Rates

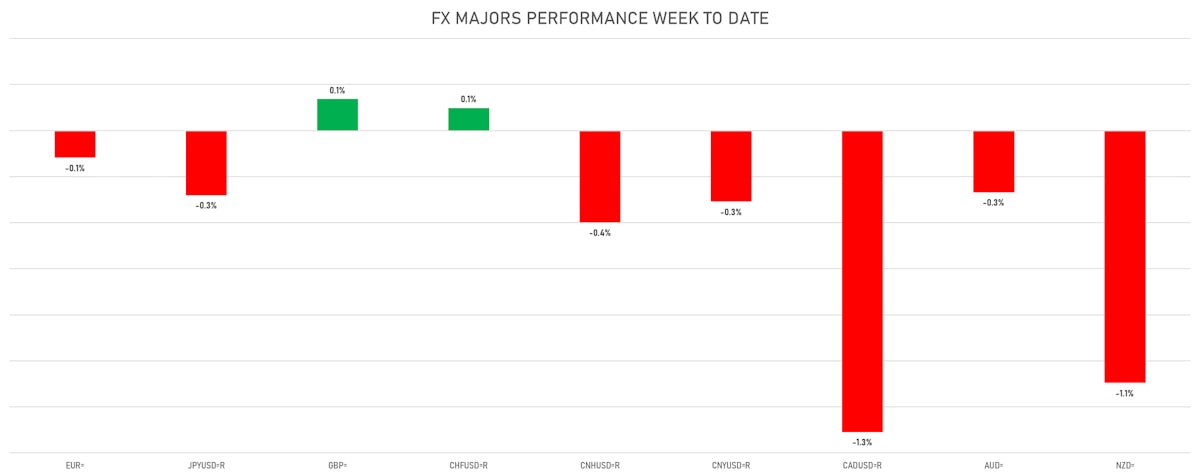

With A Hike At The May FOMC Now Locked In, June Pricing Drifts Higher On Hawkish Fed Speak

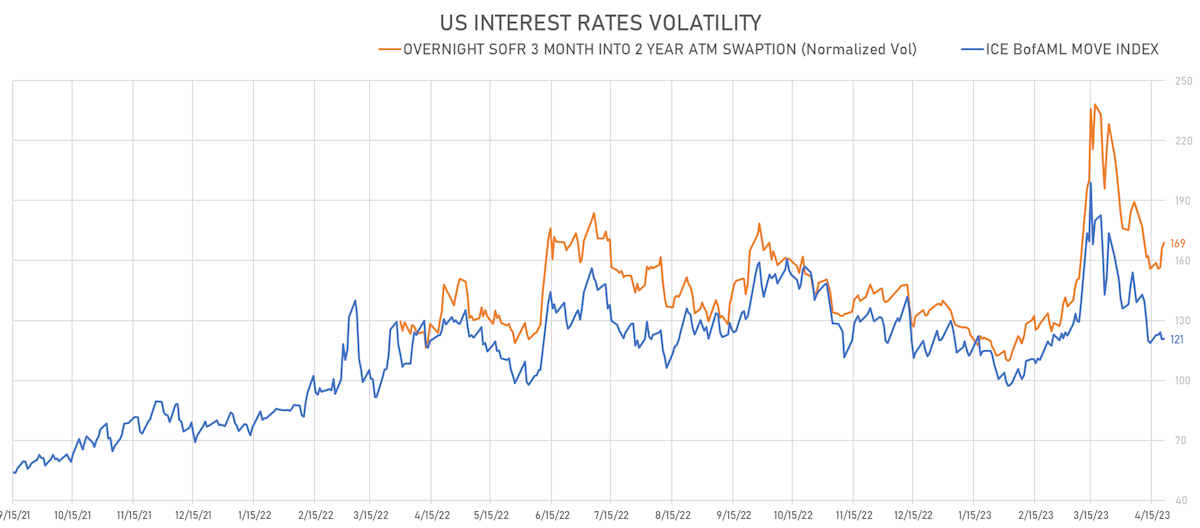

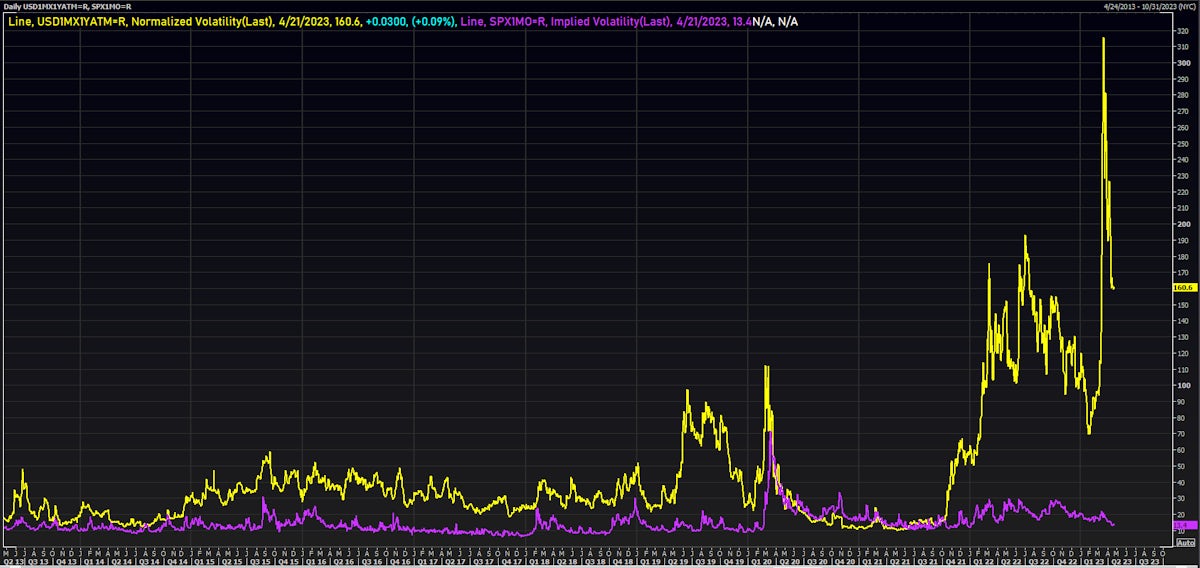

Volatility in US rates remains elevated, especially compared to the depressed level for equities, with considerable uncertainty surrounding the June FOMC hike and possible easing later this year

Published ET

USD 1M into 1Y ATM Swaption Implied Volatility vs S&P 500 1M ATM IV | Source: Refinitiv

US RATES OUTLOOK

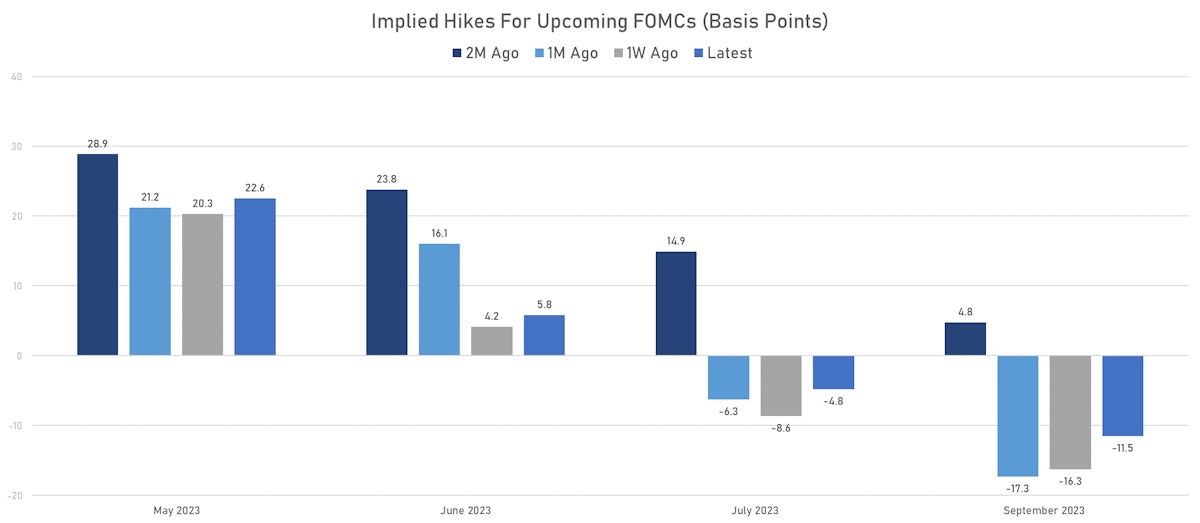

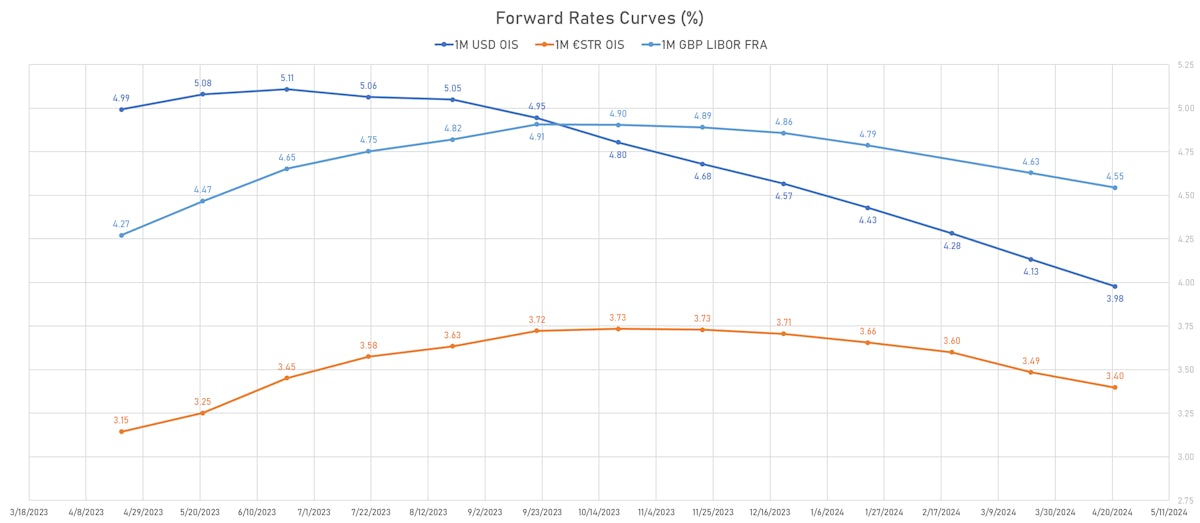

- Forward rates price in 90% probability of a 25bp hike at the May FOMC and about 20% chance of a final hike in June

- Unless we see a dramatic deterioration of US growth over the next month, we think hiking in June would make sense: core services inflation remains high and there is no clear sign of it slowing down any time soon

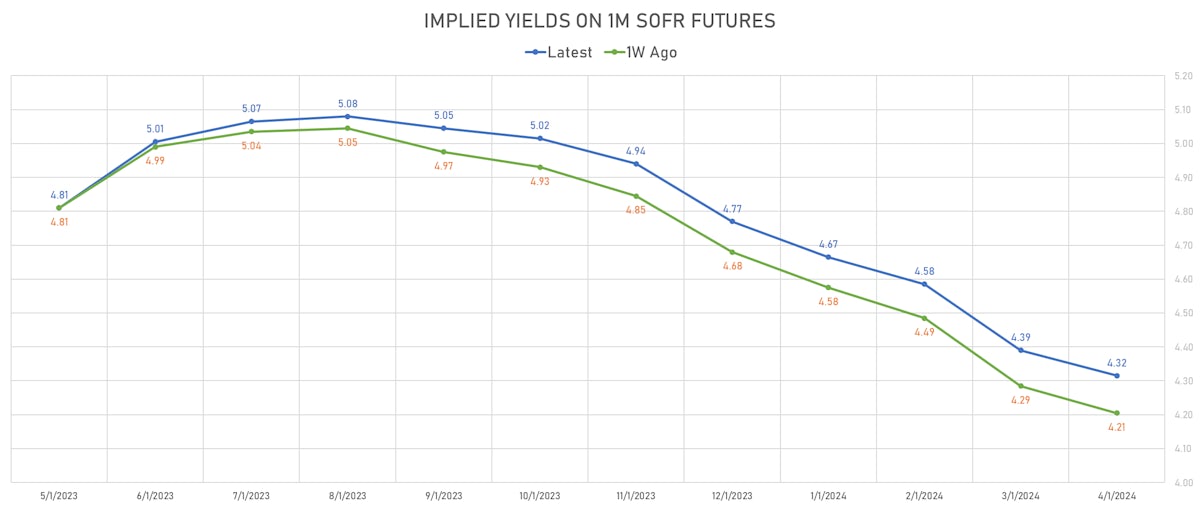

- In this context, it's unclear why markets continue to price in rate cuts starting in July: even if the Fed doesn't hike in June, it's hard to see them switch into easing mode before November. It will take a while for them to be sure that inflation really is on a sustained path to normalization

- Although the timing looks wrong, the total number of cuts priced into year end (about 53bp from the peak) is a sensible average of different possible paths (somewhere between no recession and a hard landing)

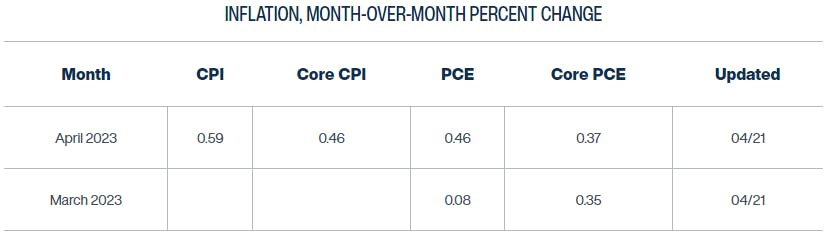

- 1Q23 GDP and PCE deflator important data points this week, with the Cleveland Fed's latest inflation nowcasting at 37bp MoM

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 7.1 bp, now at -119.6 bp (YTD change: -36.2bp)

- 1Y: 4.7627% (down 1.8 bp)

- 2Y: 4.1785% (up 8.2 bp)

- 5Y: 3.6595% (up 5.6 bp)

- 7Y: 3.6132% (up 5.6 bp)

- 10Y: 3.5671% (up 5.3 bp)

- 30Y: 3.7704% (up 3.4 bp)

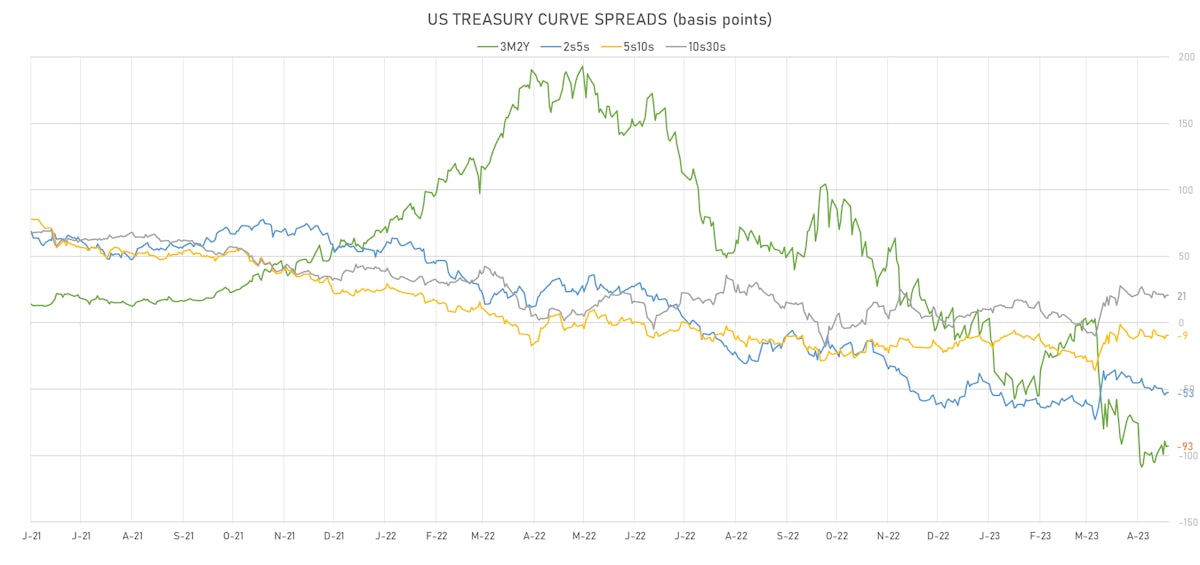

- US treasury curve spreads: 3m2Y at -93.0bp (up 6.1bp this week), 2s5s at -51.9bp (down -2.8bp), 5s10s at -9.2bp (unchanged , 10s30s at 20.3bp (down -1.8bp)

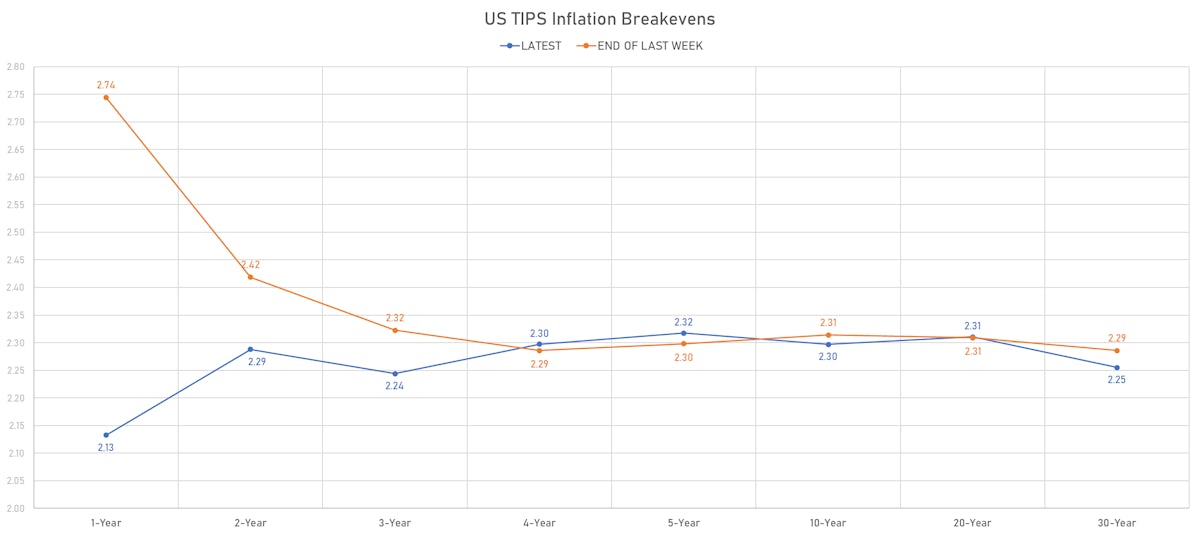

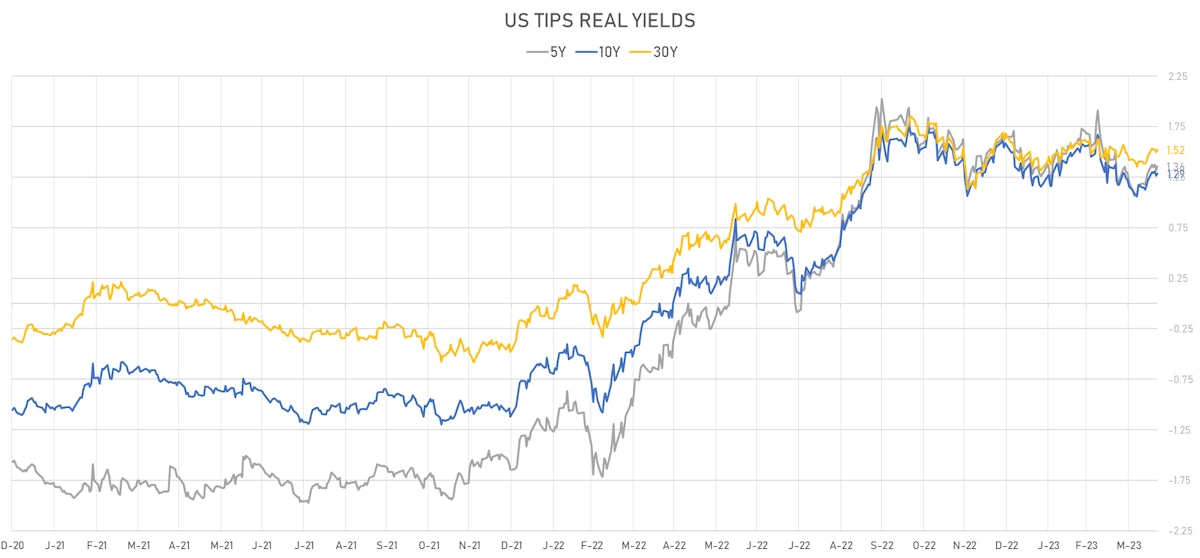

- US 5Y TIPS inflation breakeven at 2.33% down 5.7bp; 10Y breakeven at 2.29% down 0.8bp; 30Y breakeven at 2.25% down 2.5bp

- US 5Y TIPS Real Yield: +6.2 bp at 1.3590%; 10Y TIPS Real Yield: +6.9 bp at 1.2860%; 30Y TIPS Real Yield: +6.4 bp at 1.5210%

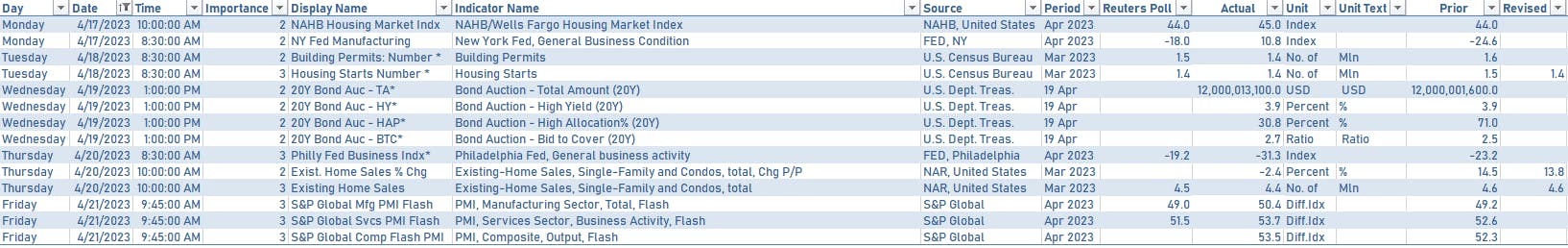

US ECONOMIC DATA OVER THE PAST WEEK

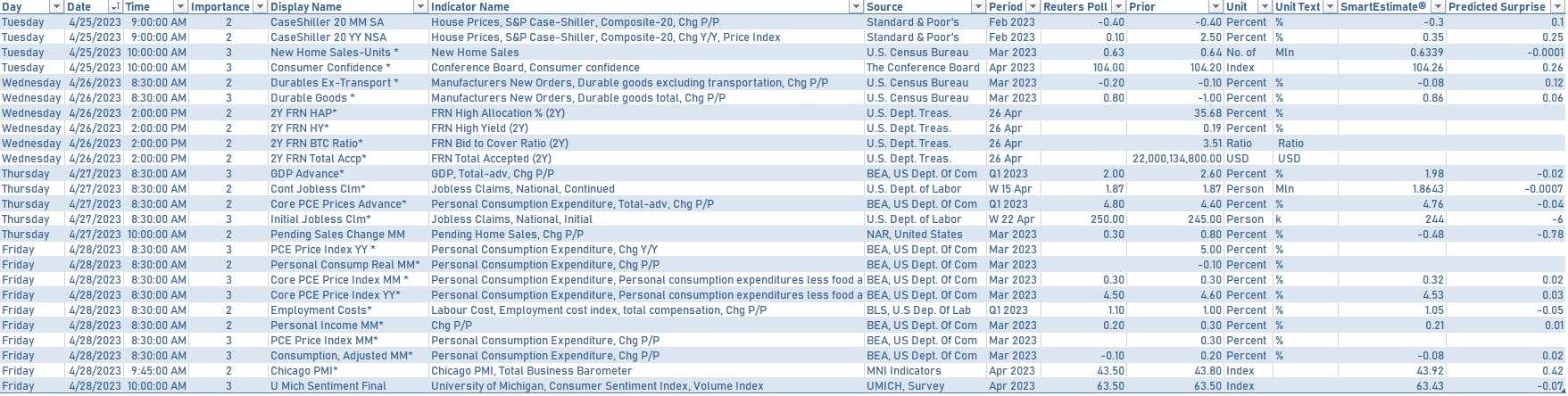

US MACRO RELEASES IN THE WEEK AHEAD

- Next week will see the release of 1Q23 GDP, Durable Goods, Personal Income/Spending, PCE Deflator, MNI Chicago PMIs, and UMich Sentiment

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday 1:00PM: $42bn in 2Y notes

- Wednesday 11:30AM: $24bn in 2Y FRNs

- Wednesday 1:00PM: $43bn in 5Y notes

- Thursday 1:00PM: $35bn in 7Y notes

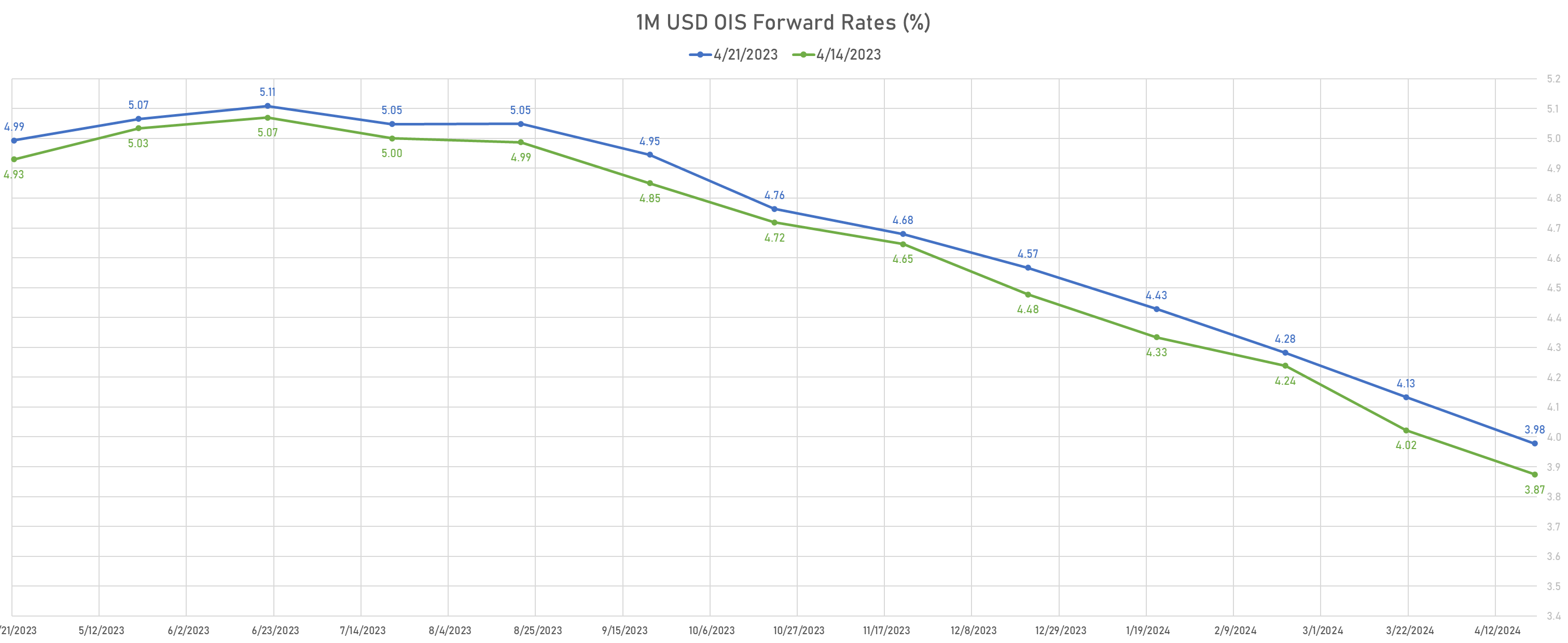

US FORWARD RATES

- Fed Funds futures now price in 22.6bp of Fed hikes by the end of May 2023, 28.4bp (1.1 x 25bp hikes) by the end of June 2023, and cuts starting in July

- Implied yields on 3-month SOFR futures top out at 5.10% for the August 2023 expiry and price in 212bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.13% (down -1.2bp); 2Y at 2.29% (up 2.0bp); 5Y at 2.32% (up 1.2bp); 10Y at 2.30% (up 1.3bp); 30Y at 2.25% (up 0.4bp)

- 6-month spot US CPI swap up 1.2 bp to 1.719%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.3590%, +4.5 bp today; 10Y at 1.2860%, +1.9 bp today; 30Y at 1.5210%, +2.3 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) up 1.0 vols at 158.6 normals

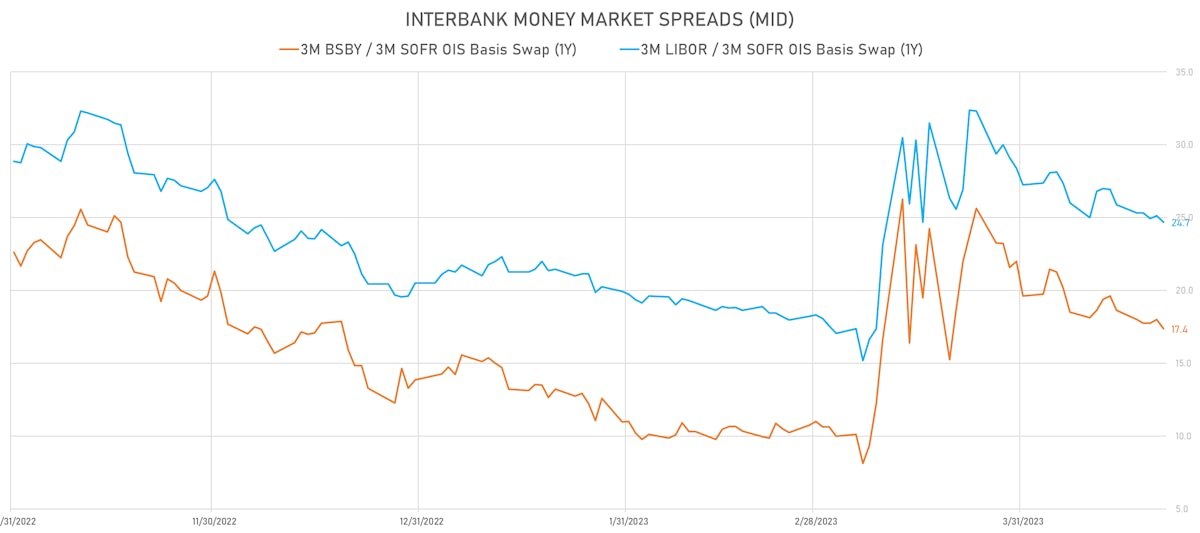

- 3-Month LIBOR-OIS spread down -2.2 bp at 16.9 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.520% (up 4.0 bp); the German 1Y-10Y curve is 6.1 bp steeper at -80.5bp (YTD change: -75.2 bp)

- Japan 5Y: 0.161% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 57.8bp (YTD change: +16.9 bp)

- China 5Y: 2.674% (down -0.1 bp); the Chinese 1Y-10Y curve is 0.8 bp flatter at 67.5bp (YTD change: -6.1 bp)

- Switzerland 5Y: 1.156% (up 10.3 bp); the Swiss 1Y-10Y curve is 10.5 bp steeper at -44.5bp (YTD change: -66.4 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.2 bp at 128.5 bp (Weekly change: +2.9 bp; YTD change: -45.1 bp)

- US-JAPAN: -2.3 bp at 422.6 bp (Weekly change: +5.8 bp; YTD change: -16.7 bp)

- US-CHINA: +3.3 bp at 183.6 bp (Weekly change: +8.3 bp; YTD change: -34.7 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.9 bp at 123.2 bp (Weekly change: +4.7bp; YTD change: -5.6bp)

- US-JAPAN: +5.3 bp at 157.1 bp (Weekly change: +12.8bp; YTD change: -46.8bp)

- GERMANY-JAPAN: +6.2 bp at 33.9 bp (Weekly change: +8.1bp; YTD change: -41.2bp)