Rates

US Front-End Rates Inversion Deepens As FOMC Takes A Backseat To Other Concerns

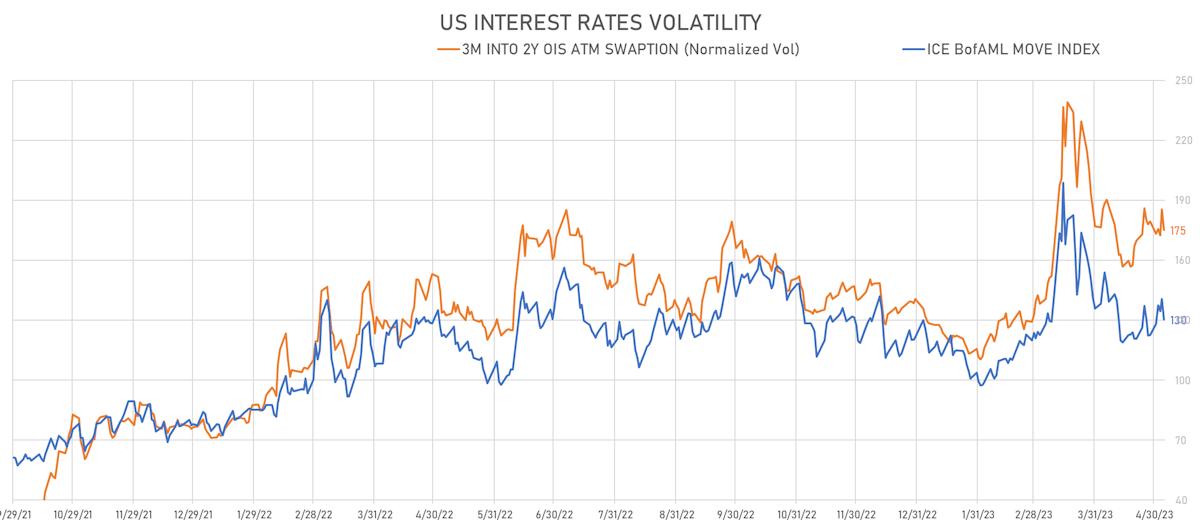

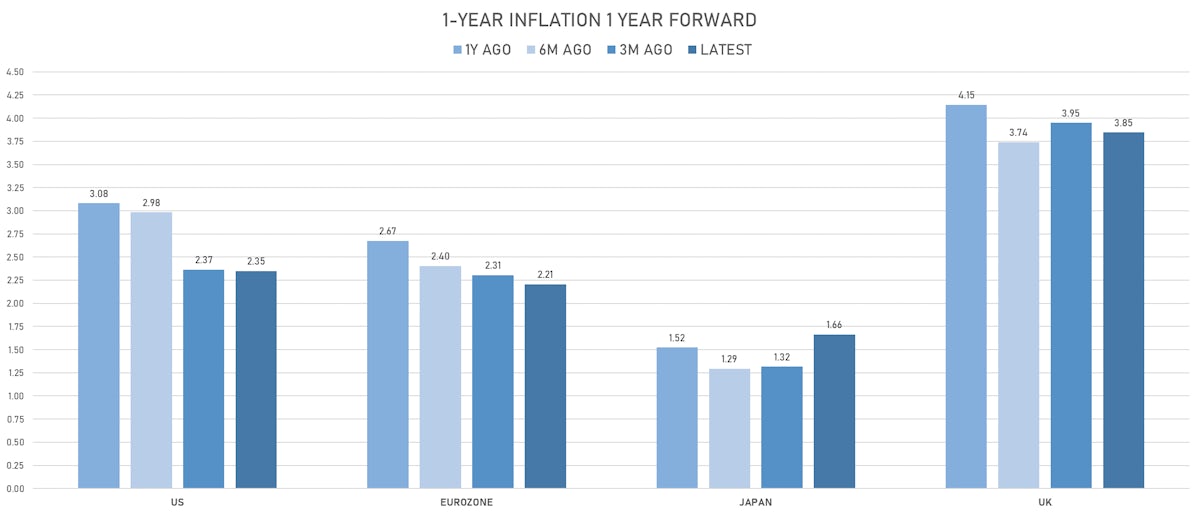

USD rates volatility remains extremely high, especially in the right tail: forward rates have come down to reflect a more benign policy path for the Fed, but market participants are hedging the possibility of dislocation over the next 3 months

Published ET

3M into 2Y OIS Swaption Implied Volatility | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

- The FOMC was broadly in line with our expectation: the Fed cut forward guidance of future hikes and stuck to a data dependent path for future policy decisions

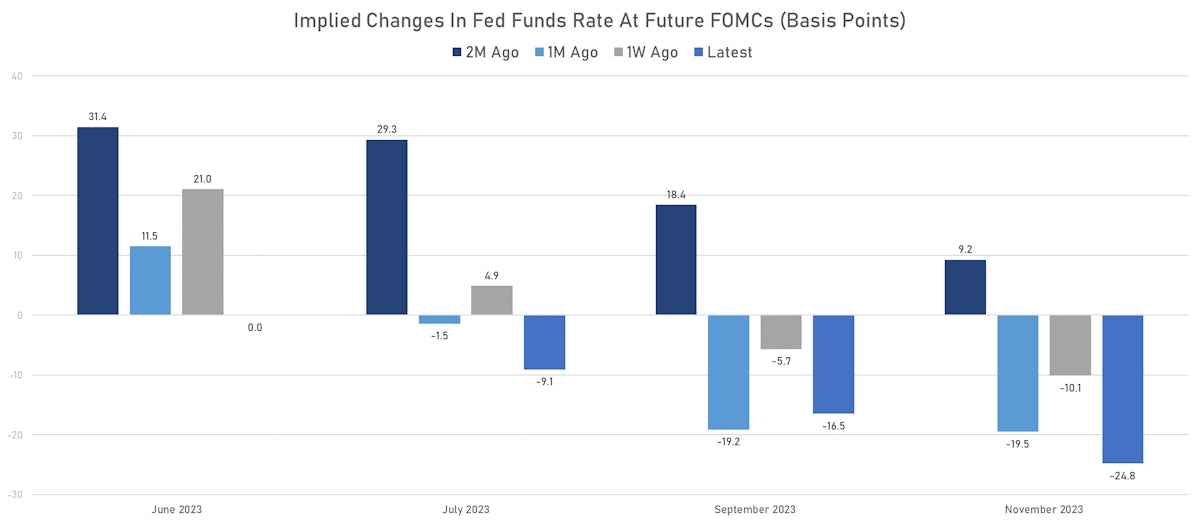

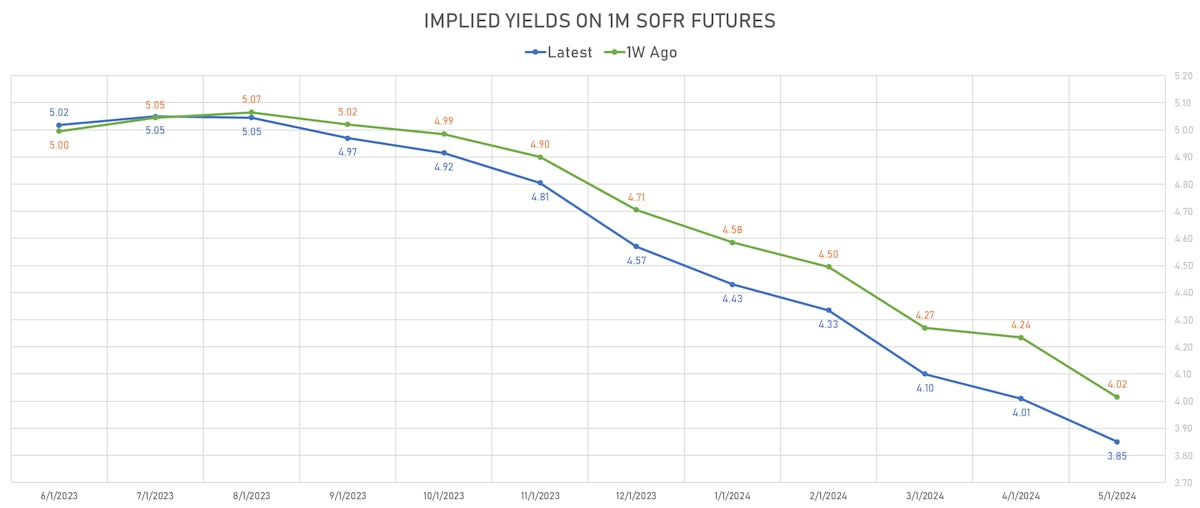

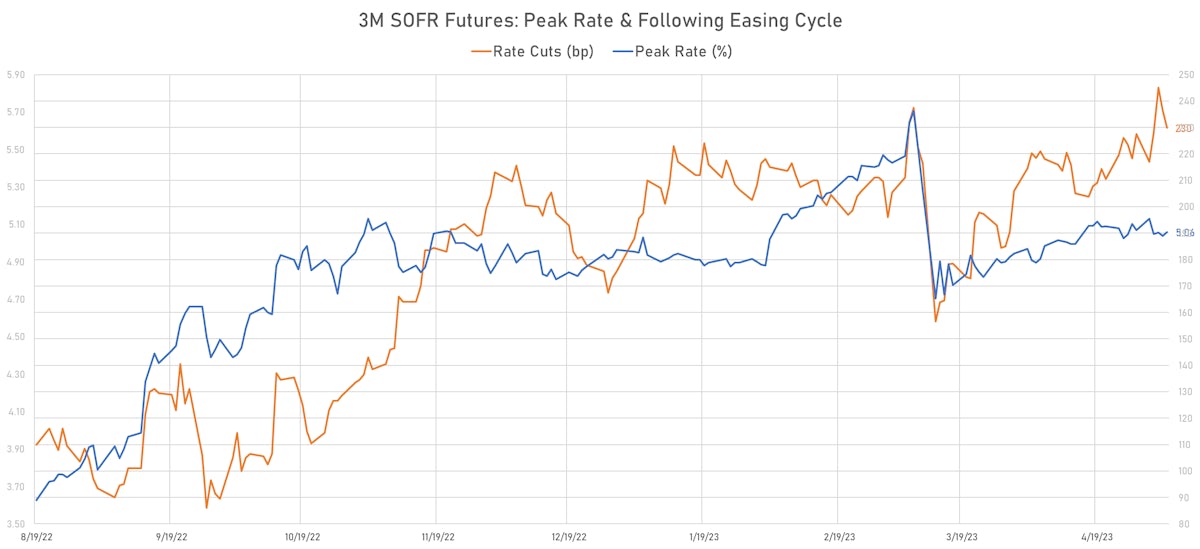

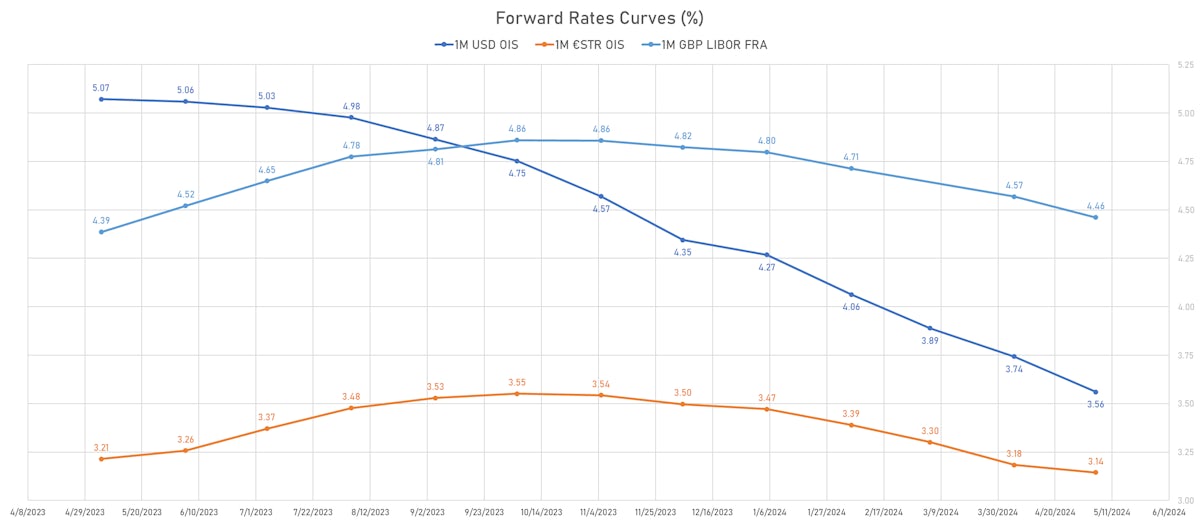

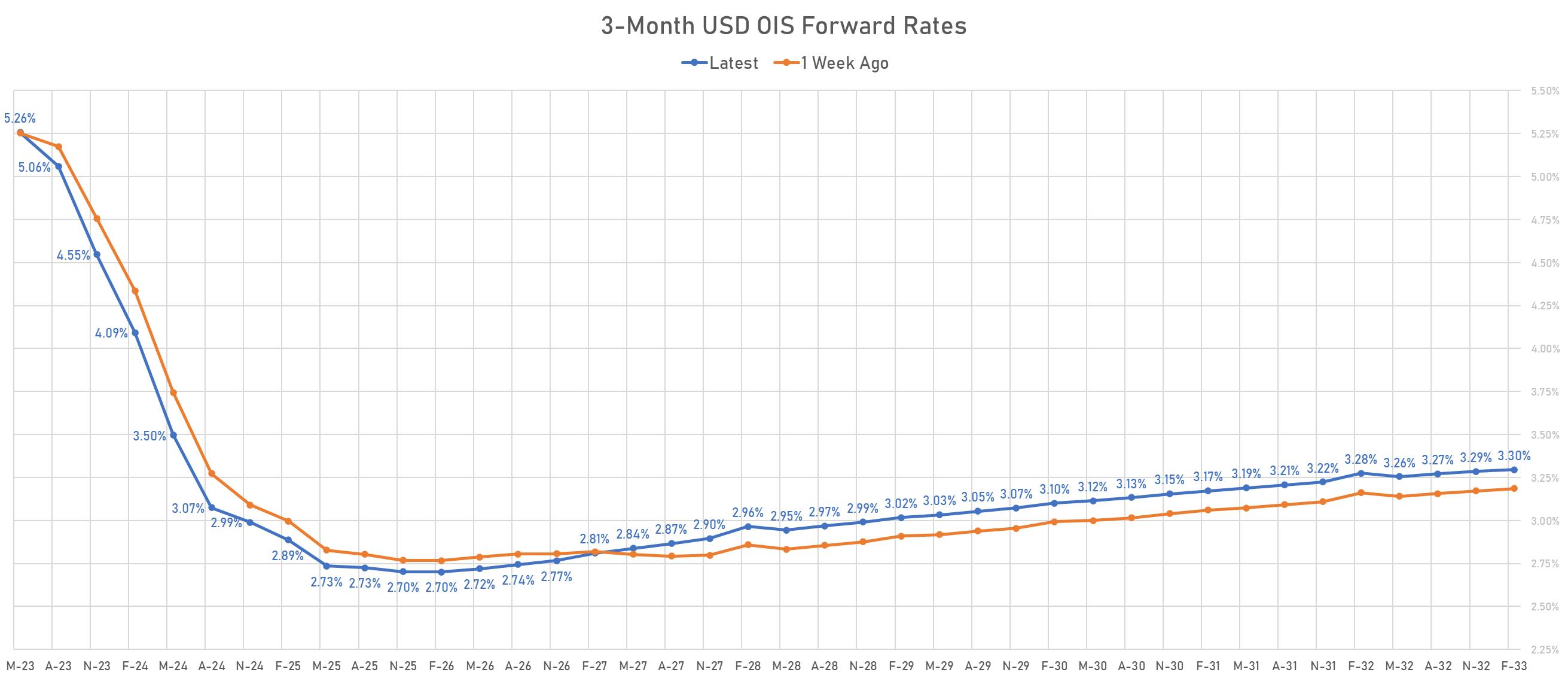

- But the market heard what it wanted to hear, which is "the Fed is done hiking", which led to a dovish repricing of the forward curve this year: now 85bp of rate cuts priced into year end from the current peak

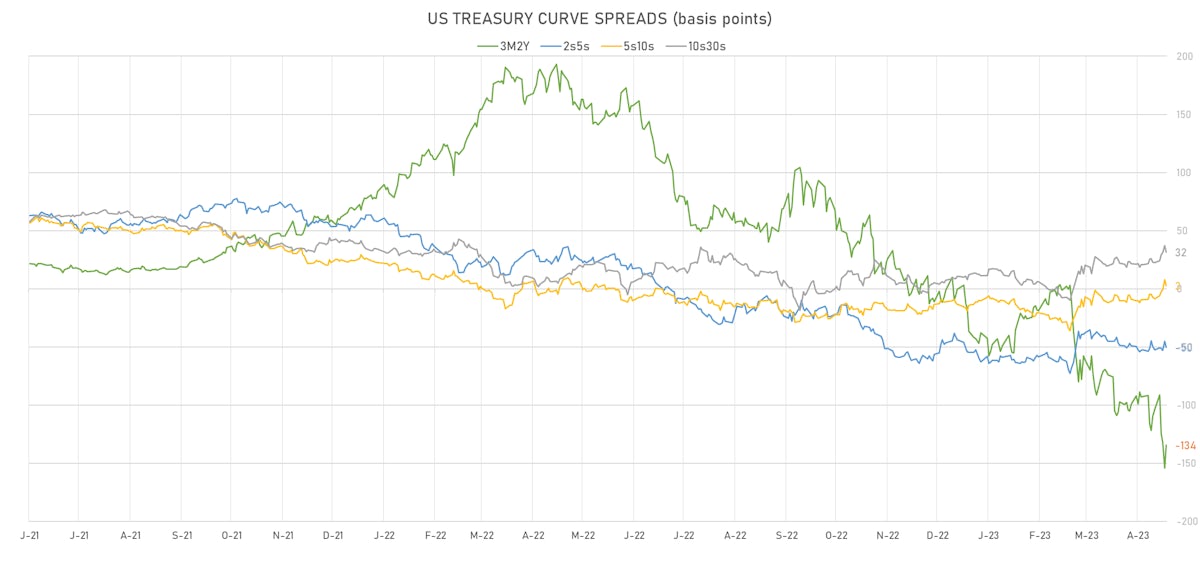

- Of course, the Fed's policy outlook got somewhat lost in the noise of the latest regional banking issues, which has led to a deeper front-end inversion and forward steepening:

- In this context, handicapping the June FOMC is hard (and still far away), with 3 possible paths: a Fed cut if banking problems turn into real financial instability, a hold if the Fed is afraid its decisions might lead to financial instability, or a 25bp hike if fear recedes and economic data continue to be strong

- For the moment, economic data is coming in strong, with the unemployment rate now at the lowest level since 1969 (the last time the unemployment rate was lower was in September 1953)

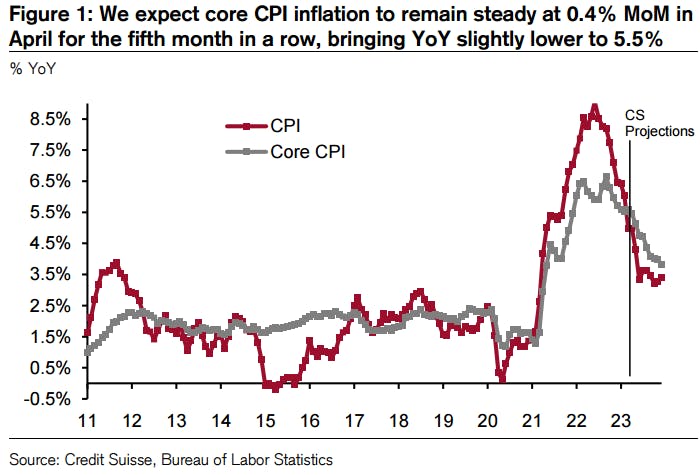

- The CPI data next week could also come in on the hot side of expectations, with the Reuters' median for core around 40bp MoM and 5.5% YoY

WEEKLY US RATES SUMMARY

- The treasury yield curve steepened, with the 1s10s spread widening 2.8 bp, now at -131.4 bp (YTD change: -48.1bp)

- 1Y: 4.7482% (down 2.6 bp)

- 2Y: 3.9160% (down 10.4 bp)

- 5Y: 3.4087% (down 8.8 bp)

- 7Y: 3.4105% (down 6.0 bp)

- 10Y: 3.4342% (up 0.2 bp)

- 30Y: 3.7487% (up 6.7 bp)

- US treasury curve spreads: 3m2Y at -135.7bp (down -26.4bp this week), 2s5s at -50.7bp (up 1.7bp), 5s10s at 2.6bp (up 8.7bp), 10s30s at 31.5bp (up 6.5bp)

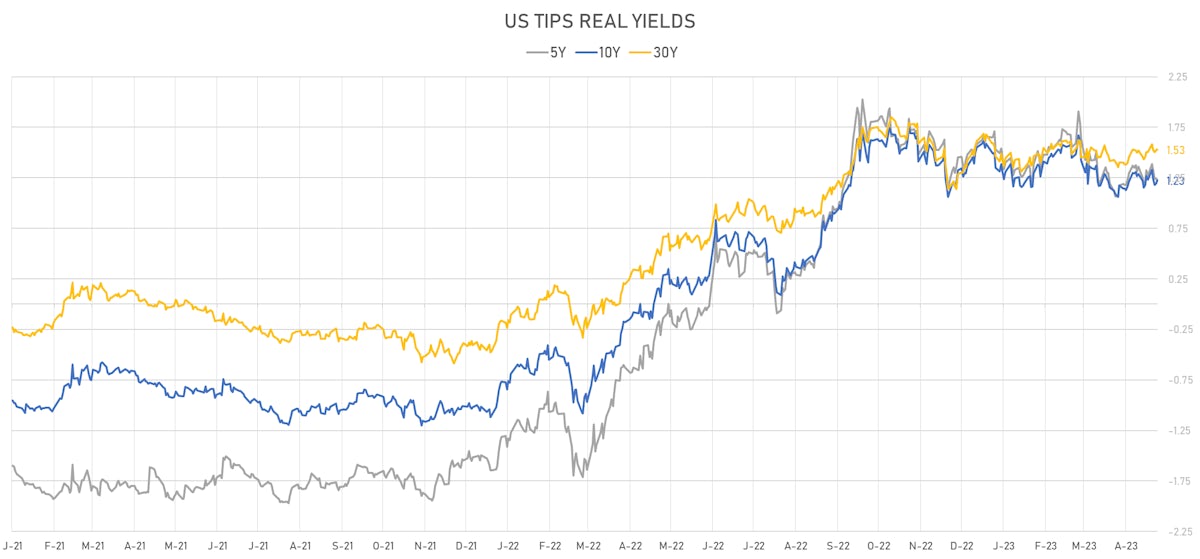

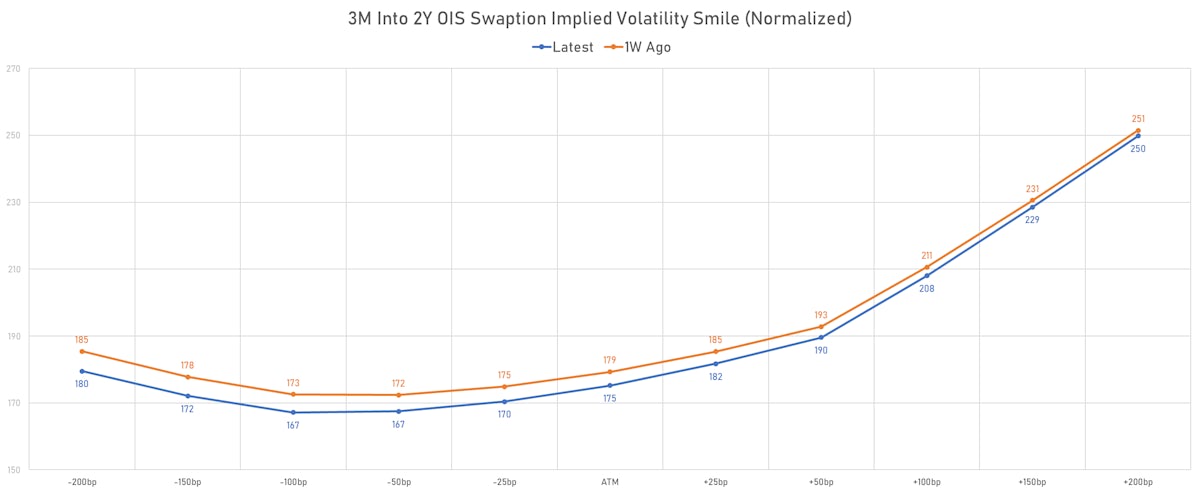

- US 5Y TIPS inflation breakeven at 2.20% down 3.6bp; 10Y breakeven at 2.22% up 1.3bp; 30Y breakeven at 2.23% up 4.7bp

- US 5Y TIPS Real Yield: -4.3 bp at 1.2270%; 10Y TIPS Real Yield: -0.4 bp at 1.2250%; 30Y TIPS Real Yield: +2.5 bp at 1.5300%

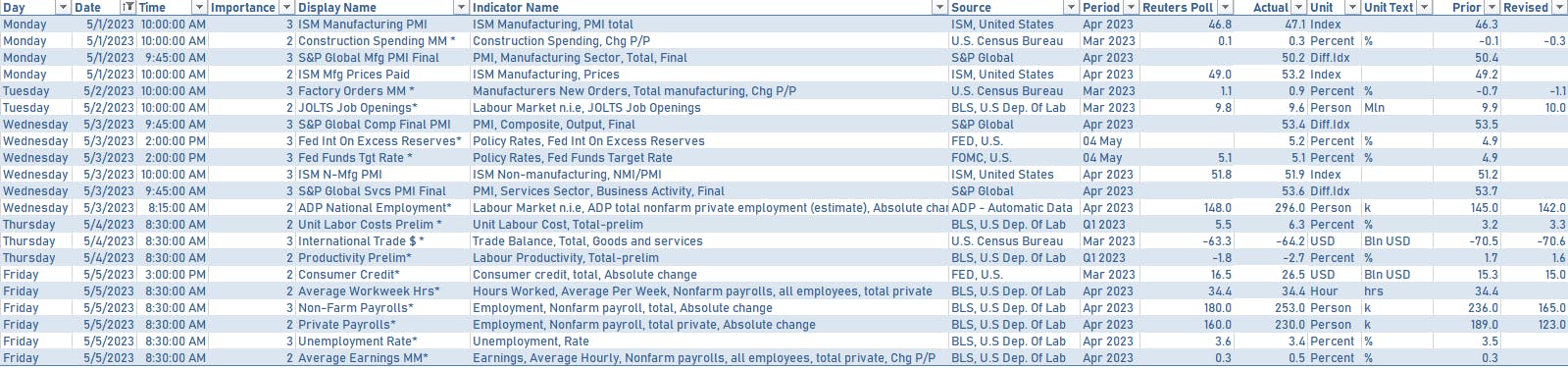

US ECONOMIC DATA OVER THE PAST WEEK

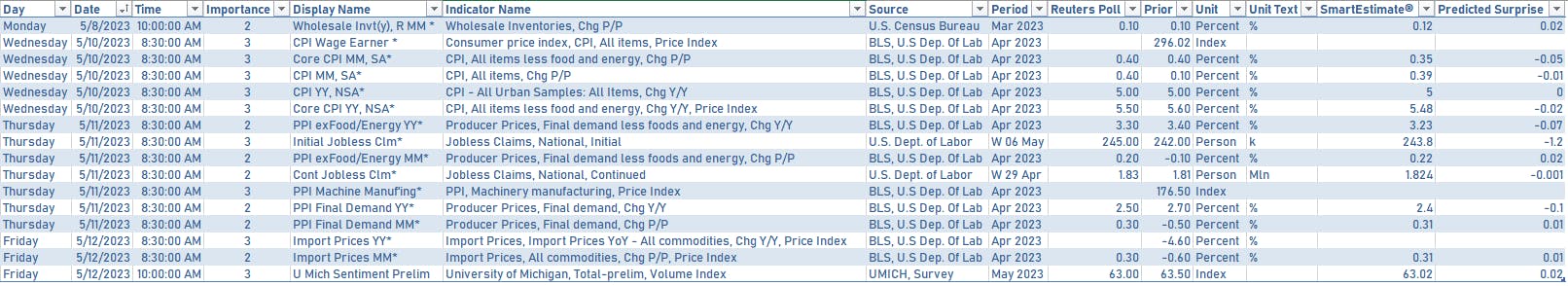

US MACRO RELEASES IN THE WEEK AHEAD

- The main focus next week will be on the April CPI and the May UMich sentiment survey

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday at 1:00PM: $40 bn in 3Y notes

- Wednesday at 1:00PM: $35 bn in 10Y notes

- Thursday at 1:00PM: $21 bn in 30Y bonds

FED SPEAKERS IN THE WEEK AHEAD

- Monday 4:45PM: Minneapolis Fed President Kashkari

- Tuesday 8:30AM: Fed Governor Jefferson

- Tuesday 12:05PM: New York Fed President Williams

- Thursday 10:15AM: Fed Governor Waller

- Friday 2:20PM: San Francisco Fed President Daly

- Friday 7:45PM: Fed Governor Jefferson and St. Louis Fed President Bullard

US FORWARD RATES

- Fed Funds futures now price a pause in June 2023, and rate cuts starting in July: -9.1bp (-0.4 x 25bp hikes) by the end of July 2023, and -1.0 hikes by the end of September 2023

- Implied yields on 3-month SOFR futures top out at 5.06% for the August 2023 expiry and price in 229bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.03% (up 13.7bp); 2Y at 2.06% (up 9.7bp); 5Y at 2.21% (up 4.9bp); 10Y at 2.22% (up 2.8bp); 30Y at 2.23% (up 1.7bp)

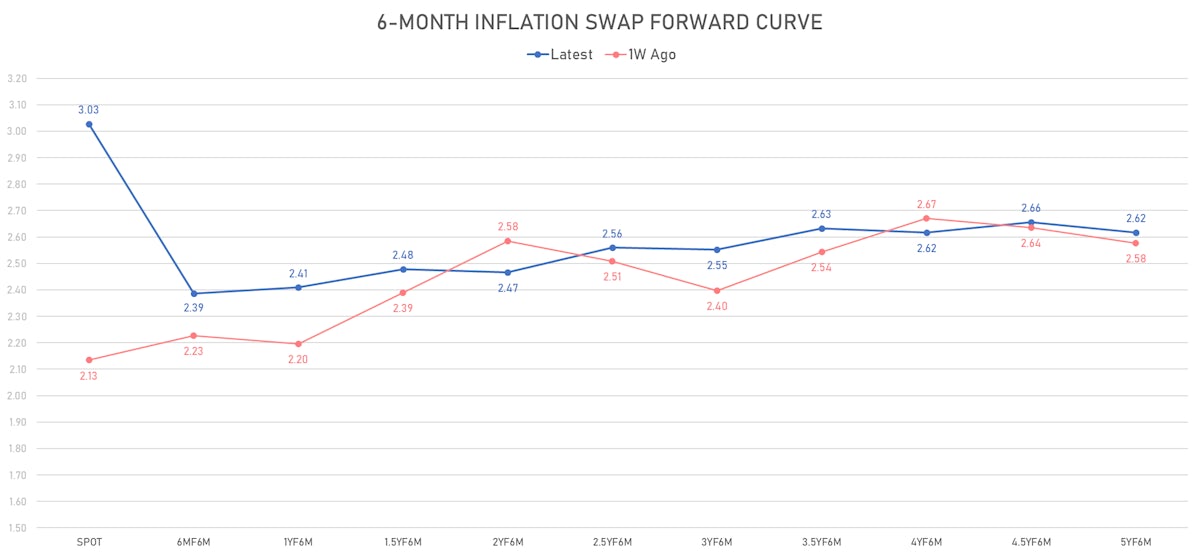

- 6-month spot US CPI swap up 6.8 bp to 3.028%, with a steepening of the forward curve

- US Real Rates: 5Y at 1.2270%, -1.6 bp today; 10Y at 1.2250%, +3.2 bp today; 30Y at 1.5300%, +0.4 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -12.4 vols at 174.9 normals

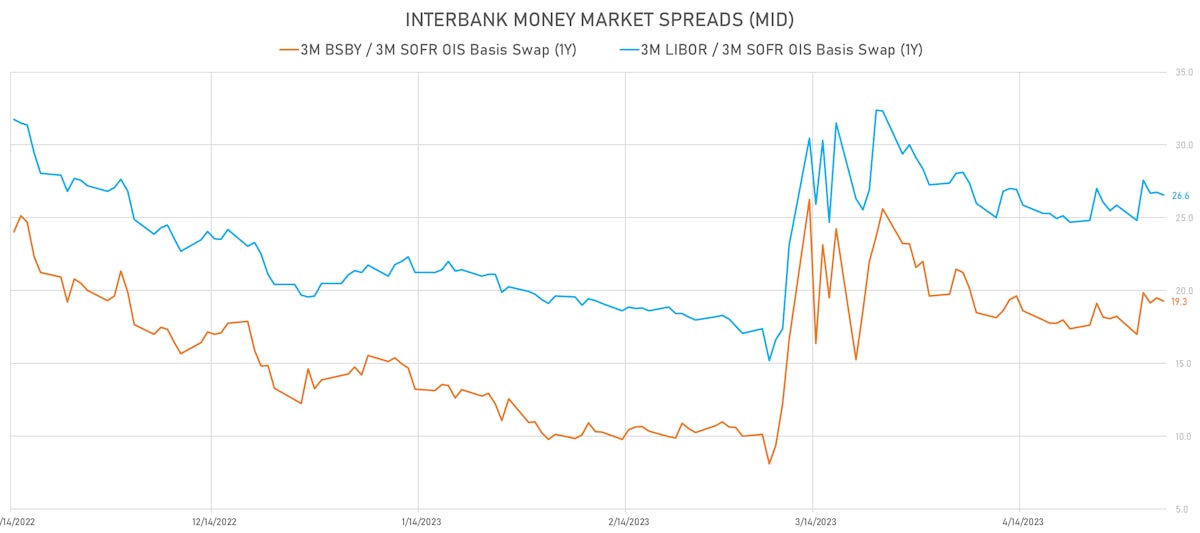

- 3-Month LIBOR-OIS spread down -2.5 bp at 25.0 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.214% (up 10.3 bp); the German 1Y-10Y curve is 1.2 bp steeper at -82.4bp (YTD change: -77.9 bp)

- Japan 5Y: 0.122% (up 1.4 bp); the Japanese 1Y-10Y curve is 1.5 bp steeper at 52.7bp (YTD change: +11.6 bp)

- China 5Y: 2.580% (down -3.7 bp); the Chinese 1Y-10Y curve is 2.1 bp flatter at 64.5bp (YTD change: -7.1 bp)

- Switzerland 5Y: 0.949% (up 3.8 bp); the Swiss 1Y-10Y curve is 5.2 bp steeper at -37.2bp (YTD change: -69.5 bp)

GLOBAL 5Y NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +11.6 bp at 133.6 bp (Weekly change: +11.3 bp; YTD change: -40.0 bp)

- US-JAPAN: -18.3 bp at 400.4 bp (Weekly change: -7.0 bp; YTD change: -38.9 bp)

- US-CHINA: +15.8 bp at 171.8 bp (Weekly change: -5.1 bp; YTD change: -49.0 bp)