Rates

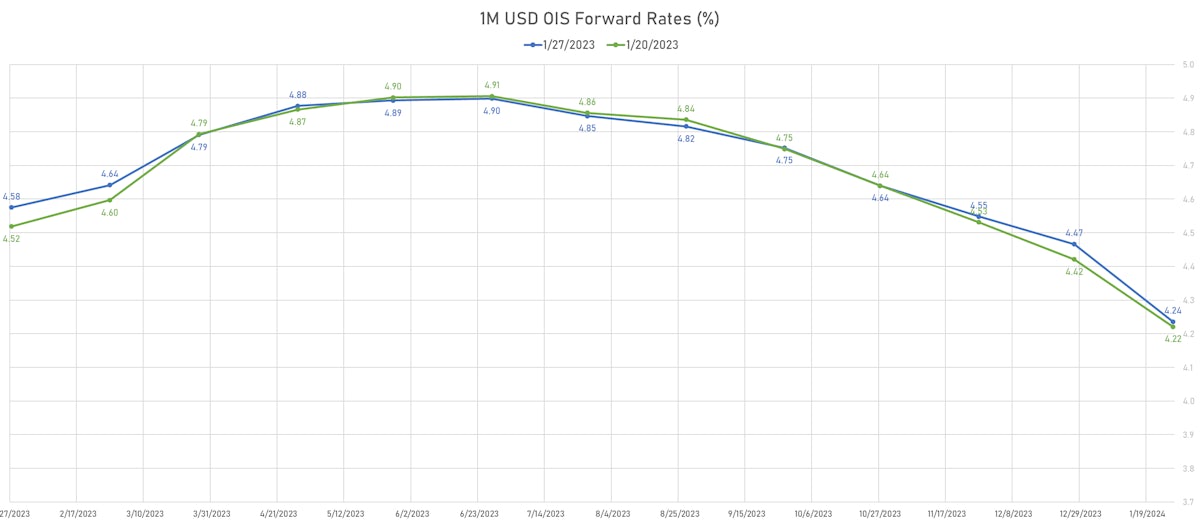

Very Little Change In US Fed Funds Forward Rates This Week, With No Surprise Expected From The FOMC

Having said that, the event risk is tilted towards a more hawkish Fed, as disinflationary data over the last 3 months has led to a dovish repricing of the forward curve, which Powell has a good opportunity to lean against

Published ET

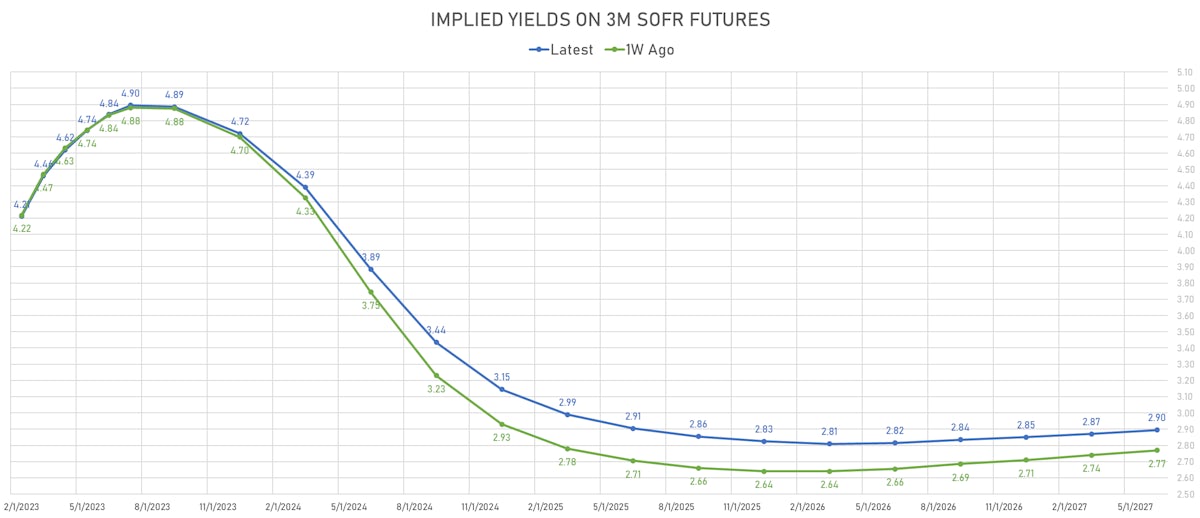

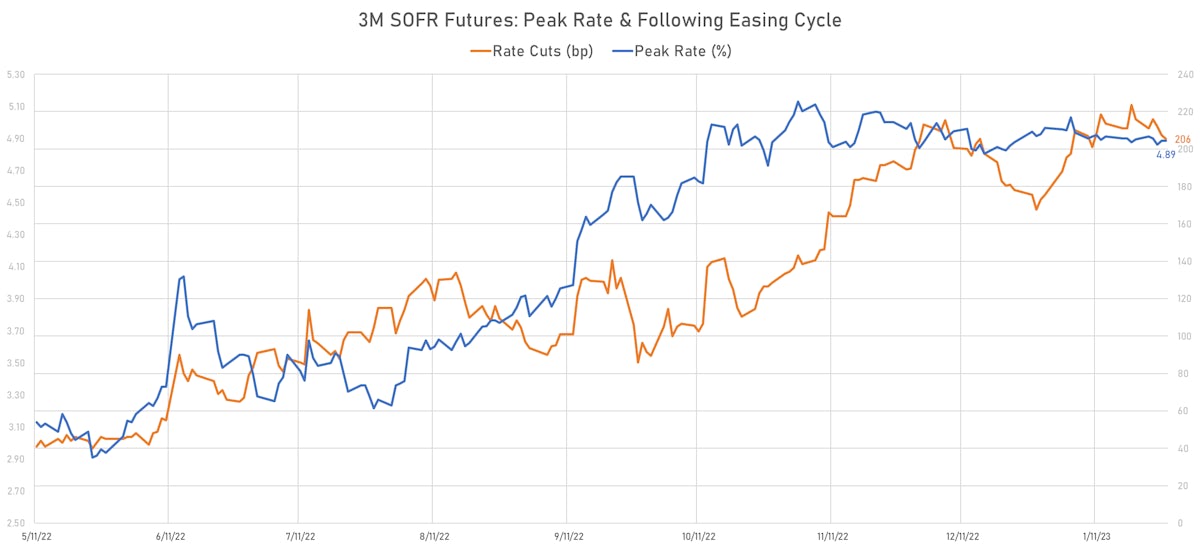

Peak Rate And Following Rate Cuts Implied From 3M USD SOFR Futures | Sources: phipost.com, Refinitiv data

1 FEB 2023 FOMC PREVIEW

- No doubt about the outcome of this one, as voting members haven't expressed any recent reservation about slowing down the pace further to 25bp per meeting

- It's in line with the good news on wages and price pressures we've seen over the last couple of months

- After this 25bp hike, there is more uncertainty: the Bank of Canada signaled a pause this week, meaning that the mike drop is not too far for the Fed either (probably in May after 2 more 25bp hikes)

- Despite recession fears coming through sentiment surveys, US hard data has been pretty solid: GDP growth is below potential but remains positive, which should lead the Fed to keep hikes on for the moment. We don't expect them to indicate any possible change in the peak rate or timing of the future pause

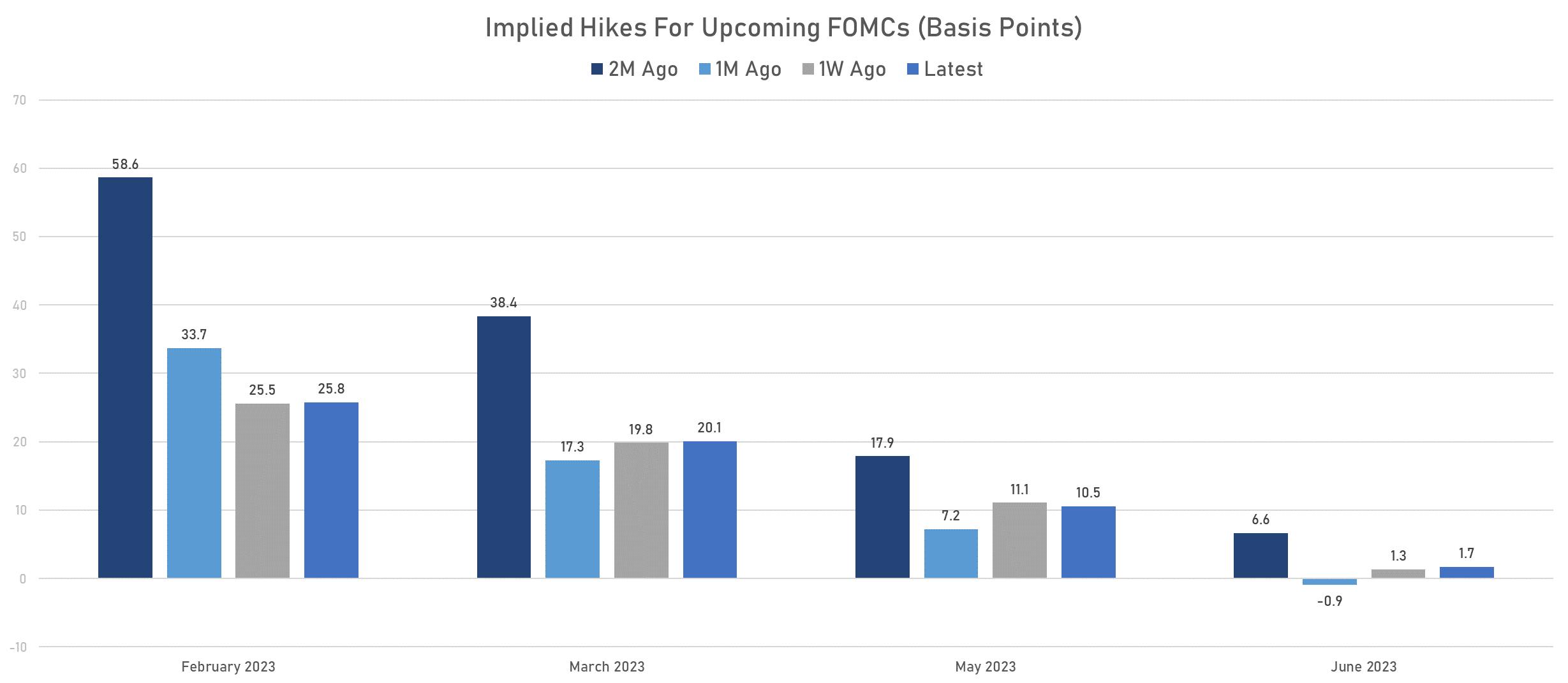

- Money markets are pricing just over 30bp of additional hikes after this one, with a peak rate well short of the Fed's 5 1/8 dot plot

- With financial conditions loosening 60bp since the start of the year, and nearly 2 rate cuts priced into the end of 2023, event risk is to the hawkish side: Powell could easily lean into market pricing by reiterating that a slower pace doesn't mean a lower peak and/or a shorter pause

- Credit Suisse economists: "The FOMC is likely considering an earlier pause to the hiking cycle, especially if inflation data continue to ease in the months ahead, but it will be wary of signaling anything that will encourage further easing in financial conditions. The Fed is in a difficult position as it attempts to maintain a data-dependent policy but also push back against any easing in market conditions. In our view, it will continue to err on the hawkish side as it waits for further confirmation that inflation has slowed."

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 3.5 bp, now at -115.9 bp (YTD change: -32.6bp)

- 1Y: 4.6655% (down 1.0 bp)

- 2Y: 4.2001% (up 2.4 bp)

- 5Y: 3.6111% (up 4.7 bp)

- 7Y: 3.5648% (up 4.5 bp)

- 10Y: 3.5062% (up 2.6 bp)

- 30Y: 3.6248% (down 2.3 bp)

- US treasury curve spreads: 3m2Y at -47.4bp (up 1.3bp this week), 2s5s at -58.9bp (up 2.0bp), 5s10s at -10.5bp (down -2.5bp), 10s30s at 11.9bp (down -6.1bp)

- TIPS 1Y breakeven inflation at 2.20% (up 17.7bp); 2Y at 2.21% (up 15.6bp); 5Y at 2.30% (up 11.7bp); 10Y at 2.32% (up 7.7bp); 30Y at 2.31% (up 5.1bp)

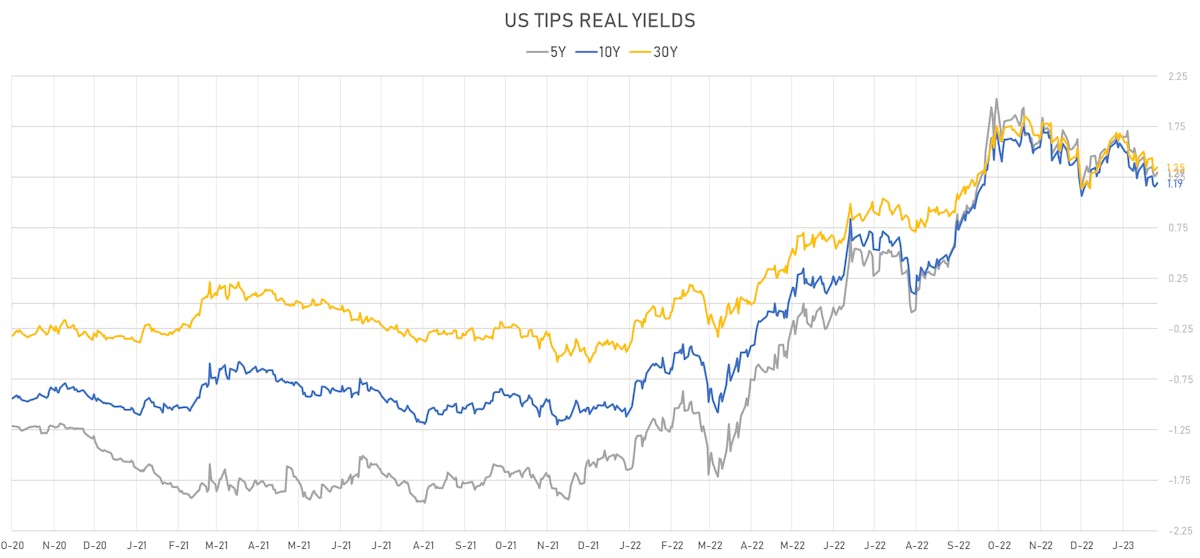

- US 5-Year TIPS Real Yield: -3.7 bp at 1.2940%; 10-Year TIPS Real Yield: -5.1 bp at 1.1940%; 30-Year TIPS Real Yield: -8.1 bp at 1.3450%

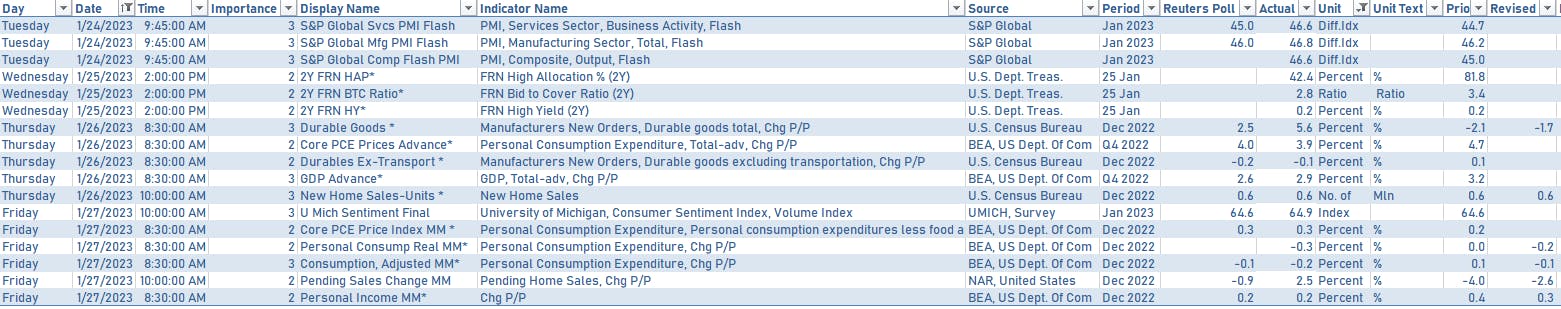

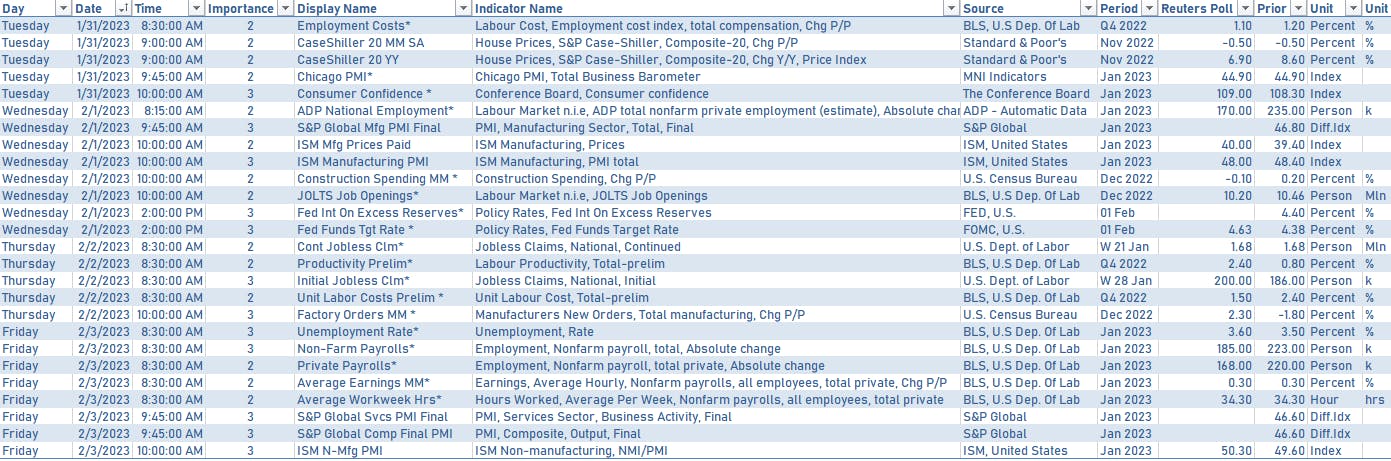

US MACRO RELEASES OVER THE PAST WEEK

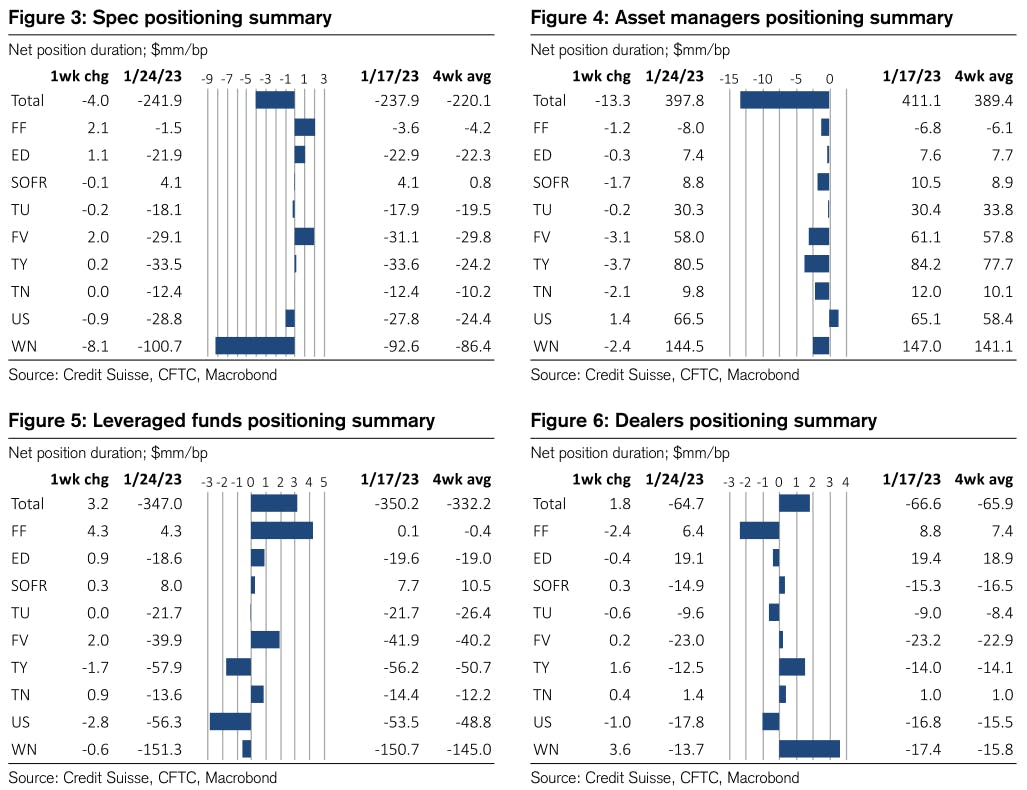

WEEKLY CFTC NET DURATION POSITIONING

US ECONOMIC DATA IN THE WEEK AHEAD

- Major economic releases this week, with a focus (beside the FOMC meeting) on the Employment Cost Index for 4Q22, ISM Manufacturing, JOLTS, Unit Labor Costs, the employment report and ISM Services data

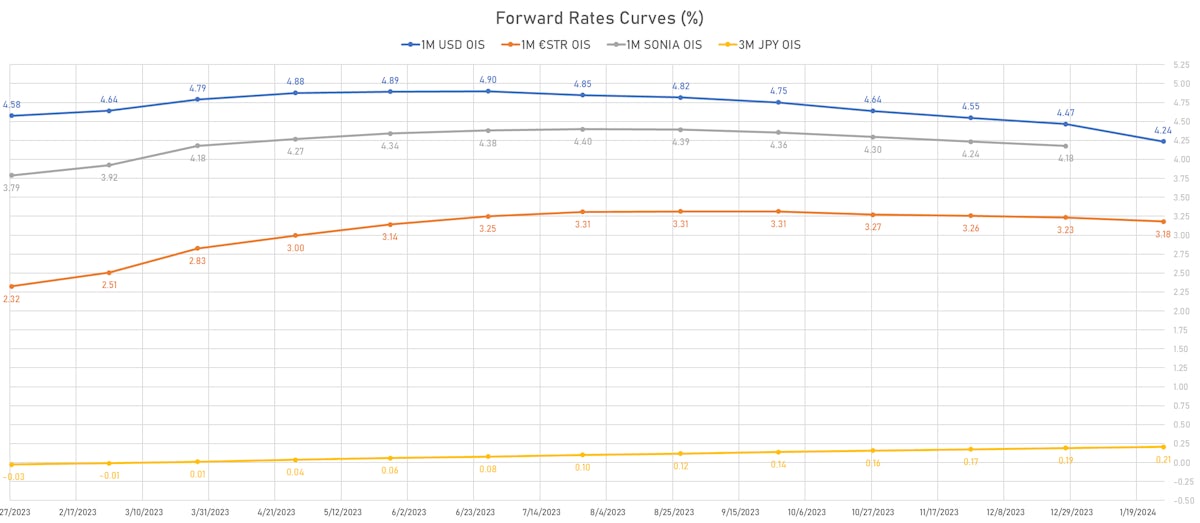

US FORWARD RATES

- Fed Funds futures now price in 25.8bp of Fed hikes by the end of February 2023, 45.9bp (1.8 x 25bp hikes) by the end of March 2023, and 2.3 hikes by the end of May 2023

- Implied yields on 3-month SOFR futures top out at 4.90% for the July 2023 expiry and price in 205bp of rate cuts over the following easing cycle

- The "neutral" forward rate (3M SOFR after 2025) rose about 20bp this week, now around 2.85%

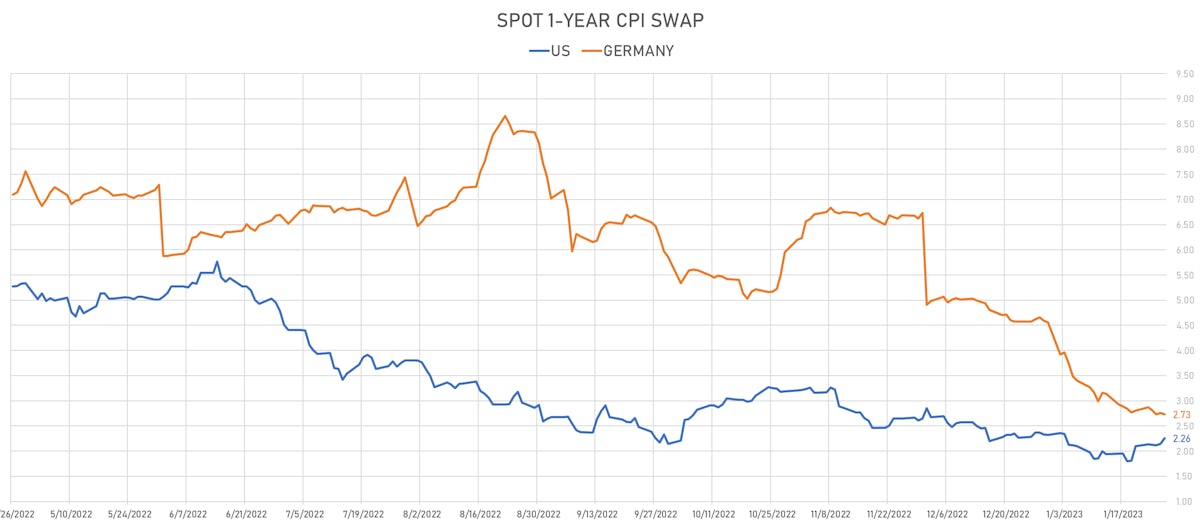

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.20% (down -2.9bp); 2Y at 2.21% (up 0.8bp); 5Y at 2.30% (down -1.3bp); 10Y at 2.32% (down -1.9bp); 30Y at 2.31% (down -2.4bp)

- 6-month spot US CPI swap down -0.1 bp to 1.878%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.2940%, +1.9 bp today; 10Y at 1.1940%, +2.0 bp today; 30Y at 1.3450%, +0.8 bp today

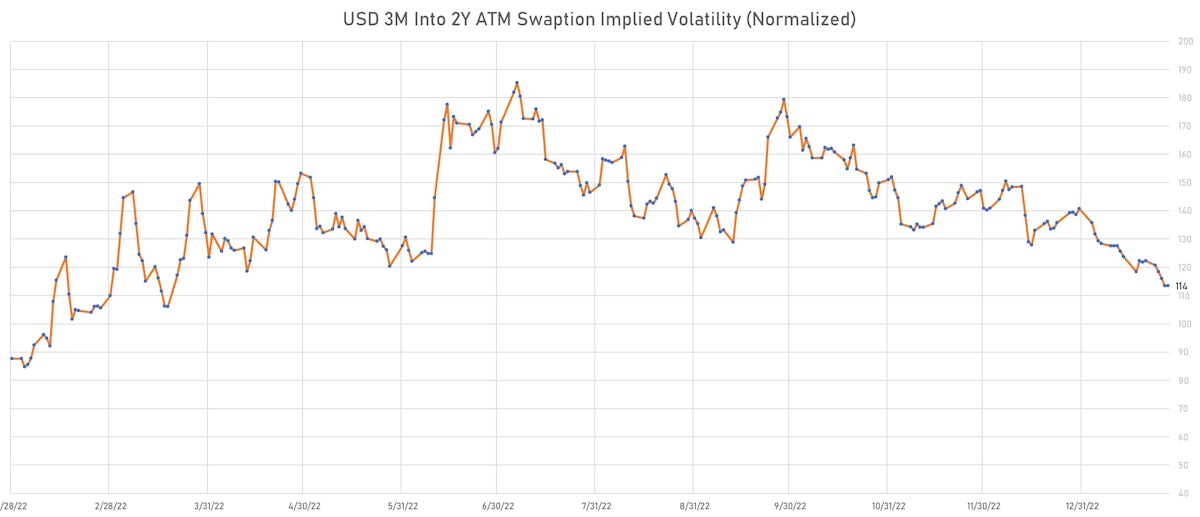

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -4.0 vols at 69.6 normals

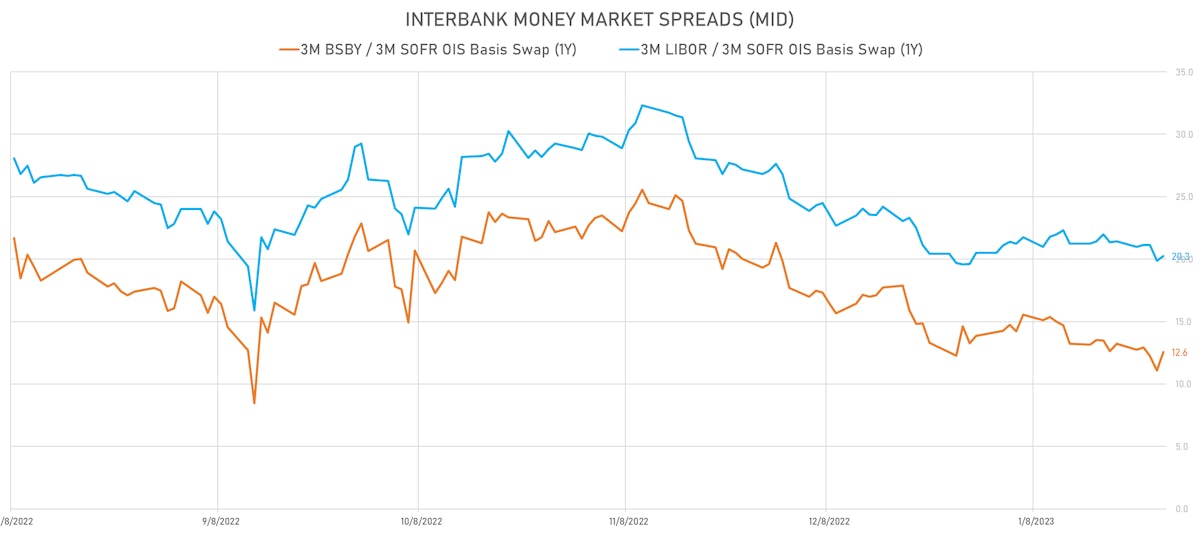

- 3-Month LIBOR-OIS spread up 2.5 bp at 13.5 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

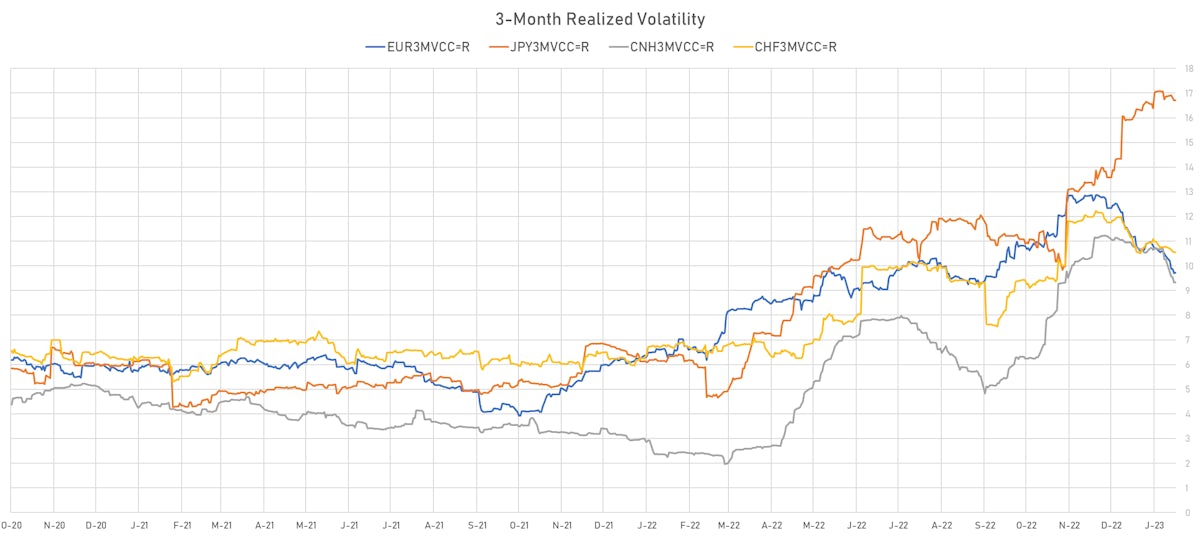

- Germany 5Y: 2.234% (up 2.2 bp); the German 1Y-10Y curve is 4.3 bp steeper at -43.4bp (YTD change: +1.9 bp)

- Japan 5Y: 0.196% (up 1.1 bp); the Japanese 1Y-10Y curve is 1.8 bp steeper at 53.3bp (YTD change: -40.6 bp)

- China 5Y: 2.795% (up 6.7 bp); the Chinese 1Y-10Y curve is 1.0 bp steeper at 79.5bp (YTD change: -72.8 bp)

- Switzerland 5Y: 1.091% (down -0.9 bp); the Swiss 1Y-10Y curve is 2.7 bp steeper at -17.8bp (YTD change: -6.5 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +1.6 bp at 164.5 bp (Weekly change: 0.0 bp; YTD change: -9.1 bp)

- US-JAPAN: +3.2 bp at 423.7 bp (YTD change: -15.6 bp)

- US-CHINA: +1.2 bp at 195.0 bp (Weekly change: +2.5 bp; YTD change: -24.7 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.5 bp at 112.7 bp (Weekly change: +0.2bp; YTD change: -16.1bp)

- US-JAPAN: +0.9 bp at 143.0 bp (Weekly change: -6.6bp; YTD change: -60.9bp)

- GERMANY-JAPAN: +1.4 bp at 30.3 bp (Weekly change: -6.8bp; YTD change: -44.8bp)