Rates

US CPI Brings The Fed's Terminal Rate To 5% In 1Q23, Money Markets Still Price In A Rate Cut In 4Q23

Compared to where the market currently sits, we see more upside risk to short rates over the next twelve months, and more downside risk from 2024 onward, with the likelihood of a recession not fully priced in

Published ET

US RATES OUTLOOK

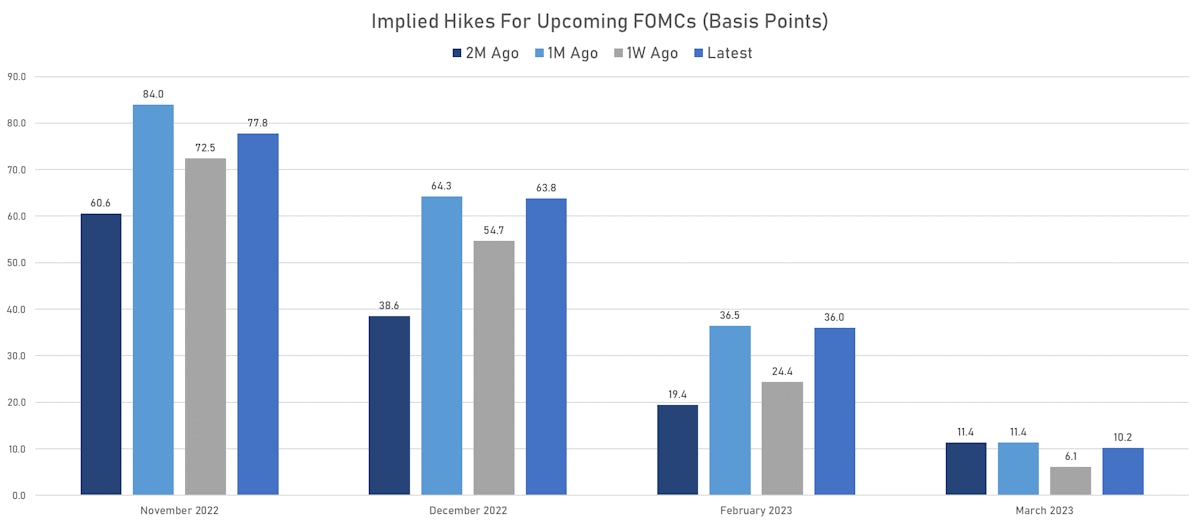

- Following the hot CPI release, peak rate pricing rose to 4.97% at the March 2023 FOMC, with the move mainly coming from a shift towards 75bp at the December 2022 FOMC, and towards 50bp at the February FOMC

- After the British debacle, US market participants have lowered the probability of anything over 75bp at the November FOMC, with the view that financial stability will be top of mind for Fed decision makers, and 100bp increments will be seen as potentially disruptive to market functioning

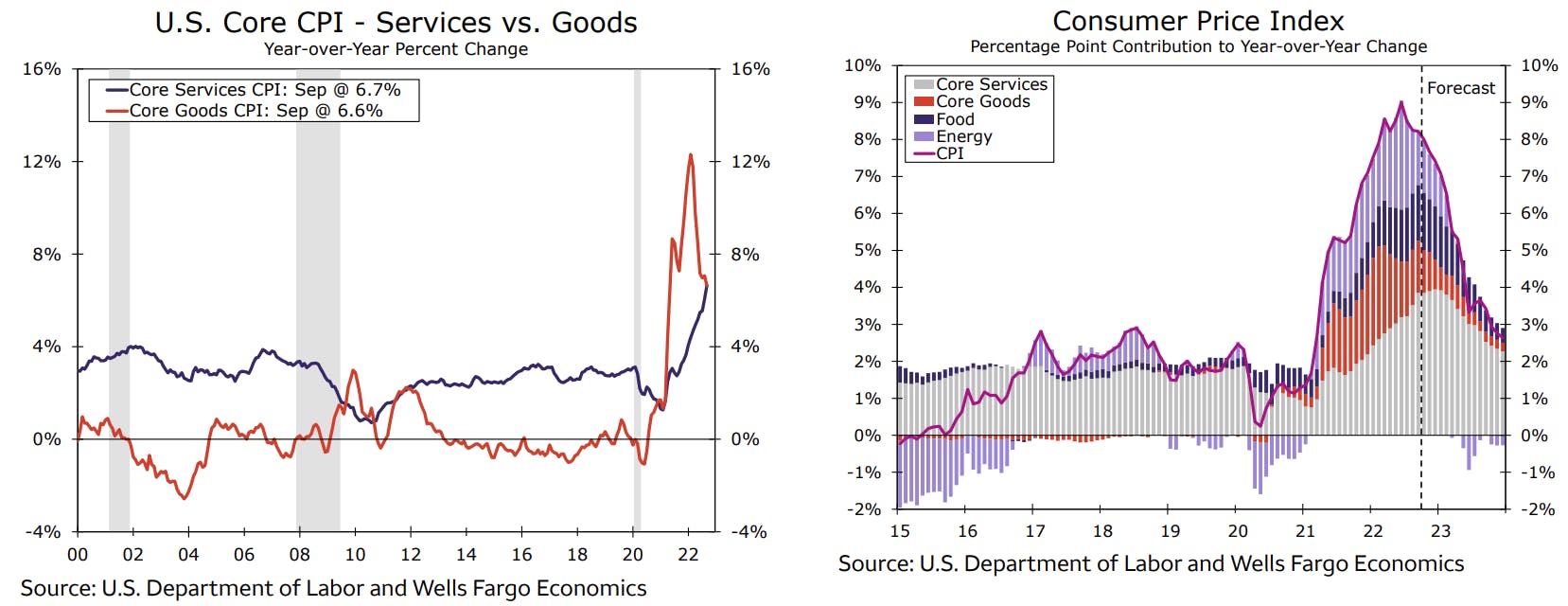

- With core services inflation accelerating, the ECI (employment cost index) to be released in a couple of weeks will be important ahead of the November FOMC, although a 75bp decision now looks pretty locked in

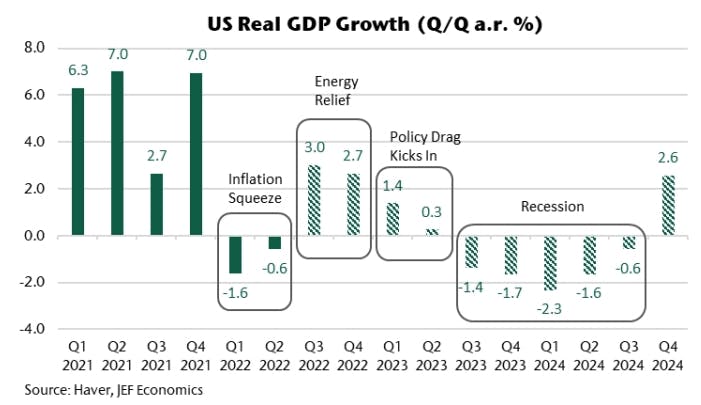

- The outlook for the US economy could be described as trimodal, with three main scenarios: 1) the base Fed scenario of a soft landing, with the economy slowing down without causing a recession; 2) a more resilient economy and labor market requiring continued forceful Fed action, leading to a deeper recession; 3) a scenario that is garnering interest after the UK situation is one where exogenous shocks (like a financial crisis or a war in Asia) lead the Fed to pause their hikes earlier, and never reach the current terminal rate

- In other words, it's very hard at this point to take a directional view on US rates, with a wide multimodal distribution: it's easy to see Fed Funds rates rising to 6% to contain persistent inflation, but they could also go materially lower in case of shocks

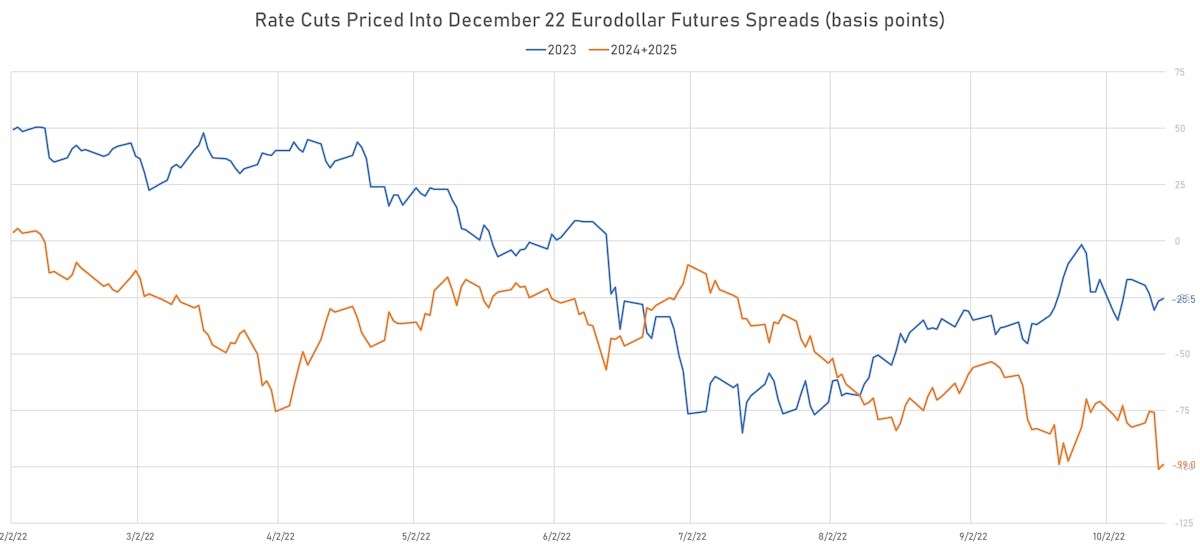

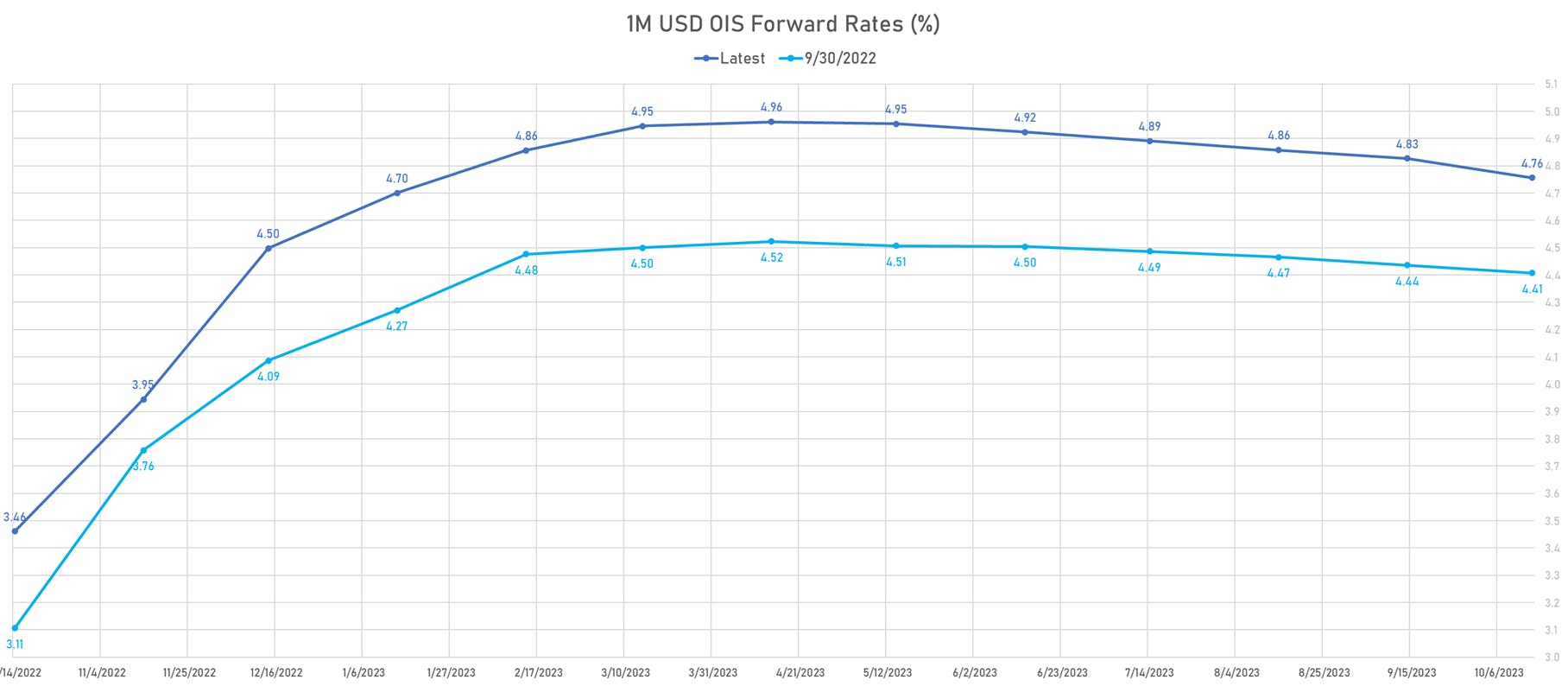

- In this context, markets are still pricing one rate cut in 4Q23, when we would be tempted to think the Fed won't cut at all through 2023. Not a strong conviction but a small short position in EDU3 may be warranted.

- A potentially more asymmetric trade is how few cuts are priced in after 2023: Eurodollar futures currently see only 4 rate cuts between December 2023 and December 2025. As the base case of many economists moves away from a soft landing, and towards a deeper recession, we think the Fed is likely to cut much more than 100bp over the 2 year-period

- Jefferies' Aneta Markowska: "After a 'stronger for longer' expansion, we envision a recession that comes later than consensus currently expects, but hits the economy much harder than anticipated. Consensus expects a mild recession starting in Q1 and lasting about 3 quarters. We believe it will start later (around Q3) and last longer (5 quarters). "

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -10.8 bp, now at -45.7 bp (YTD change: -158.9bp)

- 1Y: 4.4784% (up 30.4 bp)

- 2Y: 4.4949% (up 24.1 bp)

- 5Y: 4.2686% (up 19.7 bp)

- 7Y: 4.1712% (up 20.3 bp)

- 10Y: 4.0215% (up 19.6 bp)

- 30Y: 3.9926% (up 20.6 bp)

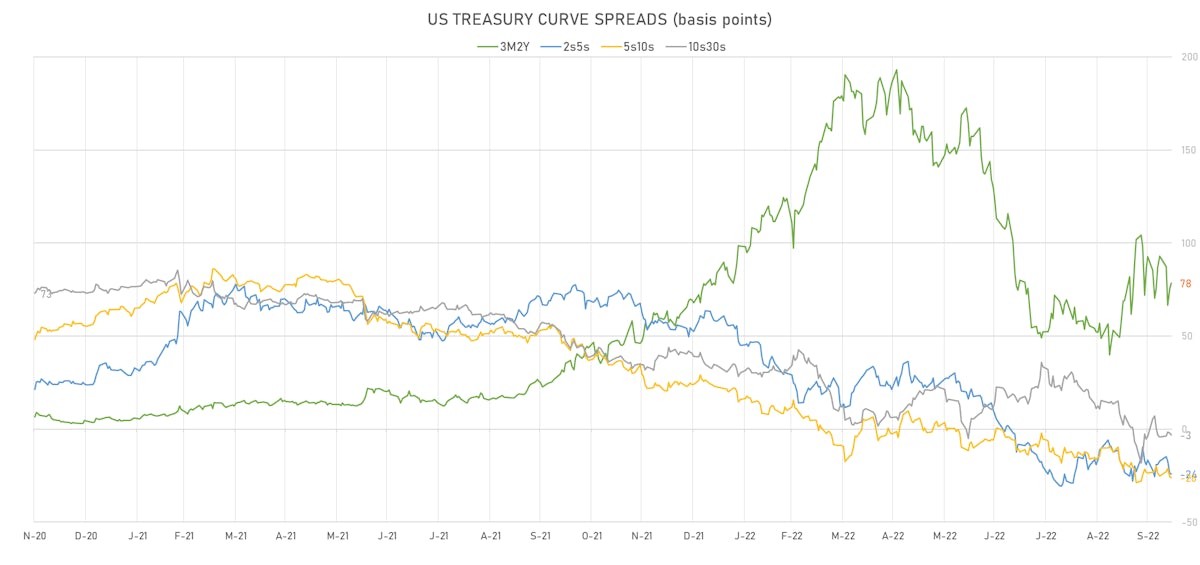

- US treasury curve spreads: 3m2Y at 77.1bp (down -16.2bp this week), 2s5s at -22.6bp (down -6.2bp), 5s10s at -24.7bp (up 1.5bp), 10s30s at -2.9bp (up 1.0bp)

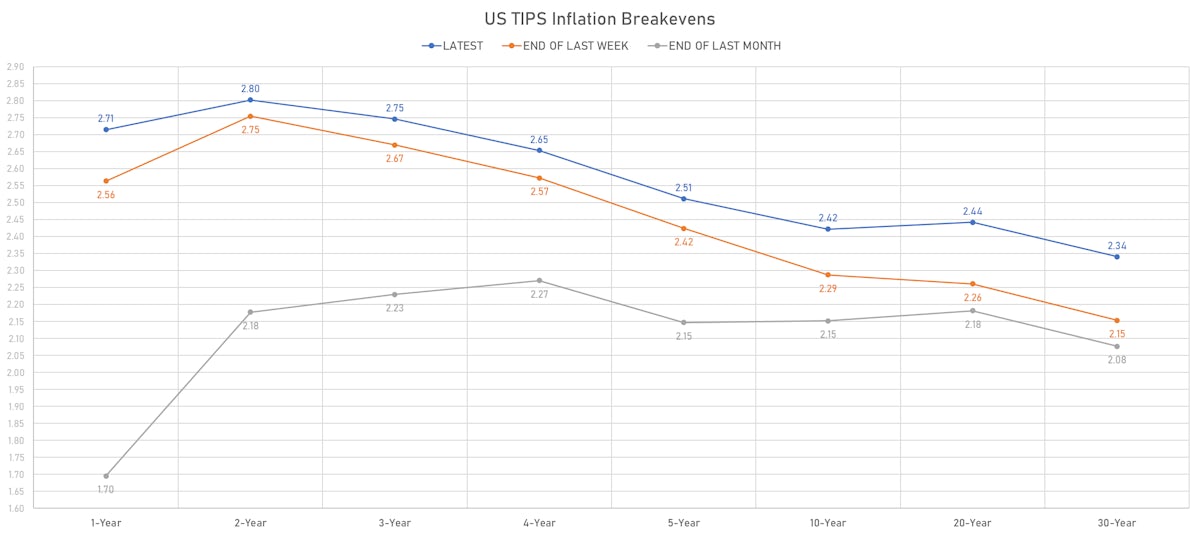

- TIPS 1Y breakeven inflation at 2.71% (up 15.1bp); 2Y at 2.80% (up 4.8bp); 5Y at 2.51% (up 8.7bp); 10Y at 2.42% (up 13.4bp); 30Y at 2.34% (up 18.7bp)

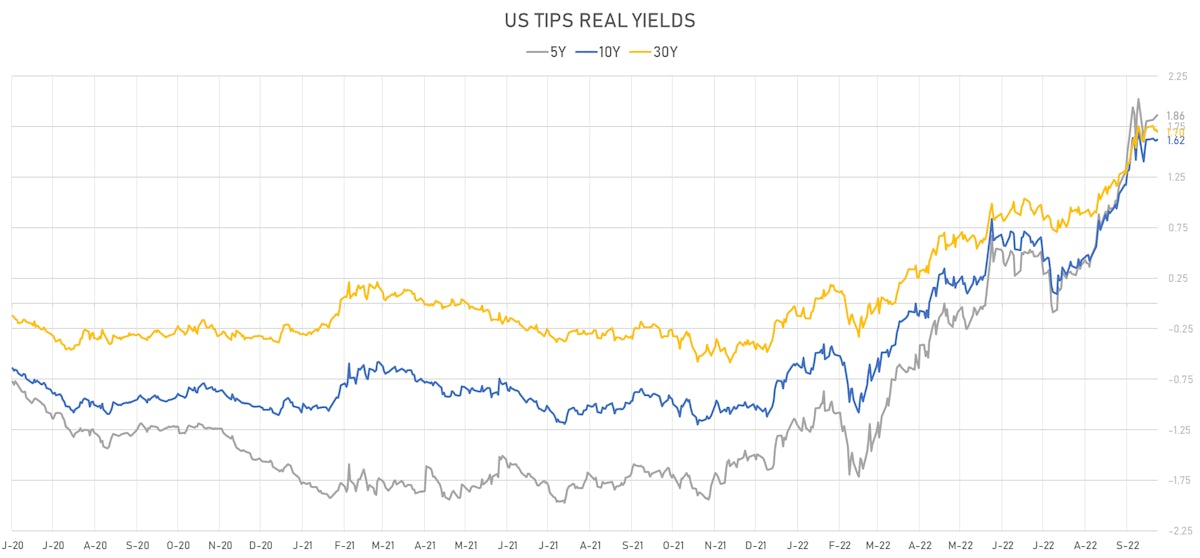

- US 5-Year TIPS Real Yield: +5.9 bp at 1.8610%; 10-Year TIPS Real Yield: 0.0 bp at 1.6220%; 30-Year TIPS Real Yield: -3.6 bp at 1.7000%

US ECONOMIC DATA OVER THE PAST WEEK

US MACRO DATA IN THE WEEK AHEAD

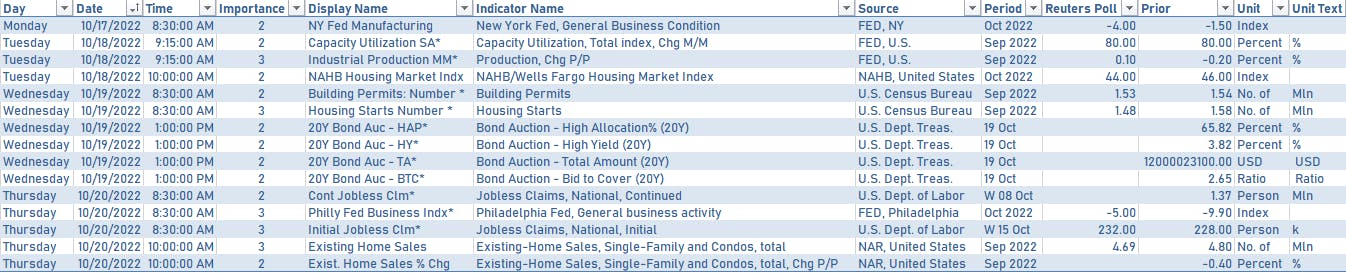

- Focus next week will be on September industrial production, housing starts,

and existing home sales - The Fed will release its Beige Book at 2:00PM on Wednesday

US TREASURY AUCTIONS

- Wednesday 19 October: $12bn in 20Y Bonds

- Thursday 20 October: $21bn in 5Y TIPS

FED SPEECHES THIS WEEK

- Tuesday 2:00PM: Atlanta Fed President Bostic

- Tuesday 5:30PM: Minneapolis Fed President Kashkari

- Wednesday 1:00PM: Minneapolis Fed President Kashkari

- Wednesday 6:30PM: Chicago Fed President Evans

- Wednesday 6:30PM: St. Louis Fed President Bullard

- Thursday 1:30PM: Fed Governor Jefferson

- Thursday 1:45PM: Fed Governor Cook

- Thursday 2:05PM: Fed Governor Bowman

- Friday 9:10AM: New York Fed President Williams

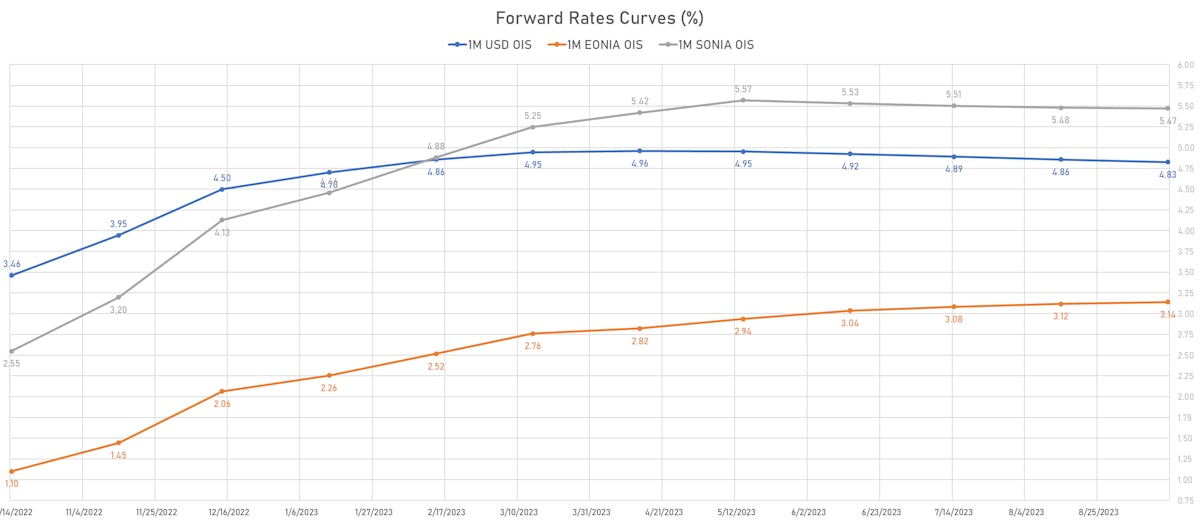

US FORWARD RATES

- Fed Funds futures now price in 77.8bp of Fed hikes by the end of November 2022, 141.6bp (5.7 x 25bp hikes) by the end of December 2022, and 7.1 hikes by the end of February 2023

- 3-month Eurodollar futures (EDZ) spreads price in 25.5 bp of cuts in 2023, and 74.0 bp of cuts in 2024

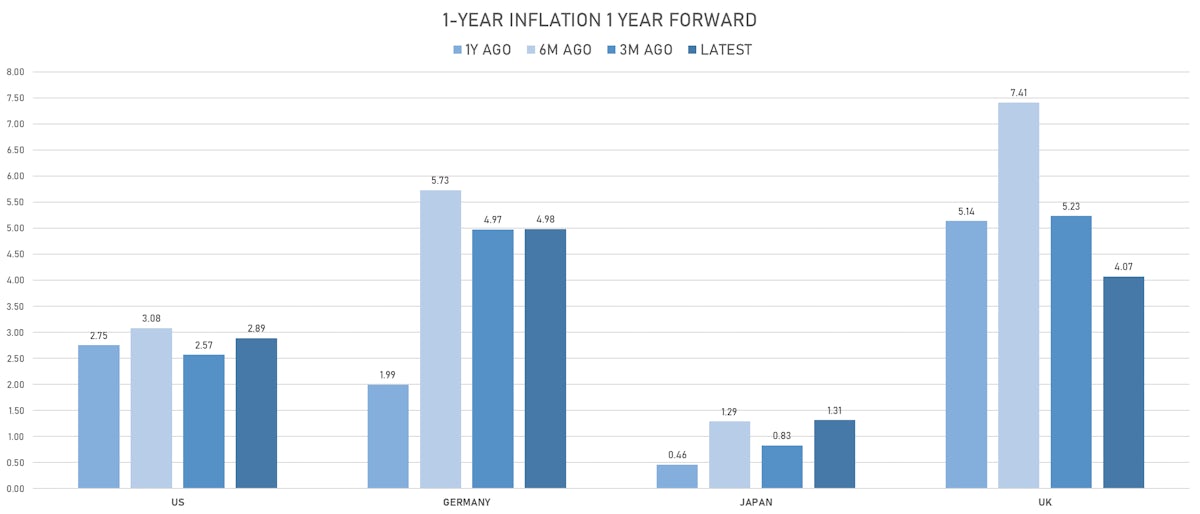

US INFLATION & REAL RATES TODAY

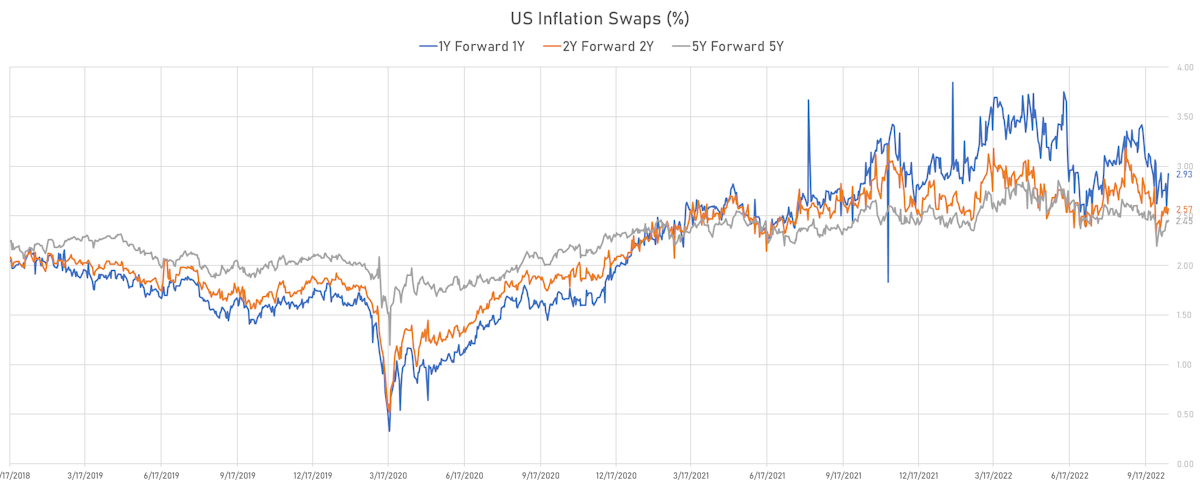

- TIPS 1Y breakeven inflation at 2.71% (down -9.0bp); 2Y at 2.80% (down -4.8bp); 5Y at 2.51% (up 5.9bp); 10Y at 2.42% (up 6.3bp); 30Y at 2.34% (up 8.2bp)

- 6-month spot US CPI swap up 19.0 bp to 2.896%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.8610%, +0.7 bp today; 10Y at 1.6220%, +1.0 bp today; 30Y at 1.7000%, -1.8 bp today

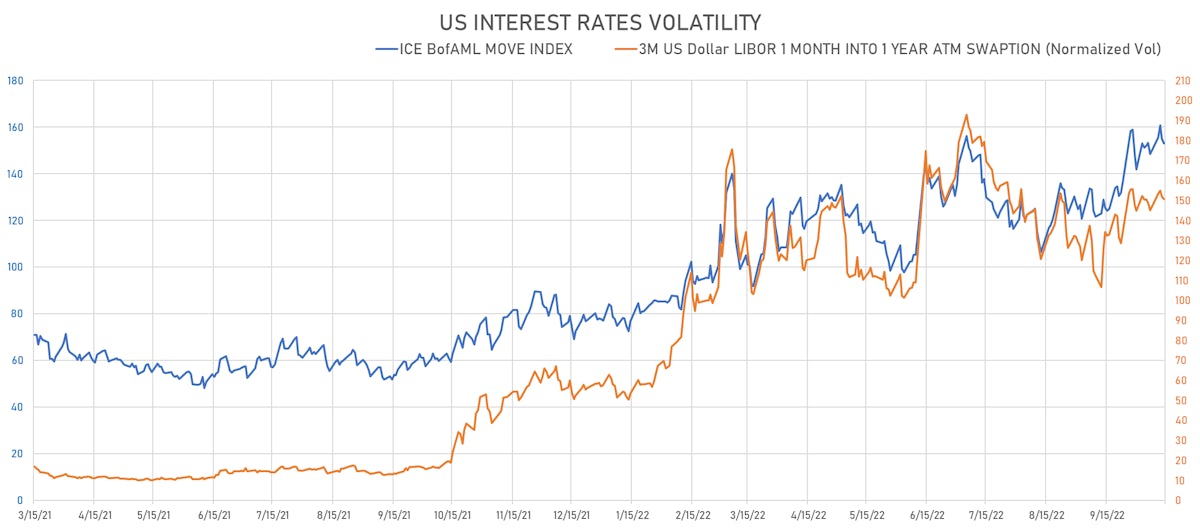

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.2 vols at 150.7 normals

- 3-Month LIBOR-OIS spread up 10.0 bp at 21.3 bp (18-months range: -11.3 to 39.3 bp)

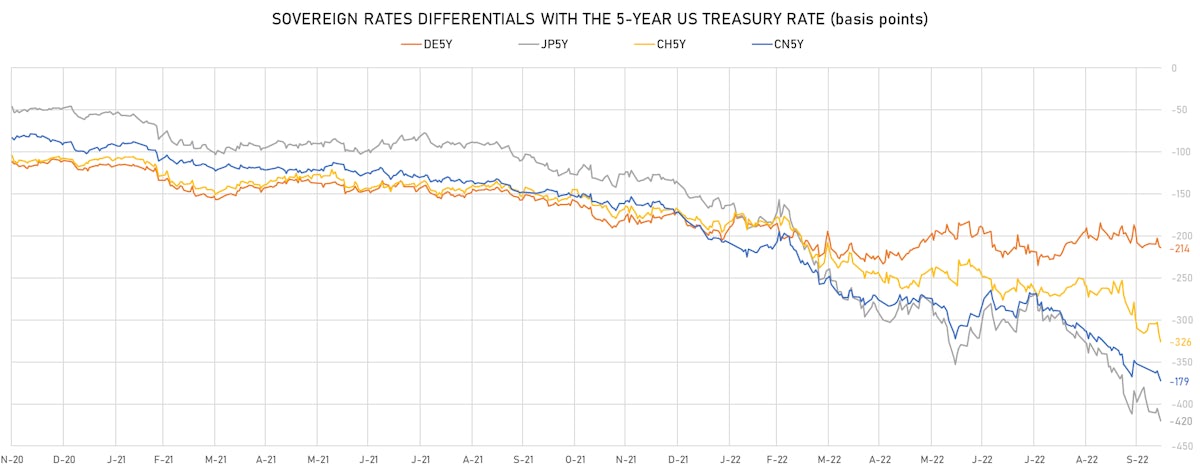

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.098% (up 3.9 bp); the German 1Y-10Y curve is 5.1 bp steeper at 47.1bp (YTD change: -43.1 bp)

- Japan 5Y: 0.069% (down -0.3 bp); the Japanese 1Y-10Y curve is unchanged at 35.9bp (YTD change: -15.8 bp)

- China 5Y: 2.473% (down -1.8 bp); the Chinese 1Y-10Y curve is 0.1 bp steeper at 95.7bp (YTD change: -50.0 bp)

- Switzerland 5Y: 1.010% (down -1.8 bp); the Swiss 1Y-10Y curve is 4.1 bp steeper at 32.8bp (YTD change: -56.2 bp)