Rates

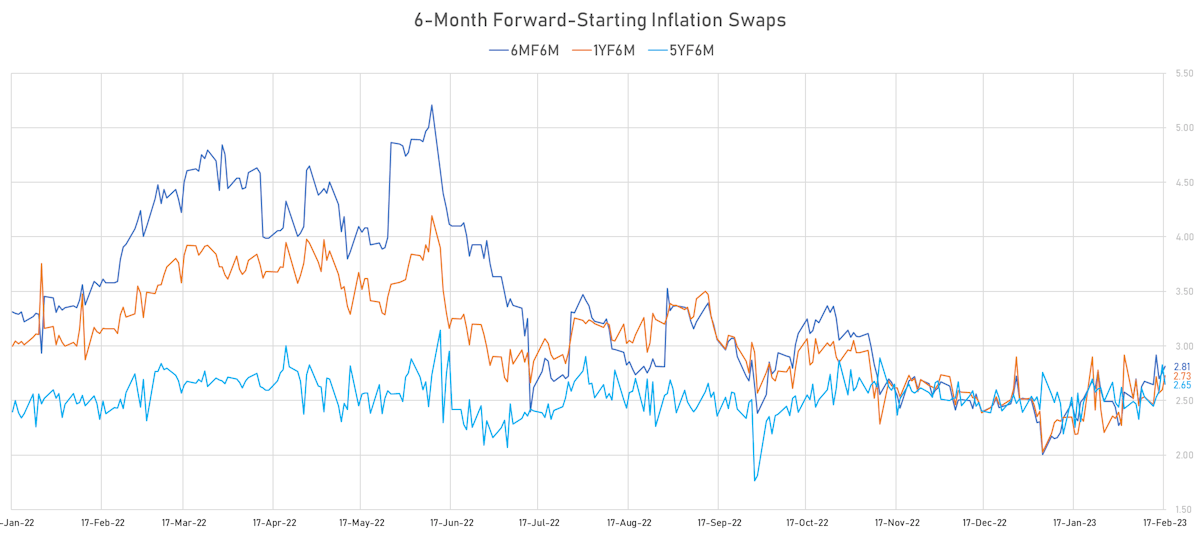

US Rates Sell Off Across The Curve, Led By The Front End, Driven By A Repricing Of Short-Term Inflation Expectations

The recent US activity data has been strong, and core inflation has been coming down very slowly, pointing to a possible reacceleration of inflation: the risk of overtightening has come down and the risk of not doing enough has gone up

Published ET

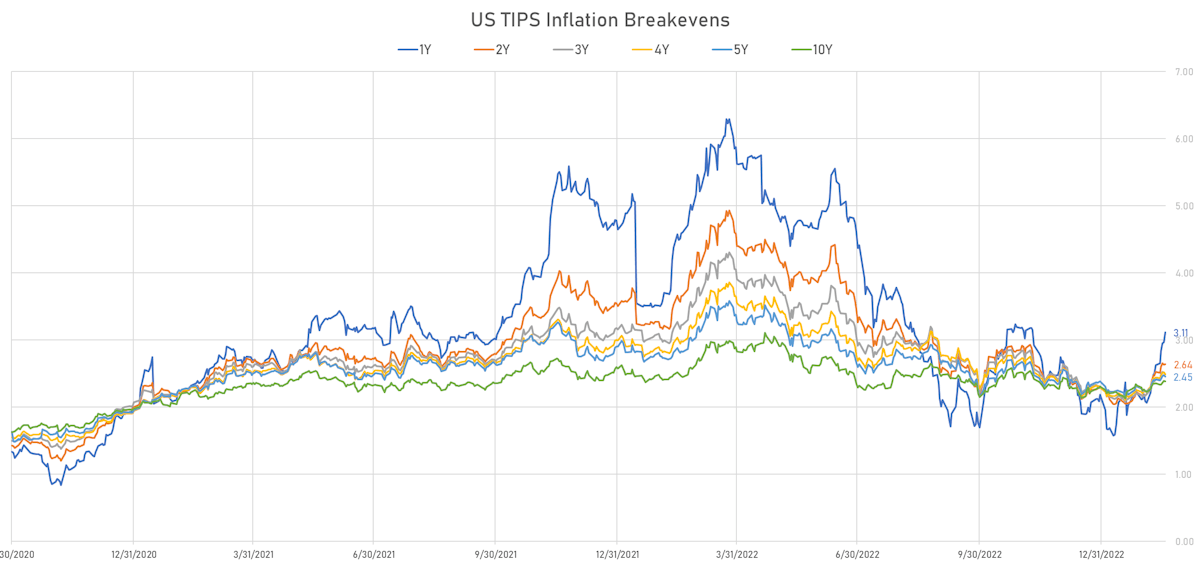

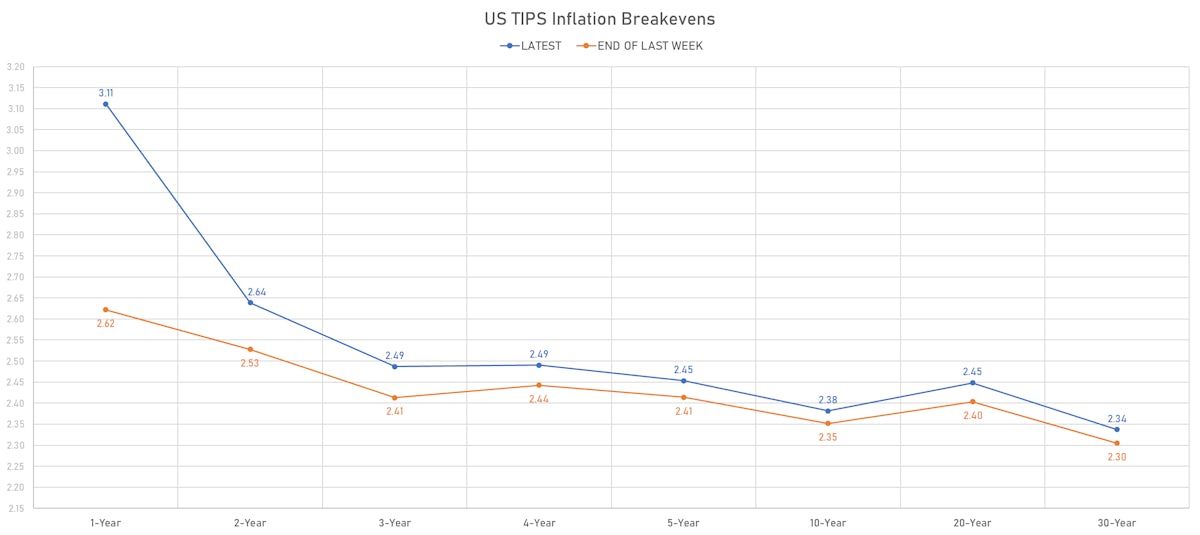

US TIPS Inflation Breakevens | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

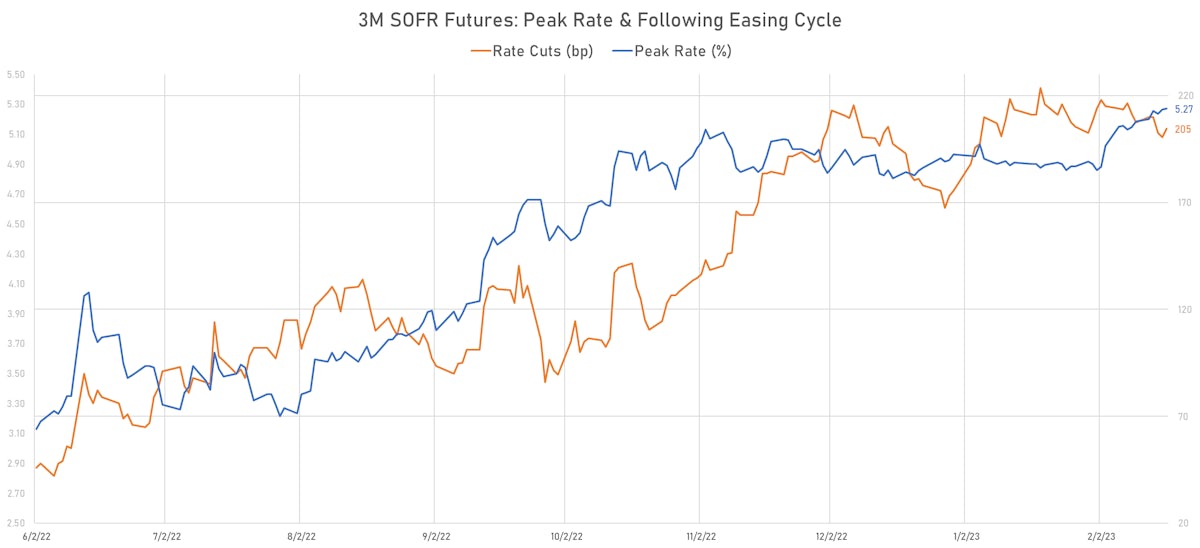

- The strength of the hard data we've seen this month has led to a significant sell-off at the front end of the curve and reduction in the forward curve inversion, with 1Y forward 1Y rising about 85bp

December 2025 3M SOFR Futures Implied Yield, and 1Y forward 1Y USD OIS | Source: Refinitiv

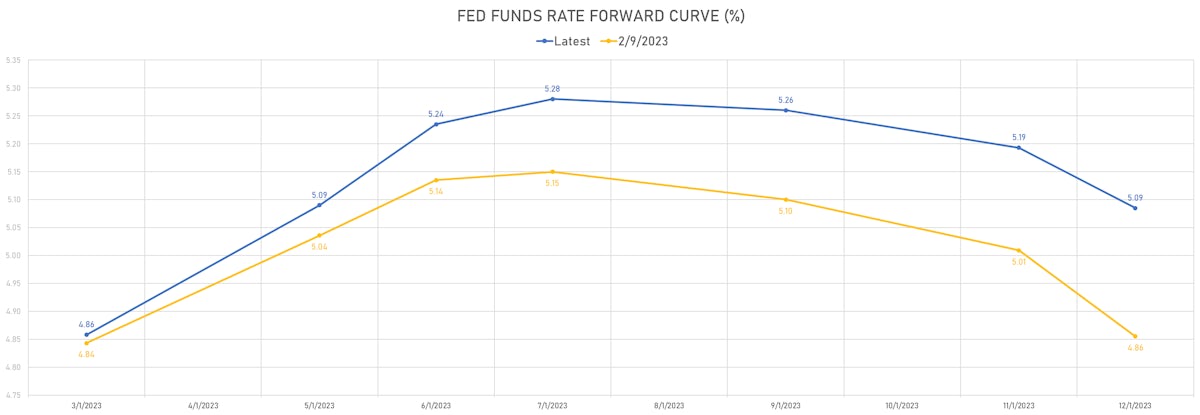

- Market pricing is sensible: Fed Funds futures now price in 100% probability of 25bp hikes in March and May, with rates peaking at 5.28% after the July FOMC

- But unless the hard data continues to come in on the hot side of expectations, we're likely to see the July FOMC pricing lighten up over the coming weeks

- Further down the curve, it's hard to see the Fed Funds rate remain above 5% for a long period without also seeing an increase in the neutral rate: 3M USD OIS at 3.20% from 2026 looks light if inflation and growth prove more persistent

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -3.7 bp, now at -117.6 bp (YTD change: -34.3bp)

- 1Y: 4.9918% (up 11.0 bp)

- 2Y: 4.6148% (up 9.0 bp)

- 5Y: 4.0265% (up 9.9 bp)

- 7Y: 3.9369% (up 8.2 bp)

- 10Y: 3.8158% (up 7.3 bp)

- 30Y: 3.8647% (up 3.8 bp)

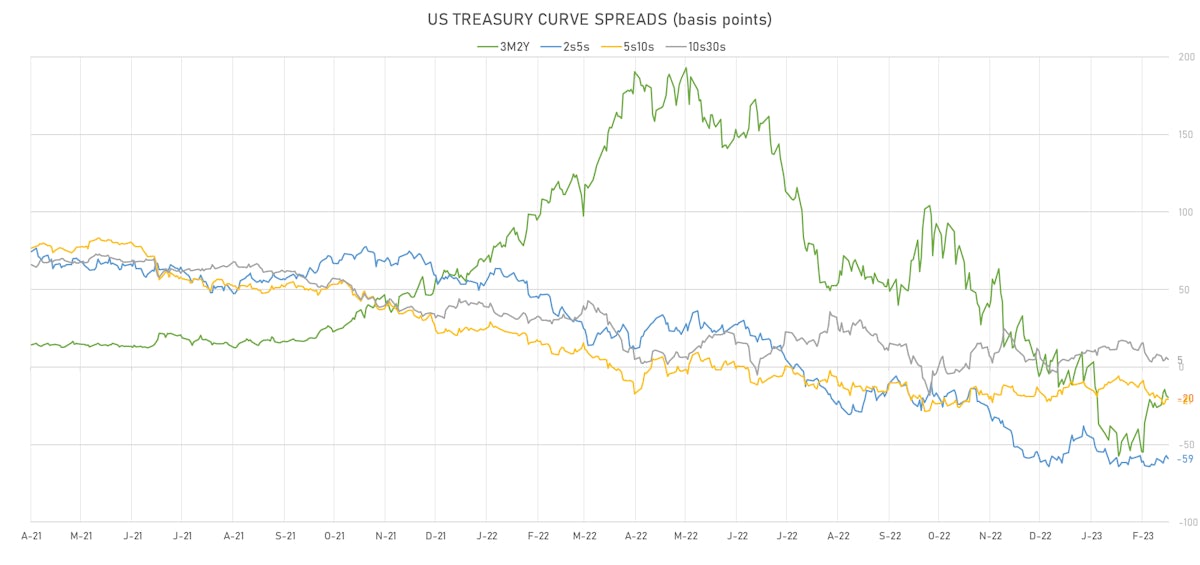

- US treasury curve spreads: 3m2Y at -19.5bp (up 5.4bp this week), 2s5s at -58.8bp (down -0.1bp), 5s10s at -21.1bp (down -2.8bp), 10s30s at 4.9bp (down -2.8bp)

- TIPS 1Y breakeven inflation at 3.11% (up 48.9bp); 2Y at 2.64% (up 11.1bp); 5Y at 2.45% (up 4.0bp); 10Y at 2.38% (up 3.0bp); 30Y at 2.34% (up 3.3bp)

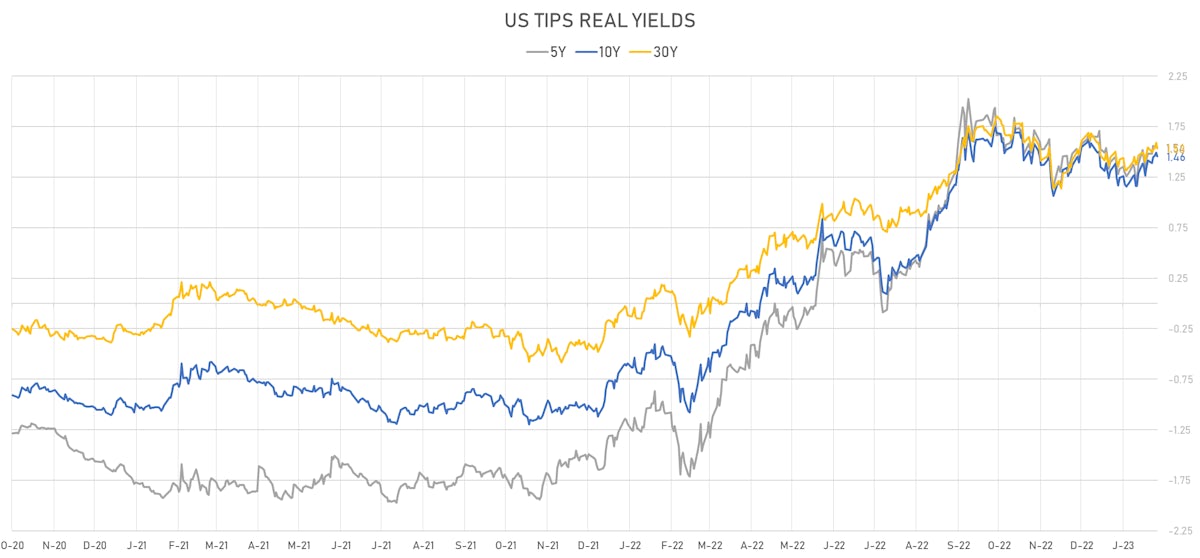

- US 5-Year TIPS Real Yield: +6.0 bp at 1.5410%; 10-Year TIPS Real Yield: +4.3 bp at 1.4560%; 30-Year TIPS Real Yield: -1.1 bp at 1.5340%

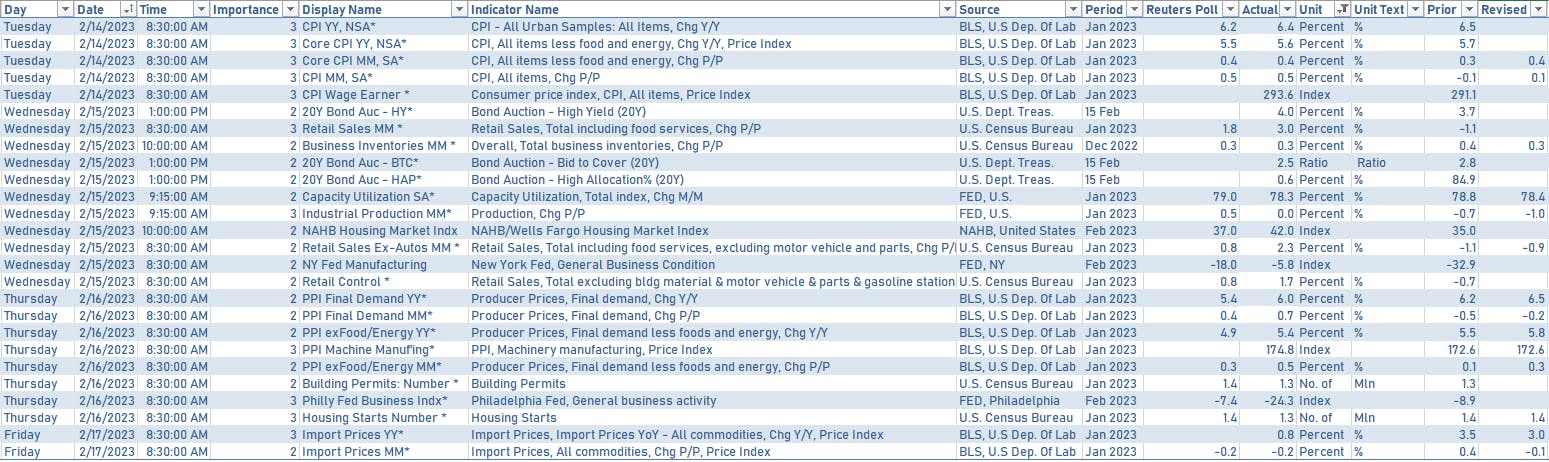

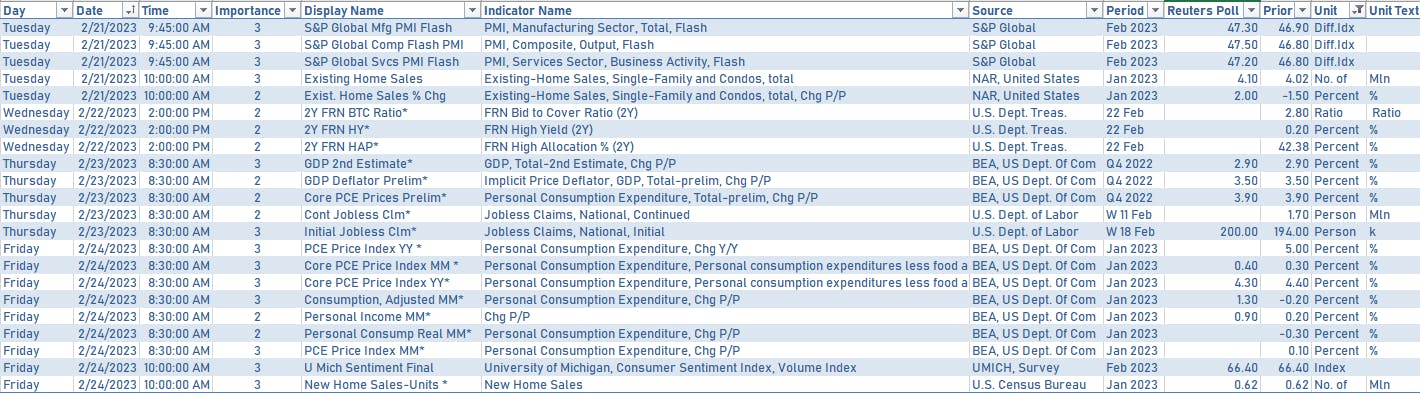

US MACRO RELEASES OVER THE PAST WEEK

US ECONOMIC DATA IN THE WEEK AHEAD

- The main focus next week will be on January PCE and housing data, with the minutes of the FOMC now pretty stale

US TREASURY AUCTIONS IN THE WEEK AHEAD

- Tuesday at 1:00PM: $42bn in 2Y notes

- Wednesday at 11:30AM: $22bn in 2Y FRNs

- Wednesday at 1:00PM: $43bn in 5Y notes

- Thursday at 1:00PM: $35bn in 7Y notes

FED SPEAKERS IN THE WEEK AHEAD

- Thursday 10:50AM: Atlanta Fed President Bostic

- Thursday 2:00PM: San Francisco Fed President Daly

- Friday 10:15AM: Fed Governor Jefferson and Cleveland Fed President Mester

- Friday 1:30PM: Boston Fed President Collins

- Friday 1:30PM: Fed Governor Waller

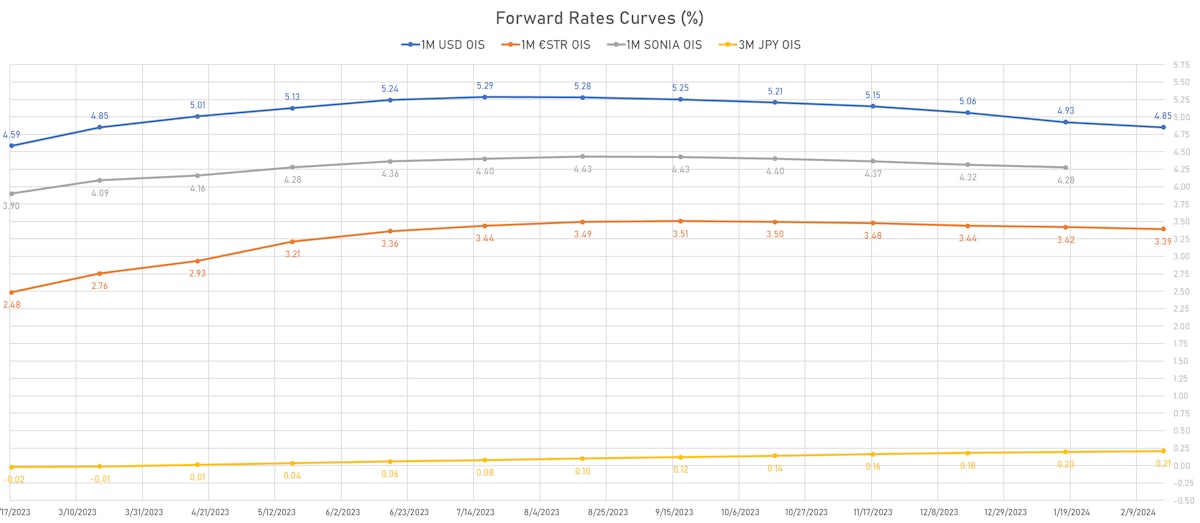

US FORWARD RATES

- Fed Funds futures now price in 27.5bp of Fed hikes by the end of March 2023, 50.7bp (2.0 x 25bp hikes) by the end of May 2023, and 2.6 hikes by the end of June 2023

- Implied yields on 3-month SOFR futures top out at 5.28% for the September 2023 expiry and price in 206bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.11% (up 14.5bp); 2Y at 2.64% (up 0.4bp); 5Y at 2.45% (down -2.2bp); 10Y at 2.38% (down -1.1bp); 30Y at 2.34% (down -1.7bp)

- 6-month spot US CPI swap down -0.2 bp to 2.951%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.5410%, -2.6 bp today; 10Y at 1.4560%, -3.5 bp today; 30Y at 1.5340%, -5.4 bp today

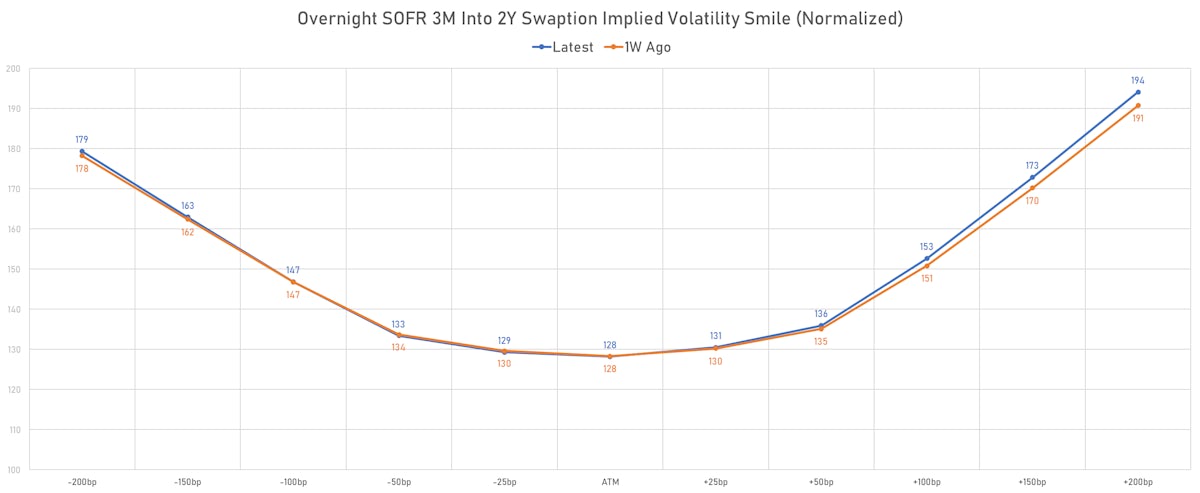

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.3 vols at 83.4 normals

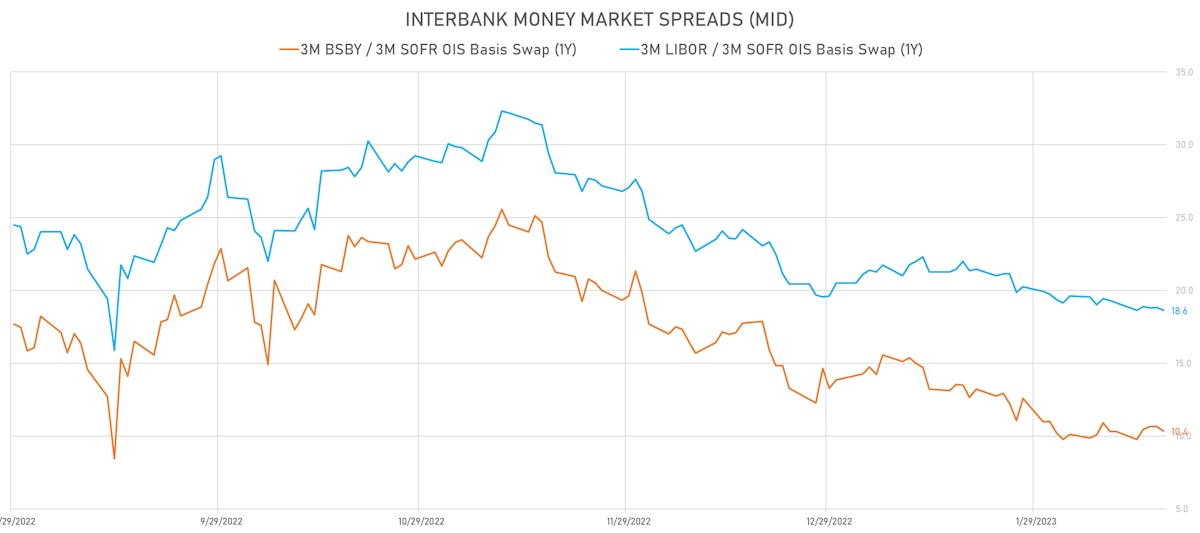

- 3-Month LIBOR-OIS spread down 0.0 bp at 6.9 bp (18-months range: -11.3 to 39.3 bp)

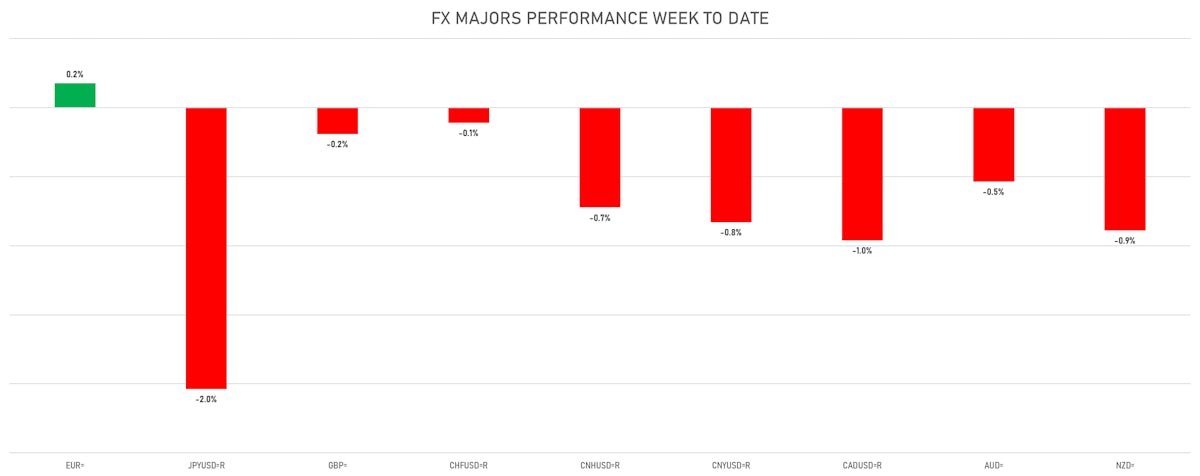

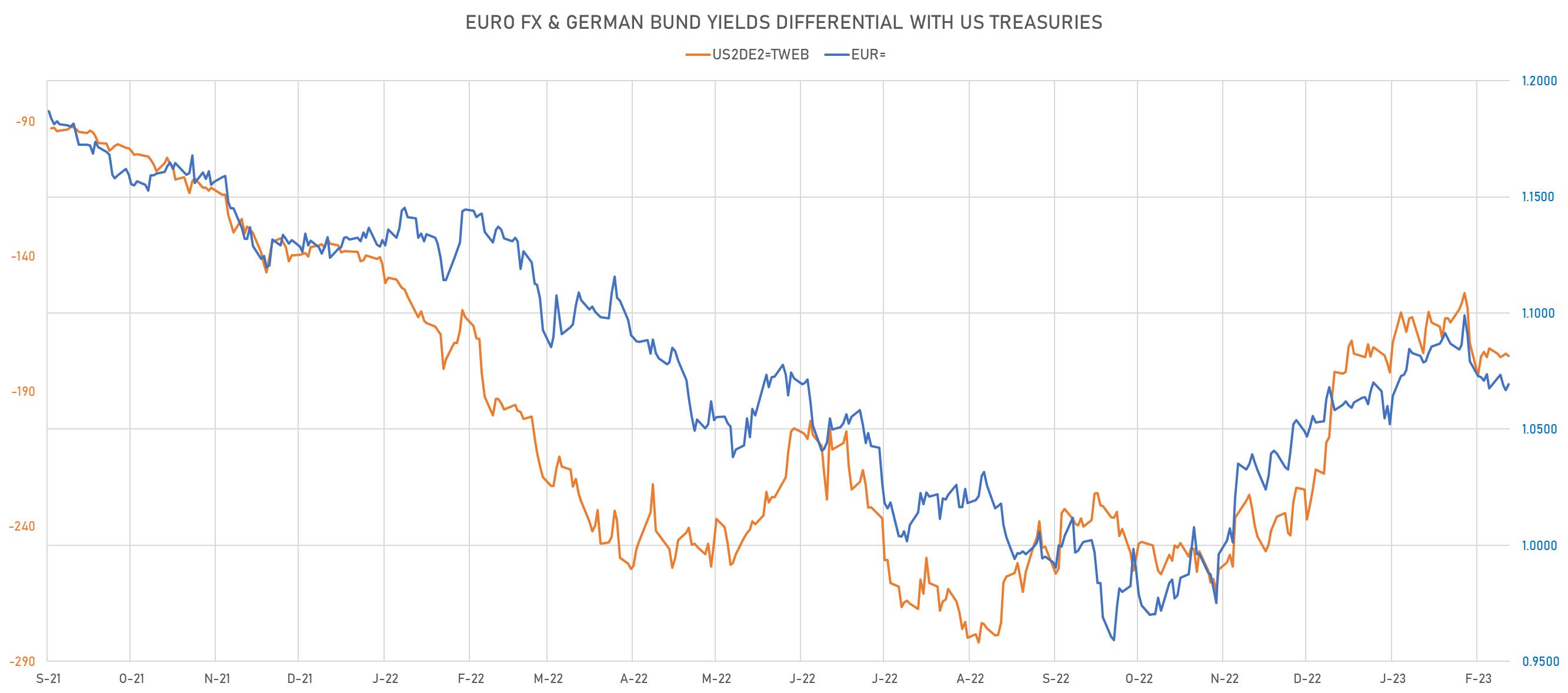

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.494% (down -1.6 bp); the German 1Y-10Y curve is 1.9 bp flatter at -54.6bp (YTD change: +1.8 bp)

- Japan 5Y: 0.216% (up 1.9 bp); the Japanese 1Y-10Y curve is 0.2 bp steeper at 60.0bp (YTD change: -40.5 bp)

- China 5Y: 2.703% (down -0.2 bp); the Chinese 1Y-10Y curve is 3.8 bp flatter at 67.6bp (YTD change: -72.9 bp)

- Switzerland 5Y: 1.343% (down -0.8 bp); the Swiss 1Y-10Y curve is 0.8 bp steeper at -12.3bp (YTD change: -6.4 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +0.9 bp at 176.9 bp (Weekly change: +2.8 bp; YTD change: +3.3 bp)

- US-JAPAN: +0.4 bp at 469.3 bp (Weekly change: +14.2 bp; YTD change: +30.0 bp)

- US-CHINA: -3.0 bp at 220.2 bp (Weekly change: +7.6 bp; YTD change: +1.9 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -1.5 bp at 137.4 bp (Weekly change: +3.2bp; YTD change: +8.6bp)

- US-JAPAN: -2.4 bp at 163.5 bp (Weekly change: +2.7bp; YTD change: -40.4bp)

- GERMANY-JAPAN: -0.9 bp at 26.1 bp (Weekly change: -0.5bp; YTD change: -49.0bp)