Rates

US Yield Curve Bear Flattens, As Hawkish Bullard Speech Puts Terminal Rate Range At 5% To 7%

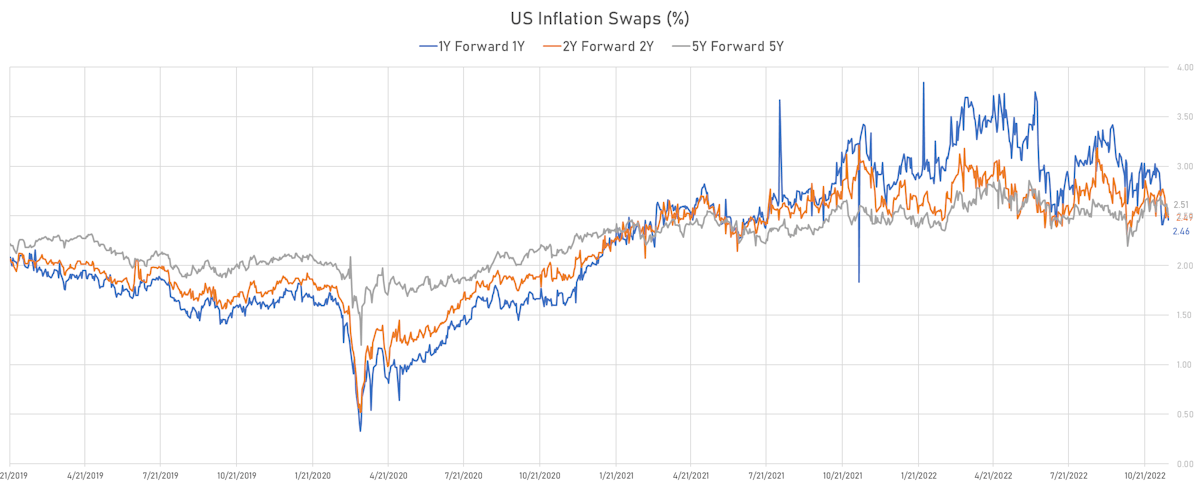

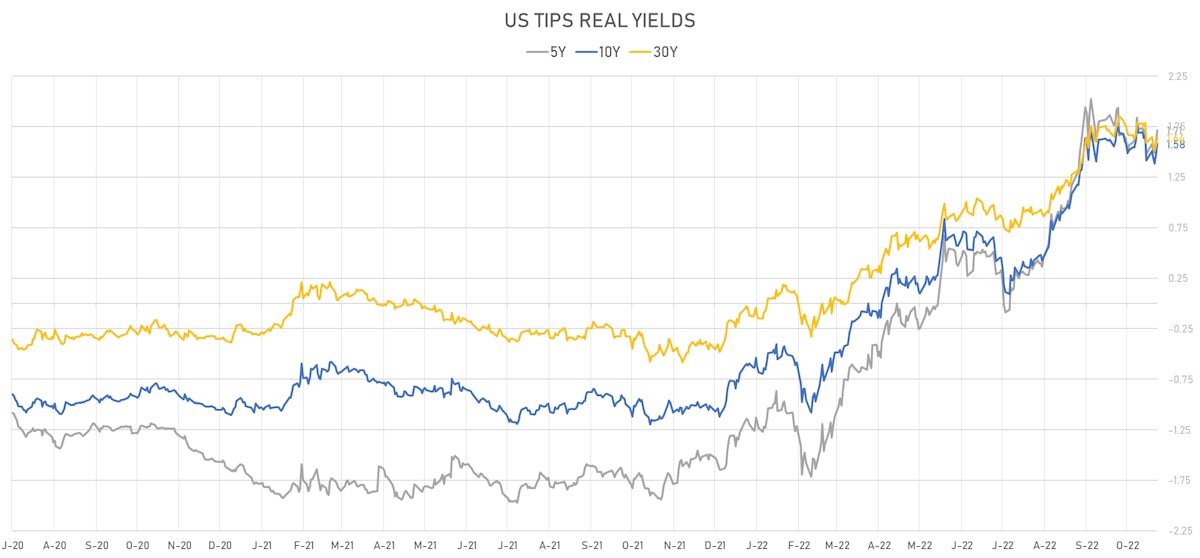

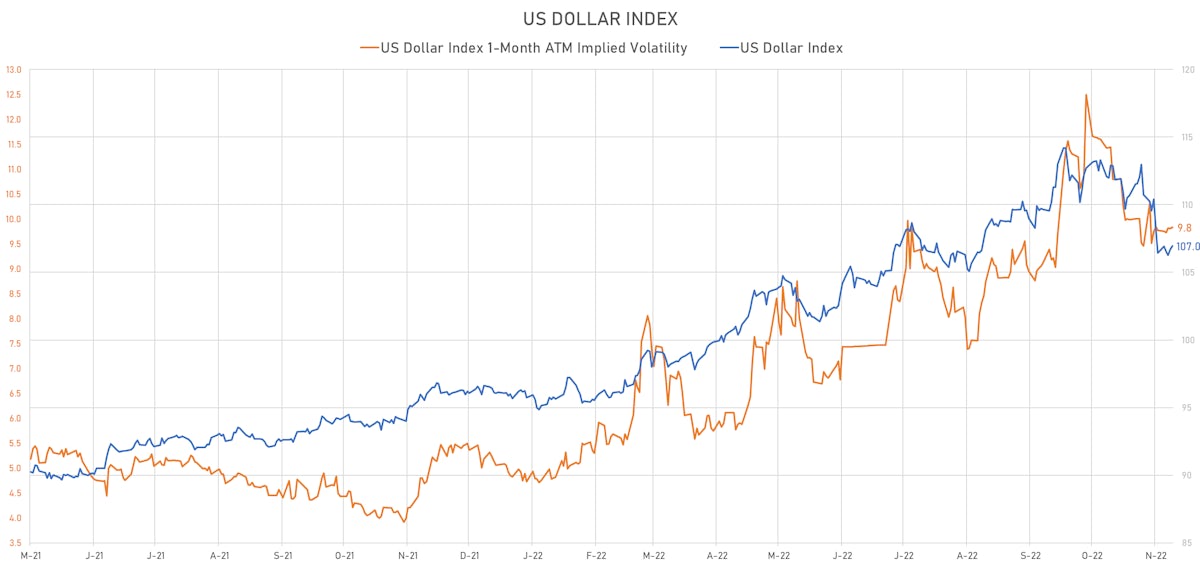

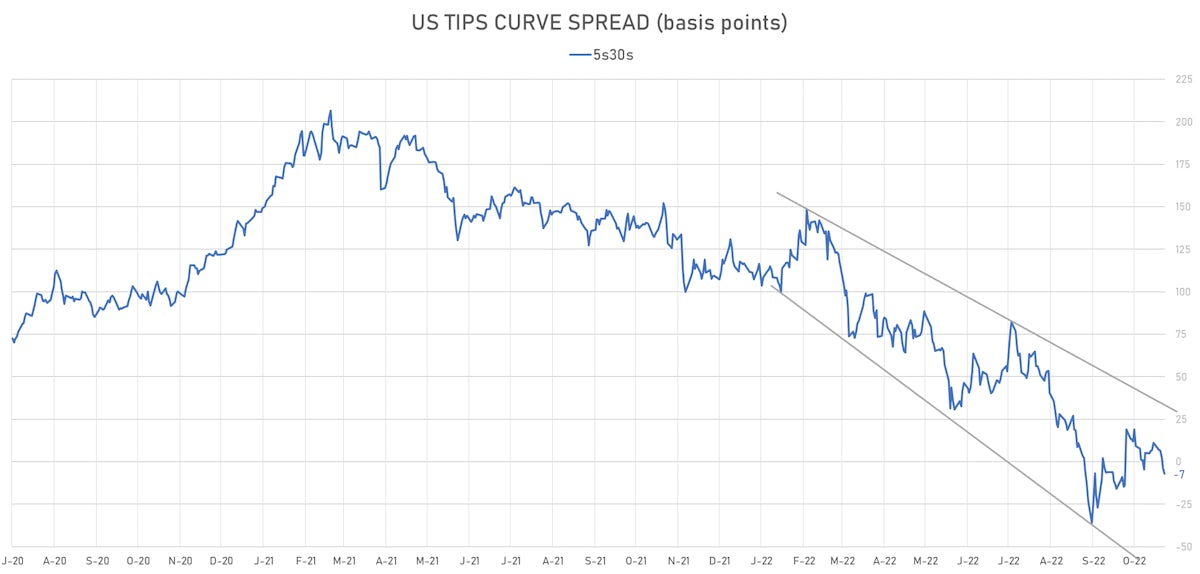

The sharp drop in breakevens and the flattening of the real yields curve reflect the credibility of the recent Fed shift to a "higher for longer" rates environment (with sub-par GDP growth and lower inflation expectations)

Published ET

US TIPS 5s30s Spread | Sources: ϕpost, Refinitiv data

US RATES OUTLOOK

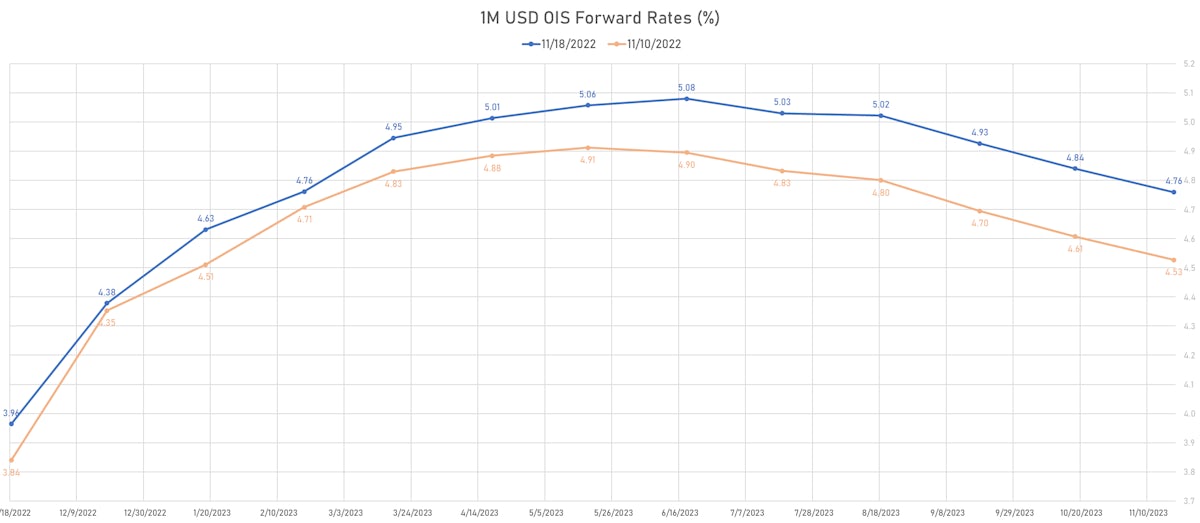

- The market now prices in 54bp for December and 125bp until the peak rate is reached in June '23, with the expectation of a slower hiking pace pushing the peak later in the year

- The market was slightly spooked by the Bullard speech: his view that the hikes in the policy rate should be greater than the deviations of inflation from target put a peak rate of 7% in play (though his base case for the inflation path points to a peak rate just above 5%)

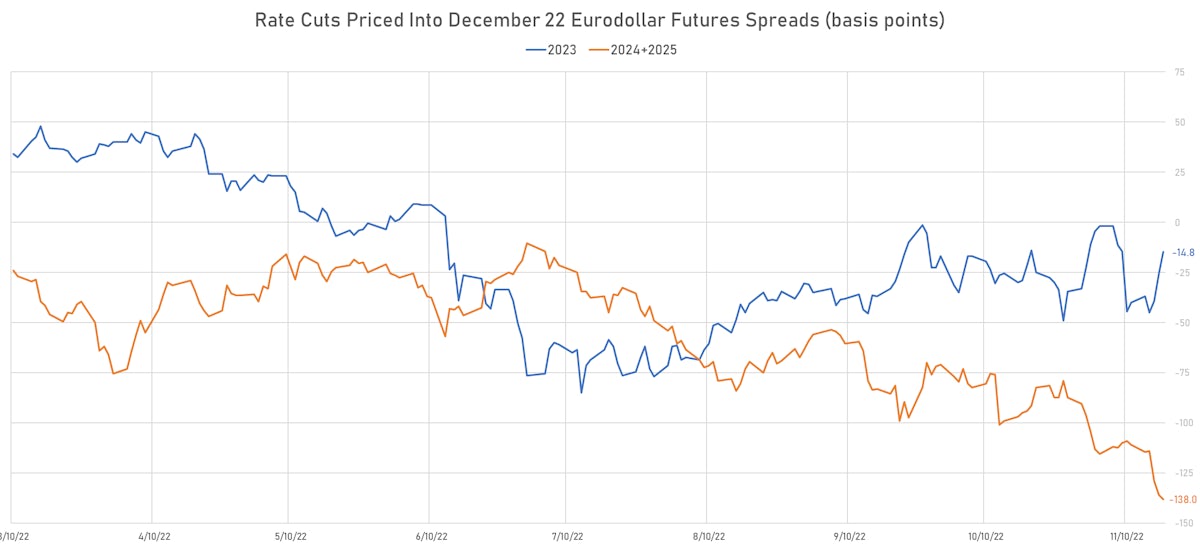

- One of the views we've expressed here before worked well this week: fewer rate cuts priced in 2023 (still too many if the Fed is to be believed) and more in 2024+2025 (still too few if a recession materializes)

- It's this time of the year again: the sell-side is rolling out their views for the year ahead. Goldman Sachs' chief economist presented his 2023 economic outlook on Wednesday, which still pointed to a benign slowdown / soft landing in the US:

"We expect global growth of just 1.8% in 2023, as US resilience contrasts with a European recession and a bumpy reopening in China. The US should narrowly avoid recession as core PCE inflation slows from 5% now to 3% in late 2023 with a 0.5% rise in the unemployment rate."

GS did add one 25bp hike to their previous Fed Funds forecast, raising the peak rate to 5-5.25% for "3 reasons: (1) monetary policy needs to do more as fiscal tightening behind us + income is rising, (2) inflation is likely to remain uncomfortably high for a while, and (3) need to keep FCI tightening, and it's the change in FCI that matters, not the level"

WEEKLY US RATES SUMMARY

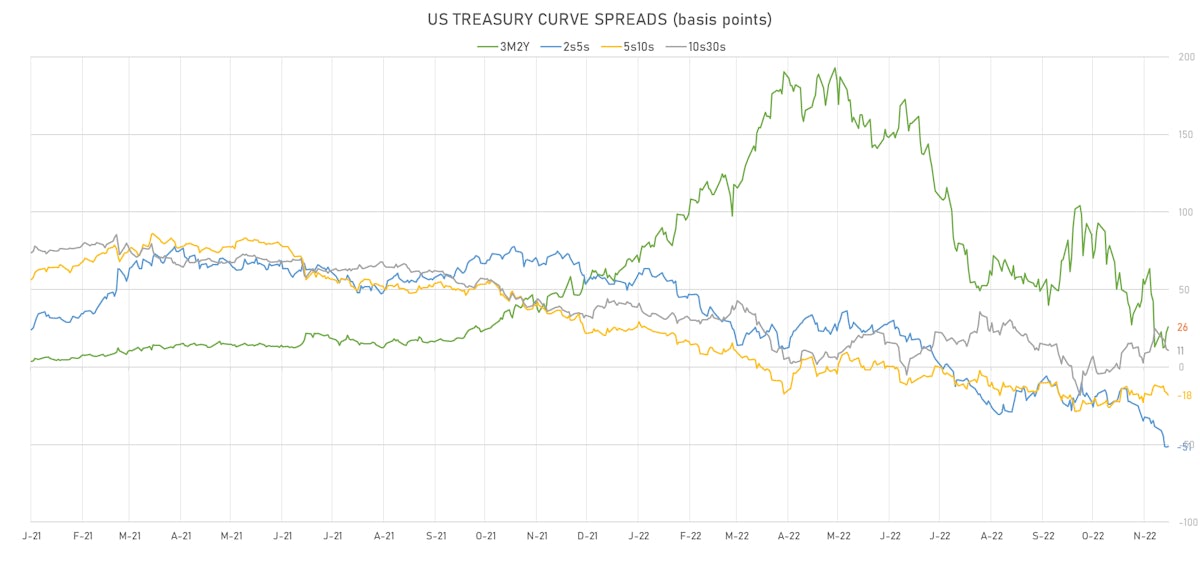

- The treasury yield curve flattened, with the 1s10s spread tightening -13.3 bp, now at -90.5 bp (YTD change: -203.7bp)

- 1Y: 4.7325% (up 15.1 bp)

- 2Y: 4.5298% (up 20.2 bp)

- 5Y: 4.0068% (up 7.2 bp)

- 7Y: 3.9290% (up 5.5 bp)

- 10Y: 3.8279% (up 1.8 bp)

- 30Y: 3.9251% (down 13.2 bp)

- US treasury curve spreads: 3m2Y at 28.5bp (up 13.3bp this week), 2s5s at -52.3bp (down -13.2bp), 5s10s at -17.9bp (down -5.6bp), 10s30s at 9.7bp (down -14.1bp)

- TIPS 1Y breakeven inflation at 2.38% (down -54.3bp); 2Y at 2.36% (down -27.0bp); 5Y at 2.31% (down -16.2bp); 10Y at 2.27% (down -15.0bp); 30Y at 2.36% (down -14.8bp)

- US 5-Year TIPS Real Yield: +23.5 bp at 1.7130%; 10-Year TIPS Real Yield: +16.5 bp at 1.5790%; 30-Year TIPS Real Yield: +5.5 bp at 1.6430%

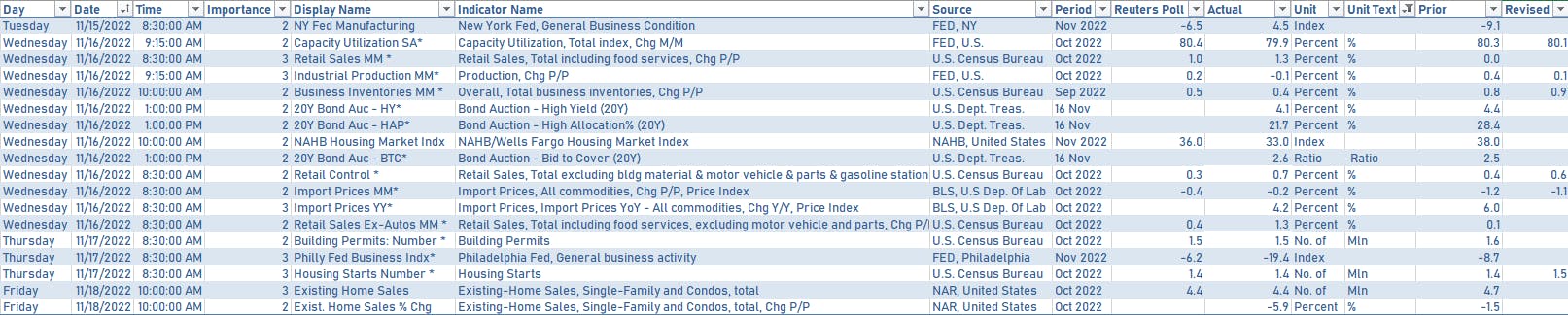

US ECONOMIC DATA RELEASED IN THE PAST WEEK

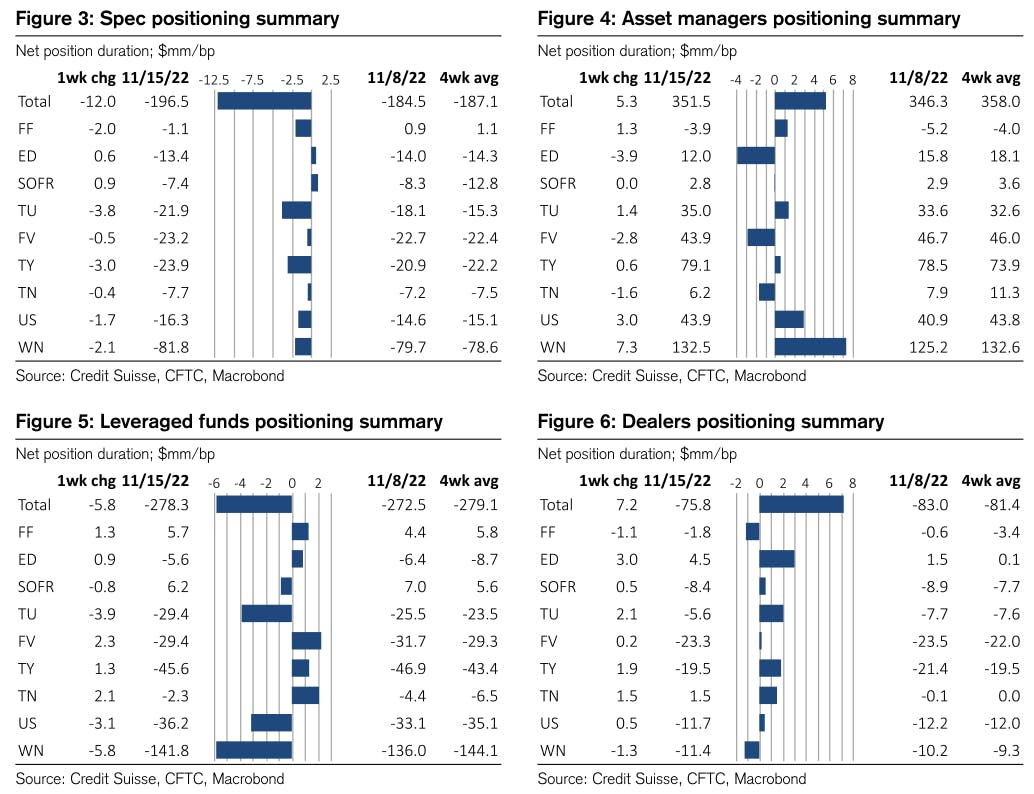

WEEKLY CFTC RATES POSITIONING UPDATE

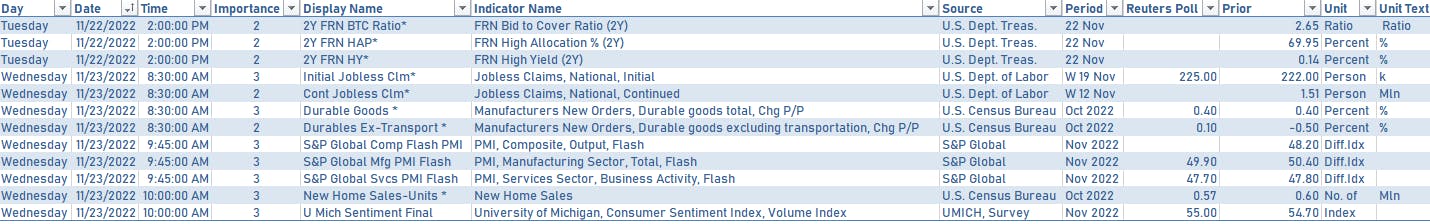

US ECONOMIC DATA IN THE WEEK AHEAD

- Pretty light schedule ahead of Thanksgiving, but the focus will be on the minutes of the November FOMC meeting, and October new home sales data

FED SPEAKERS IN THE WEEK AHEAD

- Tuesday 11:00AM: Cleveland Fed President Mester

- Tuesday 2:15PM: Kansas City Fed President George

- Tuesday 2:45PM: St. Louis Fed President Bullard

US TREASURY COUPON-BEARING AUCTIONS THIS WEEK

- Monday 11:30AM: $42bn 2Ynotes

- Monday 1:00PM: $43bn 5Y notes

- Tuesday 11:30AM: $22bn 2Y FRNs

- Tuesday 1:00PM: $35bn 7Y notes

US FORWARD RATES

- Fed Funds futures now price in 54.3bp of Fed hikes by the end of December 2022, 91.8bp (3.7 x 25bp hikes) by the end of February 2023, and 4.5 hikes by the end of March 2023

- 3-month Eurodollar futures (EDZ) spreads price in 108.5 bp of cuts in 2024 (equivalent to 4.3 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.38% (down -10.1bp); 2Y at 2.36% (down -7.3bp); 5Y at 2.31% (down -2.5bp); 10Y at 2.27% (down -2.9bp); 30Y at 2.36% (down -1.1bp)

- 6-month spot US CPI swap down -11.9 bp to 2.632%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.7130%, +9.6 bp today; 10Y at 1.5790%, +8.7 bp today; 30Y at 1.6430%, +6.2 bp today

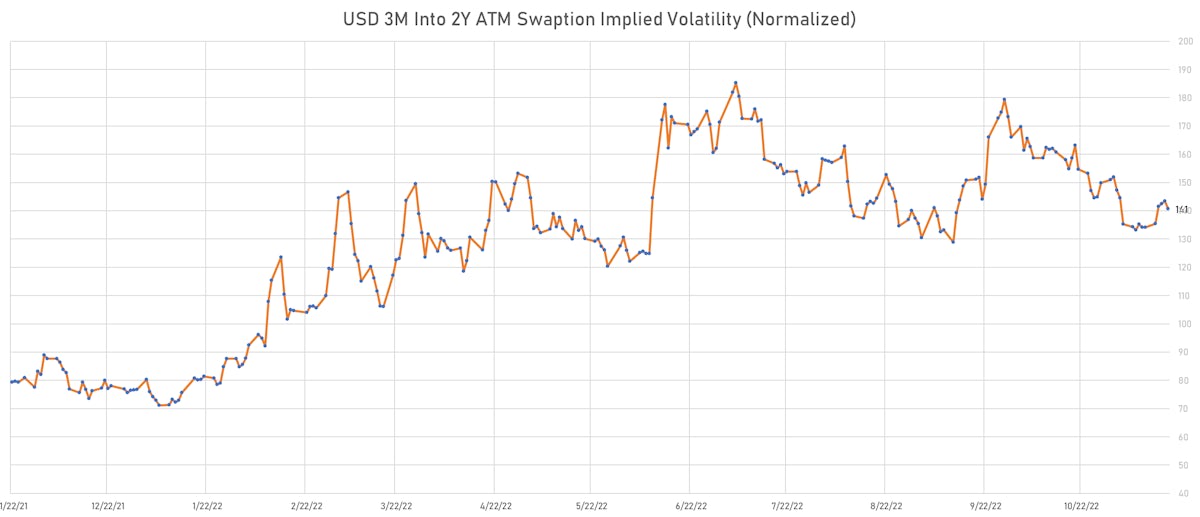

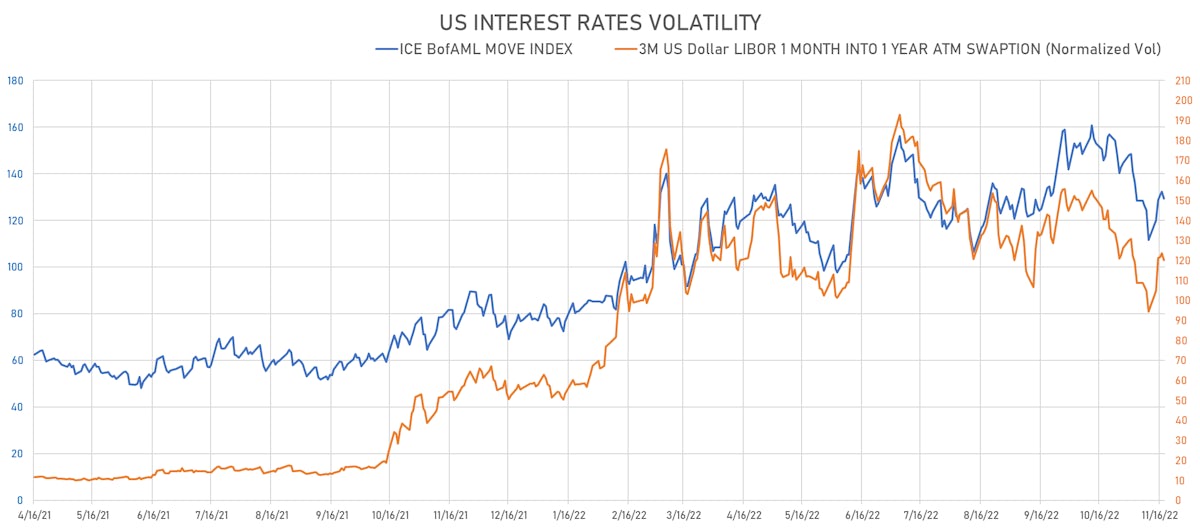

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -3.5 vols at 120.1 normals

- 3-Month LIBOR-OIS spread down -3.4 bp at 32.1 bp (18-months range: -11.3 to 39.3 bp)

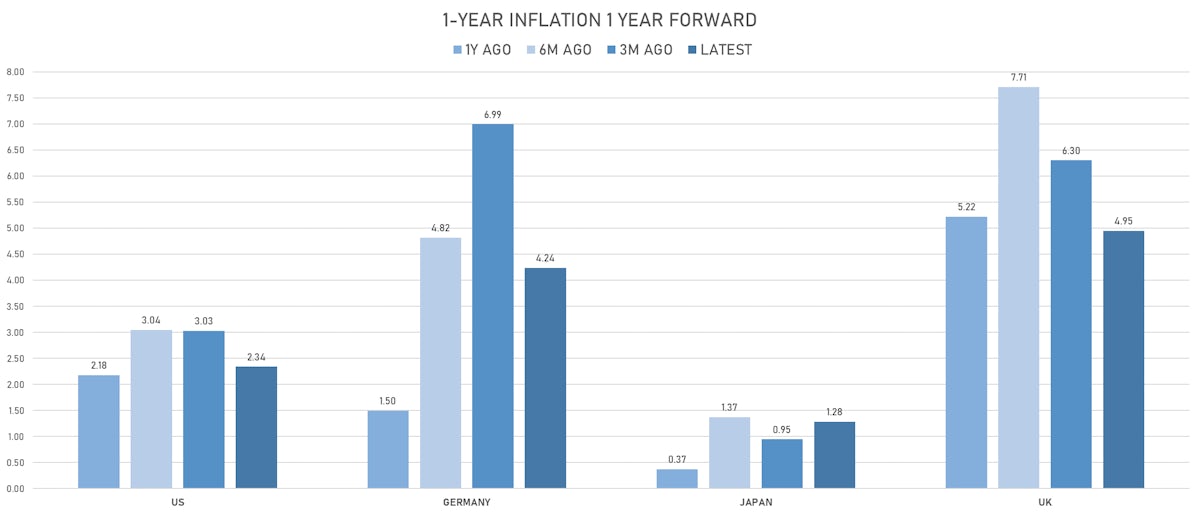

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.995% (down -2.3 bp); the German 1Y-10Y curve is 0.2 bp flatter at -12.0bp (YTD change: -43.7 bp)

- Japan 5Y: 0.090% (up 2.0 bp); the Japanese 1Y-10Y curve is 1.3 bp flatter at 32.4bp (YTD change: -15.9 bp)

- China 5Y: 2.653% (up 1.2 bp); the Chinese 1Y-10Y curve is 3.9 bp steeper at 65.3bp (YTD change: -50.3 bp)

- Switzerland 5Y: 0.819% (down -2.7 bp); the Swiss 1Y-10Y curve is 3.4 bp steeper at -6.3bp (YTD change: -56.6 bp)