56% (up 14.8bp); 2Y at 2.75% (up 11.0bp); 5Y at 2.42% (up 7.2bp); 10Y at 2.29% (up 6.1bp); 30Y at 2.15% (up 5.3bp)

- 6-month spot US CPI swap up 18.4 bp to 2.614%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.8060%, +0.4 bp today; 10Y at 1.6200%, -0.2 bp today; 30Y at 1.7440%, +0.8 bp today

RATES VOLATILITY & LIQUIDITY TODAY

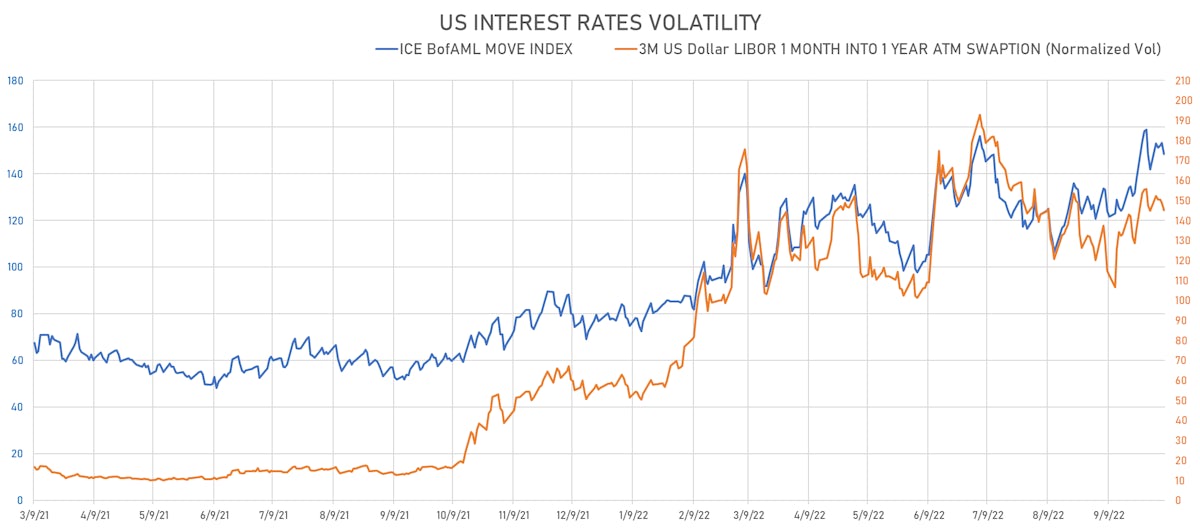

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -3.7 vols at 145.1 normals

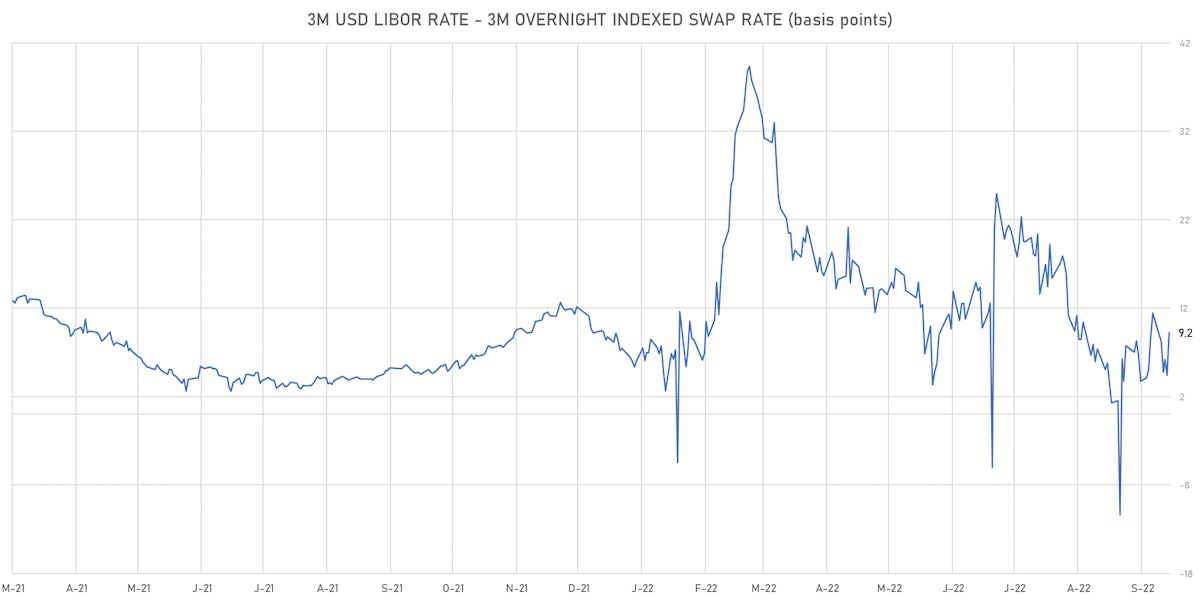

- 3-Month LIBOR-OIS spread up 4.9 bp at 9.2 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.035% (up 8.9 bp); the German 1Y-10Y curve is 8.8 bp steeper at 47.9bp (YTD change: -43.1 bp)

- Japan 5Y: 0.048% (up 1.0 bp); the Japanese 1Y-10Y curve is 0.6 bp flatter at 36.4bp (YTD change: -15.8 bp)

- China 5Y: 2.530% (down -3.4 bp); the Chinese 1Y-10Y curve is 6.9 bp flatter at 90.0bp (YTD change: -50.1 bp)

- Switzerland 5Y: 1.091% (up 15.1 bp); the Swiss 1Y-10Y curve is 47.0 bp steeper at 28.6bp (YTD change: -56.2 bp)