Rates

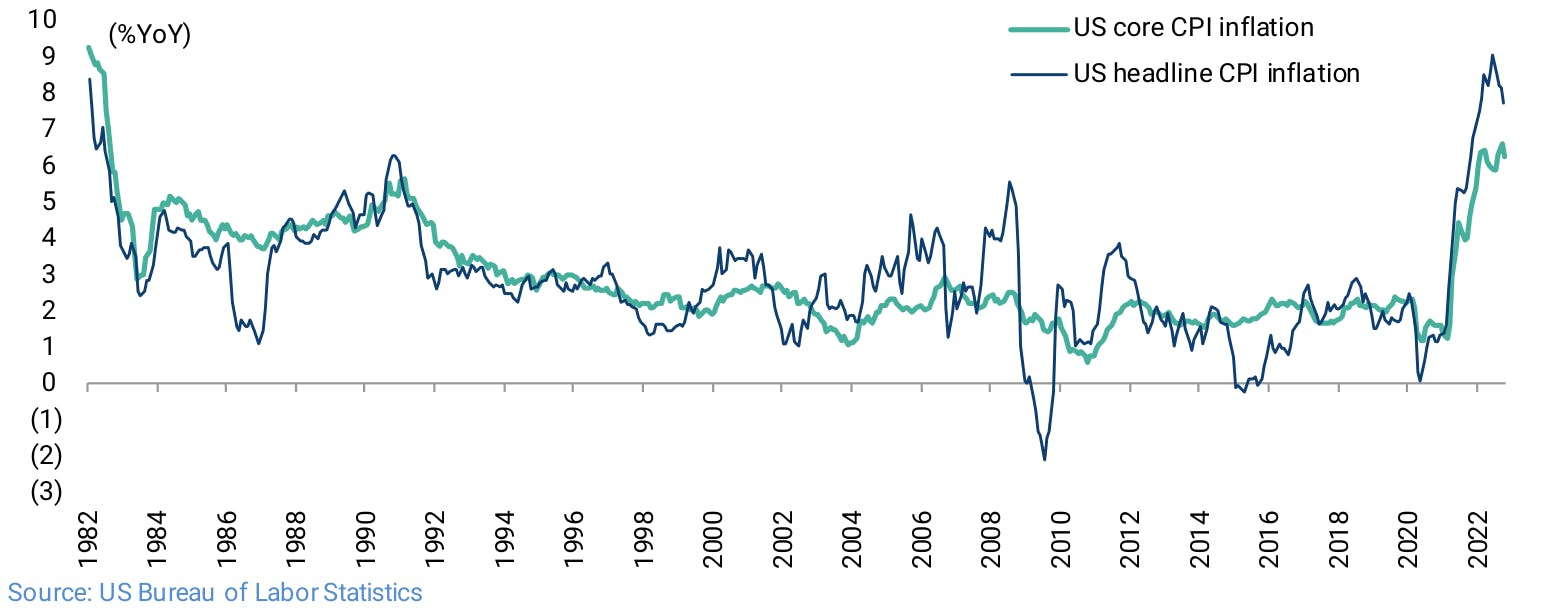

Fed Likely To Push Back Against Overreaction To Positive CPI Print, As Inflation Still Very Elevated

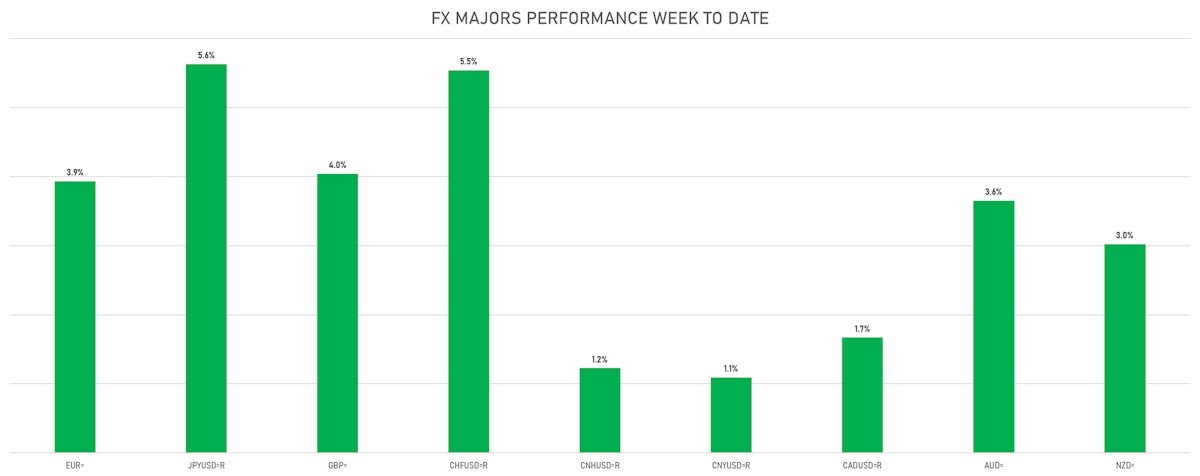

The CPI surprise brought huge moves across asset classes, with rates differentials pushing the dollar lower and driving one of the largest one-day loosening in the GS financial conditions index

Published ET

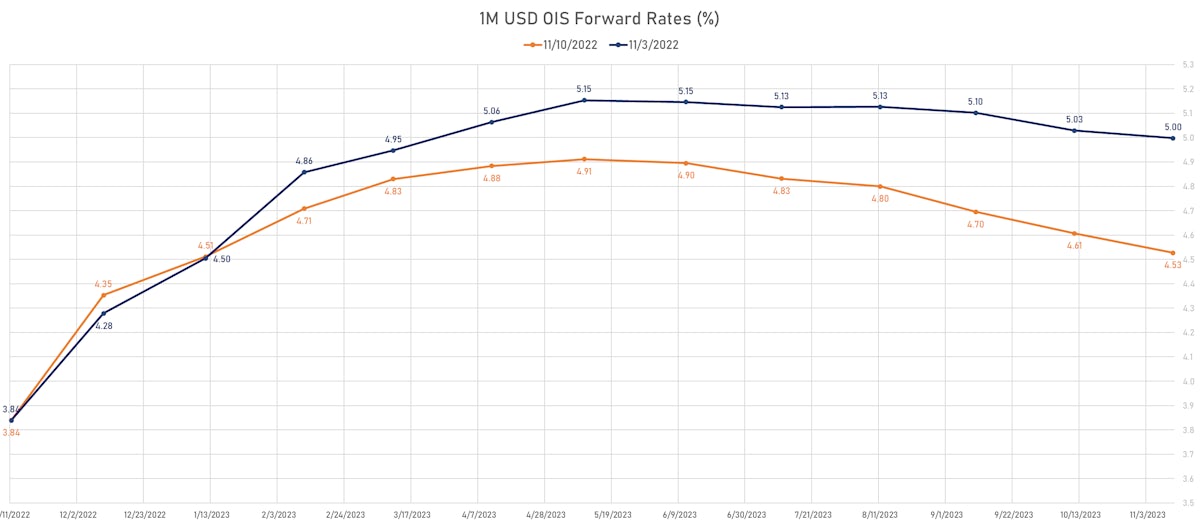

1M USD OIS Forward Rates Curve After CPI Surprise | Sources: ϕpost, Refinitiv data

US RATES OUTLOOK POST CPI

- The CPI data was a definite positive, with the broad-based moderation in inflation leading to a massive repricing of the rates curve lower (+ lower dollar and higher risk markets)

- It's unclear yet whether it truly is a game changer: markets always move first and ask questions later, and we have some doubt about the persistence of such a violent reaction

- First, the size of the surprise was a modest 20 basis points (0.2%), and October’s 7.7% top-line YoY CPI was still a frighteningly high number. There remains a long way to go before inflation returns to a level that the Fed will be comfortable with.

- Two, the resulting loosening in financial conditions is something the Fed will have to lean against: there is no way they will be convinced that they won based on the actual data. One better than expected CPI report doesn't change the potential for continued upside risk.

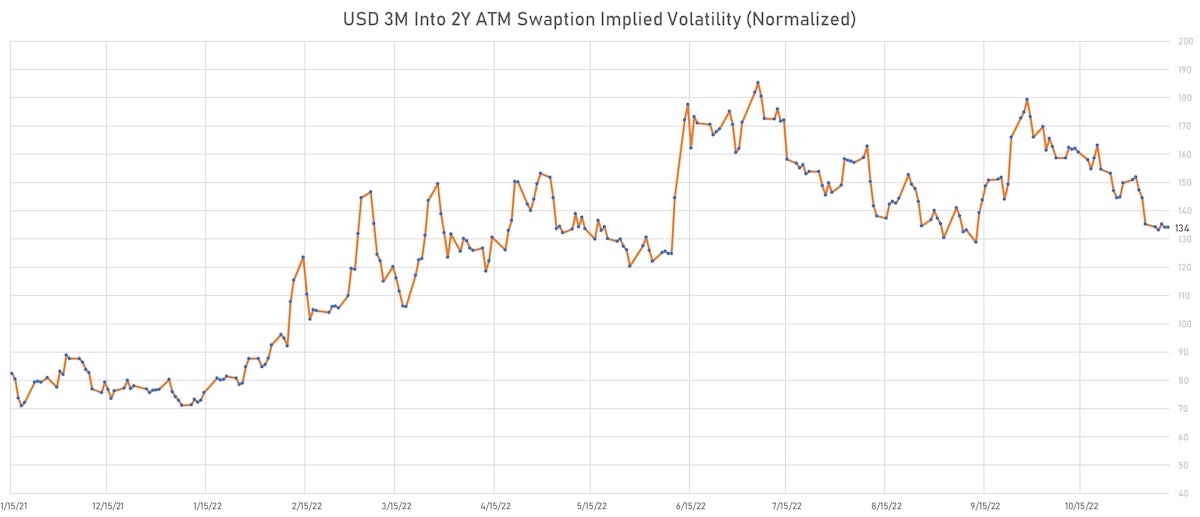

- We understand that lower rates volatility (with smaller hiking increments) narrows the distribution, and we saw a big drop in the implied probability of more extreme cases, particularly on the right tail (stubborn inflation requiring peak rates over 6%)

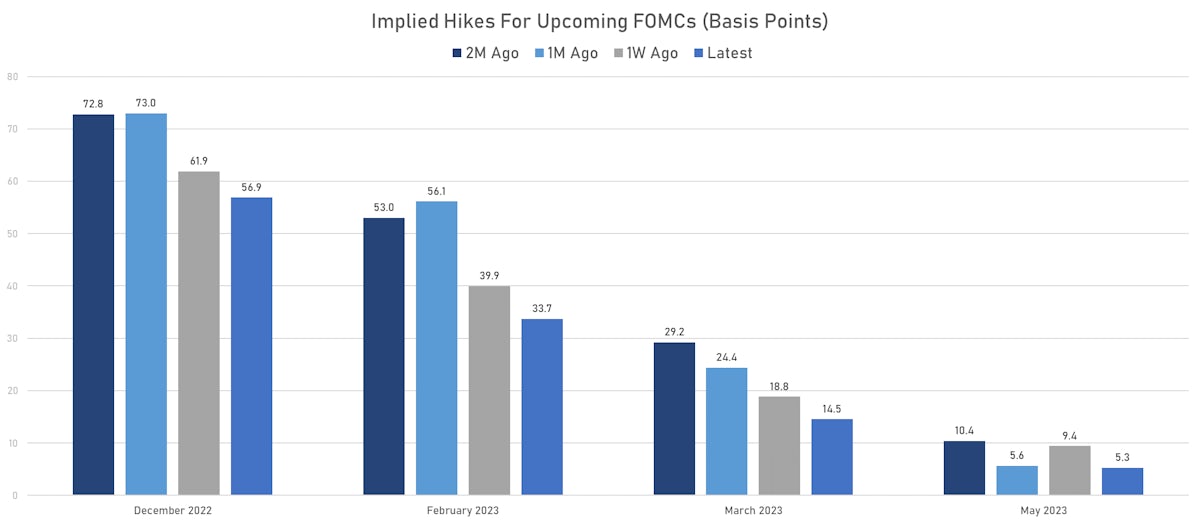

- Having said that, if a softish landing is the now the central scenario, why did the forward inversion get deeper? Why does the market now price (again) 2 rate cuts in 2023? The Fed has clearly indicated that smaller increments come with a "higher for longer" stance

Eurodollar futures prices now imply >50bp of cuts in 2023 (a 30bp change in 1 day)

- It feels like money markets are getting over their skis, with an understandable fear of missing out on a powerful "out of the woods" move

- There is a lot of data until the December 14 FOMC and it's too early to tell what the Fed will do then considering how fast things are changing at the moment. One thing that hasn't changed though is the asymmetric nature of the risk management problem they have to deal with.

WEEKLY US RATES SUMMARY

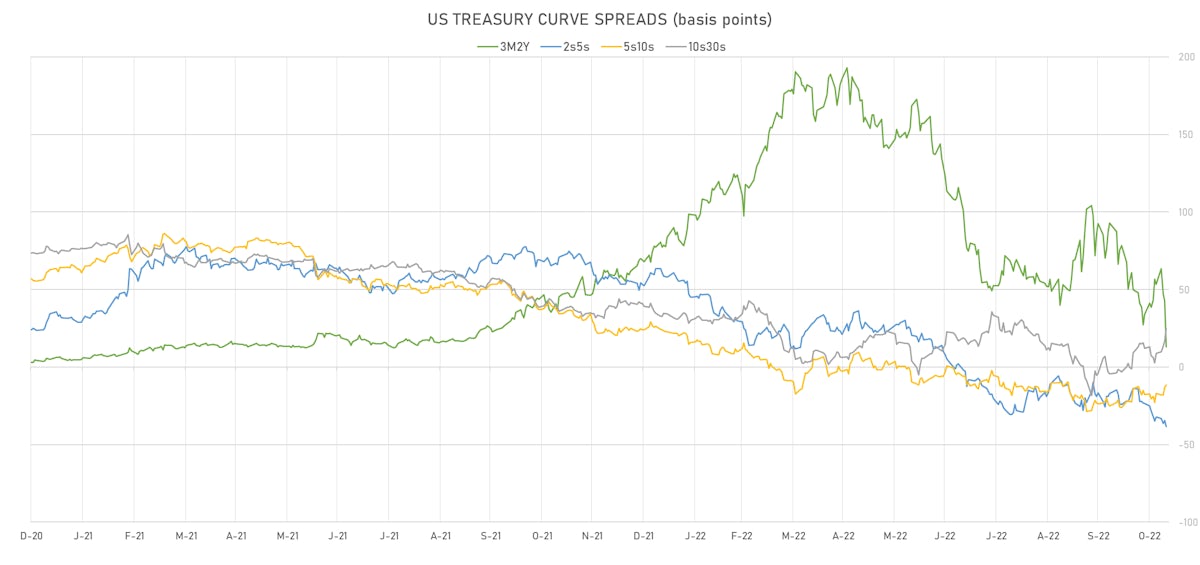

- The treasury yield curve bull flattened, with the 1s10s spread tightening 14.7 bp, now at -77.1 bp (YTD change: -190.4bp)

- 1Y: 4.5812% (down 19.2 bp)

- 2Y: 4.3280% (down 38.8 bp)

- 5Y: 3.9350% (down 43.0 bp)

- 7Y: 3.8745% (down 39.4 bp)

- 10Y: 3.8097% (down 33.8 bp)

- 30Y: 4.0576% (down 12.6 bp)

- US treasury curve spreads: 3m2Y at 14.6bp (down -25.0bp this week), 2s5s at -39.3bp (down -13.8bp), 5s10s at -12.5bp (up 5.5bp), 10s30s at 24.8bp (up 13.5bp)

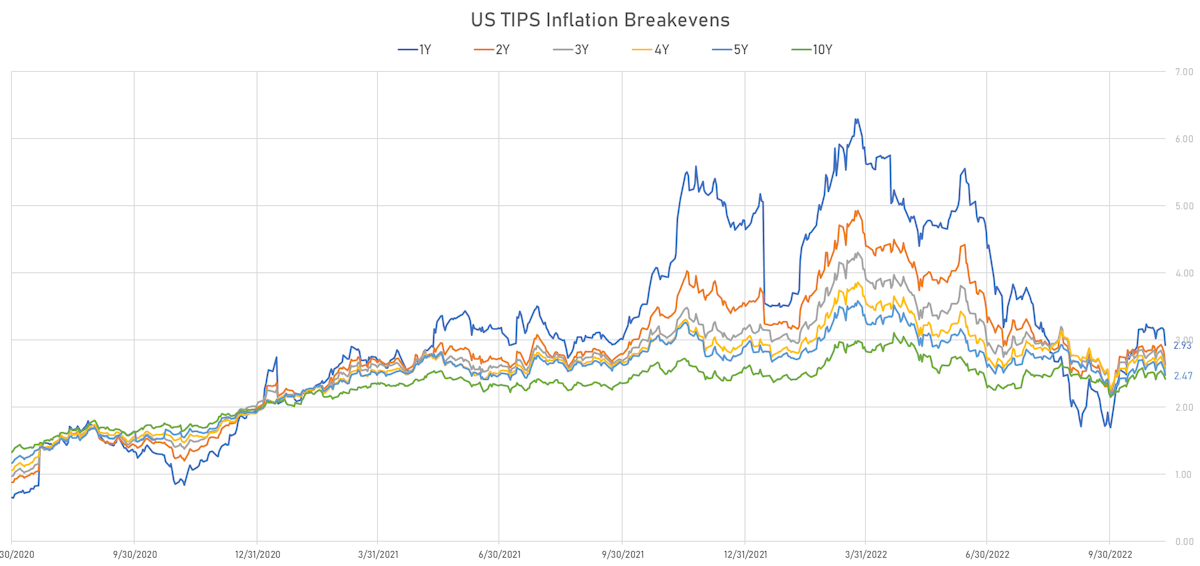

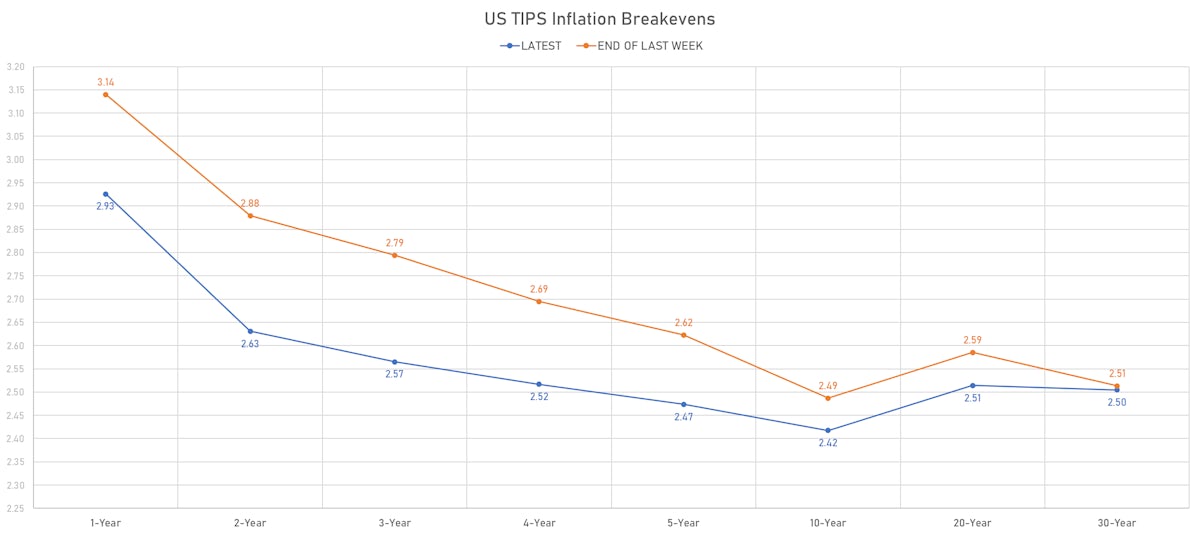

- TIPS 1Y breakeven inflation at 2.93% (down -21.4bp); 2Y at 2.63% (down -24.9bp); 5Y at 2.47% (down -14.9bp); 10Y at 2.42% (down -7.0bp); 30Y at 2.50% (down -0.9bp)

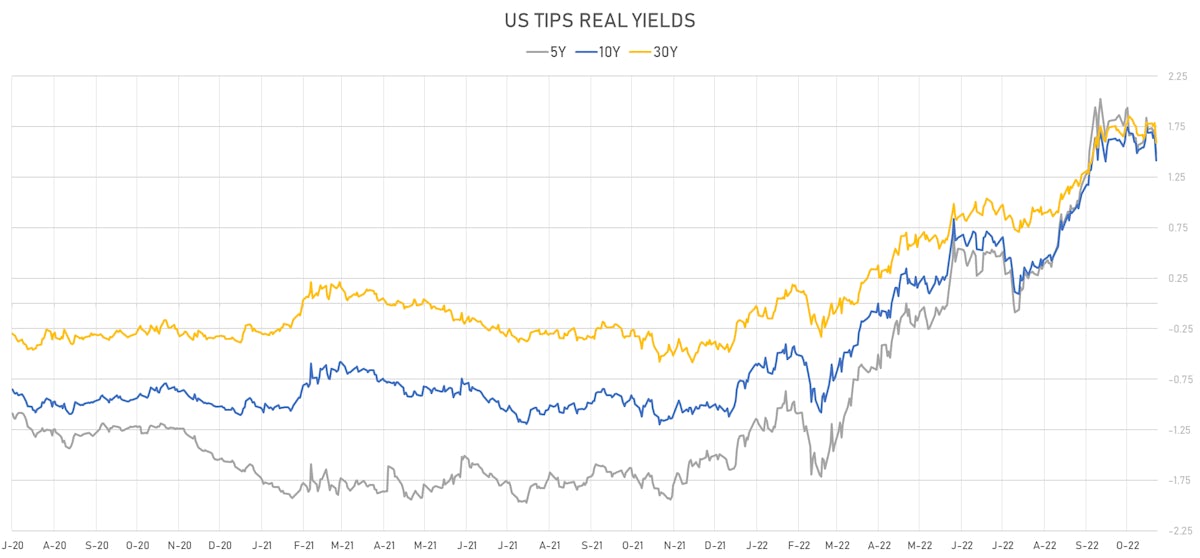

- US 5-Year TIPS Real Yield: -35.9 bp at 1.4780%; 10-Year TIPS Real Yield: -34.0 bp at 1.4140%; 30-Year TIPS Real Yield: -20.4 bp at 1.5880%

US MACRO RELEASES OVER THE PAST WEEK

FED SPEAKERS NEXT WEEK

- Monday 6:30PM: Fed’s Williams Moderates Panel

- Tuesday 9:00AM: Fed's Harker Discusses the Economic Outlook

- Tuesday 10:00AM: Fed's Vice Chair for Supervision Barr Speaks Before Senate Panel

- Wednesday 9:50AM: Fed’s Williams Speaks at 2022 Treasury Market Conference

- Thursday 8:00AM: Fed's Bullard Discusses the Economy and Monetary Policy

- Thursday 9:40AM: Fed's Mester Speaks at Financial Stability Conference

- Thursday 10:40AM: Fed's Jefferson and Kashkari Take Part in Panel Discussion

- Thursday 1:35PM: Fed's Kashkari Takes Part in Moderated Q&A

COUPON-BEARING AUCTIONS NEXT WEEK

- Wednesday: $15bn 10Y TIPS

- Thursday: $15bn issue of 20Y bond

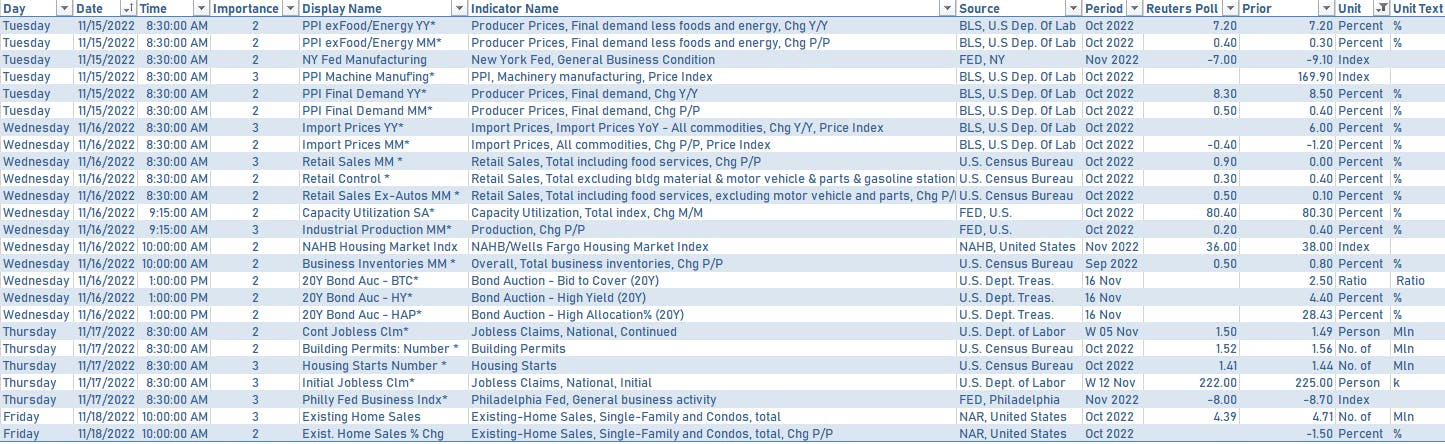

US MACRO RELEASES IN THE WEEK AHEAD

- Focus next week will be on October retail sales, IP, housing starts, and existing home sales

US FORWARD RATES

- Fed Funds futures now price in 57.1bp of Fed hikes by the end of December 2022, 92.6bp (3.7 x 25bp hikes) by the end of February 2023, and 4.4 hikes by the end of March 2023

- 3-month Eurodollar futures (EDZ) spreads price in 44.5 bp of cuts in 2023 (equivalent to 1.8 x 25 bp cuts), up 30.0 bp today (!), and 85.0 bp of cuts in 2024 (equivalent to 3.4 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.93% (down -22.0bp); 2Y at 2.63% (down -19.1bp); 5Y at 2.47% (down -9.9bp); 10Y at 2.42% (down -5.5bp); 30Y at 2.50% (down -2.9bp)

- 6-month spot US CPI swap down -25.2 bp to 2.582%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.4780%, -24.2 bp today; 10Y at 1.4140%, -25.2 bp today; 30Y at 1.5880%, -19.9 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -10.4 vols at 94.3 normals

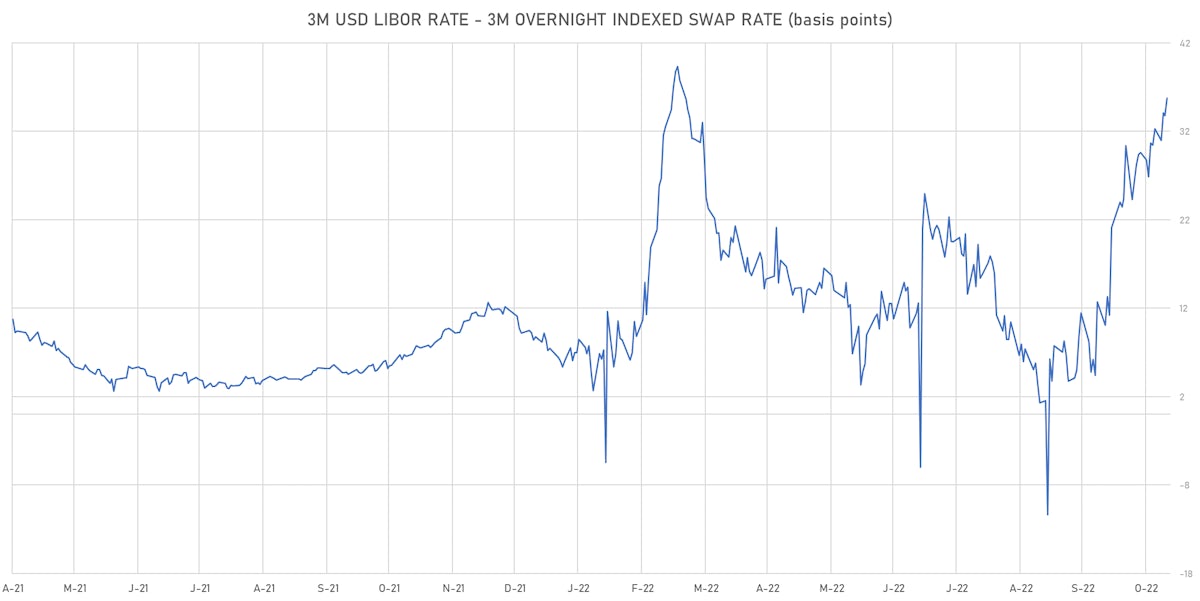

- 3-Month LIBOR-OIS spread up 2.0 bp at 35.8 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

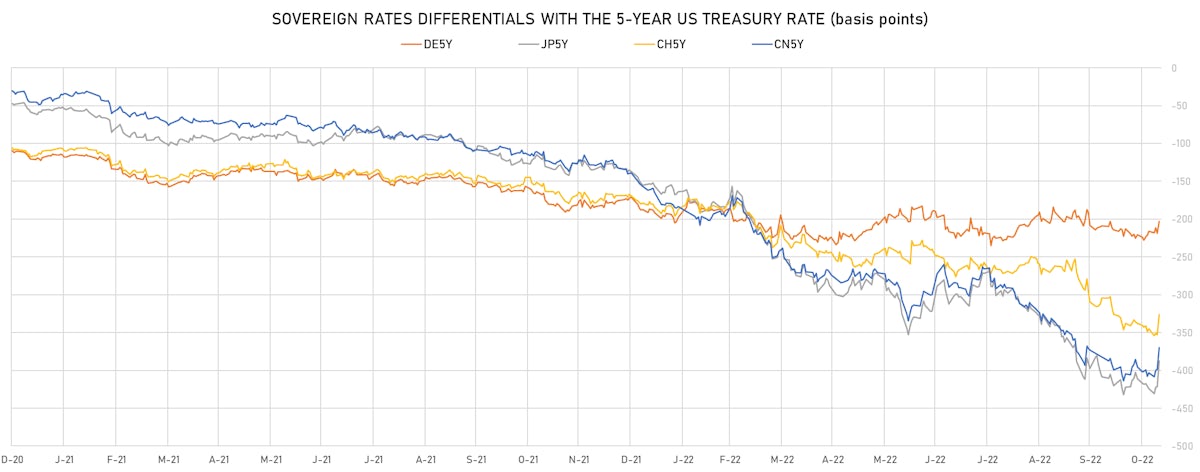

- Germany 5Y: 2.082% (up 17.4 bp); the German 1Y-10Y curve is 10.5 bp steeper at -12.6bp (YTD change: -43.7 bp)

- Japan 5Y: 0.047% (down -1.5 bp); the Japanese 1Y-10Y curve is 0.9 bp flatter at 33.9bp (YTD change: -15.9 bp)

- China 5Y: 2.538% (up 3.0 bp); the Chinese 1Y-10Y curve is 4.7 bp flatter at 79.8bp (YTD change: -50.2 bp)

- Switzerland 5Y: 0.816% (up 13.3 bp); the Swiss 1Y-10Y curve is 13.9 bp steeper at 16.6bp (YTD change: -56.4 bp)