Rates

Strong Selloff In USD Rates Partially Undone Before The Weekend, As The Debt Ceiling Issue Remains Top Of Mind

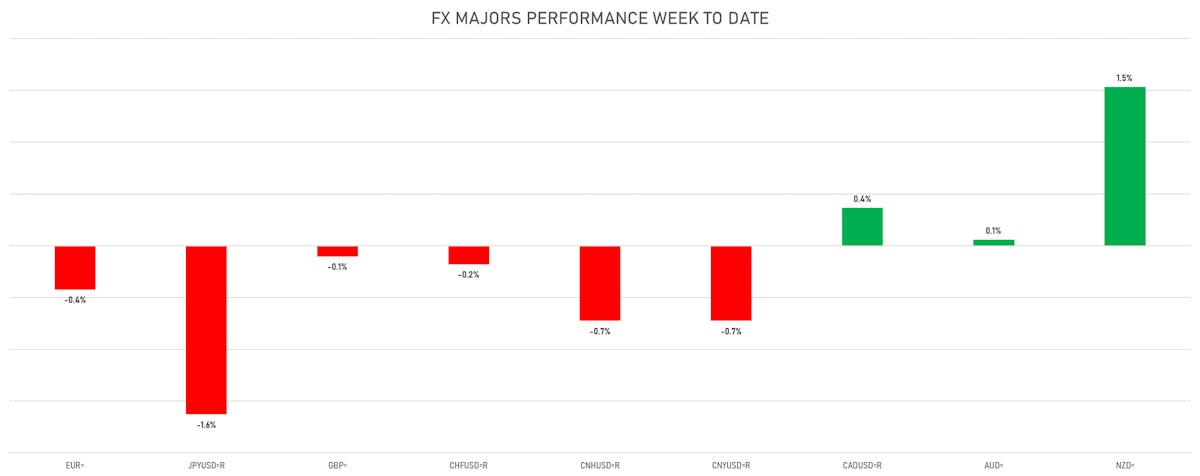

The US dollar has benefited from the positive dynamics in rates differentials across currencies, especially with the JPY where too much was expected too soon from the new CB governor

Published ET

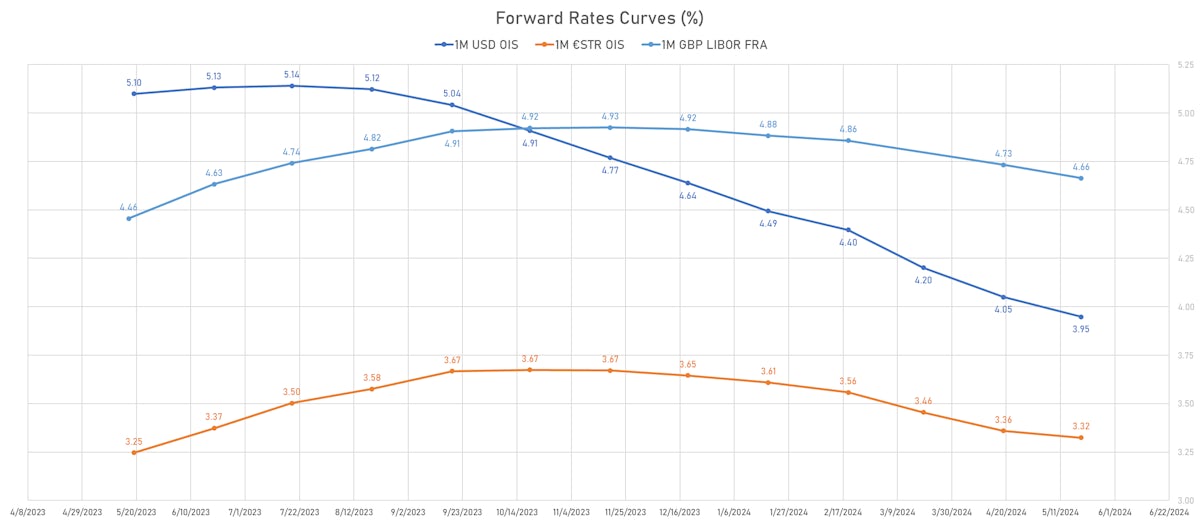

Real 10Y Yields Differentials | Sources: phipost.com, Refinitiv data

US RATES OUTLOOK

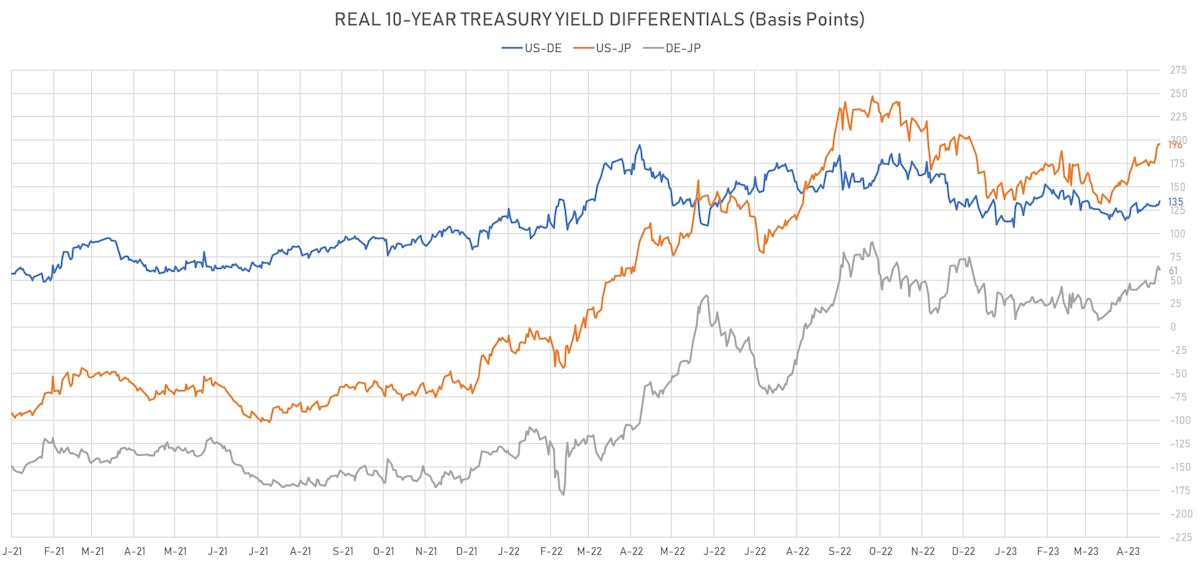

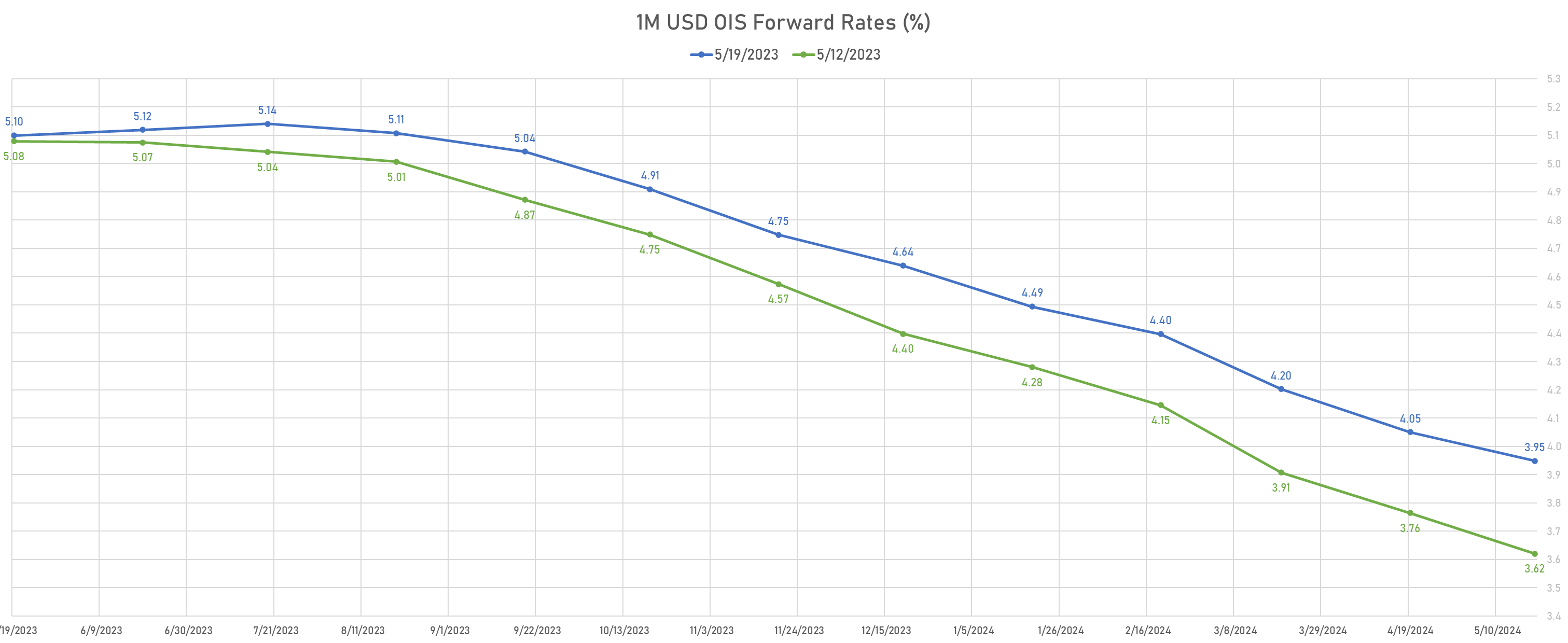

- Current pricing in 1M USD OIS: 5bp of hike to the peak Fed Funds rate (5.14%), and 49bp of cuts through the end of the year

- The strong selloff in USD rates earlier this week was driven primarily by two factors: 1) optimism around a fast resolution of the debt ceiling standoff and 2) hawkish commentary by some Fed members suggesting that the hiking cycle still had room to run further.

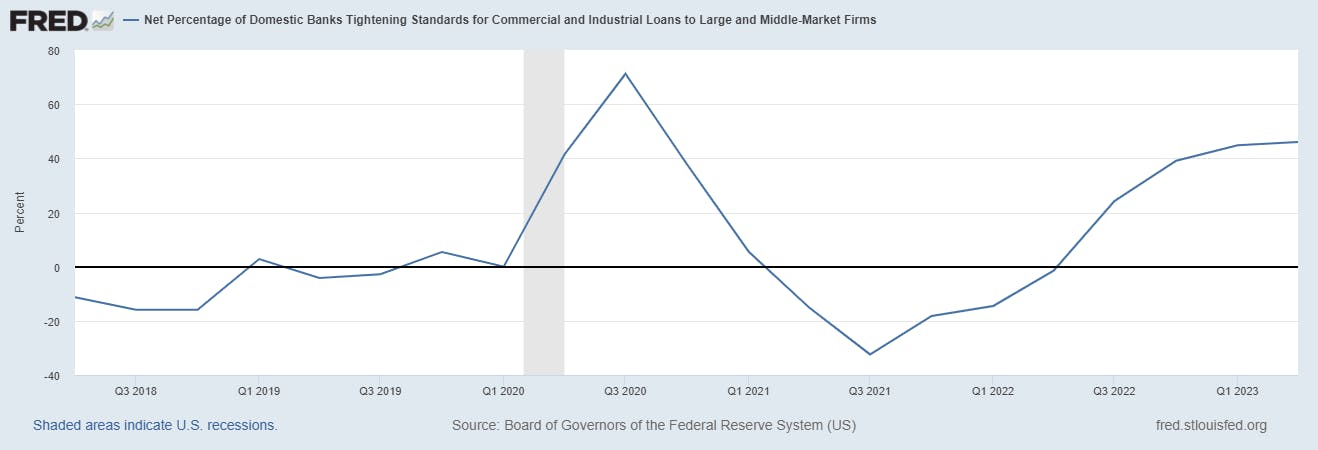

- We still have sympathy for this view: macro data remains robust, inflation is extremely high, and the Fed pause narrative is almost entirely driven by the notion that the regional banking crisis will tighten lending conditions meaningfully more than previously expected (SLOOS had been tightening for a while before failures occurred, and the latest data shows a stabilization rather than worsening).

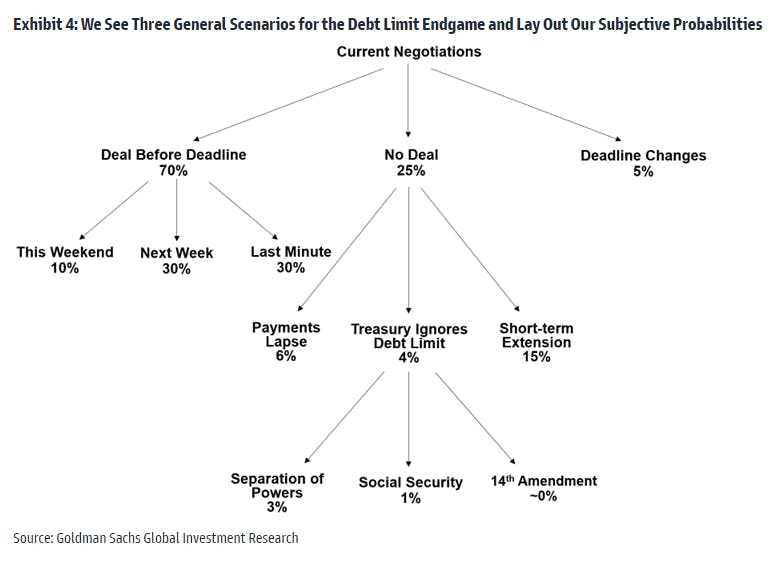

- Gamesmanship will likely keep the debt ceiling situation unresolved until the last minute, in order for politicians to maximize the publicity they can milk out of this. Here's a less binary outlook from GS research:

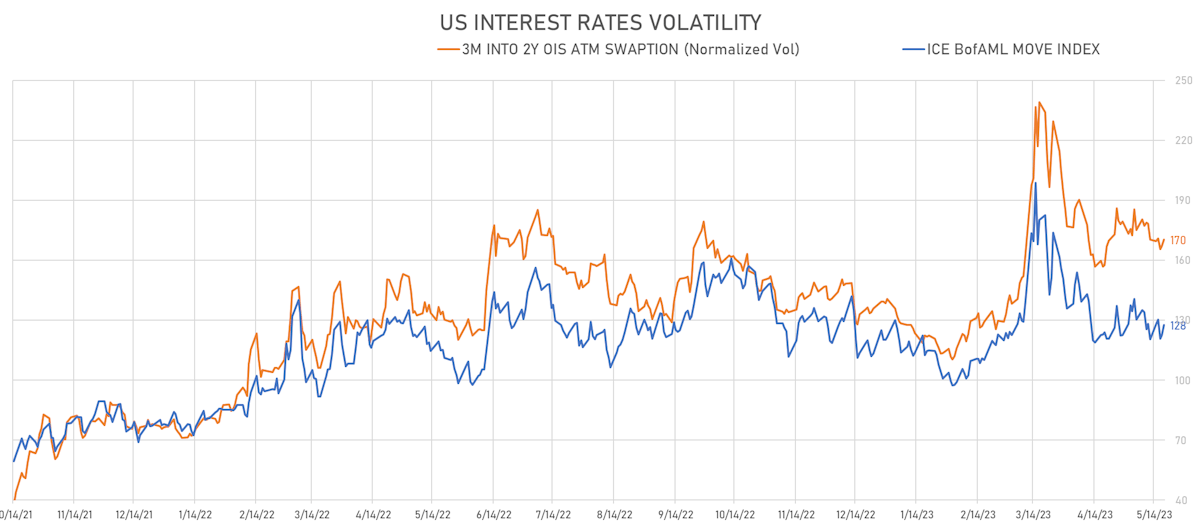

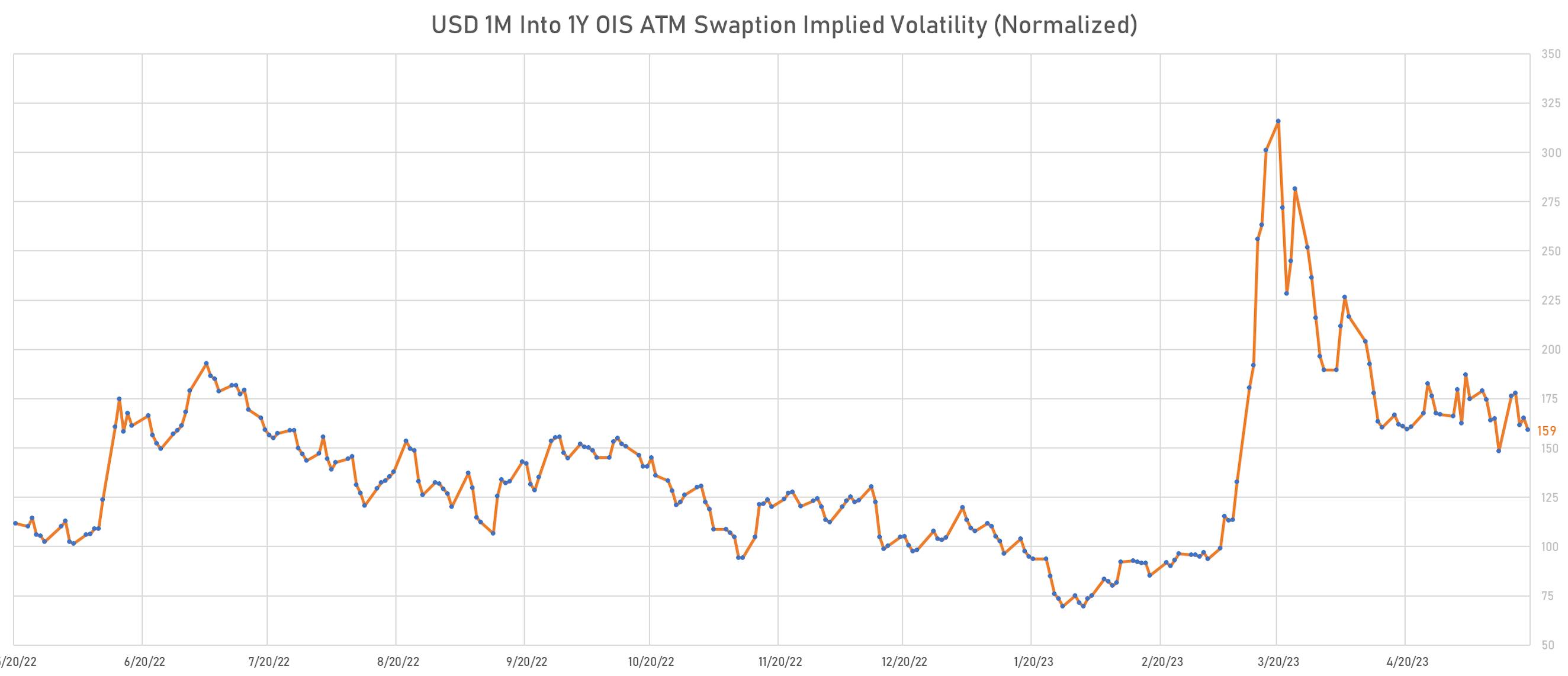

- It's too early to have a strong opinion on the June FOMC, with important data releases in the weeks ahead (May employment and CPI reports, April PCE inflation, weekly banking data), but rates volatility should stay high as long as this much uncertainty hangs over money markets

WEEKLY US RATES SUMMARY

- The treasury yield curve flattened, with the 1s10s spread tightening -1.7 bp, now at -133.0 bp (YTD change: -49.6bp)

- 1Y: 5.0111% (up 23.6 bp)

- 2Y: 4.2766% (up 28.6 bp)

- 5Y: 3.7381% (up 29.3 bp)

- 7Y: 3.7173% (up 26.5 bp)

- 10Y: 3.6813% (up 22.0 bp)

- 30Y: 3.9346% (up 15.3 bp)

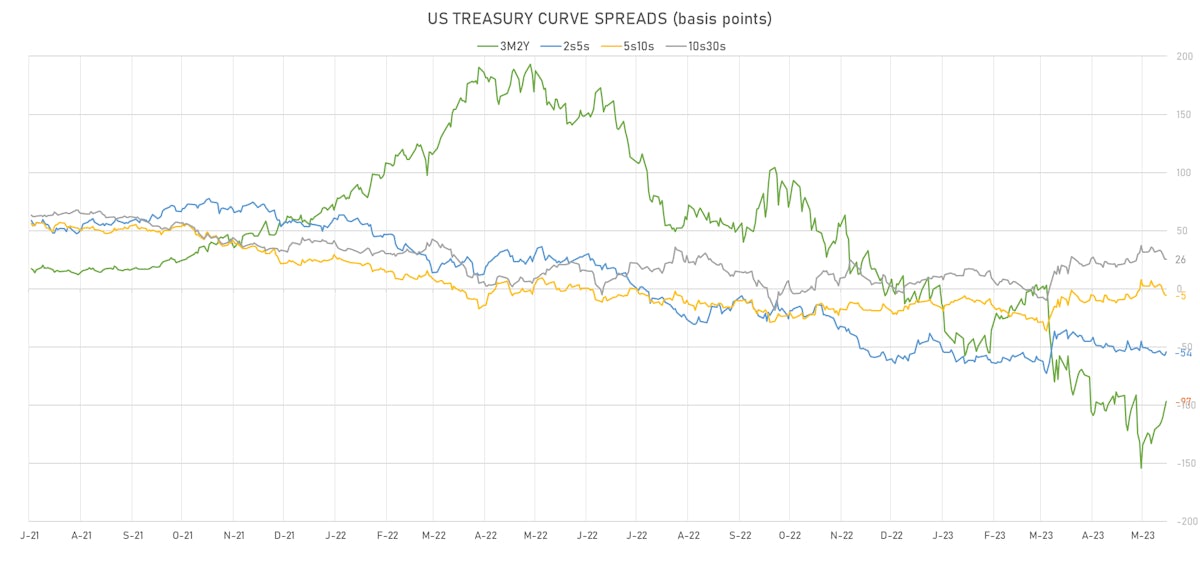

- US treasury curve spreads: 3m2Y at -100.7bp (up 22.2bp this week), 2s5s at -53.9bp (up 0.8bp), 5s10s at -5.7bp (down -7.7bp), 10s30s at 25.3bp (down -6.8bp)

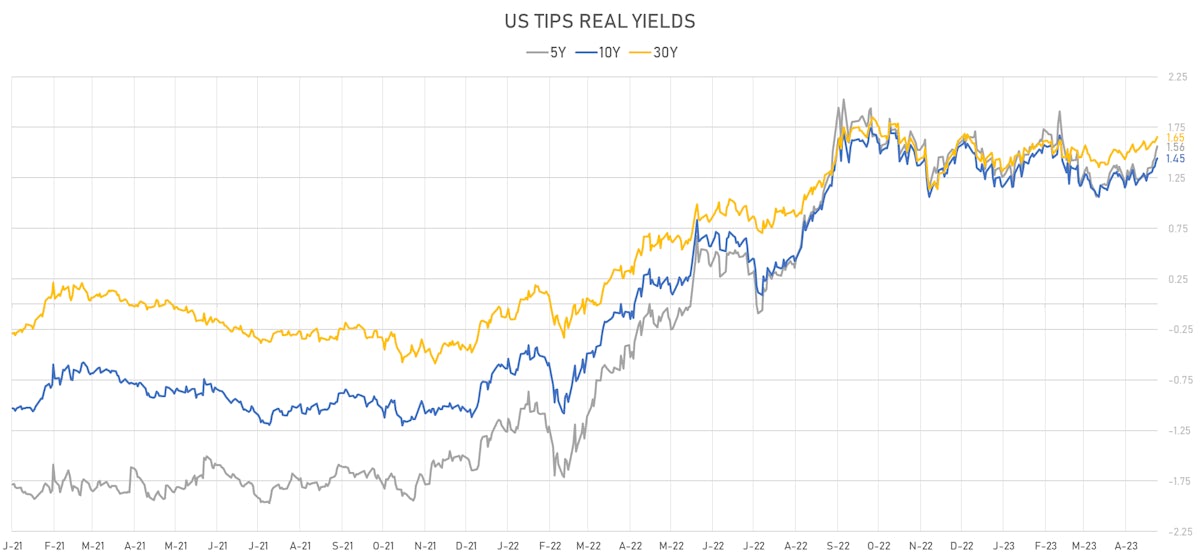

- US 5Y TIPS inflation breakeven at 2.19% up 7.8bp; 10Y breakeven at 2.25% up 7.0bp; 30Y breakeven at 2.29% up 4.8bp

- US 5-Year TIPS Real Yield: +21.7 bp at 1.5610%; 10-Year TIPS Real Yield: +16.3 bp at 1.4450%; 30-Year TIPS Real Yield: +11.0 bp at 1.6530%

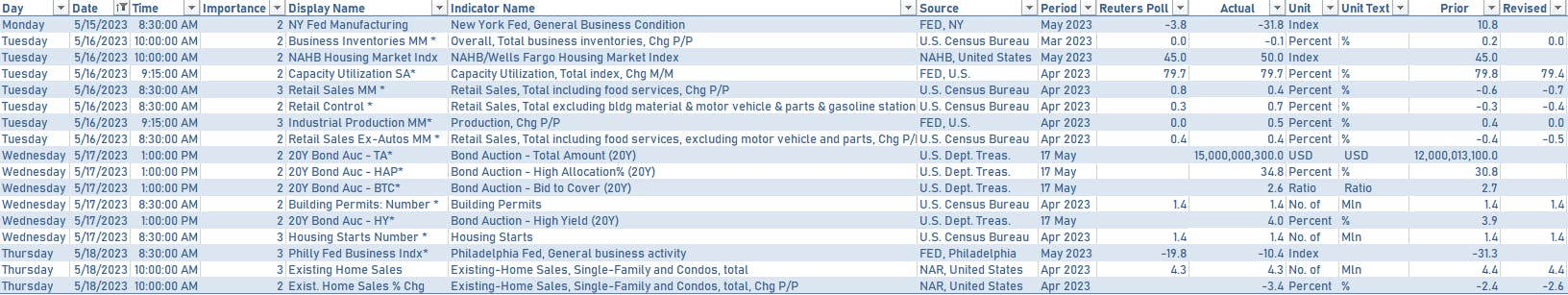

US ECONOMIC DATA OVER THE PAST WEEK

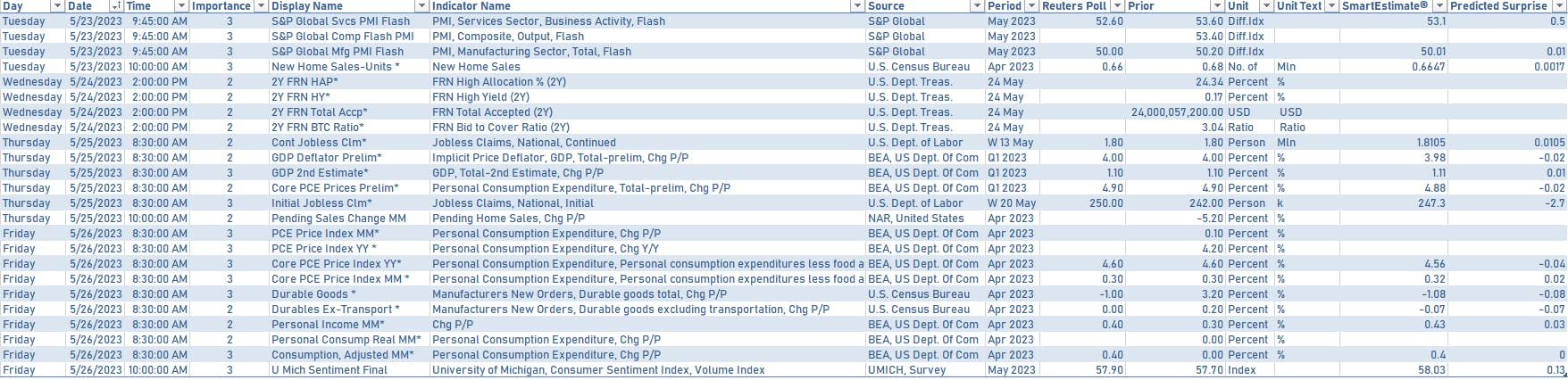

US MACRO RELEASES IN THE WEEK AHEAD

US TREASURY COUPON-BEARING AUCTIONS IN THE WEEK AHEAD

- Tuesday 1:00PM: $42bn in 2Y notes

- Wednesday 11:30AM: $22bn in 2Y FRNs

- Wednesday 1:00PM: $43bn in 5Y notes

- Thursday 1:00PM: $35bn in 7Y notes

FED SPEAKERS IN THE WEEK AHEAD

- Monday 8:30AM: St. Louis Fed President Bullard

- Monday 11:05AM: Atlanta Fed President Bostic and Richmond Fed President Barkin

- Monday 11:05AM: San Francisco Fed President Daly

- Tuesday 9:00AM: Dallas Fed President Logan

- Wednesday 12:10PM: Fed Governor Waller

- Thursday 10:30AM: Boston Fed President Collins

US FORWARD RATES

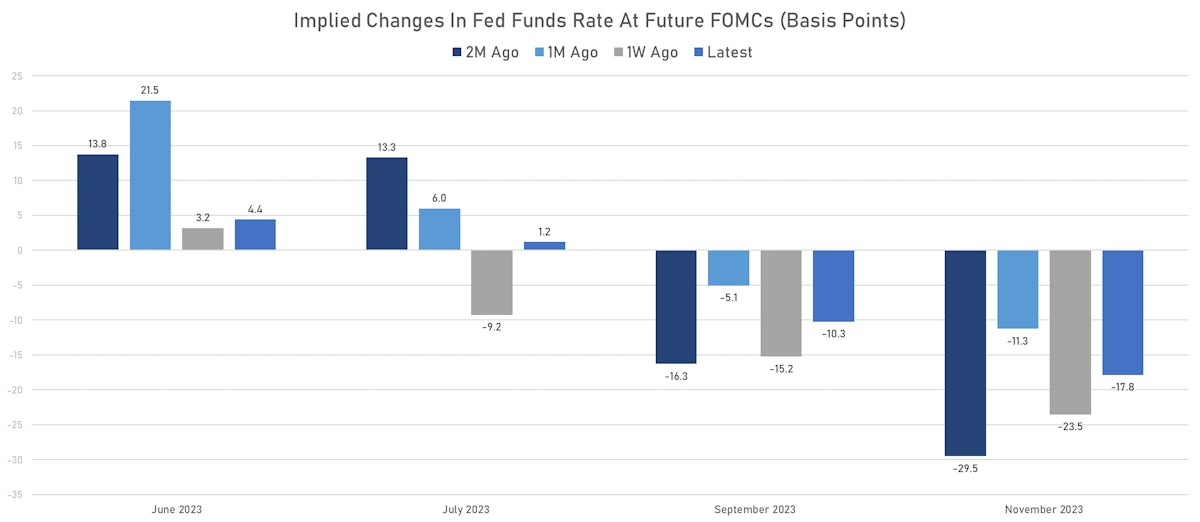

- Fed Funds futures now price in 4.4bp of Fed hikes by the end of June 2023, 5.6bp (22% x 25bp) by the end of July 2023, and 49bp of cuts (from the peak) by the end of 2023

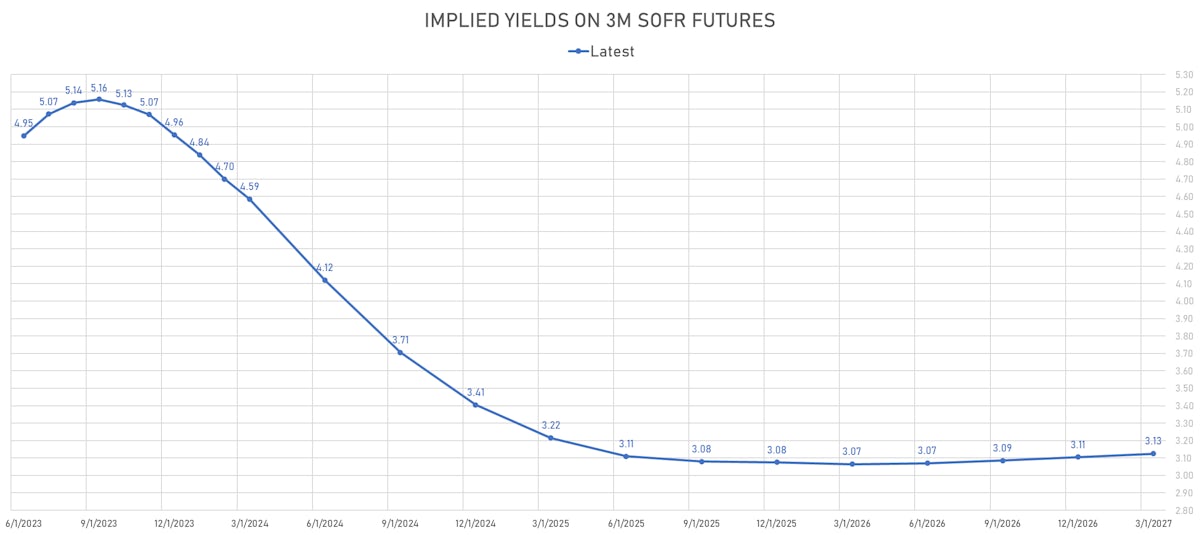

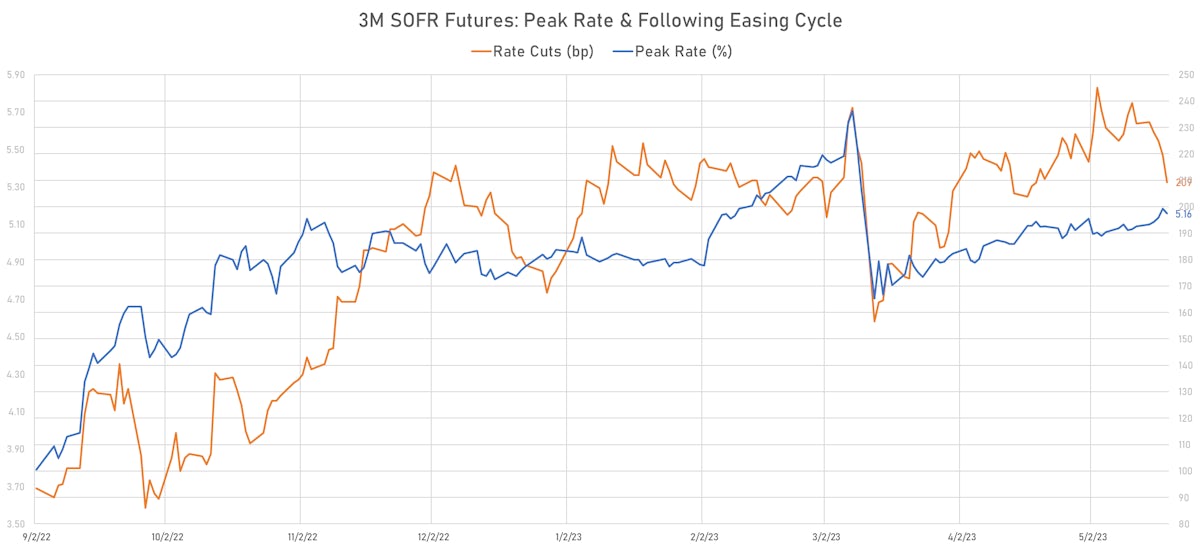

- Implied yields on 3-month SOFR futures top out at 5.16% for the September 2023 expiry and price in 208bp of rate cuts over the following easing cycle

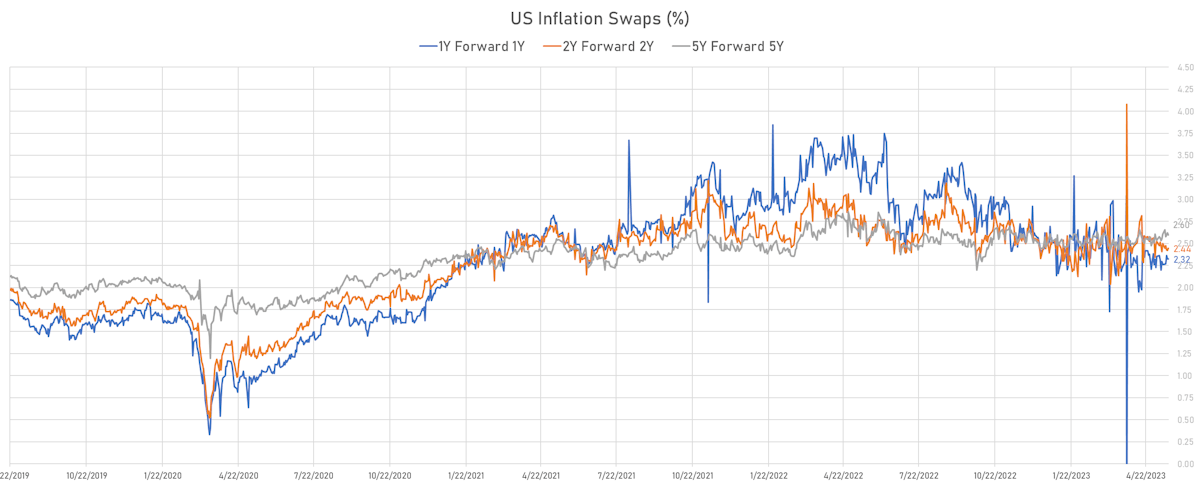

US INFLATION & REAL RATES TODAY

- TIPS 1Y breakeven inflation at 2.01% (down -2.4bp); 2Y at 2.06% (down -2.4bp); 5Y at 2.20% (up 1.6bp); 10Y at 2.26% (up 1.1bp); 30Y at 2.29% (up 0.5bp)

- 6-month spot US CPI swap at 2.512%, with a flattening of the forward curve

- US Real Rates: 5Y at 1.5610%, +3.7 bp today; 10Y at 1.4450%, +2.4 bp today; 30Y at 1.6530%, +2.1 bp today

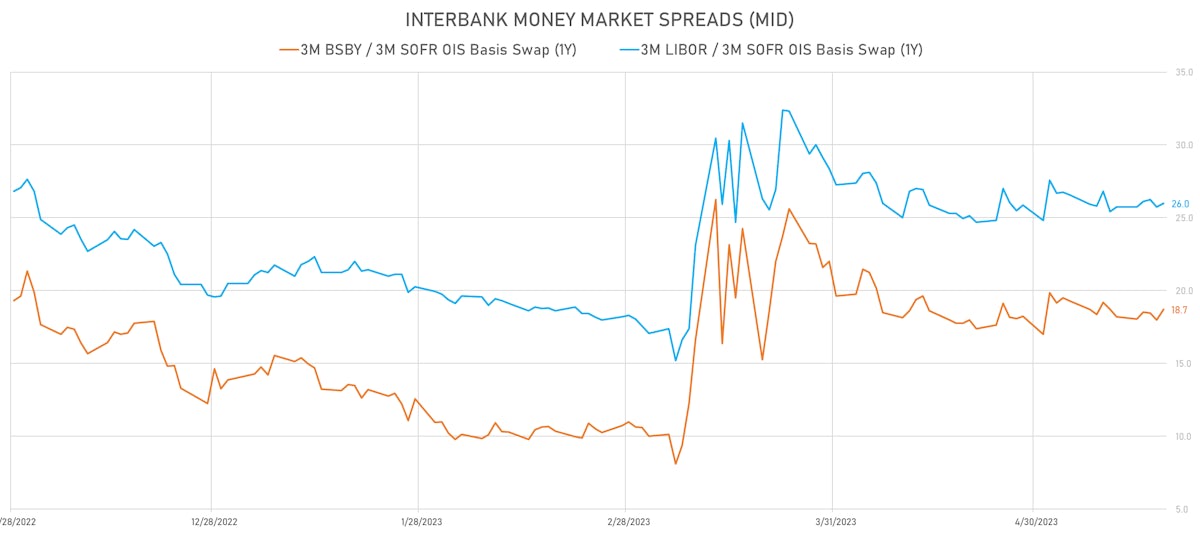

RATES VOLATILITY & LIQUIDITY TODAY

- USD swap rate implied volatility (USD 1 Month by 1 Year ATM Swaption) down -6.2 vols at 159.1 normals

- 3-Month LIBOR-OIS spread up 3.6 bp at 24.5 bp (18-months range: -11.3 to 39.3 bp)

KEY INTERNATIONAL RATES TODAY

- Germany 5Y: 2.423% (down -1.8 bp); the German 1Y-10Y curve is 2.1 bp flatter at -69.0bp (YTD change: -70.9 bp)

- Japan 5Y: 0.106% (up 0.4 bp); the Japanese 1Y-10Y curve is 1.6 bp steeper at 52.2bp (YTD change: +10.9 bp)

- China 5Y: 2.536% (down -1.9 bp); the Chinese 1Y-10Y curve is 4.3 bp steeper at 70.8bp (YTD change: -2.8 bp)

- Switzerland 5Y: 0.906% (up 0.1 bp); the Swiss 1Y-10Y curve is 0.7 bp steeper at -66.4bp (YTD change: -72.7 bp)

GLOBAL 5-YEAR NOMINAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +4.0 bp at 148.4 bp (Weekly change: +10.7 bp; YTD change: -25.2 bp)

- US-JAPAN: +2.5 bp at 433.2 bp (Weekly change: +28.7 bp; YTD change: -6.1 bp)

- US-CHINA: +2.8 bp at 202.7 bp (Weekly change: +22.9 bp; YTD change: -15.6 bp)

GLOBAL 10-YEAR REAL INTEREST RATES DIFFERENTIALS TODAY

- US-GERMANY: +4.2 bp at 134.8 bp (Weekly change: +5.0bp; YTD change: +6.0bp)

- US-JAPAN: +0.4 bp at 196.0 bp (Weekly change: +18.9bp; YTD change: -7.9bp)

- GERMANY-JAPAN: -3.8 bp at 61.2 bp (Weekly change: +13.9bp; YTD change: -13.9bp)