Rates

The US Yield Curve Bull Flattened For The Week, Driven By Much Lower Inflation Breakevens

The market fright around Western regional banks impacted mostly equities, but did cause a jolt to money markets: basis swaps were extremely tight on Tuesday and got wider into the weekend, though nothing to worry about for the moment

Published ET

1Y 3M BSBY - 3M SOFR OIS Basis Swap | Source: Refinitiv

US RATES OUTLOOK

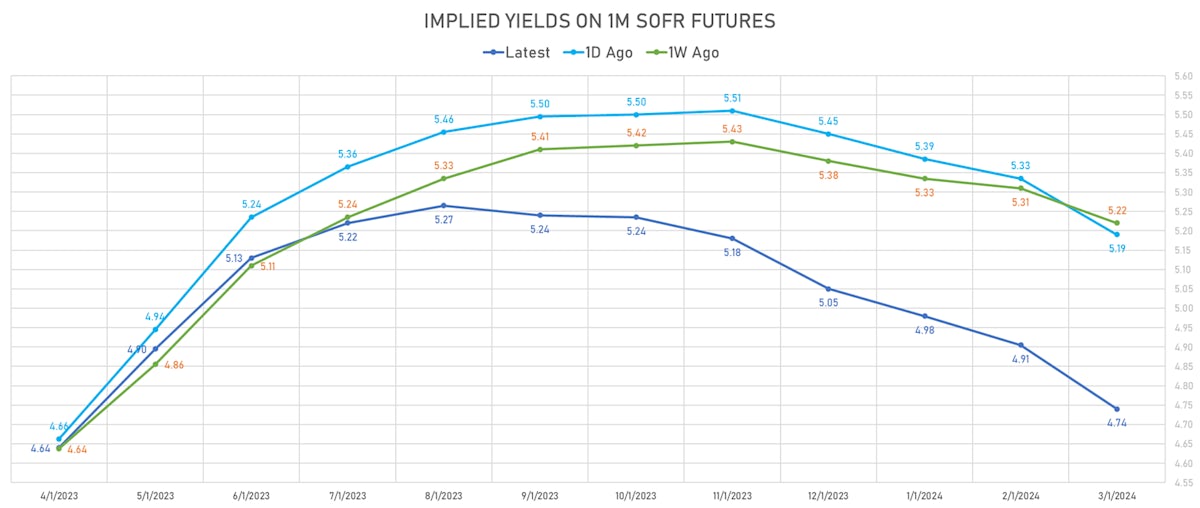

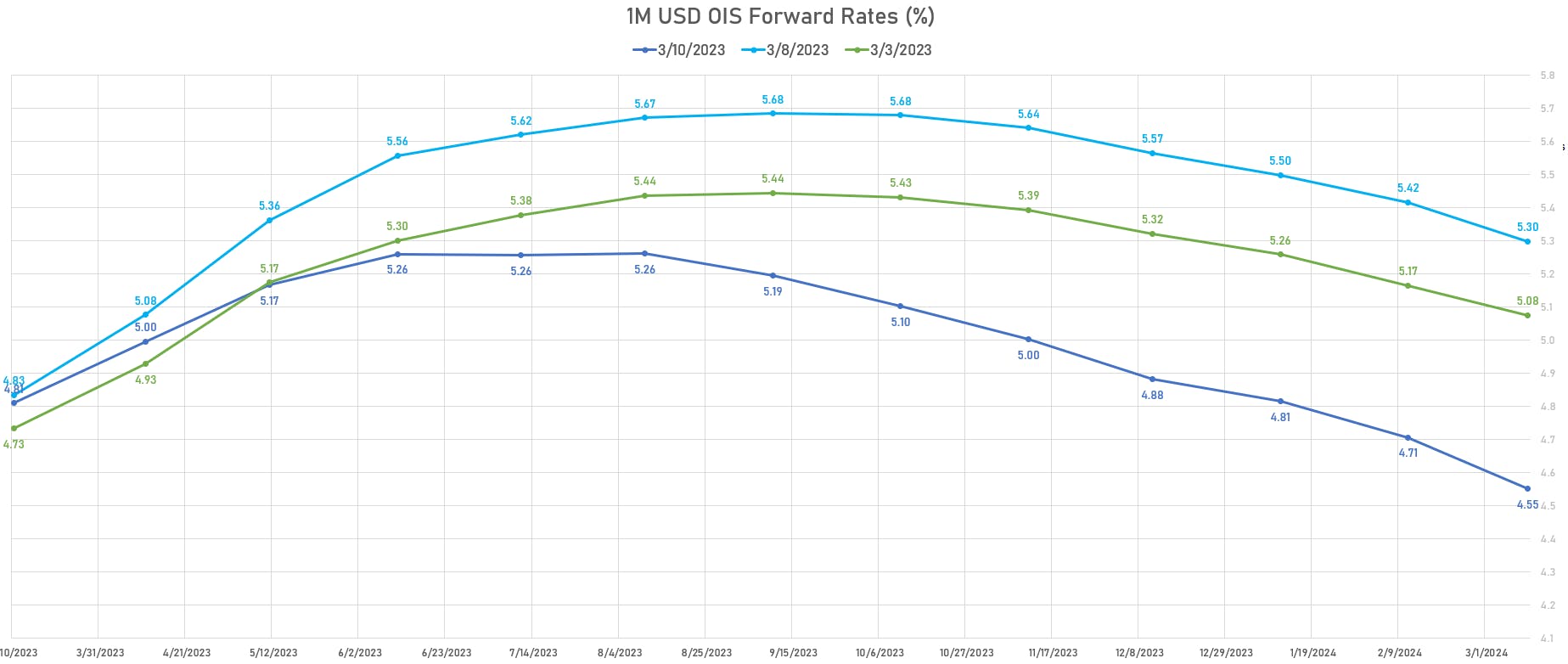

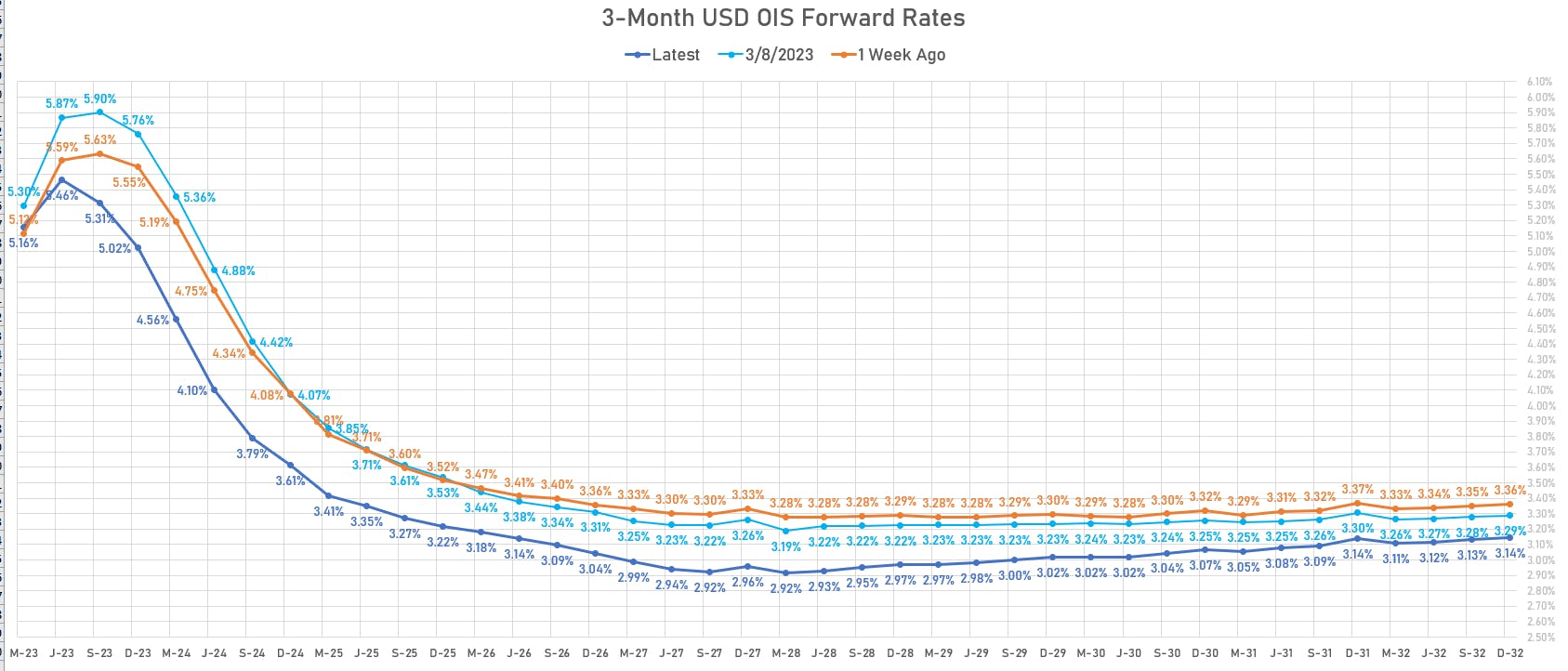

- Money markets now price in about 70bp of additional hikes by the Fed, with a peak Funds rate of 5.27% in July (from 5.44% in September a week ago, down 17bp WoW)

- Powell surprised the market in his senate appearance, by making a direct reference to a possible 50bp hike in March, which led the front end to sell off aggressively and temporarily price in a peak Fed Funds rate of 5.69%

- This move came with a downward shift in the OIS forward curve (a wider inversion), meaning the market expected a more hawkish rates path to cause a lasting recession

- And then, two completely unrelated things happened on Thursday / Friday: SVB went kaput and the employment report showed a slowdown under the hood (despite stronger than expected headline numbers)

- Where does that leave us? Unless the Fed wants to appear tone deaf, and decides to completely ignore the market tension around regional banks, they will hike by 25bp at the March FOMC

- In addition, as we said before, there isn't a strong impetus to hike in 50bp increments if the peak rate is under 6%: the Fed isn't in a rush to go nowhere

- But it's going to be a balancing act from a communication standpoint because the CPI on Tuesday is expected to be much too hot for comfort for the Fed: GS expects a core CPI increase of 45bp MoM, Jefferies expects 44bp, both banks slightly above the market consensus of 40bp

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened: the 1s10s inversion deepened by 9.3 bp, with the spread now at -115.7 bp (YTD change: -32.4bp)

- 1Y: 4.8599% (down 16.1 bp)

- 2Y: 4.5904% (down 26.9 bp)

- 5Y: 3.9683% (down 27.9 bp)

- 7Y: 3.8643% (down 27.7 bp)

- 10Y: 3.7026% (down 25.4 bp)

- 30Y: 3.7101% (down 16.6 bp)

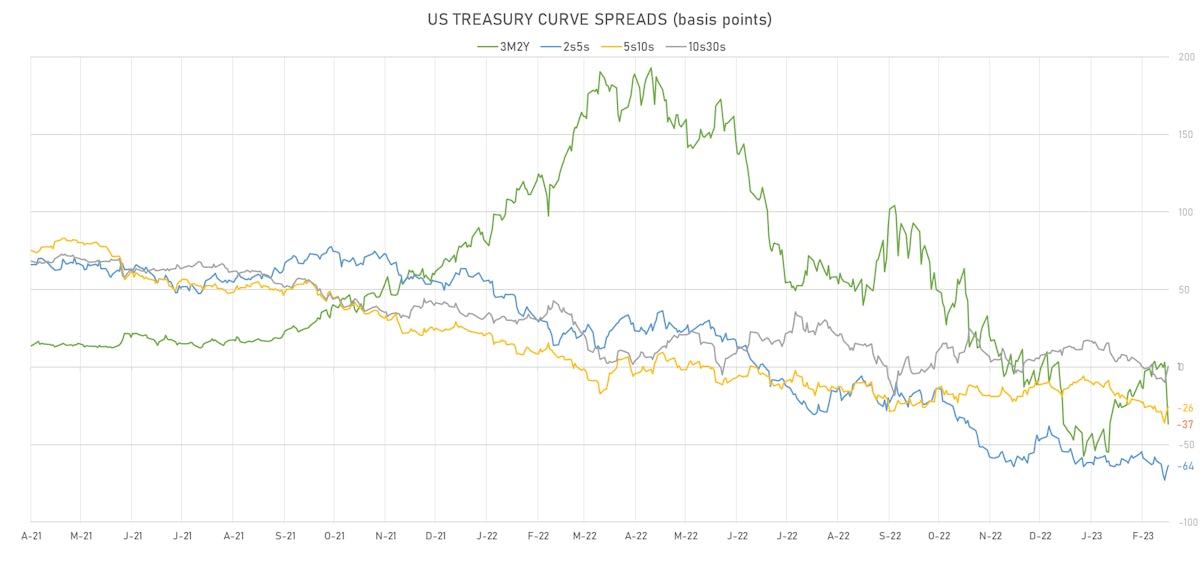

- US treasury curve spreads: 3m2Y at -36.2bp (down -34.8bp this week), 2s5s at -62.2bp (down -1.0bp), 5s10s at -26.6bp (up 2.2bp), 10s30s at 0.8bp (up 8.6bp)

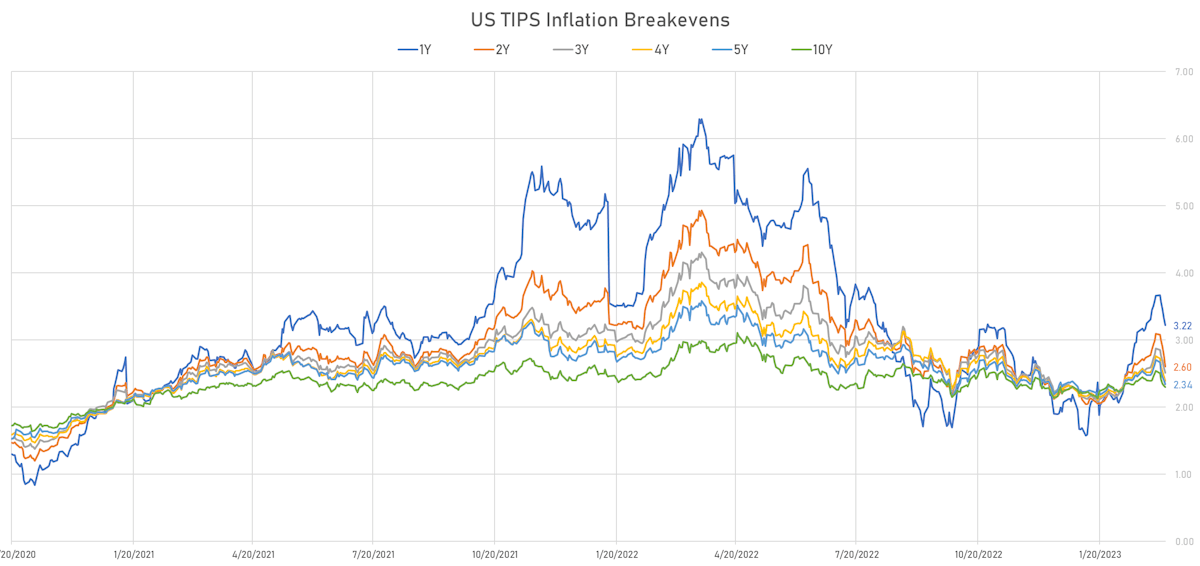

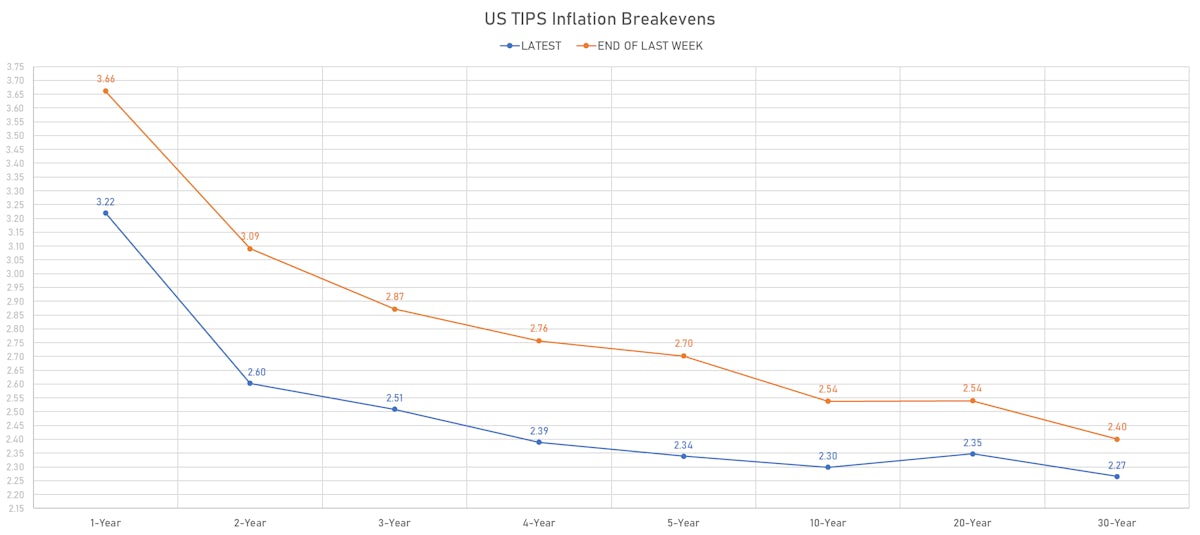

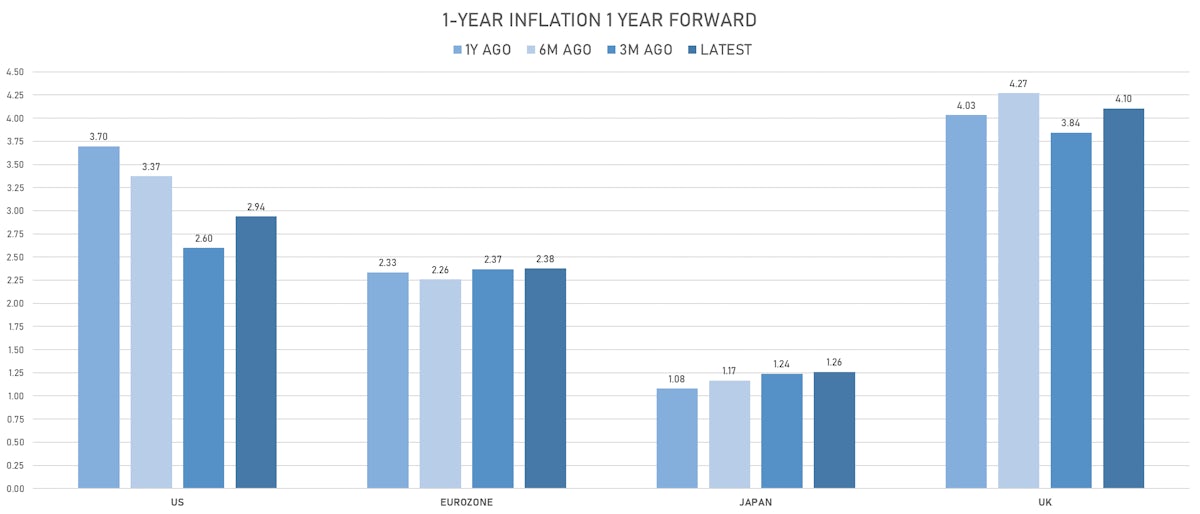

- TIPS 1Y breakeven inflation at 3.22% (down -44.2bp); 2Y at 2.60% (down -48.7bp); 5Y at 2.34% (down -36.3bp); 10Y at 2.30% (down -23.8bp); 30Y at 2.27% (down -13.5bp)

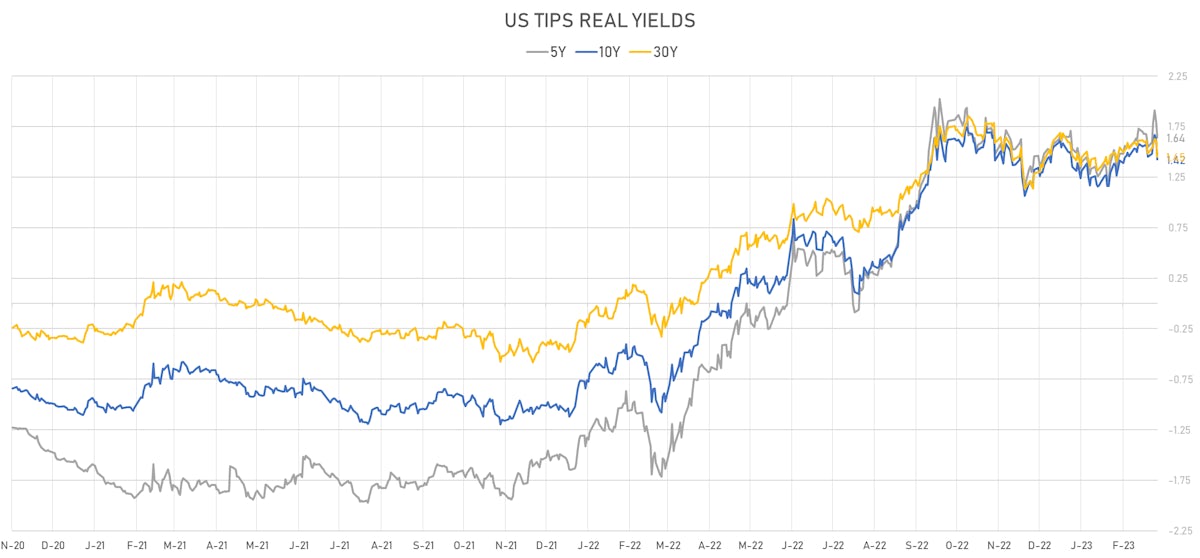

- US 5-Year TIPS Real Yield: +9.0 bp at 1.6410%; 10-Year TIPS Real Yield: -2.5 bp at 1.4240%; 30-Year TIPS Real Yield: -3.1 bp at 1.4510%

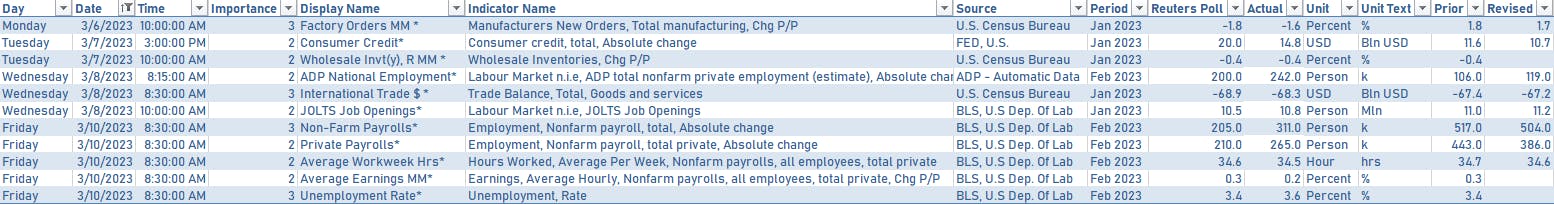

US ECONOMIC RELEASES OVER THE PAST WEEK

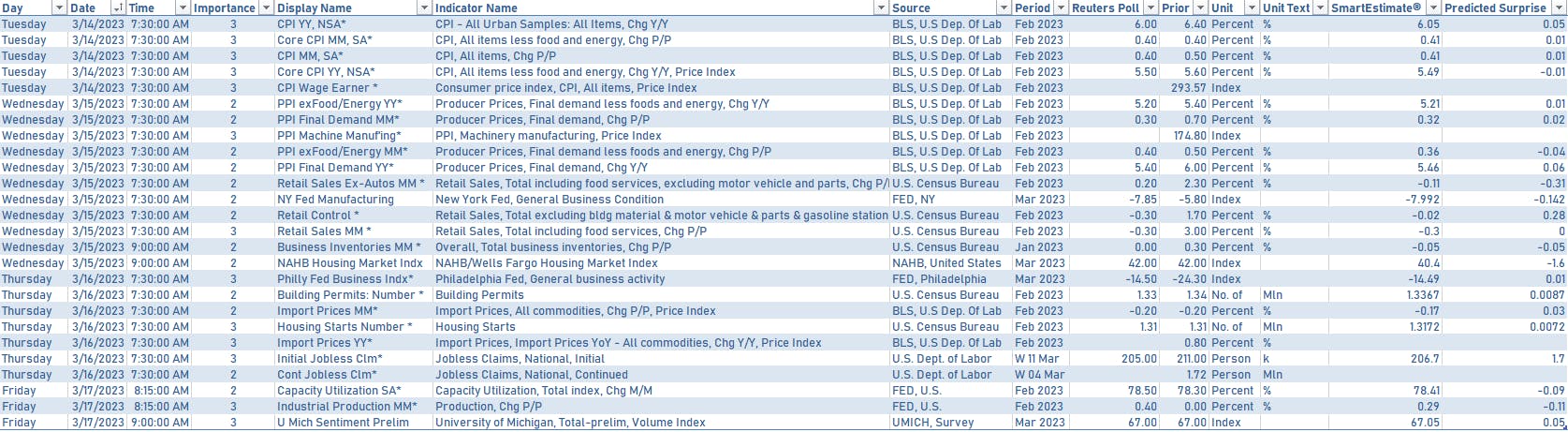

US ECONOMIC DATA IN THE WEEK AHEAD

- The focus next week will be on the February CPI, retail sales, IP, housing starts, and on March UMich sentiment.

US FORWARD RATES

- Fed Funds futures now price in 32.1bp of Fed hikes by the end of March 2023, 58.7bp (2.3 x 25bp hikes) by the end of May 2023, and a total of 2.9 hikes by the end of June 2023

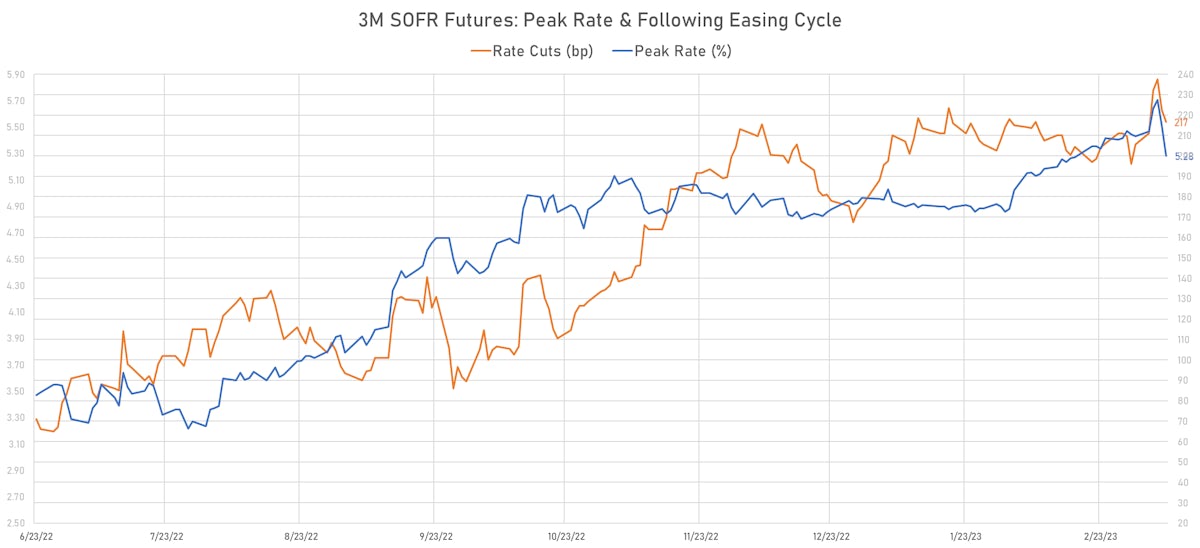

- Implied yields on 3-month SOFR futures top out at 5.29% for the September 2023 expiry and price in 218bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.22% (down -10.5bp); 2Y at 2.60% (down -16.8bp); 5Y at 2.34% (down -6.5bp); 10Y at 2.30% (down -2.1bp); 30Y at 2.27% (up 1.5bp)

- 6-month spot US CPI swap up 50.1 bp to 2.961%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.6410%, -15.1 bp today; 10Y at 1.4240%, -19.1 bp today; 30Y at 1.4510%, -16.0 bp today

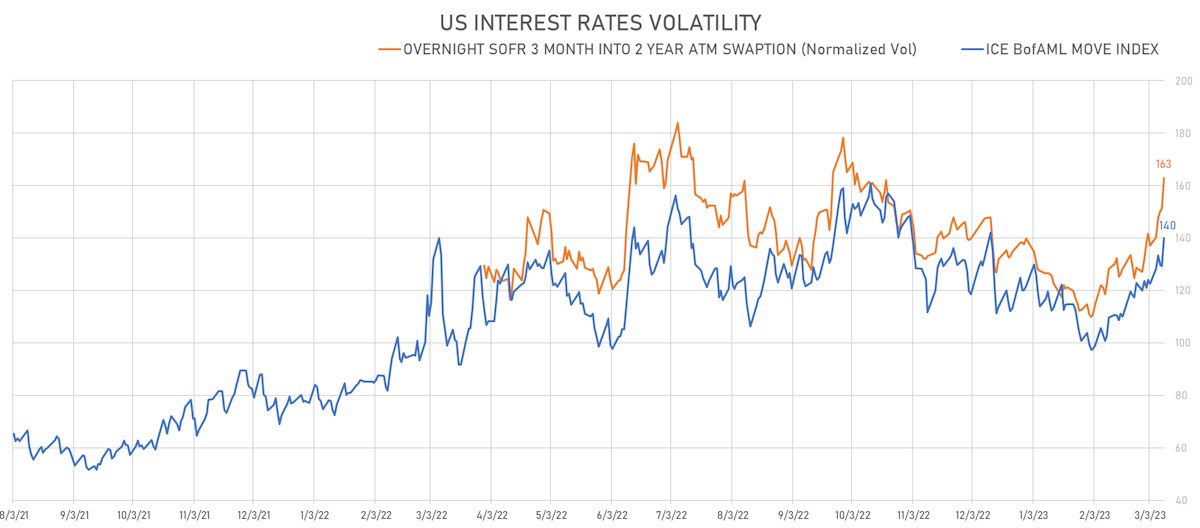

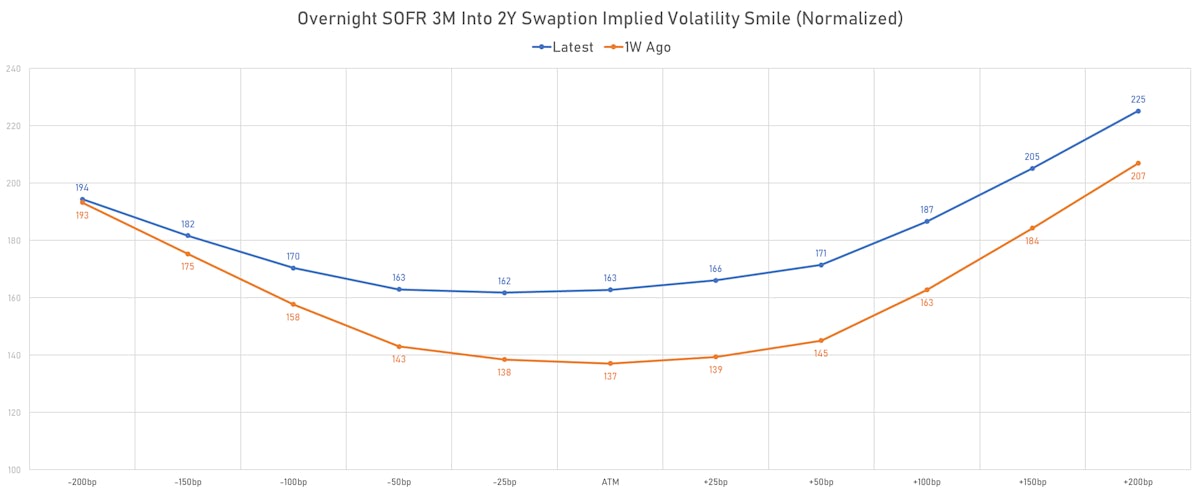

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 19.3 vols at 130.7 normals

- 3-Month LIBOR-OIS spread up 8.5 bp at 12.5 bp (18-months range: -11.3 to 39.3 bp)

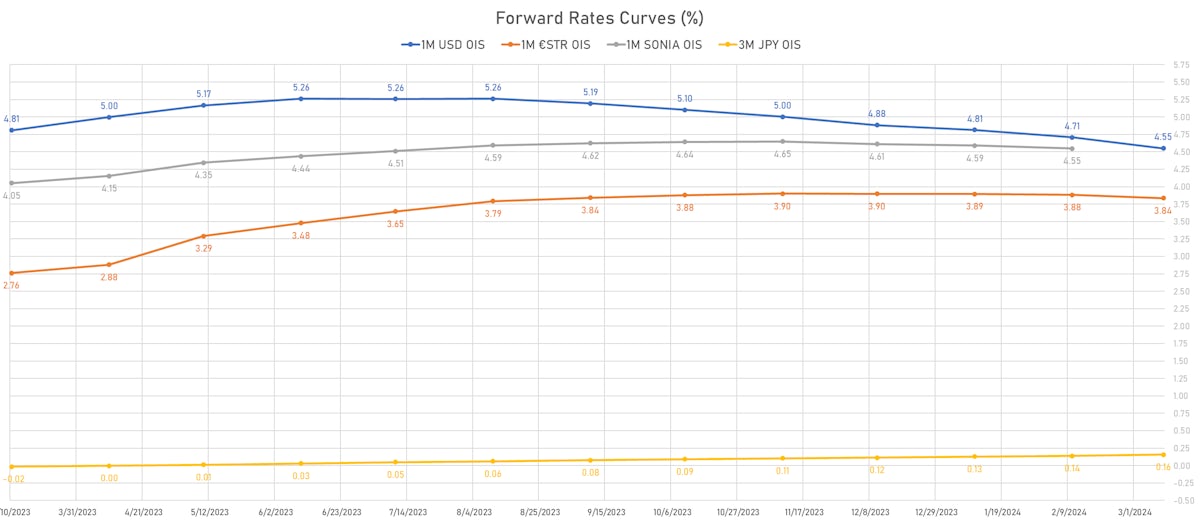

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.600% (down -17.2 bp); the German 1Y-10Y curve is 2.3 bp flatter at -76.1bp (YTD change: -71.3 bp)

- Japan 5Y: 0.201% (down -3.4 bp); the Japanese 1Y-10Y curve is 9.0 bp flatter at 49.4bp (YTD change: +6.7 bp)

- China 5Y: 2.695% (down -1.0 bp); the Chinese 1Y-10Y curve is 0.7 bp steeper at 64.5bp (YTD change: -9.1 bp)

- Switzerland 5Y: 1.472% (down -6.1 bp); the Swiss 1Y-10Y curve is 8.3 bp flatter at -60.0bp (YTD change: -75.3 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

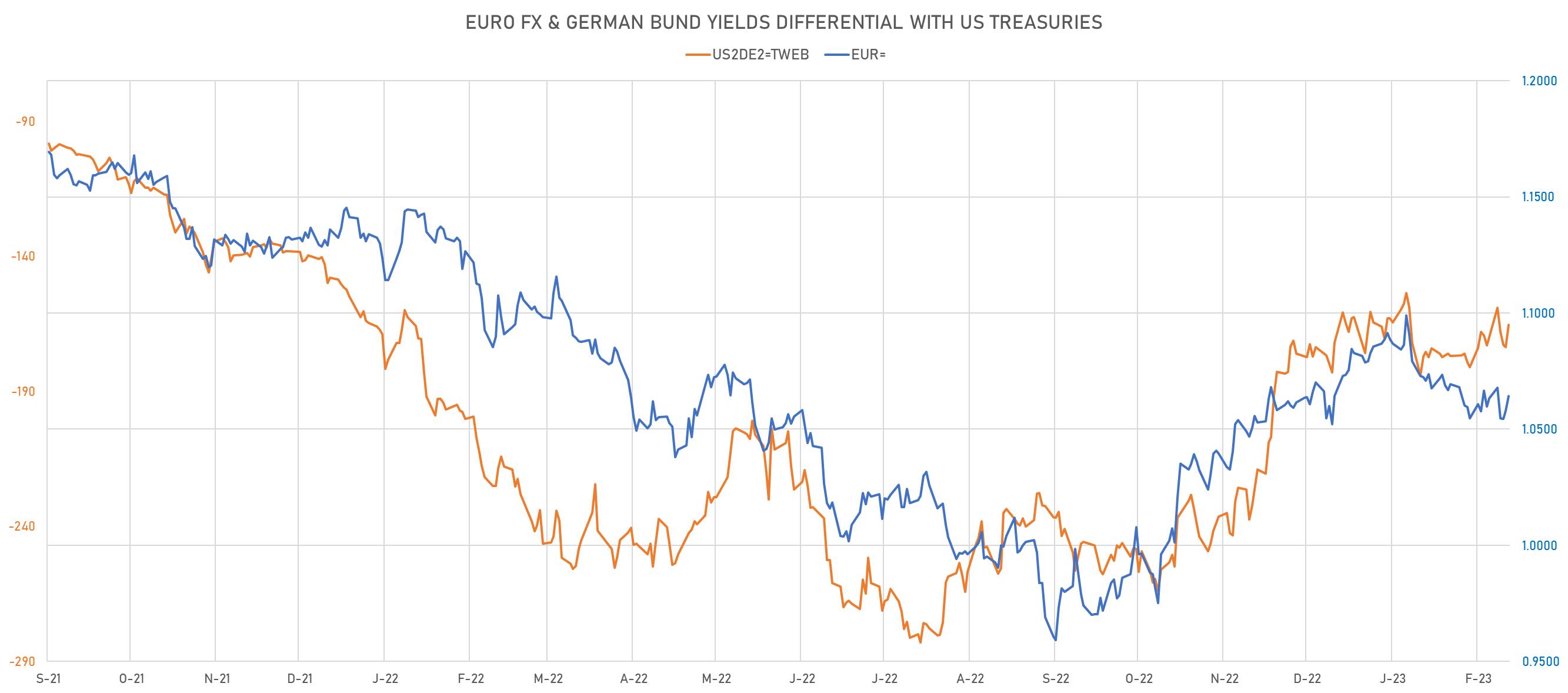

- US-GERMANY: -8.3 bp at 165.4 bp (Weekly change: -4.6 bp; YTD change: -8.2 bp)

- US-JAPAN: -30.5 bp at 466.5 bp (Weekly change: -25.6 bp; YTD change: +27.2 bp)

- US-CHINA: -25.2 bp at 219.0 bp (Weekly change: -23.6 bp; YTD change: +0.7 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -8.8 bp at 136.8 bp (Weekly change: -5.8bp; YTD change: +8.0bp)

- US-JAPAN: -13.7 bp at 161.5 bp (Weekly change: -1.9bp; YTD change: -42.4bp)

- GERMANY-JAPAN: -4.9 bp at 24.7 bp (Weekly change: +3.9bp; YTD change: -50.4bp)