US Rates: Little Expected From The Next FOMC, All Eyes On Jackson Hole

With markets focused on the timing of tapering, the monetary committee is unlikely to announce anything until the symposium unless inflation really surprises to the upside in the next couple of months

Published ET

US 5Y Treasury Yield | Source: Refinitiv

A QUICK RECAP OF WHERE WE STAND

The first quarter of this year was marked by a strong repricing of rates in the US, based on a multitude of factors:

- Renewed optimism about the US economy, with record GDP growth, ISM surveys, etc.

- Various supply chain issues (from shipping to chips) and a rapid rise in the prices of major commodities (base metals, crude, gasoline) also fueled a major repricing of inflation expectations

- The forward inflation curve inverted, indicating that markets saw the sharp inflation spike as short-lived

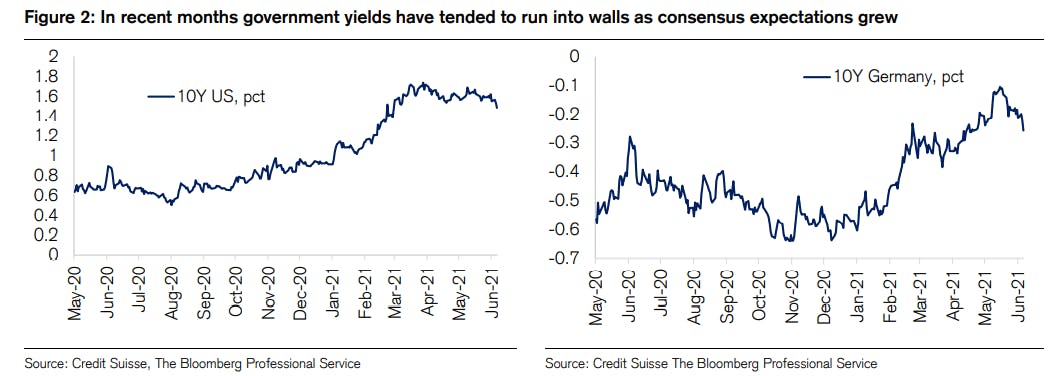

That led to strong steepening of the US curve, with a fast rise of the 5-year rate from 0.36% at the end of 2020 to 0.99% in the first week of April and the 10-year from 0.91% to 1.78% at the end of March.

But then rates stalled and have been trading down in a fairly narrow range since:

- The second derivative of the positive momentum slowed, and reversed in some cases

- Some economic data points came in well below expectations, notably jobs (a big focus for the Fed)

- Economic policymakers reinforced the message that the end of QE is not here yet, to ensure a taper tantrum was not repeated as the economy was just emerging from a recession

- Some inflation measures (notably wage growth) did come out on the high side, but interestingly never lead to a lasting impact on rates, as the market had already priced in a large risk premium for inflation (especially for a world of transitory inflation)

- In addition, Fed officials have begun to discuss, in a very careful and calculated way, the tapering of asset purchases (what the Fed's Mary Daly called "talking about talking about" tapering)

So here we are, stuck in this range and wondering when rates volatility could return.

UNLIKELY (BUT POSSIBLE) THINGS THAT COULD GET US OUT OF THE RANGE

- Core inflation data points that are extremely high and far outside what is currently priced in by inflation markets

- Clearer indications (and wider acknowledgement) that the labor market is in fact tighter than it appears, pushing the FOMC to be concerned about real pressure on wages (stickier than supply chain issues)

A MORE LIKELY OUTCOME

The Fed announces in Jackson Hole, at the annual bucolic retreat of the monetary nerds, a gradual game plan for tightening, a prudent path to avoid a brutal "tantrum" repricing.

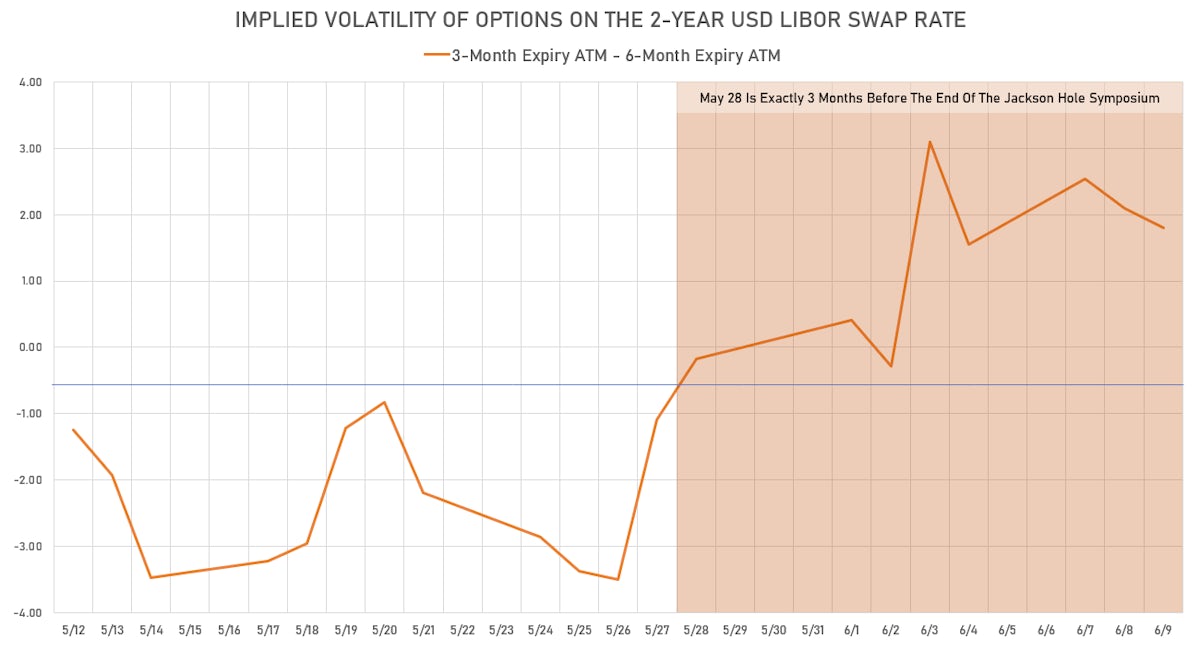

The Jackson Hole event risk has now been priced into the term structure of various asset classes:

- S&P 500 options

- FX options

- Eurodollar listed options

- OTC swaptions (see chart below)

What does this chart mean? It shows how exactly 3 months before the end of Jackson Hole options on 2-year swap rates with 3 months to maturity became more expensive (in terms of implied volatility) than options with 6 months to maturity. That points to the date being seen as the next critical event risk for interest rates.

As always, time will tell, but option markets currently imply a possible Wyoming ending for the on-going drift.