Rates

Fed Chooses To Ignore FCI Loosening, While The ECB Points To Unexpectedly Hawkish Path In 2023

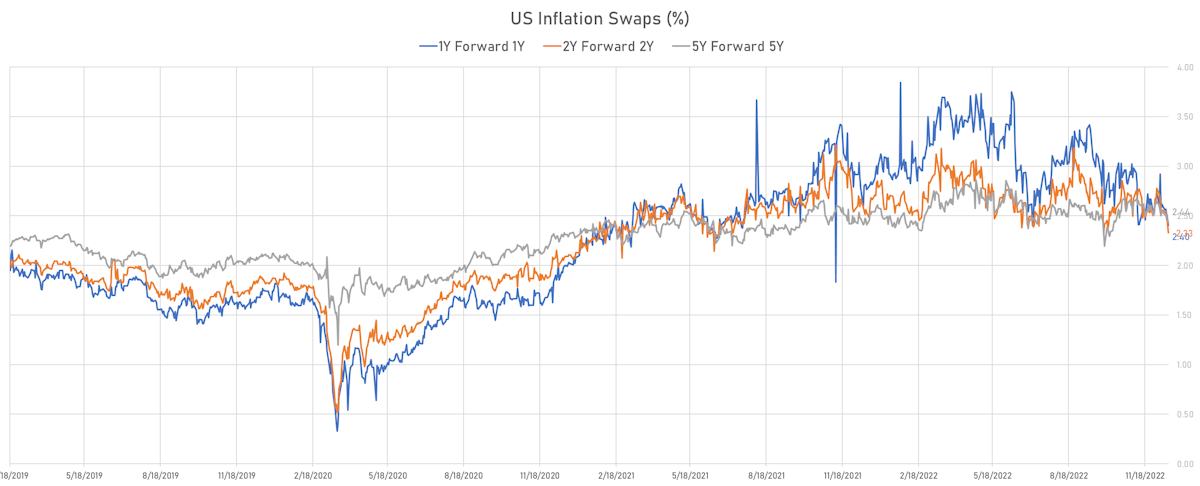

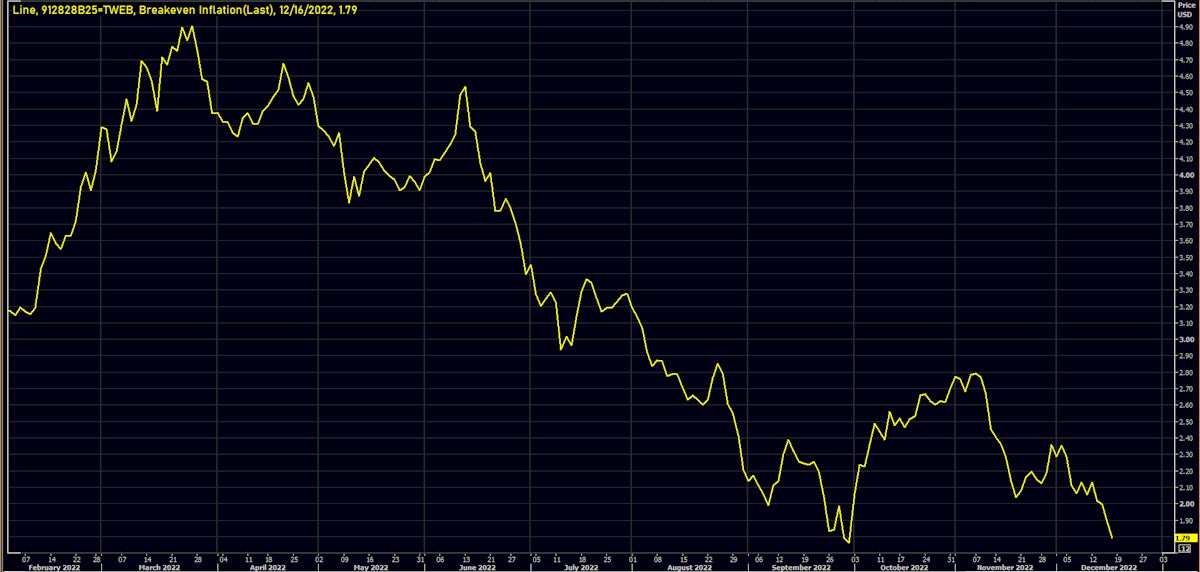

The most surprising thing to us at this point is how low the market is pricing inflation 1Y forward, with the 1Y US TIPS breakeven now around 1.80%, while the Fed's own forecast for the end of 2023 is above 3%

Published ET

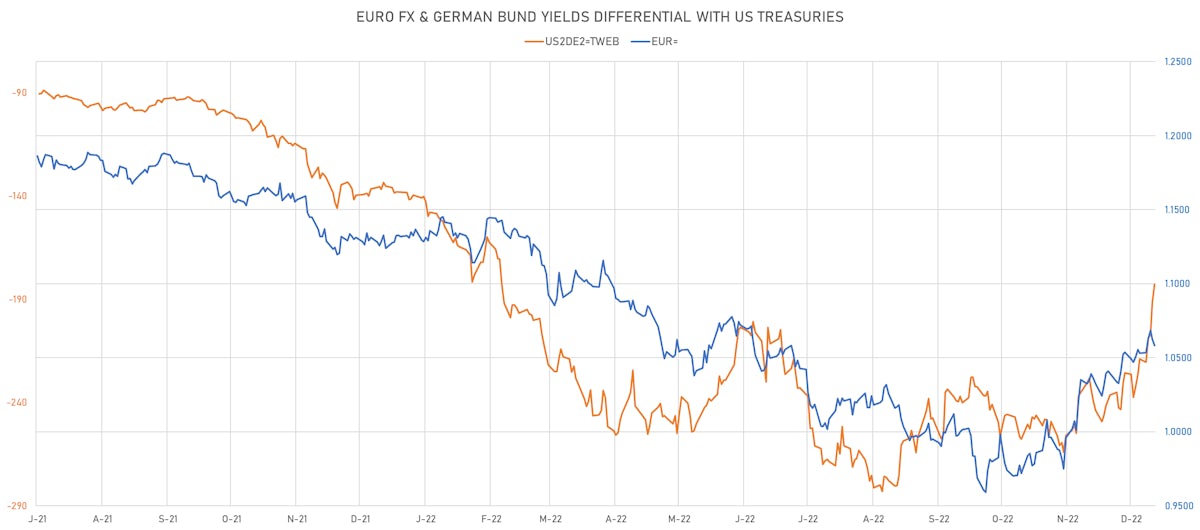

US 1Y TIPS (912828B25) Breakeven Inflation | Source: Refinitiv

FINAL US RATES COMMENTARY FOR 2022

As a year-end piece, we will just point out three areas where the rates complex may be positioned for surprises in 2023

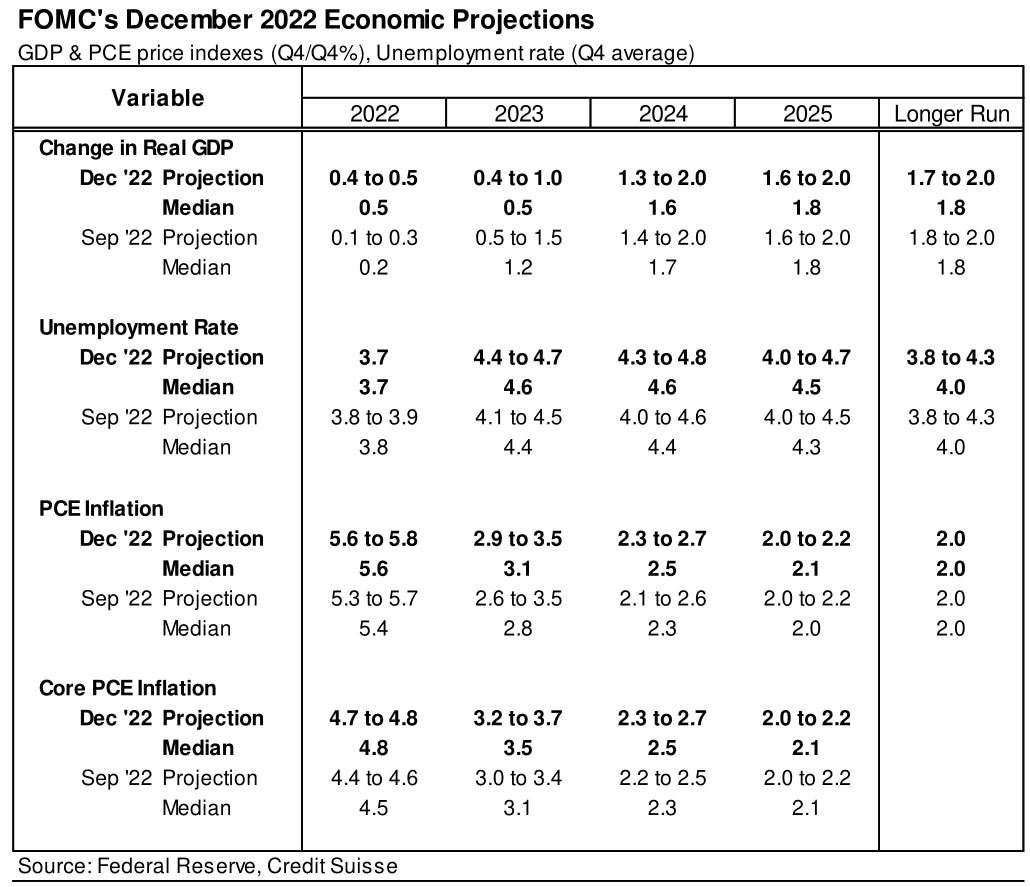

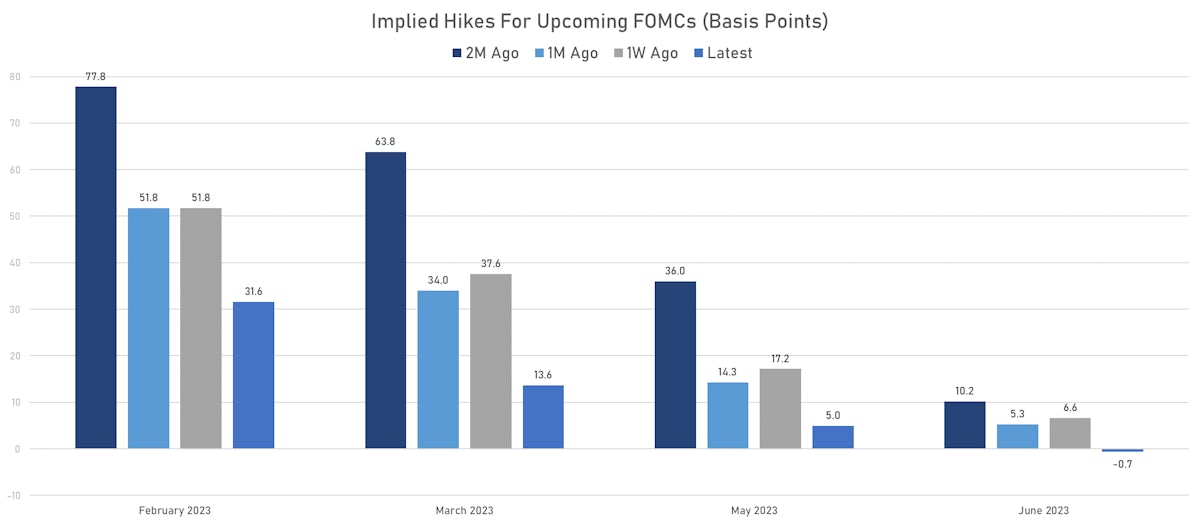

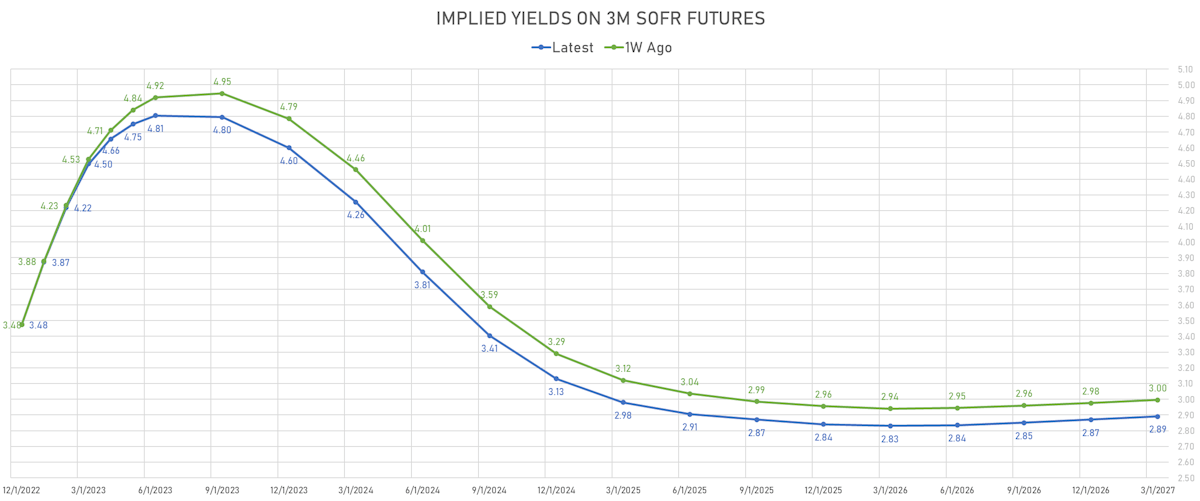

- The market's peak rate is below the Fed's terminal rate projections: the latest SEP shows a median of 5 1/8 in 2023 while the USD OIS curve is currently at 4.82% (30bp below the Fed)

- The market still expects rate close to 2x25bp cuts in 2023, despite the Fed's projections and Powell's commentary (though he declined to lean against market pricing)

- We understand that the Fed is potentially hiking into a recession, but the US TIPS breakevens look exceedingly benign: with the 1Y around 1.80%, the market sees an inflation overshoot as a very low probability event (something we would push back against)

WEEKLY US RATES SUMMARY

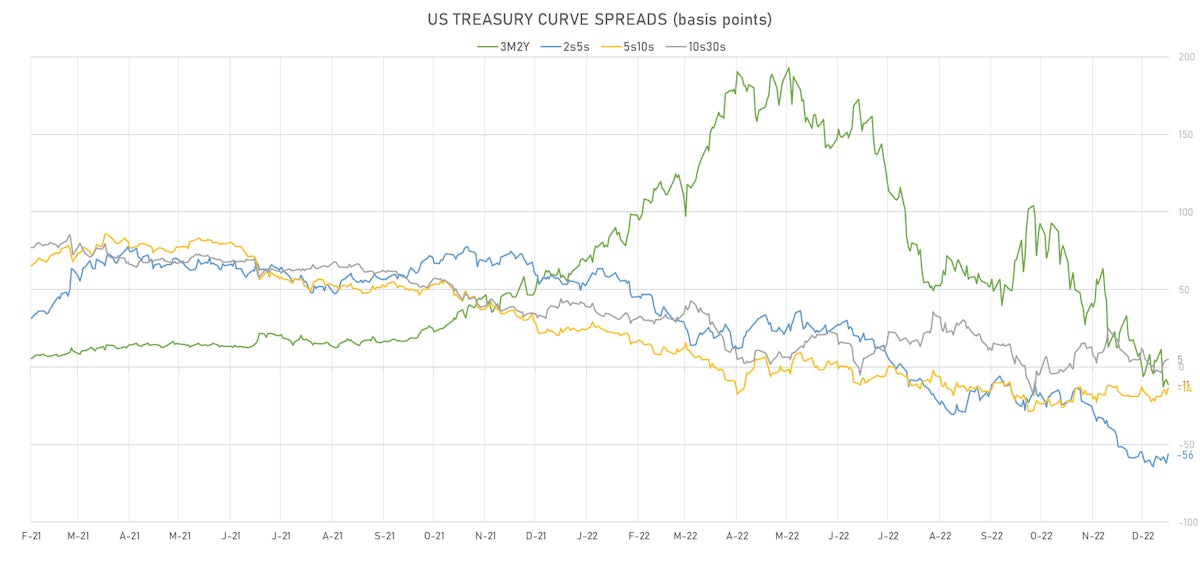

- The treasury yield curve steepened, with the 1s10s spread widening 0.4 bp, now at -111.1 bp (YTD change: -224.4bp)

- 1Y: 4.5971% (down 10.3 bp)

- 2Y: 4.1804% (down 16.0 bp)

- 5Y: 3.6208% (down 15.0 bp)

- 7Y: 3.5841% (down 11.8 bp)

- 10Y: 3.4859% (down 9.9 bp)

- 30Y: 3.5418% (down 2.5 bp)

- US treasury curve spreads: 3m2Y at -13.4bp (down -17.6bp this week), 2s5s at -56.0bp (up 2.0bp), 5s10s at -13.5bp (up 5.0bp), 10s30s at 5.6bp (up 8.0bp)

- TIPS 1Y breakeven inflation at 1.90% (down -45.5bp); 2Y at 2.12% (down -21.4bp); 5Y at 2.19% (down -17.6bp); 10Y at 2.13% (down -14.2bp); 30Y at 2.17% (down -15.7bp)

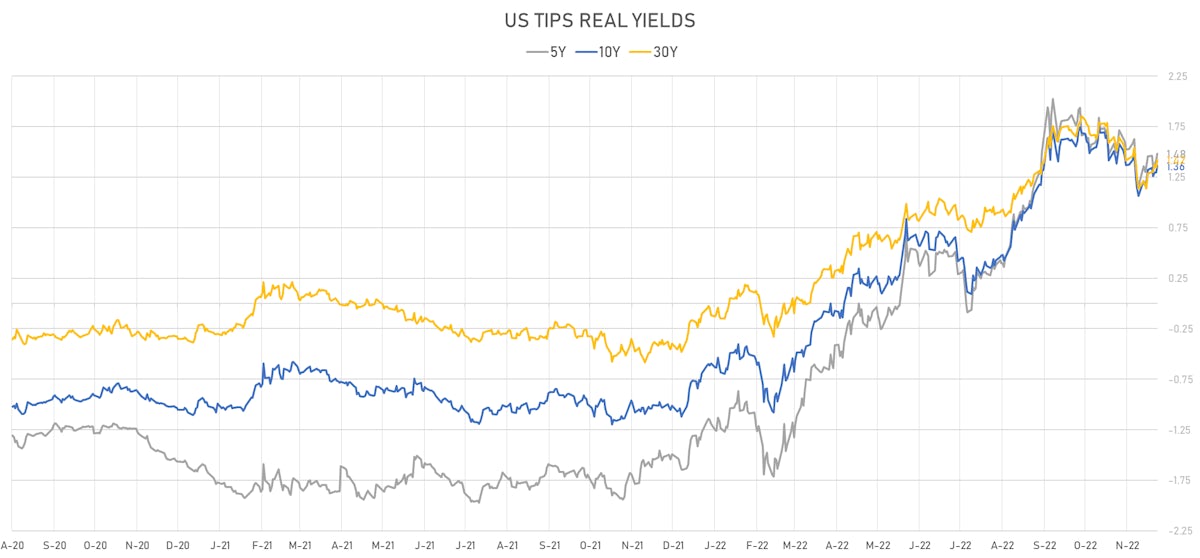

- US 5-Year TIPS Real Yield: +2.6 bp at 1.4800%; 10-Year TIPS Real Yield: +4.2 bp at 1.3640%; 30-Year TIPS Real Yield: +13.5 bp at 1.4220%

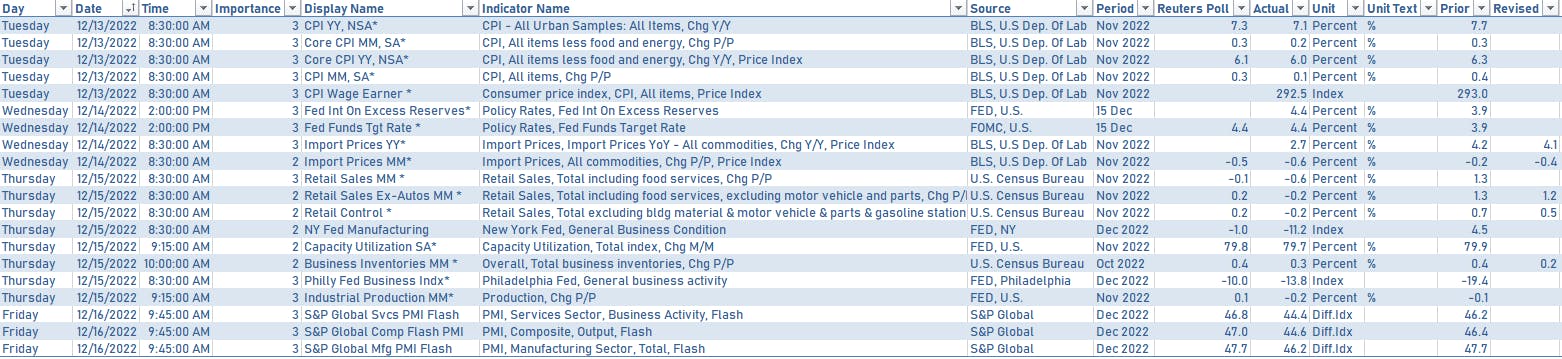

US MACRO RELEASES OVER THE PAST WEEK

US FORWARD RATES

- Fed Funds futures now price in just 50bp of hikes until the Fed pauses

- 3-month Eurodollar futures (EDZ) spreads price in 127.5 bp of cuts in 2024 (equivalent to 5.1 x 25 bp cuts)

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 1.90% (down -15.4bp); 2Y at 2.12% (down -9.7bp); 5Y at 2.19% (down -5.6bp); 10Y at 2.13% (down -3.5bp); 30Y at 2.17% (down -2.2bp)

- 6-month spot US CPI swap down -3.6 bp to 2.362%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.4800%, +6.0 bp today; 10Y at 1.3640%, +7.0 bp today; 30Y at 1.4220%, +7.4 bp today

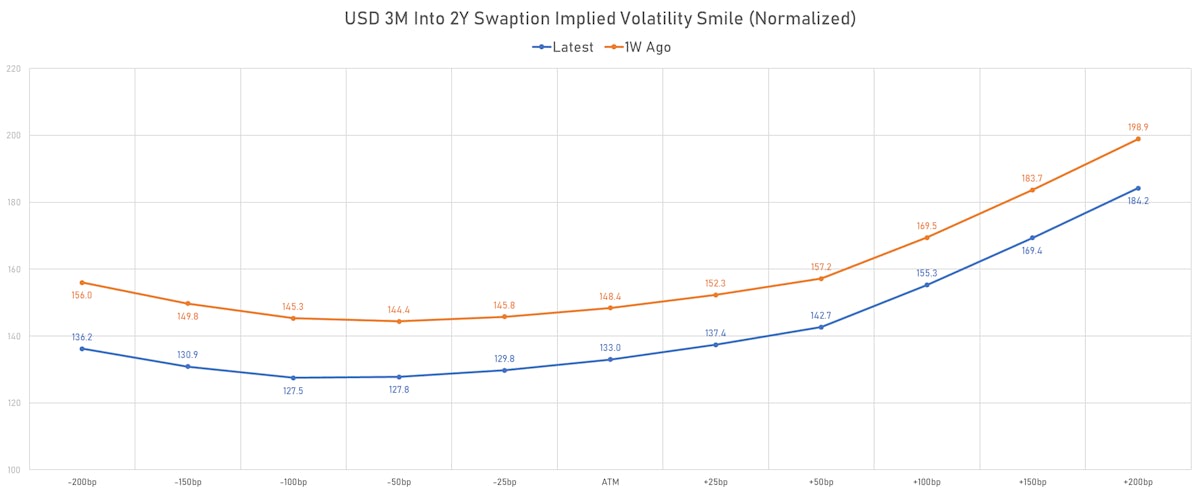

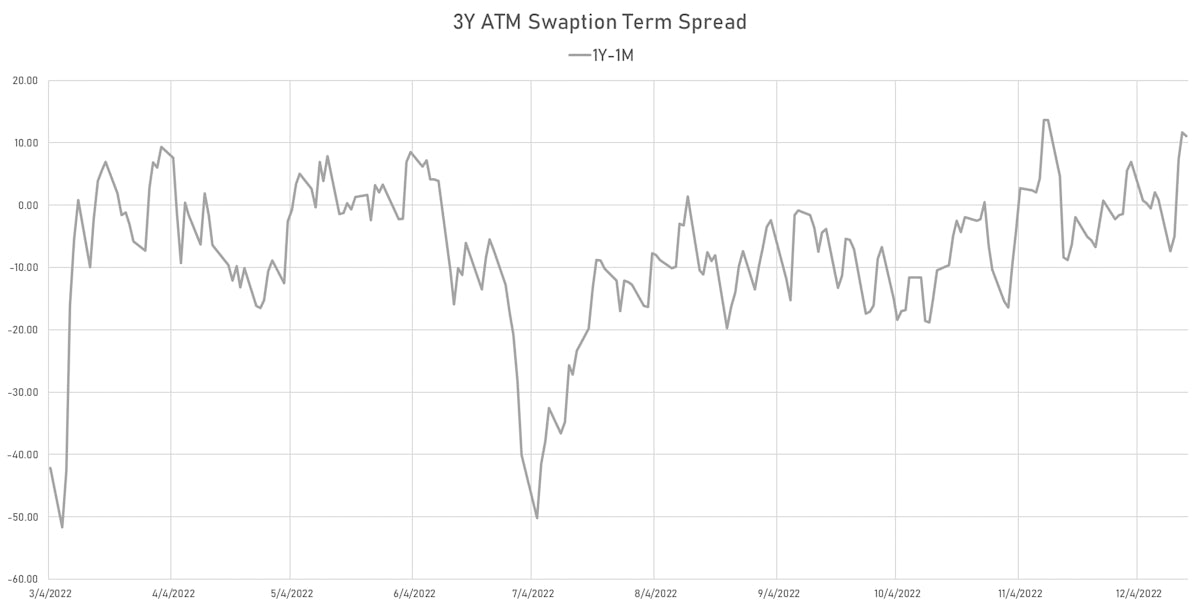

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.5 vols at 100.3 normals

- 3-Month LIBOR-OIS spread up 0.8 bp at 22.7 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.226% (up 7.3 bp); the German 1Y-10Y curve is 0.2 bp flatter at -26.4bp (YTD change: -43.7 bp)

- Japan 5Y: 0.128% (down -0.4 bp); the Japanese 1Y-10Y curve is 0.1 bp steeper at 34.4bp (YTD change: -15.9 bp)

- China 5Y: 2.701% (up 0.2 bp); the Chinese 1Y-10Y curve is 1.2 bp flatter at 59.1bp (YTD change: -50.4 bp)

- Switzerland 5Y: 1.157% (up 6.5 bp); the Swiss 1Y-10Y curve is 3.3 bp steeper at 17.6bp (YTD change: -56.5 bp)