Rates

US Rates Complex Feeling Hopeful That Inflation Is Normalizing, With A Soft Landing As The New Base Case

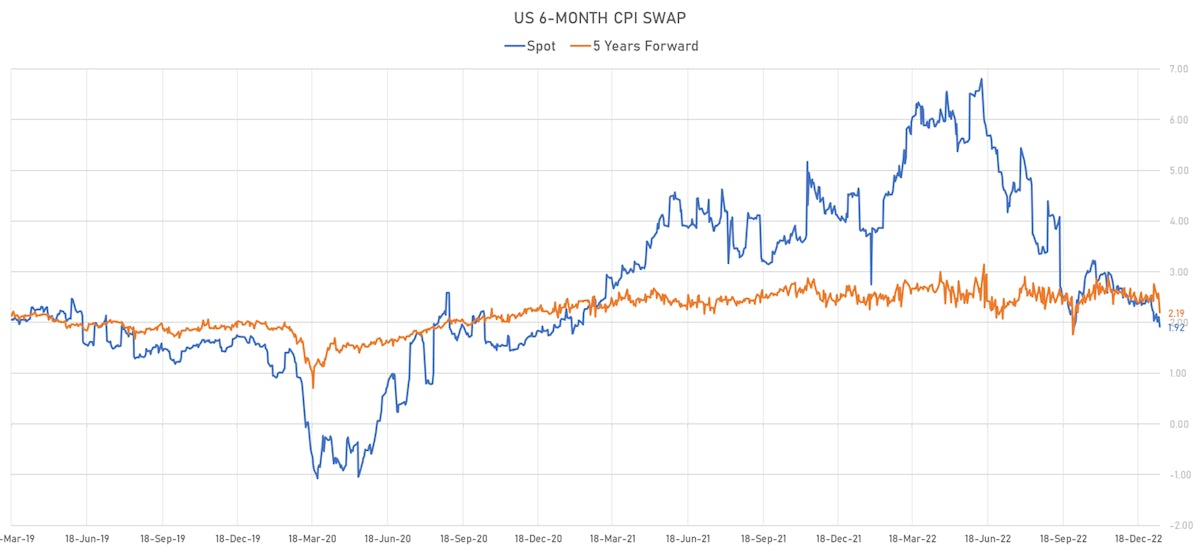

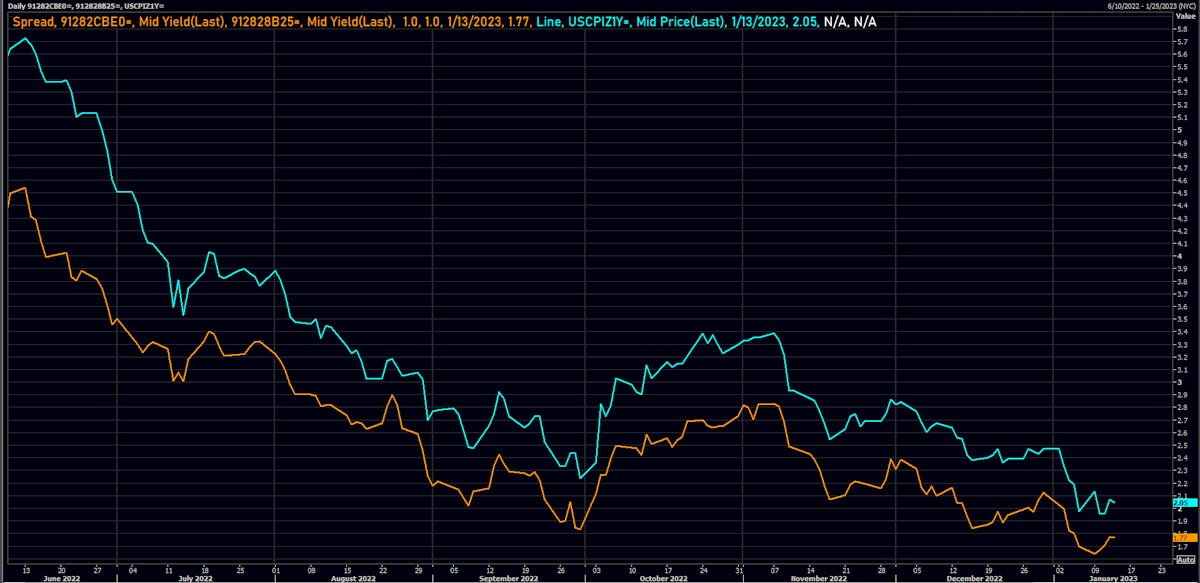

Even if headline inflation seems to be coming down rapidly markets are too sanguine about inflation pricing : 1Y TIPS breakeven around 1.80% and 1Y CPI swap at 2% look too low

Published ET

1Y Inflation Pricing Looks Too Low | Source: Refinitiv

US RATES OUTLOOK

- Money markets currently price in 92% probability of a 25bp hike in February and it's getting late for the Fed to change that: unless we get a big surprise from Fed speakers this week, a step down to 25bp is almost certain now

- Although the immediate path of policy is getting clearer, there is considerable uncertainty around two main questions:

- Will the Fed go 25+25+25+pause or just 25+25+pause? The market has recently priced out a lot of the right tail in terms of rate hikes, but will that prove to be correct?

- Will the pause be followed by a rate cut (as the market expects) or by a resumption of hikes? If core inflation slows down but settles around 3.5%, the Fed will have to hike again to get to a 2 handle.. unless a deep recession emerges, in which case they will likely blink and choose growth / jobs over inflation.

- Larry Summers recently outlined 2 plausible scenarios for the longer term Fed Funds rate:

- We return to long-term stagnation with low inflation, driven mainly by demographics, which requires a long term neutral real rate around 0.5% (2.5% Fed funds)

- Deglobalization / onshoring leads to persistent inflationary pressures driven by wage growth + supply chain inefficiencies, requiring a higher long term real neutral rate around 1.5% (4% Fed funds)

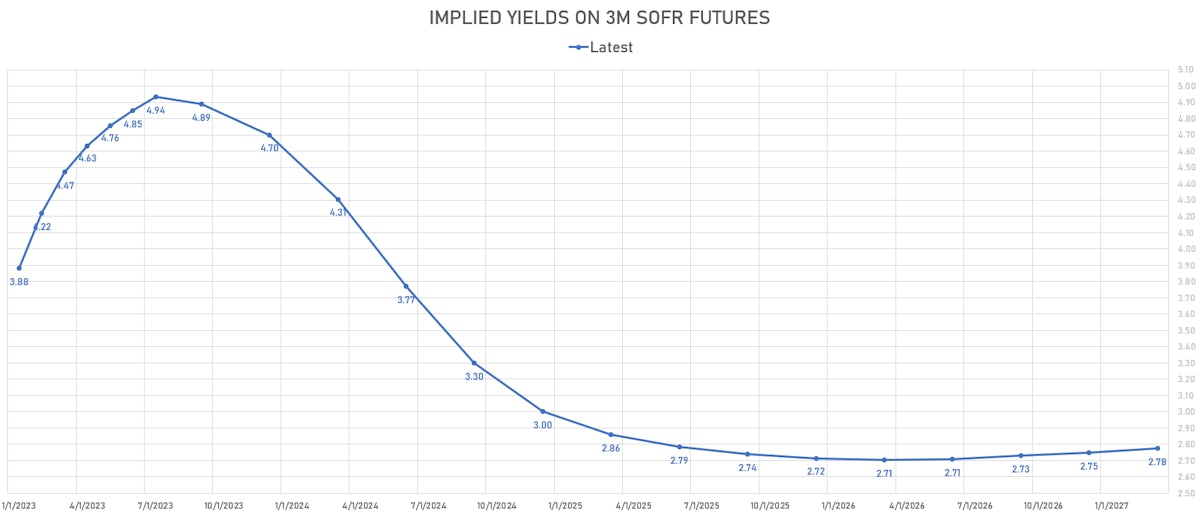

- Forward Fed Funds rates are currently around 2.80% from late 2025 onward, implying a probability of 80% on the first scenario. But Summers doesn't believe that, and sees a need for the unemployment rate to reach or 6-7% to counter the stickiness of wage growth.

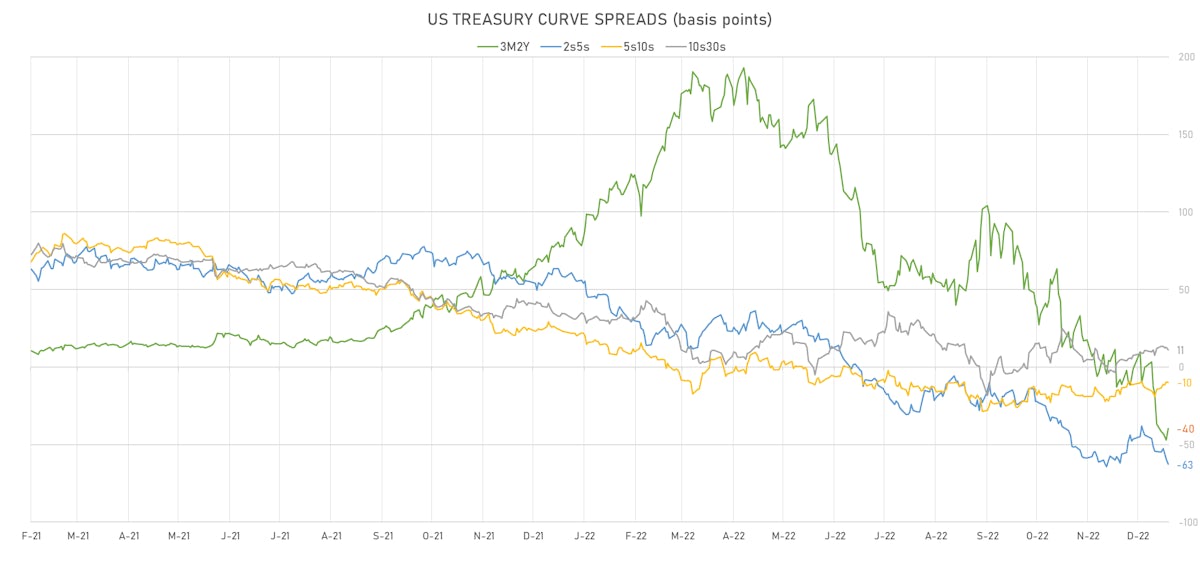

- If you think the base case is a soft landing / no recession, then the current market pricing (peak rate < 5% followed by >200bp in cuts) doesn't entirely make sense: the inversion of the US curve is overdone, especially the two cuts already priced in for 2H 2023

- With all this uncertainty, the market will have to wait for things to play out over the course of 1H23: as data slowly rolls in, these issues will become more settled.

WEEKLY US RATES SUMMARY

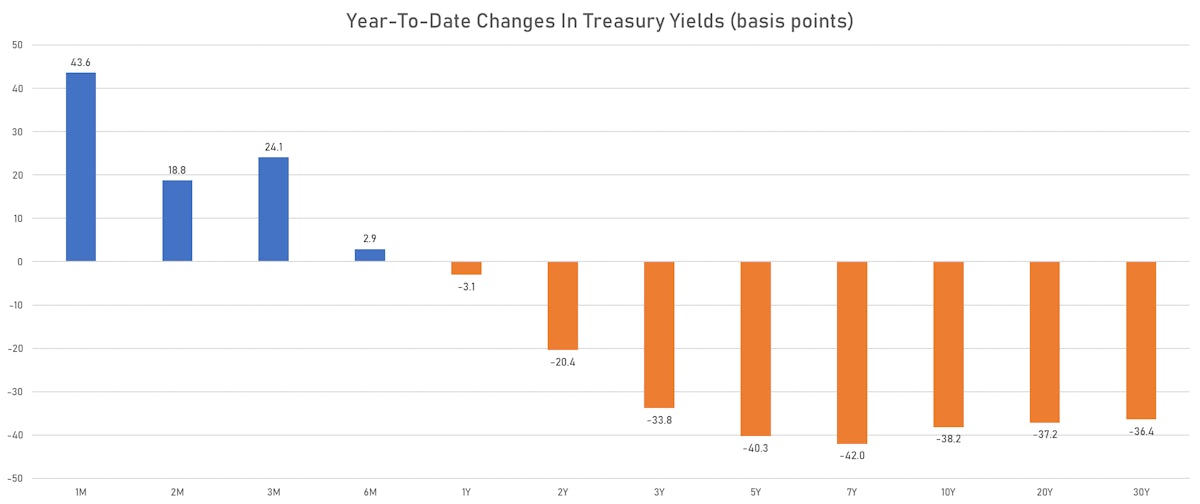

- The treasury yield curve flattened, with the 1s10s spread tightening -4.5 bp, now at -118.4 bp (YTD change: -35.1bp)

- 1Y: 4.6806% (down 1.7 bp)

- 2Y: 4.2216% (down 3.4 bp)

- 5Y: 3.5961% (down 10.7 bp)

- 7Y: 3.5464% (down 8.9 bp)

- 10Y: 3.4962% (down 6.2 bp)

- 30Y: 3.6086% (down 7.4 bp)

- US treasury curve spreads: 3m2Y at -38.5bp (down -1.2bp this week), 2s5s at -62.6bp (down -6.5bp), 5s10s at -10.0bp (up 3.4bp), 10s30s at 11.2bp (down -2.3bp)

- TIPS 1Y breakeven inflation at 2.07% (up 38.4bp); 2Y at 2.13% (up 1.3bp); 5Y at 2.24% (up 1.5bp); 10Y at 2.18% (down -2.3bp); 30Y at 2.21% (down -6.3bp)

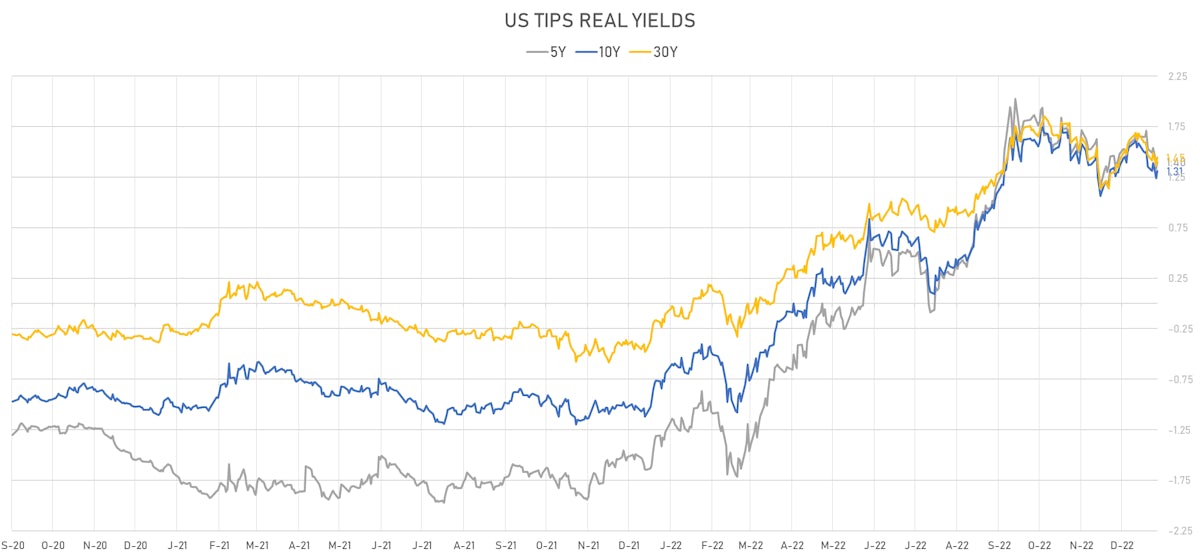

- US 5-Year TIPS Real Yield: -12.7 bp at 1.4010%; 10-Year TIPS Real Yield: -4.3 bp at 1.3090%; 30-Year TIPS Real Yield: -1.9 bp at 1.4450%

US ECONOMIC DATA RELEASED OVER THE PAST WEEK

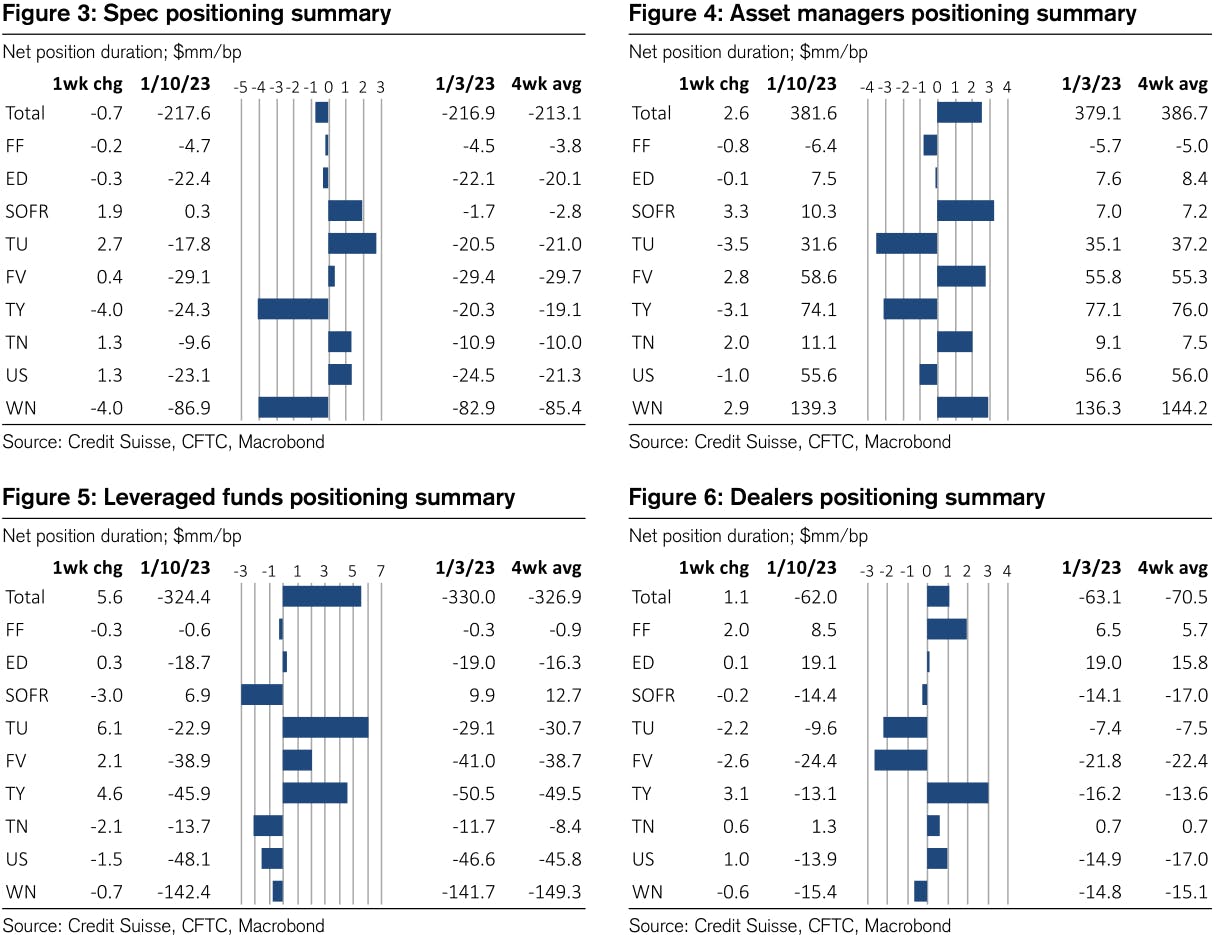

CFTC NET RATES POSITIONING DATA

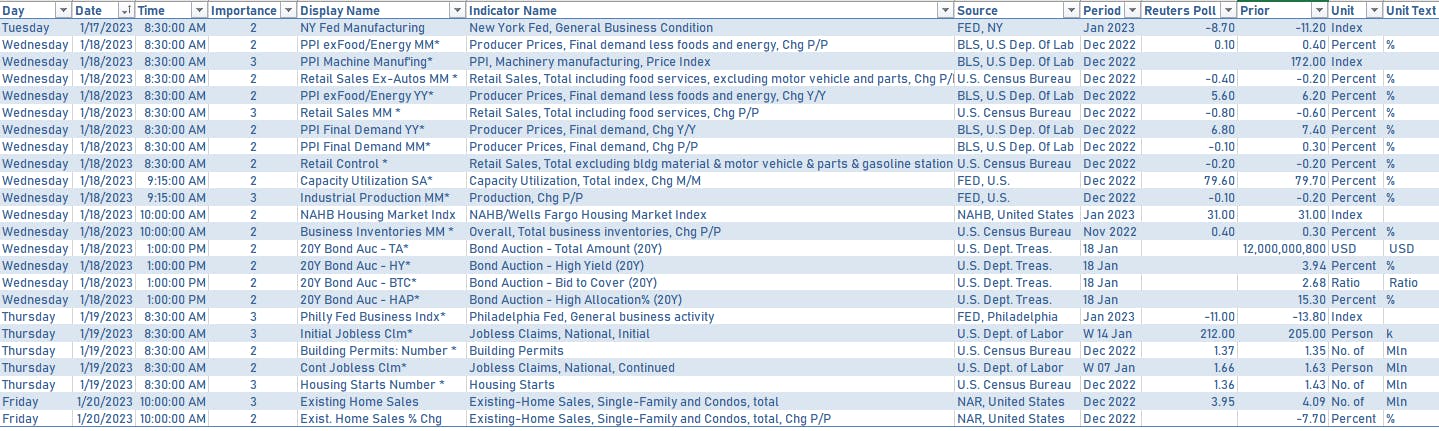

US ECONOMIC DATA TO BE RELEASED NEXT WEEK

FED SPEAKERS THIS WEEK

- Tuesday 3:00PM: New York Fed President Williams

- Wednesday 9:00AM: Atlanta Fed President Bostic

- Wednesday 2:00PM: Philadelphia Fed President Harker

- Wednesday 5:00Pm: Dallas Fed President Logan

- Thursday 9:00AM: Boston Fed President Collins

- Thursday 1:15PM: Fed Vice Chair Brainard

- Thursday 6:35PM: New York Fed President Williams

- Friday 9:00AM: Philadelphia Fed President Harker

- Friday 1:00PM: Fed Governor Waller

US TREASURY COUPON-BEARING AUCTIONS

- Wednesday 1PM: $12bn in reopened 20Y bonds

- Thursday 1PM: $17bn in reopened 10Y TIPS

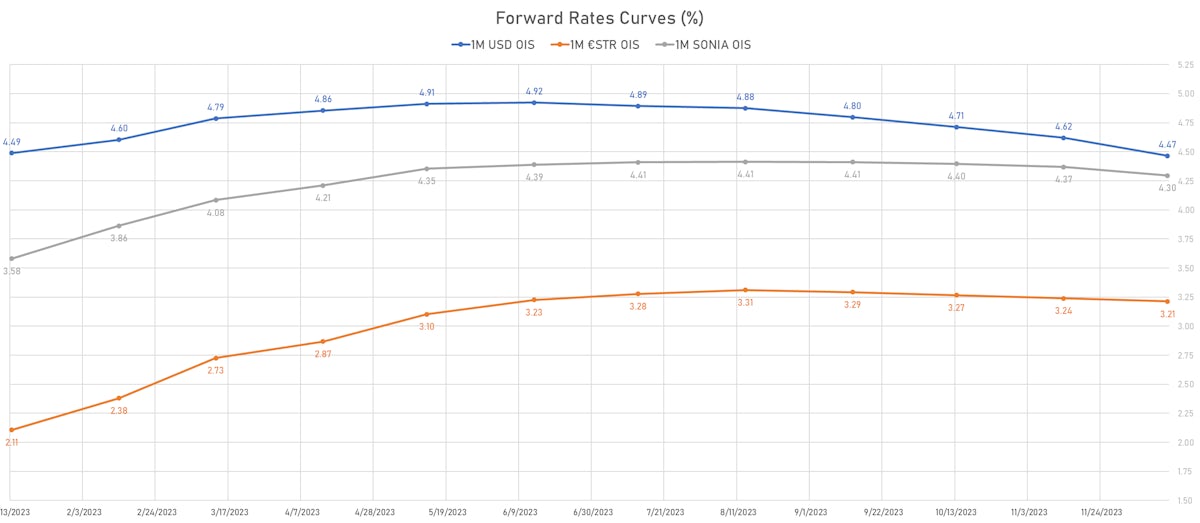

US FORWARD RATES

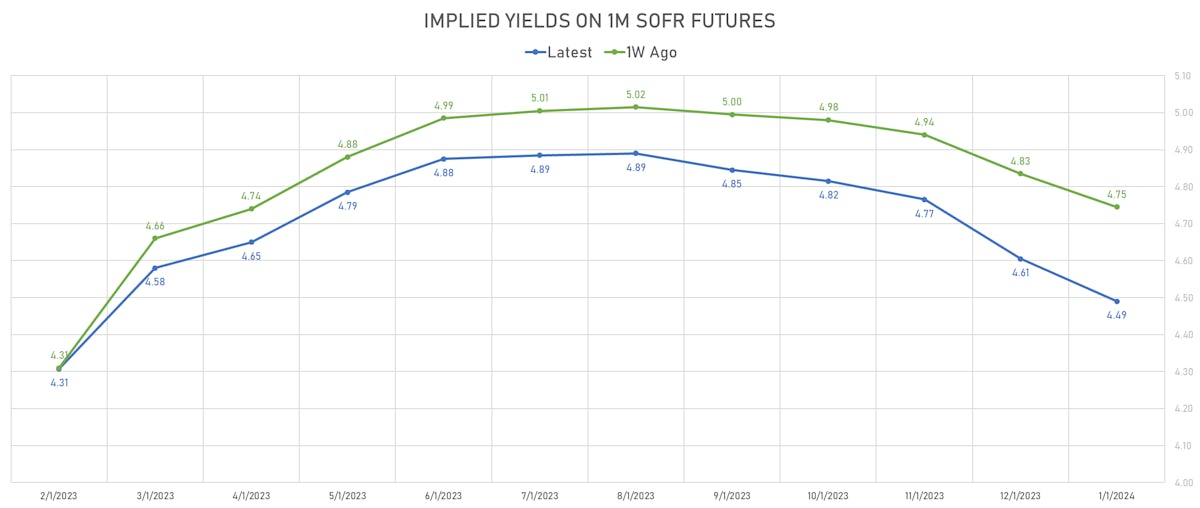

- Fed Funds futures now price in 27.1bp of Fed hikes by the end of February 2023, 47.1bp (1.9 x 25bp hikes) by the end of March 2023, and 2.3 hikes by the end of May 2023

- Implied yields on 3-month SOFR futures top out at 4.95% for the July 2023 expiry and price in 217bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.07% (up 7.7bp); 2Y at 2.13% (up 0.8bp); 5Y at 2.24% (down -0.5bp); 10Y at 2.18% (down -2.0bp); 30Y at 2.21% (down -5.1bp)

- 6-month spot US CPI swap down -20.0 bp to 1.915%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.4010%, +6.9 bp today; 10Y at 1.3090%, +7.1 bp today; 30Y at 1.4450%, +8.2 bp today

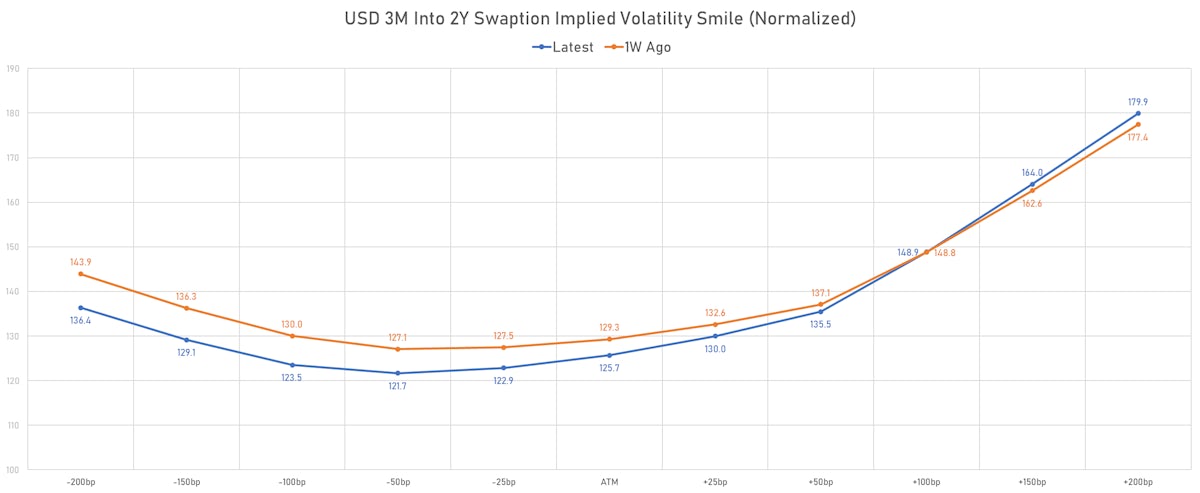

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.3 vols at 96.4 normals

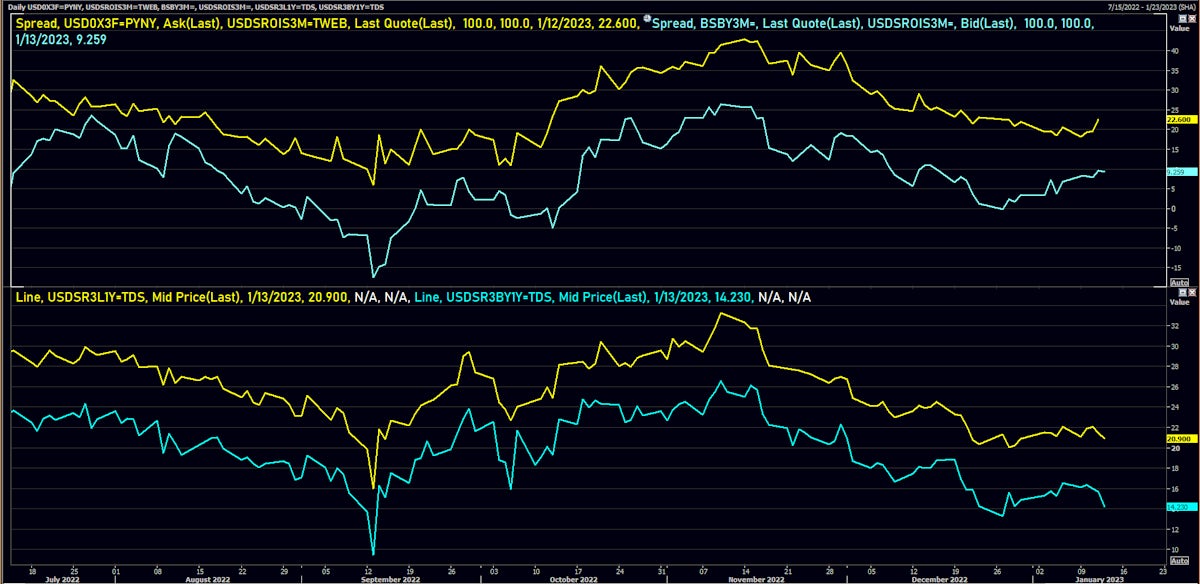

- 3-Month LIBOR-OIS spread down -4.6 bp at 15.1 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.210% (down -0.2 bp); the German 1Y-10Y curve is 0.1 bp steeper at -50.0bp (YTD change: +1.8 bp)

- Japan 5Y: 0.281% (unchanged 0.0 bp); the Japanese 1Y-10Y curve is 0.4 bp steeper at 50.5bp (YTD change: -40.6 bp)

- China 5Y: 2.708% (up 2.3 bp); the Chinese 1Y-10Y curve is 1.6 bp steeper at 79.8bp (YTD change: -72.8 bp)

- Switzerland 5Y: 0.976% (down -1.0 bp); the Swiss 1Y-10Y curve is 0.3 bp flatter at -33.5bp (YTD change: -6.6 bp)

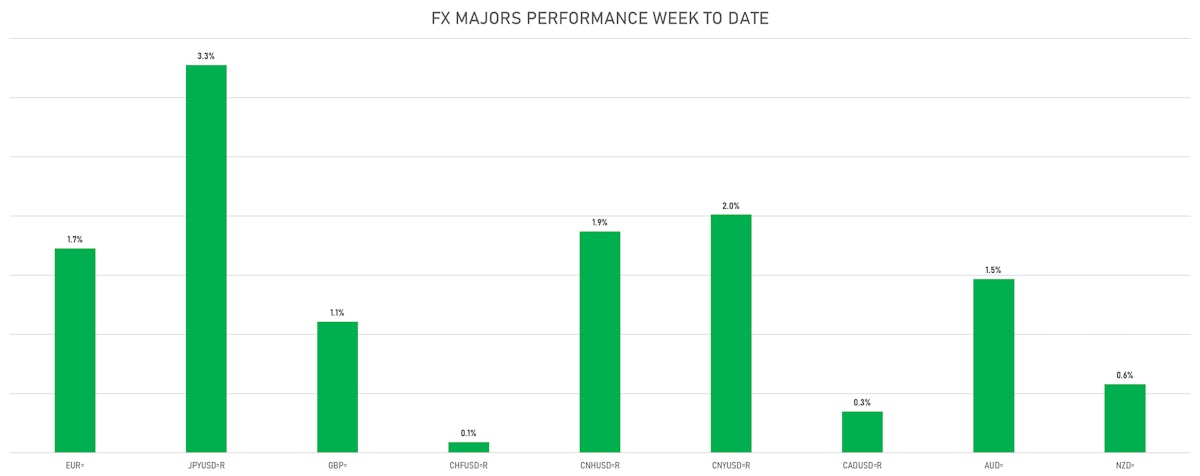

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.5 bp at 162.5 bp (Weekly change: -9.4 bp; YTD change: -11.1 bp)

- US-JAPAN: +7.6 bp at 418.6 bp (YTD change: -20.7 bp)

- US-CHINA: +7.8 bp at 191.9 bp (Weekly change: -6.2 bp; YTD change: -26.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +2.0 bp at 124.3 bp (Weekly change: -3.3bp; YTD change: -4.5bp)

- US-JAPAN: -1.9 bp at 138.0 bp (Weekly change: -40.2bp; YTD change: -65.9bp)

- GERMANY-JAPAN: -3.9 bp at 13.7 bp (Weekly change: -29.6bp; YTD change: -61.4bp)