Rates

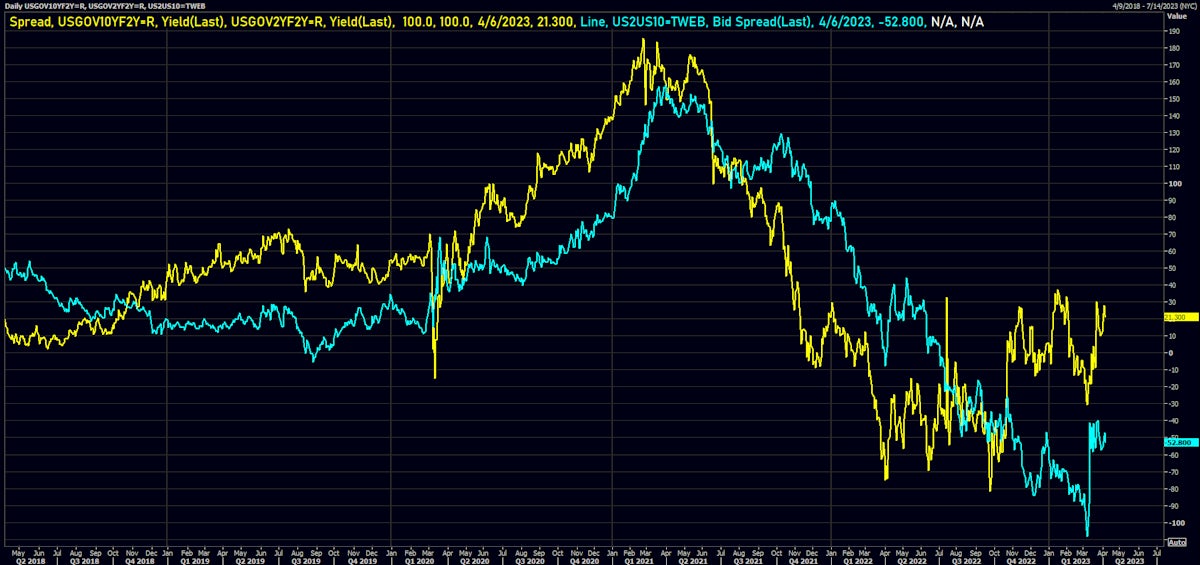

US Front-End Inversion Deepens As Rates Expectations For May And June FOMCs Firm Up

After a quiet holiday week, it will be interesting to see whether the Treasury market returns to more normal liquidity and pricing, with volumes likely to rise into the latest CPI print on Wednesday

Published ET

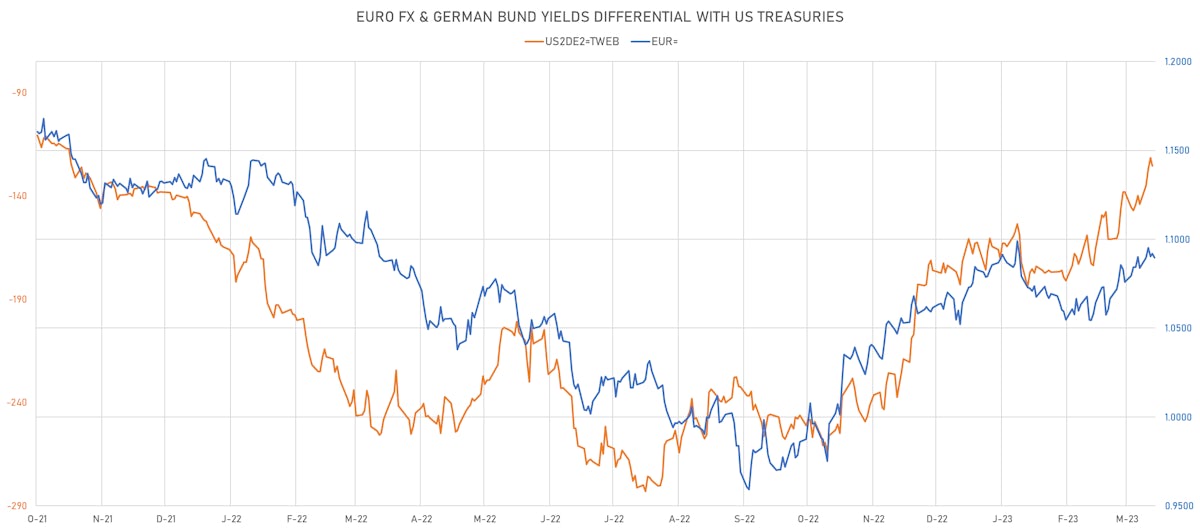

US Treasuries 2s10s Spread: Spot vs 2Y forward | Source: Refinitiv

US RATES OUTLOOK AHEAD OF MARCH CPI

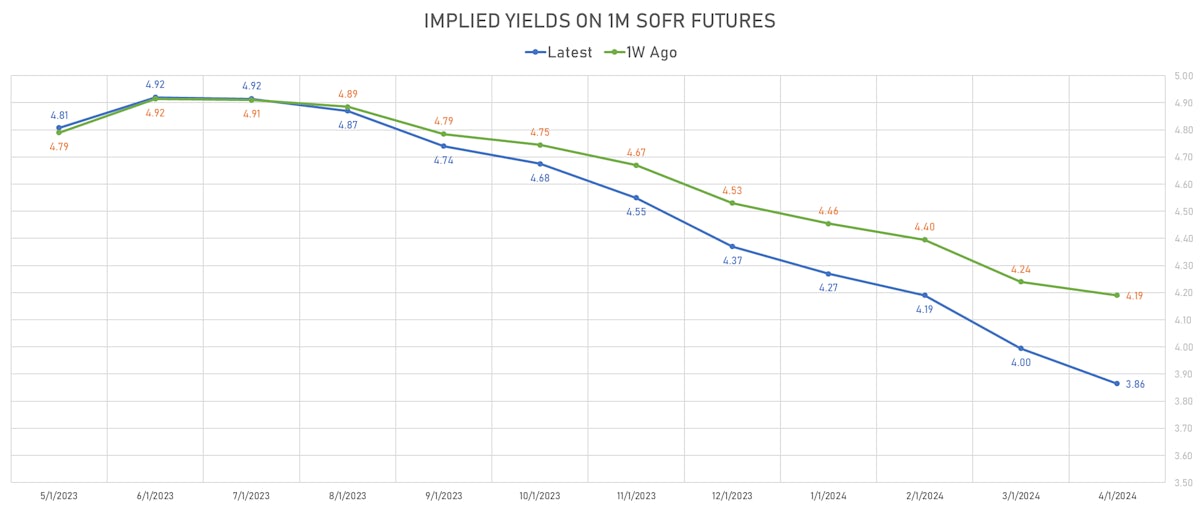

- The peak Fed Funds rate is now 5.00%, pricing in 70% probability of a 25bp hike at the next FOMC (about 18bp), followed by a hold in June

- US rates saw big moves again this week, amplified by the holiday-thinned volumes. Top of book liquidity and bid-ask spreads have normalized, but remain high: for 2Y treasury notes futures, the weekly bid-ask spread is now around the 75th percentile over the past year.

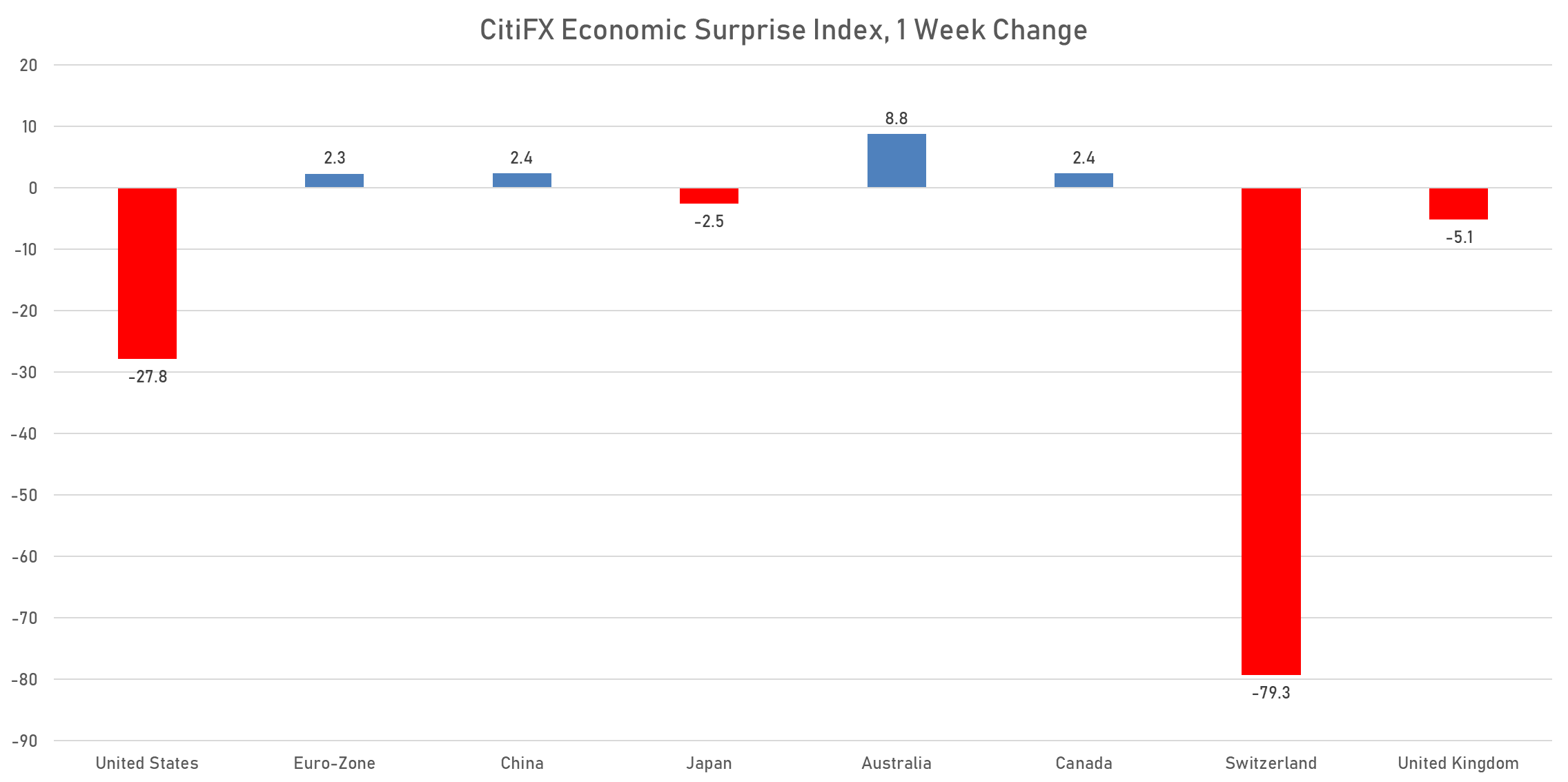

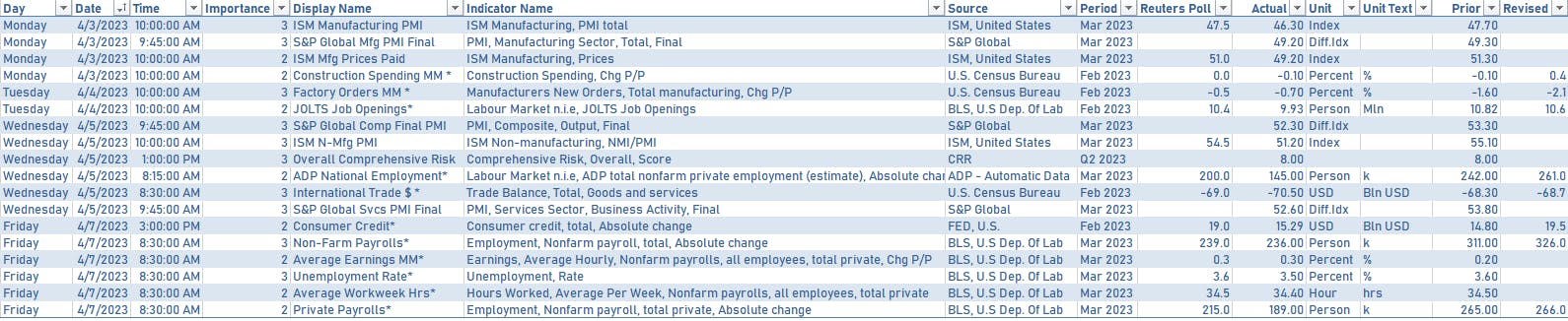

- The latest US data has mostly surprised on the weak side, thereby justifying the 3 rate cuts priced into year end (-75bp from the peak)

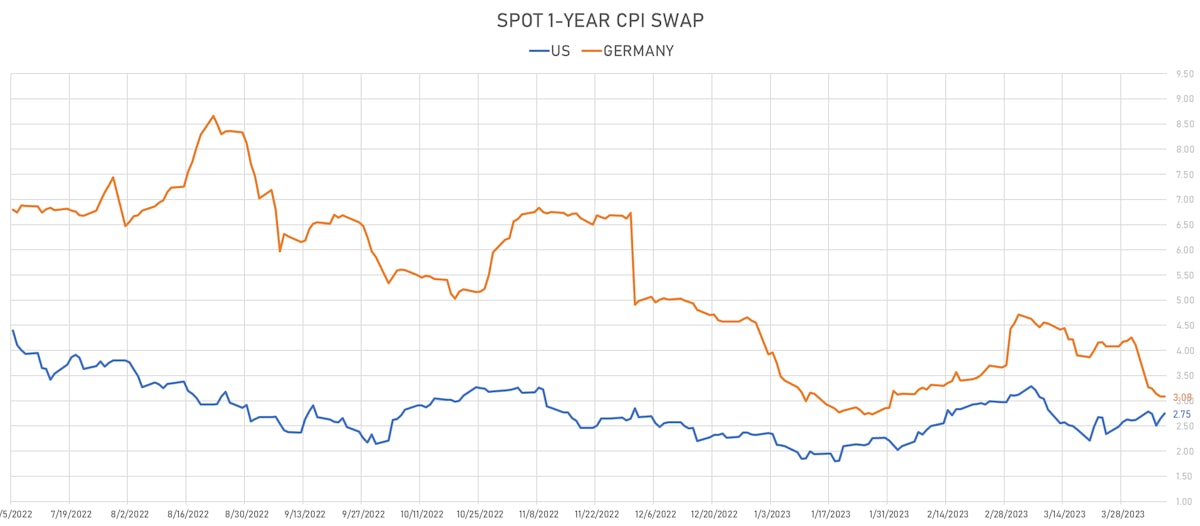

- It will be key to see whether the core services CPI starts moderating. The latest employment report showed some signs of cooling (in a still very tight labor market)

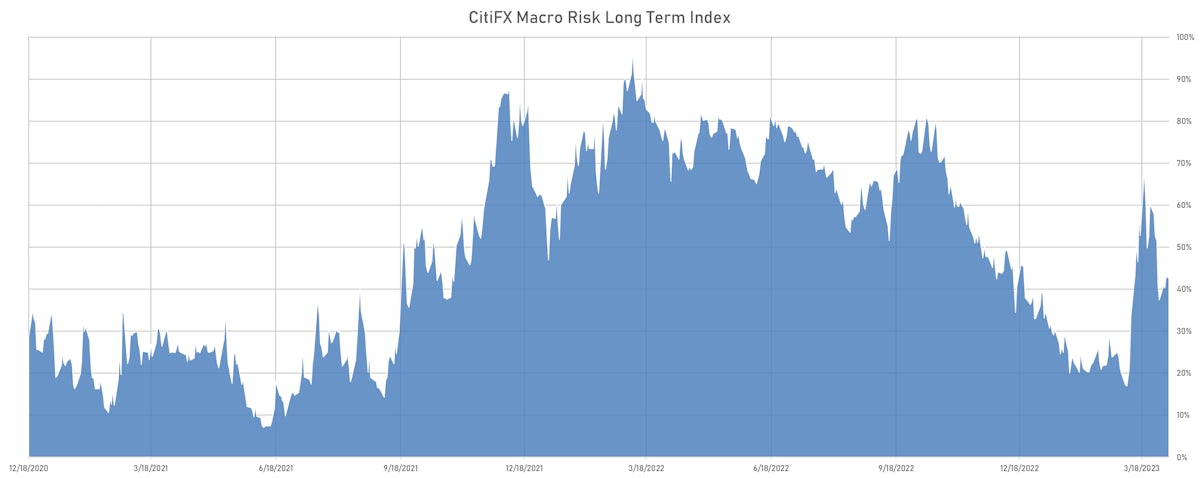

- We're of the view that Fed will likely hike at least once more: unless more problems emerge from the regional banking sector, the risk-on sentiment gives the Fed a green light to keep going

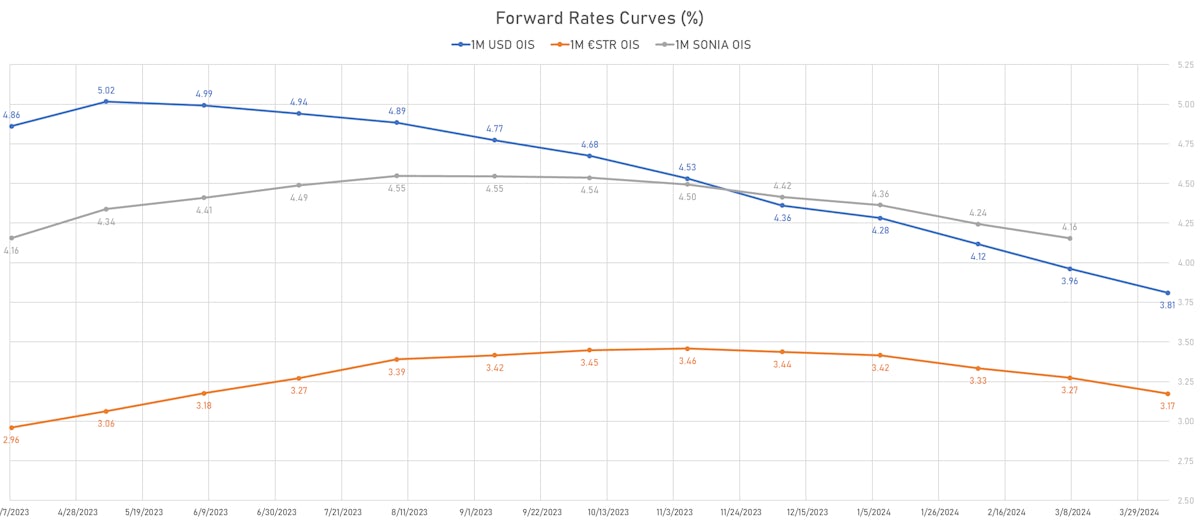

- The forward curve is pricing in close to 3 rate cuts through year end (-75bp from the peak), but it's hard to see the Fed cut imminently considering the current absolute level of inflation

- Although there's not a lot of asymmetry in trading the forward STIR curve at the moment, we would be fading rate cuts at the September FOMC (-29bp priced from the peak)

- Jefferies economists: "On the whole, the employment data shows that inflation pressure remains very sticky. There is evidence that slack may be accumulating in some pockets, but not in the aggregate. Pending the CPI print next week, which we expect will continue to show uncomfortably high core inflation pressure, we expect that the Fed will raise rates by 25 bps in May to 5-5.25%. It is likely that this is going to be the final hike of the cycle, but the data needs to show more signs of weakness between now and June for the Fed to pause."

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -6.8 bp, now at -121.4 bp (YTD change: -38.0bp)

- 1Y: 4.6260% (up 0.8 bp)

- 2Y: 3.9888% (down 4.8 bp)

- 5Y: 3.5153% (down 6.7 bp)

- 7Y: 3.4648% (down 7.6 bp)

- 10Y: 3.4122% (down 6.0 bp)

- 30Y: 3.6214% (down 2.8 bp)

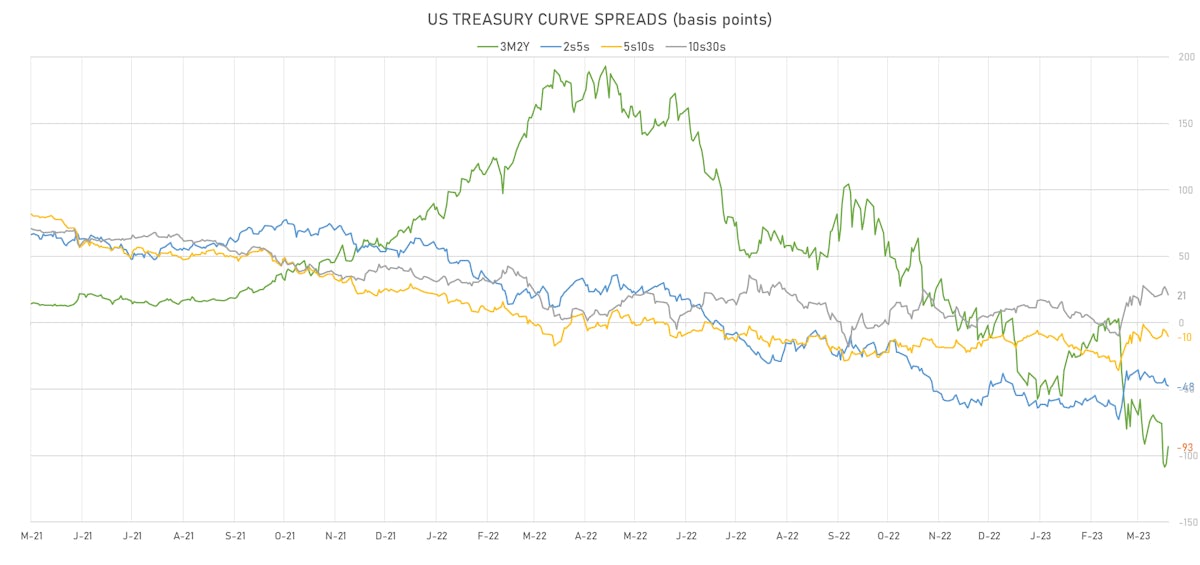

- US treasury curve spreads: 3m2Y at -104.6bp (down -30.5bp this week), 2s5s at -47.4bp (down -2.0bp), 5s10s at -10.3bp (up 6.4bp), 10s30s at 20.9bp (up 6.1bp)

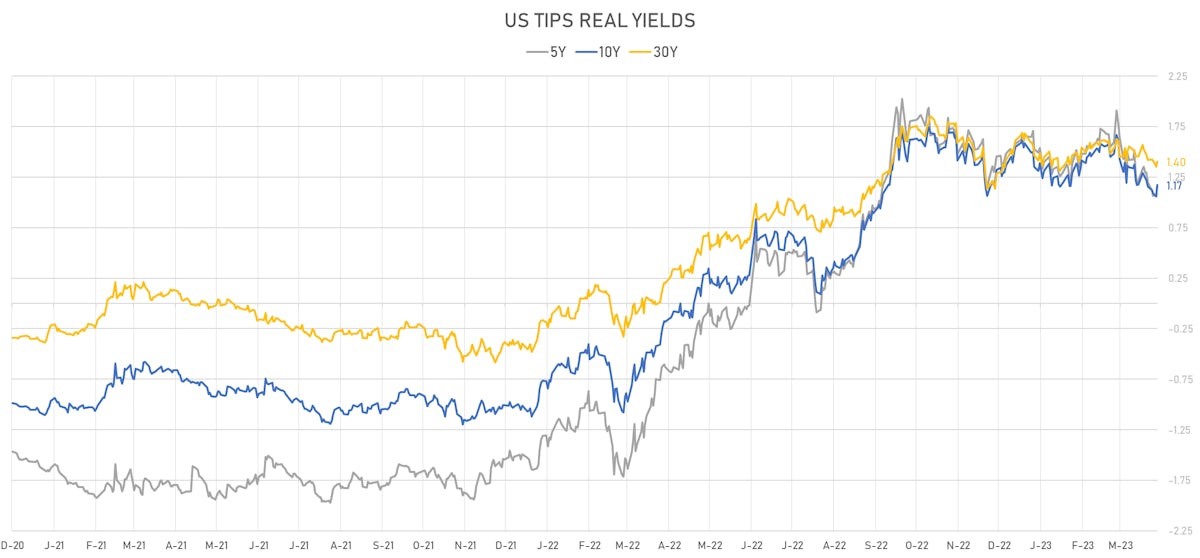

- US 5Y TIPS inflation breakeven at 2.40% down 6.9bp; 10Y breakeven at 2.26% down 5.4bp; 30Y breakeven at 2.23% down 0.7bp

- US 5-Year TIPS Real Yield: -2.3 bp at 1.1720%; 10-Year TIPS Real Yield: +1.7 bp at 1.1720%; 30-Year TIPS Real Yield: -1.7 bp at 1.4020%

US ECONOMIC DATA OVER THE PAST WEEK

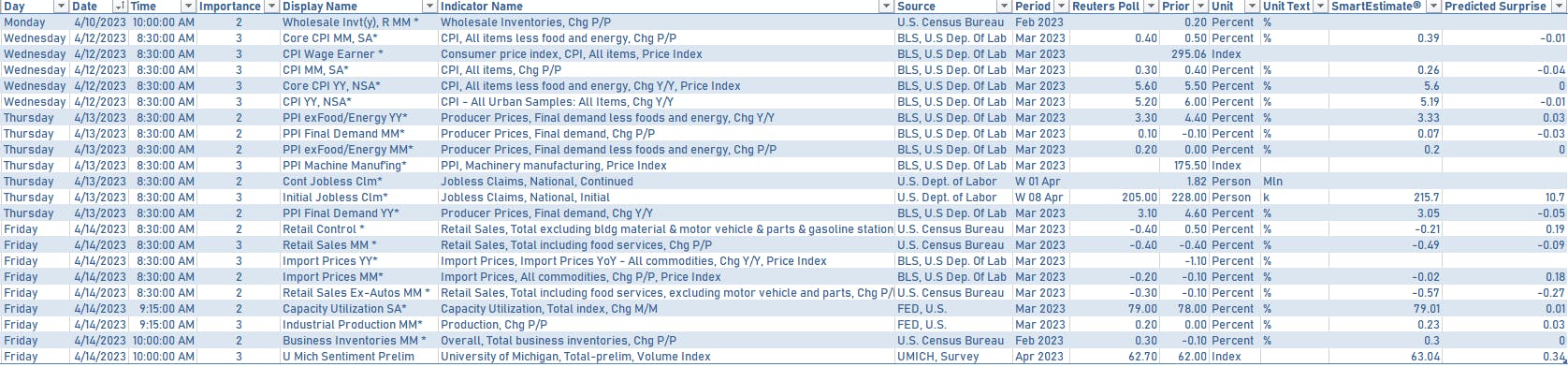

US MACRO RELEASES IN THE WEEK AHEAD

- Main focus will be on the March CPI and FOMC minutes (both on Wednesday), as well as the latest retail sales (on Friday).

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday: $43bn in 3Y notes

- Wednesday: $32bn in 10Y notes

- Thursday: $18bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- Monday 4:15PM: New York Fed President Williams

- Tuesday 1:30PM: Chicago Fed President Goolsbee

- Tuesday 6:00PM: Philadelphia Fed President Harker

- Tuesday 7:30PM: Minneapolis Fed President Kashkari

- Wednesday 9:00AM: Richmond Fed President Barkin

US FORWARD RATES

- Fed Funds futures now price in 17.6bp of Fed hikes by the end of May 2023, 17.0bp (0.7 x 25bp hikes) by the end of June 2023

- Implied yields on 3-month SOFR futures top out at 4.99% for the August 2023 expiry and price in 218bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 3.05% (down -3.0bp); 2Y at 2.56% (up 4.8bp); 5Y at 2.31% (up 1.9bp); 10Y at 2.27% (up 1.2bp); 30Y at 2.23% (up 2.8bp)

- 6-month spot US CPI swap up 8.3 bp to 2.050%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.1720%, +10.7 bp today; 10Y at 1.1720%, +11.2 bp today; 30Y at 1.4020%, +4.8 bp today

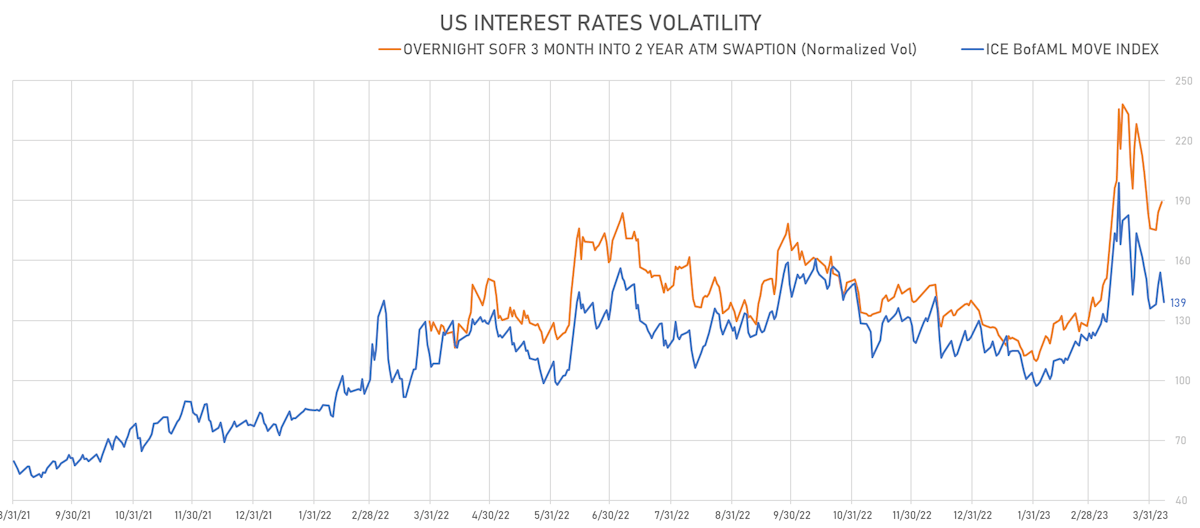

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -10.0 vols at 214.5 normals

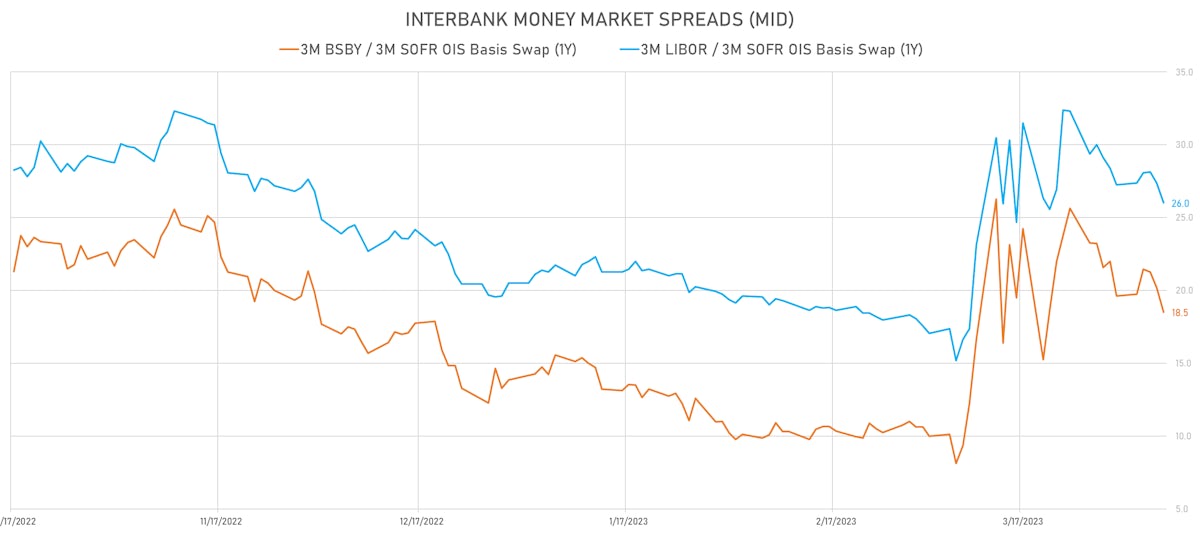

- 3-Month LIBOR-OIS spread down -5.2 bp at 21.8 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.175% (up 0.1 bp); the German 1Y-10Y curve is 0.2 bp flatter at -81.4bp (YTD change: -77.6 bp)

- Japan 5Y: 0.148% (down -0.6 bp); the Japanese 1Y-10Y curve is 0.2 bp flatter at 59.2bp (YTD change: +18.6 bp)

- China 5Y: 2.680% (down -1.0 bp); the Chinese 1Y-10Y curve is 0.3 bp flatter at 66.4bp (YTD change: -7.2 bp)

- Switzerland 5Y: 1.168% (down -3.9 bp); the Swiss 1Y-10Y curve is 14.5 bp flatter at -28.3bp (YTD change: -77.1 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +4.0 bp at 125.5 bp (Weekly change: -14.4 bp; YTD change: -48.1 bp)

- US-JAPAN: +6.0 bp at 383.8 bp (Weekly change: -34.8 bp; YTD change: -55.5 bp)

- US-CHINA: +16.5 bp at 162.8 bp (Weekly change: -5.8 bp; YTD change: -55.5 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -2.5 bp at 122.8 bp (Weekly change: -4.8bp; YTD change: -6.0bp)

- US-JAPAN: +10.2 bp at 141.9 bp (Weekly change: -3.0bp; YTD change: -62.0bp)

- GERMANY-JAPAN: +0.3 bp at 8.9 bp (Weekly change: -16.2bp; YTD change: -66.2bp)