Rates

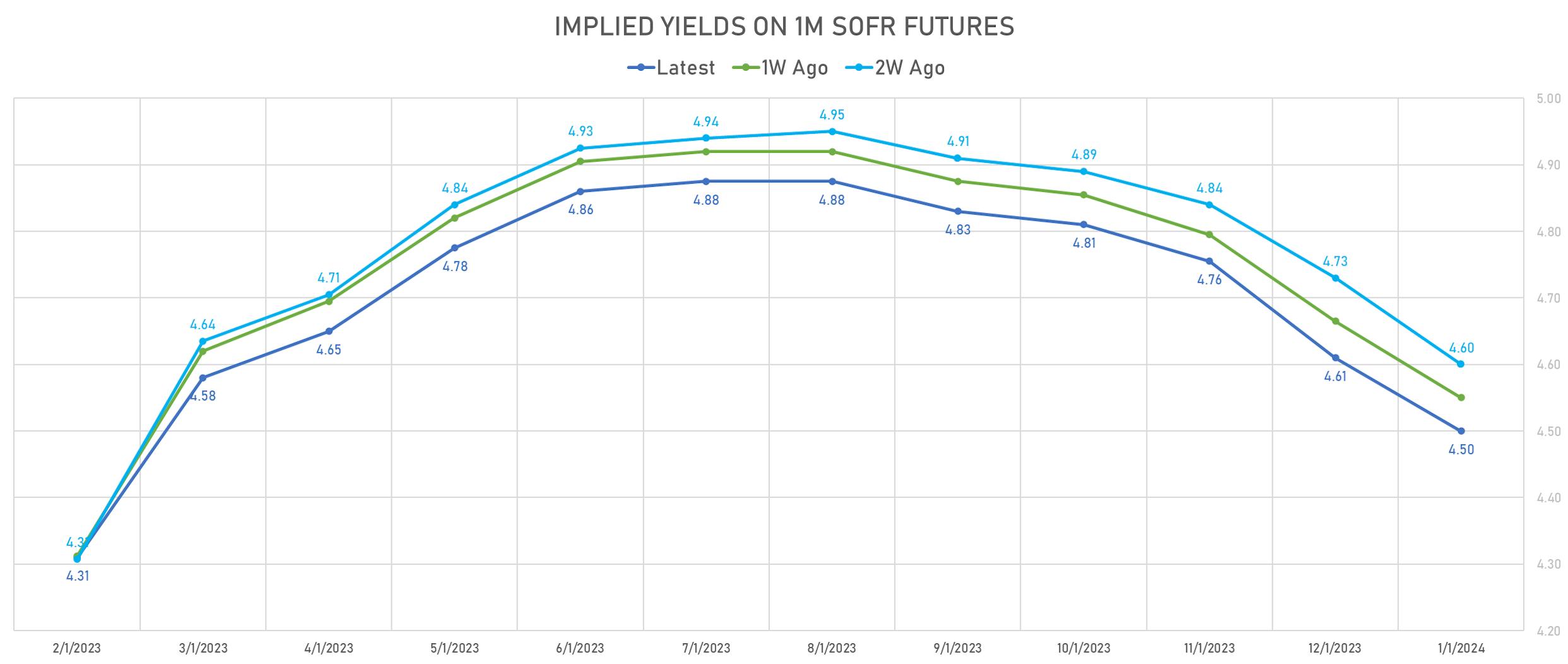

Weak US Economic Data, Fear Of Recession Mean Fewer Rate Hikes Priced Into US Short-Term Rates

Despite the negative recent incoming data, US consumers should see a rise in real income of about 3.5% this year, helped by substantial wage growth, which will push the "stronger for longer" economic theme for a good part of the year

Published ET

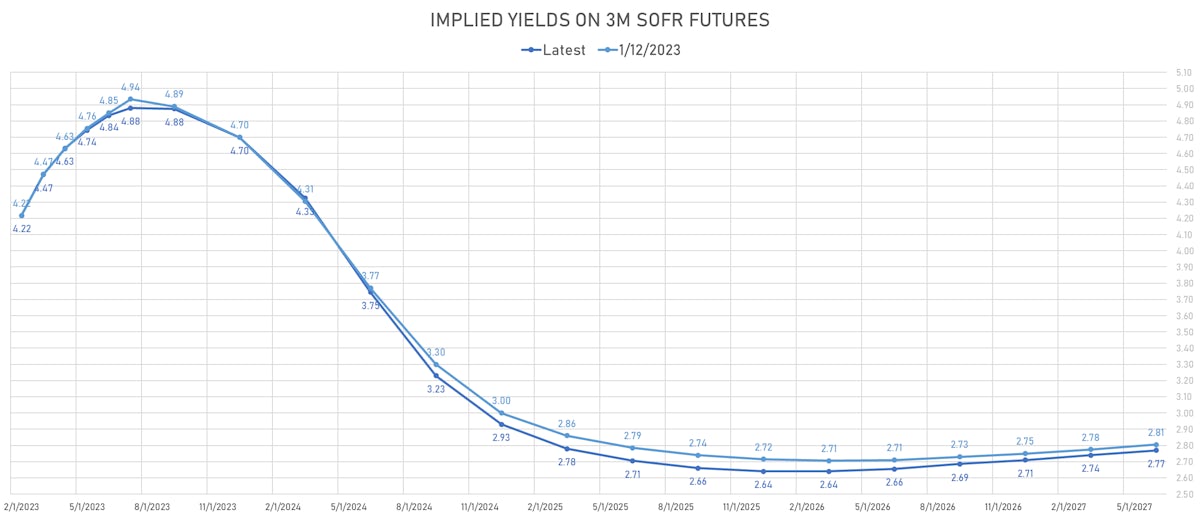

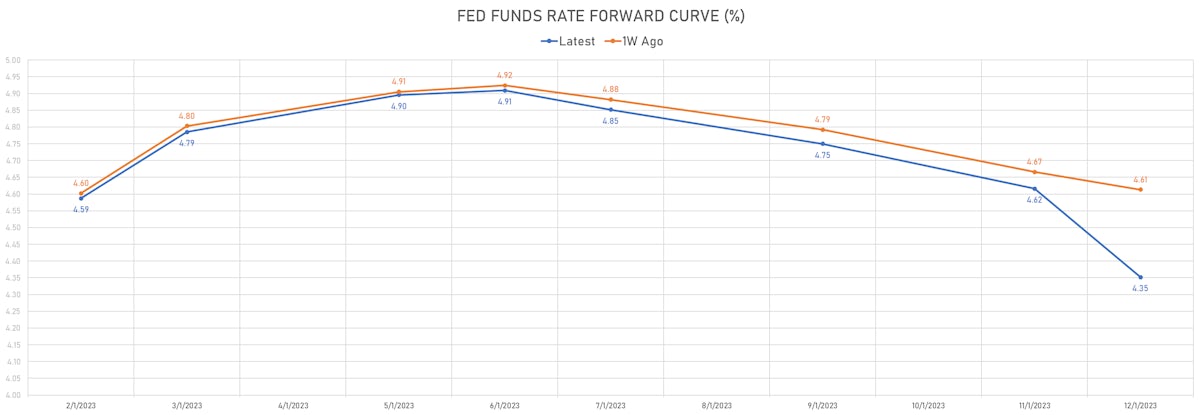

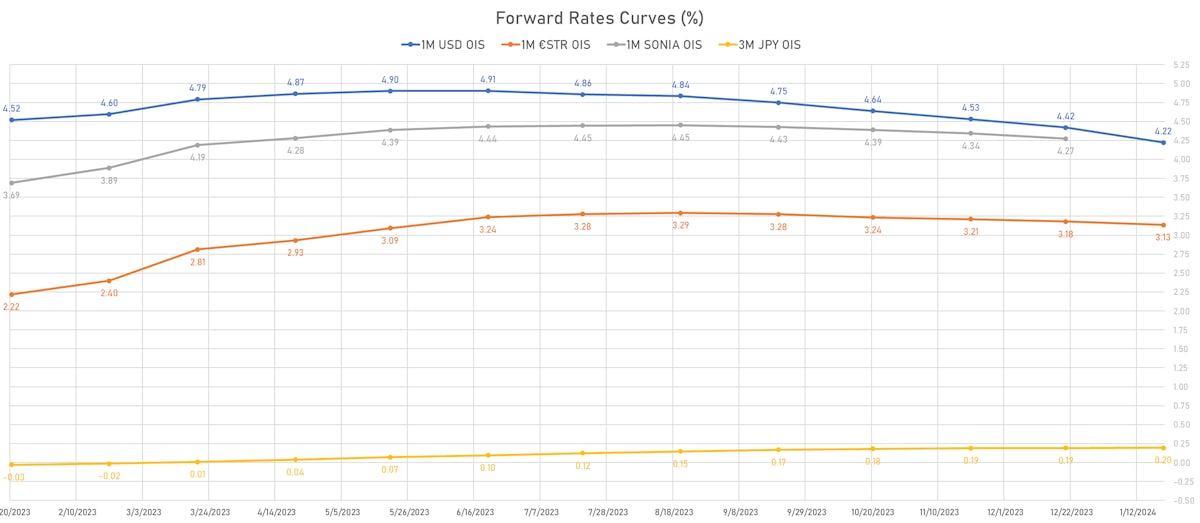

Forward Rates Curves | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- Money markets price in a 98% probability of a 25bp rate hike on Feb. 1 and a peak Fed Funds rate of 4.92%, about 20bp below the Fed's dot plot (5 and 1/8)

- In addition, USD forward rates curves price in nearly 2 rate cuts by the end of 2023

- Our core views are unchanged: the US growth will be more resilient than expected in 1H22, the market is underpricing the peak Fed Funds rate and too many rate cuts are priced at the back end of 2023

- US economic data has been mostly weaker lately, but the Atlanta Fed's GDP Now indicator for 4Q22 is at 3.5% and payrolls are very firm, indicating a possible rebound in consumer spending

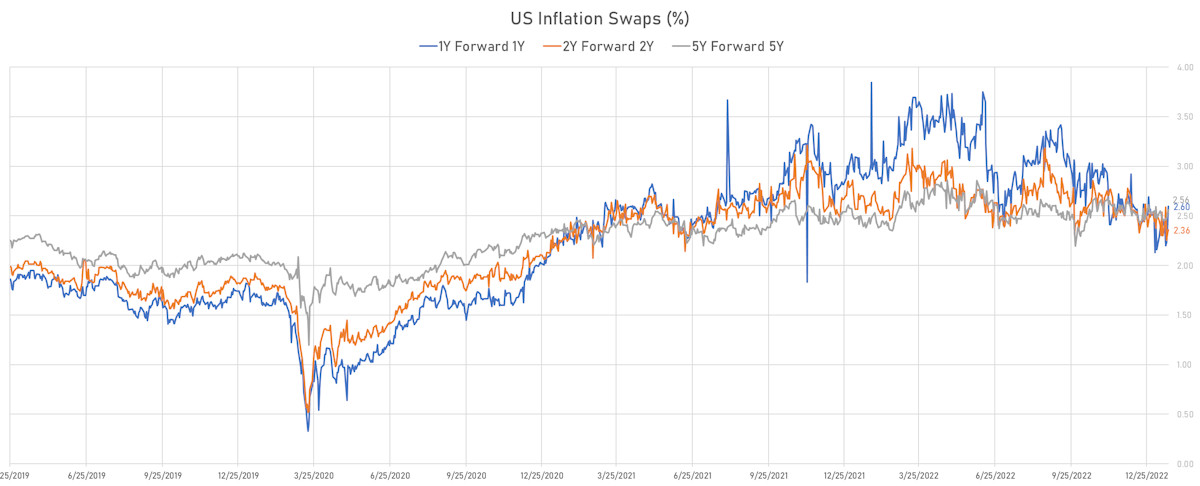

- With core inflation far above the Fed's target, inflation pricing looks light and the rally in duration overdone (US 10Y Treasury notes are now yielding less than 3.5%)

Market pricing of 1Y US Inflation | Source: Refinitiv

- Goldman Sachs: "rates markets appear to be overweighting the US data and discounting what has been better growth news out of Europe and China so far this year. While this tension may remain in the near-term, the resolution of a fading drag from tightening onto US growth and relatively smooth labor market rebalancing should be towards higher yields later this year. (..) The market-implied inflation path implies much more significant softening than our economists expect to see from inflation over the next year. While the recent narrative has been clearly towards a lowering of inflation risks, a lot is already priced, leaving the market vulnerable to upside surprises after the recent stretch of relief."

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened slightly, with the 1s10s spread widening 2.6 bp, now at -119.5 bp (YTD change: -36.1bp)

- 1Y: 4.6753% (up 1.2 bp)

- 2Y: 4.1756% (up 3.3 bp)

- 5Y: 3.5640% (up 2.7 bp)

- 7Y: 3.5197% (up 3.1 bp)

- 10Y: 3.4806% (up 3.8 bp)

- 30Y: 3.6481% (up 7.5 bp)

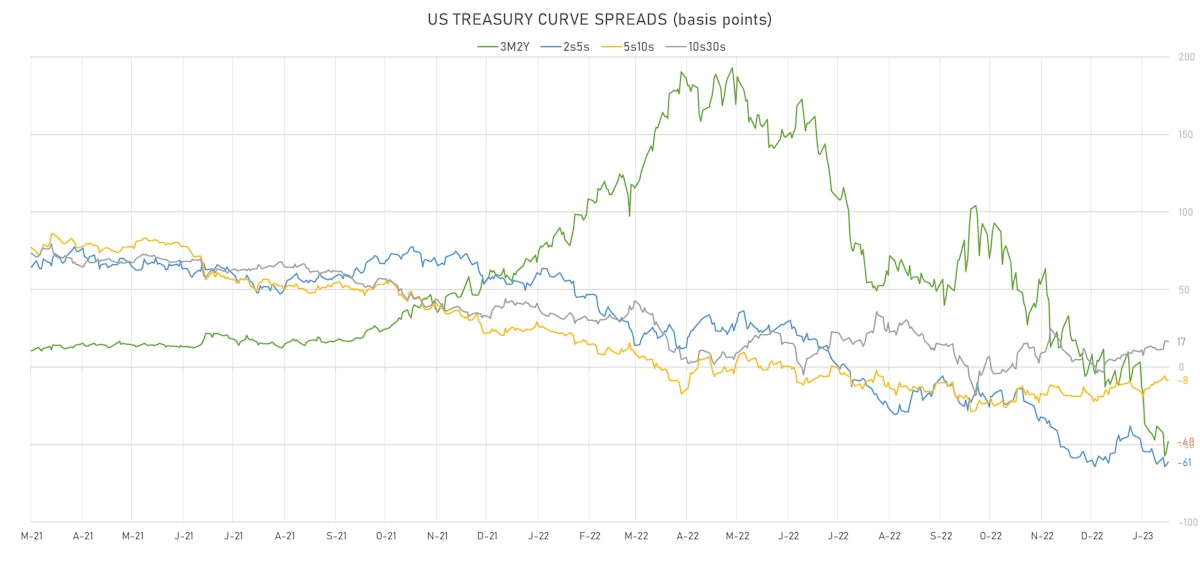

- US treasury curve spreads: 3m2Y at -48.7bp (down -2.6bp this week), 2s5s at -61.2bp (unchanged), 5s10s at -8.4bp (up 0.9bp), 10s30s at 16.8bp (up 4.1bp)

- TIPS 1Y breakeven inflation at 2.03% (down -4.6bp); 2Y at 2.06% (down -7.0bp); 5Y at 2.19% (down -5.9bp); 10Y at 2.24% (up 5.9bp); 30Y at 2.26% (up 5.2bp)

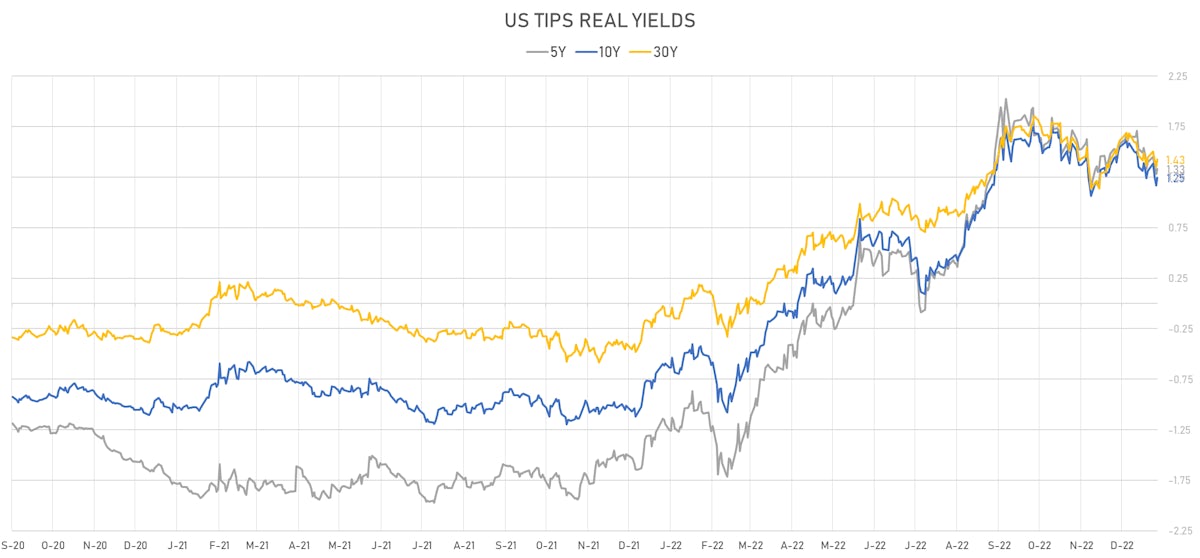

- US 5-Year TIPS Real Yield: -0.1 bp at 1.3310%; 10-Year TIPS Real Yield: +0.7 bp at 1.2450%; 30-Year TIPS Real Yield: +6.3 bp at 1.4260%

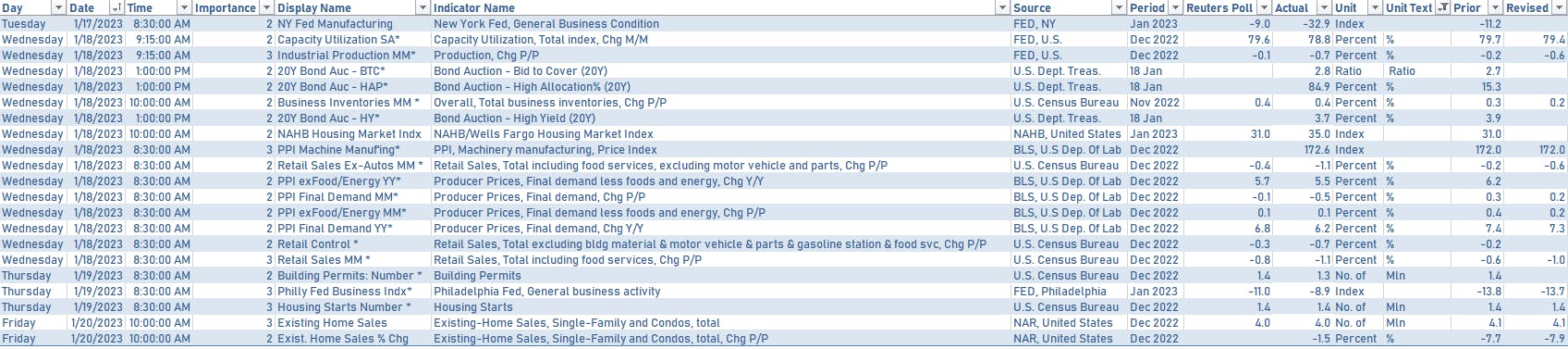

US ECONOMIC DATA OVER THE PAST WEEK

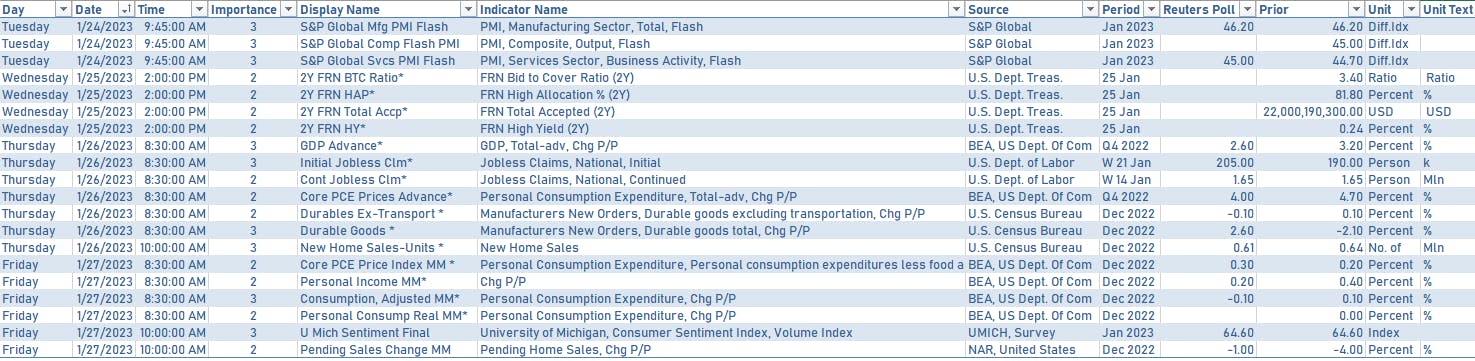

US MACRO RELEASES IN THE WEEK AHEAD

- The focus this week will be on 4Q22 GDP, December PCE, durable goods orders,

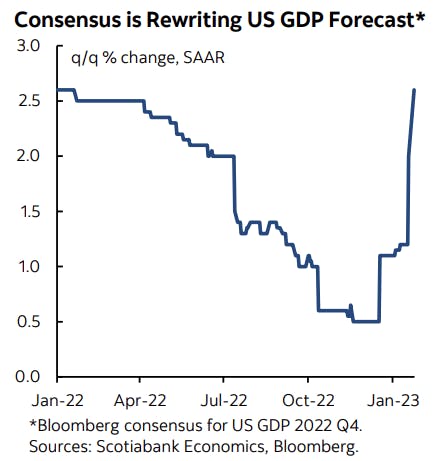

and new home sales - Sell-side economist have fairly disparate GDP growth estimates for 4Q22, but much more optimistic than a month ago: CS at 1.7%, GS at 2.2%, Jefferies at 2.4%, Wells Fargo at 2.8%, Morgan Stanley and Wrightson ICAP at 3.0%, while the Atlanta Fed's latest GDP Now sees 3.5%

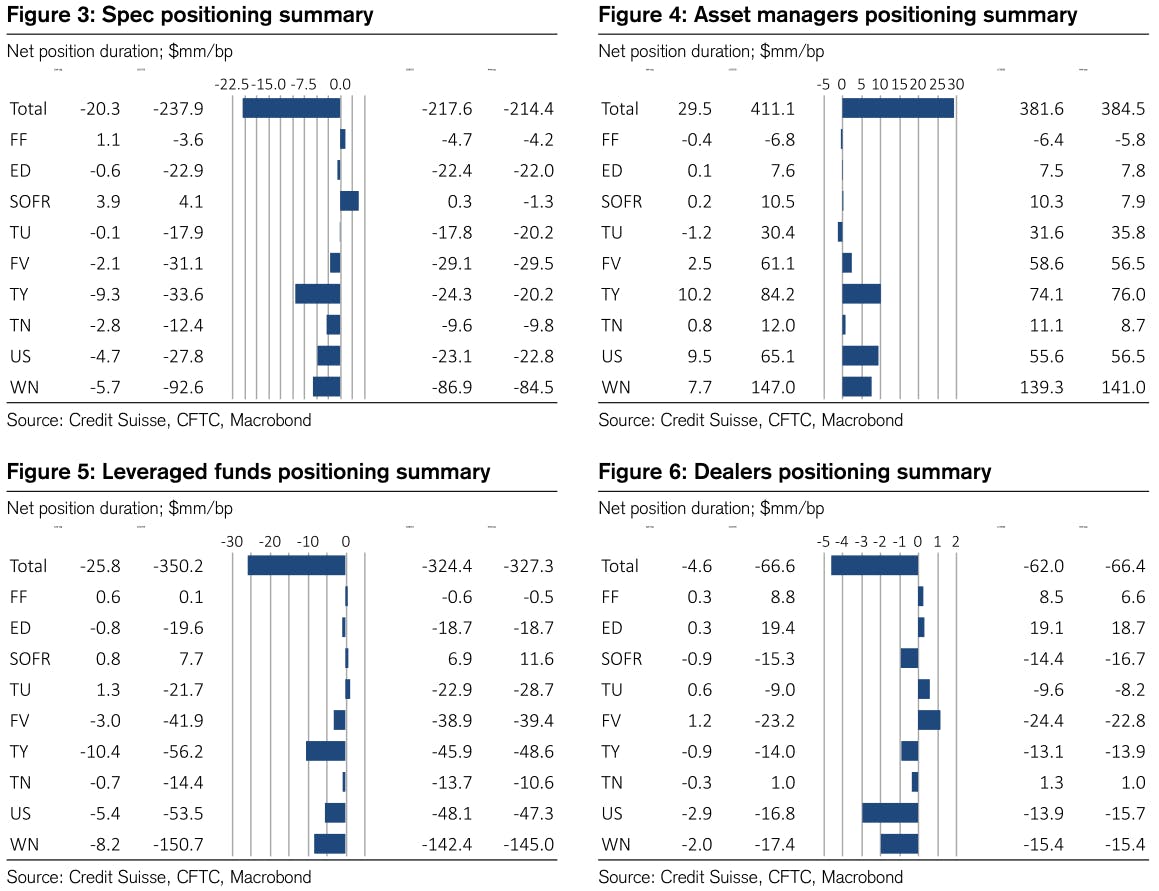

WEEKLY CFTC NET POSITIONING UPDATE

US TREASURY COUPON-BEARING AUCTIONS THIS WEEK

- Tuesday: $42 bn in 2Y notes at 1:00PM

- Wednesday: $24 bn in 2Y FRNs at 11:30AM and $43 bn in 5Y notes at 1:00PM

- Thursday: $35 bn in 7Y notes at 1:00PM

FED SPEAKERS

- There will be no Fed speeches this week, as we're in the blackout period ahead of the January 31-February 1 FOMC meeting

US FORWARD RATES

- Fed Funds futures now price in 25.5bp of Fed hikes by the end of February 2023, 45.4bp (1.8 x 25bp hikes) by the end of March 2023, and 2.3 hikes by the end of May 2023

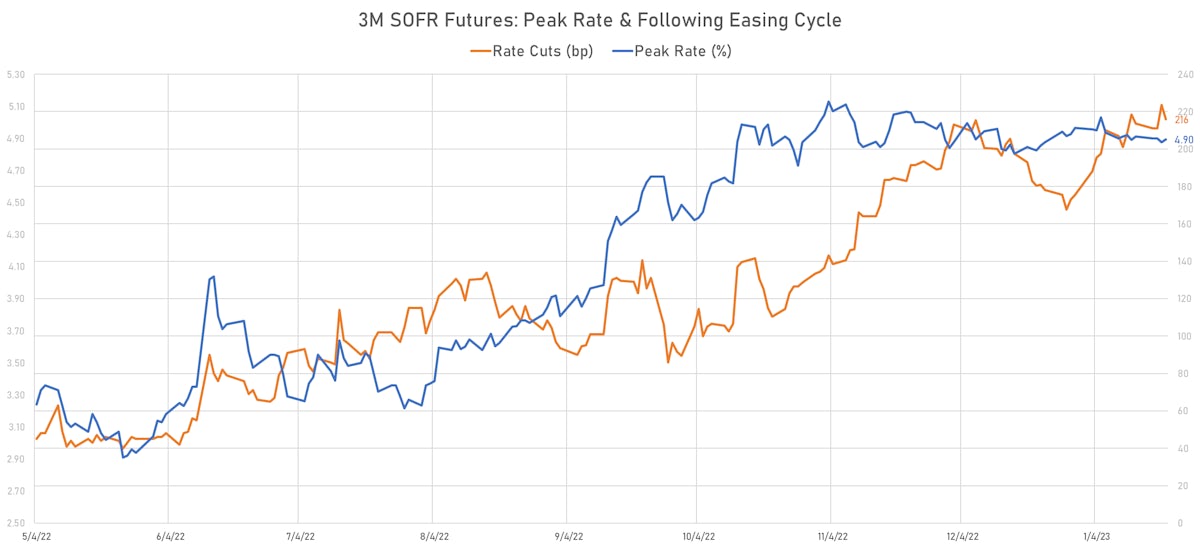

- Implied yields on 3-month SOFR futures top out at 4.89% for the July 2023 expiry and price in 214bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.03% (up 14.5bp); 2Y at 2.06% (up 0.4bp); 5Y at 2.19% (down -7.2bp); 10Y at 2.24% (up 1.4bp); 30Y at 2.26% (up 0.9bp)

- 6-month spot US CPI swap up 7.5 bp to 1.844%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.3310%, +5.2 bp today; 10Y at 1.2450%, +8.0 bp today; 30Y at 1.4260%, +7.2 bp today

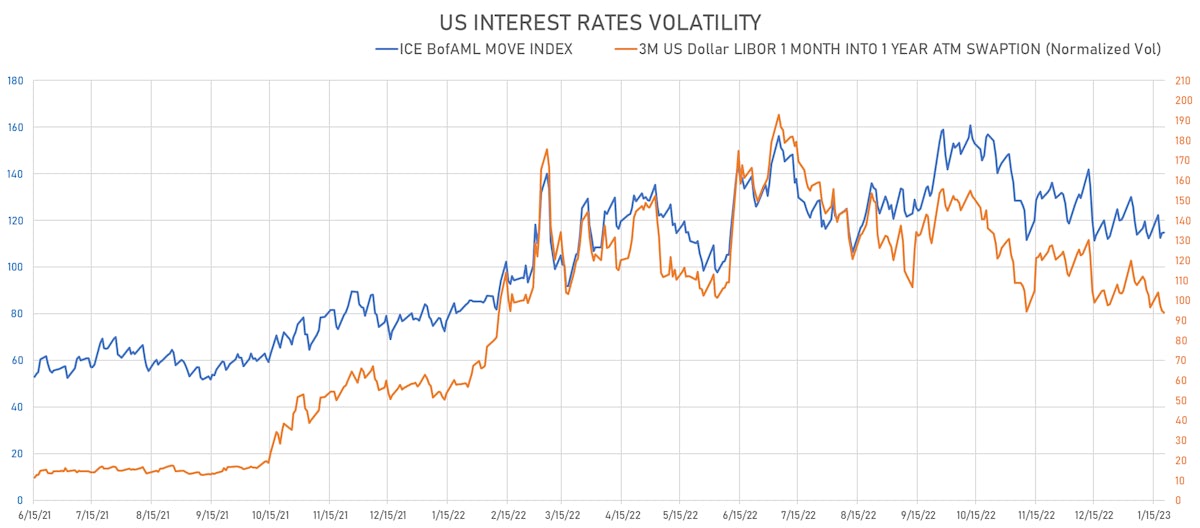

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -1.1 vols at 93.8 normals

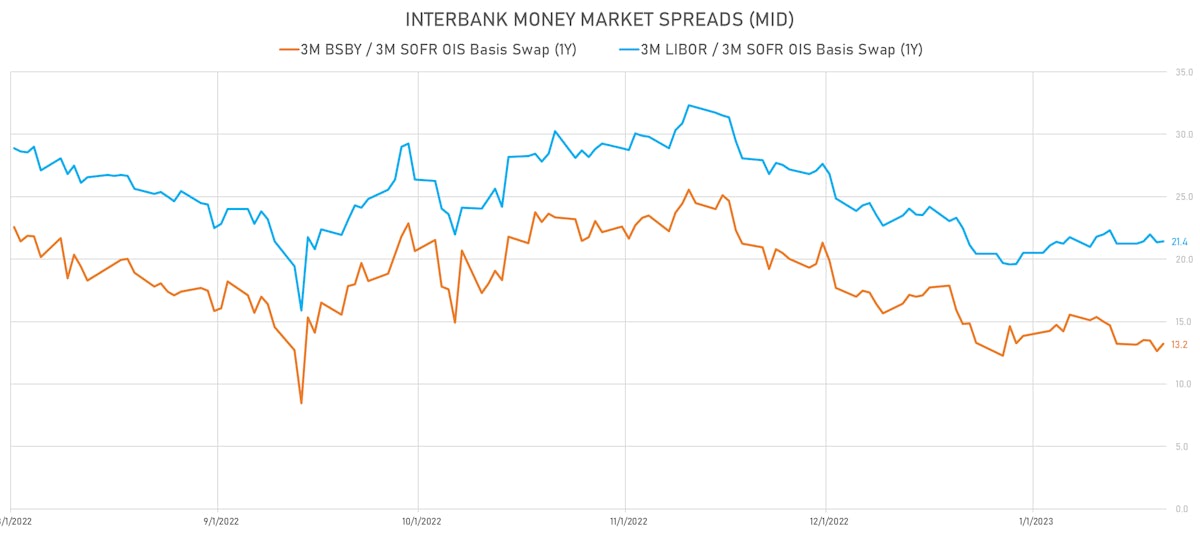

- 3-Month LIBOR-OIS spread up 0.1 bp at 15.6 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.208% (up 9.6 bp); the German 1Y-10Y curve is 6.5 bp steeper at -57.0bp (YTD change: +1.7 bp)

- Japan 5Y: 0.196% (down -2.2 bp); the Japanese 1Y-10Y curve is 1.2 bp flatter at 40.4bp (YTD change: -40.7 bp)

- China 5Y: 2.795% (up 6.7 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 79.5bp (YTD change: -72.8 bp)

- Switzerland 5Y: 1.072% (up 8.2 bp); the Swiss 1Y-10Y curve is 12.4 bp steeper at -19.7bp (YTD change: -6.5 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

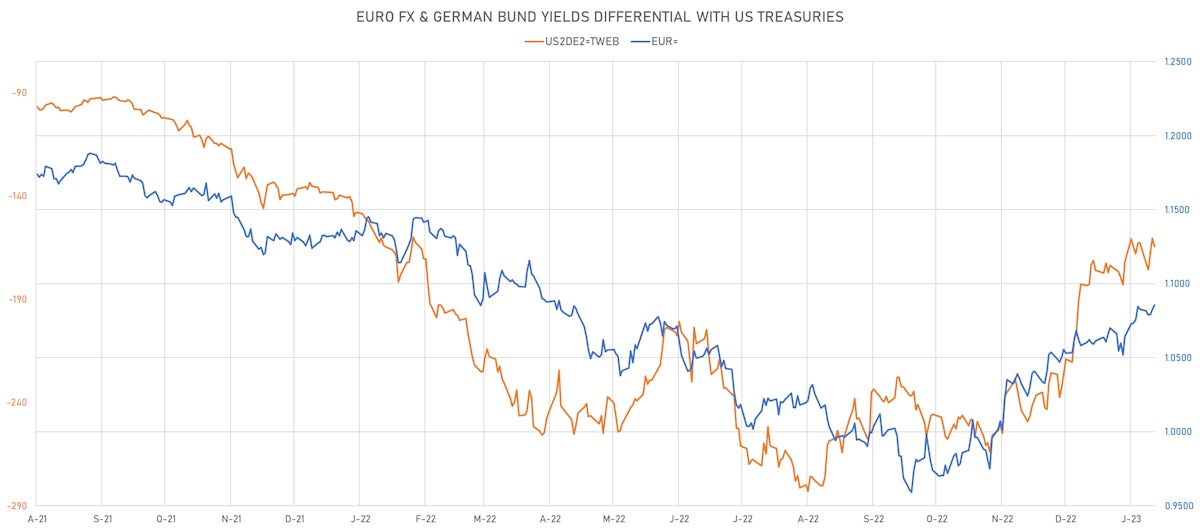

- US-GERMANY: +4.0 bp at 164.5 bp (Weekly change: +1.5 bp; YTD change: -9.1 bp)

- US-JAPAN: +4.5 bp at 421.7 bp (YTD change: -17.6 bp)

- US-CHINA: +10.1 bp at 191.2 bp (Weekly change: -0.7 bp; YTD change: -27.1 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +2.9 bp at 112.5 bp (Weekly change: -9.8bp; YTD change: -16.3bp)

- US-JAPAN: +12.2 bp at 149.6 bp (Weekly change: +9.7bp; YTD change: -54.3bp)

- GERMANY-JAPAN: +9.3 bp at 37.1 bp (Weekly change: +23.4bp; YTD change: -38.0bp)