Rates

Fed Signals Pivot Towards Smaller Hiking Increments, Higher Terminal Rate

Perhaps the most important outcome is that the Fed no longer makes decisions based on the evolution of spot inflation data, but instead looks at the levels of rates (with uncertainty about the lagged impact of their actions), hoping to maximize the chances of a soft landing

Published ET

Fed Funds Rate Priced For The Next FOMCs | Sources: ϕpost, Refinitiv data

US RATES OUTLOOK: FOMC WRAP-UP

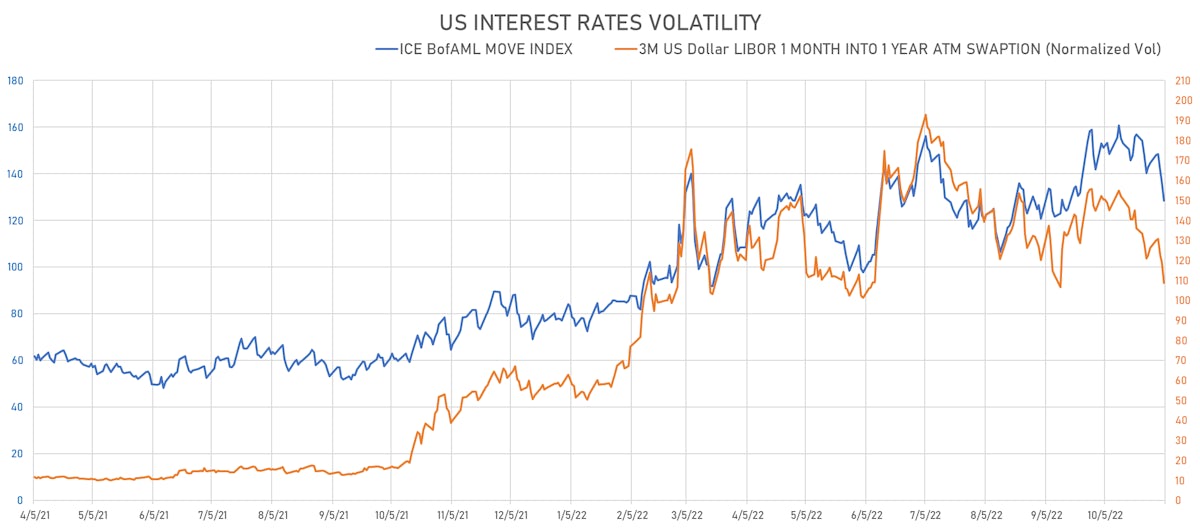

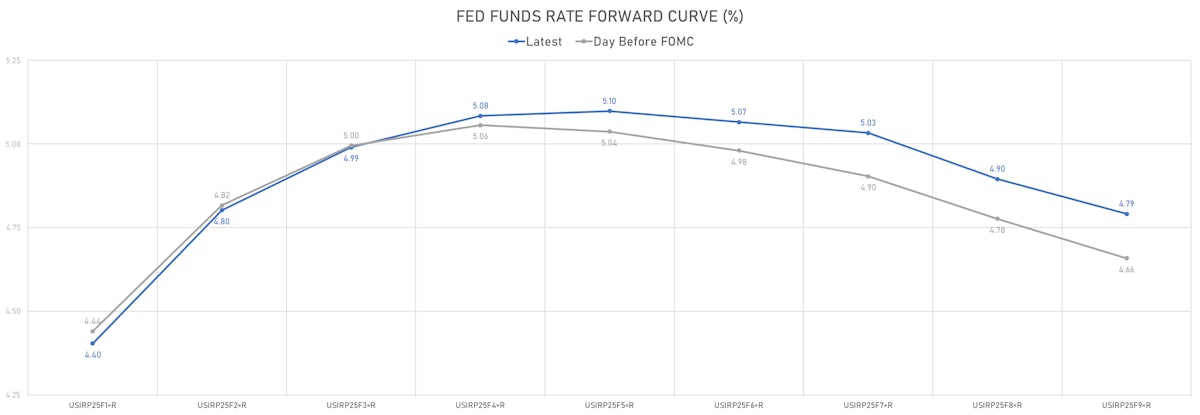

- Two main impacts from the FOMC: 1) the terminal rate is being repriced higher, now sits at 5.10%, and 2) rates implied volatilities are falling, as rates hikes will get incrementally smaller

- Money markets now price in 62bp for the December FOMC, reflecting an even likelihood of a 50bp vs 75bp hike. That sounds reasonable with two more CPI prints and one more labor report until then.

- Powell was quite emphatic about the current views being ahead the last dot plot, which means to us that the Fed probably sees a terminal at least 50bp above the September release (meaning we should get a terminal rate in the 5.00-5.25% range in the December dot plot)

- The Fed's communication strategy continued to puzzle, as there were two important outcomes of the FOMC: the upcoming downshift to 50bp and the need for a higher terminal rate, summarized by many as "slower for longer". But somehow the Fed's official statement only mentioned the first one, leaving the document unnecessarily unbalanced.

- Looking at the stark difference between the FOMC statement and Jay Powell's press conference, it's clear that committee members are more dovish than the Chairman. He seems to understand better than his cohort the asymmetrical nature of the risk management problem at hand.

- Jefferies' Aneta Markowska thinks markets are getting close to the right pricing for the terminal rate: "We believe a ~5% funds rate is high enough to slow growth materially next year, and thus is a reasonable place to pause. There is some risk is that the slowdown takes longer to materialize, which might force the Fed to deliver another - albeit small - hike next spring. Thus, risks for rates are still skewed to the upside, but only marginally so."

- The rise of the US dollar should continue until the terminal rate is reached or until the Fed tells us what it is. The notable development in the last 10 days has been the overtly dovish surprises from all other core Central Banks (most notably the BoE).

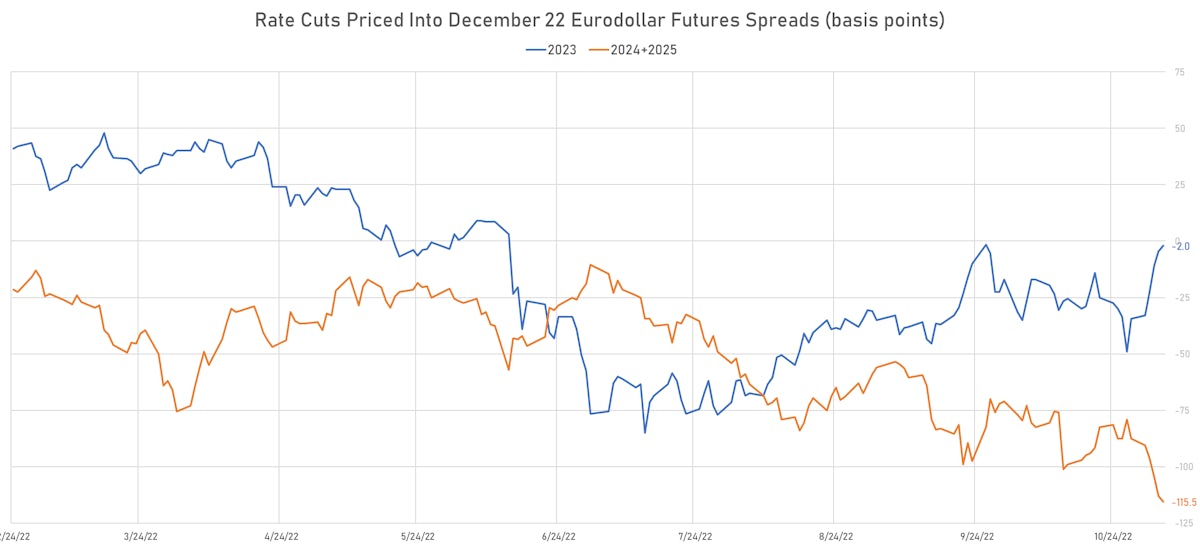

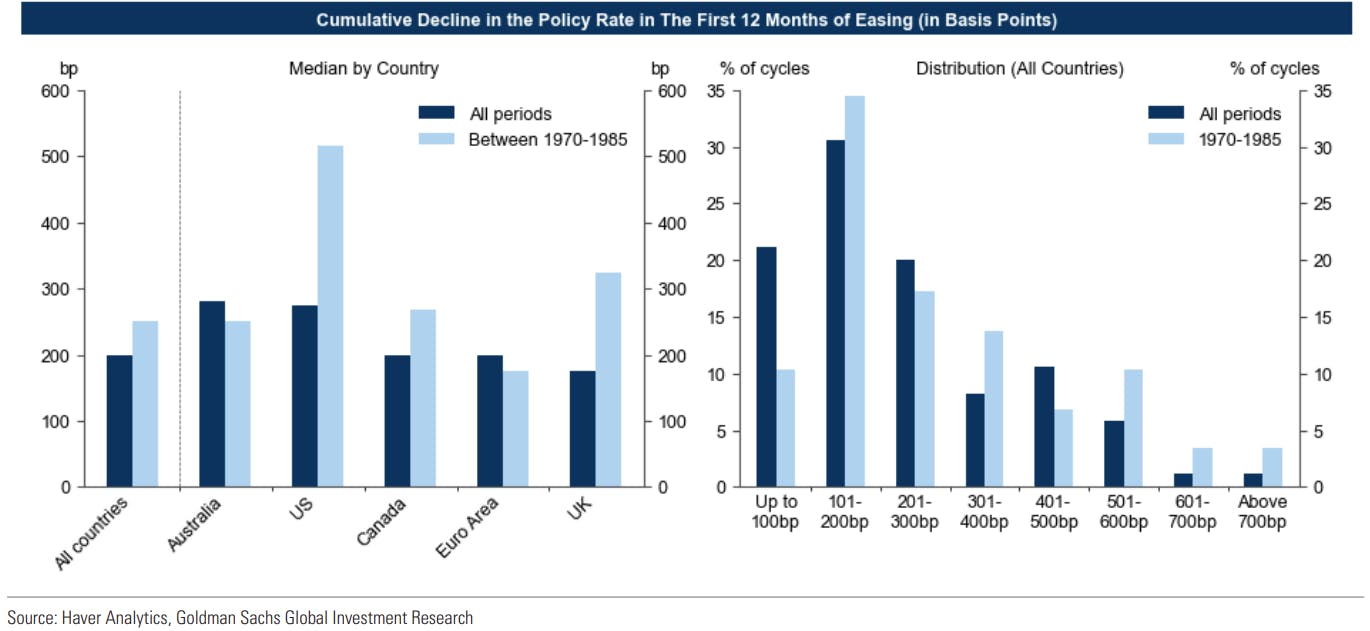

- In terms of possible US curve trades, the forward pace of rate cuts still looks too slow: 2Y forward 1Y rates look high, not pricing the high likelihood of a recession. Historically, the median pace of rate cuts over the first year of a Fed easing cycle is close to 300bp. That view is most easily expressed in futures spreads (Eurodollar reds-blues strips or EDZ3-EDZ26)

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -3.9 bp, now at -57.6 bp (YTD change: -170.8bp)

- 1Y: 4.7361% (up 19.0 bp)

- 2Y: 4.6574% (up 24.5 bp)

- 5Y: 4.3299% (up 15.0 bp)

- 7Y: 4.2518% (up 15.2 bp)

- 10Y: 4.1605% (up 15.1 bp)

- 30Y: 4.2545% (up 12.2 bp)

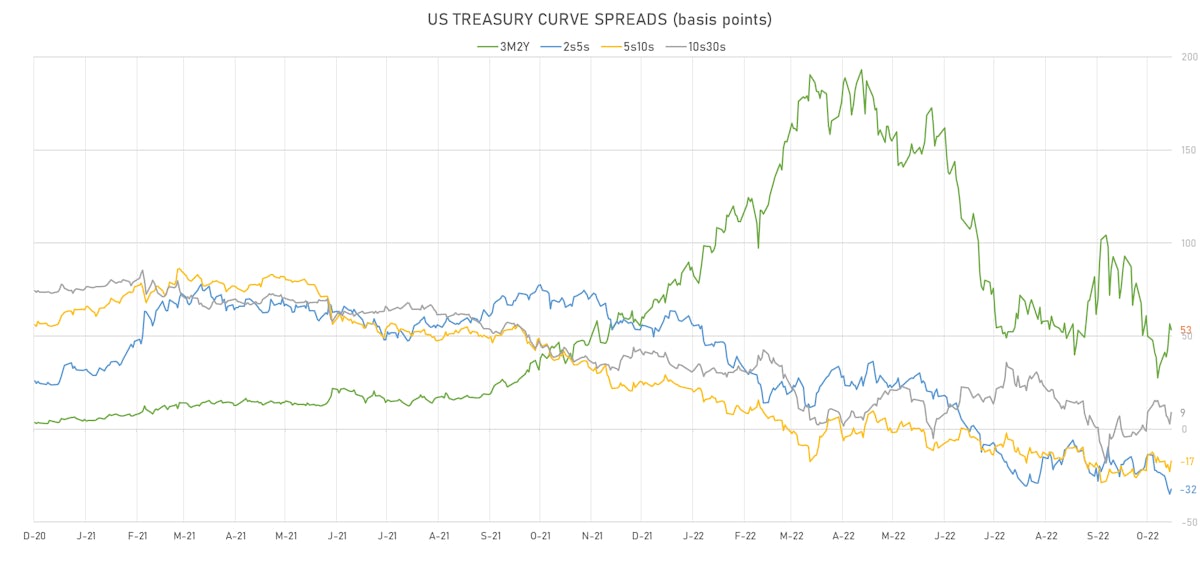

- US treasury curve spreads: 3m2Y at 53.8bp (up 21.5bp this week), 2s5s at -32.7bp (down -9.4bp), 5s10s at -16.9bp (up 0.0bp), 10s30s at 9.4bp (down -3.0bp)

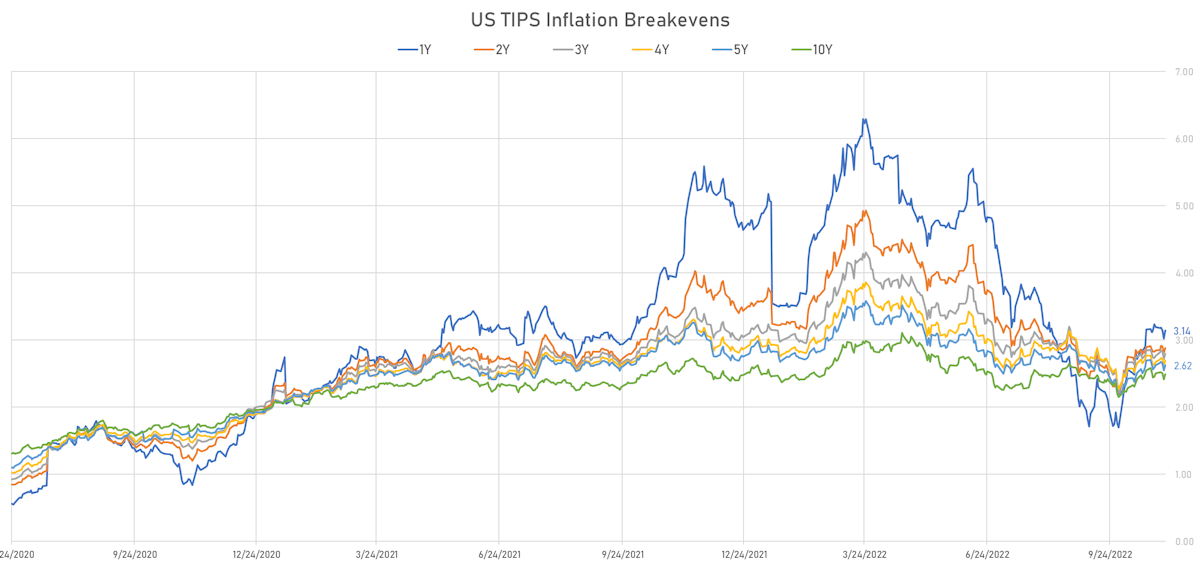

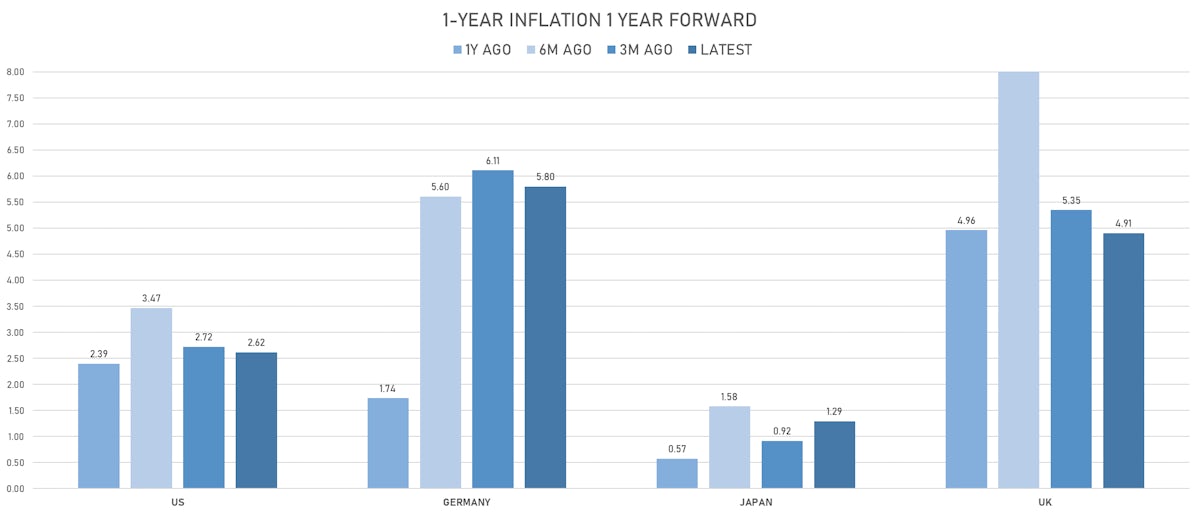

- TIPS 1Y breakeven inflation at 3.14% (down -5.5bp); 2Y at 2.88% (up 3.5bp); 5Y at 2.62% (down -0.5bp); 10Y at 2.49% (down -1.9bp); 30Y at 2.51% (down -1.0bp)

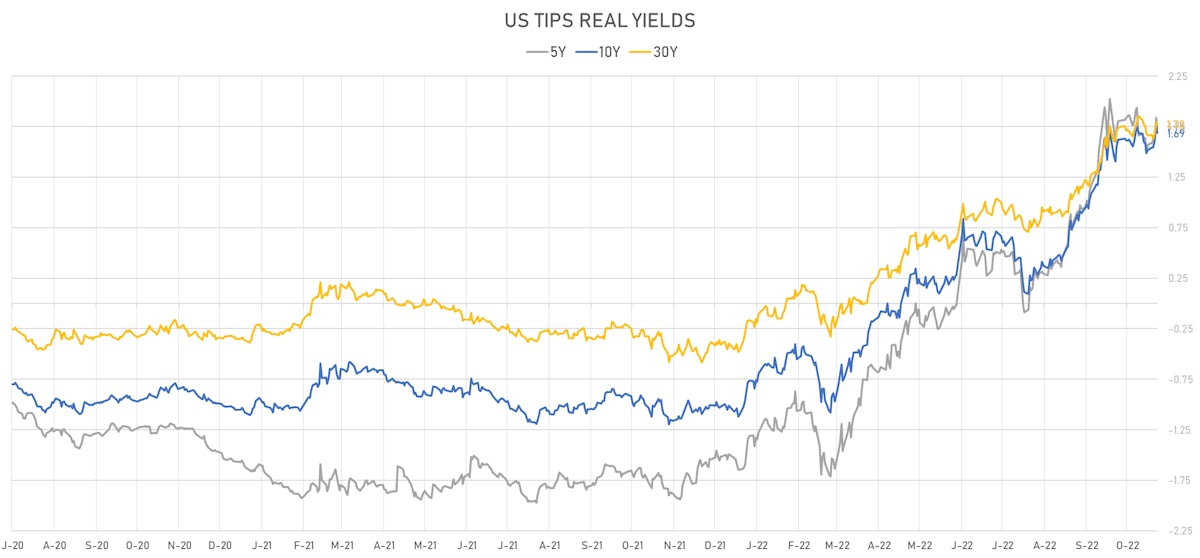

- US 5-Year TIPS Real Yield: +15.3 bp at 1.7240%; 10-Year TIPS Real Yield: +16.9 bp at 1.6890%; 30-Year TIPS Real Yield: +11.4 bp at 1.7760%

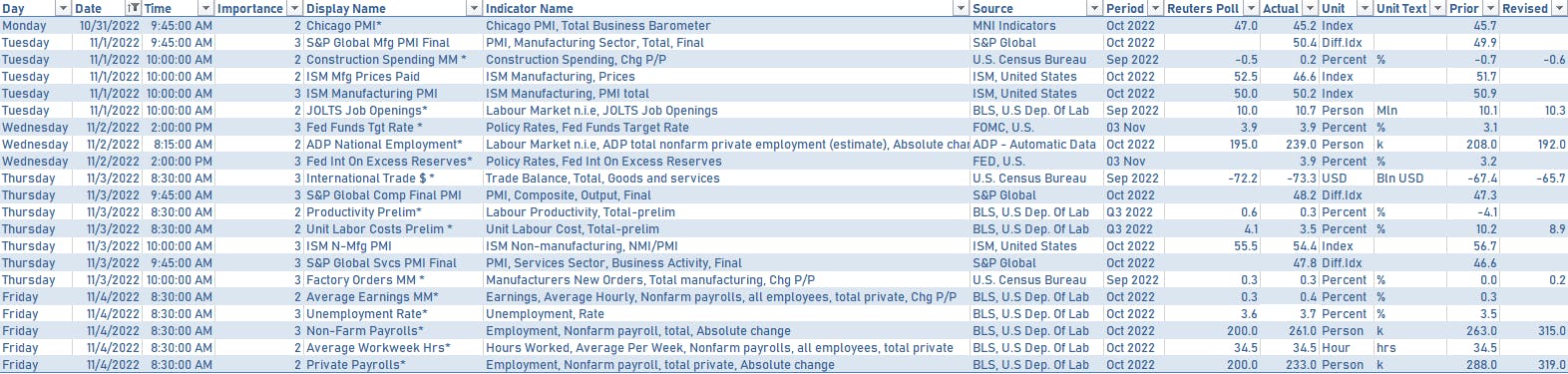

US MACRO RELEASES OVER THE PAST WEEK

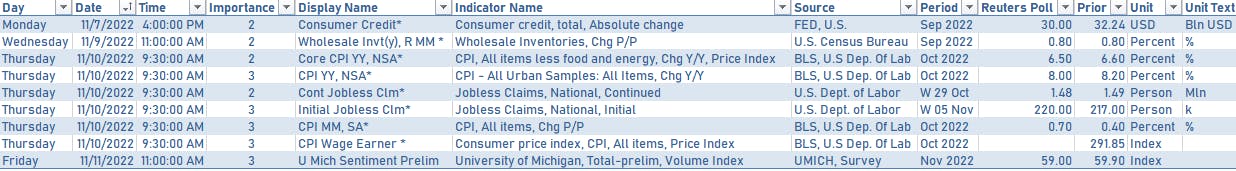

US MACRO RELEASES IN THE WEEK AHEAD

- The October CPI report is by far the most important data point this week, followed by the University of Michigan's sentiment survey for November

- Wells Fargo points out that there is now more beta to the downside when it comes to spot inflation data: "In our estimation, the implied terminal rate will rise 7-8bps on Thursday if core CPI prints 0.6%, but fall around 12bps if core is 0.4%."

FED SPEAKERS THIS WEEK

- Monday 3:40PM -- Boston Fed President Collins and Cleveland Fed President Mester

- Monday 6:00PM -- Richmond Fed President Barkin

- Wednesday 3:00AM -- New York Fed President Williams

- Wednesday 11:00AM -- Richmond Fed President Barkin

- Thursday 2:00AM -- Fed Governor Waller

- Thursday 9:35AM -- Dallas Fed President Logan

- Thursday 12:30PM -- Cleveland Fed President Mester

- Thursday 1:30PM -- Kansas City Fed President

US TREASURY COUPON-BEARING AUCTIONS THIS WEEK

- Three auctions to raise $96bn, including $40.7bn in new cash

- Tuesday: $40bn in 3Y notes

- Wednesday: $35bn in 10Y notes

- Thursday: $21bn in 30Y bonds

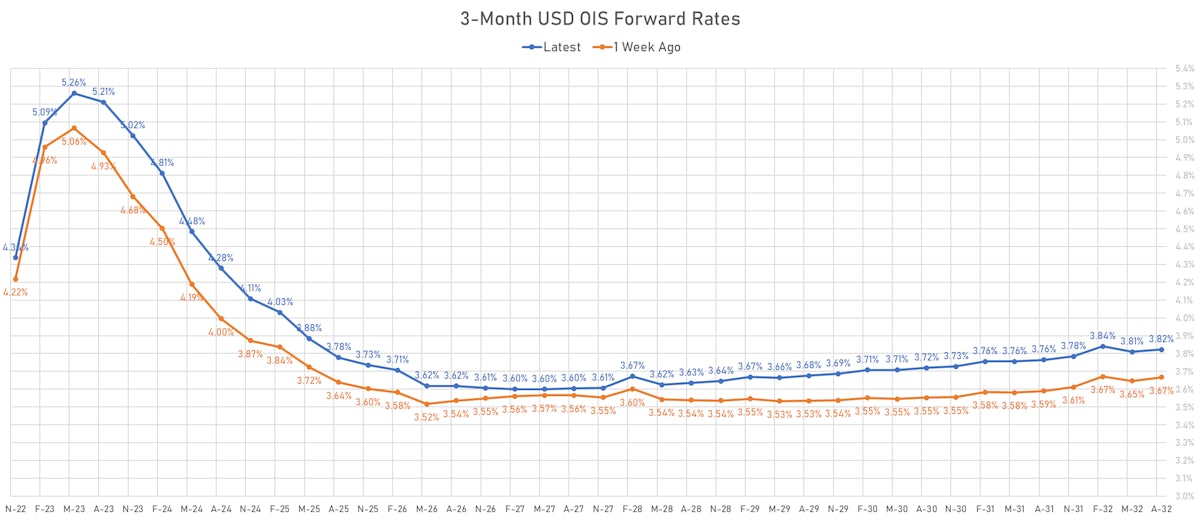

US FORWARD RATES

- Fed Funds futures now price in 61.9bp of Fed hikes by the end of December 2022, 101.8bp (4.1 x 25bp hikes) by the end of February 2023, and 4.8 hikes by the end of March 2023

- 3-month Eurodollar futures (EDZ) spreads price in 83.0 bp of rate cuts in 2024 (equivalent to 3.3 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.14% (up 12.0bp); 2Y at 2.88% (up 7.3bp); 5Y at 2.62% (up 7.9bp); 10Y at 2.49% (up 7.7bp); 30Y at 2.51% (up 8.4bp)

- 6-month spot US CPI swap down -0.3 bp to 2.948%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.7240%, -11.3 bp today; 10Y at 1.6890%, -6.5 bp today; 30Y at 1.7760%, -1.6 bp today

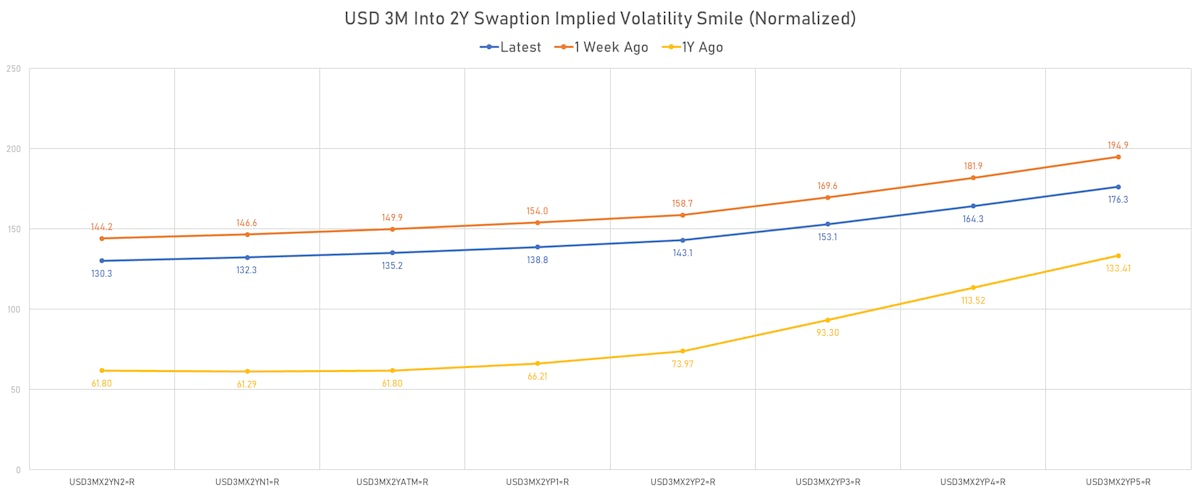

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -10.2 vols at 108.8 normals

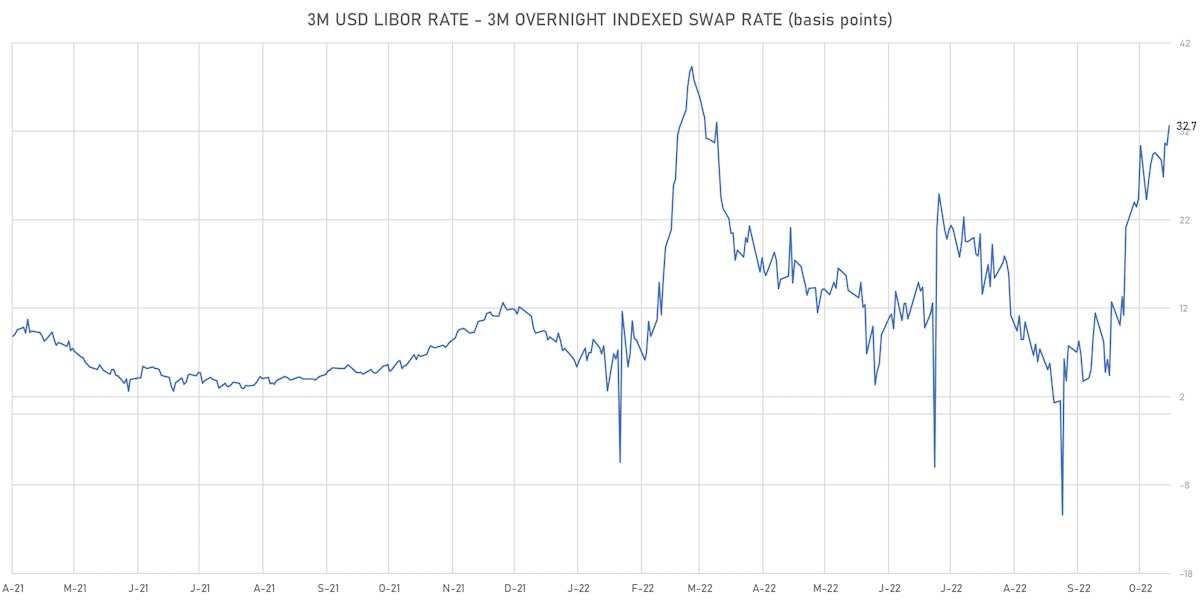

- 3-Month LIBOR-OIS spread up 2.2 bp at 32.7 bp (18-months range: -11.3 to 39.3 bp)

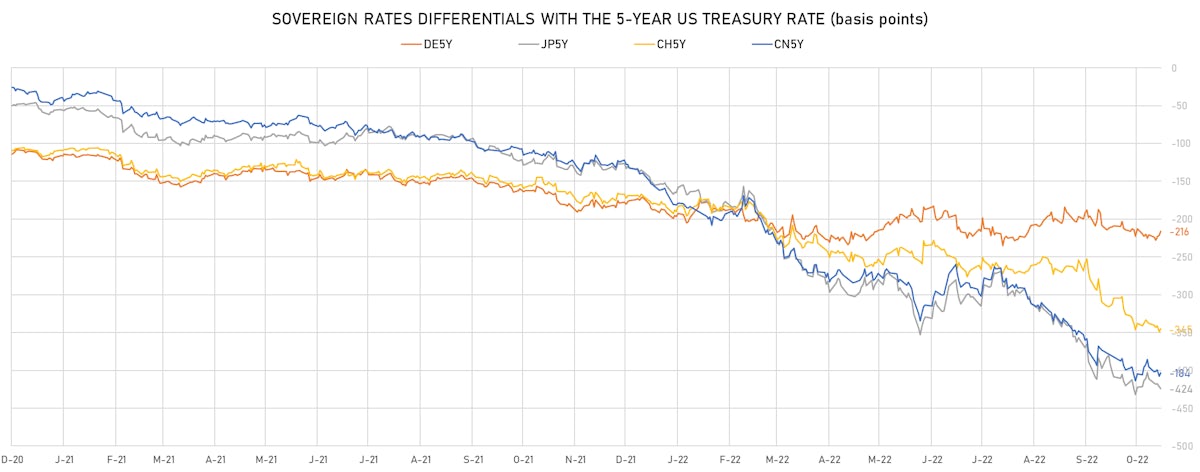

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.161% (up 3.1 bp); the German 1Y-10Y curve is 4.5 bp flatter at 4.2bp (YTD change: -43.5 bp)

- Japan 5Y: 0.095% (up 1.5 bp); the Japanese 1Y-10Y curve is 0.1 bp flatter at 34.4bp (YTD change: -15.9 bp)

- China 5Y: 2.487% (up 3.6 bp); the Chinese 1Y-10Y curve is 3.0 bp steeper at 99.8bp (YTD change: -50.0 bp)

- Switzerland 5Y: 0.877% (up 1.1 bp); the Swiss 1Y-10Y curve is 4.5 bp steeper at 38.2bp (YTD change: -56.1 bp)