Rates

The Front End Rates Selloff Continues: Peak Fed Funds Rate Now Above 5.40%, As June FOMC Fully In Play

If confirmed over the coming weeks, the positive recent data in the US could put the Fed in a difficult position at the March FOMC, with the soft-landing scenario becoming increasingly challenged by a more hawkish outlook

Published ET

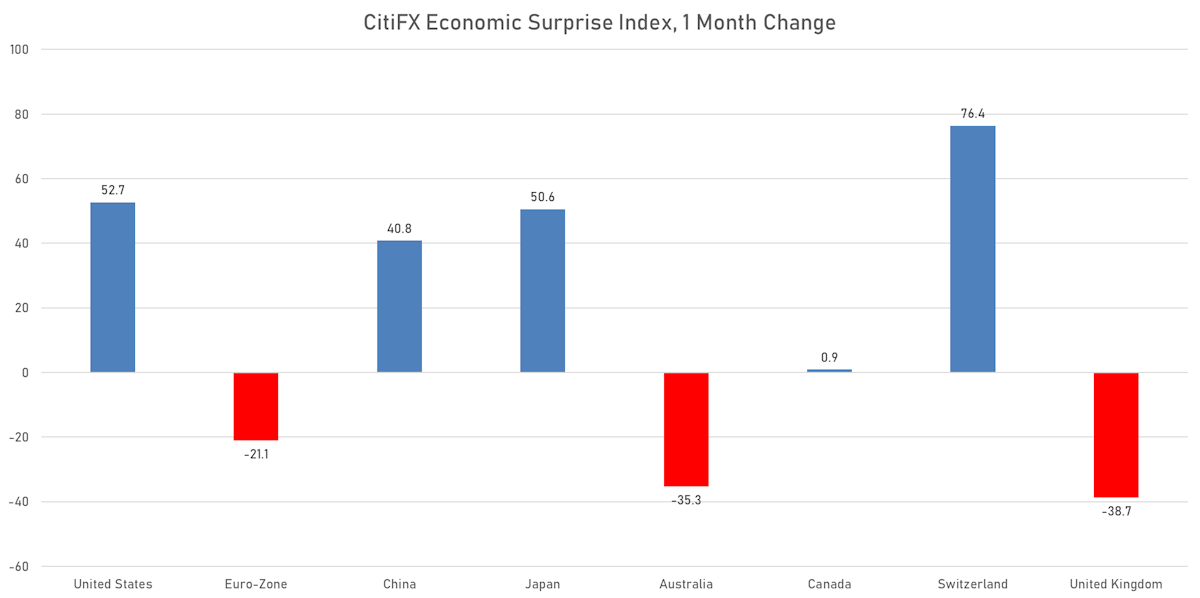

1-Month Change In CitiFX Economic Surprise Indices | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

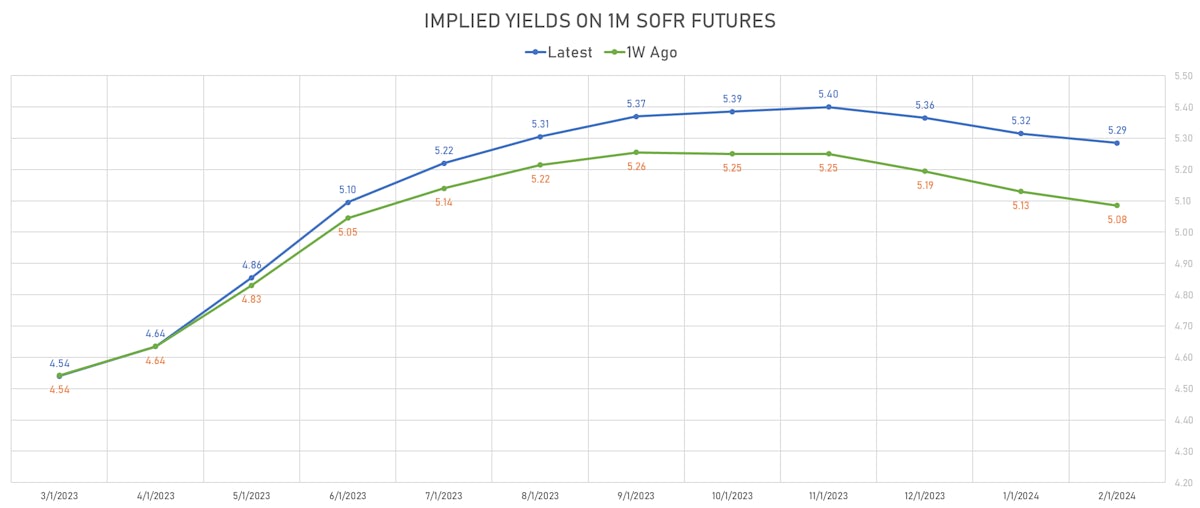

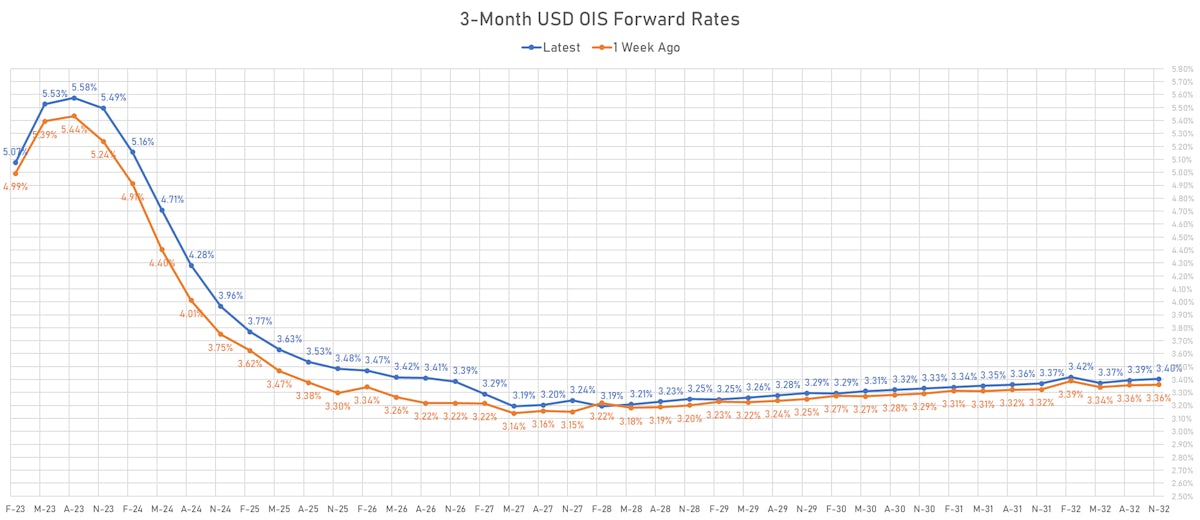

- The peak Fed Funds rate is now at 5.40% in September, about 82bp above where we currently stand

- Much has been made of the increased probability of a 50bp hike at the March FOMC, but that remains a fairly remote possibility, with a 21% probability priced in after the recent front-end selloff

- The Fed still sees a soft landing as the central scenario, and is therefore focused on not overtightening, rather than risk management / avoiding continued inflationary pressures

- The pace of hikes is thus stuck at 25bp unless very hot economic surprises force the Fed to recognize that they are no longer on an appropriate landing path. That means that for the moment the market is more likely to price in 25 hikes in the second half of the year (i.e. forward steepening) than 50bp in the next couple of months

- But there is a possibility that could change if the next employment and inflation reports show continued strength, and a fair bit of that is now priced into the market

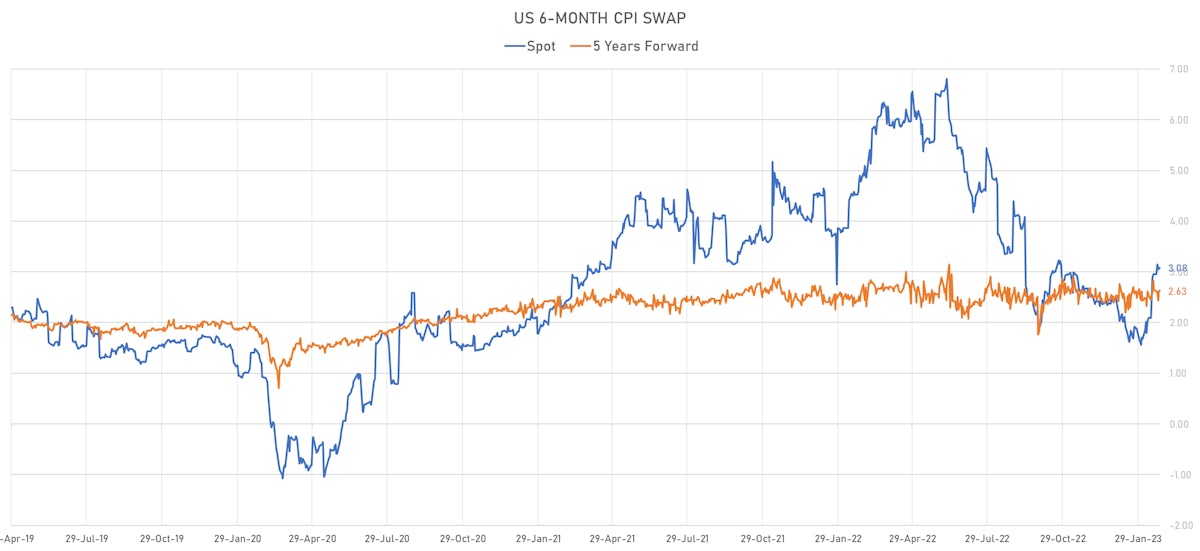

- TIPS have also seen a decent selloff: 1Y inflation breakeven is back above 3% from 1.70% last month, and the data (rather than the Fed) will determine the end game

- From a tactical standpoint we'd stay pretty close to home: although the market is probably more inclined to buy the dips than sell the rallies, the risk/reward doesn't look compelling for either side of the duration trade

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 2.5 bp, now at -109.2 bp (YTD change: -25.9bp)

- 1Y: 5.0383% (up 5.9 bp)

- 2Y: 4.8126% (up 17.0 bp)

- 5Y: 4.2108% (up 13.7 bp)

- 7Y: 4.1114% (up 12.5 bp)

- 10Y: 3.9462% (up 8.4 bp)

- 30Y: 3.9291% (up 1.2 bp)

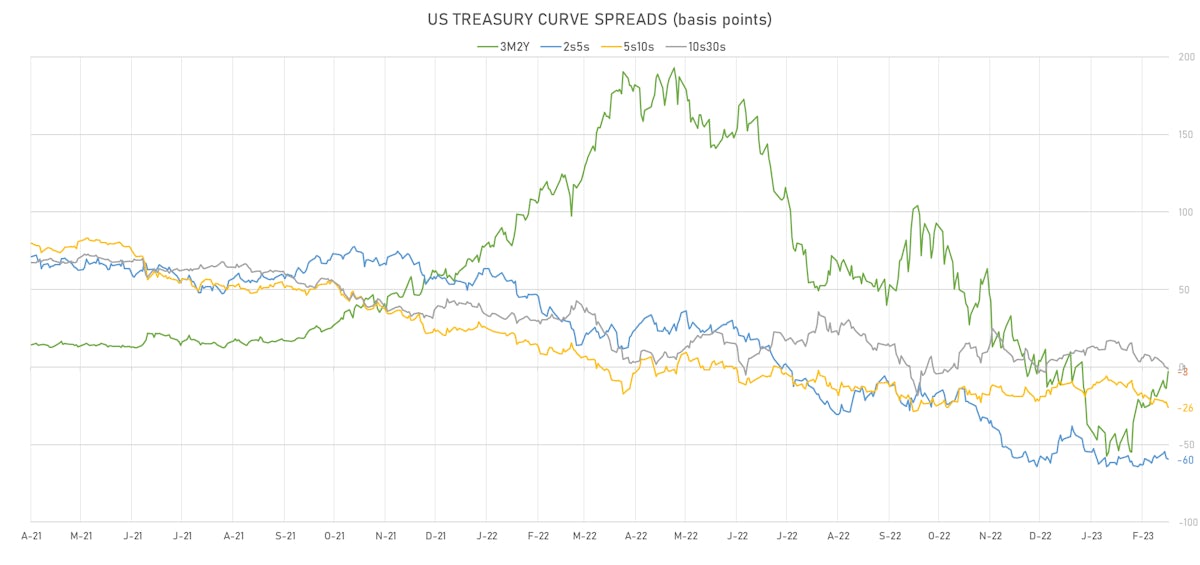

- US treasury curve spreads: 3m2Y at -1.2bp (up 16.0bp this week), 2s5s at -60.2bp (down -3.6bp), 5s10s at -26.5bp (down -5.9bp), 10s30s at -1.7bp (down -6.9bp)

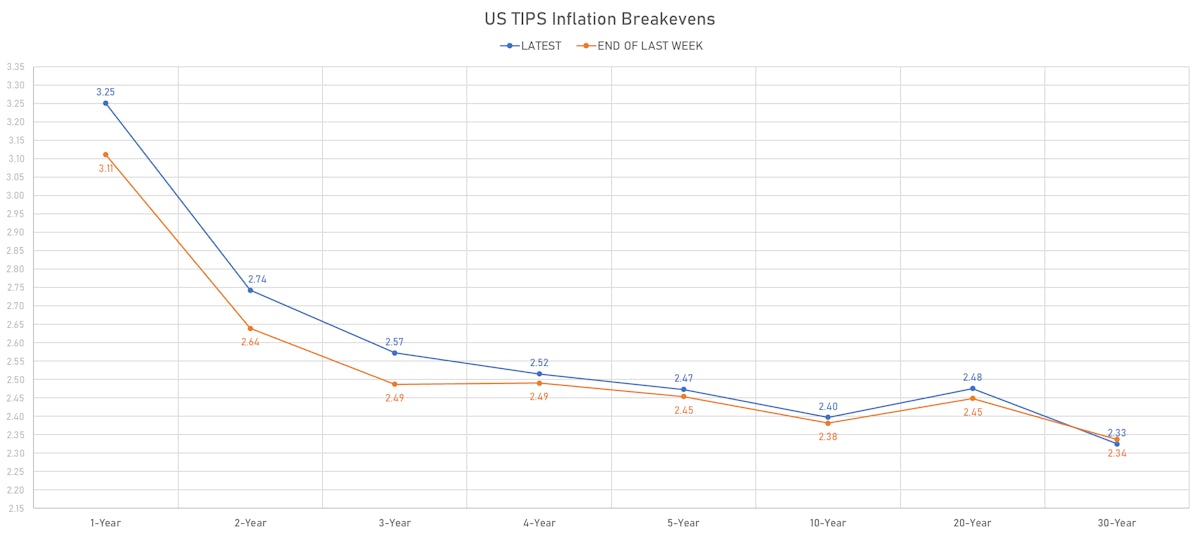

- TIPS 1Y breakeven inflation at 3.25% (up 13.9bp); 2Y at 2.74% (up 10.4bp); 5Y at 2.47% (up 2.0bp); 10Y at 2.40% (up 1.5bp); 30Y at 2.33% (down -1.2bp)

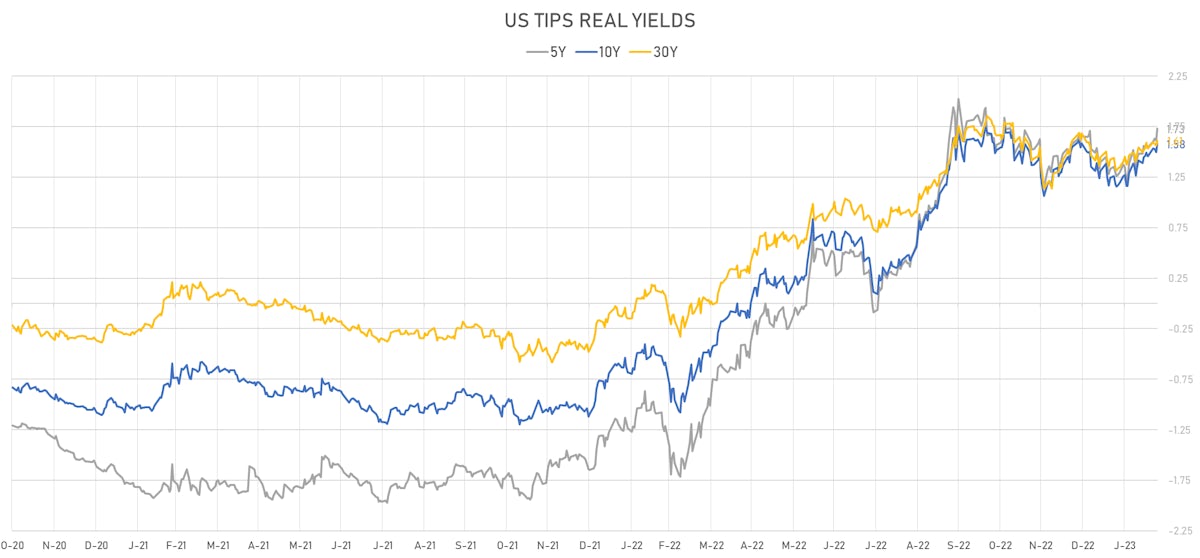

- US 5-Year TIPS Real Yield: +16.4 bp at 1.7310%; 10-Year TIPS Real Yield: +8.7 bp at 1.5780%; 30-Year TIPS Real Yield: +2.3 bp at 1.6110%

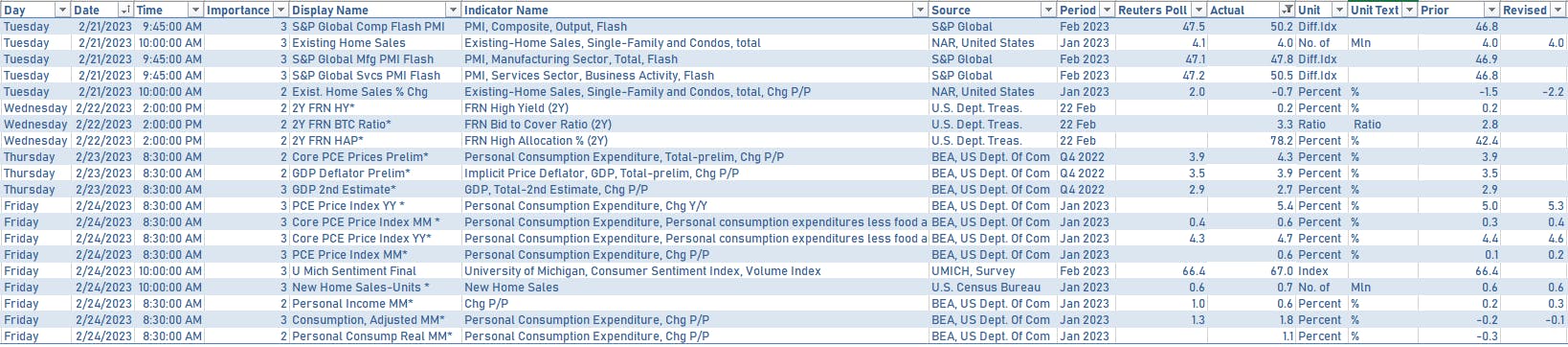

US MACRO DATA OVER THE PAST WEEK

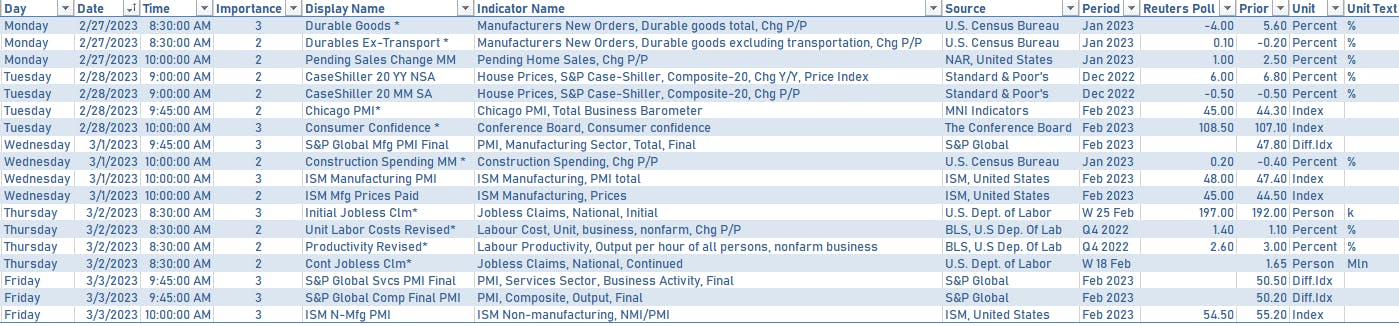

US MACRO DATA IN THE WEEK AHEAD

- Pretty light schedule next week, with the focus on ISM manufacturing and Conference Board consumer confidence

FED SPEAKERS IN THE WEEK AHEAD

- Monday 10:30AM: Fed Governor Jefferson

- Tuesday 2:30PM: Chicago Fed President Goolsbee

- Wednesday 9:00AM: Minneapolis Fed President Kashkari

- Thursday 2:00PM: Fed Governor Waller

- Thursday 6:00PM: Minneapolis Fed President Kashkari

- Friday 11:00AM: Dallas Fed President Logan

- Friday 12:00PM: Atlanta Fed President Bostic

- Friday 3:00PM: Fed Governor Bowman

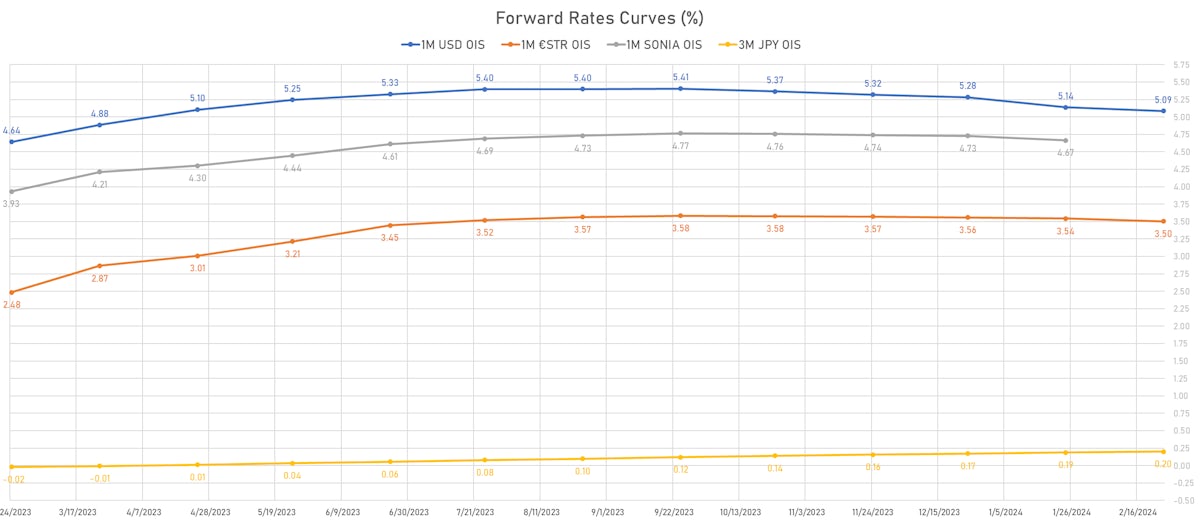

US FORWARD RATES

- Money markets now price in a peak Fed Funds rate of 5.40 in September, 82bp from where we stand; although the implied probability of a 50bp hike in March has now risen to 21%, money markets widely expect the Fed to maintain a slower pace of hikes. After March, the forward curve has 26bp priced in May, 18bp in June, 7bp in July, 1bp in September

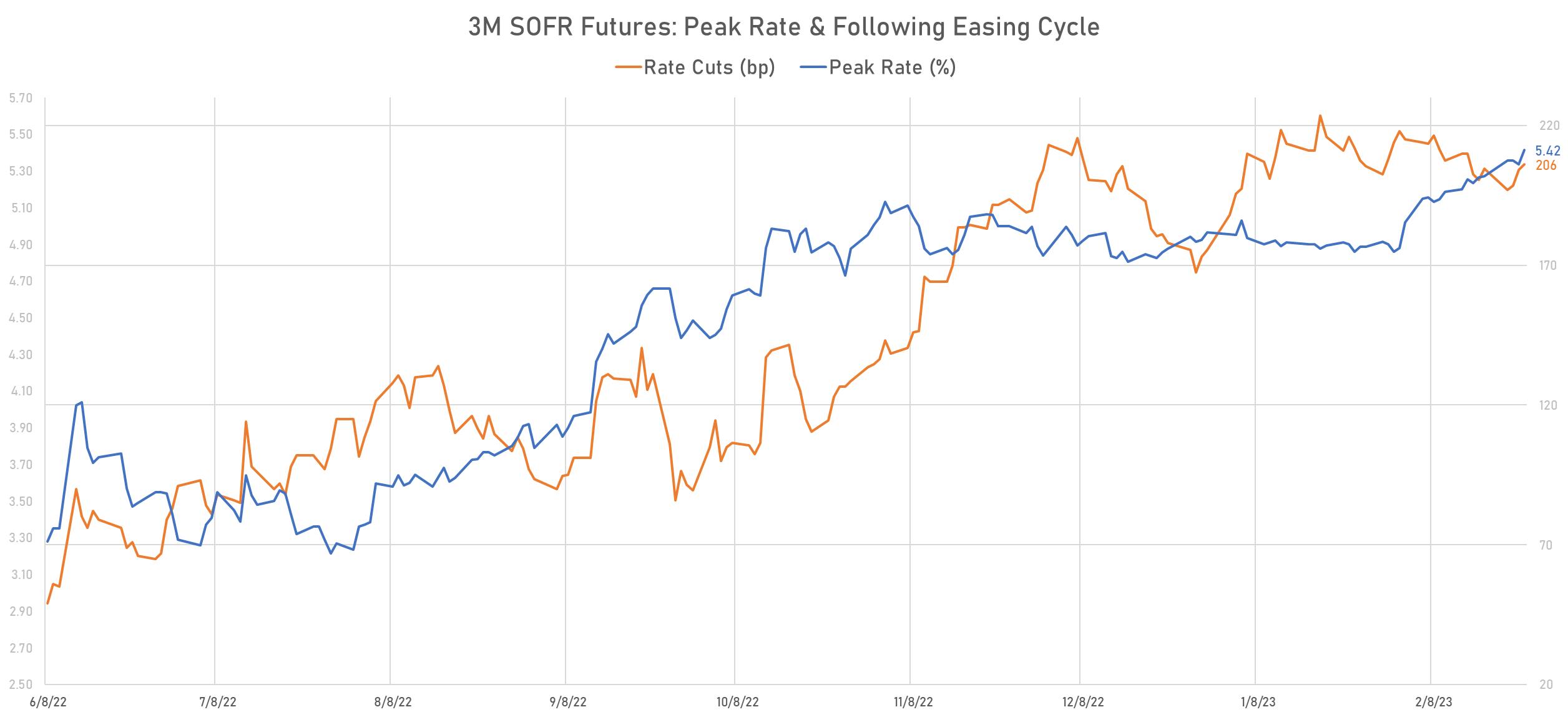

- Implied yields on 3-month SOFR futures top out at 5.41% for the December 2023 expiry and price in 205bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.25% (up 8.5bp); 2Y at 2.74% (up 1.5bp); 5Y at 2.47% (down -2.6bp); 10Y at 2.40% (down -2.4bp); 30Y at 2.33% (down -0.8bp)

- 6-month spot US CPI swap up 1.1 bp to 3.083%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.7310%, +12.0 bp today; 10Y at 1.5780%, +8.3 bp today; 30Y at 1.6110%, +4.8 bp today

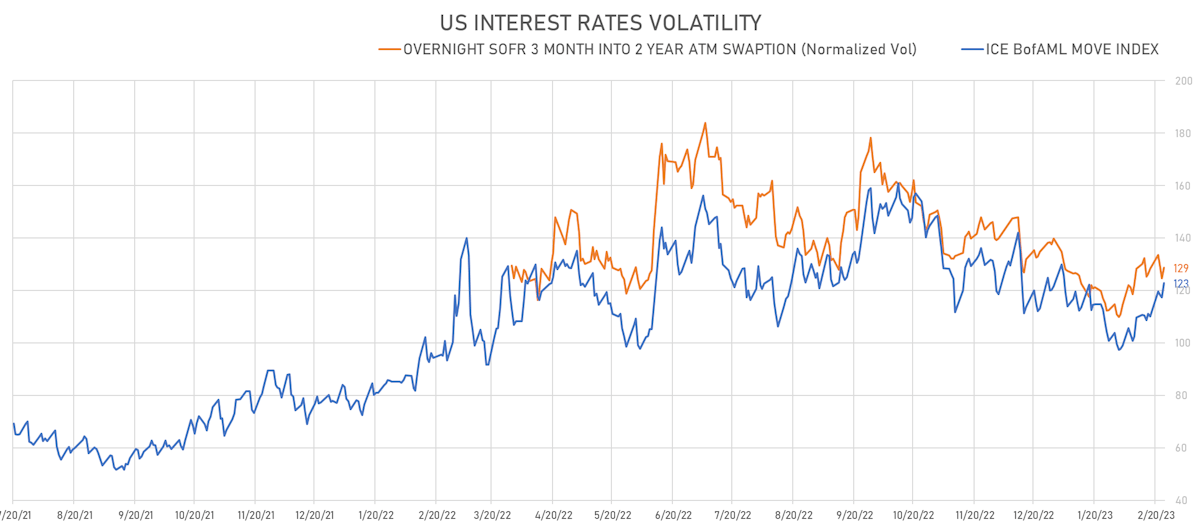

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 3.4 vols at 94.4 normals

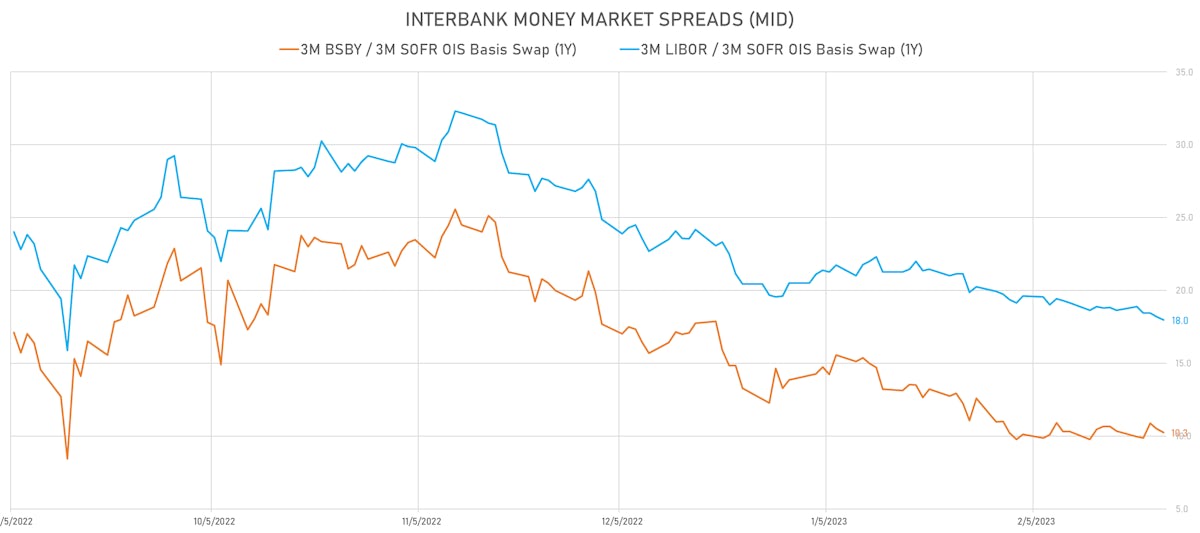

- 3-Month LIBOR-OIS spread down -0.7 bp at 4.1 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.619% (up 7.9 bp); the German 1Y-10Y curve is 3.3 bp steeper at -54.4bp (YTD change: +1.8 bp)

- Japan 5Y: 0.223% (down -2.0 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 59.6bp (YTD change: -40.5 bp)

- China 5Y: 2.740% (unchanged); the Chinese 1Y-10Y curve is 2.6 bp flatter at 62.9bp (YTD change: -73.0 bp)

- Switzerland 5Y: 1.333% (up 3.6 bp); the Swiss 1Y-10Y curve is 2.4 bp flatter at -15.2bp (YTD change: -6.5 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +1.9 bp at 181.1 bp (Weekly change: +5.1 bp; YTD change: +7.5 bp)

- US-JAPAN: +16.9 bp at 487.0 bp (Weekly change: +19.4 bp; YTD change: +47.7 bp)

- US-CHINA: +10.5 bp at 235.9 bp (Weekly change: +15.7 bp; YTD change: +17.6 bp)

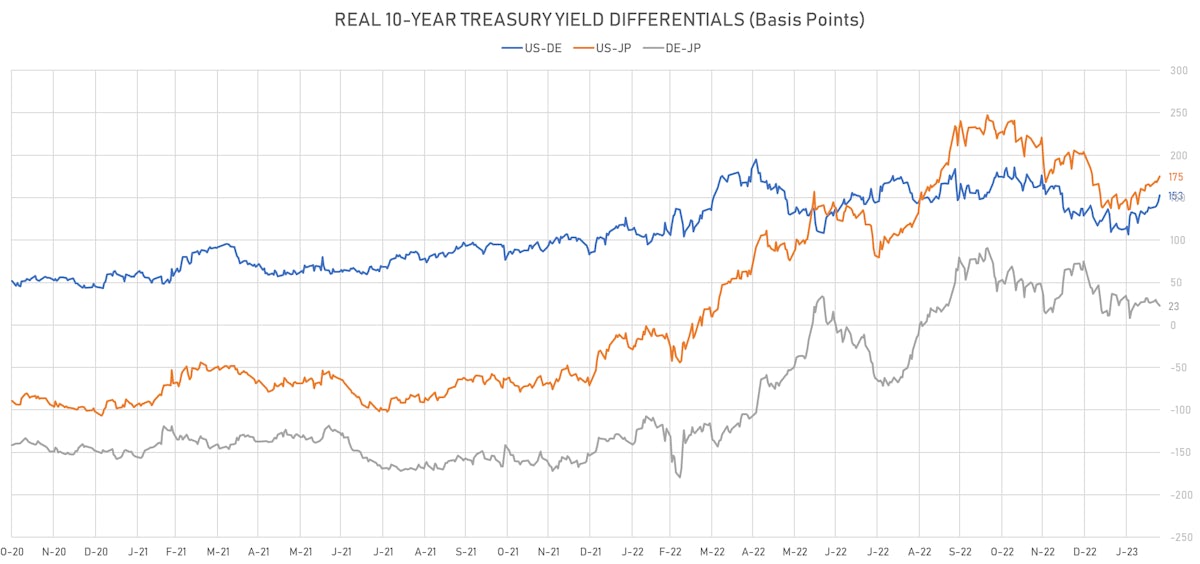

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +7.4 bp at 152.7 bp (Weekly change: +13.8bp; YTD change: +23.9bp)

- US-JAPAN: +7.3 bp at 175.2 bp (Weekly change: +10.1bp; YTD change: -28.7bp)

- GERMANY-JAPAN: -4.5 bp at 22.5 bp (Weekly change: -4.5bp; YTD change: -52.6bp)