Rates

Big Macro Week Ahead Gives The Fed An Opportunity To Reset Recent Dovish Leanings

The easing in financial conditions over the past month has not been met by any pushback from the Fed, but the December FOMC is as good a time as any to change expectations and market pricing

Published ET

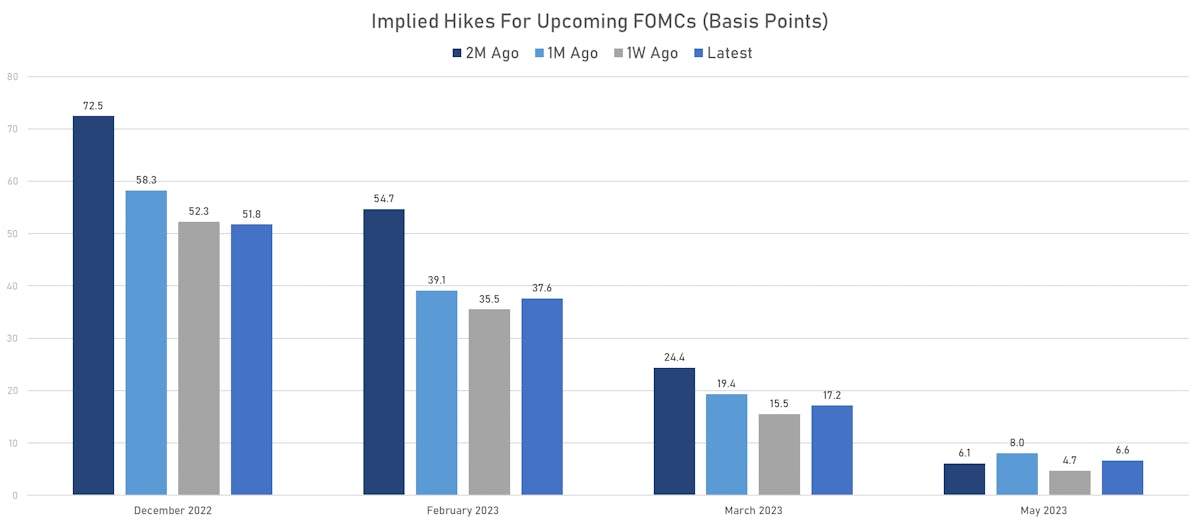

Implied Hikes For Upcoming FOMCs | Sources: ϕpost, Refinitiv data

14 DECEMBER 2022 FOMC PREVIEW

- A 50bp hike is baked in the cake (51.8bp priced in or 93% probability of a 50bp hike), turning the conversation to the updated SEP: most important will be the median 2023 dot and the long-run dot, as the Fed needs to emphasize a higher terminal rate after the most recent payroll print (even if we get another soft CPI print the day before the FOMC)

- The 2023 median dot should move up to 5.125% (50bp higher than in September), and if the Fed wanted to fight current market pricing (peak rate below 5% and close to 2 rate cuts priced in 2023), they could signal that they are likely to stay at a 50bp pace, with risks still skewed to the upside

- The latest Inflation Nowcasting core PCE is at 4.72%, meaning the real effective Fed Funds rate will still be negative after a 50bp hike in December, clearly not in restrictive territory despite recent official commentary

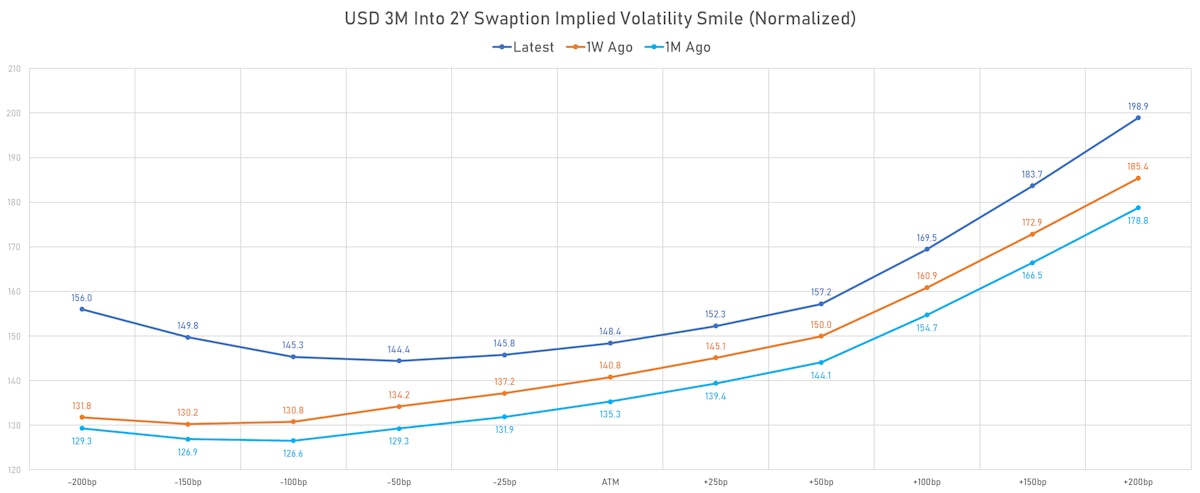

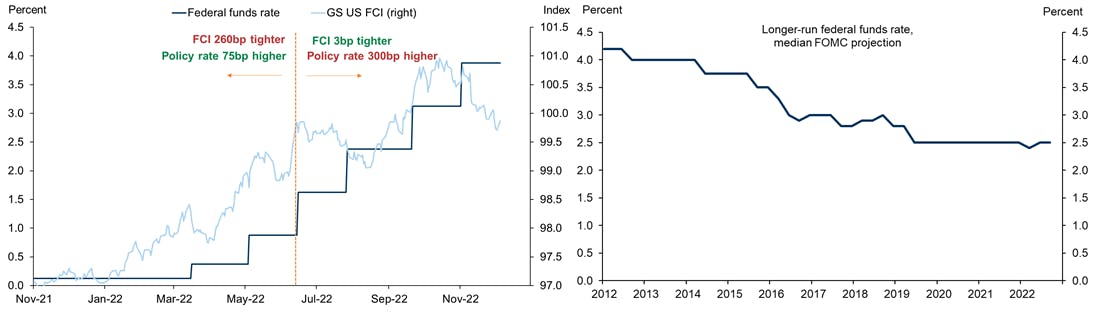

- The problem of a slower for longer hiking cycle is that rates volatility matters to asset prices, and in turn to financial conditions: if the Fed were to announce a decrease in the pace of hikes to 25bp in February, rates vols would fall, risk markets would rise and FCI would ease further. The pace of hikes at the very front of the curve is much more impactful from a market perspective than promising a higher peak later when your policy is data dependent

- The Fed tried to convince the market that downshifting to 50bp from 75bp was not dovish because the peak rate would rise, but markets ignored that and rallied furiously in November, encouraged by a weaker than expected CPI print

- The reason why the Fed has been reluctant to push back against the latest FCI easing: at this point, there is no way to do it without committing to 50bp in February, and committee members have repeated their concern about the lagged impact of rates on economic activity (they don't want to overtighten). So they're stuck to watching financial conditions get away from where they think they should be (tighter).

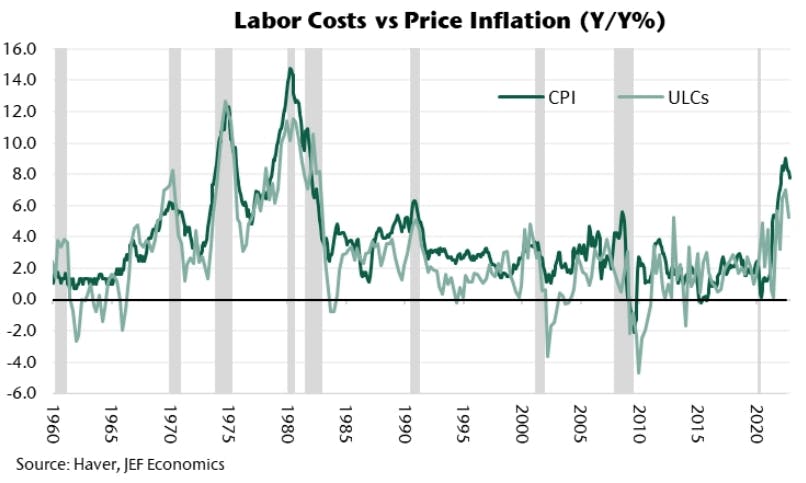

- Having said that, it's hard to understand the worry about overtightening for several reasons: 1) a hot labor market with fast-rising unit labor cost is putting a floor on inflation, 2) unemployment is low and not moving materially higher, 3) there is a risk of an unwanted reacceleration of growth with the negative impact of fiscal + monetary policies behind us, 4) Chinese reopening next year could cause a renewed rise in oil prices and industrial commodities, 5) overtightening is an easy problem to solve compared to unanchored inflation expectations

- Powell seems to understand the risk management problem of declaring victory too early, though lately his communication has turned noticeably less forceful. Our advice to him (though he most certainly has no idea we exist) is to look through a weak CPI, keep rates volatility high and the forward rates distribution as open as possible.

WEEKLY US RATES SUMMARY

- The treasury yield curve bear steepened, with the 1s10s spread widening 6.0 bp, now at -111.6 bp (YTD change: -224.8bp)

- 1Y: 4.7004% (up 3.5 bp)

- 2Y: 4.3401% (up 5.8 bp)

- 5Y: 3.7704% (up 11.3 bp)

- 7Y: 3.7017% (up 11.1 bp)

- 10Y: 3.5847% (up 9.5 bp)

- 30Y: 3.5671% (up 2.0 bp)

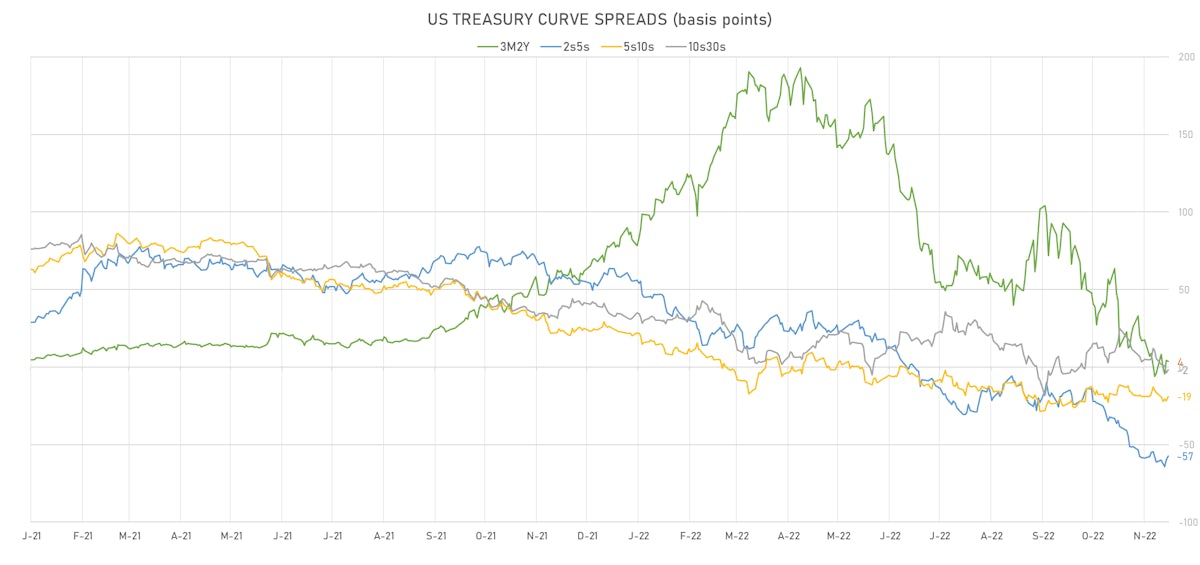

- US treasury curve spreads: 3m2Y at 4.2bp (up 8.4bp this week), 2s5s at -57.0bp (up 4.1bp), 5s10s at -18.6bp (down -2.6bp), 10s30s at -1.8bp (down -8.2bp)

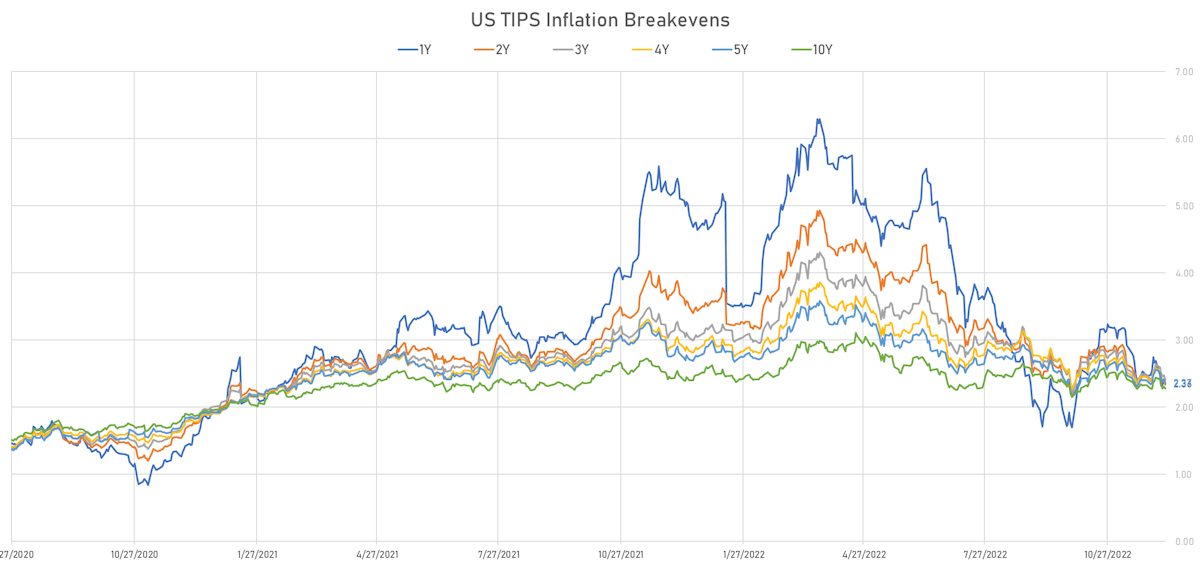

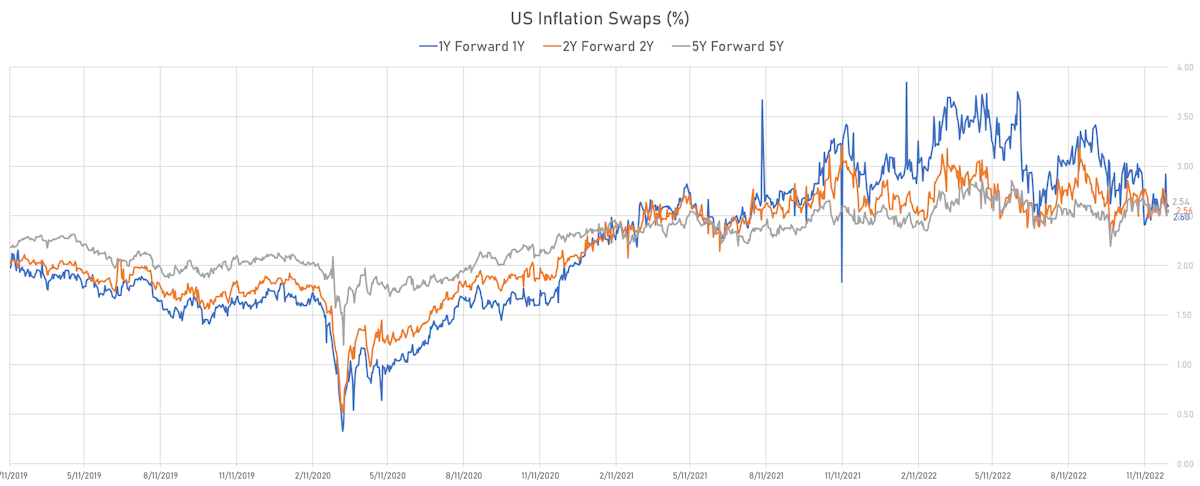

- TIPS 1Y breakeven inflation at 2.36% (down -10.8bp); 2Y at 2.33% (down -13.6bp); 5Y at 2.37% (down -3.1bp); 10Y at 2.28% (down -4.8bp); 30Y at 2.33% (down -5.6bp)

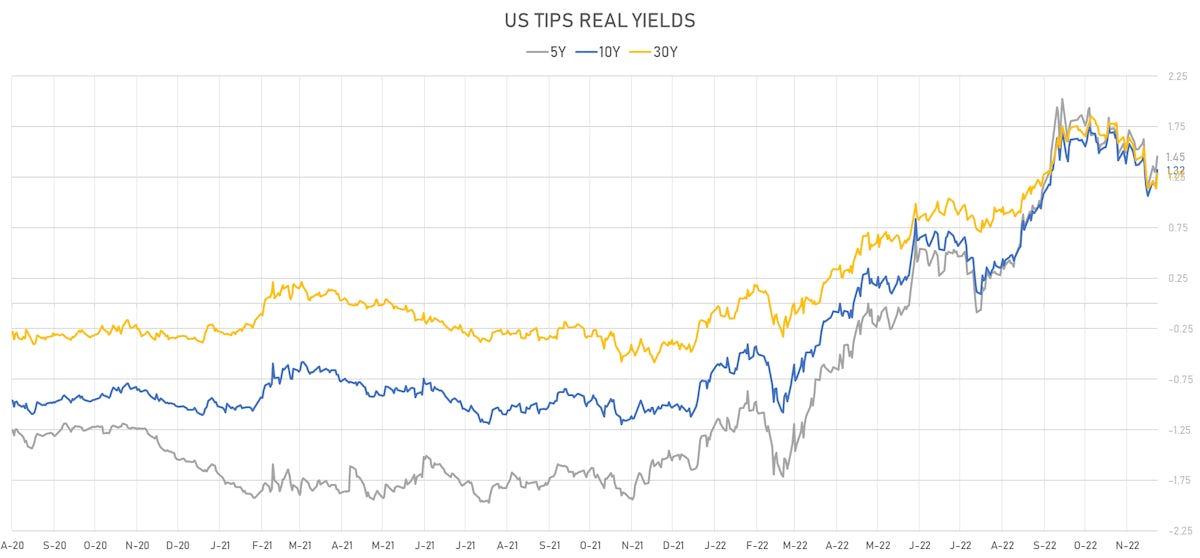

- US 5-Year TIPS Real Yield: +30.0 bp at 1.4540%; 10-Year TIPS Real Yield: +25.9 bp at 1.3220%; 30-Year TIPS Real Yield: +14.9 bp at 1.2870%

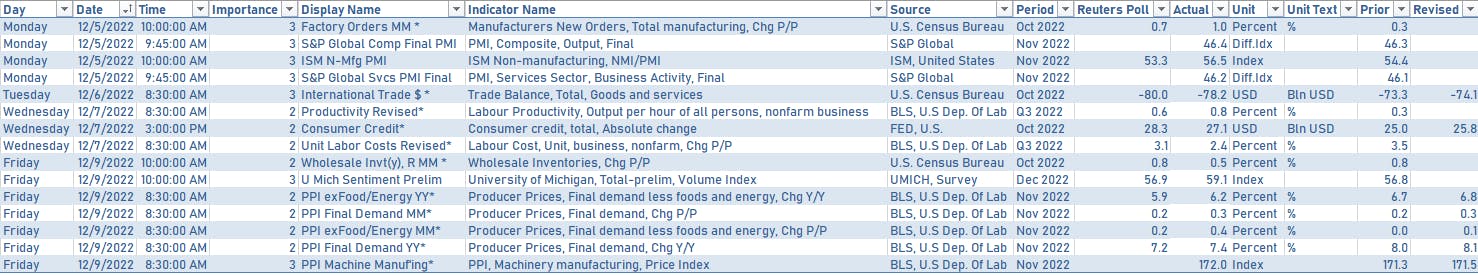

US MACRO RELEASES OVER THE PAST WEEK

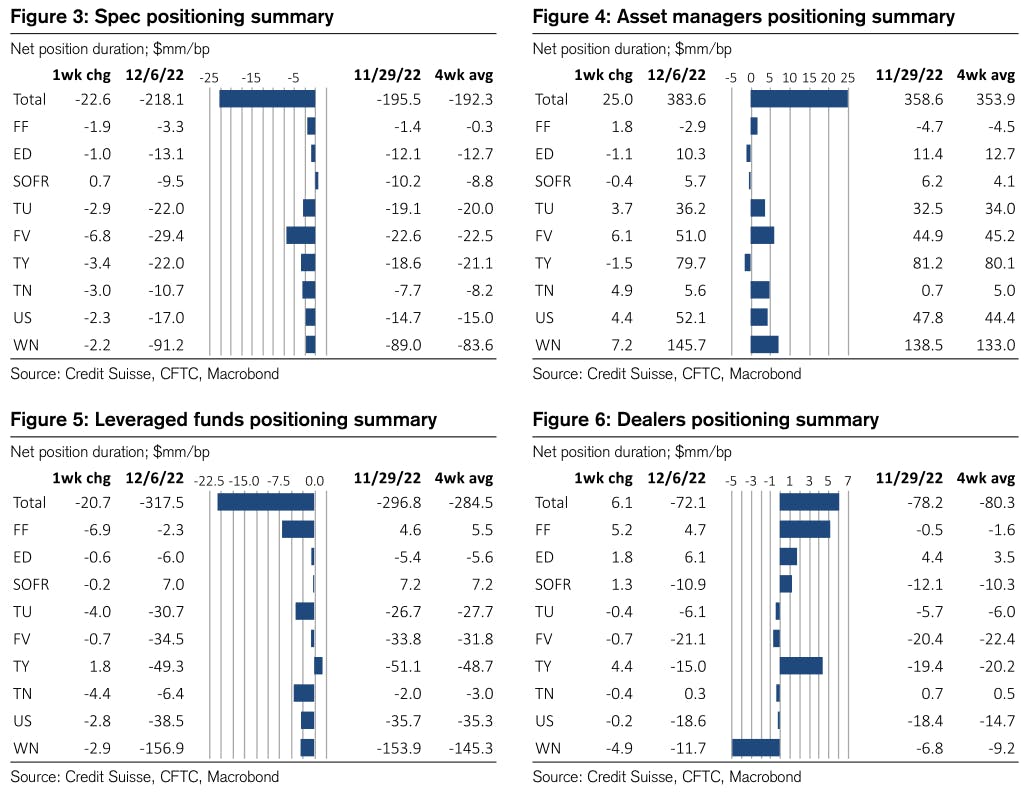

WEEKLY CFTC RATES POSITIONING UPDATE

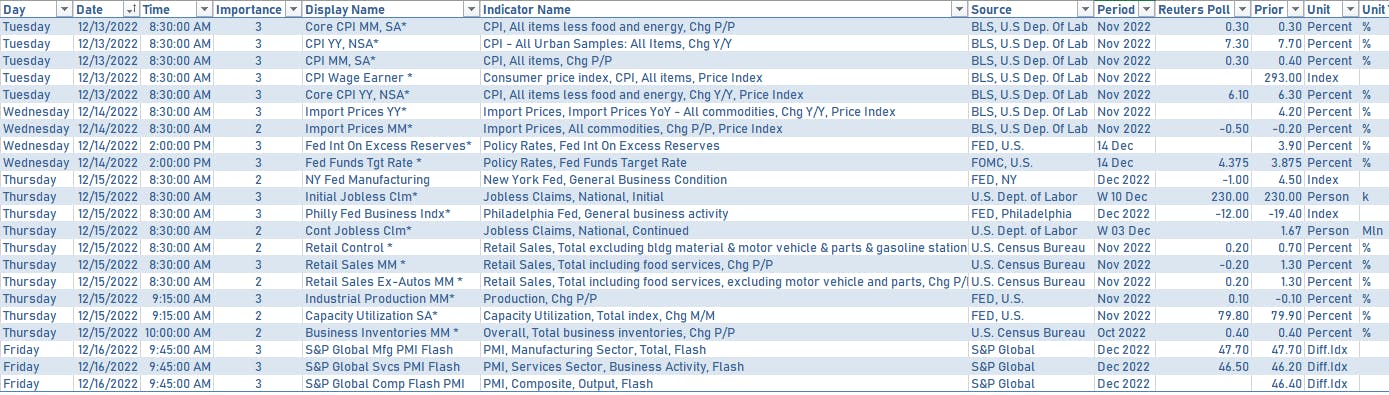

US MACRO RELEASES IN THE WEEK AHEAD

- Most important data point is the latest CPI report on the first day of the FOMC

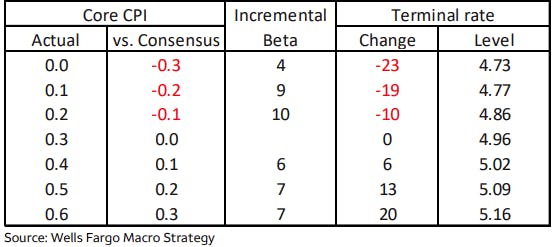

- Wells Fargo estimates that the peak Fed Funds rate is more sensitive to a fall than a rise in core CPI: "if core prints 0.1% then the terminal rate is likely to fall near 4.75%, i.e. nearly 20bps below the level at pixel time. In contrast, a 0.5% print probably would boost the terminal rate by less than 15bps"

US TREASURY COUPON-BEARING AUCTIONS NEXT WEEK

- Monday: $40bn in 3Y Notes at 11:30AM and $32bn in 10Y Notes at 1:00PM

- Tuesday: $18bn in 30Y Bonds at 1:00PM

US FORWARD RATES

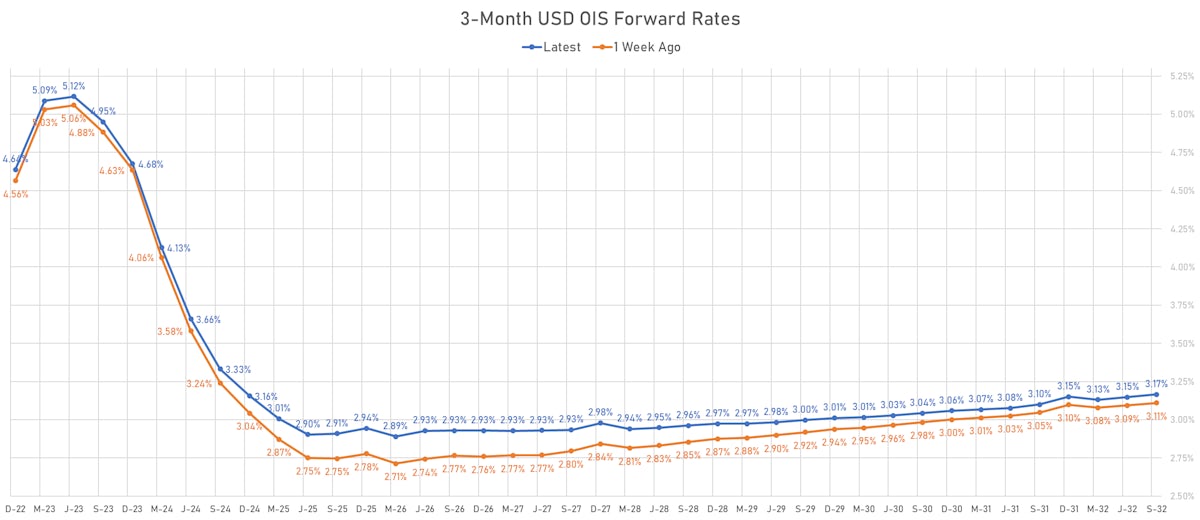

- Fed Funds futures now price in 51.8bp of Fed hikes by the end of December 2022, 89.3bp (3.6 x 25bp hikes) by the end of February 2023, and 4.3 hikes by the end of March 2023

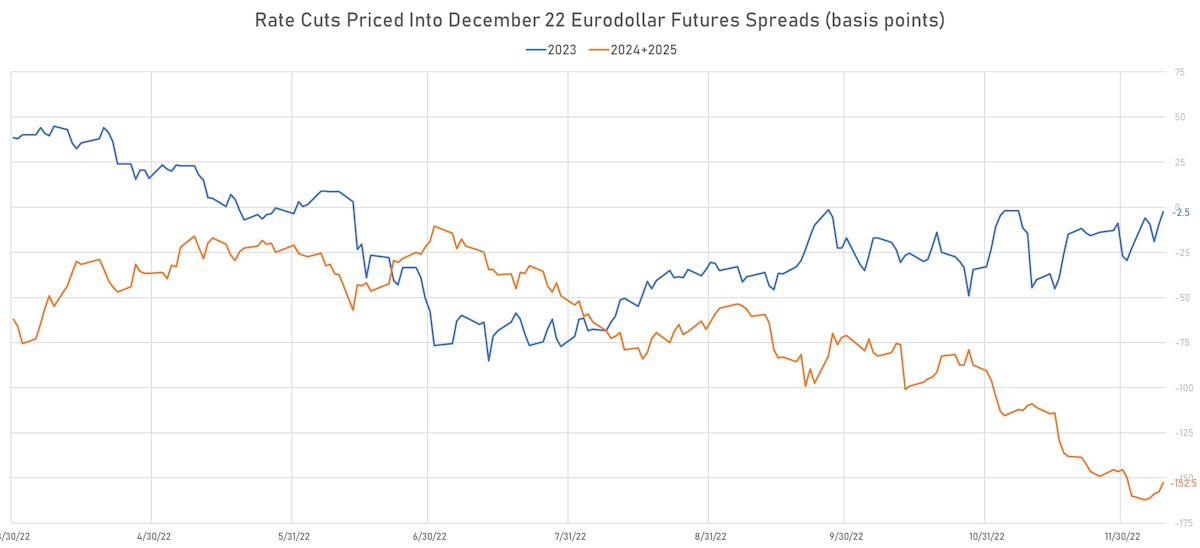

- 3-month Eurodollar futures (EDZ) spreads price in 134.0 bp of cuts in 2024 (equivalent to 5.4 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.36% (down -5.2bp); 2Y at 2.33% (down -7.3bp); 5Y at 2.37% (down -4.2bp); 10Y at 2.28% (down -3.1bp); 30Y at 2.33% (down -1.8bp)

- 6-month spot US CPI swap up 2.1 bp to 2.425%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.4540%, +10.0 bp today; 10Y at 1.3220%, +12.4 bp today; 30Y at 1.2870%, +14.9 bp today

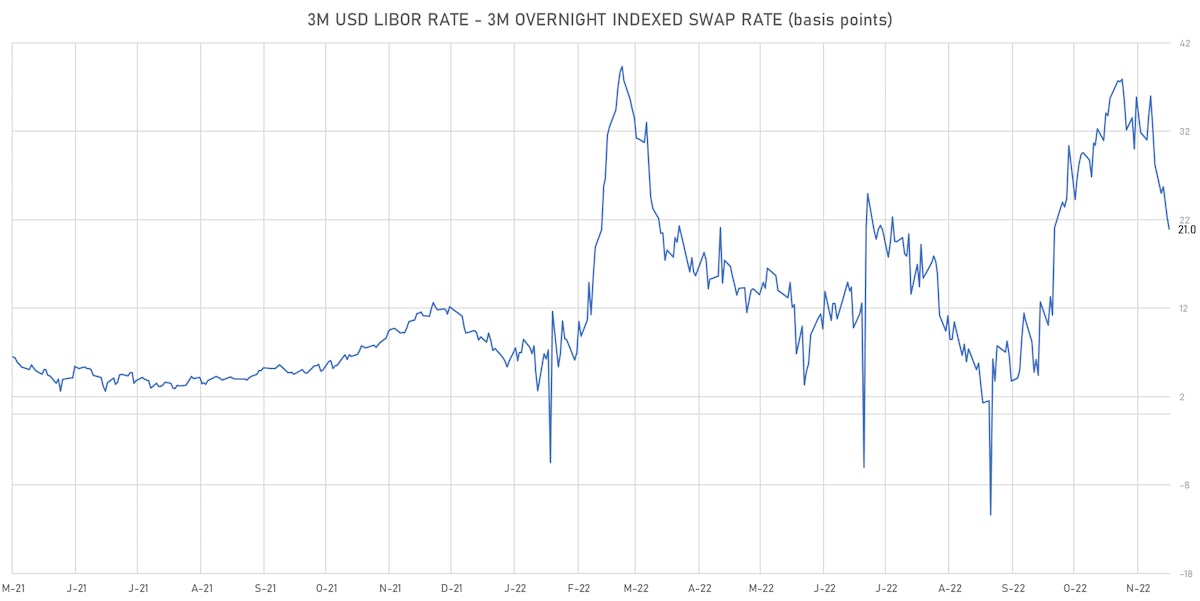

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 0.7 vols at 123.3 normals

- 3-Month LIBOR-OIS spread down -1.4 bp at 21.0 bp (18-months range: -11.3 to 39.3 bp)

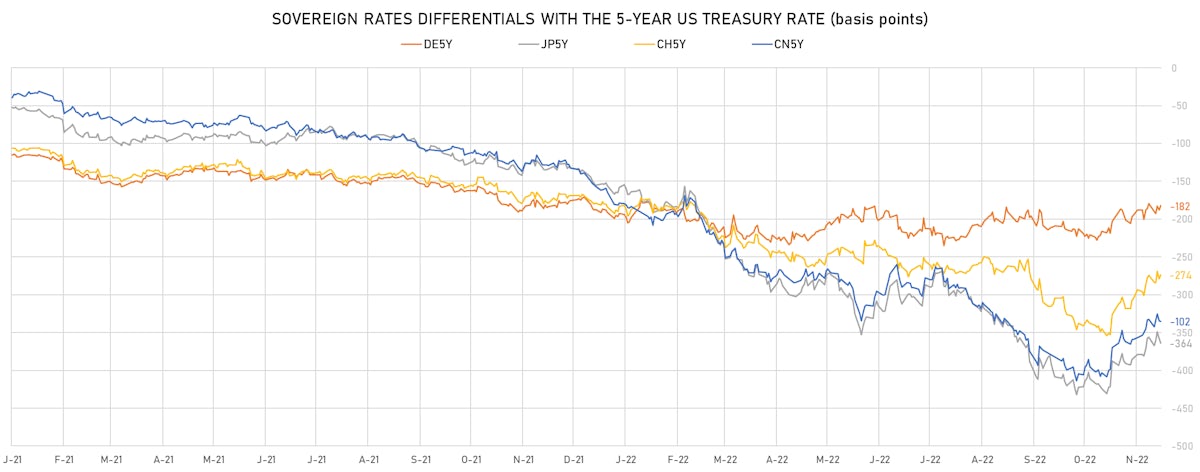

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 1.947% (up 10.3 bp); the German 1Y-10Y curve is 0.8 bp steeper at -33.5bp (YTD change: -44.0 bp)

- Japan 5Y: 0.124% (down -1.0 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 33.8bp (YTD change: -15.9 bp)

- China 5Y: 2.735% (up 3.5 bp); the Chinese 1Y-10Y curve is 2.2 bp flatter at 63.1bp (YTD change: -50.4 bp)

- Switzerland 5Y: 1.020% (up 9.9 bp); the Swiss 1Y-10Y curve is 12.6 bp steeper at 16.3bp (YTD change: -56.5 bp)