Rates

Front-End Rates Up Slightly, With Higher Inflation Breakevens, And A Steepening Of The Curve

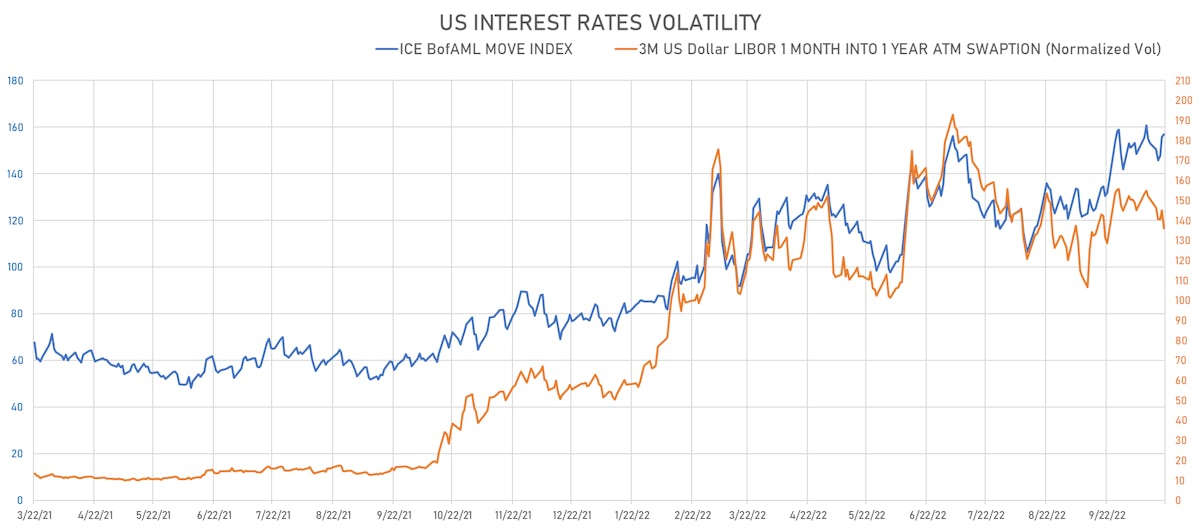

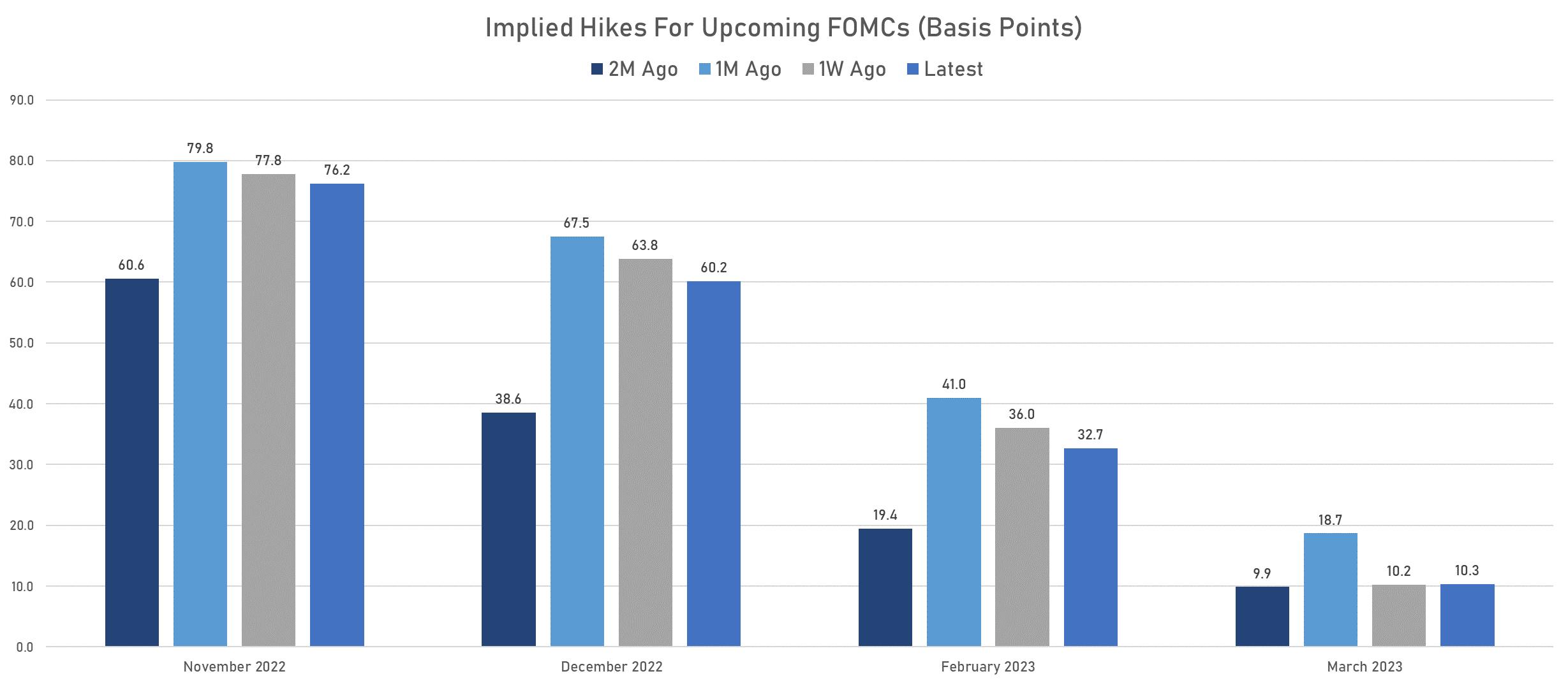

Although two consecutive 75bp hikes are still our baseline for the next 2 FOMCs, we expect continued rates volatility and worsening market liquidity into year end

Published ET

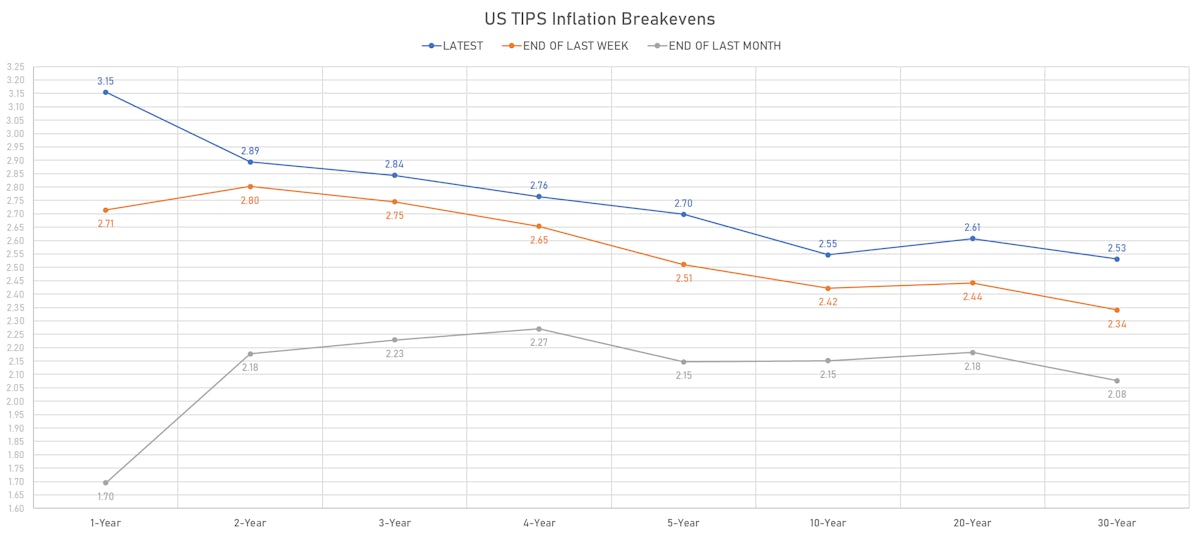

US TIPS Inflation Breakevens | Sources: ϕpost, Refinitiv data

US RATES OUTLOOK

- Another volatile week started with a hawkish tilt, which was reversed by a WSJ piece about the Fed potentially slowing down the pace of hikes from December. In itself not really news, as that's obviously an outcome the market was already pricing, but recent Fed leaks through the WSJ have made the market more receptive to this kind of headlines

- The important thing is that the Fed is still concerned about easing financial conditions before inflation is clearly under control (as it should be); in this context, a downshift to a 50bp pace in December seems unlikely unless the trend in the inflation data changes radically over the next 6 weeks (all eyes on the ECI this week) or the recent deterioration in market liquidity leads to an unexpected pause

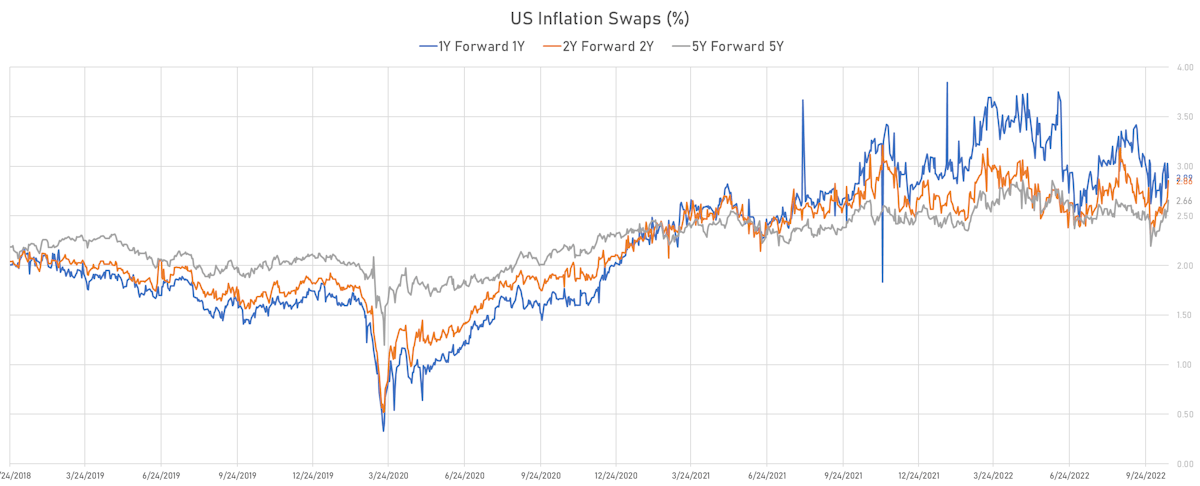

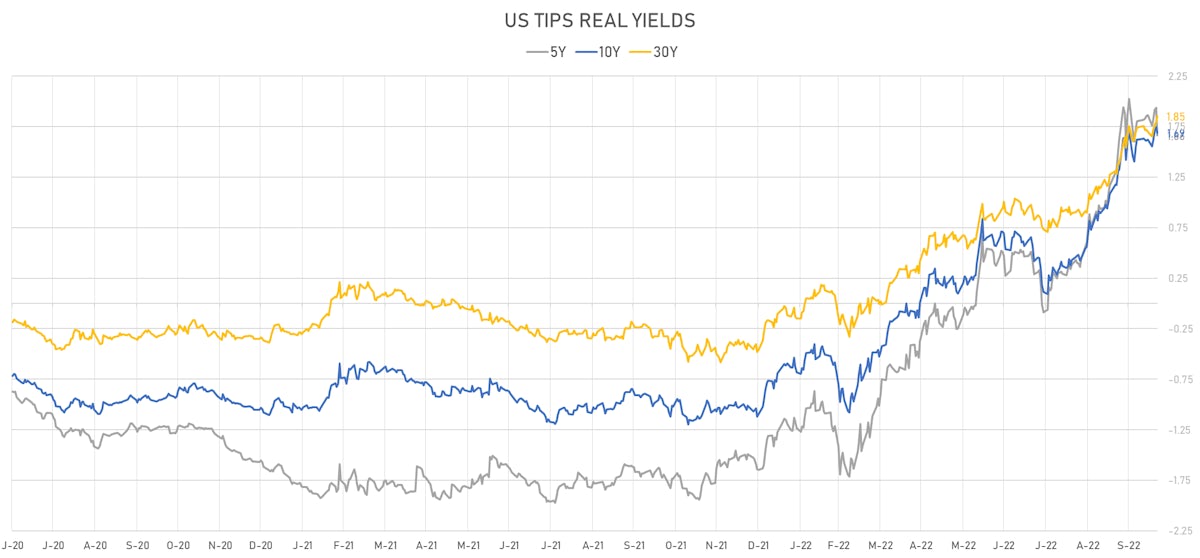

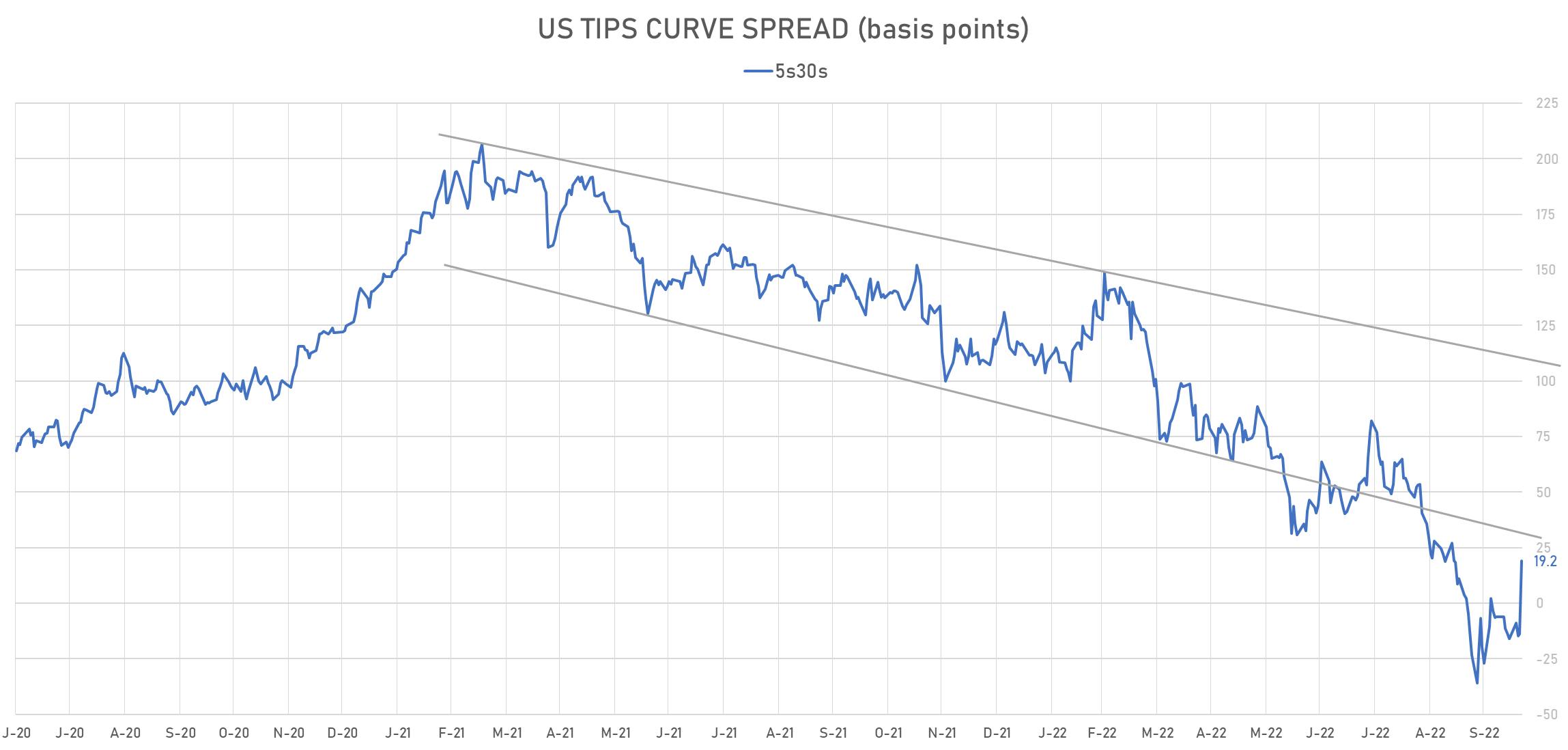

- Market pricing seems to imply a Fed willing to accept higher inflation over the long term to help economic growth: breakevens are higher across the curve, with the steepening in the 5s30s TIPS spread pointing to a deeper recession (5Y real rates down 20bp this week) but stronger long-term real GDP growth outlook (30Y real rates up 15bp this week)

- As the front end is coming closer to the terminal rate, we expect to see the curve bull steepen, with a focus around the belly: for example, we could see a meaningful widening in the 3s7s spread

US Treasuries 3s7s Spread | Source: Refinitiv

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening by 12.5 bp, now at -33.2 bp (YTD change: -146.4bp)

- 1Y: 4.5498% (up 7.1 bp)

- 2Y: 4.4809% (down 1.4 bp)

- 5Y: 4.3465% (up 7.8 bp)

- 7Y: 4.2914% (up 12.0 bp)

- 10Y: 4.2178% (up 19.6 bp)

- 30Y: 4.3358% (up 34.3 bp)

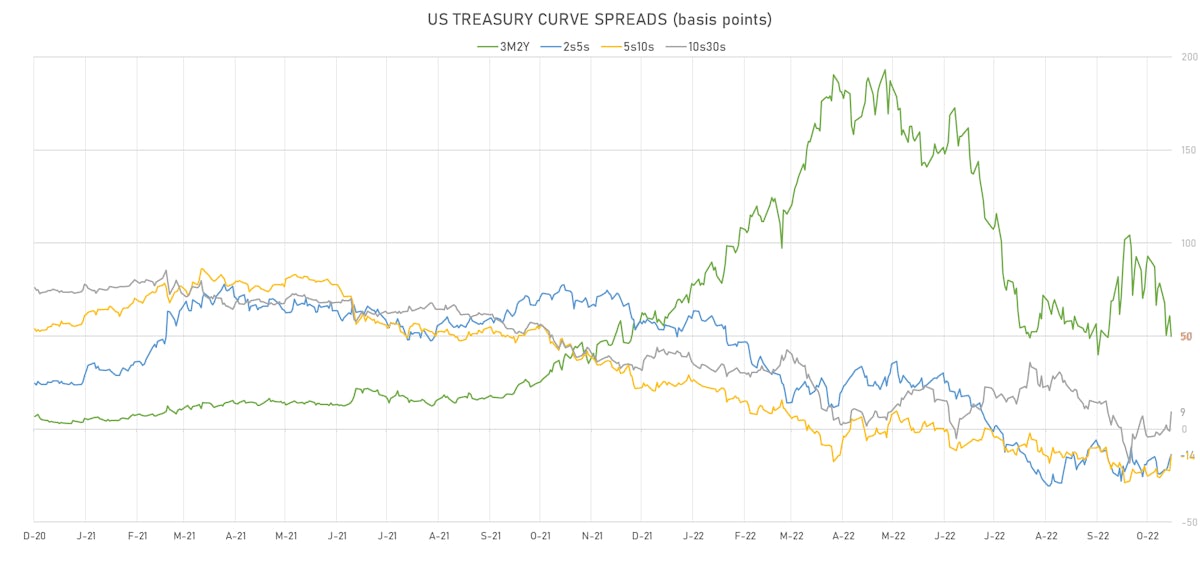

- US treasury curve spreads: 3m2Y at 44.3bp (down -32.8bp this week), 2s5s at -13.4bp (up 9.0bp), 5s10s at -12.9bp (up 11.7bp), 10s30s at 11.8bp (up 14.7bp)

- TIPS 1Y breakeven inflation at 3.15% (up 44.0bp); 2Y at 2.89% (up 9.2bp); 5Y at 2.70% (up 18.7bp); 10Y at 2.55% (up 12.5bp); 30Y at 2.53% (up 19.1bp)

- US 5-Year TIPS Real Yield: -20.0 bp at 1.6610%; 10-Year TIPS Real Yield: +6.4 bp at 1.6860%; 30-Year TIPS Real Yield: +15.3 bp at 1.8530%

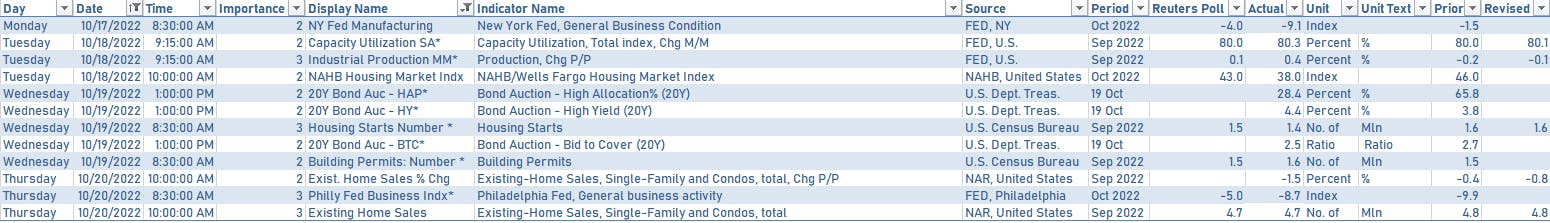

US MACRO RELEASES IN THE PAST WEEK

- The week's backward-looking data came in mostly soft, and forward-looking indicators also suggest a loss of economic momentum, with a likely recession next year

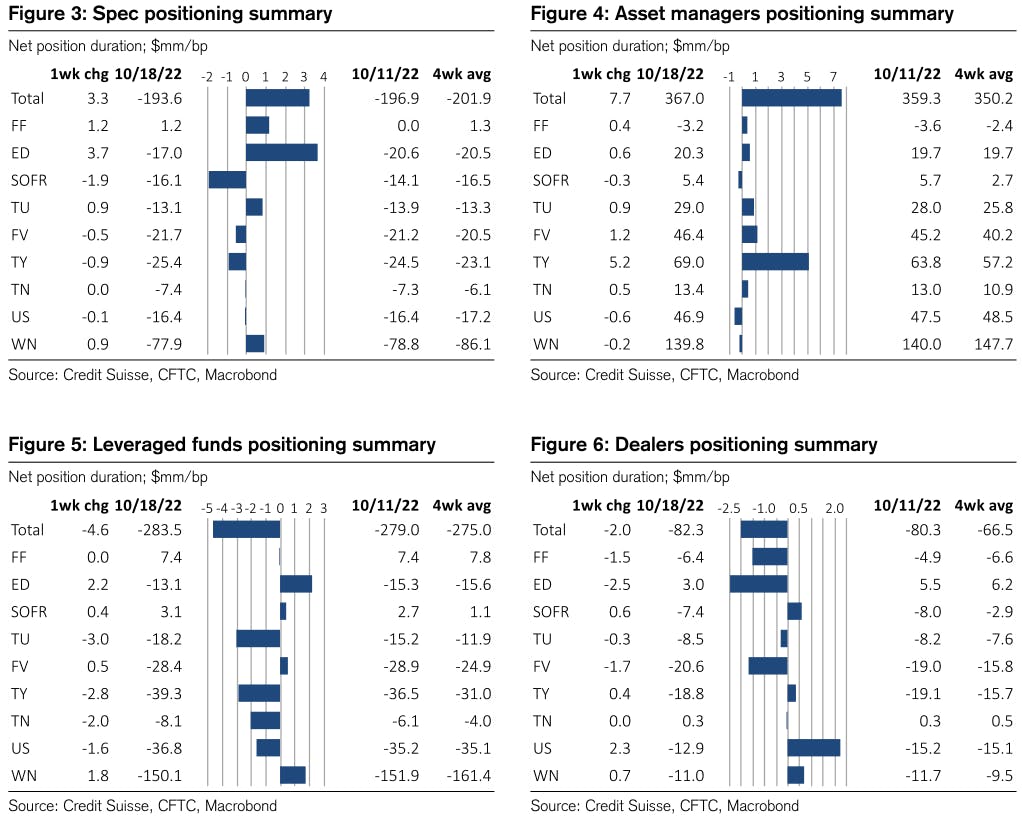

CFTC WEEKLY NET DURATION POSITIONING (CS ANALYSIS)

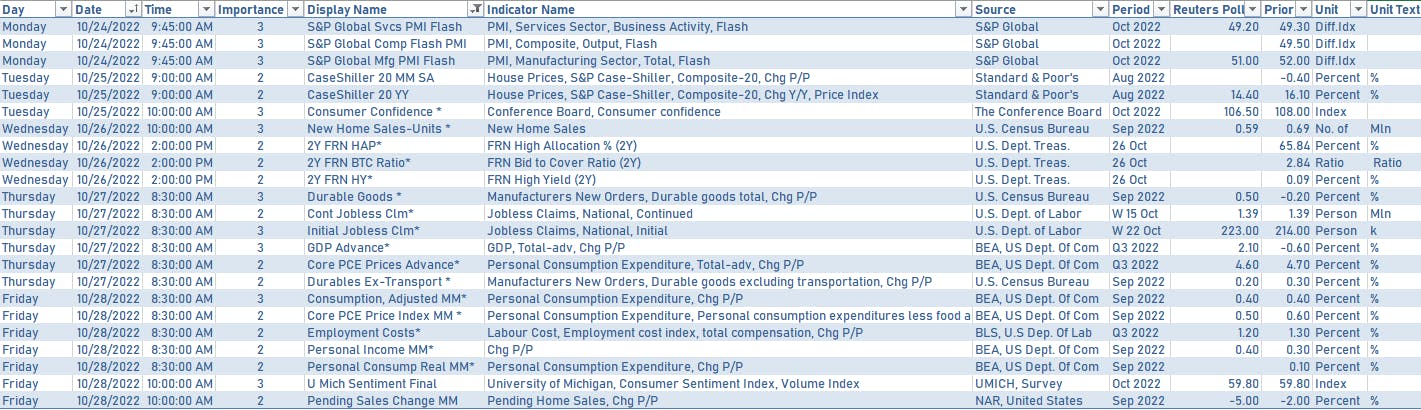

US ECONOMIC DATA IN THE WEEK AHEAD

- The most important data points this week will be the latest employment cost index and the Q3 GDP

- No Fed speakers, blackout period until the conclusion of the 1-2 November FOMC

US TREASURY AUCTIONS IN THE WEEK AHEAD

- Tuesday 11:30AM: $24bn 2Y FRN

- Tuesday 1PM: $42bn in 2Y Notes

- Wednesday 1PM: $43bn in 5Y Notes

- Thursday 1PM: $35bn in 7Y Notes

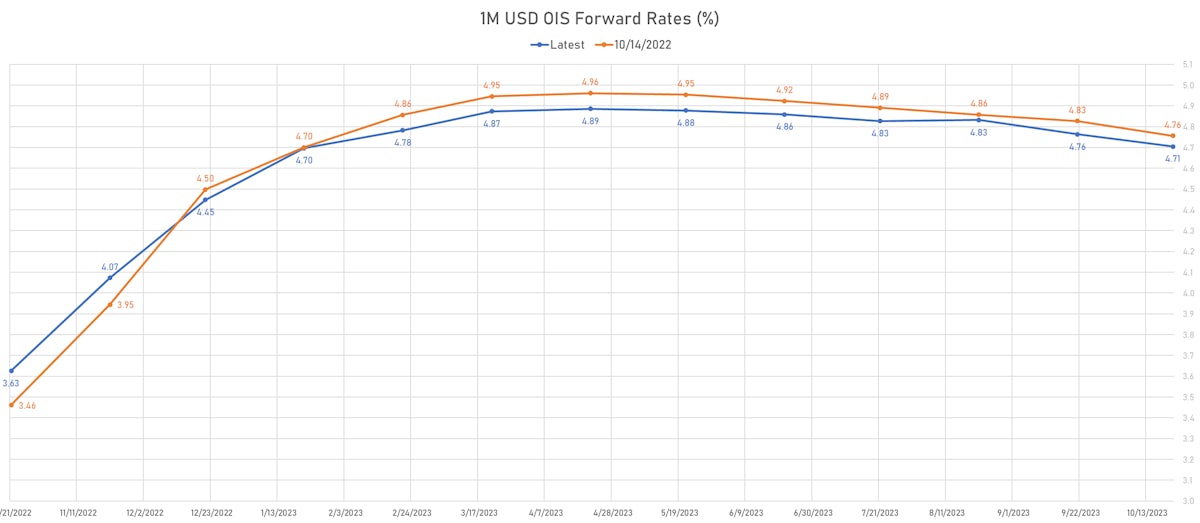

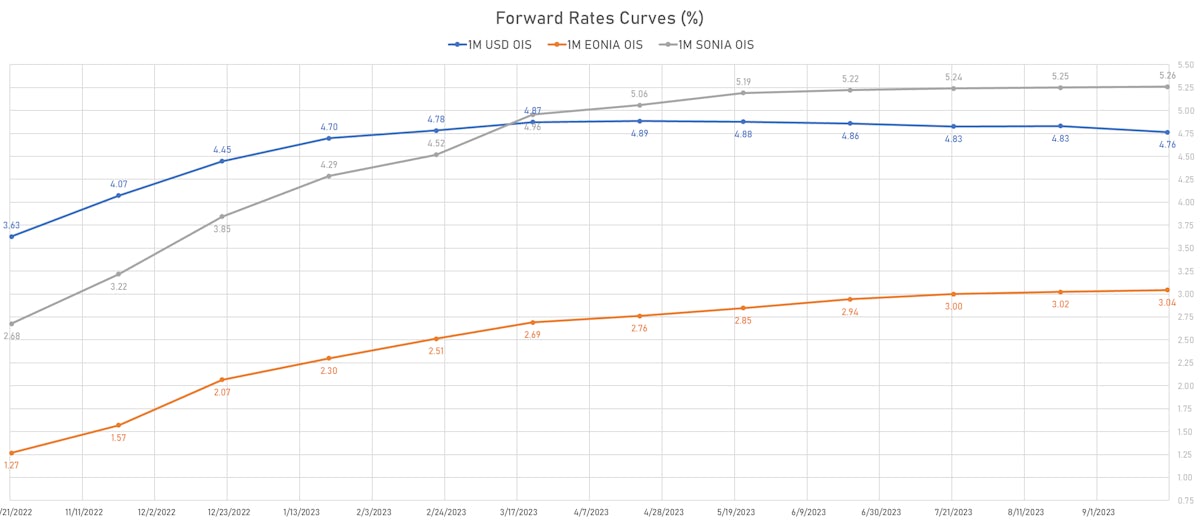

US FORWARD RATES

- Fed Funds futures now price in 76.2bp of Fed hikes by the end of November 2022, 136.4bp (5.5 x 25bp hikes) by the end of December 2022, and 6.8 hikes by the end of February 2023

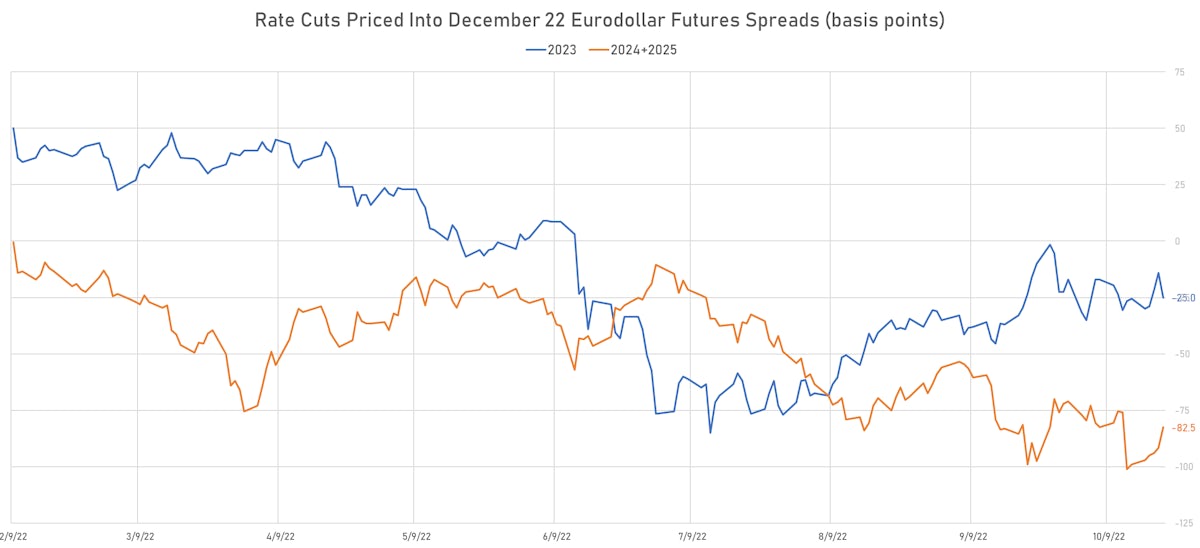

- 3-month Eurodollar futures (EDZ) spreads price in 25.0 bp of cuts in 2023, up 11.0 bp today, and 64.5 bp of cuts in 2024

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.15% (up 24.3bp); 2Y at 2.89% (up 9.4bp); 5Y at 2.70% (up 9.3bp); 10Y at 2.55% (up 4.2bp); 30Y at 2.53% (up 5.8bp)

- 6-month spot US CPI swap up 5.6 bp to 3.057%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.6610%, -27.5 bp today; 10Y at 1.6860%, -5.7 bp today; 30Y at 1.8530%, +5.6 bp today

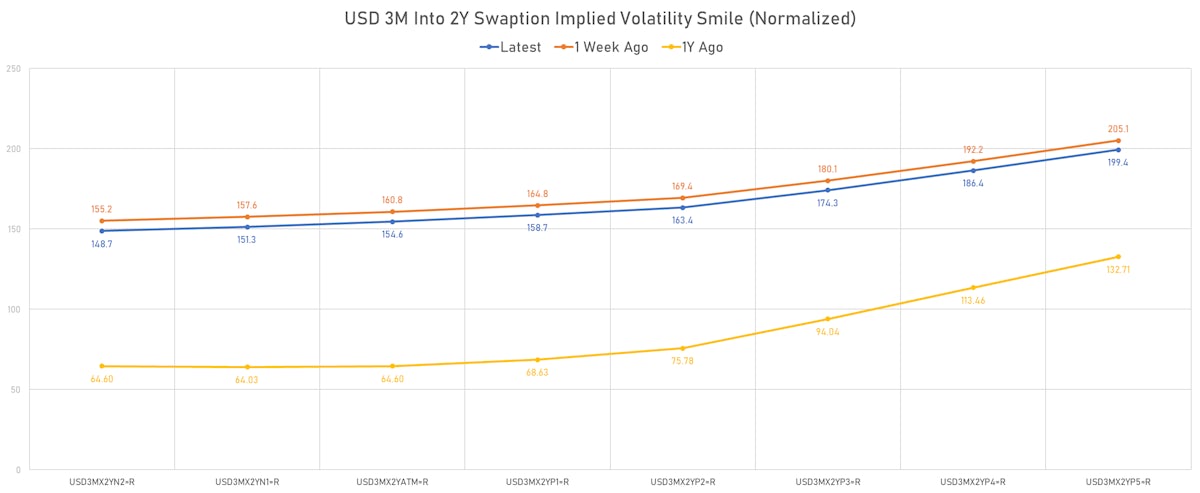

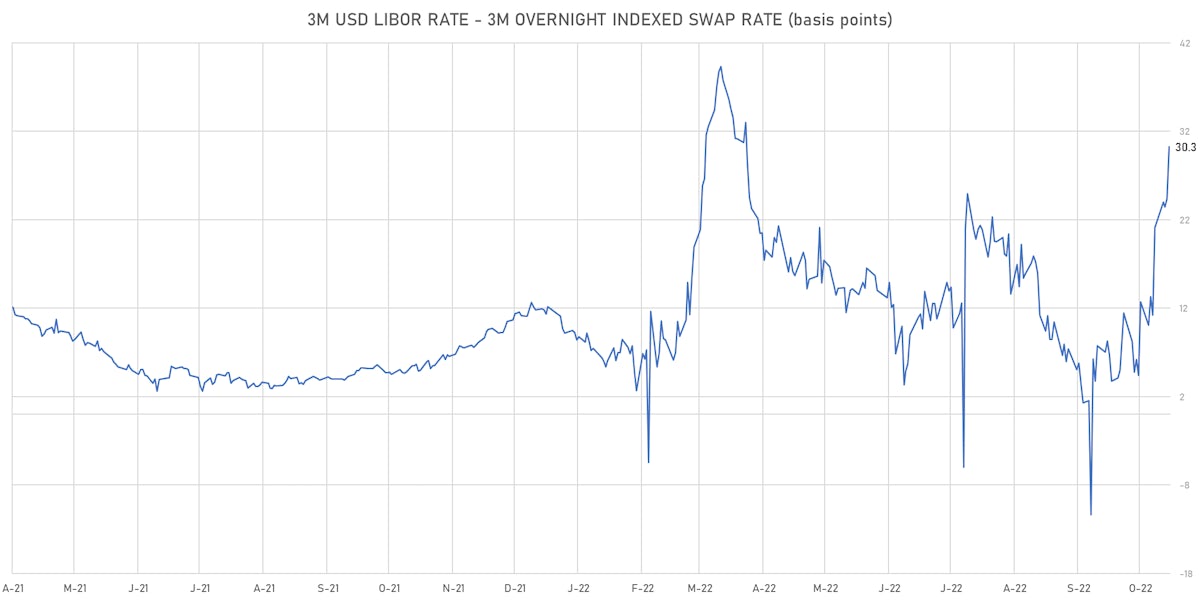

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -9.1 vols at 136.0 normals

- 3-Month LIBOR-OIS spread up 5.8 bp at 30.3 bp (18-months range: -11.3 to 39.3 bp)

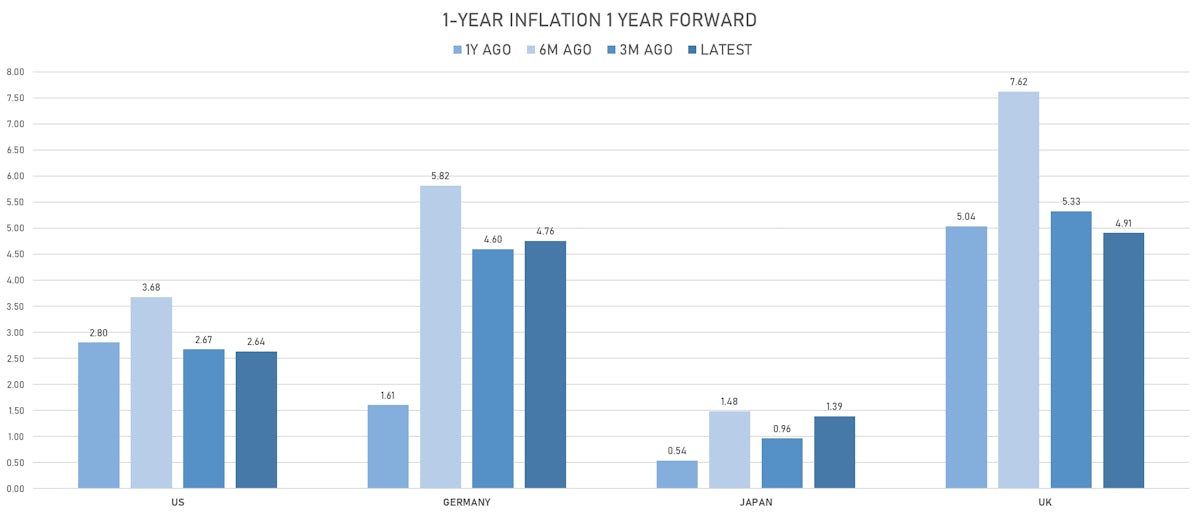

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.209% (down -0.3 bp); the German 1Y-10Y curve is 11.2 bp steeper at 33.7bp (YTD change: -43.3 bp)

- Japan 5Y: 0.146% (up 0.5 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 32.5bp (YTD change: -15.9 bp)

- China 5Y: 2.496% (up 0.8 bp); the Chinese 1Y-10Y curve is 1.9 bp flatter at 98.1bp (YTD change: -50.0 bp)

- Switzerland 5Y: 0.979% (down -0.5 bp); the Swiss 1Y-10Y curve is 3.3 bp flatter at 28.0bp (YTD change: -56.2 bp)