Rates

Crazily Volatile Week For Rates, US Money Markets Now Price In More Than 3 Rate Cuts Through Year End

Regardless of whether the FOMC results in a 25bp hike or no hike, clarity of purpose will be critical as the Fed fights to restore confidence in the regional banking sector

Published ET

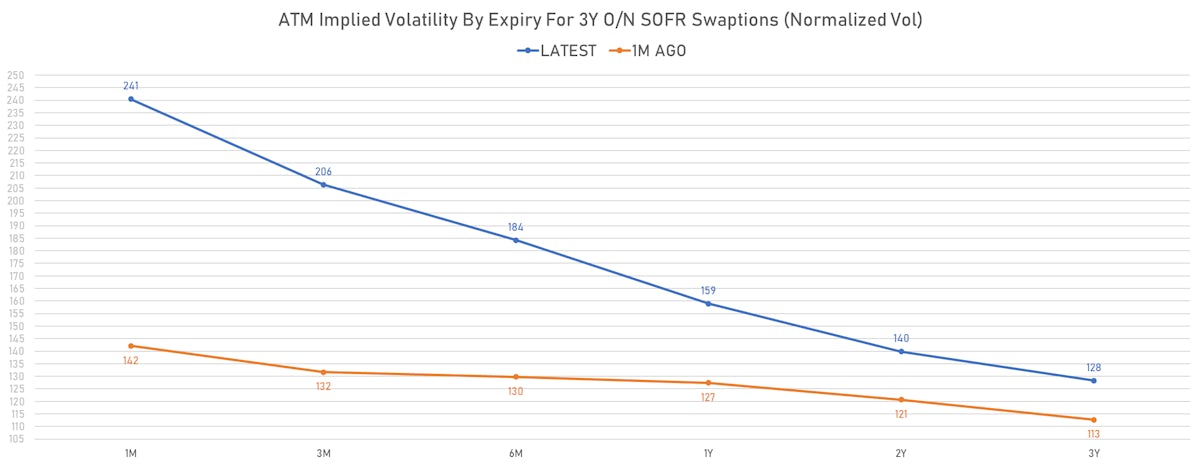

USD 1 Month Into 1Y ATM Swaption Implied Volatility (Normalized) | Source: Refinitiv

US RATES OUTLOOK AND MARCH 2023 FOMC PREVIEW

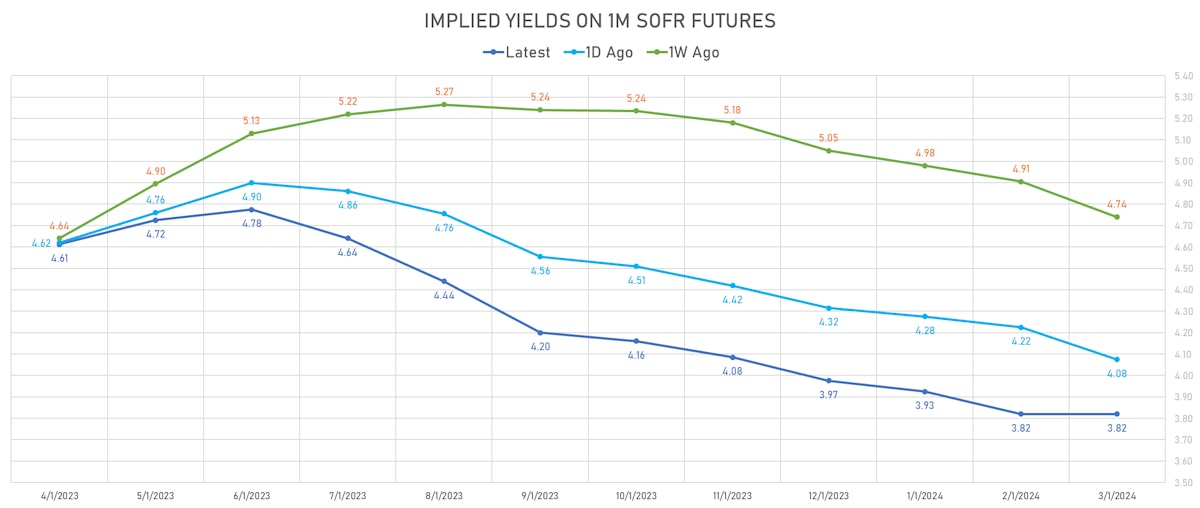

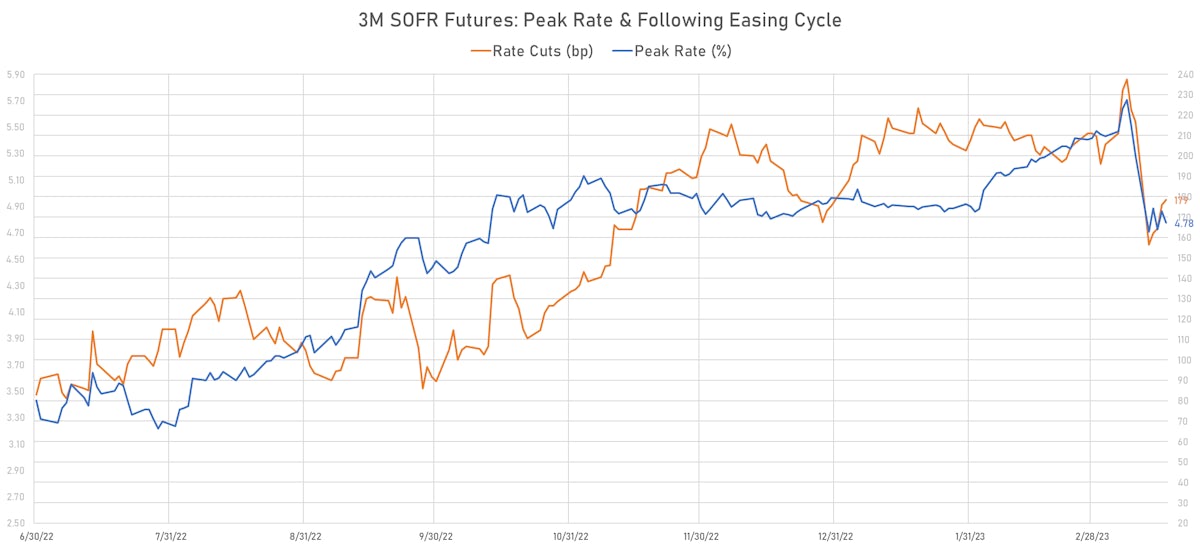

- Considering the current level of inflation (and the Fed's own outlook regarding inflation) the front end now looks much too dovish to us: 15bp priced for the March FOMC, 6bp for the May FOMC, for a peak Fed Funds rate of 4.78% (vs 5.69% 10 days ago)

- Rate cuts are then priced to start in June, with ~95bp of cuts priced from the peak into year end

- It's worth adding that the policy easing priced into forward rates is a reflection of shrinking growth expectations (rather than anyone thinking it could help regional banks)

- Many market participants were surprised to see how much the Fed's balance sheet has grown over the past week (reserves balances at the Fed had gone up by ~$441bn on Wednesday night)

- The Fed finds itself in a more difficult position, as it needs to explain that raising rates is the right tool against inflation while balance sheet operations are a better way to help the liquidity of banks

- Further, they should worry that pausing might be seen as a sign of potentially more undisclosed banking issues: the Fed has a lot more information than the market when it comes to bank deposits, funding, etc. So they should be careful not to make markets infer further weakness. It's not going to be easy, there will be enormous pressure for them to pause, especially if other regional banks are downgraded to junk at the start of the week.

- Our take on the FOMC: if Powell had a problem with current market pricing, he would have leaked something to the WSJ. In other words, we expect to see a 25bp hike this week.

- In addition, Powell will need to articulate very clearly how / why financial stability and monetary policy require different tools working together.

- Below is a summary of views from different brokers: GS and WFC both forecast the Fed will skip this meeting and resume hiking in May. Jefferies thinks they should and will keep hiking by 25bp next week.

- GS: "Our economists have adjusted their outlook for Fed policy and economic growth similar to equity market pricing. They estimate a pullback in lending will trim 2023 real US GDP growth by 0.3 pp to a Q4/Q4 rate of 1.2%. The probability of recession during the next 12 months has risen to 35% (from 25%). Our economists expect the Fed will pause at next week’s meeting but still forecast a peak funds rate of 5.25%-5.5%."

- Wells Fargo: "In isolation, the recent economic data are supportive of further tightening at the March 22 FOMC meeting. However, recent developments in the financial system have clouded the outlook to a considerable degree. Financial conditions tightened abruptly following the failures of Silicon Valley Bank (SVB) and Signature Bank on March 10 and 12, respectively. Financial markets have been highly volatile but clearly have reduced the amount of anticipated policy tightening by the Federal Reserve. Further hiking the fed funds rate would be a crystal-clear signal of the FOMC's commitment to reducing inflation while also displaying confidence in the measures put in place to stem recent financial market stress. However, the dust is still settling from the nation's second and third largest bank failures in history. We look for the FOMC to briefly pause its tightening efforts to ensure the situation is under control. In our view, the last thing the FOMC wants is more financial instability that threatens the banking system and forestalls any additional rate hikes down the road. But, neither a hike nor a pause would surprise us. If, as we anticipate, the FOMC opts to hold the fed funds rate at 4.50-4.75% at next week's meeting, it could use the "dot plot" to clearly signal that the tightening cycle is unlikely to be over just yet. Between the economic data's recent strength and the presumption that efforts to stem stress in the financial system will be effective, we expect the median dot for 2023 to move up 25 bps to a range of 5.25-5.50%."

- Scotiabank: "On the future guidance, the FOMC may not go as high with revised terminal rate projections in next week’s dot plot as they would have otherwise, but it would be a misstep in my opinion for them to signal panic and abandon the fight against inflation at the first whiff of trouble. Trouble that is being contained. They can work caution into the bias by not going as high on the terminal rate given a rate equivalence to tightened financial conditions and signal that it’s just a dot plot, but that they will take all decisions meeting-by-meeting while monitoring conditions. Chair Powell needs to be a steady hand on the tiller and resist the flightiness that has characterized some market voices. It’s not a shoe-in call, but I’ll be disappointed in the Chair if he caves"

- Jefferies: "We continue to expect that the FOMC will raise the fed funds target range by 25 bps when they meet on Wednesday this week. We do not think that the instability in financial markets justifies a pause when weighed against the risk that the Fed loses their credibility in fighting inflation, for which they worked so hard to regain. In our view, the idea of a pause to help stabilize what is happening in the regional banking sector doesn't make much sense. If the Fed wanted to use interest rates as a tool to help the regional banks, it would require them to completely abandon their fight against inflation and cut rates 200-300 bps. That simply isn't going to happen until there is evidence that stress is spilling over into the real economy and inflationary dynamics have reversed course. The actions taken by the Fed show that they intend to use the balance sheet to help support the banking system rather than rate hikes, allowing them to provide targeted credit to the institutions that need it the most. The Fed has shown that they see very different macroeconomic risks vs financial system operational risks in using their different tools to address each. If pausing won't help the banks, then the Fed should continue its fight against inflation with another rate hike. The recent data shows that there is still too much pressure in core non-housing service inflation, and it won't go away on its own."

WEEKLY US RATES SUMMARY

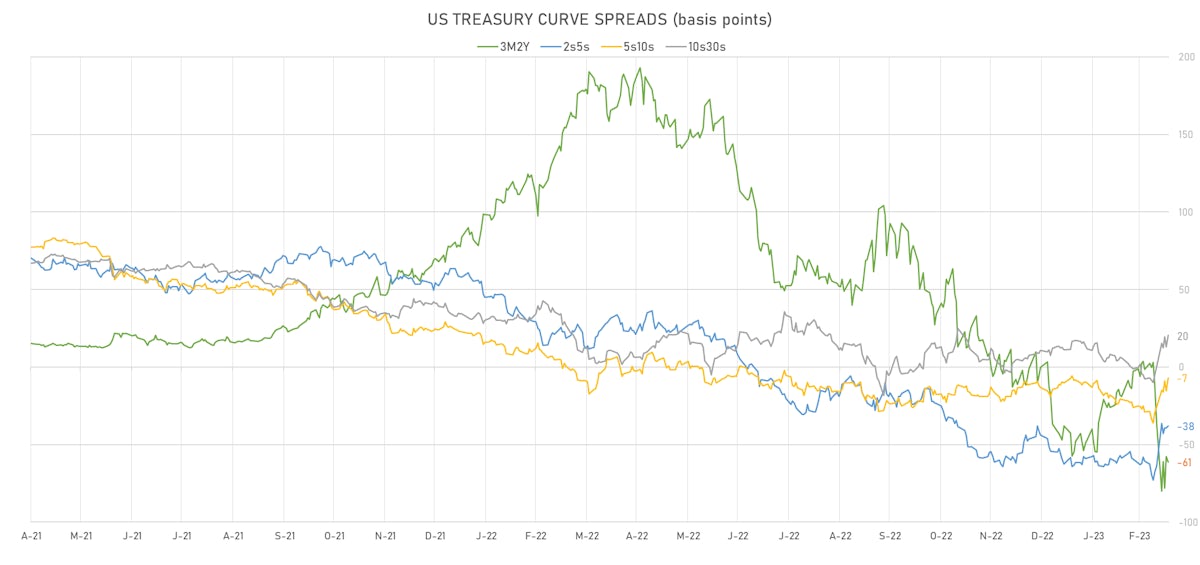

- The treasury yield curve steepened, with the 1s10s spread widening 36.7 bp, now at -79.0 bp (YTD change: +4.3bp)

- 1Y: 4.2265% (down 63.3 bp)

- 2Y: 3.8427% (down 74.8 bp)

- 5Y: 3.5062% (down 46.2 bp)

- 7Y: 3.5024% (down 36.2 bp)

- 10Y: 3.4361% (down 26.7 bp)

- 30Y: 3.6231% (down 8.7 bp)

- US treasury curve spreads: 3m2Y at -62.7bp (down -26.5bp this week), 2s5s at -33.7bp (up 27.9bp), 5s10s at -7.0bp (up 19.9bp), 10s30s at 18.7bp (up 18.0bp)

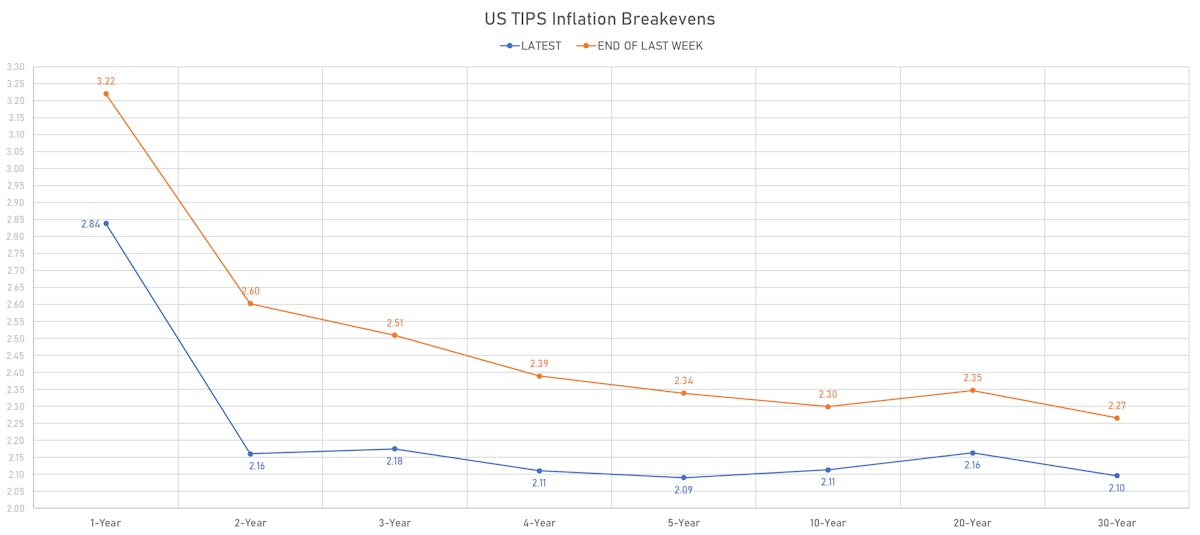

- TIPS 1Y breakeven inflation at 2.84% (down -38.2bp); 2Y at 2.16% (down -44.2bp); 5Y at 2.09% (down -24.9bp); 10Y at 2.11% (down -18.6bp); 30Y at 2.10% (down -17.0bp)

- US 5-Year TIPS Real Yield: -22.0 bp at 1.4210%; 10-Year TIPS Real Yield: -7.5 bp at 1.3490%; 30-Year TIPS Real Yield: +10.1 bp at 1.5520%

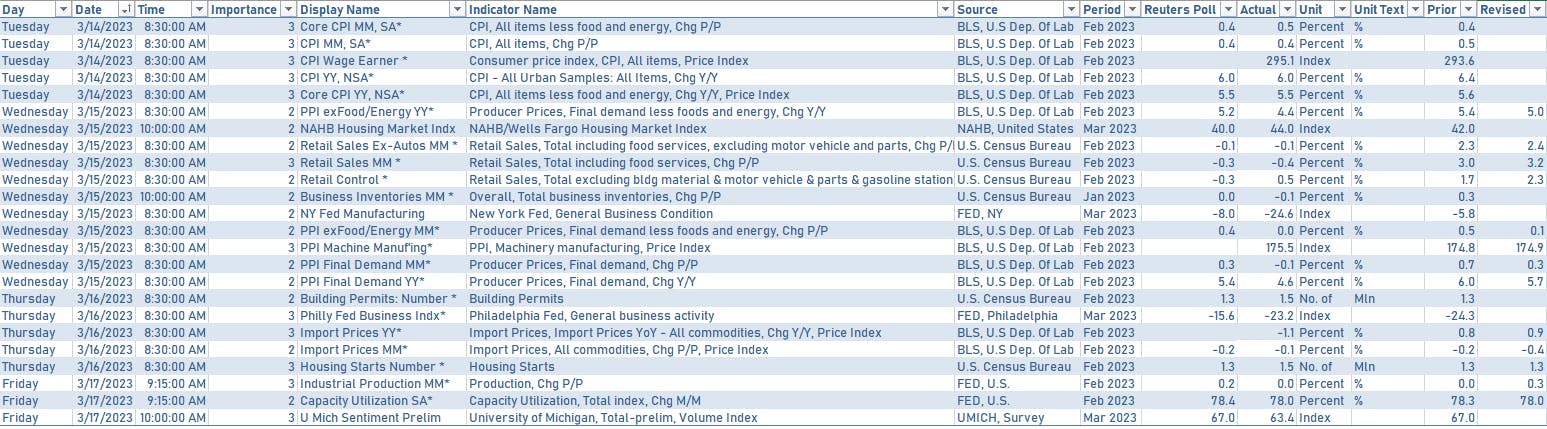

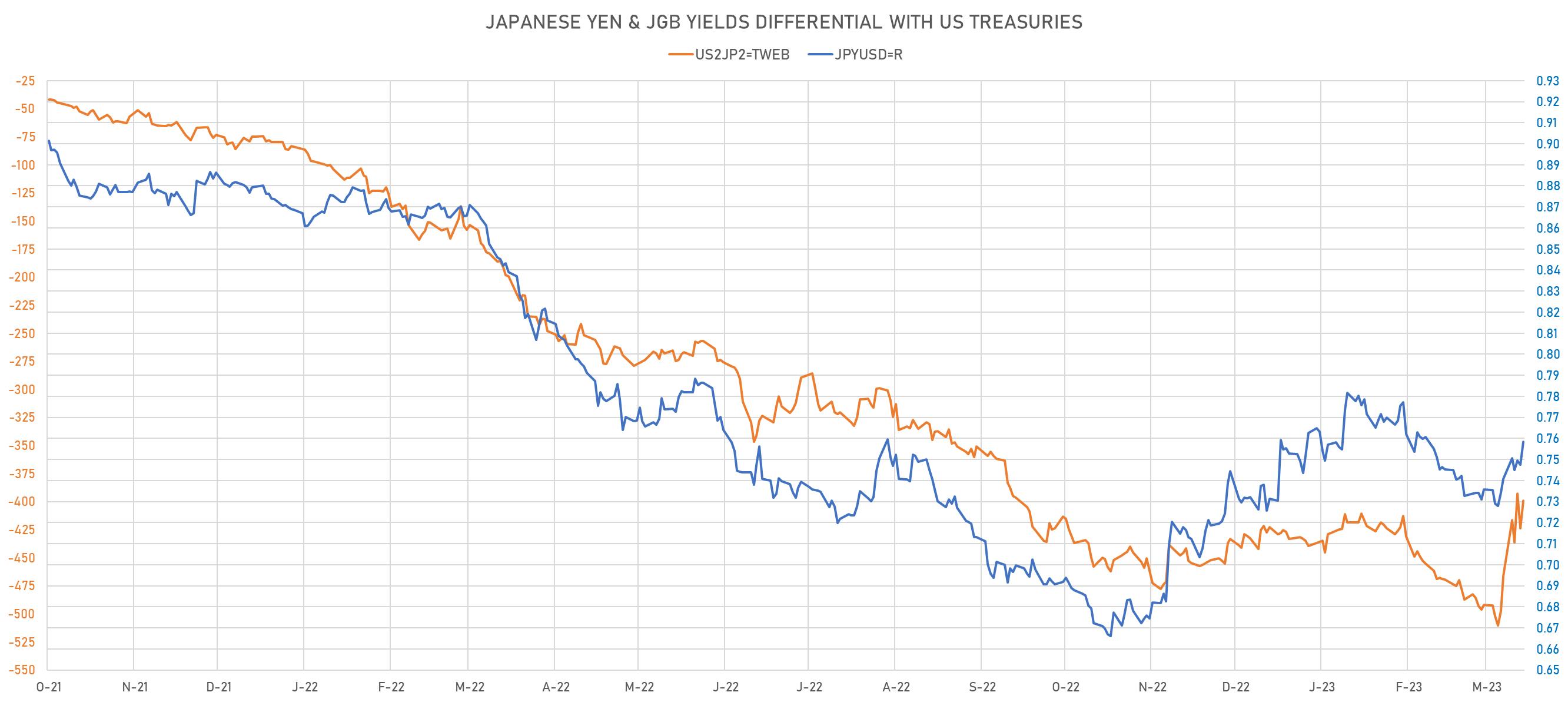

US ECONOMIC RELEASES OVER THE PAST WEEK

US ECONOMIC DATA IN THE WEEK AHEAD

- Not a heavyweight week in terms of data, but home sales and flash PMIs will be worth watching

US TREASURY AUCTIONS IN THE WEEK AHEAD

- Tuesday at 1:00PM: $12bn in 20Y bonds

- Thursday at 1:00PM: $15bn in 10Y TIPS

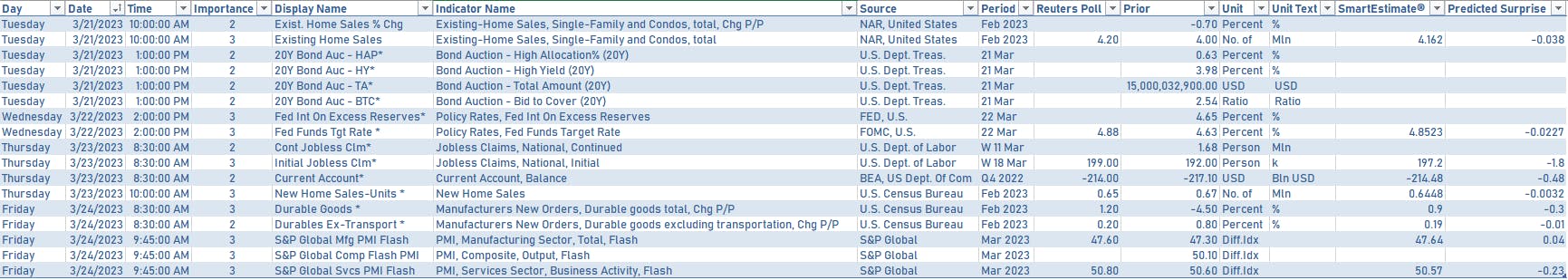

RATES POSITIONING IN FUTURES MARKETS

US FORWARD RATES

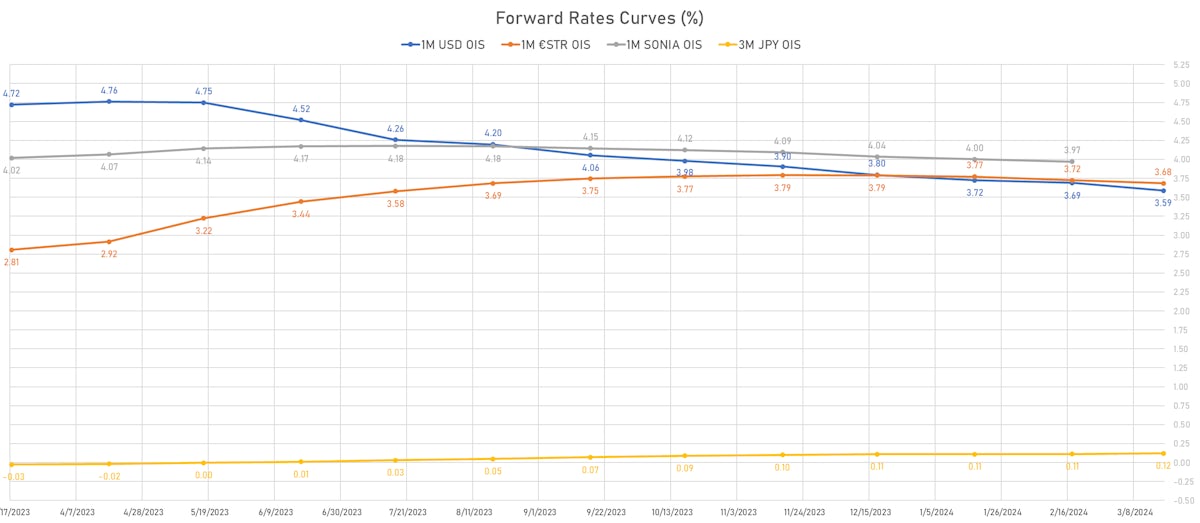

- Fed Funds futures now price in 15.0bp of Fed hikes by the end of March 2023, 21.3bp (0.9 x 25bp hikes) by the end of May 2023, and -0.3 hikes by the end of June 2023

- Implied yields on 3-month SOFR futures top out at 4.77% for the June 2023 expiry and price in 178bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.84% (down -21.7bp); 2Y at 2.16% (down -27.7bp); 5Y at 2.09% (down -16.0bp); 10Y at 2.11% (down -12.5bp); 30Y at 2.10% (down -11.5bp)

- 6-month spot US CPI swap up 0.9 bp to 2.142%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.4210%, -6.6 bp today; 10Y at 1.3490%, -1.4 bp today; 30Y at 1.5520%, +4.6 bp today

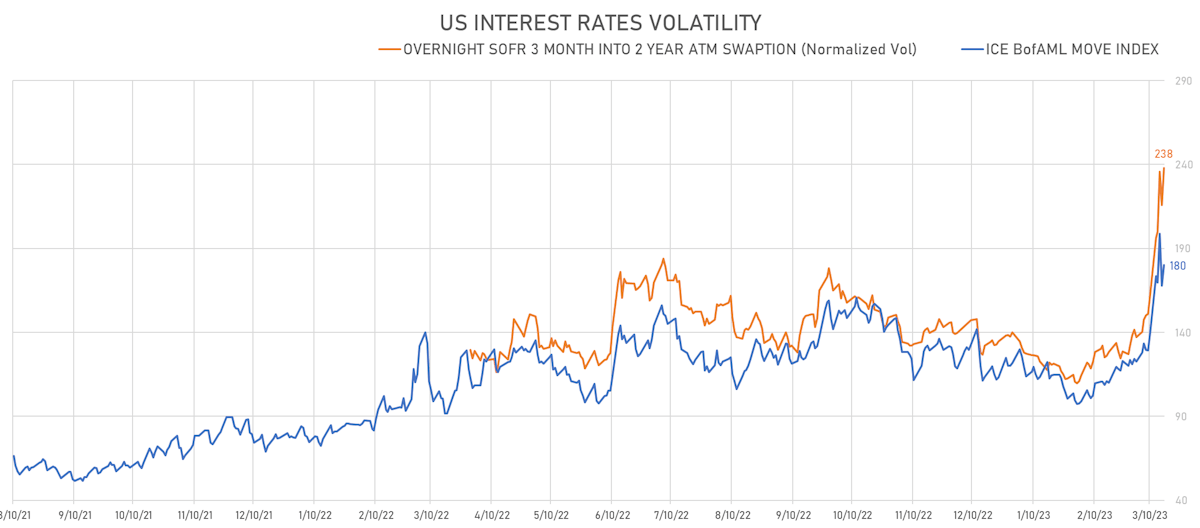

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month into 1 Year ATM Swaption) up 37.8 vols at 299.0 normals

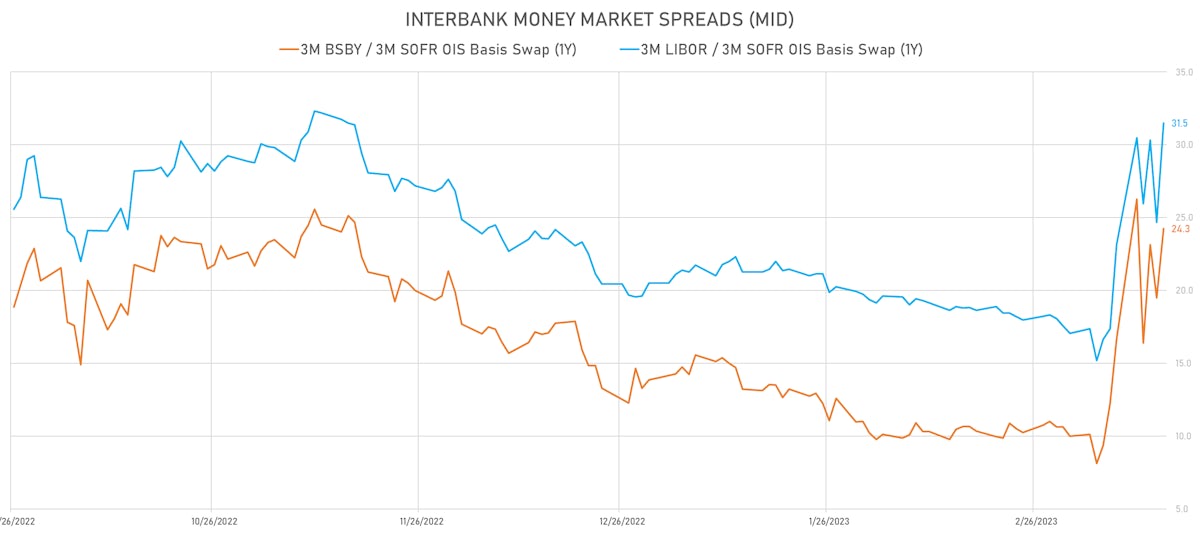

- 3-Month LIBOR-OIS spread up 15.6 bp at 24.8 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.087% (down -14.5 bp); the German 1Y-10Y curve is 8.2 bp flatter at -63.8bp (YTD change: -56.4 bp)

- Japan 5Y: 0.104% (down -0.4 bp); the Japanese 1Y-10Y curve is 1.7 bp steeper at 43.0bp (YTD change: +0.6 bp)

- China 5Y: 2.680% (unchanged); the Chinese 1Y-10Y curve is 3.4 bp steeper at 66.2bp (YTD change: -7.4 bp)

- Switzerland 5Y: 0.998% (down -7.9 bp); the Swiss 1Y-10Y curve is 18.2 bp flatter at -53.3bp (YTD change: -60.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: unchanged at 160.9 bp (Weekly change: -4.5 bp; YTD change: -12.7 bp)

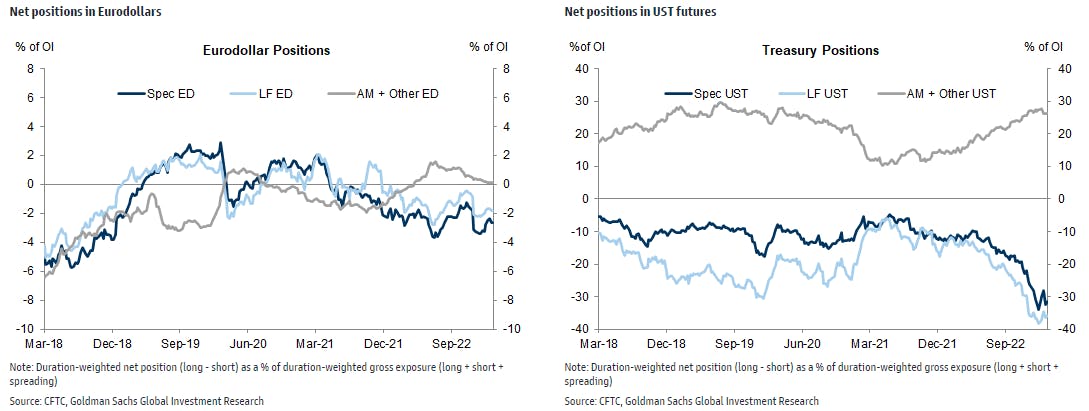

- US-JAPAN: -24.7 bp at 398.9 bp (Weekly change: -67.6 bp; YTD change: -40.4 bp)

- US-CHINA: -31.6 bp at 146.9 bp (Weekly change: -72.1 bp; YTD change: -71.4 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +8.0 bp at 146.1 bp (Weekly change: +9.3bp; YTD change: +17.3bp)

- US-JAPAN: -1.3 bp at 172.6 bp (Weekly change: +11.1bp; YTD change: -31.3bp)

- GERMANY-JAPAN: -9.3 bp at 26.5 bp (Weekly change: +1.8bp; YTD change: -48.6bp)