Rates

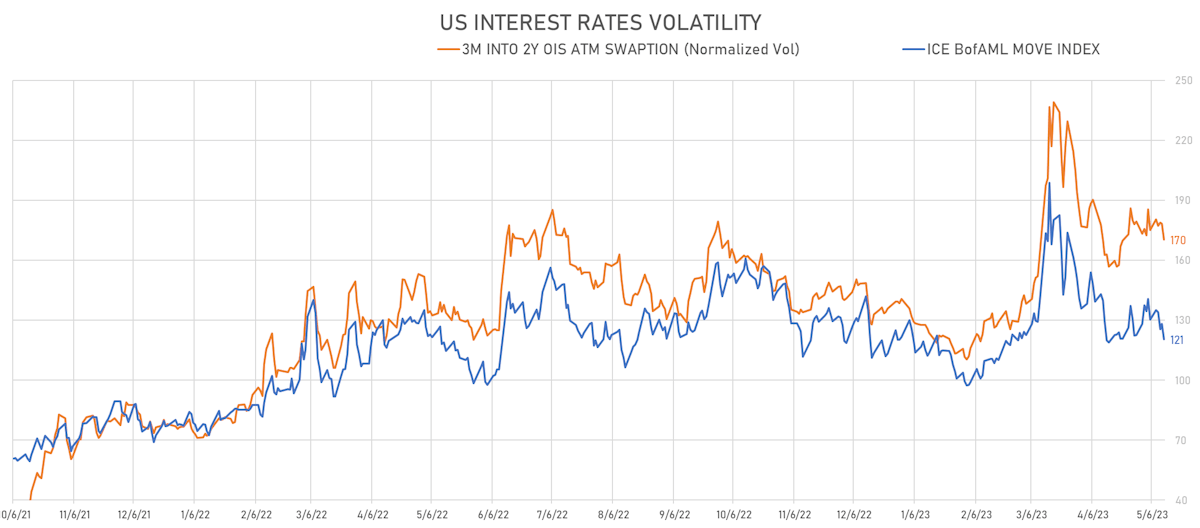

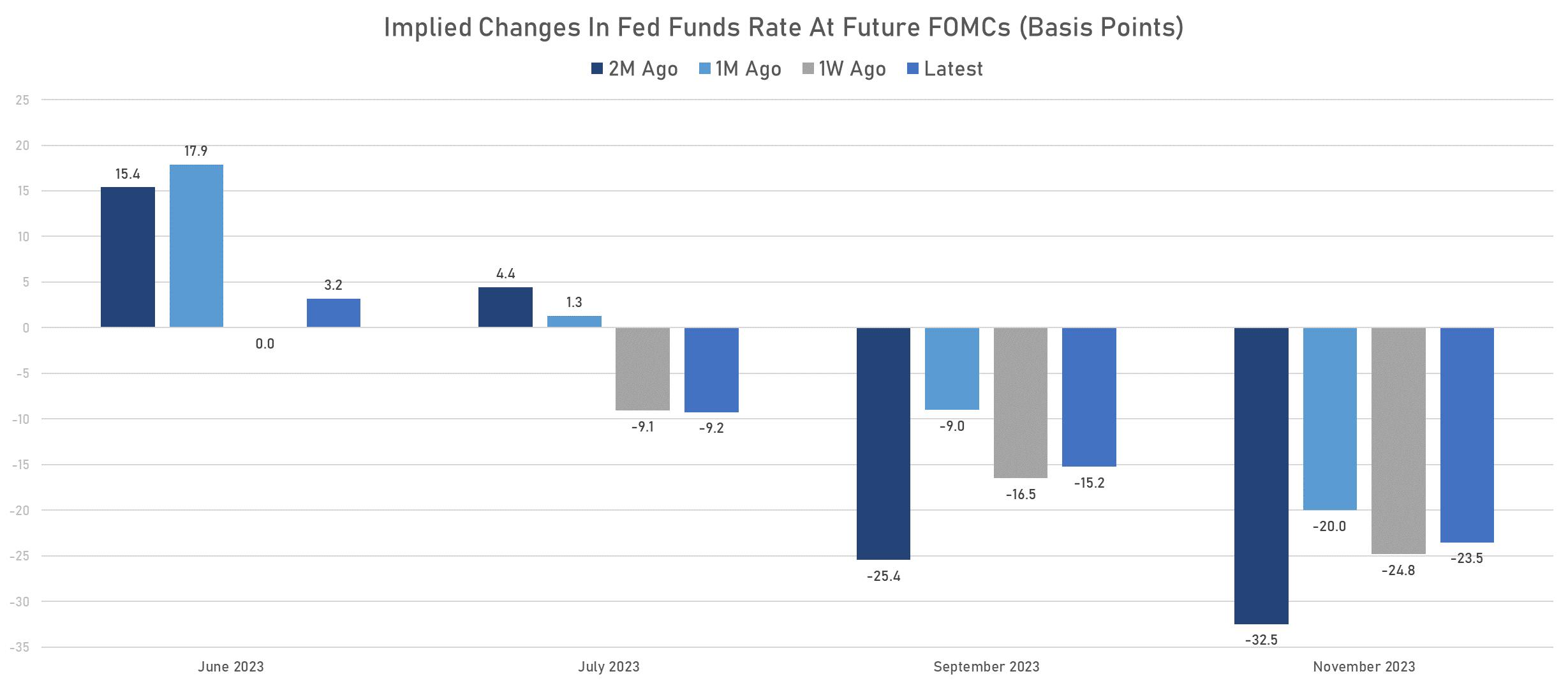

US Short-Term Rates Volatility Dropped This Week As Conviction In A Fed Pause Increased

With the right tail of the peak rate distribution now all but priced out, strength in incoming data could slowly tip the scale away from worries about a recession and regional banks failures

Published ET

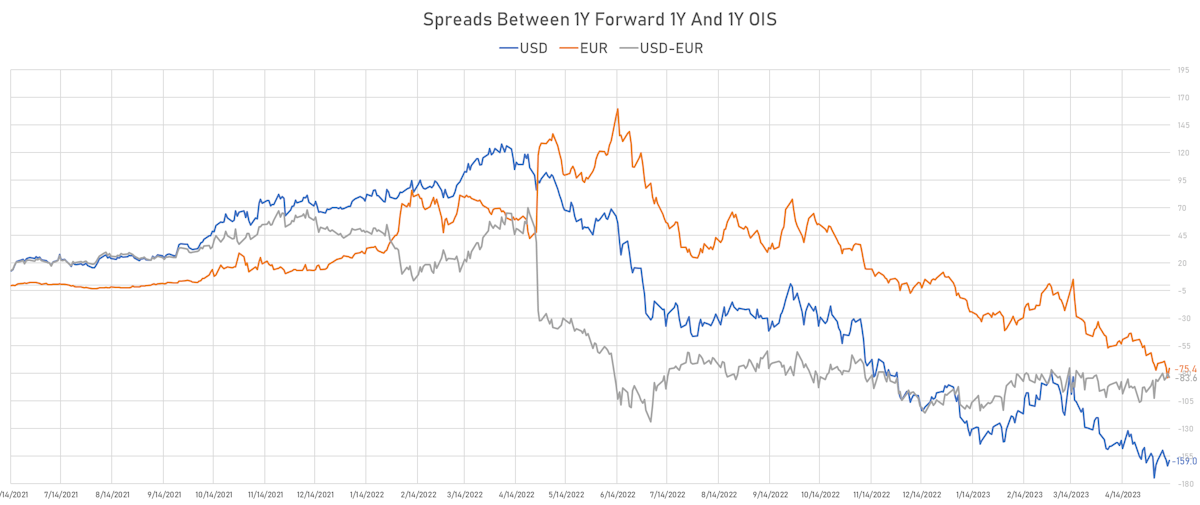

US-EU Policy Divergence Starting To Come Off | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

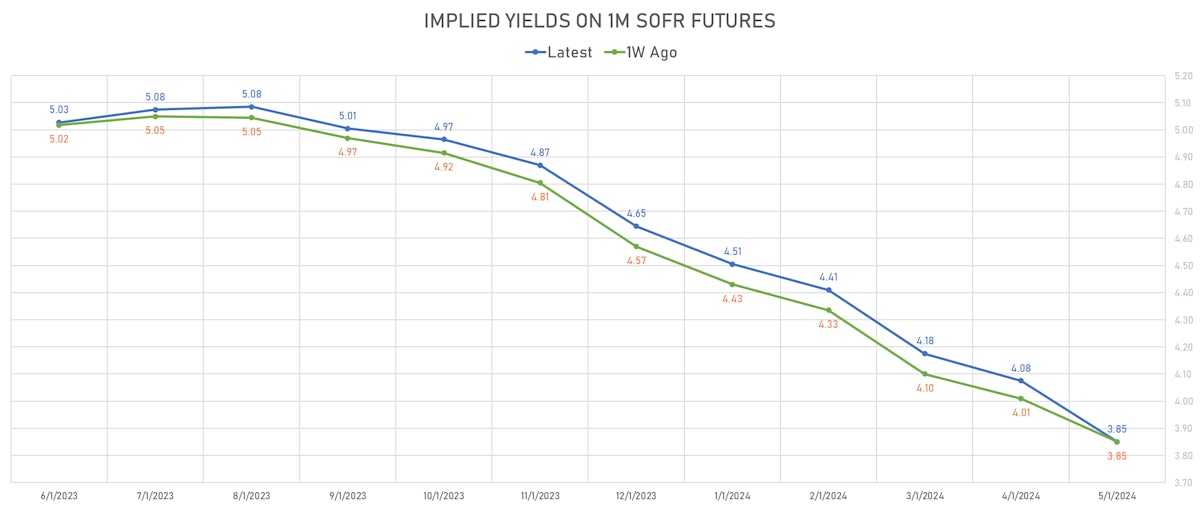

- Just 3bp of hike priced for the June FOMC (12% probability), and over 80bp of cuts priced from the peak through year end

- As expected, the Fed governors who still want to hike in June have made themselves heard this week

- The WSJ presents those views as a minority within the Fed, meaning that the base case is now clearly a hold in June

- Financial conditions have been roughly stable over the past month (looser than in March after SVB's failure), but are likely to ease should the Fed acknowledge that they are now on hold

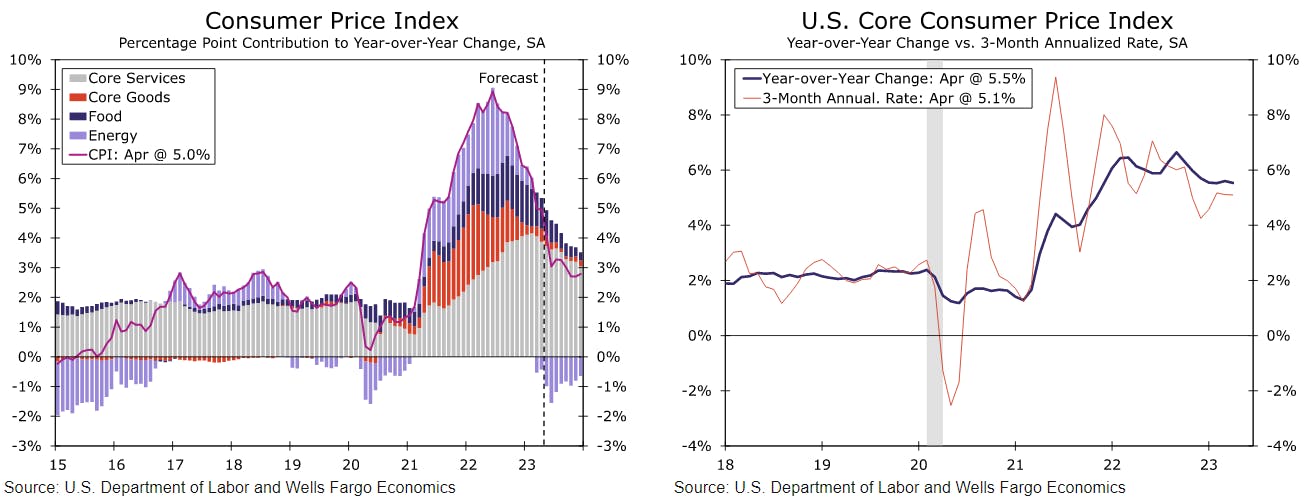

- With the latest CPI data largely in line with elevated expectations, the market is more focused on regional banks and the debt ceiling issue (i.e. possible negative growth shocks)

- Nothing terribly surprising about that: if you think inflation is coming down steadily and the hiking cycle is done, it's logical to try and figure out when the easing cycle will start

- In this context, it will be very interesting to hear next week what the big retailers (WMT, HD, TJX, TGT, LOW) have to say about US consumers and the state of the economy

WEEKLY US RATES SUMMARY

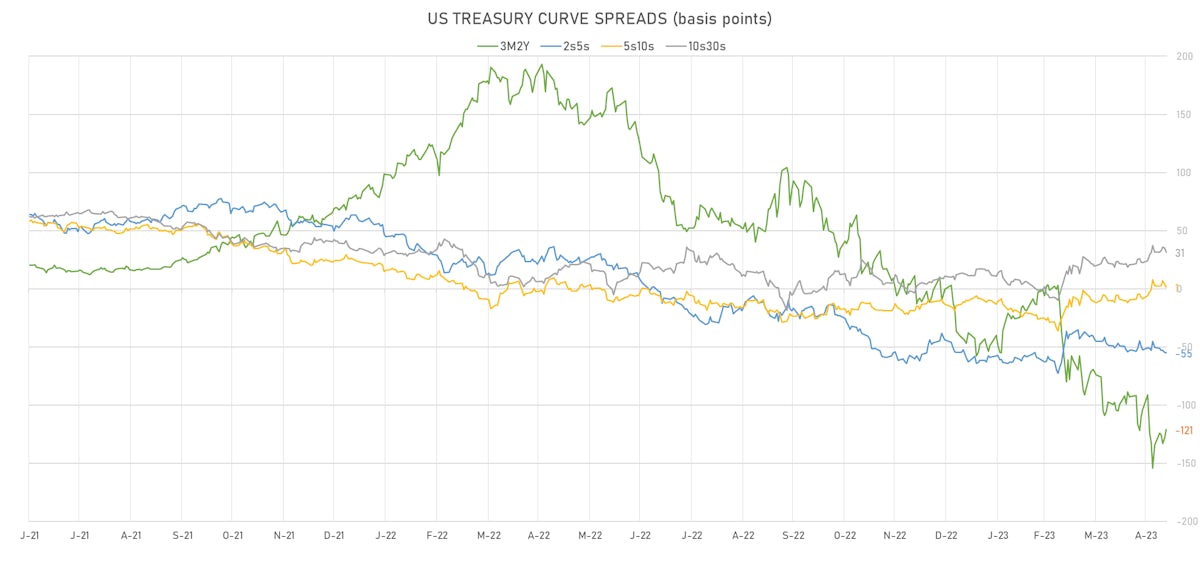

- The treasury yield curve steepened, with the 1s10s spread widening 0.1 bp, now at -131.3 bp (YTD change: -48.0bp)

- 1Y: 4.7749% (up 2.7 bp)

- 2Y: 3.9904% (up 7.4 bp)

- 5Y: 3.4454% (up 3.7 bp)

- 7Y: 3.4528% (up 4.2 bp)

- 10Y: 3.4616% (up 2.7 bp)

- 30Y: 3.7813% (up 3.3 bp)

- US treasury curve spreads: 3m2Y at -122.9bp (up 12.8bp this week), 2s5s at -54.5bp (down -4.0bp), 5s10s at 1.6bp (down -0.7bp), 10s30s at 32.0bp (up 0.8bp)

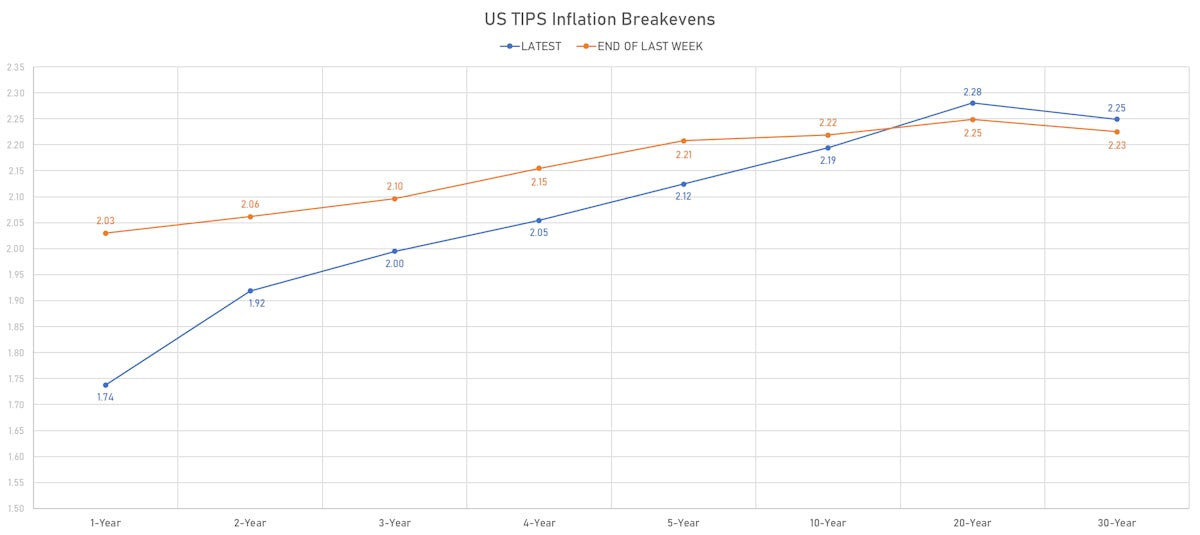

- US 5Y TIPS inflation breakeven at 2.12% down 7.6bp; 10Y breakeven at 2.19% down 1.9bp; 30Y breakeven at 2.25% up 2.9bp

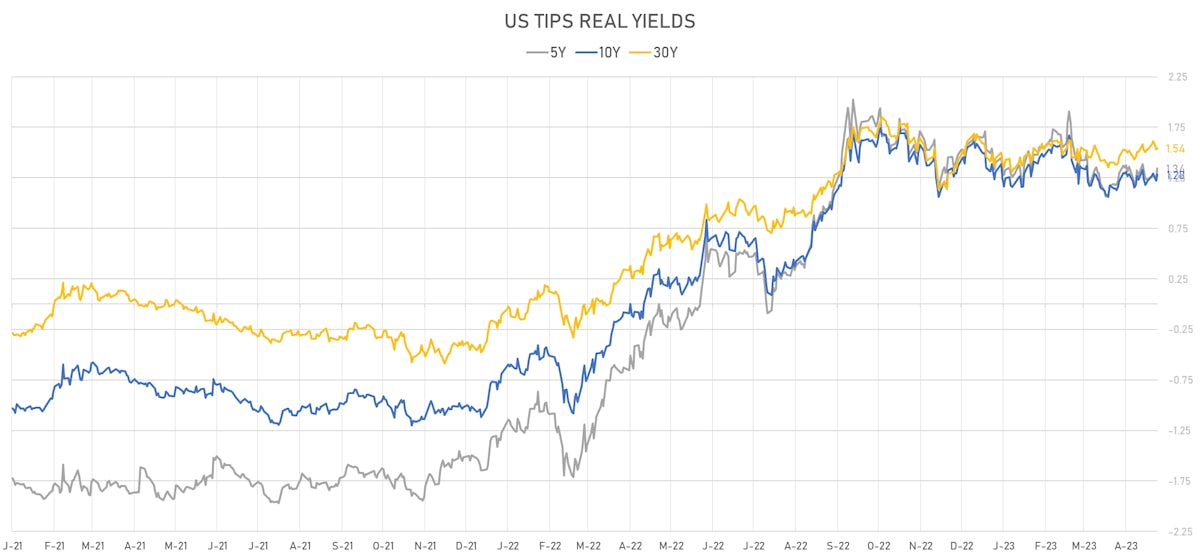

- US 5-Year TIPS Real Yield: +11.7 bp at 1.3440%; 10-Year TIPS Real Yield: +5.7 bp at 1.2820%; 30-Year TIPS Real Yield: +1.3 bp at 1.5430%

US ECONOMIC DATA OVER THE PAST WEEK

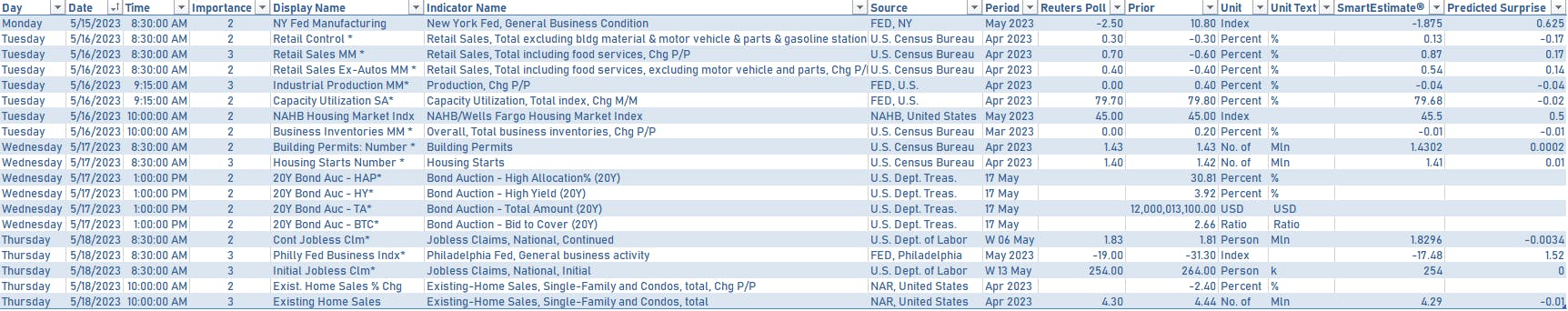

US MACRO RELEASES IN THE WEEK AHEAD

- The data schedule is lighter next week, and the focus will be on April retail sales, industrial production, housing starts, and existing home

sales

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday at 1:00PM: $15bn in 20Y bonds

- Wednesday at 1:00PM: $15bn 10Y TIPS

FED SPEAKERS IN THE WEEK AHEAD

- Monday 8:45AM -- Atlanta Fed President Bostic

- Monday 9:15AM -- Minneapolis Fed President Kashkari

- Monday 5:00PM -- Fed Governor Cook

- Tuesday 8:15AM -- Cleveland Fed President Mester

- Tuesday 10:00AM -- Fed Vice Chair for Supervision Barr

- Tuesday 12:15PM -- New York Fed President Williams

- Tuesday 3:15PM -- Dallas Fed President Logan

- Tuesday 7:00PM -- Atlanta Fed President Bostic and Chicago Fed President Goolsbee

- Thursday 9:05AM -- Fed Governor Jefferson

- Thursday 9:30AM -- Fed Vice Chair for Supervision Barr

- Thursday 10:00AM -- Dallas Fed President Logan

- Friday 8:45AM -- New York Fed President Williams

- Friday 9:00AM -- Fed Governor Bowman

- Friday 11:00AM -- Fed Chair Powell + former Fed Chair Bernanke

US FORWARD RATES

- Fed Funds futures now price in 3.2bp of Fed hikes by the end of June 2023, and 83bp of cuts from the June peak to year end

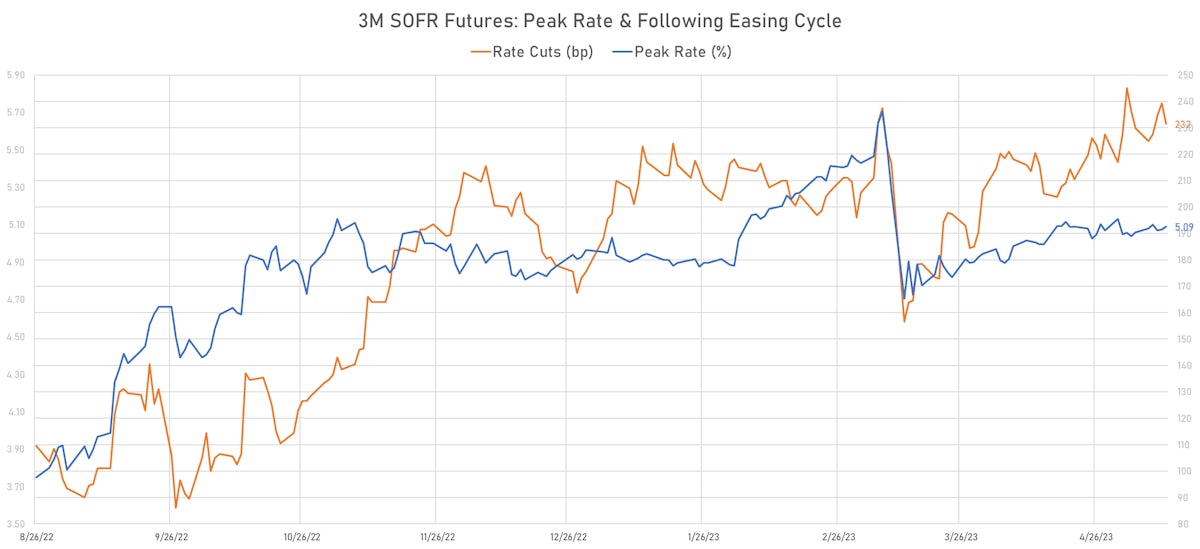

- Implied yields on 3-month SOFR futures top out at 5.09% for the August 2023 expiry and price in 231bp of rate cuts over the following easing cycle

US INFLATION & REAL RATES TODAY

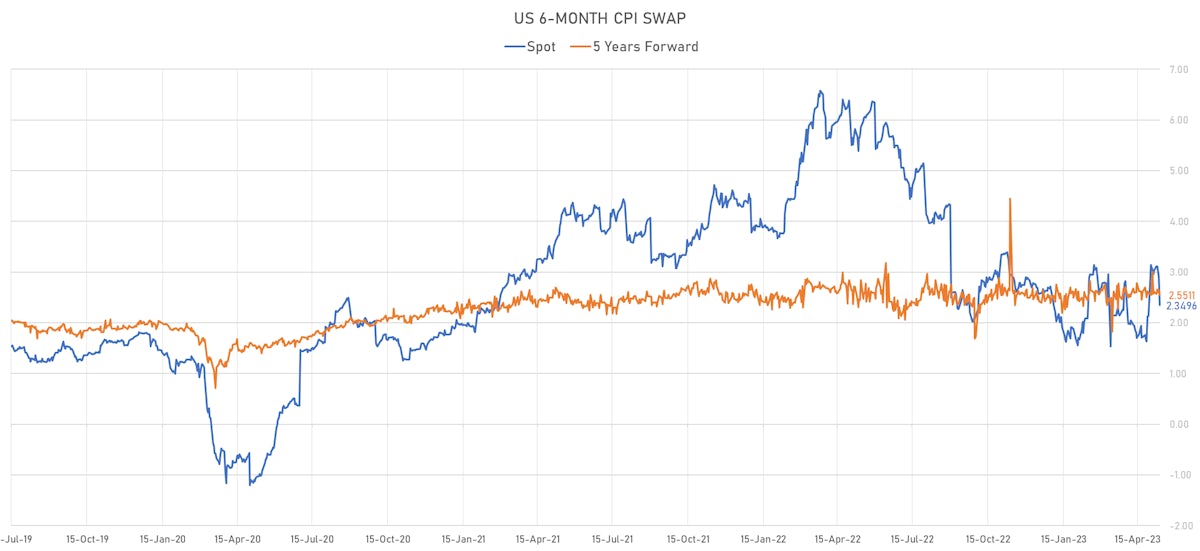

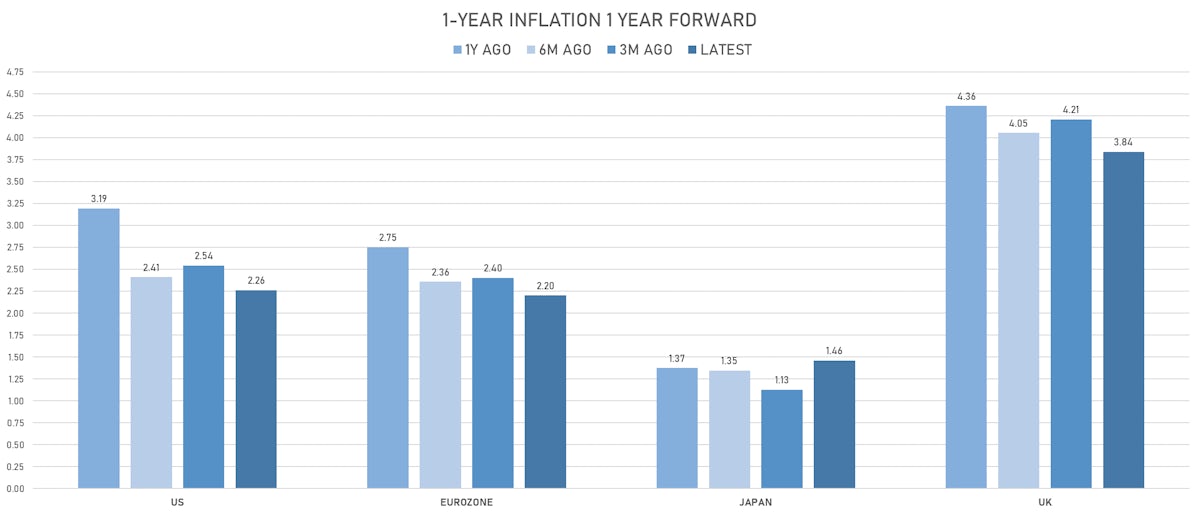

- TIPS 1Y breakeven inflation at 1.74% (down -10.7bp); 2Y at 1.92% (down -2.3bp); 5Y at 2.12% (down -0.3bp); 10Y at 2.19% (up 1.8bp); 30Y at 2.25% (up 3.8bp)

- 6-month spot US CPI swap down -55.3 bp to 2.350%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.3440%, +9.1 bp today; 10Y at 1.2820%, +6.0 bp today; 30Y at 1.5430%, +1.0 bp today

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -16.6 vols at 148.4 normals

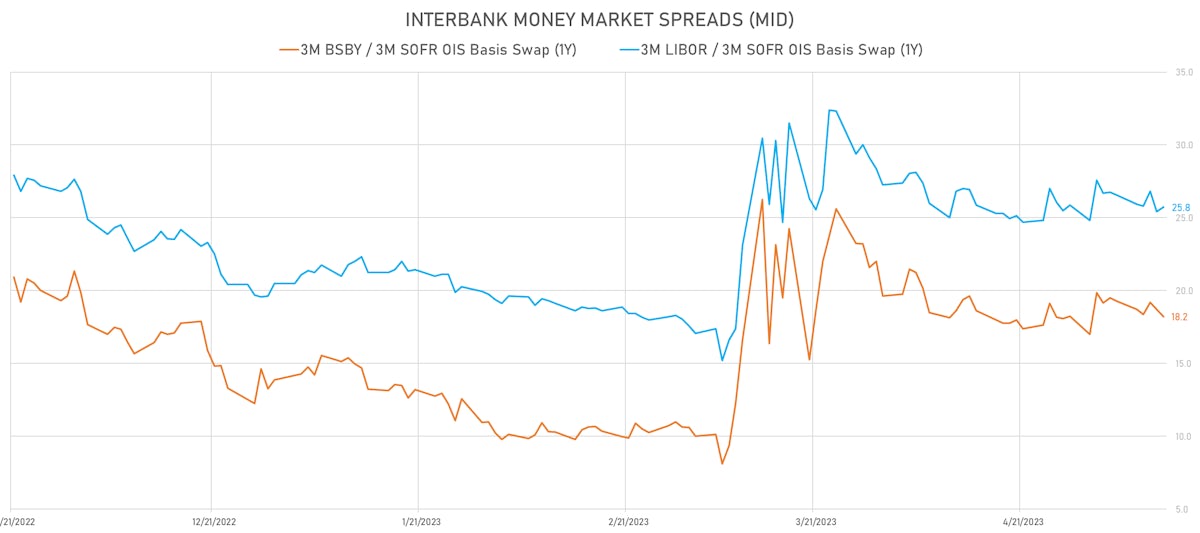

- 3-Month LIBOR-OIS spread down -1.6 bp at 21.6 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.232% (up 4.8 bp); the German 1Y-10Y curve is 0.5 bp flatter at -84.1bp (YTD change: -83.5 bp)

- Japan 5Y: 0.103% (down -0.5 bp); the Japanese 1Y-10Y curve is 0.3 bp flatter at 51.7bp (YTD change: +10.4 bp)

- China 5Y: 2.531% (up 0.5 bp); the Chinese 1Y-10Y curve is 1.0 bp flatter at 68.0bp (YTD change: -5.6 bp)

- Switzerland 5Y: 0.902% (up 5.3 bp); the Swiss 1Y-10Y curve is 9.9 bp steeper at -29.0bp (YTD change: -75.0 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +7.6 bp at 137.7 bp (Weekly change: +4.1 bp; YTD change: -35.9 bp)

- US-JAPAN: +11.9 bp at 404.5 bp (Weekly change: +4.1 bp; YTD change: -34.8 bp)

- US-CHINA: +8.5 bp at 179.7 bp (Weekly change: +10.4 bp; YTD change: -38.6 bp)

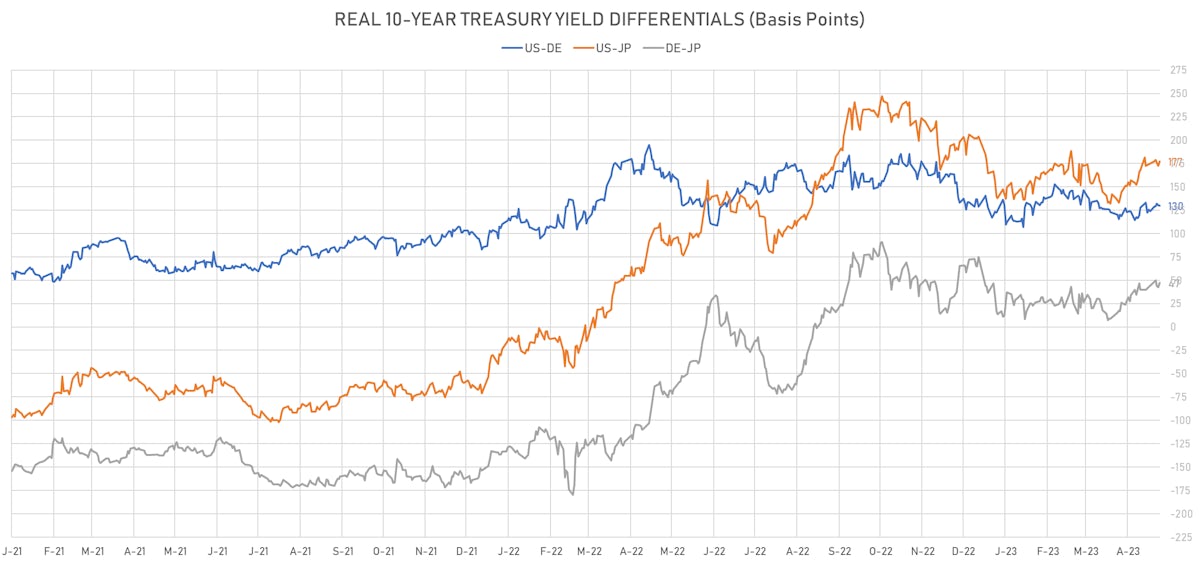

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: -0.4 bp at 129.8 bp (Weekly change: +5.7bp; YTD change: +1.0bp)

- US-JAPAN: +4.5 bp at 177.1 bp (Weekly change: +4.4bp; YTD change: -26.8bp)

- GERMANY-JAPAN: +4.9 bp at 47.3 bp (Weekly change: +7.4bp; YTD change: -27.8bp)